Sophie's Kitchen

-

DATABASE (340)

-

ARTICLES (489)

The municipal government of Wuhan launched Wuhan S&T Angel Venture Fund in September 2013. With RMB 300 million under management, the fund is operated by Wuhan S&T Angel Venture Fund Management Co., Ltd. It invests mainly in the information technology, new materials, advanced equipment manufacturing, biomedicine, new energy, automotive, energy conservation, environmental protection and modern agriculture fields.

The municipal government of Wuhan launched Wuhan S&T Angel Venture Fund in September 2013. With RMB 300 million under management, the fund is operated by Wuhan S&T Angel Venture Fund Management Co., Ltd. It invests mainly in the information technology, new materials, advanced equipment manufacturing, biomedicine, new energy, automotive, energy conservation, environmental protection and modern agriculture fields.

H&S Investment is a German investment company and accredited member of the Business Angels Network Germany (BAND). Founded by Martin Heubeck and Ulrich Stommel, the fund focuses on new technologies and innovations counting on over 25 years of experience in technology companies in Germany and overseas.

H&S Investment is a German investment company and accredited member of the Business Angels Network Germany (BAND). Founded by Martin Heubeck and Ulrich Stommel, the fund focuses on new technologies and innovations counting on over 25 years of experience in technology companies in Germany and overseas.

Co-founder of FarmCloud

Pedro S. Sarmento is a Portuguese technology entrepreneur and co-founder of FarmCloud, where he was head of strategy from its founding in April 2016 until June 2017. From June 2017 until April 2018, Sarmento was head of product for PriOps, a blockchain API data sharing platform, after which he assumed the CFO role at Kolokium Blockchain Technologies, the firm that commercializes PriOps' product. Sarmento had previously worked in a variety of entrepreneurial roles, including in the aquaculture and used goods sectors. He holds an MBA specializing in Management from Lisbon Lusiada University.

Pedro S. Sarmento is a Portuguese technology entrepreneur and co-founder of FarmCloud, where he was head of strategy from its founding in April 2016 until June 2017. From June 2017 until April 2018, Sarmento was head of product for PriOps, a blockchain API data sharing platform, after which he assumed the CFO role at Kolokium Blockchain Technologies, the firm that commercializes PriOps' product. Sarmento had previously worked in a variety of entrepreneurial roles, including in the aquaculture and used goods sectors. He holds an MBA specializing in Management from Lisbon Lusiada University.

Invest FWD A/S is an investment vehicle owned by Anders Holch Povlsen, founder of BESTSELLER and Heartland. It is also BESTSELLER’s investment arm for sustainable fashion. In June 2021, the firm made its investment by participating in a Series B round of Finnish cleantech Infinited Fiber. BESTSELLER’s sustainability innovation platform Fashion FWD Lab has been collaborating with Infinited Fiber over the past year to develop and patent Infinna™ fiber material. BESTSELLER has also signed a multi-year commercial agreement with Infinited Fiber to secure access to the startup’s regenerated fibers to be made from textile and other industrial waste.

Invest FWD A/S is an investment vehicle owned by Anders Holch Povlsen, founder of BESTSELLER and Heartland. It is also BESTSELLER’s investment arm for sustainable fashion. In June 2021, the firm made its investment by participating in a Series B round of Finnish cleantech Infinited Fiber. BESTSELLER’s sustainability innovation platform Fashion FWD Lab has been collaborating with Infinited Fiber over the past year to develop and patent Infinna™ fiber material. BESTSELLER has also signed a multi-year commercial agreement with Infinited Fiber to secure access to the startup’s regenerated fibers to be made from textile and other industrial waste.

Hirokazu “Hiro” Mashita is a founder and director at M&S Partners Pte Ltd, a venture capital firm based in Singapore. A prolific business angel, he is known to have invested in more than 20 Indian startups in 2015 alone, earning him the nickname “Super Angel from Japan”.

Hirokazu “Hiro” Mashita is a founder and director at M&S Partners Pte Ltd, a venture capital firm based in Singapore. A prolific business angel, he is known to have invested in more than 20 Indian startups in 2015 alone, earning him the nickname “Super Angel from Japan”.

Hera Capital is a Singapore-registered private fund management firm with an entrepreneur-focused strategy. Specifically, it invests in digital, consumer retail and media-related businesses. Hera Capital’s portfolio features notable businesses such as Sophie Paris (direct-sales fashion firm founded in Indonesia), SaladStop and Gojek.

Hera Capital is a Singapore-registered private fund management firm with an entrepreneur-focused strategy. Specifically, it invests in digital, consumer retail and media-related businesses. Hera Capital’s portfolio features notable businesses such as Sophie Paris (direct-sales fashion firm founded in Indonesia), SaladStop and Gojek.

Co-founder and CCO of Sampingan

Margana Mohamad studied Management and Entrepreneurship at Universitas Padjadjaran, Indonesia, from 2010 to 2014. As a student, he had run his own Bandung-based bartending and kitchen consultancy, which he left in 2016 to join pharmaceutical giant GSK. Between 2017 and 2018, Margana was managing director at outsourcing firm Palu Business Services, after which he established gig marketplace startup Sampingan.

Margana Mohamad studied Management and Entrepreneurship at Universitas Padjadjaran, Indonesia, from 2010 to 2014. As a student, he had run his own Bandung-based bartending and kitchen consultancy, which he left in 2016 to join pharmaceutical giant GSK. Between 2017 and 2018, Margana was managing director at outsourcing firm Palu Business Services, after which he established gig marketplace startup Sampingan.

SPH Media Fund is a S$100 million venture capital fund set up by government-backed listed group, Singapore Press Holdings Limited.The fund invests in early growth technology companies globally. Although the fund is stage agnostic, most of the portfolio companies are at Series A or later. The size of the investment depends on the needs of the startup. A typical ticket size is between S$1 million and S$2 million, with possible bigger amounts of up to S$5 million per round.

SPH Media Fund is a S$100 million venture capital fund set up by government-backed listed group, Singapore Press Holdings Limited.The fund invests in early growth technology companies globally. Although the fund is stage agnostic, most of the portfolio companies are at Series A or later. The size of the investment depends on the needs of the startup. A typical ticket size is between S$1 million and S$2 million, with possible bigger amounts of up to S$5 million per round.

Co-founder and CEO of Tiaoguoshi

The author of the earliest book on the online-to-offline (O2O) business model in China “Theory of O2O Evolution”, and an iResearch columnist, Yu Jinhua was an independent scholar before joining fresh fruit business Tiaoguoshi in May 2014, and transforming it into a roaring O2O success. He also once served as general manager, independent brands, at beauty e-retailer Lefeng.com, and vice-president of D&S Media Group, as well as created PR firm REBRAND. Aka Banzhuandayu, his online moniker, Yu was born in the 1970s and is married to fellow Tiaoguoshi co-founder Xiao Hongtao.

The author of the earliest book on the online-to-offline (O2O) business model in China “Theory of O2O Evolution”, and an iResearch columnist, Yu Jinhua was an independent scholar before joining fresh fruit business Tiaoguoshi in May 2014, and transforming it into a roaring O2O success. He also once served as general manager, independent brands, at beauty e-retailer Lefeng.com, and vice-president of D&S Media Group, as well as created PR firm REBRAND. Aka Banzhuandayu, his online moniker, Yu was born in the 1970s and is married to fellow Tiaoguoshi co-founder Xiao Hongtao.

Co-founder and CEO of Akseleran

Ivan Nikolas Tambunan is a lawyer-turned-entrepreneur who co-founded the P2P lending site Akseleran. After graduating from Universitas Indonesia in 2009 with a Bachelor's in Law, Ivan worked as an associate at AFS Partnership, handling various corporate law cases in civil and criminal courts. He left in 2011 for a short stint at the Makarim & Taira S law firm. In 2012, he joined Allen & Overy as a transactional banking lawyer. Before he left Allen & Overy in 2017, he advised various clients, including the Artha Graha Group and Macquarie. He and his co-founders started developing Akseleran in 2016 and launched an early version in March 2017.Ivan earned a Master's degree in Law & Finance from Queen Mary University of London. His thesis was on the topic of crowdfunding and became part of the inspiration behind establishing Akseleran.

Ivan Nikolas Tambunan is a lawyer-turned-entrepreneur who co-founded the P2P lending site Akseleran. After graduating from Universitas Indonesia in 2009 with a Bachelor's in Law, Ivan worked as an associate at AFS Partnership, handling various corporate law cases in civil and criminal courts. He left in 2011 for a short stint at the Makarim & Taira S law firm. In 2012, he joined Allen & Overy as a transactional banking lawyer. Before he left Allen & Overy in 2017, he advised various clients, including the Artha Graha Group and Macquarie. He and his co-founders started developing Akseleran in 2016 and launched an early version in March 2017.Ivan earned a Master's degree in Law & Finance from Queen Mary University of London. His thesis was on the topic of crowdfunding and became part of the inspiration behind establishing Akseleran.

Invested and used by BlackRock, the pioneer in AI-based qualitative analysis-recommendation SaaS for ESG investments covers 100k+ funds, 25k listed firms, with 1,000 indicators.

Invested and used by BlackRock, the pioneer in AI-based qualitative analysis-recommendation SaaS for ESG investments covers 100k+ funds, 25k listed firms, with 1,000 indicators.

Founder and CEO of ParkBox

Founder and CEO of ParkBox. Huang graduated from Zhejiang University with a bachelor’s in Engineering and Industrial Design. In 2016, she received her master’s in Management from the Stanford University Graduate School of Business. She worked at P&G for almost four years and then at Philips for five years. ParkBox is her first entrepreneurial venture.

Founder and CEO of ParkBox. Huang graduated from Zhejiang University with a bachelor’s in Engineering and Industrial Design. In 2016, she received her master’s in Management from the Stanford University Graduate School of Business. She worked at P&G for almost four years and then at Philips for five years. ParkBox is her first entrepreneurial venture.

Founded in 2012 in Geneva, Seedstars is one of the world’s largest accelerators with programs operating globally including Seedstars Global Startup Competition for emerging economies and seed-stage investors. Seedstars is also an investor, focusing on supporting startups founded in emerging economies across market segments. Its portfolio of 60 companies includes startups from its accelerator programs and participation in the $30,000 pre-seed round for Mexican loan fintech DB Menos. It is also one of two impact investors backing the $530,000 seed funding round for Bangladeshi cloud-kitchen and delivery startup Kludio.

Founded in 2012 in Geneva, Seedstars is one of the world’s largest accelerators with programs operating globally including Seedstars Global Startup Competition for emerging economies and seed-stage investors. Seedstars is also an investor, focusing on supporting startups founded in emerging economies across market segments. Its portfolio of 60 companies includes startups from its accelerator programs and participation in the $30,000 pre-seed round for Mexican loan fintech DB Menos. It is also one of two impact investors backing the $530,000 seed funding round for Bangladeshi cloud-kitchen and delivery startup Kludio.

Accelerating Asia focuses on Asian startups for its three-month intensive acceleration program. The Singapore-based investor was founded in 2018 and focuses on diversity investments, with 40% of its portfolio companies being led by women.The firm invests up to S$200,000 in participating pre-Series A startups. All of the program’s startups receive S$50,000–75,000 with an additional investment of up to S$150,000 for top performing companies.To date, the early-stage VC has invested in 25 startups. Recent investments in 2020 include stakes in Bangladeshi mobility platform Shuttle and Indonesian startups KaryaKarsa and MyBrand.

Accelerating Asia focuses on Asian startups for its three-month intensive acceleration program. The Singapore-based investor was founded in 2018 and focuses on diversity investments, with 40% of its portfolio companies being led by women.The firm invests up to S$200,000 in participating pre-Series A startups. All of the program’s startups receive S$50,000–75,000 with an additional investment of up to S$150,000 for top performing companies.To date, the early-stage VC has invested in 25 startups. Recent investments in 2020 include stakes in Bangladeshi mobility platform Shuttle and Indonesian startups KaryaKarsa and MyBrand.

Co-founder of Tonic App

Andrew Barnes is a Canadian resident and co-founder of Tonic App for doctors, which he co-founded in 2016 after meeting the co-founding team during MBA studies at IE Business School in Madrid. Barnes is currently both a Partner at Barnes Strategy, a consultancy for video game production, and the CEO at Coho Commissary, a shared kitchen community for food entrepreneurs, both in Vancouver. He was previously COO and co-founder of Preview Careers, an external university relations agency in Vancouver, and a Senior Director at Electronic Arts gaming company in the same city.

Andrew Barnes is a Canadian resident and co-founder of Tonic App for doctors, which he co-founded in 2016 after meeting the co-founding team during MBA studies at IE Business School in Madrid. Barnes is currently both a Partner at Barnes Strategy, a consultancy for video game production, and the CEO at Coho Commissary, a shared kitchen community for food entrepreneurs, both in Vancouver. He was previously COO and co-founder of Preview Careers, an external university relations agency in Vancouver, and a Senior Director at Electronic Arts gaming company in the same city.

Yudha Kartohadiprodjo wants to empower Indonesian farmers

Kartohadiprodjo founded Karsa, an agritech social media startup, to arm farmers with better knowledge and information sharing

“Sniper investor” Zhu Xiaohu: GSR Ventures chief’s slow but steady way of spotting future unicorns

Known for his conservative investing in China’s often-euphoric tech startup scene, Zhu Xiaohu has caught unicorns like Didi Chuxing while making a profitable exit from Ofo just before it sank

Iomob: Universal mobility app to help people find best route from A to B

Rapid growth in MaaS will boost revenue to over €1m by 2020 for Spanish transport app Iomob

Visualfy: Tech for autonomy for the hearing-impaired, at home and in public

Visualfy’s app-plus-hardware solution helps the deaf lead fully independent lives

Shrimp-farming data made easy: Interview with JALA’s CEO Liris Maduningtyas

Indonesian agritech startup JALA managed to overcome the hurdles caused by lack of experience after participating in accelerator programs. It is now taking the next steps to better products

Carlos Guerrero: The legal guardian of tech startups

The lawyer and investor dives deep in the Spanish startup ecosystem, supporting young tech companies with both financial and specialized legal support

Gojek acquires Indonesian POS startup Moka, gains greater share of SME fintech market

Deal reportedly worth $120m will add Moka's network of over 30,000 merchants to Gojek's reach

IONIC AI: Human-centric technology that enhances mobile phone performance

Giving new life to old mobile phones and upgrading cheaper ones, IONIC AI's tech also keeps gamers' phones cool for longer usage

Dronak looks beyond the skies to a future of robotics

Dronak CEO Fabia Silva wants to make the world a better place through robotics innovation, but needs funding so the company can spread its tech wings past drones

HighPitch: E-grocery marketplace Pasar20 and healthcare edtech Appskep top the Medan chapter

Representing Sumatra’s startup ecosystem in the national finals later in November, Pasar20 and Appskep have ambitious expansion plans in store

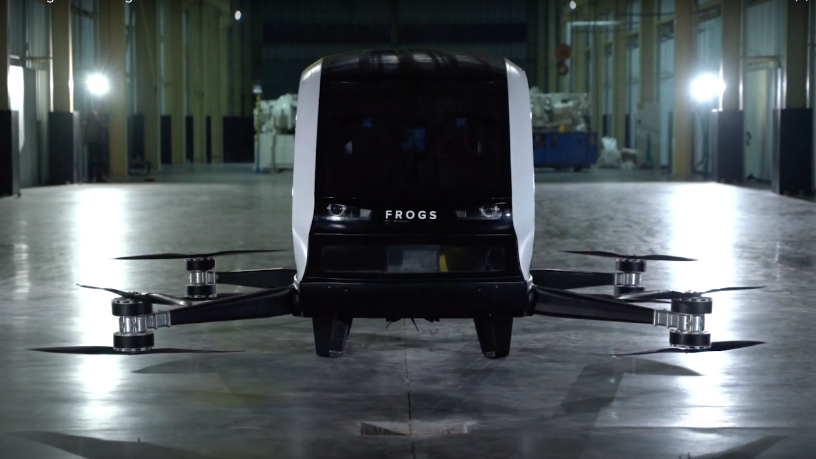

FROGS: Overcoming challenges to launch Indonesia's first drone-taxi for daily commutes

The Yogyakarta-based startup backed by UMG Idealab seeks more technical resources to launch Indonesia's first homegrown “flying taxi,” after the success of its agritech drones

Nucaps Nanotechnology: New encapsulation tech for nutritional and pharmaceutical sectors

Nucaps Nanotechnology is growing through a mix of accelerating market penetration and continuous R&D

Xu Jinghong: Champion of young entrepreneurs and high-tech startups

Under Xu Jinghong’s leadership, Tsinghua Holdings grew its assets sevenfold and incubated over 10,000 businesses. In his new role as VC investor, Xu wants to nurture startups into future global leaders

Senior Deli: Creating easy-to-swallow, appealing food for dysphagia sufferers

Already supplying to over 200 senior homes and hospitals, the Future Food Asia 2021 co-winner uses proprietary tech to make nutritious, affordable texture-modified foods for people with swallowing difficulties

Stockeld Dreamery: Vegan cheese created together with chefs

Backed by €16.5m in new funding, Stockeld Dreamery sets to expand into Europe and North America, and double its team to 50 a year on

Sorry, we couldn’t find any matches for“Sophie's Kitchen”.