Startup Europe Awards

-

DATABASE (682)

-

ARTICLES (719)

Previously known as Incubate Capital Partners, Incubate Fund was founded in 1999 by Tohru Akaura and partners. Focusing on providing early stage funding, its portfolio includes more than 120 companies. It also hosts Incubate Camp, a seed-stage startup acceleration program.

Previously known as Incubate Capital Partners, Incubate Fund was founded in 1999 by Tohru Akaura and partners. Focusing on providing early stage funding, its portfolio includes more than 120 companies. It also hosts Incubate Camp, a seed-stage startup acceleration program.

UMG Indonesia is a subsidiary of the Myanmar-based UMG conglomerate that was founded in 1998. The Indonesian company is a hardware and machine distributor, with property interests in Indonesia. In 2017, UMG provided seed funding to fishery tech startup Aruna.

UMG Indonesia is a subsidiary of the Myanmar-based UMG conglomerate that was founded in 1998. The Indonesian company is a hardware and machine distributor, with property interests in Indonesia. In 2017, UMG provided seed funding to fishery tech startup Aruna.

Demium Startups is a startup incubator with offices in Madrid, Barcelona and Valencia. It has two other branches: Demium Games that focuses on the video-gaming sector and Oarsis, oriented to startups working on VR/AR-related technology.

Demium Startups is a startup incubator with offices in Madrid, Barcelona and Valencia. It has two other branches: Demium Games that focuses on the video-gaming sector and Oarsis, oriented to startups working on VR/AR-related technology.

Centro para el Desarollo Tecnológico Industrial (CDTI) is a Spanish government startup accelerator under the Ministry of Science, Education and Universities. Based in Madrid, it has invested in 13 startups since 2015, predominantly focusing on scientific enterprises.

Centro para el Desarollo Tecnológico Industrial (CDTI) is a Spanish government startup accelerator under the Ministry of Science, Education and Universities. Based in Madrid, it has invested in 13 startups since 2015, predominantly focusing on scientific enterprises.

Carex Logistics is a logistics industry leader in Spain. Headquartered in Murcia, the company is involved in cargo shipping, integral logistics, domestic and international freight; as well as national and international couriers. Carex is one of the first logistics company in Europe to use blockchain technology.The founder and president of Carex Logistics is Ricardo Rúbio, a sector expert with over 30 years of experience in cargo shipping. He is also a business angel and advisor in startups that provide logistic solutions to innovate and digitalize the industry through cutting-edge technologies.

Carex Logistics is a logistics industry leader in Spain. Headquartered in Murcia, the company is involved in cargo shipping, integral logistics, domestic and international freight; as well as national and international couriers. Carex is one of the first logistics company in Europe to use blockchain technology.The founder and president of Carex Logistics is Ricardo Rúbio, a sector expert with over 30 years of experience in cargo shipping. He is also a business angel and advisor in startups that provide logistic solutions to innovate and digitalize the industry through cutting-edge technologies.

Grupo Cosimet primarily exports metallic components all over Europe. Originally a family business, the group has diversified investments in renewable energy, healthcare and civil engineering; as well as new and emerging technologies.The company participates in key projects like energy storage company SaltX Technology Holding, that trades on Nasdaq First North. Its subsidiary Suncool manufactures solar cooling panels in China. Another investment is Wisekey, a Swiss-based company that develops web-security solutions. The company has also invested in ChainGo, a Spanish blockchain platform that builds logistics solutions for ocean freight.

Grupo Cosimet primarily exports metallic components all over Europe. Originally a family business, the group has diversified investments in renewable energy, healthcare and civil engineering; as well as new and emerging technologies.The company participates in key projects like energy storage company SaltX Technology Holding, that trades on Nasdaq First North. Its subsidiary Suncool manufactures solar cooling panels in China. Another investment is Wisekey, a Swiss-based company that develops web-security solutions. The company has also invested in ChainGo, a Spanish blockchain platform that builds logistics solutions for ocean freight.

Pablo Fernandez Alveraz is the CEO and co-founder of Clicars.com, an online marketplace for second-hand cars. Clicars secured investments from former executives working at Mercedes, General Motors, Santander Bank and Mapfre. He has degrees from Harvard Business School and the University of Madrid. He spent over 14 years working as an investment banker and consultant in Europe, USA and Latin America before diving into the world of startups. The former Boston Consulting Group (BCG) consultant was also part of the team that led the corporate strategy and digital transformation of Santander Bank in the US.

Pablo Fernandez Alveraz is the CEO and co-founder of Clicars.com, an online marketplace for second-hand cars. Clicars secured investments from former executives working at Mercedes, General Motors, Santander Bank and Mapfre. He has degrees from Harvard Business School and the University of Madrid. He spent over 14 years working as an investment banker and consultant in Europe, USA and Latin America before diving into the world of startups. The former Boston Consulting Group (BCG) consultant was also part of the team that led the corporate strategy and digital transformation of Santander Bank in the US.

BDMI is a New York-based VC company that is part of the global media group, Bertelsmann, which backs mainly companies in the new digital media ecosystem. The company usually invests through Series A and Series B rounds ranging from US$500,000 to US$5 million with reserves for follow-ons.Companies backed by BDMI get access to a vast network of media companies in the Bertelsmann group and benefit from their extensive media expertise with a global perspective.The firm’s portfolio includes startups from North America, Europe and Israel.

BDMI is a New York-based VC company that is part of the global media group, Bertelsmann, which backs mainly companies in the new digital media ecosystem. The company usually invests through Series A and Series B rounds ranging from US$500,000 to US$5 million with reserves for follow-ons.Companies backed by BDMI get access to a vast network of media companies in the Bertelsmann group and benefit from their extensive media expertise with a global perspective.The firm’s portfolio includes startups from North America, Europe and Israel.

Nauta Capital is one of the oldest VC funds in Spain with offices in London, Munich and Barcelona. It focusses its investment on SaaS companies in Europe and the US east-coast, but the firm’s portfolio includes startups specialized in cyber security, retail, HR, marketplace and platform, marketing and social intelligence as well as big data and analytics.The firm usually participates in Series A rounds from €500,000 to €7 million with an average ticket for first investments of between €1 million and €3 million. Nauta Capital occasionally invests in late-seed and Series B rounds.

Nauta Capital is one of the oldest VC funds in Spain with offices in London, Munich and Barcelona. It focusses its investment on SaaS companies in Europe and the US east-coast, but the firm’s portfolio includes startups specialized in cyber security, retail, HR, marketplace and platform, marketing and social intelligence as well as big data and analytics.The firm usually participates in Series A rounds from €500,000 to €7 million with an average ticket for first investments of between €1 million and €3 million. Nauta Capital occasionally invests in late-seed and Series B rounds.

Didac Lee is a Spanish entrepreneur and angel investor of Chinese descent. Lee focuses on investments in Spanish startups with recent participation in seed rounds of e-sports training program Gamestry and life management tool Eelp!Based in Barcelona, he has also established 15 companies including co-founding Galdana Ventures, a VC with interests in the US, Asia, Israel and Europe. Galdana has a portfolio of 30 companies with total investments worth US$1bn. Other companies include Tradeinn online sports stores and Inspirit business incubator. The serial entrepreneur is also a board member of Barcelona FC.

Didac Lee is a Spanish entrepreneur and angel investor of Chinese descent. Lee focuses on investments in Spanish startups with recent participation in seed rounds of e-sports training program Gamestry and life management tool Eelp!Based in Barcelona, he has also established 15 companies including co-founding Galdana Ventures, a VC with interests in the US, Asia, Israel and Europe. Galdana has a portfolio of 30 companies with total investments worth US$1bn. Other companies include Tradeinn online sports stores and Inspirit business incubator. The serial entrepreneur is also a board member of Barcelona FC.

Verlinvest is the investment diversification vehicle of the de Spoelberch family, the Belgian noble house, which founded the AB InBev beverage conglomerate. Founded in 1995, it currently manages over €1.6bn in assets across multiple geographies, including Europe, India, Southeast Asia and Latin America. Aside from investing in various F&B brands like Vita Coco (coconut water), F&B Asia (which operates various restaurant franchise brands in Southeast Asia) and Glaceau Vitamin Water, it has also backed e-commerce businesses like Global Fashion Group and Lazada, as well as Indian edtech platform Byju’s.

Verlinvest is the investment diversification vehicle of the de Spoelberch family, the Belgian noble house, which founded the AB InBev beverage conglomerate. Founded in 1995, it currently manages over €1.6bn in assets across multiple geographies, including Europe, India, Southeast Asia and Latin America. Aside from investing in various F&B brands like Vita Coco (coconut water), F&B Asia (which operates various restaurant franchise brands in Southeast Asia) and Glaceau Vitamin Water, it has also backed e-commerce businesses like Global Fashion Group and Lazada, as well as Indian edtech platform Byju’s.

Founded in 2008, Newfund Capital is a Paris-based VC firm investing in pre-seed, seed and follow-up rounds with fundings between $300,000 and $2m in startups based in Europe and North America. To date, it has $260m worth of assets under management, mostly subscribed by entrepreneurs and family offices. The firm has also started a NAEH fund of $100,000 in the Nouvelle Aquitaine region. Newfund Capital describes the NAEH fund as a risky mutual fund that will take minority stakes in unlisted companies.

Founded in 2008, Newfund Capital is a Paris-based VC firm investing in pre-seed, seed and follow-up rounds with fundings between $300,000 and $2m in startups based in Europe and North America. To date, it has $260m worth of assets under management, mostly subscribed by entrepreneurs and family offices. The firm has also started a NAEH fund of $100,000 in the Nouvelle Aquitaine region. Newfund Capital describes the NAEH fund as a risky mutual fund that will take minority stakes in unlisted companies.

CareCapital, with offices in Hong Kong and Shangai, is a leading investor in the global oral and dental industry. The firm’s operations span clinical and education, consumers product, orthodontics, digital equipment, SaaS, distribution, and industry-specific services. Its team comprises industry experts such as dental entrepreneurs, managers, and practitioners, healthcare investors; the company’s portfolio includes companies based in North America with revenues of RMB 5bn, Europe RMB 1.5bn, and Asia RMB 3.5bn. In June 2020, the company signed strategic partnerships with SINOCERA and Hillhouse Capital to work closely in the development and growth of dental restoration.

CareCapital, with offices in Hong Kong and Shangai, is a leading investor in the global oral and dental industry. The firm’s operations span clinical and education, consumers product, orthodontics, digital equipment, SaaS, distribution, and industry-specific services. Its team comprises industry experts such as dental entrepreneurs, managers, and practitioners, healthcare investors; the company’s portfolio includes companies based in North America with revenues of RMB 5bn, Europe RMB 1.5bn, and Asia RMB 3.5bn. In June 2020, the company signed strategic partnerships with SINOCERA and Hillhouse Capital to work closely in the development and growth of dental restoration.

Samator Education is part of the Indonesian conglomerate PT Samator, with business interests in the petrochemical, real estate, healthcare and automotive industries. To date, it has only backed one company: HarukaEdu, an edtech startup that provides online courses and degree programs in Indonesia.

Samator Education is part of the Indonesian conglomerate PT Samator, with business interests in the petrochemical, real estate, healthcare and automotive industries. To date, it has only backed one company: HarukaEdu, an edtech startup that provides online courses and degree programs in Indonesia.

Founded in 2018, Agaeti Ventures is an Indonesia-focused VC that participates at the pre-Series A and Series A levels. Agaeti's portfolio includes smart retail kiosk startup Warung Pintar, delivery coffee chain Fore Coffee and Bangladeshi transportation firm Pathao.

Founded in 2018, Agaeti Ventures is an Indonesia-focused VC that participates at the pre-Series A and Series A levels. Agaeti's portfolio includes smart retail kiosk startup Warung Pintar, delivery coffee chain Fore Coffee and Bangladeshi transportation firm Pathao.

Backed by pharmas, doctors, medtech startup DyCare is expanding fast across Europe

Its remote musculoskeletal rehabilitation and monitoring system sets to improve rehabilitation outcomes in an overtaxed sector

4YFN: Investment booms across Europe during pandemic

Speaking at the recent 4YFN conference, prolific European startup investor Mattias Ljungman provided a highly optimistic assessment of the continent's current ecosystem strength and climate for seed funding

Refurbed: Electronics recycling marketplace gets $54m for EU consolidation, overseas expansion

Consumers can reduce their carbon footprints by shifting toward a circular economy, become carbon-neutral by planting one tree with every purchase from Refurbed

FuVeX: Long-range hybrid-technology drones for multiple business uses

With its innovative hybrid helicopter and airplane technology, FuVeX is poised to take full advantage of the business opportunities afforded by new European regulations governing long-range drones

Sheetgo: Easy and secure cloud-powered spreadsheet data at your fingertips

Named Most Scalable Product at South Summit 2018, Sheetgo turns spreadsheets into data clouds for business users around the world

James, an AI-powered tool for faster, more accurate credit risk assessment

Capable of analyzing over 7,000 types of data, the award-winning credit risk tool for financial institutions is also quick to install and roll out

GOI Travel: From collaborative economy to professional transporter

Optimizing last-mile delivery to guarantee the cheapest service

Clicars: Bringing certainty to buying a used car

Spanish online used car dealer aims to sell 10,000 vehicles by 2021 via its unique sales offer that has booked it €50 million in sales since 2016

Lluvia Sólida: An economic lifeline for farmers in drier, unpredictable climate conditions

Reducing the need for watering by up to 90%, this Mexican startup’s polymer-based water retention technology is a potential game-changer for farming worldwide

In Spain, women are busy launching startups

Official data show women-led startups are on the rise in Spain. We take you to some of the biggest names in the game

Solatom: Cost-effective flatpack mobile solar energy units for SMEs

Solatom's turnkey solar thermal solutions can cut energy costs by 37%. Its real-time data analytics can also be used to ensure that the industrial processing units are operating at optimal conditions

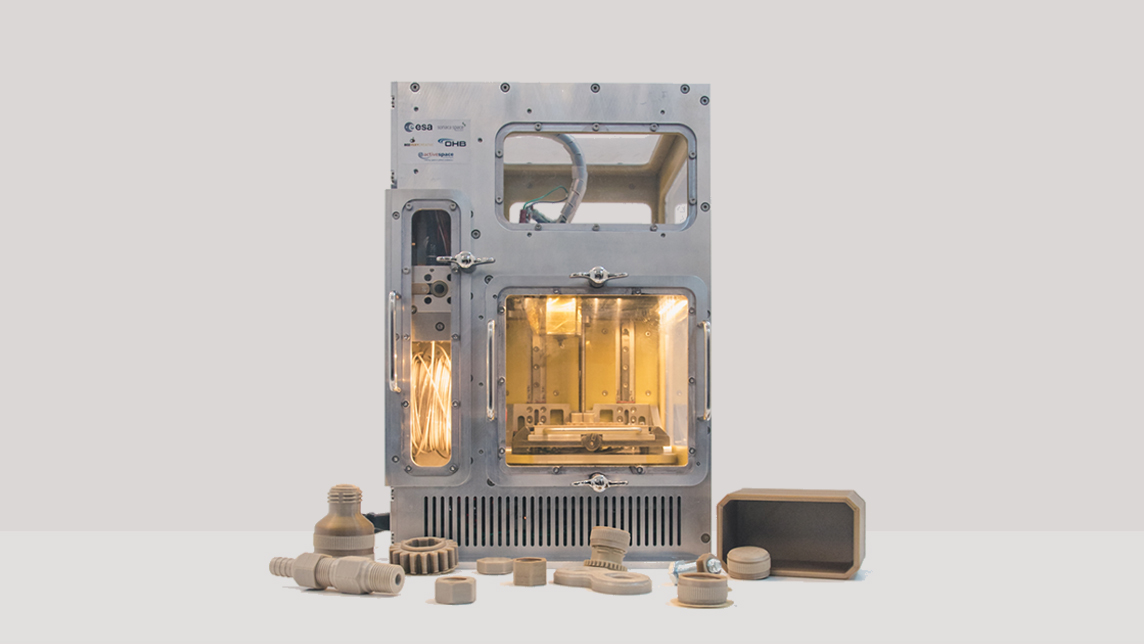

BEEVERYCREATIVE: Taking 3D printing from classrooms into Outer Space

Innovative 3D printing for daily use from a picturesque fishing village in Portugal.

Europe ramps up development of local EV battery sector in race to zero emissions

Startups, automakers jostle or unite to ride the fast-growing EV battery market, as the EU pumps billions into developing its own value chain, to cut reliance on imports

In Portugal tourism tech gets disrupted, in time for post-Covid-19 era

As Portugal reopens to tourists early next month, the sector is banking on a new generation of tourism tech startups to enable safety and reassure visitors

Drone Hopper: Firefighters of the future

A senior Airbus engineer from Spain has developed heavy-duty autonomous drones to quell wildfires safely

Sorry, we couldn’t find any matches for“Startup Europe Awards”.