Sophie's BioNutrients

-

DATABASE (335)

-

ARTICLES (484)

Founded in 2015, Zuoyu Capital is a research investment firm focused on the travel & tourism and consumer services sectors. It manages an angel fund of RMB 100 million.

Founded in 2015, Zuoyu Capital is a research investment firm focused on the travel & tourism and consumer services sectors. It manages an angel fund of RMB 100 million.

Founded in 1994, Fosun Pharma covers all key sectors of the pharmaceutical and healthcare industrial chain. It has been aggressively expanding globally, conducting investment and M&As in healthcare industries.

Founded in 1994, Fosun Pharma covers all key sectors of the pharmaceutical and healthcare industrial chain. It has been aggressively expanding globally, conducting investment and M&As in healthcare industries.

Founded in 2014, Prosperico Ventures targets the healthcare sector. The VC has invested in nearly 30 startups working on medical devices, pharmaceutical R&D, provision of medical services and precision medicine.

Founded in 2014, Prosperico Ventures targets the healthcare sector. The VC has invested in nearly 30 startups working on medical devices, pharmaceutical R&D, provision of medical services and precision medicine.

Verlinvest is the investment diversification vehicle of the de Spoelberch family, the Belgian noble house, which founded the AB InBev beverage conglomerate. Founded in 1995, it currently manages over €1.6bn in assets across multiple geographies, including Europe, India, Southeast Asia and Latin America. Aside from investing in various F&B brands like Vita Coco (coconut water), F&B Asia (which operates various restaurant franchise brands in Southeast Asia) and Glaceau Vitamin Water, it has also backed e-commerce businesses like Global Fashion Group and Lazada, as well as Indian edtech platform Byju’s.

Verlinvest is the investment diversification vehicle of the de Spoelberch family, the Belgian noble house, which founded the AB InBev beverage conglomerate. Founded in 1995, it currently manages over €1.6bn in assets across multiple geographies, including Europe, India, Southeast Asia and Latin America. Aside from investing in various F&B brands like Vita Coco (coconut water), F&B Asia (which operates various restaurant franchise brands in Southeast Asia) and Glaceau Vitamin Water, it has also backed e-commerce businesses like Global Fashion Group and Lazada, as well as Indian edtech platform Byju’s.

Founded in 1969, Hong Kong-based Sun Hung Kai & Co is an investment company listed in the Hong Kong Stock Exchange. Its founder, Fung King-hey, is also the co-founder of Sun Hung Kai Properties. It invests mainly in finance, fintech, health insurance, media and technology sectors. The company has about HKD 43bn in assets and is the main shareholder of UA Finance and Everbright Sun Hung Kai.

Founded in 1969, Hong Kong-based Sun Hung Kai & Co is an investment company listed in the Hong Kong Stock Exchange. Its founder, Fung King-hey, is also the co-founder of Sun Hung Kai Properties. It invests mainly in finance, fintech, health insurance, media and technology sectors. The company has about HKD 43bn in assets and is the main shareholder of UA Finance and Everbright Sun Hung Kai.

CICC Jiatai Fund (RMB M&A Fund) is managed by the private equity department of China International Capital Corporation Limited (CICC). It focuses on industrial consolidation, growth enterprise and cross-border investment opportunities.

CICC Jiatai Fund (RMB M&A Fund) is managed by the private equity department of China International Capital Corporation Limited (CICC). It focuses on industrial consolidation, growth enterprise and cross-border investment opportunities.

H&CK Partners is a private equity firm based in South Korea. Its expertise primarily lies in the South Korean and Southeast Asian markets, with a focus on small to mid-sized deals (US$10-100 million).

H&CK Partners is a private equity firm based in South Korea. Its expertise primarily lies in the South Korean and Southeast Asian markets, with a focus on small to mid-sized deals (US$10-100 million).

Co-founder and CEO of Seedrs

Formerly a corporate and M&A lawyer in New York and London, Jeff Lynn began his career at Sullivan & Cromwell LLP after graduating from the University of Virginia School of Law and the University of Oxford (where he majored in Civil Law). The US-born Lynn later obtained an MBA from the Saïd Business School, University of Oxford, and went on to co-found equity crowdfunding platform Seedrs.

Formerly a corporate and M&A lawyer in New York and London, Jeff Lynn began his career at Sullivan & Cromwell LLP after graduating from the University of Virginia School of Law and the University of Oxford (where he majored in Civil Law). The US-born Lynn later obtained an MBA from the Saïd Business School, University of Oxford, and went on to co-found equity crowdfunding platform Seedrs.

Based in Seattle, Washington, Pivotal Ventures was founded by Melinda Gates in 2015 as a separate, independent organization from the Bill & Melinda Gates Foundation. The VC-arm and incubator aim to foster social innovation in the US, focusing on the social progress of women and families. It has supported diversity & inclusion, healthcare and impact startups by providing early-stage funding to enterprises with philanthropic and scalable goals. In October 2020, Pivotal launched a fund for adolescent mental health in partnership with Panorama Global. In September 2020, it also joined Techstars to create a new accelerator program to find innovative eldercare solutions for seniors and their caregivers.

Based in Seattle, Washington, Pivotal Ventures was founded by Melinda Gates in 2015 as a separate, independent organization from the Bill & Melinda Gates Foundation. The VC-arm and incubator aim to foster social innovation in the US, focusing on the social progress of women and families. It has supported diversity & inclusion, healthcare and impact startups by providing early-stage funding to enterprises with philanthropic and scalable goals. In October 2020, Pivotal launched a fund for adolescent mental health in partnership with Panorama Global. In September 2020, it also joined Techstars to create a new accelerator program to find innovative eldercare solutions for seniors and their caregivers.

Mitchell Presser is a New York-based lawyer. He is currently co-chair of global law service Morrison & Foerster’s Global Corporate Department and a partner in the firm’s M&A and Private Equity group, advising on agriculture, amongst other areas. He previously was a founding partner of Paine Schwartz, a US-based $1.2 bn private equity firm specializing in sustainable food chain investing from 2006 to 2014. His sole disclosed angel investment to date was an undisclosed sum in the pre-seed funding of NovoNutrients, the US-based biotech producer of alt-protein from fermentation using CO2 and other emissions,

Mitchell Presser is a New York-based lawyer. He is currently co-chair of global law service Morrison & Foerster’s Global Corporate Department and a partner in the firm’s M&A and Private Equity group, advising on agriculture, amongst other areas. He previously was a founding partner of Paine Schwartz, a US-based $1.2 bn private equity firm specializing in sustainable food chain investing from 2006 to 2014. His sole disclosed angel investment to date was an undisclosed sum in the pre-seed funding of NovoNutrients, the US-based biotech producer of alt-protein from fermentation using CO2 and other emissions,

Started in 2008 by Joe Zhou (Zhou Zhixiong), one of the founders of Kleiner Perkins Caufield & Byers' China fund, Keytone Ventures primarily invests in high-growth companies in the cleantech, media, hi-tech and consumer sectors.

Started in 2008 by Joe Zhou (Zhou Zhixiong), one of the founders of Kleiner Perkins Caufield & Byers' China fund, Keytone Ventures primarily invests in high-growth companies in the cleantech, media, hi-tech and consumer sectors.

58 Industry Fund is the VC arm of China’s leading local services provider 58 Group. Founded in 2018, the fund mainly invests in early- and mid-stage startups working on urban lifestyle and education & training.

58 Industry Fund is the VC arm of China’s leading local services provider 58 Group. Founded in 2018, the fund mainly invests in early- and mid-stage startups working on urban lifestyle and education & training.

Co-founder and CTO of Shangshangqian (BestSign)

Lin Xianfeng has 13 years of experience in R&D and management, and was a former senior IT specialist at Alibaba.

Lin Xianfeng has 13 years of experience in R&D and management, and was a former senior IT specialist at Alibaba.

Co-founder & CEO of Parclick

Luis Paris is co-founder and CEO of Parclick, a parking reservation app. He is an Industrial engineer who built his career in the US, Europe and Venezuela leading projects for HP, Procter & Gamble and British American Tobacco. Paris holds an MBA and a master's in Supply Chain Management. He also attended an executive program at Harvard Business School where he specialized in new internet ventures and an M&A program at the London Business School.

Luis Paris is co-founder and CEO of Parclick, a parking reservation app. He is an Industrial engineer who built his career in the US, Europe and Venezuela leading projects for HP, Procter & Gamble and British American Tobacco. Paris holds an MBA and a master's in Supply Chain Management. He also attended an executive program at Harvard Business School where he specialized in new internet ventures and an M&A program at the London Business School.

Sophie's Bionutrients: Alternative protein from microalgae

Inspired by fish in the ocean, the startup developed microalgae-based flour that can take on unlimited forms, textures or colors to make almost any alt protein product

SWITCH Singapore: Sustainability startups see growing demand from corporates

Sophie’s BioNutrients, Ubiik and Intello Labs also note new trends in technology and supply chain arising from the Covid-19 pandemic, across the food, manufacturing and e-commerce sectors

Plant-based meat faces backlash in China despite gaining traction

An innocuous video clip sparked debate on social media over plant-based meat, with suspicion about its nutritional value, cost-effectiveness and even the motives of foreign companies

Les Nouveaux Affineurs: Disrupting centuries-old French cheese culture

Backed by Michelin-star chefs and investors, Les Noveaux Affineurs is gearing up to be a global player in the billion-dollar vegan cheese market

CarBlock eyes opportunities presented by the multi-billion car data market

This startup aims to transform the connected car and transportation industry by building a data circulation system based on blockchain

Tuvalum: Fast-growing vertical marketplace for used quality bikes

Banking on organic reach, Tuvalum has set its sights on a €40 billion market

This voice technology startup empowers both developers and machines

AISpeech shifted its business from education to IoT but has always remained focused on voice interaction between humans and machines

Sequoia China Seed Fund: Growing an era of deep-tech startups

Managing Partner Neil Shen wants to help deep-tech and enterprise tech startups get investments more easily, across quantum computing, semiconductors, synthetic biology and more

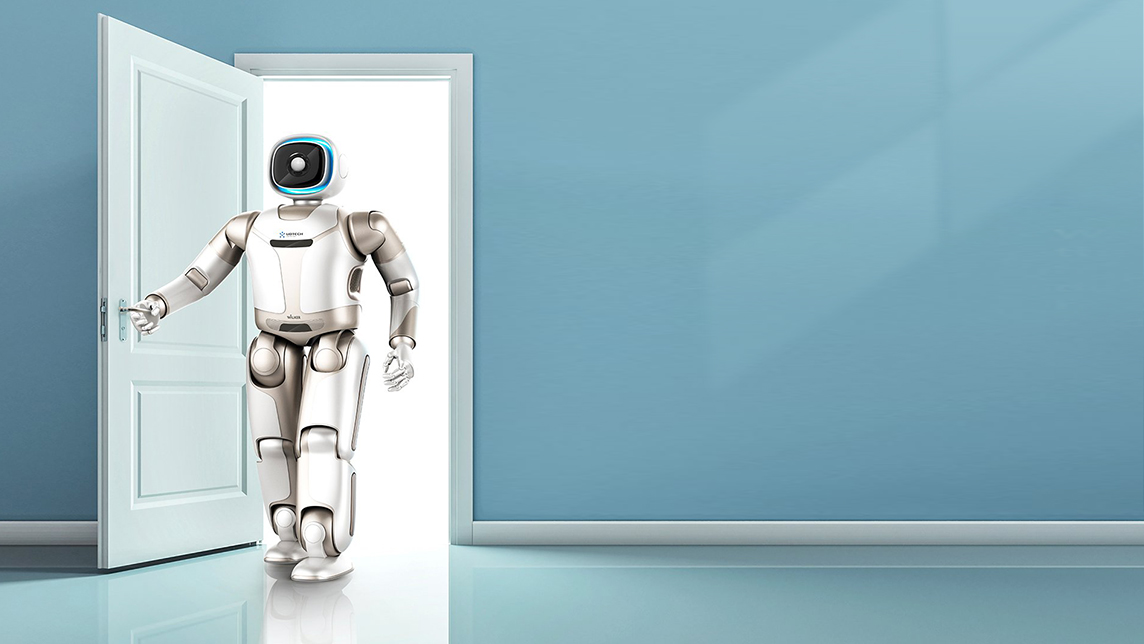

UBTECH: CES robotics star wants to bring humanoid robots to every family

UBTECH’s next-generation bipedal robot recently made an impressive global debut, and the startup’s founder has once again become the focus of attention

Bukalapak CEO under fire for tweet about Indonesia’s R&D budget

Achmad Zaky is the latest top startup executive to get embroiled in a politically charged social media storm

Will China ride into a car-sharing future?

Chinese car-sharing startups face reckoning as more than 500 players crowd into a fast-growing, but young, market

How Xiaomi founder Lei Jun became a billionaire by pursuing passion, not fortune

From young man deconstructing and rebuilding smartphones at Kingsoft to top of the smartphone world as founder and chair of Xiaomi, Lei has always let his interests lead the way

Yu Minhong: Rags-to-riches education guru

When the New Oriental founder was working in the rice paddies as a teenager, it never occurred to him that he would become the richest teacher in China one day

After a Covid-led boom in 2020, what next for China's K-12 edtech?

Unicorns Yuanfudao and Zuoyebang raised more than $6bn combined last year as demand for online learning continues to grow, but some smaller players are running out of cash

Meituan, the “Amazon for local services”

Now worth over US$50 billion, the company has always focused on one end-goal: help consumers eat better, live better

Sorry, we couldn’t find any matches for“Sophie's BioNutrients”.