Sophie's Kitchen

-

DATABASE (340)

-

ARTICLES (489)

The municipal government of Wuhan launched Wuhan S&T Angel Venture Fund in September 2013. With RMB 300 million under management, the fund is operated by Wuhan S&T Angel Venture Fund Management Co., Ltd. It invests mainly in the information technology, new materials, advanced equipment manufacturing, biomedicine, new energy, automotive, energy conservation, environmental protection and modern agriculture fields.

The municipal government of Wuhan launched Wuhan S&T Angel Venture Fund in September 2013. With RMB 300 million under management, the fund is operated by Wuhan S&T Angel Venture Fund Management Co., Ltd. It invests mainly in the information technology, new materials, advanced equipment manufacturing, biomedicine, new energy, automotive, energy conservation, environmental protection and modern agriculture fields.

Biotech Bluepha has secured close to $100m Series B funding to boost bioplastics production and R&D to develop greener solutions for industrial manufacturers.

Biotech Bluepha has secured close to $100m Series B funding to boost bioplastics production and R&D to develop greener solutions for industrial manufacturers.

H&S Investment is a German investment company and accredited member of the Business Angels Network Germany (BAND). Founded by Martin Heubeck and Ulrich Stommel, the fund focuses on new technologies and innovations counting on over 25 years of experience in technology companies in Germany and overseas.

H&S Investment is a German investment company and accredited member of the Business Angels Network Germany (BAND). Founded by Martin Heubeck and Ulrich Stommel, the fund focuses on new technologies and innovations counting on over 25 years of experience in technology companies in Germany and overseas.

Pawoon enables SMEs to automate POS and business transactions to create a real-time data kitchen through its cloud-based mobile technology.

Pawoon enables SMEs to automate POS and business transactions to create a real-time data kitchen through its cloud-based mobile technology.

The first Chinese rehabilitation robotics company to have its robots used for clinical and research purposes in major rehabilitation hospitals and institutions worldwide.

The first Chinese rehabilitation robotics company to have its robots used for clinical and research purposes in major rehabilitation hospitals and institutions worldwide.

Cheers Capital Partners is a PE investment firm focusing on early- and growth-stage investment in internet, IT, culture & media and consumption & retail sectors.

Cheers Capital Partners is a PE investment firm focusing on early- and growth-stage investment in internet, IT, culture & media and consumption & retail sectors.

H&M’s first shop was founded 74 years ago in Sweden by Erling Persson under the name “Hennes”, Swedish for "hers" since the shop was selling only women's apparel. In 1968, Persson expanded into menswear by acquiring Swedish retailer Mauritz Widforss. Hence the rebranding of the company into Hennes & Mauritz (H&M). In 1974, H&M was listed on the Stockholm Stock Exchange. Since then, H&M has expanding internationally opening its first store in London and the rest of Europe and also to the US in early 2000.In 2008, the company also moved into the home furnishings segment and launched H&M Home stores worldwide. The fashion chain can now be found across Europe, the US, Asia and the Middle East. The group expanded further by acquiring fast-fashion brands like Weekday, Monki and Cheap Monday. In April 2021, H&M Group announced a collaboration with textile cleantech Infinited Fiber to launch proof-of-concept denim created wholly from regenerated textile waste as part of its commitment to use only recycled or sustainably sourced materials by 2030.

H&M’s first shop was founded 74 years ago in Sweden by Erling Persson under the name “Hennes”, Swedish for "hers" since the shop was selling only women's apparel. In 1968, Persson expanded into menswear by acquiring Swedish retailer Mauritz Widforss. Hence the rebranding of the company into Hennes & Mauritz (H&M). In 1974, H&M was listed on the Stockholm Stock Exchange. Since then, H&M has expanding internationally opening its first store in London and the rest of Europe and also to the US in early 2000.In 2008, the company also moved into the home furnishings segment and launched H&M Home stores worldwide. The fashion chain can now be found across Europe, the US, Asia and the Middle East. The group expanded further by acquiring fast-fashion brands like Weekday, Monki and Cheap Monday. In April 2021, H&M Group announced a collaboration with textile cleantech Infinited Fiber to launch proof-of-concept denim created wholly from regenerated textile waste as part of its commitment to use only recycled or sustainably sourced materials by 2030.

SEEDS Capital is the investment arm of Enterprise Singapore supporting locally based startups that have innovative technologies and global market potential. Sectors of focus include advanced manufacturing & engineering, health & biomedical sciences, urban sustainability & solutions, fintech, artificial intelligence and agritech. SEEDS currently works with more than 500 deep tech startups, and over 40 incubators, accelerators and venture capital firms.

SEEDS Capital is the investment arm of Enterprise Singapore supporting locally based startups that have innovative technologies and global market potential. Sectors of focus include advanced manufacturing & engineering, health & biomedical sciences, urban sustainability & solutions, fintech, artificial intelligence and agritech. SEEDS currently works with more than 500 deep tech startups, and over 40 incubators, accelerators and venture capital firms.

For rich Chinese wanting to acquire nice things and good taste, glamorous lifestyle editor Wendy can help with her online magazine, e-store and offline events.

For rich Chinese wanting to acquire nice things and good taste, glamorous lifestyle editor Wendy can help with her online magazine, e-store and offline events.

Hirokazu “Hiro” Mashita is a founder and director at M&S Partners Pte Ltd, a venture capital firm based in Singapore. A prolific business angel, he is known to have invested in more than 20 Indian startups in 2015 alone, earning him the nickname “Super Angel from Japan”.

Hirokazu “Hiro” Mashita is a founder and director at M&S Partners Pte Ltd, a venture capital firm based in Singapore. A prolific business angel, he is known to have invested in more than 20 Indian startups in 2015 alone, earning him the nickname “Super Angel from Japan”.

Investisseurs & Partenaires (I&P)

Set up in 2002 by Patrice Hoppenot 15 years after he founded European investment fund BC Partners, Investisseurs & Partenaires (I&P) is an impact investor seeking to help SMEs prosper in Africa and create sustainable jobs and income there. With about €210m raised to date, I&P finances SMEs, startups and regional investment funds in Africa through equity participation and loans, as well as through microfinance institutions. Its I&P Acceleration Technologies focuses on digital startups with €2.5m of funding to be invested in 10–15 startups in 2020–2023. To date, I&P has supported more than 100 capital-funded companies and 20 companies benefiting from subsidized acceleration programs. I&P has about 100 staff based in Paris, Washington D.C. and in seven African offices (Burkina Faso, Cameroon, Côte d'Ivoire, Ghana, Madagascar, Niger and Senegal).

Set up in 2002 by Patrice Hoppenot 15 years after he founded European investment fund BC Partners, Investisseurs & Partenaires (I&P) is an impact investor seeking to help SMEs prosper in Africa and create sustainable jobs and income there. With about €210m raised to date, I&P finances SMEs, startups and regional investment funds in Africa through equity participation and loans, as well as through microfinance institutions. Its I&P Acceleration Technologies focuses on digital startups with €2.5m of funding to be invested in 10–15 startups in 2020–2023. To date, I&P has supported more than 100 capital-funded companies and 20 companies benefiting from subsidized acceleration programs. I&P has about 100 staff based in Paris, Washington D.C. and in seven African offices (Burkina Faso, Cameroon, Côte d'Ivoire, Ghana, Madagascar, Niger and Senegal).

Co-founder and CEO of Akseleran

Ivan Nikolas Tambunan is a lawyer-turned-entrepreneur who co-founded the P2P lending site Akseleran. After graduating from Universitas Indonesia in 2009 with a Bachelor's in Law, Ivan worked as an associate at AFS Partnership, handling various corporate law cases in civil and criminal courts. He left in 2011 for a short stint at the Makarim & Taira S law firm. In 2012, he joined Allen & Overy as a transactional banking lawyer. Before he left Allen & Overy in 2017, he advised various clients, including the Artha Graha Group and Macquarie. He and his co-founders started developing Akseleran in 2016 and launched an early version in March 2017.Ivan earned a Master's degree in Law & Finance from Queen Mary University of London. His thesis was on the topic of crowdfunding and became part of the inspiration behind establishing Akseleran.

Ivan Nikolas Tambunan is a lawyer-turned-entrepreneur who co-founded the P2P lending site Akseleran. After graduating from Universitas Indonesia in 2009 with a Bachelor's in Law, Ivan worked as an associate at AFS Partnership, handling various corporate law cases in civil and criminal courts. He left in 2011 for a short stint at the Makarim & Taira S law firm. In 2012, he joined Allen & Overy as a transactional banking lawyer. Before he left Allen & Overy in 2017, he advised various clients, including the Artha Graha Group and Macquarie. He and his co-founders started developing Akseleran in 2016 and launched an early version in March 2017.Ivan earned a Master's degree in Law & Finance from Queen Mary University of London. His thesis was on the topic of crowdfunding and became part of the inspiration behind establishing Akseleran.

Market leader Tuhu offers quality tires, auto aftermarket services and much more–at low prices, 24-hour online ordering and installation at its nationwide partner garages.

Market leader Tuhu offers quality tires, auto aftermarket services and much more–at low prices, 24-hour online ordering and installation at its nationwide partner garages.

Guangdong China Science & Merchants Capital Management

Founded in 2009, Guangdong China Science & Merchants Capital Management is a subsidiary of China Science & Merchants Investment (Fund) Management, with the support of the Guangdong government. It invests in pre-IPO companies, regional leading enterprises and fast-growing innovative startups.

Founded in 2009, Guangdong China Science & Merchants Capital Management is a subsidiary of China Science & Merchants Investment (Fund) Management, with the support of the Guangdong government. It invests in pre-IPO companies, regional leading enterprises and fast-growing innovative startups.

Future Food Asia 2021: Regenerative agriculture in Asia

The unique challenges facing regenerative agriculture in Asia require solutions different from those in the West, presenting opportunities for microfinancing and impact investment

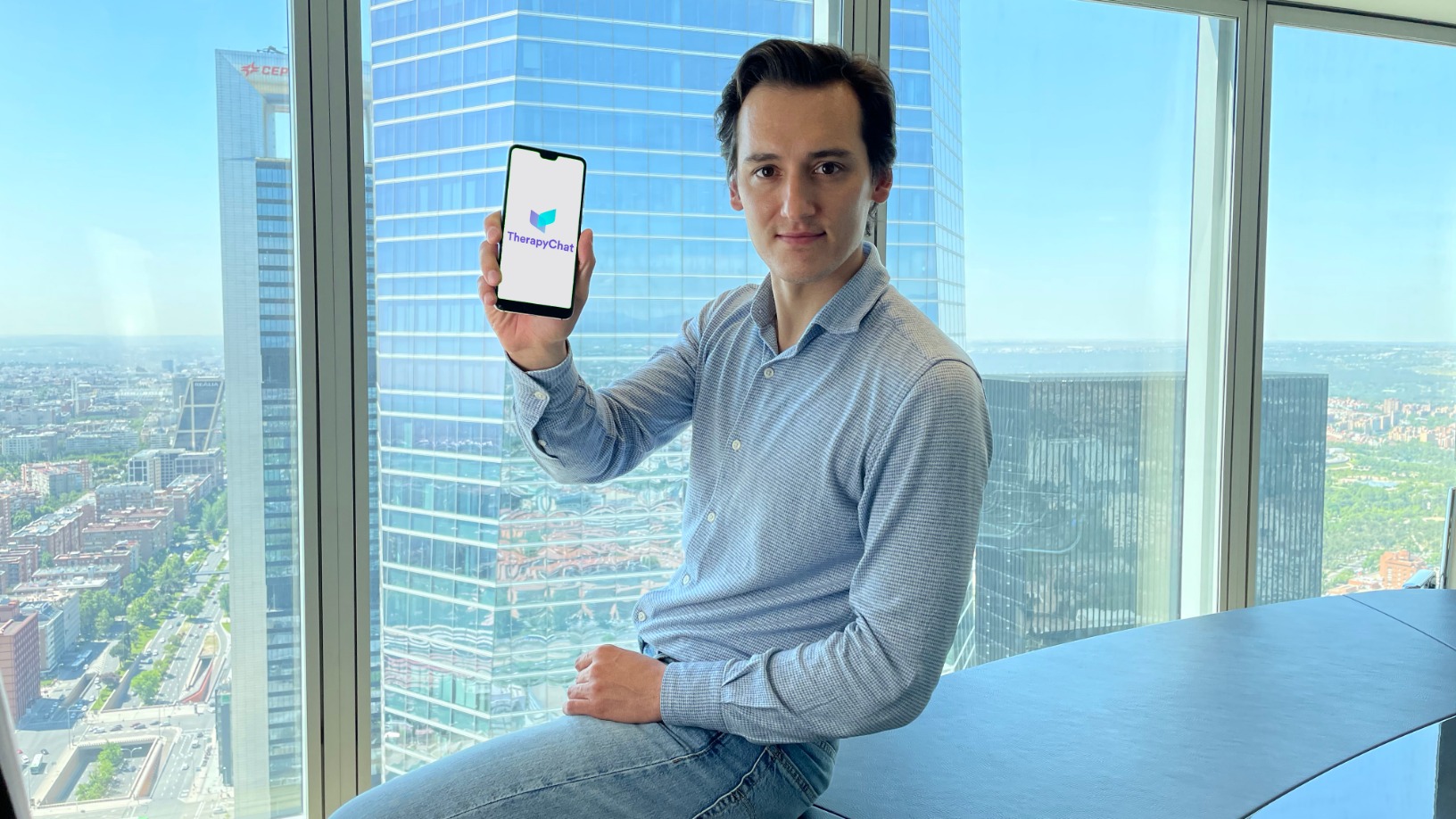

TherapyChat: Using AI to scale and improve accuracy in mental health treatment

Business for the Spanish startup has surged ninefold since Covid-19, with the company expanding to the UK and Italy

Forget solar panels and batteries, Bioo wants to scale soil bioelectricity generation

Improving on NASA’s microbial fuel cell tech, Bioo hopes to boost crop efficiency and transform the way urbanites live, in future green cities powered by plants

Vegan fish substitute Mimic Seafood set to disrupt the sustainable food market

Founder of food innovation hub Ivoro launches Mimic Seafood, a European pioneer in vegan fish substitutes

New Food Invest: Growing an alternative protein business in Asia

With more than 4bn people, Asia presents unique opportunities and challenges to alternative protein startups. Four leading entrepreneurs shared their experiences at the recent New Food Invest conference

Catalonia: Spain's fast-rising robotics hub and next opportunity

With the robotics sector on the rise in Catalonia, expect to see more growth ahead, driving opportunities in related segments, especially services

ID Capital CEO & founder Isabelle Decitre, an early mover investing in Asian agrifood startups

An early backer of Ynsect, one of the best-funded insect protein startups to date, Decitre sees growing interest in agrifood tech startups, but notes they still need to offer exit opportunities

SOURCE Global's solar-run panels turn air into drinking water

The US startup’s adapted solar panels extract water vapor from the air to produce potable water, a vital resource for distressed communities in disaster zones and remote areas

Solatom plans overseas expansion with backing from energy giants, impact investor

With a US patent in hand, the Valencian startup is banking on international sales of its concentrated solar power modules, targeting €1m in revenue by end-2021

Diamond Foundry: Growing conflict-free, eco-friendly diamonds in a lab

The world’s first lab-grown diamond producer certified carbon-neutral, Diamond Foundry became a unicorn recently with a $200m investment from Fidelity, adding to earlier funding from tech billionaires

South Summit 2021: European seed investment is booming post-Covid

Investors from The Fund, Northzone and Pale Blue Dot highlight climate change, consumer credit and business tools as hot areas to follow

OLIO: Zero food waste app expands with new product categories, going global

Recent $43m Series B funding will let sustainability app more than triple hiring, add homemade products and household goods to product listings

QOA: Gourmet guilt-free chocolate, without the cocoa

Munich-based QOA transforms industrial food waste into vegan chocolate, enabling consumers to avoid the sustainability and ethical issues of cocoa production

FIWARE Accelerator: More open source ecosystem than accelerator

The European open source initiative to boost smart infrastructures and solutions is calling for new participants to join its unique acceleration ecosystem

China’s online mutual aid market: A new battleground for tech giants and startups

Startups spotted the opportunity and tech giants too have entered a market seen tripling by 2025. But profitability is still in doubt amid regulatory uncertainty

Sorry, we couldn’t find any matches for“Sophie's Kitchen”.