Startup Europe Awards

-

DATABASE (682)

-

ARTICLES (719)

Established in August 2015 in Beijing, AC Accelerator is a startup incubator. CEO Xu Yong is also the executive director of Angel Camp, China's first non-profit organization that trains angel investors. In addition to funding, AC Accelerator also offers startups resources such as mentors and access to qualified suppliers.

Established in August 2015 in Beijing, AC Accelerator is a startup incubator. CEO Xu Yong is also the executive director of Angel Camp, China's first non-profit organization that trains angel investors. In addition to funding, AC Accelerator also offers startups resources such as mentors and access to qualified suppliers.

Tunas Nusantara Kapital, also known as TNKapital, is an Indonesian early stage venture capital firm founded in 2017. TNKapital has invested in payroll software startup Gadjian, logistics and fulfilment firm Pakde, as well as employee attendance and management software Hadirr. Like many early stage venture capital firms, TNKapital also provides mentorship and networking support to its portfolio companies.

Tunas Nusantara Kapital, also known as TNKapital, is an Indonesian early stage venture capital firm founded in 2017. TNKapital has invested in payroll software startup Gadjian, logistics and fulfilment firm Pakde, as well as employee attendance and management software Hadirr. Like many early stage venture capital firms, TNKapital also provides mentorship and networking support to its portfolio companies.

Zurich-based Übermorgen Ventures was founded in 2019 to invest in climate-change startups that focus on reducing greenhouse gas emissions. The VC has invested in five startups including recent participation in the €500,000 seed investment of German low-cost solar provider Sunvigo in January 2021 and the $6.2m seed round of Finnish biocarbon startup Carbo Culture in April.

Zurich-based Übermorgen Ventures was founded in 2019 to invest in climate-change startups that focus on reducing greenhouse gas emissions. The VC has invested in five startups including recent participation in the €500,000 seed investment of German low-cost solar provider Sunvigo in January 2021 and the $6.2m seed round of Finnish biocarbon startup Carbo Culture in April.

Launched in 2014, Convergence Ventures (formerly Convergence Accel) is a venture fund focused on investing in Indonesia. The fund is led by Donald Wihardja and ex-Rocket Internet man Adrian Li. Li is also the co-founder of Qraved, one of Indonesia's leading food social networking startup.

Launched in 2014, Convergence Ventures (formerly Convergence Accel) is a venture fund focused on investing in Indonesia. The fund is led by Donald Wihardja and ex-Rocket Internet man Adrian Li. Li is also the co-founder of Qraved, one of Indonesia's leading food social networking startup.

One of the earliest and independent VC firms in China, Chengwei Capital was founded in Shanghai in 1999. It’s also the first and only evergreen fund in China.With Yale University Endowment as its largest investor, the VC limited partners also include institutional investors from around the world. With a portfolio of about 30 companies, the firm mainly invests in manufacturing, consumer goods, education, internet and petroleum & natural gas.In 2012, Chengwei and China Europe International Business School (CEIBS) jointly launched the $100m CEIBS-Chengwei Venture Capital Fund to invest in early- and growth-stage companies founded or managed by CEIBS alumni. The VC also seeks to support entrepreneurs to build sustainable businesses over a long period of time, acting as their long-term business partner.

One of the earliest and independent VC firms in China, Chengwei Capital was founded in Shanghai in 1999. It’s also the first and only evergreen fund in China.With Yale University Endowment as its largest investor, the VC limited partners also include institutional investors from around the world. With a portfolio of about 30 companies, the firm mainly invests in manufacturing, consumer goods, education, internet and petroleum & natural gas.In 2012, Chengwei and China Europe International Business School (CEIBS) jointly launched the $100m CEIBS-Chengwei Venture Capital Fund to invest in early- and growth-stage companies founded or managed by CEIBS alumni. The VC also seeks to support entrepreneurs to build sustainable businesses over a long period of time, acting as their long-term business partner.

Avianta Capital is a private equity and venture capital firm helmed by Fernando Jamie-Fernández, who is also co-founder of the Madrid-based Bipi, a Spanish on-demand car rental app startup. Headquartered in San Pedro Garza Garcia, Mexico, Avianta Capital also has a satellite office in Madrid to facilitate cross-border investments and operations between Spain and Latin America.

Avianta Capital is a private equity and venture capital firm helmed by Fernando Jamie-Fernández, who is also co-founder of the Madrid-based Bipi, a Spanish on-demand car rental app startup. Headquartered in San Pedro Garza Garcia, Mexico, Avianta Capital also has a satellite office in Madrid to facilitate cross-border investments and operations between Spain and Latin America.

UOB Venture Management is a private equity firm backed by the United Overseas Bank (UOB). It invests in growing companies at their expansion stages, with special focus on the Southeast Asia and China markets. Its portfolio is diverse, ranging from food and health companies to petrochemicals and tech businesses like Giosis (which operates e-commerce site Qoo10) and AI-powered marketing service startup Appier.

UOB Venture Management is a private equity firm backed by the United Overseas Bank (UOB). It invests in growing companies at their expansion stages, with special focus on the Southeast Asia and China markets. Its portfolio is diverse, ranging from food and health companies to petrochemicals and tech businesses like Giosis (which operates e-commerce site Qoo10) and AI-powered marketing service startup Appier.

Moventis is a Spanish family-run transportation company that specializes in urban and inter-city bus and tram services, as well as bus rentals. It was established in 1923 and is based in the Catalan city of Lerida. It does not normally invest in tech startups and its investment in Shotl is believed to be its first in a startup.

Moventis is a Spanish family-run transportation company that specializes in urban and inter-city bus and tram services, as well as bus rentals. It was established in 1923 and is based in the Catalan city of Lerida. It does not normally invest in tech startups and its investment in Shotl is believed to be its first in a startup.

Established in 2015, EQT Ventures is a Stockholm-based investor that describes itself as "half VC, half startup." It has invested in more than 50 companies, acting as lead investor in almost two-thirds of its investments, to date, of a total investment fund of €566m. EQT Ventures invests across sectors locally and globally and has successfully managed the exits of two Scandinavian startups.

Established in 2015, EQT Ventures is a Stockholm-based investor that describes itself as "half VC, half startup." It has invested in more than 50 companies, acting as lead investor in almost two-thirds of its investments, to date, of a total investment fund of €566m. EQT Ventures invests across sectors locally and globally and has successfully managed the exits of two Scandinavian startups.

Eurovending is a family-run, Italian business in the automatic vending sector based in Trento. To date, it has only invested in one tech startup, the Spanish vending machine hardware and interactive payment app Orain, leading its €1m seed investment round in 2017. The company is a producer of plastic cups and also rents and services automatic vending machines across Italy and Spain.

Eurovending is a family-run, Italian business in the automatic vending sector based in Trento. To date, it has only invested in one tech startup, the Spanish vending machine hardware and interactive payment app Orain, leading its €1m seed investment round in 2017. The company is a producer of plastic cups and also rents and services automatic vending machines across Italy and Spain.

Public-listed PT Surya Semesta Internusa Tbk (aka Surya Internusa or SSIA) is a property conglomerate with interests in hospitality, property, construction and infrastructure. Founded by the President Director Johannes Suriadjaja in 1971 as a private property developer, the company was listed as SSIA in 1997. His daughter Christina Suriadjaja is a co-founder of Travelio, a tech startup that was originally created for Surya Internusa in 2014.

Public-listed PT Surya Semesta Internusa Tbk (aka Surya Internusa or SSIA) is a property conglomerate with interests in hospitality, property, construction and infrastructure. Founded by the President Director Johannes Suriadjaja in 1971 as a private property developer, the company was listed as SSIA in 1997. His daughter Christina Suriadjaja is a co-founder of Travelio, a tech startup that was originally created for Surya Internusa in 2014.

SeedRocket is one of the biggest networks of mentors and industry experts in Spain. Founded by Jesus Monleon and Vicente Arias, the firm offers mentorship, acceleration and seed funding programs of up to €150,000 per startup. SeedRocket is headquartered in Barcelona with a branch office in the Google Campus Madrid. SeedRocket has backed 160 startups with a total capital investment of €55 million, including five exits.

SeedRocket is one of the biggest networks of mentors and industry experts in Spain. Founded by Jesus Monleon and Vicente Arias, the firm offers mentorship, acceleration and seed funding programs of up to €150,000 per startup. SeedRocket is headquartered in Barcelona with a branch office in the Google Campus Madrid. SeedRocket has backed 160 startups with a total capital investment of €55 million, including five exits.

S2 Capital was founded by Y Combinator alums Sohail Prasad, Samvit Ramadurgam and Ritik Malhotra. The founders of S2 Capital have mostly invested in the US, leveraging their relationships with startups there, both before and during their time at Y Combinator. Payfazz is a notable exception in S2 Capital's portfolio, being the first startup from Indonesia to have participated in the Y Combinator program.

S2 Capital was founded by Y Combinator alums Sohail Prasad, Samvit Ramadurgam and Ritik Malhotra. The founders of S2 Capital have mostly invested in the US, leveraging their relationships with startups there, both before and during their time at Y Combinator. Payfazz is a notable exception in S2 Capital's portfolio, being the first startup from Indonesia to have participated in the Y Combinator program.

UK-based Portuguese unicorn Farfetch is a global omni-channel marketplace for luxury fashion, ranging from established brands to cult and emerging designers. Entrepreneur José Neves started the company in 2007 to enable small designers and fashion retailers to become global players through a single online marketplace. Farfetch participated in the 2019 seed investment round for Didimo, a Portuguese 3D digital twin animation production startup based in Porto.

UK-based Portuguese unicorn Farfetch is a global omni-channel marketplace for luxury fashion, ranging from established brands to cult and emerging designers. Entrepreneur José Neves started the company in 2007 to enable small designers and fashion retailers to become global players through a single online marketplace. Farfetch participated in the 2019 seed investment round for Didimo, a Portuguese 3D digital twin animation production startup based in Porto.

The Oil & Natural Gas Corporation, also known as Maharatna ONGC, is the largest crude oil and natural gas company in India, contributing around 75% of India’s domestic production. It has committed to carbon reduction initiatives and has 15 projects that can potentially reduce total emissions equivalent to 2.1m tons of CO2 annually. String Bio is its first tech startup investment, part of the Series A round in 2019.

The Oil & Natural Gas Corporation, also known as Maharatna ONGC, is the largest crude oil and natural gas company in India, contributing around 75% of India’s domestic production. It has committed to carbon reduction initiatives and has 15 projects that can potentially reduce total emissions equivalent to 2.1m tons of CO2 annually. String Bio is its first tech startup investment, part of the Series A round in 2019.

Backed by pharmas, doctors, medtech startup DyCare is expanding fast across Europe

Its remote musculoskeletal rehabilitation and monitoring system sets to improve rehabilitation outcomes in an overtaxed sector

4YFN: Investment booms across Europe during pandemic

Speaking at the recent 4YFN conference, prolific European startup investor Mattias Ljungman provided a highly optimistic assessment of the continent's current ecosystem strength and climate for seed funding

Refurbed: Electronics recycling marketplace gets $54m for EU consolidation, overseas expansion

Consumers can reduce their carbon footprints by shifting toward a circular economy, become carbon-neutral by planting one tree with every purchase from Refurbed

FuVeX: Long-range hybrid-technology drones for multiple business uses

With its innovative hybrid helicopter and airplane technology, FuVeX is poised to take full advantage of the business opportunities afforded by new European regulations governing long-range drones

Sheetgo: Easy and secure cloud-powered spreadsheet data at your fingertips

Named Most Scalable Product at South Summit 2018, Sheetgo turns spreadsheets into data clouds for business users around the world

James, an AI-powered tool for faster, more accurate credit risk assessment

Capable of analyzing over 7,000 types of data, the award-winning credit risk tool for financial institutions is also quick to install and roll out

GOI Travel: From collaborative economy to professional transporter

Optimizing last-mile delivery to guarantee the cheapest service

Clicars: Bringing certainty to buying a used car

Spanish online used car dealer aims to sell 10,000 vehicles by 2021 via its unique sales offer that has booked it €50 million in sales since 2016

Lluvia Sólida: An economic lifeline for farmers in drier, unpredictable climate conditions

Reducing the need for watering by up to 90%, this Mexican startup’s polymer-based water retention technology is a potential game-changer for farming worldwide

In Spain, women are busy launching startups

Official data show women-led startups are on the rise in Spain. We take you to some of the biggest names in the game

Solatom: Cost-effective flatpack mobile solar energy units for SMEs

Solatom's turnkey solar thermal solutions can cut energy costs by 37%. Its real-time data analytics can also be used to ensure that the industrial processing units are operating at optimal conditions

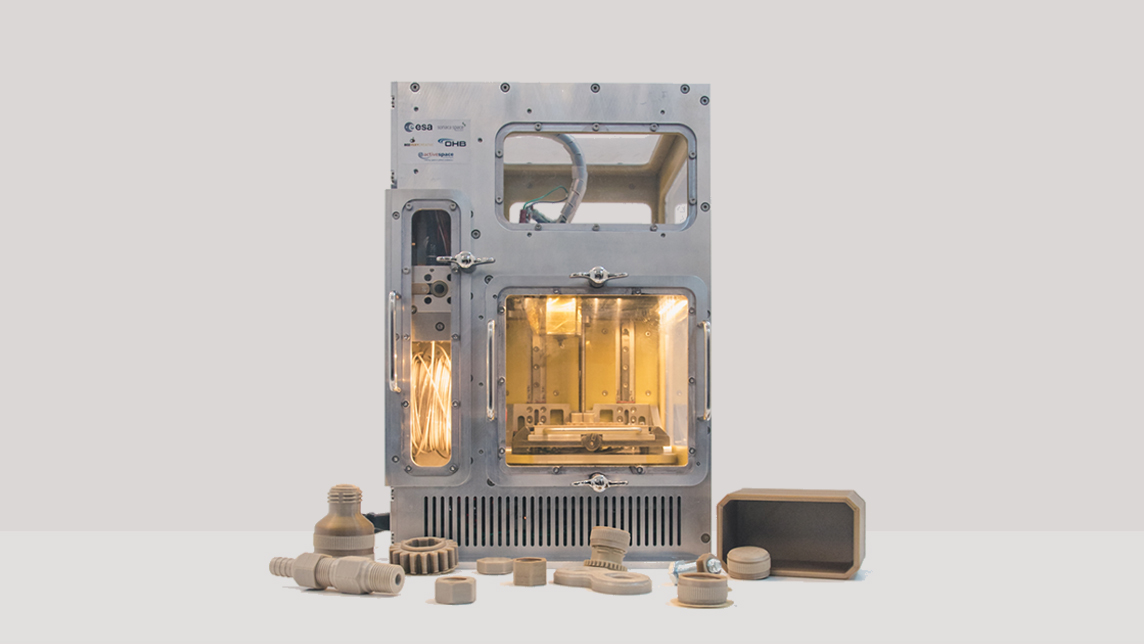

BEEVERYCREATIVE: Taking 3D printing from classrooms into Outer Space

Innovative 3D printing for daily use from a picturesque fishing village in Portugal.

Europe ramps up development of local EV battery sector in race to zero emissions

Startups, automakers jostle or unite to ride the fast-growing EV battery market, as the EU pumps billions into developing its own value chain, to cut reliance on imports

In Portugal tourism tech gets disrupted, in time for post-Covid-19 era

As Portugal reopens to tourists early next month, the sector is banking on a new generation of tourism tech startups to enable safety and reassure visitors

Drone Hopper: Firefighters of the future

A senior Airbus engineer from Spain has developed heavy-duty autonomous drones to quell wildfires safely

Sorry, we couldn’t find any matches for“Startup Europe Awards”.