Startup Europe Awards

-

DATABASE (682)

-

ARTICLES (719)

Zhejiang Jinke Venture Capital

Founded in 2000, Zhejiang Jinke Venture Capital is a private venture capital enterprise. It specializes in capital investment, capital management, real estate investment and startup investment.

Founded in 2000, Zhejiang Jinke Venture Capital is a private venture capital enterprise. It specializes in capital investment, capital management, real estate investment and startup investment.

Founded in 2016, Wave Ventures is a student-run Nordic investor supported by VC partners, angel investors and tech founders as advisors. Based in Helsinki, the VC provides pre-seed and early-stage funding to promote startup innovations for future generations. Its current portfolio of 17 startups includes participation in the SEK 2m pre-seed round of Swedish power-bank sharing startup Brick Technology in March 2021 and seed funding of German co-working space proprietor Twostay in January 2021.

Founded in 2016, Wave Ventures is a student-run Nordic investor supported by VC partners, angel investors and tech founders as advisors. Based in Helsinki, the VC provides pre-seed and early-stage funding to promote startup innovations for future generations. Its current portfolio of 17 startups includes participation in the SEK 2m pre-seed round of Swedish power-bank sharing startup Brick Technology in March 2021 and seed funding of German co-working space proprietor Twostay in January 2021.

TI Platform Management is a US-based investment firm founded by Alex Bangash and Trang T Nguyen, who are also the founders of LP network and investment news platform TrustedInsight. Founded in 2015, the firm seeks out disruptive business models and invests in a range of categories, from furniture and home construction to healthcare and deep-tech. It has invested in Singapore-based enzyme engineering startup Allozymes, B2B pharmacy fulfillment service TruePill, and supply chain management startup Tyltgo.

TI Platform Management is a US-based investment firm founded by Alex Bangash and Trang T Nguyen, who are also the founders of LP network and investment news platform TrustedInsight. Founded in 2015, the firm seeks out disruptive business models and invests in a range of categories, from furniture and home construction to healthcare and deep-tech. It has invested in Singapore-based enzyme engineering startup Allozymes, B2B pharmacy fulfillment service TruePill, and supply chain management startup Tyltgo.

H&M’s first shop was founded 74 years ago in Sweden by Erling Persson under the name “Hennes”, Swedish for "hers" since the shop was selling only women's apparel. In 1968, Persson expanded into menswear by acquiring Swedish retailer Mauritz Widforss. Hence the rebranding of the company into Hennes & Mauritz (H&M). In 1974, H&M was listed on the Stockholm Stock Exchange. Since then, H&M has expanding internationally opening its first store in London and the rest of Europe and also to the US in early 2000.In 2008, the company also moved into the home furnishings segment and launched H&M Home stores worldwide. The fashion chain can now be found across Europe, the US, Asia and the Middle East. The group expanded further by acquiring fast-fashion brands like Weekday, Monki and Cheap Monday. In April 2021, H&M Group announced a collaboration with textile cleantech Infinited Fiber to launch proof-of-concept denim created wholly from regenerated textile waste as part of its commitment to use only recycled or sustainably sourced materials by 2030.

H&M’s first shop was founded 74 years ago in Sweden by Erling Persson under the name “Hennes”, Swedish for "hers" since the shop was selling only women's apparel. In 1968, Persson expanded into menswear by acquiring Swedish retailer Mauritz Widforss. Hence the rebranding of the company into Hennes & Mauritz (H&M). In 1974, H&M was listed on the Stockholm Stock Exchange. Since then, H&M has expanding internationally opening its first store in London and the rest of Europe and also to the US in early 2000.In 2008, the company also moved into the home furnishings segment and launched H&M Home stores worldwide. The fashion chain can now be found across Europe, the US, Asia and the Middle East. The group expanded further by acquiring fast-fashion brands like Weekday, Monki and Cheap Monday. In April 2021, H&M Group announced a collaboration with textile cleantech Infinited Fiber to launch proof-of-concept denim created wholly from regenerated textile waste as part of its commitment to use only recycled or sustainably sourced materials by 2030.

CFO, CMO and co-founder of RecyGlo

Initially trained as an electrical engineer at Thanlyin Technological University in 2009, Okka Phyo Maung went on to obtain a joint degree in American studies, sustainable and green tech from Colorado State University and Daejeon University in South Korea. He also provided research and technical support for two local universities while studying in Korea.In 2013, he went to study at Vesalius College in Brussels and graduated in business administration in 2017. While living in Brussels, he gained work experience as a data analyst at Management Centre Europe and was a cost consultant at Bridgewater Consulting.In Myanmar, he has worked as a project coordinator for the construction of telecoms towers in 2013. He was also an advisory consultant for accounting firm EY’s financial due diligence projects. In 2018, he began working full-time as the CFO and CMO of RecyGlo, Myanmar’s first waste management and recycling tech company.

Initially trained as an electrical engineer at Thanlyin Technological University in 2009, Okka Phyo Maung went on to obtain a joint degree in American studies, sustainable and green tech from Colorado State University and Daejeon University in South Korea. He also provided research and technical support for two local universities while studying in Korea.In 2013, he went to study at Vesalius College in Brussels and graduated in business administration in 2017. While living in Brussels, he gained work experience as a data analyst at Management Centre Europe and was a cost consultant at Bridgewater Consulting.In Myanmar, he has worked as a project coordinator for the construction of telecoms towers in 2013. He was also an advisory consultant for accounting firm EY’s financial due diligence projects. In 2018, he began working full-time as the CFO and CMO of RecyGlo, Myanmar’s first waste management and recycling tech company.

Everis is a Madrid-based consulting firm that was acquired in 2014 by Japan's NTT Data, the sixth-largest IT services company in the world. With a turnover of €1.17bn, the company offers consultancy services in banking, healthcare, industry, insurance, media, public sector and telecommunications across Europe, in Latin America and the US. The company has established an innovation center, NextGen, focusing on technologies that drive business disruption, such as, Cloud models, Blockchain, Big Data, AI and Robotics.

Everis is a Madrid-based consulting firm that was acquired in 2014 by Japan's NTT Data, the sixth-largest IT services company in the world. With a turnover of €1.17bn, the company offers consultancy services in banking, healthcare, industry, insurance, media, public sector and telecommunications across Europe, in Latin America and the US. The company has established an innovation center, NextGen, focusing on technologies that drive business disruption, such as, Cloud models, Blockchain, Big Data, AI and Robotics.

American private equity firm Warburg Pincus was established in 1966 and has since invested more than $55bn in more than 750 companies in more than 40 countries around the world. So far, the company has raised 19 private equity funds with over $90bn in assets under management. Its investment portfolio can be divided geographically into Asia, Europe, and the Americas. Its Asian portfolio includes tech companies, real estate, healthcare and more verticals, with many Chinese companies featured on the list.

American private equity firm Warburg Pincus was established in 1966 and has since invested more than $55bn in more than 750 companies in more than 40 countries around the world. So far, the company has raised 19 private equity funds with over $90bn in assets under management. Its investment portfolio can be divided geographically into Asia, Europe, and the Americas. Its Asian portfolio includes tech companies, real estate, healthcare and more verticals, with many Chinese companies featured on the list.

Lenovo Accelerator was co-founded by Lenovo Capital and Incubator Group and Hong Kong-based business park Cyberport in Hong Kong in May 2016. It invests mainly in early-stage startups specialized in cutting-edge technologies and TMT. It is Lenovo Group's first startup accelerator in China. Each startup selected by Lenovo Accelerator receives RMB 500,000 to RMB 1m in funding from Lenovo Group.

Lenovo Accelerator was co-founded by Lenovo Capital and Incubator Group and Hong Kong-based business park Cyberport in Hong Kong in May 2016. It invests mainly in early-stage startups specialized in cutting-edge technologies and TMT. It is Lenovo Group's first startup accelerator in China. Each startup selected by Lenovo Accelerator receives RMB 500,000 to RMB 1m in funding from Lenovo Group.

Amand Ventures is a venture capital firm established in 2016. Based in Singapore, it has backed the payments startup Wallex and Indonesian online jewelry business Orori.

Amand Ventures is a venture capital firm established in 2016. Based in Singapore, it has backed the payments startup Wallex and Indonesian online jewelry business Orori.

Money Forward is a Japanese fintech startup that provides software for corporate accounting and personal finance management. The company has been listed on the Tokyo Stock Exchange since late 2017.

Money Forward is a Japanese fintech startup that provides software for corporate accounting and personal finance management. The company has been listed on the Tokyo Stock Exchange since late 2017.

Jose Maria Tarragó was the VP of Ficosa International, a global provider in research, development and manufacturing of advanced technology for the motor and mobility sectors. He was also VP of Carbures Europe that specialized in the design and manufacture of engineering systems for automotive, aerospace and security industries. In 2015, Tarragó and his four brothers founded the Lacus Group that invests and mentors new tech companies and industrial manufacturers. He is also an adviser to the Eurofred Group.

Jose Maria Tarragó was the VP of Ficosa International, a global provider in research, development and manufacturing of advanced technology for the motor and mobility sectors. He was also VP of Carbures Europe that specialized in the design and manufacture of engineering systems for automotive, aerospace and security industries. In 2015, Tarragó and his four brothers founded the Lacus Group that invests and mentors new tech companies and industrial manufacturers. He is also an adviser to the Eurofred Group.

Climate-KIC is an initiative supported by the European Institute of Innovation and Technology (EIT), whose focus is to create and support a community of entrepreneurs and mentors that jointly develop and produce innovative ideas facilitating the transition to a zero-carbon economy. Climate-KIC has launched various initiatives and acceleration programs across Europe targeted at growing startups that are tackling climate change, providing them with structure, assistance, mentoring and seed funding to develop low-carbon products and services.

Climate-KIC is an initiative supported by the European Institute of Innovation and Technology (EIT), whose focus is to create and support a community of entrepreneurs and mentors that jointly develop and produce innovative ideas facilitating the transition to a zero-carbon economy. Climate-KIC has launched various initiatives and acceleration programs across Europe targeted at growing startups that are tackling climate change, providing them with structure, assistance, mentoring and seed funding to develop low-carbon products and services.

CNBB Venture Partners is a Dutch fund with 30+ years' experience in the SaaS cloud industry – the company’s main investment focus. Through the VC fund, CNBB invests in funding rounds from €500,000 to €5m, usually provided to companies with a minimum of €1m annual recurring revenue.Through the private equity vehicle, CNBB identifies and acquires Europe-based SaaS companies active in markets with consistent growth, profitability and consolidation. CNBB provides equity investment from €3m to €10m.

CNBB Venture Partners is a Dutch fund with 30+ years' experience in the SaaS cloud industry – the company’s main investment focus. Through the VC fund, CNBB invests in funding rounds from €500,000 to €5m, usually provided to companies with a minimum of €1m annual recurring revenue.Through the private equity vehicle, CNBB identifies and acquires Europe-based SaaS companies active in markets with consistent growth, profitability and consolidation. CNBB provides equity investment from €3m to €10m.

A Linz-based pre-seed investor founded in 2015, the company currently has 17 companies in its portfolio. Its interests span market verticals and technologies, with tech and non-tech startups supported, and varied geographical locations across Europe. It also runs an online learning lab for startups called Zero21. Its most recent investments include the €2m seed round of Austrian second-hand electronics marketplace refurbed and the €300,000 pre-seed round of German interview platform-as-a-service LAMA.

A Linz-based pre-seed investor founded in 2015, the company currently has 17 companies in its portfolio. Its interests span market verticals and technologies, with tech and non-tech startups supported, and varied geographical locations across Europe. It also runs an online learning lab for startups called Zero21. Its most recent investments include the €2m seed round of Austrian second-hand electronics marketplace refurbed and the €300,000 pre-seed round of German interview platform-as-a-service LAMA.

Entrepreneur First is a global entrepreneur incubator program and early-startup investor. The incubator is an intensive six-month program for founders and aspiring entrepreneurs to help them develop ideas that can go into building their own companies. The program is held in six cities around the world: Bangalore; Berlin, London, Paris, Singapore and Toronto (Canada).Participants do not need to have a startup or a specific business idea to participate, and those who have established their own companies can seek partners or co-founders at the program. Roughly 40-50% of the cohort reach the “Launch” phase, where the participants have established their own companies and received investments from Entrepreneur First and potentially other VCs. Entrepreneur First can invest in a startup built by program participants in exchange for 10% equity. The exact amount invested varies: £80,000 for the European programs; S$75,000 for the Singapore and Bangalore programs; and C$100,000 for the Canada program.

Entrepreneur First is a global entrepreneur incubator program and early-startup investor. The incubator is an intensive six-month program for founders and aspiring entrepreneurs to help them develop ideas that can go into building their own companies. The program is held in six cities around the world: Bangalore; Berlin, London, Paris, Singapore and Toronto (Canada).Participants do not need to have a startup or a specific business idea to participate, and those who have established their own companies can seek partners or co-founders at the program. Roughly 40-50% of the cohort reach the “Launch” phase, where the participants have established their own companies and received investments from Entrepreneur First and potentially other VCs. Entrepreneur First can invest in a startup built by program participants in exchange for 10% equity. The exact amount invested varies: £80,000 for the European programs; S$75,000 for the Singapore and Bangalore programs; and C$100,000 for the Canada program.

Backed by pharmas, doctors, medtech startup DyCare is expanding fast across Europe

Its remote musculoskeletal rehabilitation and monitoring system sets to improve rehabilitation outcomes in an overtaxed sector

4YFN: Investment booms across Europe during pandemic

Speaking at the recent 4YFN conference, prolific European startup investor Mattias Ljungman provided a highly optimistic assessment of the continent's current ecosystem strength and climate for seed funding

Refurbed: Electronics recycling marketplace gets $54m for EU consolidation, overseas expansion

Consumers can reduce their carbon footprints by shifting toward a circular economy, become carbon-neutral by planting one tree with every purchase from Refurbed

FuVeX: Long-range hybrid-technology drones for multiple business uses

With its innovative hybrid helicopter and airplane technology, FuVeX is poised to take full advantage of the business opportunities afforded by new European regulations governing long-range drones

Sheetgo: Easy and secure cloud-powered spreadsheet data at your fingertips

Named Most Scalable Product at South Summit 2018, Sheetgo turns spreadsheets into data clouds for business users around the world

James, an AI-powered tool for faster, more accurate credit risk assessment

Capable of analyzing over 7,000 types of data, the award-winning credit risk tool for financial institutions is also quick to install and roll out

GOI Travel: From collaborative economy to professional transporter

Optimizing last-mile delivery to guarantee the cheapest service

Clicars: Bringing certainty to buying a used car

Spanish online used car dealer aims to sell 10,000 vehicles by 2021 via its unique sales offer that has booked it €50 million in sales since 2016

Lluvia Sólida: An economic lifeline for farmers in drier, unpredictable climate conditions

Reducing the need for watering by up to 90%, this Mexican startup’s polymer-based water retention technology is a potential game-changer for farming worldwide

In Spain, women are busy launching startups

Official data show women-led startups are on the rise in Spain. We take you to some of the biggest names in the game

Solatom: Cost-effective flatpack mobile solar energy units for SMEs

Solatom's turnkey solar thermal solutions can cut energy costs by 37%. Its real-time data analytics can also be used to ensure that the industrial processing units are operating at optimal conditions

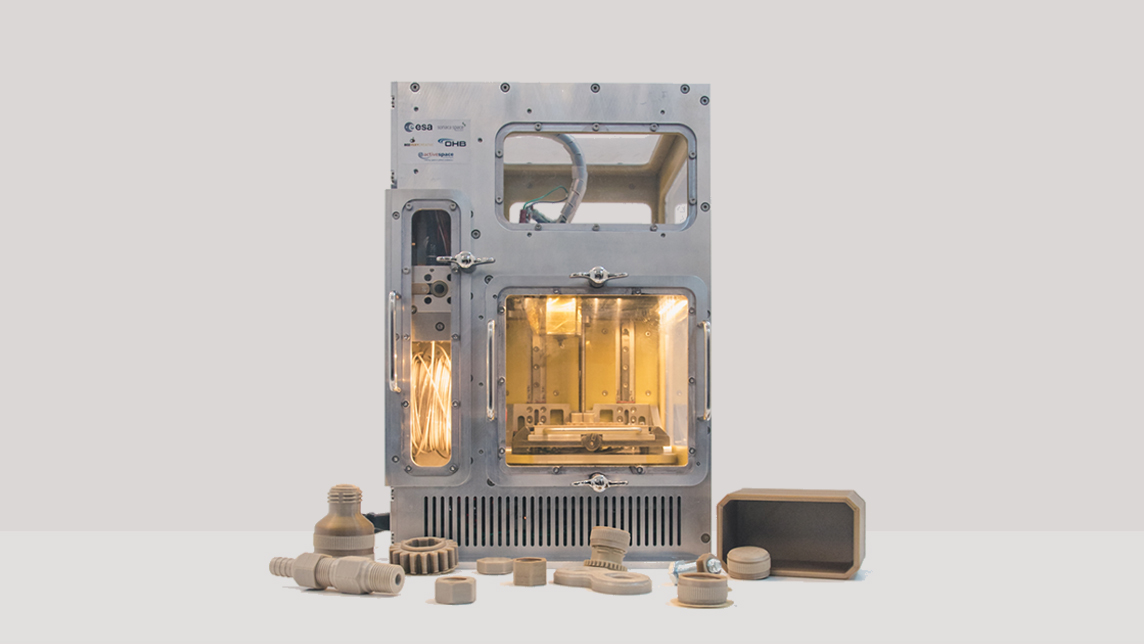

BEEVERYCREATIVE: Taking 3D printing from classrooms into Outer Space

Innovative 3D printing for daily use from a picturesque fishing village in Portugal.

Europe ramps up development of local EV battery sector in race to zero emissions

Startups, automakers jostle or unite to ride the fast-growing EV battery market, as the EU pumps billions into developing its own value chain, to cut reliance on imports

In Portugal tourism tech gets disrupted, in time for post-Covid-19 era

As Portugal reopens to tourists early next month, the sector is banking on a new generation of tourism tech startups to enable safety and reassure visitors

Drone Hopper: Firefighters of the future

A senior Airbus engineer from Spain has developed heavy-duty autonomous drones to quell wildfires safely

Sorry, we couldn’t find any matches for“Startup Europe Awards”.