Sophie's BioNutrients

-

DATABASE (335)

-

ARTICLES (484)

Co-founder and CTO of PrivyID

Guritno Adi Saputra graduated from Institut Sains & Teknologi AKPRIND, Indonesia with a bachelor's in Information Technology. Between 2013 and 2015, he was a web developer at Yogyakarta technology consultancy firm IndonesiaJogja Info Service and INDigital. Guritno is co-founder and CTO of digital signature startup PrivyID.

Guritno Adi Saputra graduated from Institut Sains & Teknologi AKPRIND, Indonesia with a bachelor's in Information Technology. Between 2013 and 2015, he was a web developer at Yogyakarta technology consultancy firm IndonesiaJogja Info Service and INDigital. Guritno is co-founder and CTO of digital signature startup PrivyID.

Co-founder and CEO of Talkdesk

Software engineer and entrepreneur Tiago Paiva holds a master’s degree in Network and Telecommunications from the Technical University of Lisbon. Previous to Talkdesk, he was a developer at Procter & Gamble. With co-founder and former classmate Cristina Fonseca, Paiva initially developed Talkdesk as a prototype at a Twilio-hosted hackathon.

Software engineer and entrepreneur Tiago Paiva holds a master’s degree in Network and Telecommunications from the Technical University of Lisbon. Previous to Talkdesk, he was a developer at Procter & Gamble. With co-founder and former classmate Cristina Fonseca, Paiva initially developed Talkdesk as a prototype at a Twilio-hosted hackathon.

China Science & Merchants Investment Management Group (CSC)

Founded in 2000, Shan Xiangshuang's private equity outfit China Science & Merchants Investment Management Group (CSC) has about US$10 billion under management. It has an extensive network in China and built relationships with more than 1,000 LPs. Dubbed "China's Schwarzman," Shan set up CSC with RMB 600,000. The company went public on China's New Third Board (NEEQ) in 2015, where it raised almost US$2 billion.

Founded in 2000, Shan Xiangshuang's private equity outfit China Science & Merchants Investment Management Group (CSC) has about US$10 billion under management. It has an extensive network in China and built relationships with more than 1,000 LPs. Dubbed "China's Schwarzman," Shan set up CSC with RMB 600,000. The company went public on China's New Third Board (NEEQ) in 2015, where it raised almost US$2 billion.

Lin Hai majored in Materials Science and Engineering at Tsinghua University and holds an EMBA from China Europe International Business School (CEIBS). He co-founded A8 Digital Music in 2000, which later became one of the largest digital music platforms in China. Lin is currently the secretary-general of CEIBS Alumni Mobile Club’ southern offices and the president of Shenzhen Nanshan Cultural & Creative Industry Association.

Lin Hai majored in Materials Science and Engineering at Tsinghua University and holds an EMBA from China Europe International Business School (CEIBS). He co-founded A8 Digital Music in 2000, which later became one of the largest digital music platforms in China. Lin is currently the secretary-general of CEIBS Alumni Mobile Club’ southern offices and the president of Shenzhen Nanshan Cultural & Creative Industry Association.

Founded in 2007 under the Chinese Fortune 500 company DunAn Group, the investment group manages total fund of RMB 6 billion today, with successful investment in 77 Chinese startups across multiple sectors including healthcare, advanced manufacturing, energy & cleantech, etc. It was nominated for “Top 10 Zhengjiang Investment Group” for seven years in a row and was awarded for “Chinese VC of Best Potential” in 2016 – 2017 by thecapital.com.cn.

Founded in 2007 under the Chinese Fortune 500 company DunAn Group, the investment group manages total fund of RMB 6 billion today, with successful investment in 77 Chinese startups across multiple sectors including healthcare, advanced manufacturing, energy & cleantech, etc. It was nominated for “Top 10 Zhengjiang Investment Group” for seven years in a row and was awarded for “Chinese VC of Best Potential” in 2016 – 2017 by thecapital.com.cn.

Founded in 2003, Hina Group is an investment bank that provides financial consulting services. It has helped more than 180 companies close their funding and perform M&As. The total value of these transactions is US$56 billion. Hina Group oversaw Alibaba’s acquisition of Ele.me and the merger Qunar.com and Ctrip. Hina Group manages over RMB 10 billion. It has invested in unicorns such as Hujiang.com and Youbao.

Founded in 2003, Hina Group is an investment bank that provides financial consulting services. It has helped more than 180 companies close their funding and perform M&As. The total value of these transactions is US$56 billion. Hina Group oversaw Alibaba’s acquisition of Ele.me and the merger Qunar.com and Ctrip. Hina Group manages over RMB 10 billion. It has invested in unicorns such as Hujiang.com and Youbao.

Taking venture capital to the next level of “Peace, Love and Seed funding”, Nordic Makers is a hands-on seed stage investor with business experience in the Nordic countries and abroad. The firm is founded and managed by serial entrepreneurs who are passionate about building and scaling tech companies for future M&A strategic planning and collaborations.

Taking venture capital to the next level of “Peace, Love and Seed funding”, Nordic Makers is a hands-on seed stage investor with business experience in the Nordic countries and abroad. The firm is founded and managed by serial entrepreneurs who are passionate about building and scaling tech companies for future M&A strategic planning and collaborations.

WuXi AppTec is a Chinese company that specializes in the outsourcing of R&D in the pharmaceuticals, biotechnology and medical devices sectors. Listed on the Hong Kong Stock Exchange, WuXi AppTec has invested in drug development and healthcare firms globally. Its portfolio includes Insilico Medicine, which is developing an AI platform for drug development, brain disease research firm Verge Genomics and Indonesian healthcare platform Halodoc.

WuXi AppTec is a Chinese company that specializes in the outsourcing of R&D in the pharmaceuticals, biotechnology and medical devices sectors. Listed on the Hong Kong Stock Exchange, WuXi AppTec has invested in drug development and healthcare firms globally. Its portfolio includes Insilico Medicine, which is developing an AI platform for drug development, brain disease research firm Verge Genomics and Indonesian healthcare platform Halodoc.

The Oil & Natural Gas Corporation, also known as Maharatna ONGC, is the largest crude oil and natural gas company in India, contributing around 75% of India’s domestic production. It has committed to carbon reduction initiatives and has 15 projects that can potentially reduce total emissions equivalent to 2.1m tons of CO2 annually. String Bio is its first tech startup investment, part of the Series A round in 2019.

The Oil & Natural Gas Corporation, also known as Maharatna ONGC, is the largest crude oil and natural gas company in India, contributing around 75% of India’s domestic production. It has committed to carbon reduction initiatives and has 15 projects that can potentially reduce total emissions equivalent to 2.1m tons of CO2 annually. String Bio is its first tech startup investment, part of the Series A round in 2019.

Founded over 110 years ago from several small agricultural cooperative banks, the Dutch commercial banking group Rabobank has over 10m customers across 47 countries. The banking group’s Rabo Investments vehicle manages Rabo Ventures with a €120m fund investing globally in early-stage fintech and agtech startups. There is also a €30m fund-of-funds to partner with leading VCs in other funding rounds like the $12m funding round of Dutch e-scooter company GO Sharing.The Rabobank Food & Agri Innovation Fund specializes in supporting enterprises involved in creating sustainable solutions for diverse food and agricultural sectors including livestock farms. Rabo F&A Innovation Fund currently has 11 agri-foodtech startups in its portfolio, including participation in a $12m Series A round of Vence, US-based virtual fencing tech company for livestock management.

Founded over 110 years ago from several small agricultural cooperative banks, the Dutch commercial banking group Rabobank has over 10m customers across 47 countries. The banking group’s Rabo Investments vehicle manages Rabo Ventures with a €120m fund investing globally in early-stage fintech and agtech startups. There is also a €30m fund-of-funds to partner with leading VCs in other funding rounds like the $12m funding round of Dutch e-scooter company GO Sharing.The Rabobank Food & Agri Innovation Fund specializes in supporting enterprises involved in creating sustainable solutions for diverse food and agricultural sectors including livestock farms. Rabo F&A Innovation Fund currently has 11 agri-foodtech startups in its portfolio, including participation in a $12m Series A round of Vence, US-based virtual fencing tech company for livestock management.

Co-Founder of Zhen Robotics

Co-founder of Zhen Robotics. Born in Hong Kong, he has a bachelor’s degree in Computer Science from the Chinese University of Hong Kong and a master’s degree in Innovation, Entrepreneurship & Management from Imperial College London. Prior to founding Zhen Robotics with his schoolmate Liu Zhiyong, he worked for a Fortune 500 technology company in Hong Kong.

Co-founder of Zhen Robotics. Born in Hong Kong, he has a bachelor’s degree in Computer Science from the Chinese University of Hong Kong and a master’s degree in Innovation, Entrepreneurship & Management from Imperial College London. Prior to founding Zhen Robotics with his schoolmate Liu Zhiyong, he worked for a Fortune 500 technology company in Hong Kong.

R&D Manager of AEInnova

Joan Oliver Malagelada is an engineer with a PhD and experience in microsensing and ultra-low power electronics. He is a co-founder of AEInnova and currently serves as its R&D manager and advisor. Since 1990, Oliver has been a physics professor at the Autonomous University of Barcelona.

Joan Oliver Malagelada is an engineer with a PhD and experience in microsensing and ultra-low power electronics. He is a co-founder of AEInnova and currently serves as its R&D manager and advisor. Since 1990, Oliver has been a physics professor at the Autonomous University of Barcelona.

Co-founder and COO of AltStory

Zeng Zhujuan graduated from Franklin & Marshall College in 2012 with a bachelor's degree in Business, Organization, and Society. She earned her MBA from Johns Hopkins University and a master's degree in Design Leadership from the Maryland Institute College of Art, both in 2015. She co-founded AltStory with Gary Kun (Kun Peng) in 2017.

Zeng Zhujuan graduated from Franklin & Marshall College in 2012 with a bachelor's degree in Business, Organization, and Society. She earned her MBA from Johns Hopkins University and a master's degree in Design Leadership from the Maryland Institute College of Art, both in 2015. She co-founded AltStory with Gary Kun (Kun Peng) in 2017.

One of the world’s oldest venture capital firms, Greylock Partner was founded in 1965 in Cambridge, Massachusetts by Bill Elfers and Dan Gregory, and later Charlie Waite. It has offices in Silicon Valley, San Francisco and Wellesley and over US$3.5 billion under management. Focused on early-stage startups, Greylock has backed more than 120 profitable M&As and more than 170 IPOs, including Facebook, LinkedIn and Workday.

One of the world’s oldest venture capital firms, Greylock Partner was founded in 1965 in Cambridge, Massachusetts by Bill Elfers and Dan Gregory, and later Charlie Waite. It has offices in Silicon Valley, San Francisco and Wellesley and over US$3.5 billion under management. Focused on early-stage startups, Greylock has backed more than 120 profitable M&As and more than 170 IPOs, including Facebook, LinkedIn and Workday.

Pedro Luis Uriarte Santamarina

Pedro Luis Uriarte Santamarina was the CEO of Spanish multinational bank BBVA from 1994 to 2001. He was also the Regional Minister-Economy & Finance of the first autonomous government of the Basque Country region in Spain. After being one of the creators of the Basque Agency for Innovation, Uriarte became an early investor of Indexa Capital and Bewa7er, both of which are co-founded by Unai Asenjo Barra.

Pedro Luis Uriarte Santamarina was the CEO of Spanish multinational bank BBVA from 1994 to 2001. He was also the Regional Minister-Economy & Finance of the first autonomous government of the Basque Country region in Spain. After being one of the creators of the Basque Agency for Innovation, Uriarte became an early investor of Indexa Capital and Bewa7er, both of which are co-founded by Unai Asenjo Barra.

Plant-based meat faces backlash in China despite gaining traction

An innocuous video clip sparked debate on social media over plant-based meat, with suspicion about its nutritional value, cost-effectiveness and even the motives of foreign companies

Sophie's Bionutrients: Alternative protein from microalgae

Inspired by fish in the ocean, the startup developed microalgae-based flour that can take on unlimited forms, textures or colors to make almost any alt protein product

SWITCH Singapore: Sustainability startups see growing demand from corporates

Sophie’s BioNutrients, Ubiik and Intello Labs also note new trends in technology and supply chain arising from the Covid-19 pandemic, across the food, manufacturing and e-commerce sectors

CarBlock eyes opportunities presented by the multi-billion car data market

This startup aims to transform the connected car and transportation industry by building a data circulation system based on blockchain

Sequoia China Seed Fund: Growing an era of deep-tech startups

Managing Partner Neil Shen wants to help deep-tech and enterprise tech startups get investments more easily, across quantum computing, semiconductors, synthetic biology and more

Tuvalum: Fast-growing vertical marketplace for used quality bikes

Banking on organic reach, Tuvalum has set its sights on a €40 billion market

This voice technology startup empowers both developers and machines

AISpeech shifted its business from education to IoT but has always remained focused on voice interaction between humans and machines

Les Nouveaux Affineurs: Disrupting centuries-old French cheese culture

Backed by Michelin-star chefs and investors, Les Noveaux Affineurs is gearing up to be a global player in the billion-dollar vegan cheese market

After a Covid-led boom in 2020, what next for China's K-12 edtech?

Unicorns Yuanfudao and Zuoyebang raised more than $6bn combined last year as demand for online learning continues to grow, but some smaller players are running out of cash

Will China ride into a car-sharing future?

Chinese car-sharing startups face reckoning as more than 500 players crowd into a fast-growing, but young, market

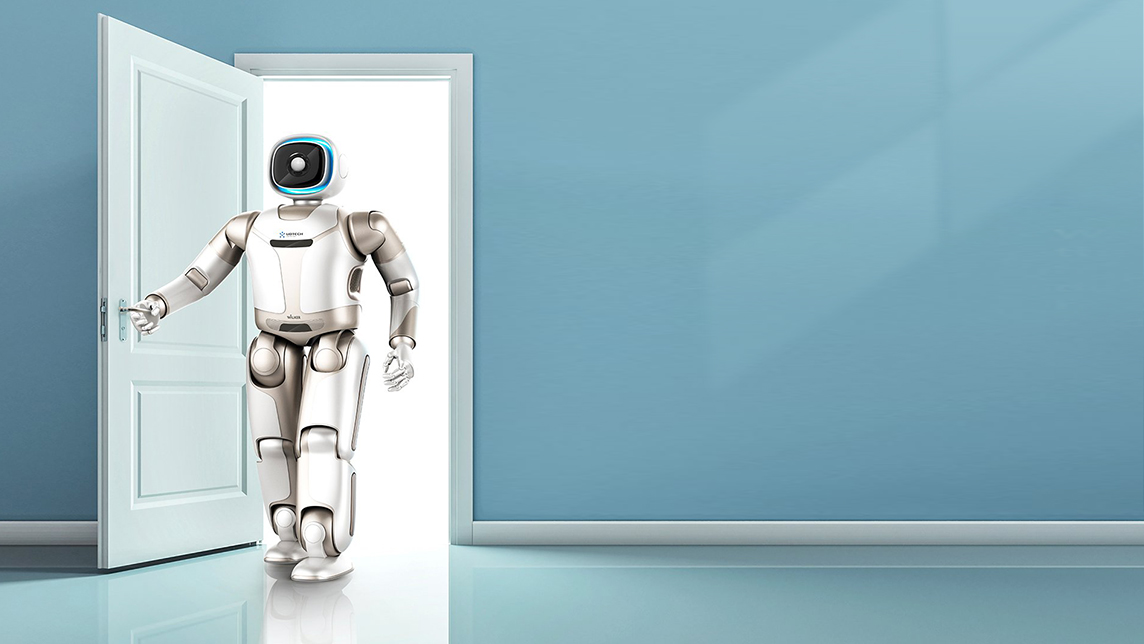

UBTECH: CES robotics star wants to bring humanoid robots to every family

UBTECH’s next-generation bipedal robot recently made an impressive global debut, and the startup’s founder has once again become the focus of attention

Bukalapak CEO under fire for tweet about Indonesia’s R&D budget

Achmad Zaky is the latest top startup executive to get embroiled in a politically charged social media storm

How Xiaomi founder Lei Jun became a billionaire by pursuing passion, not fortune

From young man deconstructing and rebuilding smartphones at Kingsoft to top of the smartphone world as founder and chair of Xiaomi, Lei has always let his interests lead the way

Yu Minhong: Rags-to-riches education guru

When the New Oriental founder was working in the rice paddies as a teenager, it never occurred to him that he would become the richest teacher in China one day

BioMind: AI medical diagnostics with over 90% accuracy for 100 diseases

BioMind helps doctors save lives by providing more accurate diagnosis of life-threatening diseases like Covid-19 and brain tumors

Sorry, we couldn’t find any matches for“Sophie's BioNutrients”.