South Asia

DATABASE (225)

ARTICLES (278)

Co-founder and Managing Executive of Jurnal

Armed with a double degree in Engineering and Commerce from the University of New South Wales, Anthony Kosasih spent most of his professional life as a researcher at his alma mater University of New South Wales in Australia. Anthony worked as a business development executive of Virtunet.

Armed with a double degree in Engineering and Commerce from the University of New South Wales, Anthony Kosasih spent most of his professional life as a researcher at his alma mater University of New South Wales in Australia. Anthony worked as a business development executive of Virtunet.

Tigris Investment is a South Korean private equity firm.

The Mirae Asset Financial Group started in 1997 with Mirae Asset Global Investment and Mirae Asset Capital. The group's business interests focus on asset and wealth management, investments, and insurance. It has also invested in a range of companies, from logistics firm Shadowfax to AmazeVR. In 2018, it established a joint venture with Naver Corporation, one of South Korea's leading tech companies, and set up the Asia Growth Fund with $940m committed to VC investing in the region. The joint venture has backed Southeast Asian ride-hailing giant Grab, Indonesian e-commerce platform Bukalapak, and Singapore-based credit scoring firm FinAccel.

The Mirae Asset Financial Group started in 1997 with Mirae Asset Global Investment and Mirae Asset Capital. The group's business interests focus on asset and wealth management, investments, and insurance. It has also invested in a range of companies, from logistics firm Shadowfax to AmazeVR. In 2018, it established a joint venture with Naver Corporation, one of South Korea's leading tech companies, and set up the Asia Growth Fund with $940m committed to VC investing in the region. The joint venture has backed Southeast Asian ride-hailing giant Grab, Indonesian e-commerce platform Bukalapak, and Singapore-based credit scoring firm FinAccel.

Co-founder and CEO of Jurnal

A CEO with a technical background, Daniel Witono is an ex-Microsoft software engineer with more than five years of experience in the development field.A computer engineering graduate from the University of New South Wales in Australia, Daniel founded the Jurnal startup with Anthony Kosasih, a friend also from the University of New South Wales.

A CEO with a technical background, Daniel Witono is an ex-Microsoft software engineer with more than five years of experience in the development field.A computer engineering graduate from the University of New South Wales in Australia, Daniel founded the Jurnal startup with Anthony Kosasih, a friend also from the University of New South Wales.

Co-founder and CEO of Zhuojian

Undergrad medicine, Zhejiang University; PhD, Medical University of South Carolina. Former surgeon at First Affiliated Hospital of Zhejiang University.

Undergrad medicine, Zhejiang University; PhD, Medical University of South Carolina. Former surgeon at First Affiliated Hospital of Zhejiang University.

Aspex Management was founded in 2018 by Hermes Li Ho Kei who was previously the executive MD and Head of Asia Equities at Och-Ziff Capital Management, aka OZ Management. Prior to joining OZ in 2011 Li worked at Goldman, Sachs & Co in Hong Kong.The London School of Economics graduate is now the chief investment officer at Aspex. The Hong Kong firm focuses on equity investments in Pan-Asia, specializing in sectors with long-term market growth potential and companies undergoing structural changes.Aspex led the $64m funding round for South Korean fintech unicorn Toss in August 2019. The P2P money transfer service platform Toss is created by Viva Republica backed by PayPal. Other participants in the round included existing Toss investors Kleiner Perkins, Altos Ventures, Singapore's GIC, Sequoia Capital China, Goodwater Capital and Bessemer Venture Partners.In May 2020, Aspex also invested in another startup Market Kurly, a grocery-delivery service provider that became South Korea’s latest unicorn via the Series E funding round that secured $328m led by DST Global. In July, Aspex also joined the $900m Series C+ funding round of Xpeng Motors, Tesla’s EV rival in China.

Aspex Management was founded in 2018 by Hermes Li Ho Kei who was previously the executive MD and Head of Asia Equities at Och-Ziff Capital Management, aka OZ Management. Prior to joining OZ in 2011 Li worked at Goldman, Sachs & Co in Hong Kong.The London School of Economics graduate is now the chief investment officer at Aspex. The Hong Kong firm focuses on equity investments in Pan-Asia, specializing in sectors with long-term market growth potential and companies undergoing structural changes.Aspex led the $64m funding round for South Korean fintech unicorn Toss in August 2019. The P2P money transfer service platform Toss is created by Viva Republica backed by PayPal. Other participants in the round included existing Toss investors Kleiner Perkins, Altos Ventures, Singapore's GIC, Sequoia Capital China, Goodwater Capital and Bessemer Venture Partners.In May 2020, Aspex also invested in another startup Market Kurly, a grocery-delivery service provider that became South Korea’s latest unicorn via the Series E funding round that secured $328m led by DST Global. In July, Aspex also joined the $900m Series C+ funding round of Xpeng Motors, Tesla’s EV rival in China.

Pick up ecommerce deliveries at your convenience with PopBox Asia’s smart lockers in Indonesia and Malaysia.

Pick up ecommerce deliveries at your convenience with PopBox Asia’s smart lockers in Indonesia and Malaysia.

Simone Investment Managers specializes in real estate and alternative assets management. It has property investments in South Korea and abroad in USA and Europe.

Simone Investment Managers specializes in real estate and alternative assets management. It has property investments in South Korea and abroad in USA and Europe.

STIC Investments is a South Korean private equity firm. It primarily invests in local companies and M&As, but has also branched overseas with its investment in EV Hive.

STIC Investments is a South Korean private equity firm. It primarily invests in local companies and M&As, but has also branched overseas with its investment in EV Hive.

Jungle Ventures was founded by serial entrepreneur Anurag Srivastava and business angel Amit Anand in Singapore. Anurag arrived in Singapore in 1993 and established interior design Space Matrix group in 2006. Amit was a vice chairman of Business Angels Network South East Asia (BANSEA). He is currently a member of the Advisory Council for Ethics in AI & Data in Singapore.The VC specializes in the finance, retail, software, media, travel and hospitality sectors. Investments include budget hotel network RedDoorz, microfinancing fintech Kredivo, photography services platform SweetEscape and digital logistics Waresix.

Jungle Ventures was founded by serial entrepreneur Anurag Srivastava and business angel Amit Anand in Singapore. Anurag arrived in Singapore in 1993 and established interior design Space Matrix group in 2006. Amit was a vice chairman of Business Angels Network South East Asia (BANSEA). He is currently a member of the Advisory Council for Ethics in AI & Data in Singapore.The VC specializes in the finance, retail, software, media, travel and hospitality sectors. Investments include budget hotel network RedDoorz, microfinancing fintech Kredivo, photography services platform SweetEscape and digital logistics Waresix.

NAVER is a South Korean internet company that runs the country’s top search engine, as well as other internet services. One of its subsidiaries, LINE, is based in Japan and operates a popular instant messaging app.

NAVER is a South Korean internet company that runs the country’s top search engine, as well as other internet services. One of its subsidiaries, LINE, is based in Japan and operates a popular instant messaging app.

CDO and Co-founder of Xiaoe Tech

Zeng Yongjun holds a master’s degree in computer science from the Central South University. Before co-founding Xiaoe Tech, he worked at Tencent as a T3 level engineer, focusing on the R&D of big data platforms and applications.

Zeng Yongjun holds a master’s degree in computer science from the Central South University. Before co-founding Xiaoe Tech, he worked at Tencent as a T3 level engineer, focusing on the R&D of big data platforms and applications.

Founder and CEO of Koudai Jianzhi

Serial entrepreneur Zhang Yiyun is a graduate of South China Institute of Software Engineering, Guangzhou University. Zhang started his first business at aged 13, and made his first million in senior high with an online hacker training platform (100,000 paying members). Koudai Jianzhi is his 5th business venture.

Serial entrepreneur Zhang Yiyun is a graduate of South China Institute of Software Engineering, Guangzhou University. Zhang started his first business at aged 13, and made his first million in senior high with an online hacker training platform (100,000 paying members). Koudai Jianzhi is his 5th business venture.

Co-founder and Co-CEO of Musical.ly

Armed with a bachelor’s in Automation from Central South University, Yang Luyu is a serial entrepreneur since 2005, whether in e-commerce, education, design and scrum. He was the product management director at eBaoTech, where he met Alex Zhu, who became his co-founder at Musical.ly.

Armed with a bachelor’s in Automation from Central South University, Yang Luyu is a serial entrepreneur since 2005, whether in e-commerce, education, design and scrum. He was the product management director at eBaoTech, where he met Alex Zhu, who became his co-founder at Musical.ly.

Co-founder of Uniplaces, CEO and co-founder of StudentFinance

Global citizen Mariano Kostelec is an Argentinian native who has lived in Asia and Europe. After earning his bachelor’s degree in Computer Science with Management from King’s College London, Kostelec moved to Asia to work at Groupon China (GaoPeng) and Wimbu China. He then moved to Portugal to launch Uniplaces with friends Miguel Amaro and Ben Grech. He is a member of the Entrepreneur Organization in Lisbon and of the Sandbox Network and has appeared on the Forbes 30 Under 30 list.

Global citizen Mariano Kostelec is an Argentinian native who has lived in Asia and Europe. After earning his bachelor’s degree in Computer Science with Management from King’s College London, Kostelec moved to Asia to work at Groupon China (GaoPeng) and Wimbu China. He then moved to Portugal to launch Uniplaces with friends Miguel Amaro and Ben Grech. He is a member of the Entrepreneur Organization in Lisbon and of the Sandbox Network and has appeared on the Forbes 30 Under 30 list.

South Summit 2021: Lessons in expanding to Asia from experts on the ground

Cast aside your Eurocentric mindsets, China-based SOSV’s Oscar Ramos and Brinc’s Heriberto Saldivar tell startups, why they should expand to the region, and how best to do it

South Summit wants to go global, as it launches Brazilian chapter

CEO Marta del Castillo on South Summit’s LatAm, Asia expansion plans; its net-zero pledge; her new role as co-head to further drive growth and more

TheVentures founders launch Singapore VC to drive deals in Southeast Asia

The Korean Viki co-founders return to Singapore as venture builders and investors, offering South Korean partnerships and “CTO-as-a-service” in Southeast Asia

Future Food Asia 2021 announces finalists for $100,000 prize

Ten startups from agrifood tech and cleantech sectors will pitch during the five-day conference, are also eligible for two more prizes from sponsors Cargill and Thai Wah

Accelerating Asia bets on unicorn wave from MSME digitalization, logistics

The investor-accelerator’s sixth batch will start accepting applications in December, with greater ESG focus and a pledge to donate 1% of profit on investments to charity

Accelerating Asia's Amra Naidoo: We’re at an inflection point in Southeast Asia

Accelerating Asia’s co-founder Amra Naidoo reveals how the program adapts its curriculum to meet startups’ needs and the challenges accelerator programs face during the pandemic

Spanish VR edtech Play2Speak targets China's K-12 market

Keen on the multibillion-dollar tutoring market in Asia, Play2Speak creates VR immersive learning to help kids overcome the fear of learning a new language

Future Food Asia 2021: Regenerative agriculture in Asia

The unique challenges facing regenerative agriculture in Asia require solutions different from those in the West, presenting opportunities for microfinancing and impact investment

South Summit 2021: European seed investment is booming post-Covid

Investors from The Fund, Northzone and Pale Blue Dot highlight climate change, consumer credit and business tools as hot areas to follow

Taronga Ventures takes RealTechX to Singapore; plans Japan, US growth

The Australian proptech investor to focus on ESG in its acceleration program, including women under-representation and site safety

Inspired by kangaroos, ProAgni wants to wean the livestock farming industry off antibiotics

Australia’s ProAgni is making grain-feed supplements to improve livestock growth, negate antibiotic use and even reduce methane emissions, all based on kangaroo gut health research

SingularCover: Spanish SME insurance sector disruptor is Virtual South Summit winner

AI-honed personalization is proving successful in the underserved SME insurtech vertical

Singrow to start selling Singapore-grown strawberries in March, plans $15m Series A this year

Singrow also plans to offer locally grown produce across Southeast Asia, starting with strawberries farmed in energy-efficient greenhouses

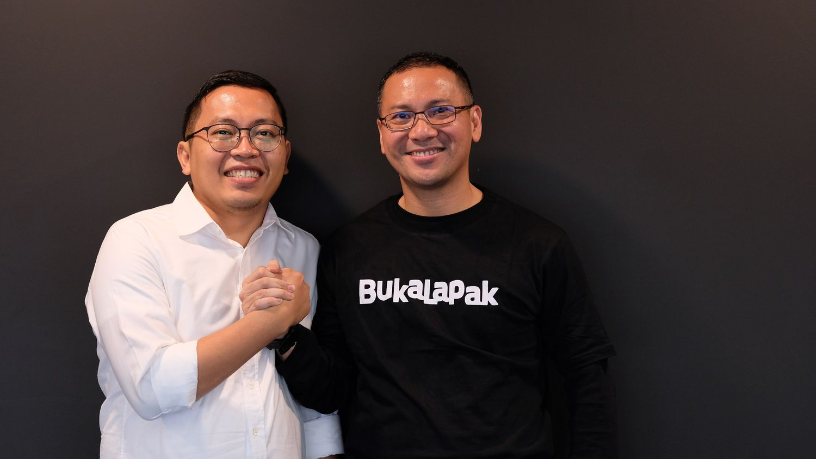

Bukalapak CEO Achmad Zaky steps down, ex-banker Rachmat Kaimuddin to take over

Rumors of a leadership change first surfaced in August as the Indonesian unicorn and its co-founder got a bad press

TroopTravel: Growth opportunities in Big Data corporate travel analytics

International award-winner TroopTravel wants to be the ultimate choice for global travellers.

Sorry, we couldn’t find any matches for“South Asia”.