Social Innovation Fund

-

DATABASE (689)

-

ARTICLES (523)

Global Investment Fund (GIF) is an impact investment fund supporting new ventures that are solving social problems in the developing world. Besides investing through debt, equity investments and SAFE (simple agreement for future equity) contracts, GIF also disburses grants for social enterprises. It invests in various sectors, including agriculture and aquaculture, health, education, water and fintech.

Global Investment Fund (GIF) is an impact investment fund supporting new ventures that are solving social problems in the developing world. Besides investing through debt, equity investments and SAFE (simple agreement for future equity) contracts, GIF also disburses grants for social enterprises. It invests in various sectors, including agriculture and aquaculture, health, education, water and fintech.

Founded in 2018, Trinity Innovation Fund is a fund management firm that mainly invests in pharmaceutical innovations. TIF currently manages two PE funds and its limited partners include renowned pharmaceuticals and institutional investors. It also has offices managing funds overseas, for example, Trinity Innovation Bioventure Singapore Pte Ltd.

Founded in 2018, Trinity Innovation Fund is a fund management firm that mainly invests in pharmaceutical innovations. TIF currently manages two PE funds and its limited partners include renowned pharmaceuticals and institutional investors. It also has offices managing funds overseas, for example, Trinity Innovation Bioventure Singapore Pte Ltd.

Mercy Corps’ Social Venture Fund

Mercy Corps’ Social Venture Fund is a seed and early-stage social impact fund operated by not-for-profit humanitarian organization Mercy Corps. The US-based organization is increasingly moving into tech investments, with key interests in agtech and fintech solutions creating social impact. FinX, a platform designed to accelerate financial inclusion worldwide, was also launched recently. Distributed ledgers, digital assets, cryptocurrencies and other digital financial solutions will be deployed to alleviate poverty in local communities. The fund has invested in 16 companies at the seed stage. Investments in the February 2021 included a pre-seed round for Kenyan healthcare fintech platform ImaliPay. In December 2020, it joined a $5.3m seed round for Colombian remittance tech Valiu.

Mercy Corps’ Social Venture Fund is a seed and early-stage social impact fund operated by not-for-profit humanitarian organization Mercy Corps. The US-based organization is increasingly moving into tech investments, with key interests in agtech and fintech solutions creating social impact. FinX, a platform designed to accelerate financial inclusion worldwide, was also launched recently. Distributed ledgers, digital assets, cryptocurrencies and other digital financial solutions will be deployed to alleviate poverty in local communities. The fund has invested in 16 companies at the seed stage. Investments in the February 2021 included a pre-seed round for Kenyan healthcare fintech platform ImaliPay. In December 2020, it joined a $5.3m seed round for Colombian remittance tech Valiu.

KDDI Open Innovation Fund is a joint corporate VC operated by Japanese telecommunications firm KDDI and investment firm Global Brain. It forms one part of KDDI's venture programs, the other being a Japan-only accelerator program, KDDI Infinity Labo. With the support of other companies in the group, such as au Financial Holdings and Soracom, KDDI is able to provide extensive and relevant support to its portfolio companies.

KDDI Open Innovation Fund is a joint corporate VC operated by Japanese telecommunications firm KDDI and investment firm Global Brain. It forms one part of KDDI's venture programs, the other being a Japan-only accelerator program, KDDI Infinity Labo. With the support of other companies in the group, such as au Financial Holdings and Soracom, KDDI is able to provide extensive and relevant support to its portfolio companies.

Social Capital is a Palo Alto-based venture capital firm. Its stated mission is to "advance humanity by solving the world's hardest problems", with the firm investing in entrepreneurs who markedly improve their communities. Social Capital's diverse portfolio comprises healthcare companies, workplace productivity software Slack and SurveyMonkey and coworking space operator Rework (now GoWork).

Social Capital is a Palo Alto-based venture capital firm. Its stated mission is to "advance humanity by solving the world's hardest problems", with the firm investing in entrepreneurs who markedly improve their communities. Social Capital's diverse portfolio comprises healthcare companies, workplace productivity software Slack and SurveyMonkey and coworking space operator Rework (now GoWork).

Founded in 2014, Giant Innovation Capital is a venture capital fund by Giant Interactive Group, an online game developer and operator listed on the NYSE. It focuses on early stage investing in Internet startups.

Founded in 2014, Giant Innovation Capital is a venture capital fund by Giant Interactive Group, an online game developer and operator listed on the NYSE. It focuses on early stage investing in Internet startups.

Hengqin CIMC Readysun Innovation & Entrepreneurship Investment Fund

Hengqin CIMC Readysun Innovation & Entrepreneurship Investment Fund is a VC fund set up by China International Marine Containers (CIMC) and Shenzhen Readysun Investment Group on June 14, 2017. The fund focuses on fast-growing high-end equipment manufacturing and new technology sectors, such as intelligent logistics, industrial automation and robots, industrial internet, green new materials.

Hengqin CIMC Readysun Innovation & Entrepreneurship Investment Fund is a VC fund set up by China International Marine Containers (CIMC) and Shenzhen Readysun Investment Group on June 14, 2017. The fund focuses on fast-growing high-end equipment manufacturing and new technology sectors, such as intelligent logistics, industrial automation and robots, industrial internet, green new materials.

Cathay Innovation invests in small to medium-sized companies with the potential to rapidly grow internationally. By 2016, Cathay Innovation had conducted 59 investments, with a total investment of €514 million. It has offices in France, China, the US and Germany, with €1.2 billion under management.

Cathay Innovation invests in small to medium-sized companies with the potential to rapidly grow internationally. By 2016, Cathay Innovation had conducted 59 investments, with a total investment of €514 million. It has offices in France, China, the US and Germany, with €1.2 billion under management.

Xora Innovation is a subsidiary of the Singapore sovereign investment fund, Temasek. It was established as an early-stage deeptech investment platform that identifies startups connected with the Singapore science and technology ecosystem (although the startup can be based anywhere in the world). Xora plans to invest as a lead or co-lead in seed or Series A rounds, with later-stage investments being handled through Temasek. As of July 2021, Xora has invested in two companies based in Singapore: Allozymes, which provides enzyme engineering services, and Nuevocor, which is developing gene therapy for certain heart diseases.

Xora Innovation is a subsidiary of the Singapore sovereign investment fund, Temasek. It was established as an early-stage deeptech investment platform that identifies startups connected with the Singapore science and technology ecosystem (although the startup can be based anywhere in the world). Xora plans to invest as a lead or co-lead in seed or Series A rounds, with later-stage investments being handled through Temasek. As of July 2021, Xora has invested in two companies based in Singapore: Allozymes, which provides enzyme engineering services, and Nuevocor, which is developing gene therapy for certain heart diseases.

With a specific focus on clean energy, Innogy Innovation Hub was established in 2014 and currently has 53 startups in its portfolio spanning from Austria to Bangladesh. Recent investments include HypeLabs' US$3m seed round and the €4m Series A round of augmented and mixed reality solutions provider Holo-Light.

With a specific focus on clean energy, Innogy Innovation Hub was established in 2014 and currently has 53 startups in its portfolio spanning from Austria to Bangladesh. Recent investments include HypeLabs' US$3m seed round and the €4m Series A round of augmented and mixed reality solutions provider Holo-Light.

Innovation Nest is an early-stage venture capitalist firm based in Krakow, Poland. Founded in 2010, the VC has invested in more than 50 startups, with a special focus on European B2B SaaS companies. The firm was the lead investor in eight of the startups' funding rounds.The VC usually participates in seed rounds, with the most recent being a US$1-million investment in Poland's fraud detection company Netone and another seed investment in Portuguese facility management platform Infraspeak. The VC has also joined a Series A round for ICT SaaS company CallPage and Series B funding in sensor company Estimote.

Innovation Nest is an early-stage venture capitalist firm based in Krakow, Poland. Founded in 2010, the VC has invested in more than 50 startups, with a special focus on European B2B SaaS companies. The firm was the lead investor in eight of the startups' funding rounds.The VC usually participates in seed rounds, with the most recent being a US$1-million investment in Poland's fraud detection company Netone and another seed investment in Portuguese facility management platform Infraspeak. The VC has also joined a Series A round for ICT SaaS company CallPage and Series B funding in sensor company Estimote.

Based in Seattle, Washington, Pivotal Ventures was founded by Melinda Gates in 2015 as a separate, independent organization from the Bill & Melinda Gates Foundation. The VC-arm and incubator aim to foster social innovation in the US, focusing on the social progress of women and families. It has supported diversity & inclusion, healthcare and impact startups by providing early-stage funding to enterprises with philanthropic and scalable goals. In October 2020, Pivotal launched a fund for adolescent mental health in partnership with Panorama Global. In September 2020, it also joined Techstars to create a new accelerator program to find innovative eldercare solutions for seniors and their caregivers.

Based in Seattle, Washington, Pivotal Ventures was founded by Melinda Gates in 2015 as a separate, independent organization from the Bill & Melinda Gates Foundation. The VC-arm and incubator aim to foster social innovation in the US, focusing on the social progress of women and families. It has supported diversity & inclusion, healthcare and impact startups by providing early-stage funding to enterprises with philanthropic and scalable goals. In October 2020, Pivotal launched a fund for adolescent mental health in partnership with Panorama Global. In September 2020, it also joined Techstars to create a new accelerator program to find innovative eldercare solutions for seniors and their caregivers.

Rubio Impact Ventures (formerly Social Impact Ventures)

Founded in Amsterdam in 2014, Rubio Impact Ventures was formerly known as Social Impact Ventures. The VC currently invests in sustainability-focused startups that are predominantly based in the Netherlands and north-western Europe. It currently has 27 portfolio companies including fair coffee brand Wakuli and cultured meat pioneer Masa Meat. The “Rubicon crossing” VC has just raised €110m for its second impact fund, Rubio Fund 2, in October 2021.Recent investments include participation in the $43m Series B round of food-sharing app OLIO in September 2021 and the €3.6m seed round in July 2021 for Portuguese Arborea that uses micro-organisms in biotech for foodtech applications.

Founded in Amsterdam in 2014, Rubio Impact Ventures was formerly known as Social Impact Ventures. The VC currently invests in sustainability-focused startups that are predominantly based in the Netherlands and north-western Europe. It currently has 27 portfolio companies including fair coffee brand Wakuli and cultured meat pioneer Masa Meat. The “Rubicon crossing” VC has just raised €110m for its second impact fund, Rubio Fund 2, in October 2021.Recent investments include participation in the $43m Series B round of food-sharing app OLIO in September 2021 and the €3.6m seed round in July 2021 for Portuguese Arborea that uses micro-organisms in biotech for foodtech applications.

Targeting Indonesia's masses, investment platform Tanamduit offers mutual funds and governments bonds through its platform and partners.

Targeting Indonesia's masses, investment platform Tanamduit offers mutual funds and governments bonds through its platform and partners.

The Repsol Foundation, part of the Repsol Group, is committed to improving social and environmental outcomes.Repsol has launched a €50m social investment fund to be used in developing a portfolio of social enterprises focused on energy transition and social inclusion of vulnerable groups in Spain. The firm invested €9,5m during 2018.

The Repsol Foundation, part of the Repsol Group, is committed to improving social and environmental outcomes.Repsol has launched a €50m social investment fund to be used in developing a portfolio of social enterprises focused on energy transition and social inclusion of vulnerable groups in Spain. The firm invested €9,5m during 2018.

UTW: Drones and big data to help farmers get the most out of their land

Analytics startup UTW also harvests real-time farming information using satellites and sensors, to offer crop yield predictions

Beyond billion dollar investment rounds, Indonesia and Singapore are working together to harness the potential of their startup ecosystems

AquaCultured Foods: World's first whole-cut vegan seafood made through microbial fermentation

Armed with its fermentation technology and proprietary strain of fungi, AquaCultured is closing an oversubscribed funding round, raising more than $1.5m to launch its non-GMO seafood alternatives, with plans to expand to more food verticals and overseas

Interview with Qlue CEO: "We didn't know what a smart city should look like"

Co-founder and CEO of Qlue, Indonesia's largest "smart city" company, Rama Raditya explains how citizen involvement – not high-tech – is the true innovation of smart cities and the agent for change; plus how his startup has grown from partnering governments to businesses, and more

Bewe: From LatAm to the US, scaling fitness and wellness business globally post-Covid

Serial entrepreneur Diego Ballesteros’s latest venture Bewe seeks to disrupt the lucrative US wellness and fitness market with more competitive pricing

Never mind the bike-sharing fiascos – China's sharing economy is still steaming ahead

China is betting on the sharing economy to drive its shift into a service-based economy and a new era of growth

China's recycling startups seek cost-effective ways to make waste management profitable

The high costs of smart garbage bins and automation to sort out recycling have created new headaches for homes and offices

Mental health services platform Ibunda wants to keep expanding its reach

Since its founding in 2015, the Indonesian startup Ibunda has provided psychological consultations to over 200,000 clients

NANOxARCH: Pioneering awareness and use of sustainable materials in China

Founder Lei Yuxi reckons Covid-19 could usher China into a new era of sustainability, as her startup seeks to make sustainable materials more affordable

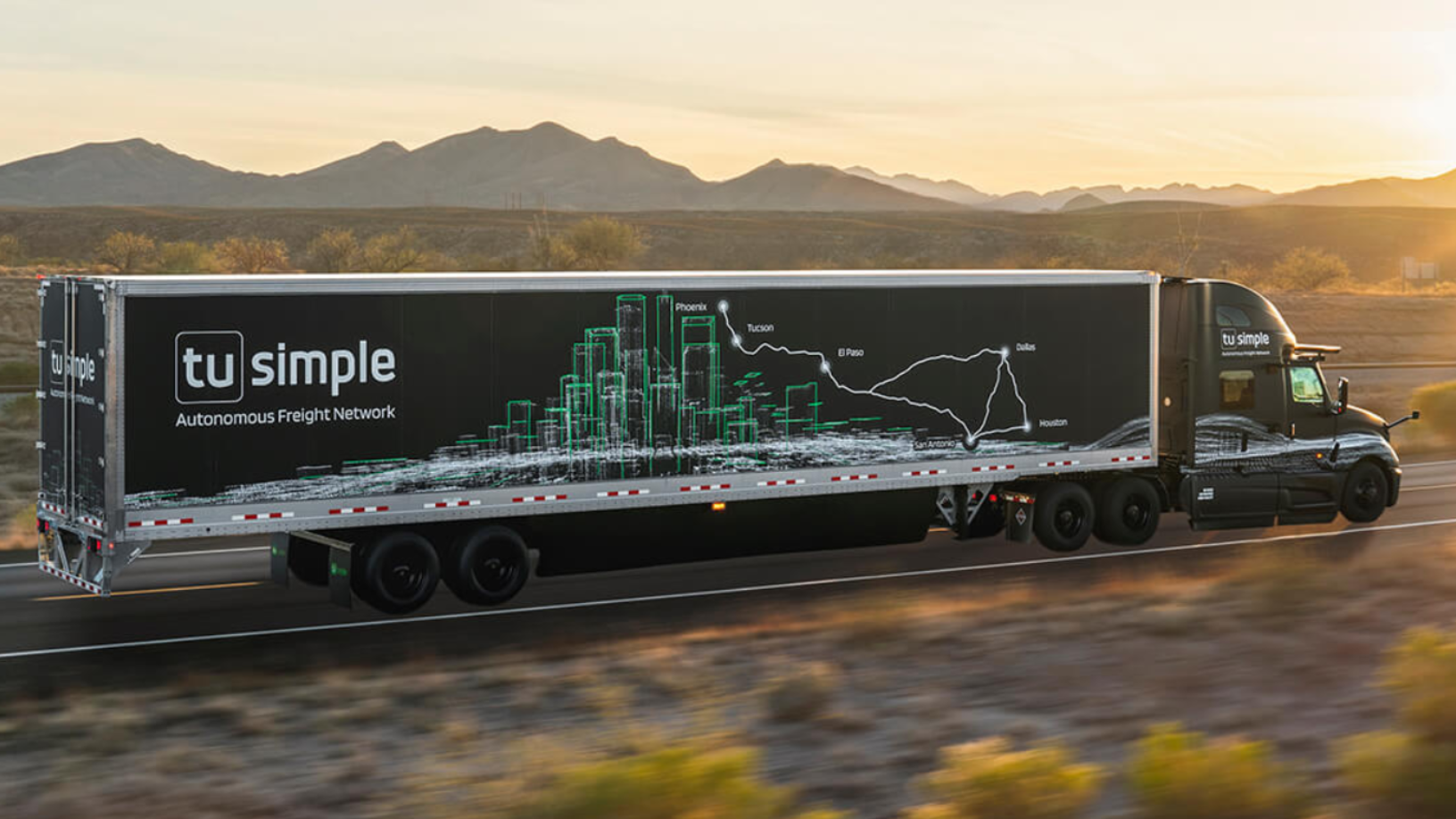

TuSimple: Banking on autonomous trucking in the US

TuSimple aims to scale its Waymo-style driverless trucking network to disrupt the $4tn global truck freight market starting with the US, with mass production by 2024

Voicemod: Voice-tweaking tech that's conquering esports and streamers

Backed by esports and gaming VC BITKRAFT Ventures, Voicemod has become a leading name in voice modification tech for gamers and livestreamers, with 2.5m MAU across 65 countries

What Indonesia’s election could mean for startups and investors

Industry players voice their hopes, concerns and expectations as the April presidential election nears

Foot Analytics: Turning pedestrian footfall into data for smart cities and retail

Applying sensors and proprietary algorithms to digitalize spaces, Foot Analytics gathers data and insights on customer behavior in retail spaces, stadia and airports

Shotl: Making public transport smarter, more sustainable

The first on-demand European mass transit app, Shotl aims to revolutionize city transit

Kopi Kenangan serves up an addictive blend of rapid expansion and profitability

Its recent $109m Series B infusion boosts the Indonesian startup's confidence for sustainability and regional expansion despite the current Covid-19 slowdown

Sorry, we couldn’t find any matches for“Social Innovation Fund”.