Sophie's BioNutrients

-

DATABASE (335)

-

ARTICLES (484)

The municipal government of Wuhan launched Wuhan S&T Angel Venture Fund in September 2013. With RMB 300 million under management, the fund is operated by Wuhan S&T Angel Venture Fund Management Co., Ltd. It invests mainly in the information technology, new materials, advanced equipment manufacturing, biomedicine, new energy, automotive, energy conservation, environmental protection and modern agriculture fields.

The municipal government of Wuhan launched Wuhan S&T Angel Venture Fund in September 2013. With RMB 300 million under management, the fund is operated by Wuhan S&T Angel Venture Fund Management Co., Ltd. It invests mainly in the information technology, new materials, advanced equipment manufacturing, biomedicine, new energy, automotive, energy conservation, environmental protection and modern agriculture fields.

Biotech Bluepha has secured close to $100m Series B funding to boost bioplastics production and R&D to develop greener solutions for industrial manufacturers.

Biotech Bluepha has secured close to $100m Series B funding to boost bioplastics production and R&D to develop greener solutions for industrial manufacturers.

Pawoon enables SMEs to automate POS and business transactions to create a real-time data kitchen through its cloud-based mobile technology.

Pawoon enables SMEs to automate POS and business transactions to create a real-time data kitchen through its cloud-based mobile technology.

The first Chinese rehabilitation robotics company to have its robots used for clinical and research purposes in major rehabilitation hospitals and institutions worldwide.

The first Chinese rehabilitation robotics company to have its robots used for clinical and research purposes in major rehabilitation hospitals and institutions worldwide.

H&S Investment is a German investment company and accredited member of the Business Angels Network Germany (BAND). Founded by Martin Heubeck and Ulrich Stommel, the fund focuses on new technologies and innovations counting on over 25 years of experience in technology companies in Germany and overseas.

H&S Investment is a German investment company and accredited member of the Business Angels Network Germany (BAND). Founded by Martin Heubeck and Ulrich Stommel, the fund focuses on new technologies and innovations counting on over 25 years of experience in technology companies in Germany and overseas.

Cheers Capital Partners is a PE investment firm focusing on early- and growth-stage investment in internet, IT, culture & media and consumption & retail sectors.

Cheers Capital Partners is a PE investment firm focusing on early- and growth-stage investment in internet, IT, culture & media and consumption & retail sectors.

H&M’s first shop was founded 74 years ago in Sweden by Erling Persson under the name “Hennes”, Swedish for "hers" since the shop was selling only women's apparel. In 1968, Persson expanded into menswear by acquiring Swedish retailer Mauritz Widforss. Hence the rebranding of the company into Hennes & Mauritz (H&M). In 1974, H&M was listed on the Stockholm Stock Exchange. Since then, H&M has expanding internationally opening its first store in London and the rest of Europe and also to the US in early 2000.In 2008, the company also moved into the home furnishings segment and launched H&M Home stores worldwide. The fashion chain can now be found across Europe, the US, Asia and the Middle East. The group expanded further by acquiring fast-fashion brands like Weekday, Monki and Cheap Monday. In April 2021, H&M Group announced a collaboration with textile cleantech Infinited Fiber to launch proof-of-concept denim created wholly from regenerated textile waste as part of its commitment to use only recycled or sustainably sourced materials by 2030.

H&M’s first shop was founded 74 years ago in Sweden by Erling Persson under the name “Hennes”, Swedish for "hers" since the shop was selling only women's apparel. In 1968, Persson expanded into menswear by acquiring Swedish retailer Mauritz Widforss. Hence the rebranding of the company into Hennes & Mauritz (H&M). In 1974, H&M was listed on the Stockholm Stock Exchange. Since then, H&M has expanding internationally opening its first store in London and the rest of Europe and also to the US in early 2000.In 2008, the company also moved into the home furnishings segment and launched H&M Home stores worldwide. The fashion chain can now be found across Europe, the US, Asia and the Middle East. The group expanded further by acquiring fast-fashion brands like Weekday, Monki and Cheap Monday. In April 2021, H&M Group announced a collaboration with textile cleantech Infinited Fiber to launch proof-of-concept denim created wholly from regenerated textile waste as part of its commitment to use only recycled or sustainably sourced materials by 2030.

SEEDS Capital is the investment arm of Enterprise Singapore supporting locally based startups that have innovative technologies and global market potential. Sectors of focus include advanced manufacturing & engineering, health & biomedical sciences, urban sustainability & solutions, fintech, artificial intelligence and agritech. SEEDS currently works with more than 500 deep tech startups, and over 40 incubators, accelerators and venture capital firms.

SEEDS Capital is the investment arm of Enterprise Singapore supporting locally based startups that have innovative technologies and global market potential. Sectors of focus include advanced manufacturing & engineering, health & biomedical sciences, urban sustainability & solutions, fintech, artificial intelligence and agritech. SEEDS currently works with more than 500 deep tech startups, and over 40 incubators, accelerators and venture capital firms.

For rich Chinese wanting to acquire nice things and good taste, glamorous lifestyle editor Wendy can help with her online magazine, e-store and offline events.

For rich Chinese wanting to acquire nice things and good taste, glamorous lifestyle editor Wendy can help with her online magazine, e-store and offline events.

Investisseurs & Partenaires (I&P)

Set up in 2002 by Patrice Hoppenot 15 years after he founded European investment fund BC Partners, Investisseurs & Partenaires (I&P) is an impact investor seeking to help SMEs prosper in Africa and create sustainable jobs and income there. With about €210m raised to date, I&P finances SMEs, startups and regional investment funds in Africa through equity participation and loans, as well as through microfinance institutions. Its I&P Acceleration Technologies focuses on digital startups with €2.5m of funding to be invested in 10–15 startups in 2020–2023. To date, I&P has supported more than 100 capital-funded companies and 20 companies benefiting from subsidized acceleration programs. I&P has about 100 staff based in Paris, Washington D.C. and in seven African offices (Burkina Faso, Cameroon, Côte d'Ivoire, Ghana, Madagascar, Niger and Senegal).

Set up in 2002 by Patrice Hoppenot 15 years after he founded European investment fund BC Partners, Investisseurs & Partenaires (I&P) is an impact investor seeking to help SMEs prosper in Africa and create sustainable jobs and income there. With about €210m raised to date, I&P finances SMEs, startups and regional investment funds in Africa through equity participation and loans, as well as through microfinance institutions. Its I&P Acceleration Technologies focuses on digital startups with €2.5m of funding to be invested in 10–15 startups in 2020–2023. To date, I&P has supported more than 100 capital-funded companies and 20 companies benefiting from subsidized acceleration programs. I&P has about 100 staff based in Paris, Washington D.C. and in seven African offices (Burkina Faso, Cameroon, Côte d'Ivoire, Ghana, Madagascar, Niger and Senegal).

Market leader Tuhu offers quality tires, auto aftermarket services and much more–at low prices, 24-hour online ordering and installation at its nationwide partner garages.

Market leader Tuhu offers quality tires, auto aftermarket services and much more–at low prices, 24-hour online ordering and installation at its nationwide partner garages.

Guangdong China Science & Merchants Capital Management

Founded in 2009, Guangdong China Science & Merchants Capital Management is a subsidiary of China Science & Merchants Investment (Fund) Management, with the support of the Guangdong government. It invests in pre-IPO companies, regional leading enterprises and fast-growing innovative startups.

Founded in 2009, Guangdong China Science & Merchants Capital Management is a subsidiary of China Science & Merchants Investment (Fund) Management, with the support of the Guangdong government. It invests in pre-IPO companies, regional leading enterprises and fast-growing innovative startups.

The state-backed, Shanghai-based media and entertainment investment group controlled by media mogul Li Ruigang has made its name and fortune in China's most lucrative industries: media & entertainment, Internet & mobile, sport & lifestyle. CMC's portfolio includes Star China, IMAX China, Flagship Entertainment, Oriental DreamWorks, TVB, Whaley Technologies, Imagine Entertainment, Shaw Brothers, Caixin, Gewara, and more. Li, who started out as a lifestyle TV reporter, set up CMC in 2009 with a RMB 2 billion fund.

The state-backed, Shanghai-based media and entertainment investment group controlled by media mogul Li Ruigang has made its name and fortune in China's most lucrative industries: media & entertainment, Internet & mobile, sport & lifestyle. CMC's portfolio includes Star China, IMAX China, Flagship Entertainment, Oriental DreamWorks, TVB, Whaley Technologies, Imagine Entertainment, Shaw Brothers, Caixin, Gewara, and more. Li, who started out as a lifestyle TV reporter, set up CMC in 2009 with a RMB 2 billion fund.

Co-founder and CEO of Akseleran

Ivan Nikolas Tambunan is a lawyer-turned-entrepreneur who co-founded the P2P lending site Akseleran. After graduating from Universitas Indonesia in 2009 with a Bachelor's in Law, Ivan worked as an associate at AFS Partnership, handling various corporate law cases in civil and criminal courts. He left in 2011 for a short stint at the Makarim & Taira S law firm. In 2012, he joined Allen & Overy as a transactional banking lawyer. Before he left Allen & Overy in 2017, he advised various clients, including the Artha Graha Group and Macquarie. He and his co-founders started developing Akseleran in 2016 and launched an early version in March 2017.Ivan earned a Master's degree in Law & Finance from Queen Mary University of London. His thesis was on the topic of crowdfunding and became part of the inspiration behind establishing Akseleran.

Ivan Nikolas Tambunan is a lawyer-turned-entrepreneur who co-founded the P2P lending site Akseleran. After graduating from Universitas Indonesia in 2009 with a Bachelor's in Law, Ivan worked as an associate at AFS Partnership, handling various corporate law cases in civil and criminal courts. He left in 2011 for a short stint at the Makarim & Taira S law firm. In 2012, he joined Allen & Overy as a transactional banking lawyer. Before he left Allen & Overy in 2017, he advised various clients, including the Artha Graha Group and Macquarie. He and his co-founders started developing Akseleran in 2016 and launched an early version in March 2017.Ivan earned a Master's degree in Law & Finance from Queen Mary University of London. His thesis was on the topic of crowdfunding and became part of the inspiration behind establishing Akseleran.

Spanish startups protest the lack of relevant aid, compared with other EU countries; investors warn of “disastrous” new foreign investment restriction

Lawtech startup Reclamador.es takes negligent companies to task

Reclamador.es’ team of top-notch lawyers has seen a 98% success rate in their fight for consumers’ rights, though scaling up has been difficult

Bound4Blue taps aeronautical technology for sustainable shipping solutions

Bound4Blue's wind-assisted vessel propulsion saves 40% on fuel costs in a €200bn market; eyes European, Asian expansion

Cecilia Tham: the power of shifting paradigms

The embodiment of unconventional thinking and creativity, this female entrepreneur from Hong Kong has been pioneering social transformation within Barcelona's startup ecosystem since 2011

HEMAV: World’s leading drone services company for agriculture

Now a global leader known for its industry-targeted software, HEMAV has expanded to 15 countries, working with utilities, farms and public bodies

SmartAHC: Wearables for pigs and smart farm management to boost productivity

SmartAHC has also expanded beyond pig farms to related sectors in the supply chain, including insurance, banking and local government

Nongguanjia: Housekeeper of Chinese farmers' fortunes

Combining fintech and e-commerce, Nongguanjia started by monetizing land circulation, to help hundreds of millions of Chinese farmers get financing and thrive

Xtrem Biotech, an agritech startup from Granada, seeks global expansion

With its research roots in the University of Granada, Xtrem Biotech was named one of the world's most innovative agtech spin-offs by accelerator TERRA Food & AgTech

HighPitch 2020: Goers wins Indonesia's national startup competition

Event ticketing startup Goers gains new revenue streams with pivot to helping leisure spots go online; hotel SaaS Izy and on-demand medical testing service CekLab also in top three

SWITCH Singapore: Race in agrifood tech as a solution to feeding 10bn people

While the potential gains are huge, giving tech solutions to farmers, especially smallholders in developing countries, remains a work in progress

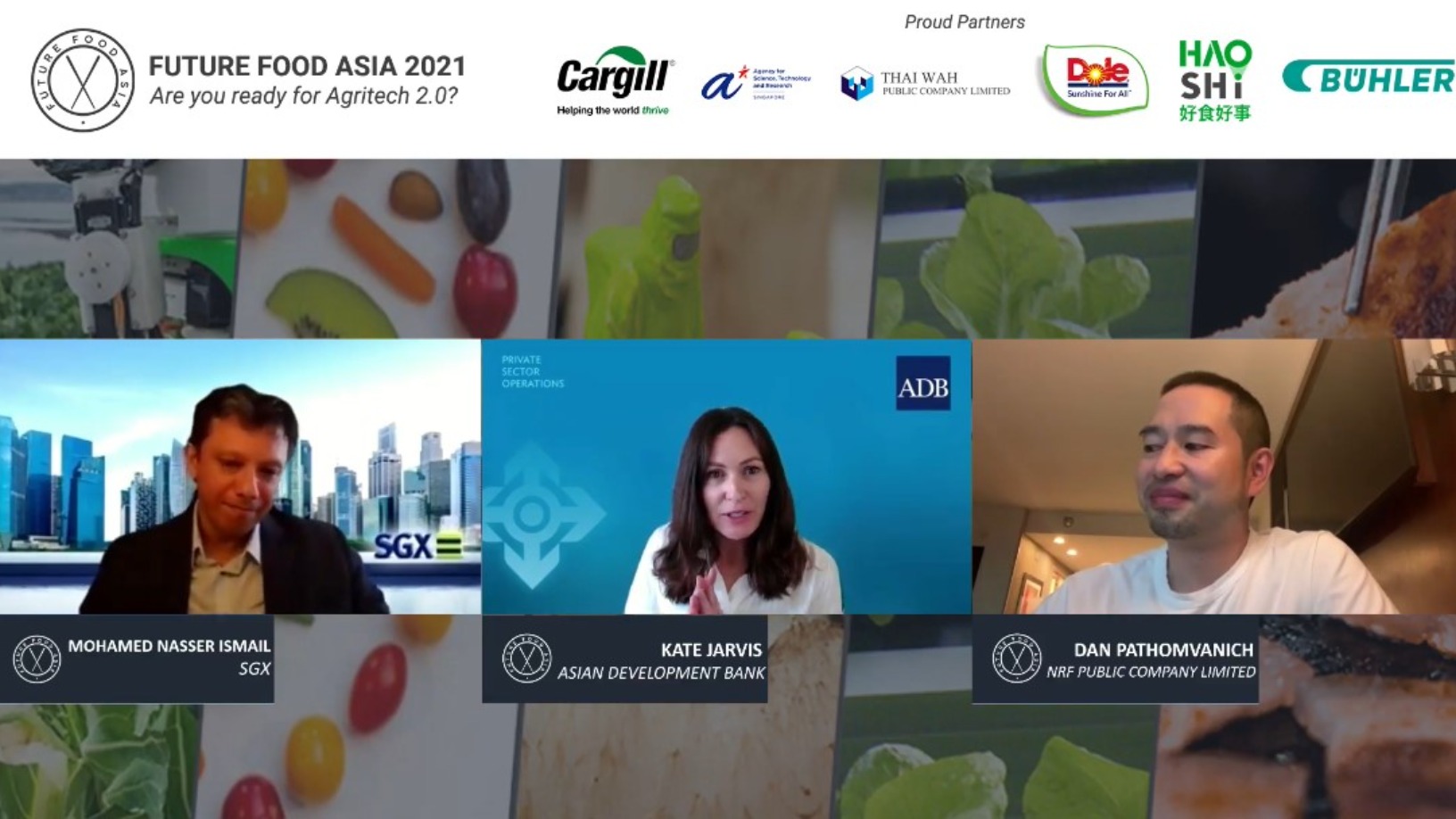

Future Food Asia 2021: Agrifood tech at an inflection point

Agrifood tech startups urged to harness consumer, investor and government feedback to create plentiful, nutritious food through sustainable means, but exercise caution when considering IPOs

Covid-19 symptoms checker and contact-tracing apps, virtual classrooms and 3D video-conferencing platforms are among the array of solutions for homebound adults and kids

Chinese startups join the race to address chip shortage amid funding boom

Would an overheated semiconductor startup scene and the ability to design cutting-edge chips be enough to help China achieve chip self-sufficiency?

Alén Space: Nanosatellite company targets contracts of over €2 million by 2020

Alén Space seeks funding of €1.5 million to accelerate plans to win a share of the global market of 2,600 small satellites to be launched by 2023

EatTasty: Portugal's sustainable meal delivery service has arrived in Spain

EatTasty's different and more sustainable business model turns the on-demand food delivery sector on its head

Sorry, we couldn’t find any matches for“Sophie's BioNutrients”.