South Asia

-

DATABASE (225)

-

ARTICLES (278)

Established in 1990, JAFCO Asia is a private equity and venture capital firm with US$650m assets under management. It has offices in Singapore, Taipei, Seoul, Beijing and Shanghai. Its parent company, JAFCO Co., Ltd., is Japan's largest venture capital firm. JAFCO Asia has invested in more than 480 companies, 110 of which have been publicly listed.

Established in 1990, JAFCO Asia is a private equity and venture capital firm with US$650m assets under management. It has offices in Singapore, Taipei, Seoul, Beijing and Shanghai. Its parent company, JAFCO Co., Ltd., is Japan's largest venture capital firm. JAFCO Asia has invested in more than 480 companies, 110 of which have been publicly listed.

Backed by Israeli-Russian billionaire Yuri Milner, Apoletto Asia is managed by Russia’s DST Global, a VC firm that funds late-stage internet startups.

Backed by Israeli-Russian billionaire Yuri Milner, Apoletto Asia is managed by Russia’s DST Global, a VC firm that funds late-stage internet startups.

Among the first private equity firms to invest in Asia, TPG Capital Asia is the regional investment arm of US private equity firm TPG Capital. With offices in Beijing, Hong Kong, Melbourne, Mumbai and Singapore, it currently has about $9.9bn in assets under management.

Among the first private equity firms to invest in Asia, TPG Capital Asia is the regional investment arm of US private equity firm TPG Capital. With offices in Beijing, Hong Kong, Melbourne, Mumbai and Singapore, it currently has about $9.9bn in assets under management.

SoftBank Ventures Asia, founded in 2000, is a subsidiary of SoftBank Korea and part of the SoftBank Group. It is SoftBank’s early stage venture arm, with a geographical focus in Asia, the US, Europe and Israel. It was previously known as SoftBank Ventures Korea.SoftBank Ventures Asia links early-stage startups with SoftBank’s wider network of partners and businesses, which include Yahoo Japan and Alibaba (both of which SoftBank has stakes in), components manufacturers ARM and nVidia, and Indonesian e-commerce platform Tokopedia, which SoftBank has invested in. Outside of its focus areas of AI, robotics and IoT, SoftBank Ventures has invested in companies like sports analytics company bepro11, telehealth service Alodokter, and property rental management Mamikos.

SoftBank Ventures Asia, founded in 2000, is a subsidiary of SoftBank Korea and part of the SoftBank Group. It is SoftBank’s early stage venture arm, with a geographical focus in Asia, the US, Europe and Israel. It was previously known as SoftBank Ventures Korea.SoftBank Ventures Asia links early-stage startups with SoftBank’s wider network of partners and businesses, which include Yahoo Japan and Alibaba (both of which SoftBank has stakes in), components manufacturers ARM and nVidia, and Indonesian e-commerce platform Tokopedia, which SoftBank has invested in. Outside of its focus areas of AI, robotics and IoT, SoftBank Ventures has invested in companies like sports analytics company bepro11, telehealth service Alodokter, and property rental management Mamikos.

Co-founder and CEO of Investree

Veteran banker Adrian Asharyanto Gunadi graduated in Accounting from the University of Indonesia and later obtained an MBA from the Rotterdam School of Management, Eramus University. Adrian started his banking career at Citibank in 1998. He was then based at the Standard Chartered Bank in Dubai, UAE, managing global Islamic finance product structuring for the Middle East and North Africa region (MENA), South Asia and Southeast Asia. He specialized in Islamic banking for over eight years at Permata Bank and Bank Muamalat in Indonesia until 2015, when he left to co-found Investree.

Veteran banker Adrian Asharyanto Gunadi graduated in Accounting from the University of Indonesia and later obtained an MBA from the Rotterdam School of Management, Eramus University. Adrian started his banking career at Citibank in 1998. He was then based at the Standard Chartered Bank in Dubai, UAE, managing global Islamic finance product structuring for the Middle East and North Africa region (MENA), South Asia and Southeast Asia. He specialized in Islamic banking for over eight years at Permata Bank and Bank Muamalat in Indonesia until 2015, when he left to co-found Investree.

Lynx Asia is an investment advisory firm based in Singapore. Its investments cover a broad range of industries, from retail and real estate to energy and manufacturing.

Lynx Asia is an investment advisory firm based in Singapore. Its investments cover a broad range of industries, from retail and real estate to energy and manufacturing.

Accelerating Asia focuses on Asian startups for its three-month intensive acceleration program. The Singapore-based investor was founded in 2018 and focuses on diversity investments, with 40% of its portfolio companies being led by women.The firm invests up to S$200,000 in participating pre-Series A startups. All of the program’s startups receive S$50,000–75,000 with an additional investment of up to S$150,000 for top performing companies.To date, the early-stage VC has invested in 25 startups. Recent investments in 2020 include stakes in Bangladeshi mobility platform Shuttle and Indonesian startups KaryaKarsa and MyBrand.

Accelerating Asia focuses on Asian startups for its three-month intensive acceleration program. The Singapore-based investor was founded in 2018 and focuses on diversity investments, with 40% of its portfolio companies being led by women.The firm invests up to S$200,000 in participating pre-Series A startups. All of the program’s startups receive S$50,000–75,000 with an additional investment of up to S$150,000 for top performing companies.To date, the early-stage VC has invested in 25 startups. Recent investments in 2020 include stakes in Bangladeshi mobility platform Shuttle and Indonesian startups KaryaKarsa and MyBrand.

With currently over $21bn of AUM, Baring Private Equity Asia (BPEA) was started in Hong Kong in 1997 by Jean Eric Salata, as the regional Asian PE investment arm of UK-based Baring Private Equity Partners. With $300m in its first fund, it focused on riding China’s economic rise spurred by the country’s market liberalization. In 2000, Salata led a management buyout of BPEA and continues to head the firm today as CEO and Founding Partner. BPEA has invested in more than 100 companies, across healthcare, logistics, IT services, media, education, financial services and retail. It is one of the largest independent PE firms in Asia and has eight offices across the continent.With offices in China, India, Japan, Australia, and Singapore, it currently has around 43 portfolio companies, almost all Asia-based, across multiple business segments in tech and non-tech startups, especially in bricks-and-mortar education establishments. It also makes acquisitions, including most recently of US outsourcing services company Virtusa in February 2021.Other recent investments include in the June 2021 $85m Series C round of Portuguese home physiotherapy tech solution SWORD Health, the world’s fastest-growing musculoskeletal solution, and in the November 2020 $198m Series D round of Chinese computer coding for kids edtech Codemao.

With currently over $21bn of AUM, Baring Private Equity Asia (BPEA) was started in Hong Kong in 1997 by Jean Eric Salata, as the regional Asian PE investment arm of UK-based Baring Private Equity Partners. With $300m in its first fund, it focused on riding China’s economic rise spurred by the country’s market liberalization. In 2000, Salata led a management buyout of BPEA and continues to head the firm today as CEO and Founding Partner. BPEA has invested in more than 100 companies, across healthcare, logistics, IT services, media, education, financial services and retail. It is one of the largest independent PE firms in Asia and has eight offices across the continent.With offices in China, India, Japan, Australia, and Singapore, it currently has around 43 portfolio companies, almost all Asia-based, across multiple business segments in tech and non-tech startups, especially in bricks-and-mortar education establishments. It also makes acquisitions, including most recently of US outsourcing services company Virtusa in February 2021.Other recent investments include in the June 2021 $85m Series C round of Portuguese home physiotherapy tech solution SWORD Health, the world’s fastest-growing musculoskeletal solution, and in the November 2020 $198m Series D round of Chinese computer coding for kids edtech Codemao.

Indonesia’s most popular OTA, Traveloka is an easy-to-use source of cheap regional flights and accommodation for the fast-rising Indonesian and Southeast Asian middle class.

Indonesia’s most popular OTA, Traveloka is an easy-to-use source of cheap regional flights and accommodation for the fast-rising Indonesian and Southeast Asian middle class.

Global Brain Corporation is an early stage venture capital fund based in Tokyo, Japan. It was founded in 1998 and has expanded globally, with offices in South Korea’s Seoul, Southeast Asia and Silicon Valley, USA. Leveraging its global network, the company aims to nurture world-class venture companies through investments and hands-on support. It also offers corporate venture capital fund management services and currently manages three such funds.

Global Brain Corporation is an early stage venture capital fund based in Tokyo, Japan. It was founded in 1998 and has expanded globally, with offices in South Korea’s Seoul, Southeast Asia and Silicon Valley, USA. Leveraging its global network, the company aims to nurture world-class venture companies through investments and hands-on support. It also offers corporate venture capital fund management services and currently manages three such funds.

Asia Africa Investment & Consulting

Founded in 2013, Asia Africa Investment & Consulting (AAIC) is a Japanese VC that invests in developing nations in Africa. Based in Singapore, the Japanese investment team are also involved in consultancy work. To date, AAIC has invested in eight companies. Investments during 2020 include two Egyptian startups: mobile teleradiology medtech Rology’s $860,000 seed funding in September and mental health medtech platform Shezlong’s Series A round in June.

Founded in 2013, Asia Africa Investment & Consulting (AAIC) is a Japanese VC that invests in developing nations in Africa. Based in Singapore, the Japanese investment team are also involved in consultancy work. To date, AAIC has invested in eight companies. Investments during 2020 include two Egyptian startups: mobile teleradiology medtech Rology’s $860,000 seed funding in September and mental health medtech platform Shezlong’s Series A round in June.

BASF Venture Capital is the investment arm of the BASF Group. Founded in 2001, the VC also has offices in Ludwigshafen, San Francisco, Boston, Austin, Shanghai, Sao Paulo, Mumbai and Tel Aviv.Global investments include stakes in young, fast-growing companies involved in agritech, chemistry, new materials, sustainability, digitalization and disruptive business models. The firm also holds shares in technology funds that target enterprises in Asia, North America and South America.

BASF Venture Capital is the investment arm of the BASF Group. Founded in 2001, the VC also has offices in Ludwigshafen, San Francisco, Boston, Austin, Shanghai, Sao Paulo, Mumbai and Tel Aviv.Global investments include stakes in young, fast-growing companies involved in agritech, chemistry, new materials, sustainability, digitalization and disruptive business models. The firm also holds shares in technology funds that target enterprises in Asia, North America and South America.

KTB Network is a leading investment firm in South Korea, conducting investments across all stages in South Korea, China and the US. KTB Network is the first South Korean investment firm to enter the Chinese PE/VC market. Since 2000, it has invested in 40+ companies in China.

KTB Network is a leading investment firm in South Korea, conducting investments across all stages in South Korea, China and the US. KTB Network is the first South Korean investment firm to enter the Chinese PE/VC market. Since 2000, it has invested in 40+ companies in China.

H&CK Partners is a private equity firm based in South Korea. Its expertise primarily lies in the South Korean and Southeast Asian markets, with a focus on small to mid-sized deals (US$10-100 million).

H&CK Partners is a private equity firm based in South Korea. Its expertise primarily lies in the South Korean and Southeast Asian markets, with a focus on small to mid-sized deals (US$10-100 million).

Pegasus Tech Ventures (Fenox Venture Capital)

Established in 2011, Fenox Venture Capital (now Pegasus Tech Ventures) is a Silicon Valley-based venture capital firm. It has offices across seven countries, including Japan, Indonesia, and South Korea. Its investment portfolio includes Memebox, Tech in Asia and 99.co. In Indonesia, the firm has invested in HijUp, BrideStory, Jurnal and Alodokter. Other notable investments include Airbnb, 23andMe, and Robinhood.The VC firm is the organizer of the Startup World Cup, a global pitching competition for tech startups that offers a grand prize of $1m in cash investment.

Established in 2011, Fenox Venture Capital (now Pegasus Tech Ventures) is a Silicon Valley-based venture capital firm. It has offices across seven countries, including Japan, Indonesia, and South Korea. Its investment portfolio includes Memebox, Tech in Asia and 99.co. In Indonesia, the firm has invested in HijUp, BrideStory, Jurnal and Alodokter. Other notable investments include Airbnb, 23andMe, and Robinhood.The VC firm is the organizer of the Startup World Cup, a global pitching competition for tech startups that offers a grand prize of $1m in cash investment.

SigmaRail in funding talks, eyes 10-fold surge in revenue

The profitable Madrid-based startup is behind the “Google Maps” for railways to help make trains safer and provide better services

SOURCE Global's solar-run panels turn air into drinking water

The US startup’s adapted solar panels extract water vapor from the air to produce potable water, a vital resource for distressed communities in disaster zones and remote areas

Bekraf: Growing a creative, productive Indonesia

Established to support Indonesia's creative industries as a whole, Bekraf is also an important link between government and the burgeoning startup landscape

Sheetgo: Easy and secure cloud-powered spreadsheet data at your fingertips

Named Most Scalable Product at South Summit 2018, Sheetgo turns spreadsheets into data clouds for business users around the world

MatMap: Making the construction sector more sustainable

Alicante-based startup MatMap gives a second lease of life to used construction materials that account for almost a third of EU waste

Indonesia's Green Rebel Foods to take its Asian-inspired plant-based meat regional

F&B veteran duo behind the Burgreens spinoff plans Series A fundraising by end-2021 for manufacturing and regional expansion

Ambit Robotics: Automated crop spraying for Southeast Asia's smallholder farmers

Small, affordable crop-spraying robots can help farmers save on labor costs and protect humans from exposure to harmful chemicals

Singapore, the place to start and grow a cellular agriculture startup

A country that imports over 90% of its food supply, Singapore has turned to foodtech, including cellular agriculture, to safeguard food security, supported by proactive regulators

Digital Union: Fighting fake users in China's mobile app industry

The Beijing-based cybersecurity startup is helping developers spot fake app downloads, so their ad money don’t go to waste

Bobobobo: Indonesian luxury at a click

Amid a booming local e-commerce market, this startup carves a niche for itself in upscale trending goods and experiences influenced by Indonesia’s rich traditions

Healthy eating: The Southeast Asian startups making it a breeze

From meal plans to novel ingredients, agriculture and foodtech startups in the region are developing new ways to improve nutrition without sacrificing taste

eCooltra CEO: Offline-to-online leader in two-wheel sharing economy

Timo Buetefisch, the CEO and co-founder of Europe's largest scooter rental firm Cooltra, discusses the successful offline-to-online shift to scooter-sharing app eCooltra

Forward Fooding: Ranking the world's agrifood startups on success and sustainability

The collaborative platform has opened applications for its FoodTech500 global ranking of agrifood startups; counts over 7,000 startups and scaleups mapped so far

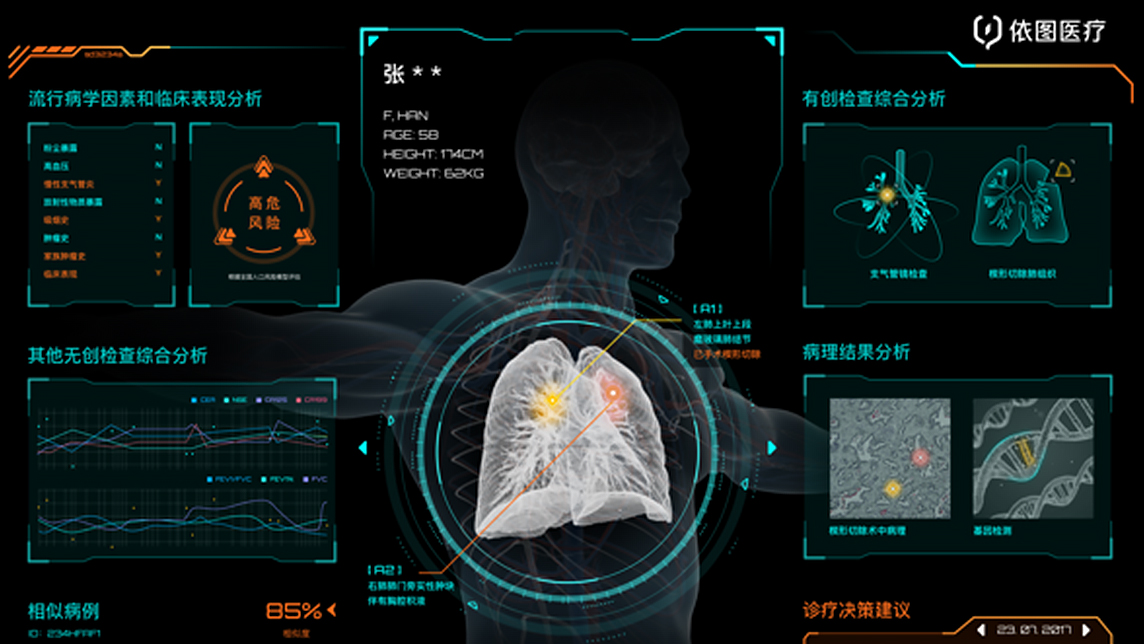

YITU takes smart healthcare to the next level

AI programs developed by this Chinese medtech startup provide more accurate diagnoses by reading medical images in conjunction with patients’ medical records

Polaroo: An expense app that finds the best deals and automates payments

Take control of your finances and save money and time with Polaroo's personalized expenses app

Sorry, we couldn’t find any matches for“South Asia”.