Solar energy

-

DATABASE (169)

-

ARTICLES (143)

CTO and co-founder of X1 Wind / PivotBuoy

Carlos Casanova is the CTO and co-founder of X1 Wind, a company developing a downwind turbine technology to reduce the Levelized Cost of Energy (LCOE) in offshore wind plants, named the PivotBuoy system. He conceived the concept that paved the way for PivotBuoy in 2012 during his MSc studies in Mechanical Engineering at the Massachusetts Institute of Technology (MIT). Prior to X1 Wind, Casanova worked as an engineer in companies developing similar solutions in the field of wind turbines and floating offshore systems, including Bluewater and Adwen Offshore.From 2012 to 2014, Casanova also was Research Assistant at MIT, investigating floating wind turbine advanced controls.

Carlos Casanova is the CTO and co-founder of X1 Wind, a company developing a downwind turbine technology to reduce the Levelized Cost of Energy (LCOE) in offshore wind plants, named the PivotBuoy system. He conceived the concept that paved the way for PivotBuoy in 2012 during his MSc studies in Mechanical Engineering at the Massachusetts Institute of Technology (MIT). Prior to X1 Wind, Casanova worked as an engineer in companies developing similar solutions in the field of wind turbines and floating offshore systems, including Bluewater and Adwen Offshore.From 2012 to 2014, Casanova also was Research Assistant at MIT, investigating floating wind turbine advanced controls.

Vangoo Capital Partners was founded in 2008 in Hongkong as a wholly owned subsidiary of Ant Capital Partners. Ant Capital Partners completed localization in China by finishing management buy-out of Vangoo Capital Partners in 2011. Vangoo Capital Partners manages both US$ Fund and RMB funds. It focuses on the investment of medical, Internet, consumer products, high-tech, and new energy.

Vangoo Capital Partners was founded in 2008 in Hongkong as a wholly owned subsidiary of Ant Capital Partners. Ant Capital Partners completed localization in China by finishing management buy-out of Vangoo Capital Partners in 2011. Vangoo Capital Partners manages both US$ Fund and RMB funds. It focuses on the investment of medical, Internet, consumer products, high-tech, and new energy.

Prosperity7 Ventures is the $1bn diversified VC fund of Aramco Ventures, a subsidiary of Aramco, the world's leading integrated energy and chemicals company. The fund's name derives from “Prosperity Well", the 7th oil well drilled in Saudi Arabia and the first to strike oil. Prosperity7 Ventures invests globally, focusing on highly scalable startups in the US and China.

Prosperity7 Ventures is the $1bn diversified VC fund of Aramco Ventures, a subsidiary of Aramco, the world's leading integrated energy and chemicals company. The fund's name derives from “Prosperity Well", the 7th oil well drilled in Saudi Arabia and the first to strike oil. Prosperity7 Ventures invests globally, focusing on highly scalable startups in the US and China.

Xiyee Assets was founded in 2016 and is headquartered in Beijing. The firm is involved in private equity investment, M&A, restructuring, real estate and disposal of non-performing assets. It mainly invests in sectors such as advanced manufacturing, new energy, environmental protection, medtech and healthcare.

Xiyee Assets was founded in 2016 and is headquartered in Beijing. The firm is involved in private equity investment, M&A, restructuring, real estate and disposal of non-performing assets. It mainly invests in sectors such as advanced manufacturing, new energy, environmental protection, medtech and healthcare.

Fortum Oyj is a Finnish state-owned energy company operating power plants and co-generation plants across the nation. Listed on the NASDAQ OMX Helsinki stock exchange, Fortum is reputed to be Finland’s biggest company in terms of revenue generated in 2020.It is also Europe's third-largest producer of carbon-free electricity and the second-largest producer of nuclear power. Ranked as the fifth largest heat producer globally, Fortum supplies electricity and heating directly to consumers in Finland, Germany, Central Europe, the UK and the Nordic countries.Fortum invested in Finnish cleantech Infinited Fiber, taking up a 4% stake in 2019, to complement the energy company’s biorefining value chain and to improve resource efficiency. The cleantech investee aims to license its biodegradable fiber technology to help industry partners to manufacture innovative materials from textile and industrial waste.

Fortum Oyj is a Finnish state-owned energy company operating power plants and co-generation plants across the nation. Listed on the NASDAQ OMX Helsinki stock exchange, Fortum is reputed to be Finland’s biggest company in terms of revenue generated in 2020.It is also Europe's third-largest producer of carbon-free electricity and the second-largest producer of nuclear power. Ranked as the fifth largest heat producer globally, Fortum supplies electricity and heating directly to consumers in Finland, Germany, Central Europe, the UK and the Nordic countries.Fortum invested in Finnish cleantech Infinited Fiber, taking up a 4% stake in 2019, to complement the energy company’s biorefining value chain and to improve resource efficiency. The cleantech investee aims to license its biodegradable fiber technology to help industry partners to manufacture innovative materials from textile and industrial waste.

Led by media and entertainment veteran Frank Yang (Yang Xingnong), ANTS Venture Capital conducts early-stage investments in Chinese companies from the TMT, culture & entertainment, healthcare, consumption & retail and new energy sectors. It expects its selected companies to become market leaders in their industries, with a CAGR of at least 30% and the potential to go public in two years.

Led by media and entertainment veteran Frank Yang (Yang Xingnong), ANTS Venture Capital conducts early-stage investments in Chinese companies from the TMT, culture & entertainment, healthcare, consumption & retail and new energy sectors. It expects its selected companies to become market leaders in their industries, with a CAGR of at least 30% and the potential to go public in two years.

Co-founder of Diamond Foundry

Kyle Gazay is a co-founder of Diamond Foundry, the US-based unicorn that makes lab-grown diamonds and which is also the world’s first diamond producer to be certified carbon neutral. He has worked at Diamond Foundry since its launch, and held several roles there, including being COO as well as president of productionCurrently, Gazay oversees all diamond production at the company. Gazay’s expertise is in engineering and production. He has a decade’s track record in working with any equipment to obtain a robust and repeatable baseline output.Like the other co-founders of Diamond Foundry, Gazay previously worked at Nanosolar, a $640m US-based solar power technology provider, which later folded due to pressure from cheaper competition in China. At Nanosolar, Gazay led the development of its production line, and oversaw the translation of the company’s research into development and baseline production output. Upon the closure of Nanosolar, Gazay joined former Nanosolar CEO Martin Roscheisen and former Nanosolar engineer Jeremy Scholz in pivoting to work on lab-grown diamonds, and in establishing Diamond Foundry.

Kyle Gazay is a co-founder of Diamond Foundry, the US-based unicorn that makes lab-grown diamonds and which is also the world’s first diamond producer to be certified carbon neutral. He has worked at Diamond Foundry since its launch, and held several roles there, including being COO as well as president of productionCurrently, Gazay oversees all diamond production at the company. Gazay’s expertise is in engineering and production. He has a decade’s track record in working with any equipment to obtain a robust and repeatable baseline output.Like the other co-founders of Diamond Foundry, Gazay previously worked at Nanosolar, a $640m US-based solar power technology provider, which later folded due to pressure from cheaper competition in China. At Nanosolar, Gazay led the development of its production line, and oversaw the translation of the company’s research into development and baseline production output. Upon the closure of Nanosolar, Gazay joined former Nanosolar CEO Martin Roscheisen and former Nanosolar engineer Jeremy Scholz in pivoting to work on lab-grown diamonds, and in establishing Diamond Foundry.

Co-founder of Santara

Mardigu Wowiek Prasantyo is a serial entrepreneur who has over 30 years of experience in various oil and gas businesses and other enterprises. Prasantyo is the founder of oil and gas services companies Titis Sampurna and Laksel EPS, which have been part of various energy projects in Indonesia. He claims to be the only civilian to have worked as special advisor for Indonesia's Ministry of Defense. Armed with a degree in criminal psychology, he has said he has taken part in interrogations and has provided opinions on terrorist movements. Prior to becoming involved with equity crowdfunding platform, Santara, he also started a gold-backed cryptocurrency called Cyronium, which purportedly supports SMEs through blockchain-based investments.

Mardigu Wowiek Prasantyo is a serial entrepreneur who has over 30 years of experience in various oil and gas businesses and other enterprises. Prasantyo is the founder of oil and gas services companies Titis Sampurna and Laksel EPS, which have been part of various energy projects in Indonesia. He claims to be the only civilian to have worked as special advisor for Indonesia's Ministry of Defense. Armed with a degree in criminal psychology, he has said he has taken part in interrogations and has provided opinions on terrorist movements. Prior to becoming involved with equity crowdfunding platform, Santara, he also started a gold-backed cryptocurrency called Cyronium, which purportedly supports SMEs through blockchain-based investments.

Technical advisor and co-founder of Bygen

Philip Kwong is a lecturer and researcher at the University of Adelaide’s School of Chemical Engineering and Advanced Materials. He joined the university in 2009 and focuses on developing low-cost technologies that can facilitate a transition from fossil fuels to renewable energy. One of his ongoing research projects primarily deals with the conversion of agricultural waste into biochar, a form of charcoal that can act as a feedstock for making activated carbon and for sequestering carbon.In 2017, Kwong and two PhD students in his research group, Ben Morton and Lewis Dunnigan, began commercialization of the waste-to-activated carbon technology they had developed. A spin-off company called Bygen was established, with Dunnigan and Morton leading the startup. Kwong is a co-founder and technical advisor of the company.

Philip Kwong is a lecturer and researcher at the University of Adelaide’s School of Chemical Engineering and Advanced Materials. He joined the university in 2009 and focuses on developing low-cost technologies that can facilitate a transition from fossil fuels to renewable energy. One of his ongoing research projects primarily deals with the conversion of agricultural waste into biochar, a form of charcoal that can act as a feedstock for making activated carbon and for sequestering carbon.In 2017, Kwong and two PhD students in his research group, Ben Morton and Lewis Dunnigan, began commercialization of the waste-to-activated carbon technology they had developed. A spin-off company called Bygen was established, with Dunnigan and Morton leading the startup. Kwong is a co-founder and technical advisor of the company.

Founded in 2007 under the Chinese Fortune 500 company DunAn Group, the investment group manages total fund of RMB 6 billion today, with successful investment in 77 Chinese startups across multiple sectors including healthcare, advanced manufacturing, energy & cleantech, etc. It was nominated for “Top 10 Zhengjiang Investment Group” for seven years in a row and was awarded for “Chinese VC of Best Potential” in 2016 – 2017 by thecapital.com.cn.

Founded in 2007 under the Chinese Fortune 500 company DunAn Group, the investment group manages total fund of RMB 6 billion today, with successful investment in 77 Chinese startups across multiple sectors including healthcare, advanced manufacturing, energy & cleantech, etc. It was nominated for “Top 10 Zhengjiang Investment Group” for seven years in a row and was awarded for “Chinese VC of Best Potential” in 2016 – 2017 by thecapital.com.cn.

Shenzhen-listed Oceanwide Holdings is part of the China Oceanwide empire founded and controlled by Lu Zhiqiang, one of China’s wealthiest billionaires. Oceanwide is also the founding and controlling shareholder of Minsheng Bank, the first private sector-backed commercial bank in China, and the third-largest shareholder of Legend Holdings, the investment group behind Lenovo. Its interests span globally across financial services, energy, culture and media, and real estate.

Shenzhen-listed Oceanwide Holdings is part of the China Oceanwide empire founded and controlled by Lu Zhiqiang, one of China’s wealthiest billionaires. Oceanwide is also the founding and controlling shareholder of Minsheng Bank, the first private sector-backed commercial bank in China, and the third-largest shareholder of Legend Holdings, the investment group behind Lenovo. Its interests span globally across financial services, energy, culture and media, and real estate.

The Bank of China is one of four major state-owned banks in China. It provides financial services to China as well as 51 other countries and regions. The BOC makes direct investments and conducts investment management through its wholly owned subsidiary Bank of China Group Investment Ltd. It invests primarily in its clients and focuses on the fields of finance, consumption, medicine and energy sources.

The Bank of China is one of four major state-owned banks in China. It provides financial services to China as well as 51 other countries and regions. The BOC makes direct investments and conducts investment management through its wholly owned subsidiary Bank of China Group Investment Ltd. It invests primarily in its clients and focuses on the fields of finance, consumption, medicine and energy sources.

Tianjin Venture Capital was co-founded by Tianjin Municipal Science & Technology Commission and Tianjin Municipal Finance Bureau in 2003. It invests mainly in the sectors of advanced manufacturing, TMT, energy conservation & environmental protection, healthcare and consumer services. The firm manages RMB 8bn in capital. Of the 100+ tech startups in which the firm has invested, nearly 10 have gone public in China.

Tianjin Venture Capital was co-founded by Tianjin Municipal Science & Technology Commission and Tianjin Municipal Finance Bureau in 2003. It invests mainly in the sectors of advanced manufacturing, TMT, energy conservation & environmental protection, healthcare and consumer services. The firm manages RMB 8bn in capital. Of the 100+ tech startups in which the firm has invested, nearly 10 have gone public in China.

Forebright Capital originates from the PE investment team established in 2001 under the state-owned China Everbright which is listed in Hong Kong. Everbright was spun off in May 2014 as an independent company. With money raised from institutional investors and family offices at home and abroad, Forebright Capital currently manages four US-dollar funds. It mainly invests in sectors of clean energy, healthcare and fintech.

Forebright Capital originates from the PE investment team established in 2001 under the state-owned China Everbright which is listed in Hong Kong. Everbright was spun off in May 2014 as an independent company. With money raised from institutional investors and family offices at home and abroad, Forebright Capital currently manages four US-dollar funds. It mainly invests in sectors of clean energy, healthcare and fintech.

China Merchants Capital (CMC), the investment management platform of China Merchants Group, was established in 2012 with a registered capital of RMB 1 billion. As of the end of 2014, it had assets under management worth nearly US$3 billion. CMC invests mainly in the infrastructure, medical & pharmaceutical, financial services, real estate, high-tech, agriculture & foods, media, equipment machinery, mining and energy sectors, among others.

China Merchants Capital (CMC), the investment management platform of China Merchants Group, was established in 2012 with a registered capital of RMB 1 billion. As of the end of 2014, it had assets under management worth nearly US$3 billion. CMC invests mainly in the infrastructure, medical & pharmaceutical, financial services, real estate, high-tech, agriculture & foods, media, equipment machinery, mining and energy sectors, among others.

Solatom: Cost-effective flatpack mobile solar energy units for SMEs

Solatom's turnkey solar thermal solutions can cut energy costs by 37%. Its real-time data analytics can also be used to ensure that the industrial processing units are operating at optimal conditions

Tipped for unicorn status, BeON Energy is making solar power accessible to the masses

BeON Energy plans to raise the energy sector's largest Series A investment round in 2020

Dipole Tech: Using blockchain to democratize access to renewable energy in Asia

Having established key markets in the Philippines and Thailand, China’s Dipole Tech is next gaining ground at home for its energy trading app

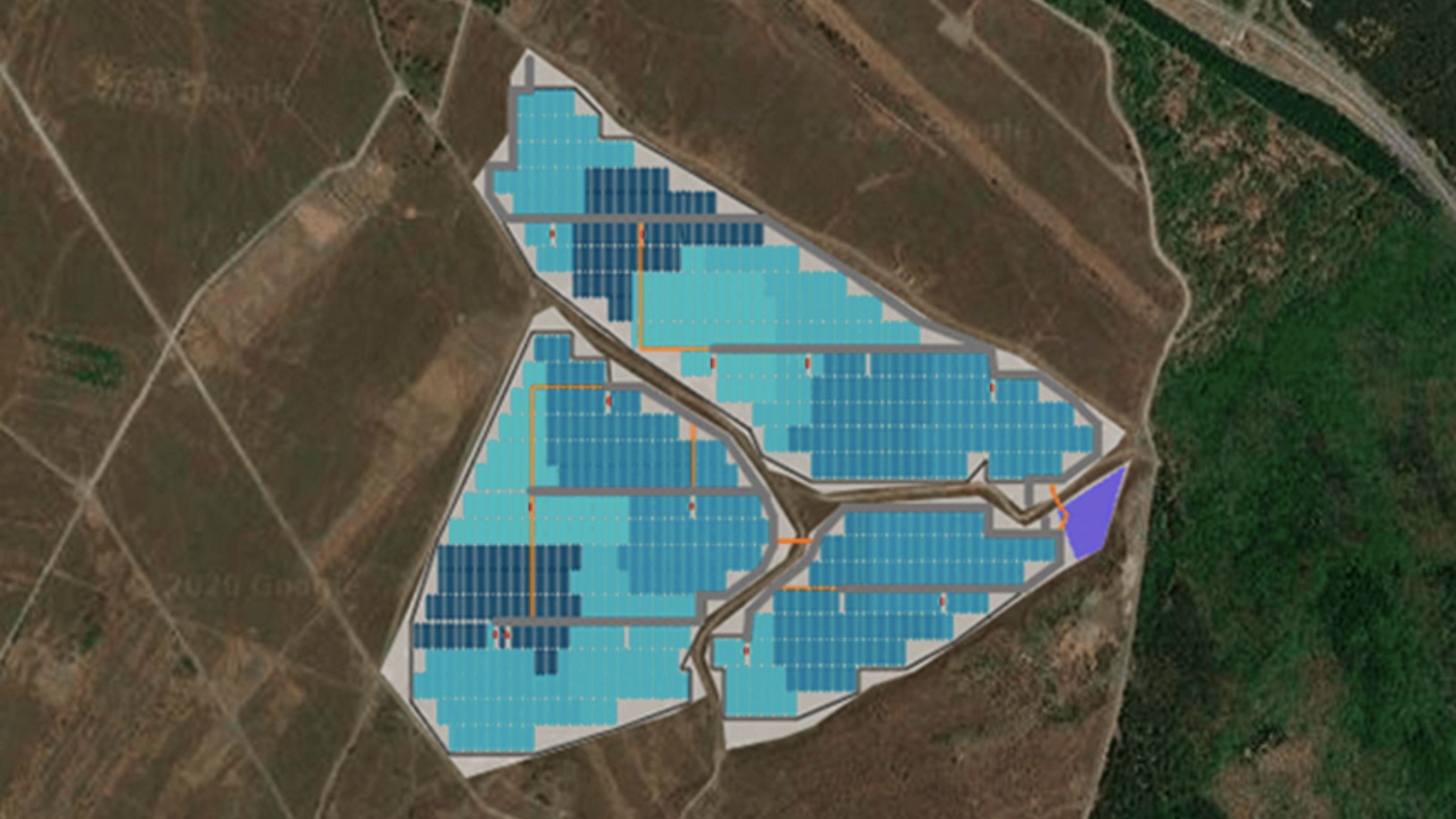

RatedPower: Creating solar power plant designs in minutes

The Spanish startup is helping solar plants expand exponentially worldwide and revolutionizing the sector with its automated software

Harnessing its innovative startups, Portugal builds a better cleantech ecosystem

With help from government and private-sector initiatives, Portuguese cleantech startups are playing an ever-increasing role in helping the country meet its energy challenges while cutting harmful greenhouse gases

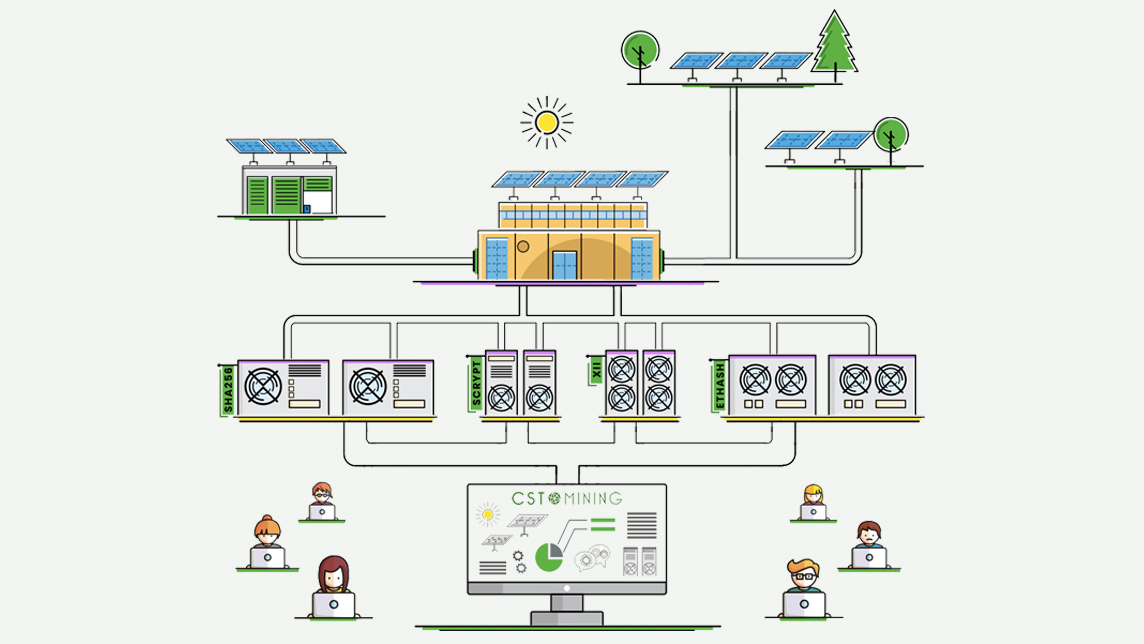

Cryptosolartech: Harnessing solar power to make cryptomining less environmentally harmful

The Spanish startup also sources cheaper electricity for cryptomining. It recently raised €8.85m in a pre-ICO, enabling it to build the world's first solar-powered cryptomining farm

Xurya: Pioneering solar power as a service in Indonesia with a leasing model

Targeting corporate customers without need for any upfront payment, two-year-old Xurya has already attracted major clients, and investment from Clime Capital’s impact investment fund SEACEF

US non-profit investor New Energy Nexus seeks to kickstart Indonesia’s clean energy sectors

With a “patient capital” approach to investments and a variety of programs, New Energy Nexus hopes to show that startups can lead the way in renewables and smart energy

SWITCH Singapore 2021: Driving renewable energy impact through better business models

Startups need to communicate the business benefits of green solutions to their customers, rather than just pitching the hi-tech

Solatom plans overseas expansion with backing from energy giants, impact investor

With a US patent in hand, the Valencian startup is banking on international sales of its concentrated solar power modules, targeting €1m in revenue by end-2021

Omniflow gets €2 million boost for its solar-, wind-powered IoT street lights

Thanks to Portugal's Omniflow, renewable energy street lamps doubling up as Wi-Fi hotspots, e-chargers and traffic monitors may soon be ubiquitous street furniture in tomorrow's smart cities

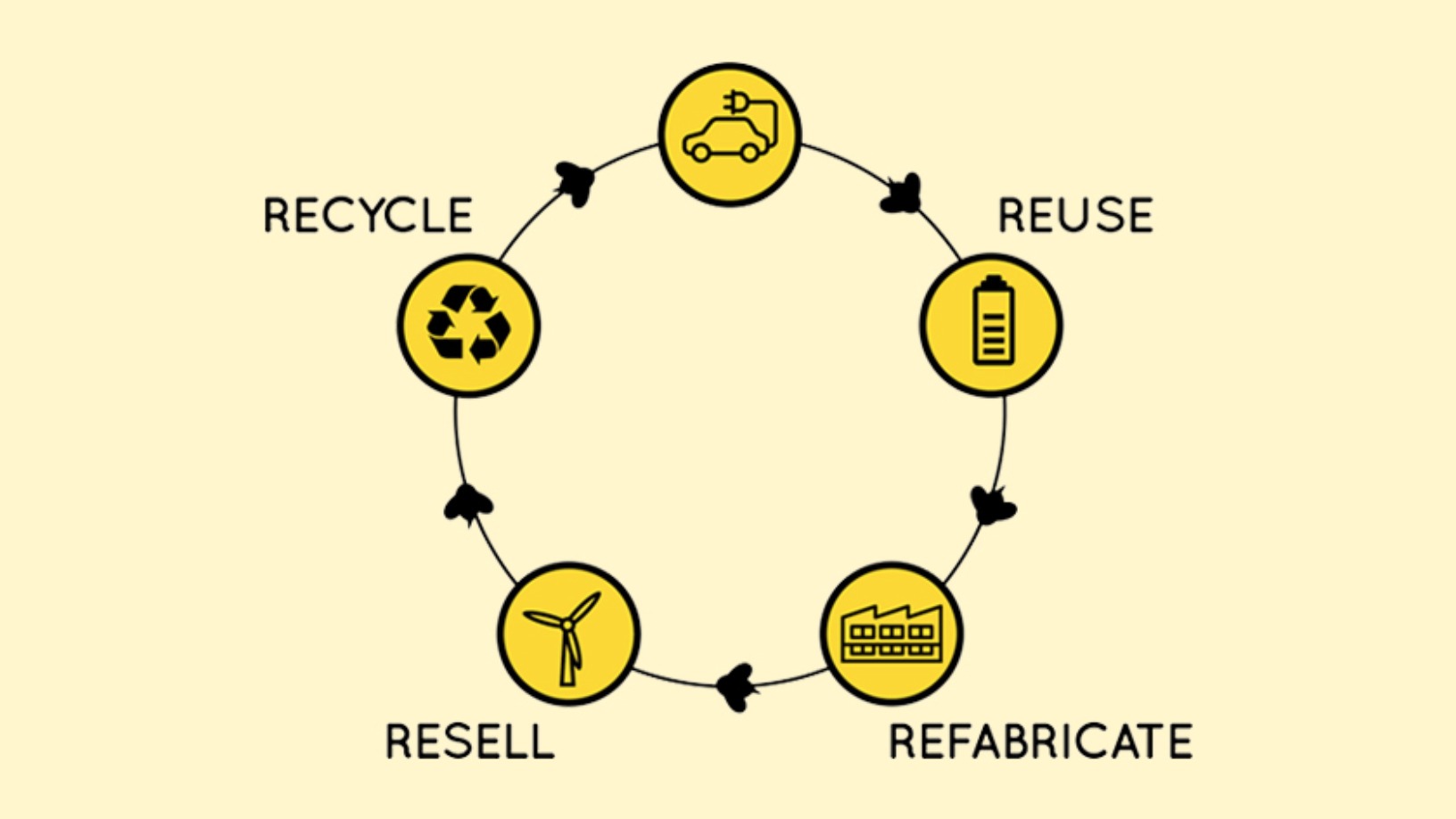

BeePlanet Factory: Recycling EV batteries as a sustainable, profitable business

With 4kWh–200kWh residential and industrial battery packs, the Pamplona-based startup wants to scale its energy storage solutions in the agri-food sector, camping sites and mountain huts

Renewable energy crowdfunding platform Fundeen eyes 2019 profit amid sector boom

The young Spanish startup is eyeing projects worth €220 million by 2023, while cutting CO2 emissions equivalent to 1.3 million Madrid-New York flights

SOURCE Global's solar-run panels turn air into drinking water

The US startup’s adapted solar panels extract water vapor from the air to produce potable water, a vital resource for distressed communities in disaster zones and remote areas

Spain’s 100% renewable energy goal: How its startup ecosystem is rising to the challenge

Energy majors and public entities are backing renewable energy startups in the country's bet on the Green Economy

Sorry, we couldn’t find any matches for“Solar energy”.