South Asia

-

DATABASE (225)

-

ARTICLES (278)

Chairman and Founder of Xpeng Motors

He received his bachelor’s from the South China University of Technology in 1999. In 2004, he co-founded Chinese mobile internet software and services provider UCWeb. In 2014, He both founded and invested in Xpeng Motors (short for Xiaopeng Motors). After UCWeb was acquired by Alibaba in 2014, he served as president of UCWeb and of the Alibaba Mobile Business Group, chairman of Ali Games and president of Tudou successively. In August 2017, he left Alibaba to join Xpeng Motors full-time as chairman.

He received his bachelor’s from the South China University of Technology in 1999. In 2004, he co-founded Chinese mobile internet software and services provider UCWeb. In 2014, He both founded and invested in Xpeng Motors (short for Xiaopeng Motors). After UCWeb was acquired by Alibaba in 2014, he served as president of UCWeb and of the Alibaba Mobile Business Group, chairman of Ali Games and president of Tudou successively. In August 2017, he left Alibaba to join Xpeng Motors full-time as chairman.

CFO, CMO and co-founder of RecyGlo

Initially trained as an electrical engineer at Thanlyin Technological University in 2009, Okka Phyo Maung went on to obtain a joint degree in American studies, sustainable and green tech from Colorado State University and Daejeon University in South Korea. He also provided research and technical support for two local universities while studying in Korea.In 2013, he went to study at Vesalius College in Brussels and graduated in business administration in 2017. While living in Brussels, he gained work experience as a data analyst at Management Centre Europe and was a cost consultant at Bridgewater Consulting.In Myanmar, he has worked as a project coordinator for the construction of telecoms towers in 2013. He was also an advisory consultant for accounting firm EY’s financial due diligence projects. In 2018, he began working full-time as the CFO and CMO of RecyGlo, Myanmar’s first waste management and recycling tech company.

Initially trained as an electrical engineer at Thanlyin Technological University in 2009, Okka Phyo Maung went on to obtain a joint degree in American studies, sustainable and green tech from Colorado State University and Daejeon University in South Korea. He also provided research and technical support for two local universities while studying in Korea.In 2013, he went to study at Vesalius College in Brussels and graduated in business administration in 2017. While living in Brussels, he gained work experience as a data analyst at Management Centre Europe and was a cost consultant at Bridgewater Consulting.In Myanmar, he has worked as a project coordinator for the construction of telecoms towers in 2013. He was also an advisory consultant for accounting firm EY’s financial due diligence projects. In 2018, he began working full-time as the CFO and CMO of RecyGlo, Myanmar’s first waste management and recycling tech company.

Co-founder of Therapixal

Olivier Clatz is the French co-founder of AI medical diagnosis company Therapixel, creator of MammoScreen breast cancer screening and diagnosis tool. Prior to co-founding Therapixel, Clatz worked for six years as a research scientist at INRIA (National Institute for Research in Digital Science and Technology) based at the Sophia Antipolis technology park near Antibes, in the south of France. His later work with INRIA focused on exploiting machine learning algorithms for medical imaging processing. Prior to this, he was a research associate at Harvard Medical School, in the US. In 2006, he completed his PhD at INRIA on the concept of personalized medicine. Clatz also holds a PhD in philosophy from the Ecole des Mines de Paris, and a master's degree in applied mathematics from the Ecole Normale Supérieure Paris-Saclay. Currently, he works at the French Government’s Commissariat Générale pour l’Investissement managing the national program AI For Diagnostics. He left Therapixel in 2019.

Olivier Clatz is the French co-founder of AI medical diagnosis company Therapixel, creator of MammoScreen breast cancer screening and diagnosis tool. Prior to co-founding Therapixel, Clatz worked for six years as a research scientist at INRIA (National Institute for Research in Digital Science and Technology) based at the Sophia Antipolis technology park near Antibes, in the south of France. His later work with INRIA focused on exploiting machine learning algorithms for medical imaging processing. Prior to this, he was a research associate at Harvard Medical School, in the US. In 2006, he completed his PhD at INRIA on the concept of personalized medicine. Clatz also holds a PhD in philosophy from the Ecole des Mines de Paris, and a master's degree in applied mathematics from the Ecole Normale Supérieure Paris-Saclay. Currently, he works at the French Government’s Commissariat Générale pour l’Investissement managing the national program AI For Diagnostics. He left Therapixel in 2019.

Telstra is a corporate venture capitalist headquartered in Sydney, Australia. It has significant investments in Asia, USA and Europe. It typically invests from US$5 million to US$50 million in established businesses that generate millions of dollars in existing revenue.

Telstra is a corporate venture capitalist headquartered in Sydney, Australia. It has significant investments in Asia, USA and Europe. It typically invests from US$5 million to US$50 million in established businesses that generate millions of dollars in existing revenue.

CEO and Co-founder of Dipole Tech

Yang Kaikai graduated in 2013, majoring in English Language and Literature at Shanghai Ocean University.In March 2016, she joined Tencent Incubator to work as a marketing and business development manager. She left Tencent in October 2016 and co-founded Energo Labs as COO, responsible for the strategic and global expansion of the company in Asia. In September 2018, Yang also co-founded Dipole Tech, a blockchain-based renewable energy management and trading platform.Yang is co-chair of the Energy Blockchain Leadership Committee and founded the Asian Cleantech Entrepreneurs Community (ACTEC) to connect entrepreneurs focusing on sustainable development and the environment. In 2019, she was nominated as one of 600 entrepreneurs 30 under 30 by the Forbes China.

Yang Kaikai graduated in 2013, majoring in English Language and Literature at Shanghai Ocean University.In March 2016, she joined Tencent Incubator to work as a marketing and business development manager. She left Tencent in October 2016 and co-founded Energo Labs as COO, responsible for the strategic and global expansion of the company in Asia. In September 2018, Yang also co-founded Dipole Tech, a blockchain-based renewable energy management and trading platform.Yang is co-chair of the Energy Blockchain Leadership Committee and founded the Asian Cleantech Entrepreneurs Community (ACTEC) to connect entrepreneurs focusing on sustainable development and the environment. In 2019, she was nominated as one of 600 entrepreneurs 30 under 30 by the Forbes China.

Bohai Financial Investment Holding (formerly Bohai Leasing)

Bohai Leasing is an Asia-based international comprehensive leasing industry group, and the largest container leasing service provider in the world. Since 2015, Bohai Leasing has begun its investment into the Bohai Life Insurance and Lianxun Securities, building up a large financial holding group with leasing as core business supplemented and enhanced by other financial services.

Bohai Leasing is an Asia-based international comprehensive leasing industry group, and the largest container leasing service provider in the world. Since 2015, Bohai Leasing has begun its investment into the Bohai Life Insurance and Lianxun Securities, building up a large financial holding group with leasing as core business supplemented and enhanced by other financial services.

Founded in 2008, Bertelsmann Asia Investments (BAI) is an evergreen fund wholly owned by Bertelsmann focusing on private equity investment in the Greater China Region. With over US$1 billion under management, BAI mainly invests in high-growth startups in industries including consumer upgrades, mobile sea, online education, financial services, mobile health and enterprise services.

Founded in 2008, Bertelsmann Asia Investments (BAI) is an evergreen fund wholly owned by Bertelsmann focusing on private equity investment in the Greater China Region. With over US$1 billion under management, BAI mainly invests in high-growth startups in industries including consumer upgrades, mobile sea, online education, financial services, mobile health and enterprise services.

Founded in 1996. With over US$3 billion under management, DCM Ventures has invested more than 280 tech companies in the US and Asia. They focus on seed, early and mid-stage companies in the mobile, consumer internet, software and services sectors. They are behind the A-Fund, which is the world’s first Android-focused VC fund.

Founded in 1996. With over US$3 billion under management, DCM Ventures has invested more than 280 tech companies in the US and Asia. They focus on seed, early and mid-stage companies in the mobile, consumer internet, software and services sectors. They are behind the A-Fund, which is the world’s first Android-focused VC fund.

Start-Up Chile is a public accelerator program set up by the Chilean government and looks to invest in startups across the world with Chile as their foundation. It has a diverse portfolio, having invested in startups from Europe, North America and Asia. Start-Up Chile primarily gives seed and grant funding, typically investing between $15,000 and $90,000.

Start-Up Chile is a public accelerator program set up by the Chilean government and looks to invest in startups across the world with Chile as their foundation. It has a diverse portfolio, having invested in startups from Europe, North America and Asia. Start-Up Chile primarily gives seed and grant funding, typically investing between $15,000 and $90,000.

Founded in 2010, Runa Capital is an early-stage VC that invests across North America, Asia and Europe. It manages funds worth US$270m and has invested in more than 40 companies, primarily in the healthcare, fintech, B2B SaaS and education sectors. The firm invested in Capptain, an app management platform acquired by Microsoft in 2014.

Founded in 2010, Runa Capital is an early-stage VC that invests across North America, Asia and Europe. It manages funds worth US$270m and has invested in more than 40 companies, primarily in the healthcare, fintech, B2B SaaS and education sectors. The firm invested in Capptain, an app management platform acquired by Microsoft in 2014.

Founded in 2007, private equity investment firm Cathay Capital runs eight funds with a total of more than €2.1 billion in assets under management. It operates six offices around the globe and has invested in 85 startups in Asia, Europe and America, focusing on the consumer products, healthcare and advanced manufacturing industries.

Founded in 2007, private equity investment firm Cathay Capital runs eight funds with a total of more than €2.1 billion in assets under management. It operates six offices around the globe and has invested in 85 startups in Asia, Europe and America, focusing on the consumer products, healthcare and advanced manufacturing industries.

Burda Principal Investments is part of Hubert Burda Media, an international media and tech conglomerate based in Germany. The VC also has offices in London and Singapore. Since 1998, BPI has invested mainly in consumer internet companies in Europe, Asia and the US. Key investments include Skillshare, fashion marketplace Zilingo and photography services platform SweetEscape.

Burda Principal Investments is part of Hubert Burda Media, an international media and tech conglomerate based in Germany. The VC also has offices in London and Singapore. Since 1998, BPI has invested mainly in consumer internet companies in Europe, Asia and the US. Key investments include Skillshare, fashion marketplace Zilingo and photography services platform SweetEscape.

Phitrust Partenaires is a France-based investment fund focused on social businesses in Europe and Asia.In Europe, the company acts as a VC firm dedicated to impact investing. Its investment vehicle contributes €150,000 to €800,000 to support projects that address social needs. Phitrust Partenaires also works in partnership with prominent European social funds.

Phitrust Partenaires is a France-based investment fund focused on social businesses in Europe and Asia.In Europe, the company acts as a VC firm dedicated to impact investing. Its investment vehicle contributes €150,000 to €800,000 to support projects that address social needs. Phitrust Partenaires also works in partnership with prominent European social funds.

Mitsubishi UFJ Financial Group

Japan's largest financial institution, the Mitsubishi UFJ Financial Group (MUFG) runs the country's flagship MUFG Bank. As part of the Mitsubishi Group, MUFG also has subsidiaries specializing in finance, securities and investments. Its investment in Indonesia's fast-growing Gojek is part of MUFG's expansion plans to enter the financial services market in Southeast-Asia.

Japan's largest financial institution, the Mitsubishi UFJ Financial Group (MUFG) runs the country's flagship MUFG Bank. As part of the Mitsubishi Group, MUFG also has subsidiaries specializing in finance, securities and investments. Its investment in Indonesia's fast-growing Gojek is part of MUFG's expansion plans to enter the financial services market in Southeast-Asia.

SDP Investment was founded in 2017 by Chi Miao, former Warburg Pincus head of real estate for Asia. It is a real estate investment management firm focusing on acquisition of prime properties in Tier 1 cities in China. The firm also invests in real estate-related areas including logistics, data center and cloud service.

SDP Investment was founded in 2017 by Chi Miao, former Warburg Pincus head of real estate for Asia. It is a real estate investment management firm focusing on acquisition of prime properties in Tier 1 cities in China. The firm also invests in real estate-related areas including logistics, data center and cloud service.

South Summit 2021: Lessons in expanding to Asia from experts on the ground

Cast aside your Eurocentric mindsets, China-based SOSV’s Oscar Ramos and Brinc’s Heriberto Saldivar tell startups, why they should expand to the region, and how best to do it

South Summit wants to go global, as it launches Brazilian chapter

CEO Marta del Castillo on South Summit’s LatAm, Asia expansion plans; its net-zero pledge; her new role as co-head to further drive growth and more

TheVentures founders launch Singapore VC to drive deals in Southeast Asia

The Korean Viki co-founders return to Singapore as venture builders and investors, offering South Korean partnerships and “CTO-as-a-service” in Southeast Asia

Future Food Asia 2021 announces finalists for $100,000 prize

Ten startups from agrifood tech and cleantech sectors will pitch during the five-day conference, are also eligible for two more prizes from sponsors Cargill and Thai Wah

Accelerating Asia bets on unicorn wave from MSME digitalization, logistics

The investor-accelerator’s sixth batch will start accepting applications in December, with greater ESG focus and a pledge to donate 1% of profit on investments to charity

Accelerating Asia's Amra Naidoo: We’re at an inflection point in Southeast Asia

Accelerating Asia’s co-founder Amra Naidoo reveals how the program adapts its curriculum to meet startups’ needs and the challenges accelerator programs face during the pandemic

Spanish VR edtech Play2Speak targets China's K-12 market

Keen on the multibillion-dollar tutoring market in Asia, Play2Speak creates VR immersive learning to help kids overcome the fear of learning a new language

Future Food Asia 2021: Regenerative agriculture in Asia

The unique challenges facing regenerative agriculture in Asia require solutions different from those in the West, presenting opportunities for microfinancing and impact investment

South Summit 2021: European seed investment is booming post-Covid

Investors from The Fund, Northzone and Pale Blue Dot highlight climate change, consumer credit and business tools as hot areas to follow

Taronga Ventures takes RealTechX to Singapore; plans Japan, US growth

The Australian proptech investor to focus on ESG in its acceleration program, including women under-representation and site safety

Inspired by kangaroos, ProAgni wants to wean the livestock farming industry off antibiotics

Australia’s ProAgni is making grain-feed supplements to improve livestock growth, negate antibiotic use and even reduce methane emissions, all based on kangaroo gut health research

SingularCover: Spanish SME insurance sector disruptor is Virtual South Summit winner

AI-honed personalization is proving successful in the underserved SME insurtech vertical

Singrow to start selling Singapore-grown strawberries in March, plans $15m Series A this year

Singrow also plans to offer locally grown produce across Southeast Asia, starting with strawberries farmed in energy-efficient greenhouses

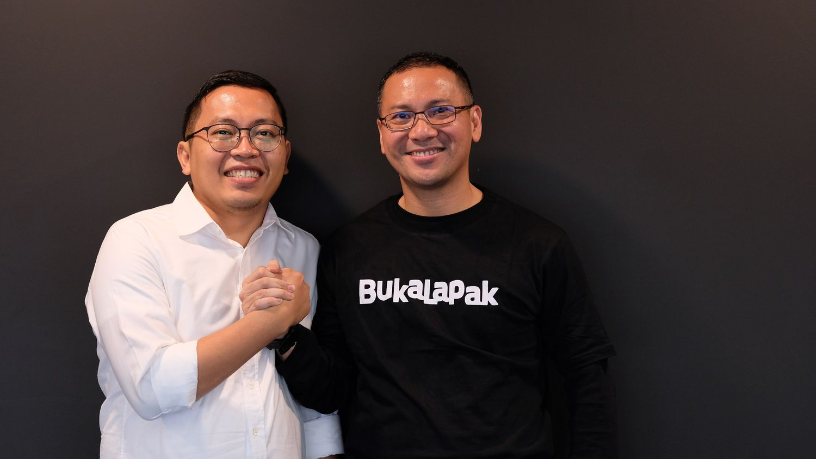

Bukalapak CEO Achmad Zaky steps down, ex-banker Rachmat Kaimuddin to take over

Rumors of a leadership change first surfaced in August as the Indonesian unicorn and its co-founder got a bad press

TroopTravel: Growth opportunities in Big Data corporate travel analytics

International award-winner TroopTravel wants to be the ultimate choice for global travellers.

Sorry, we couldn’t find any matches for“South Asia”.