Startup Lisboa

DATABASE (570)

ARTICLES (690)

UMG Indonesia is a subsidiary of the Myanmar-based UMG conglomerate that was founded in 1998. The Indonesian company is a hardware and machine distributor, with property interests in Indonesia. In 2017, UMG provided seed funding to fishery tech startup Aruna.

UMG Indonesia is a subsidiary of the Myanmar-based UMG conglomerate that was founded in 1998. The Indonesian company is a hardware and machine distributor, with property interests in Indonesia. In 2017, UMG provided seed funding to fishery tech startup Aruna.

Demium Startups is a startup incubator with offices in Madrid, Barcelona and Valencia. It has two other branches: Demium Games that focuses on the video-gaming sector and Oarsis, oriented to startups working on VR/AR-related technology.

Demium Startups is a startup incubator with offices in Madrid, Barcelona and Valencia. It has two other branches: Demium Games that focuses on the video-gaming sector and Oarsis, oriented to startups working on VR/AR-related technology.

Centro para el Desarollo Tecnológico Industrial (CDTI) is a Spanish government startup accelerator under the Ministry of Science, Education and Universities. Based in Madrid, it has invested in 13 startups since 2015, predominantly focusing on scientific enterprises.

Centro para el Desarollo Tecnológico Industrial (CDTI) is a Spanish government startup accelerator under the Ministry of Science, Education and Universities. Based in Madrid, it has invested in 13 startups since 2015, predominantly focusing on scientific enterprises.

Samator Education is part of the Indonesian conglomerate PT Samator, with business interests in the petrochemical, real estate, healthcare and automotive industries. To date, it has only backed one company: HarukaEdu, an edtech startup that provides online courses and degree programs in Indonesia.

Samator Education is part of the Indonesian conglomerate PT Samator, with business interests in the petrochemical, real estate, healthcare and automotive industries. To date, it has only backed one company: HarukaEdu, an edtech startup that provides online courses and degree programs in Indonesia.

Founded in 2018, Agaeti Ventures is an Indonesia-focused VC that participates at the pre-Series A and Series A levels. Agaeti's portfolio includes smart retail kiosk startup Warung Pintar, delivery coffee chain Fore Coffee and Bangladeshi transportation firm Pathao.

Founded in 2018, Agaeti Ventures is an Indonesia-focused VC that participates at the pre-Series A and Series A levels. Agaeti's portfolio includes smart retail kiosk startup Warung Pintar, delivery coffee chain Fore Coffee and Bangladeshi transportation firm Pathao.

Based in Singapore, GreenMeadows Accelerator (GMA) is a VC firm that provides incubator and accelerator services. GMA mainly invests in advanced manufacturing, engineering and clean/green-tech sectors. Enterprise Singapore Startup Equity SG is its co-investment partner.

Based in Singapore, GreenMeadows Accelerator (GMA) is a VC firm that provides incubator and accelerator services. GMA mainly invests in advanced manufacturing, engineering and clean/green-tech sectors. Enterprise Singapore Startup Equity SG is its co-investment partner.

Founded by Zhang Yiming in 2012, ByteDance is currently the world’s most valuable startup, worth over $100bn by May 2020. It owns quite a number of popular apps including the news aggregator Jinri Toutiao and short video platforms such as Douyin and its overseas version TikTok.ByteDance is also an active investor in China’s startup ecosystem. With a focus on education and gaming, it also invests in sectors of media, enterprise tech, education, gaming, finance, real estate, artificial intelligence and hardware. As of mid-2020, it had invested in 89 companies.

Founded by Zhang Yiming in 2012, ByteDance is currently the world’s most valuable startup, worth over $100bn by May 2020. It owns quite a number of popular apps including the news aggregator Jinri Toutiao and short video platforms such as Douyin and its overseas version TikTok.ByteDance is also an active investor in China’s startup ecosystem. With a focus on education and gaming, it also invests in sectors of media, enterprise tech, education, gaming, finance, real estate, artificial intelligence and hardware. As of mid-2020, it had invested in 89 companies.

Srinivasa Hatcheries is part of the SH Group that was set up in 1978. Based in Hyderabad, the diversified public-listed group started in poultry farming in 1965. Its first disclosed startup investment was in the Series A round of alternative protein startup String Bio in 2019.The Mega Food Park is a hi-tech chicken and egg processing facility. The Srinivasa farms also manufacture and supply poultry feed in India. Its HiPro Soybean meal has the most concentrated amount of protein in the market. The group is also involved in agriculture, goat breeding and food retailing.

Srinivasa Hatcheries is part of the SH Group that was set up in 1978. Based in Hyderabad, the diversified public-listed group started in poultry farming in 1965. Its first disclosed startup investment was in the Series A round of alternative protein startup String Bio in 2019.The Mega Food Park is a hi-tech chicken and egg processing facility. The Srinivasa farms also manufacture and supply poultry feed in India. Its HiPro Soybean meal has the most concentrated amount of protein in the market. The group is also involved in agriculture, goat breeding and food retailing.

Reus Capital is a pledge fund focused on technology startups in the Catalan ecosystem. It was founded in 2013 and is headquartered in Reus, Catalonia. To date, it has invested a total of €10 million in more than 20 startup companies.

Reus Capital is a pledge fund focused on technology startups in the Catalan ecosystem. It was founded in 2013 and is headquartered in Reus, Catalonia. To date, it has invested a total of €10 million in more than 20 startup companies.

HUNOSA Group is a Spanish energy and mining company based in the northern region of Asturias, founded in 1967. Its only disclosed tech startup investment to date was in the 2021 $1.8m seed round of Asturias-based Triditive the first automated additive manufacturing technology.

HUNOSA Group is a Spanish energy and mining company based in the northern region of Asturias, founded in 1967. Its only disclosed tech startup investment to date was in the 2021 $1.8m seed round of Asturias-based Triditive the first automated additive manufacturing technology.

Founded in 2012, Purple Orange’s objective is to support the transition away from animals in the food chain, supporting early-stage food and biotech companies across the globe with a focus on alternative proteins and cellular agriculture. It currently has 12 startups from different nations in its portfolio. Its most recently disclosed investments have been in the December 2020 pre-seed round of Chinese cultured meat startup CellX and in the November 2020 $500,000 pre-seed round of Swedish plant-based food vending startup VEAT.

Founded in 2012, Purple Orange’s objective is to support the transition away from animals in the food chain, supporting early-stage food and biotech companies across the globe with a focus on alternative proteins and cellular agriculture. It currently has 12 startups from different nations in its portfolio. Its most recently disclosed investments have been in the December 2020 pre-seed round of Chinese cultured meat startup CellX and in the November 2020 $500,000 pre-seed round of Swedish plant-based food vending startup VEAT.

Adrian Cheng Chi-kong is a third generation heir to HK billionaire Cheng Yu-tung.Adrian Cheng Chi-kong founded K11 brand in 2008, and became Executive Vice-Chairman at New World Development in 2015.Besides traditional retail, he invests in more areas such as food, fashion, technology.He founded C Ventures to invest in the businesses that focus on millennials. C Ventures has invested in Moda Operandi, an American fashion startup, Flont, luxury jewelry rental service, among others.He invested in American AI startup ObEN and Chinese cooking video platform Daydaycook, etc, through K11.He also invested in Aibee, Hua Medicine and Xiaohongshu as individual investor.

Adrian Cheng Chi-kong is a third generation heir to HK billionaire Cheng Yu-tung.Adrian Cheng Chi-kong founded K11 brand in 2008, and became Executive Vice-Chairman at New World Development in 2015.Besides traditional retail, he invests in more areas such as food, fashion, technology.He founded C Ventures to invest in the businesses that focus on millennials. C Ventures has invested in Moda Operandi, an American fashion startup, Flont, luxury jewelry rental service, among others.He invested in American AI startup ObEN and Chinese cooking video platform Daydaycook, etc, through K11.He also invested in Aibee, Hua Medicine and Xiaohongshu as individual investor.

Founded in 1996, HMC Venture is a subsidiary of the Harmony Group, a conglomerate that specializes in startup investment and chemical trade. HMC Venture’s investments focus on Internet-based FinTech and the enterprise service business, the medical and biological business and private equity.

Founded in 1996, HMC Venture is a subsidiary of the Harmony Group, a conglomerate that specializes in startup investment and chemical trade. HMC Venture’s investments focus on Internet-based FinTech and the enterprise service business, the medical and biological business and private equity.

Founded in 2009, Modara Technologies invests in SMEs in the Spanish startup ecosystem. Modara provides equity, as well as operational and organizational support. The firm comprises international partners offering a wide range of investment, management and business experience.

Founded in 2009, Modara Technologies invests in SMEs in the Spanish startup ecosystem. Modara provides equity, as well as operational and organizational support. The firm comprises international partners offering a wide range of investment, management and business experience.

Provident Capital is a Singapore-based venture capital firm, investing mostly in Indonesian businesses. Its portfolio spans various industries, including telecommunications, mining and agriculture. It has also invested in JD.id, the Indonesian branch of Chinese e-commerce giant JD.com, as well as Indonesian microlending startup JULO.

Provident Capital is a Singapore-based venture capital firm, investing mostly in Indonesian businesses. Its portfolio spans various industries, including telecommunications, mining and agriculture. It has also invested in JD.id, the Indonesian branch of Chinese e-commerce giant JD.com, as well as Indonesian microlending startup JULO.

Pushed by Covid-19, Landing.Jobs repositions itself as IT talent ecosystem

The Portuguese tech jobs portal is pivoting into global talent hub with Future.Works, providing AI-driven recruitment services, training and career management for IT professionals

Portugal's Prodsmart takes AI, IoT-based manufacturing to US factories

Smart factories can cut wastage by 80% and improve inventory, production and supply chains, tackling US$200 billion worth of losses

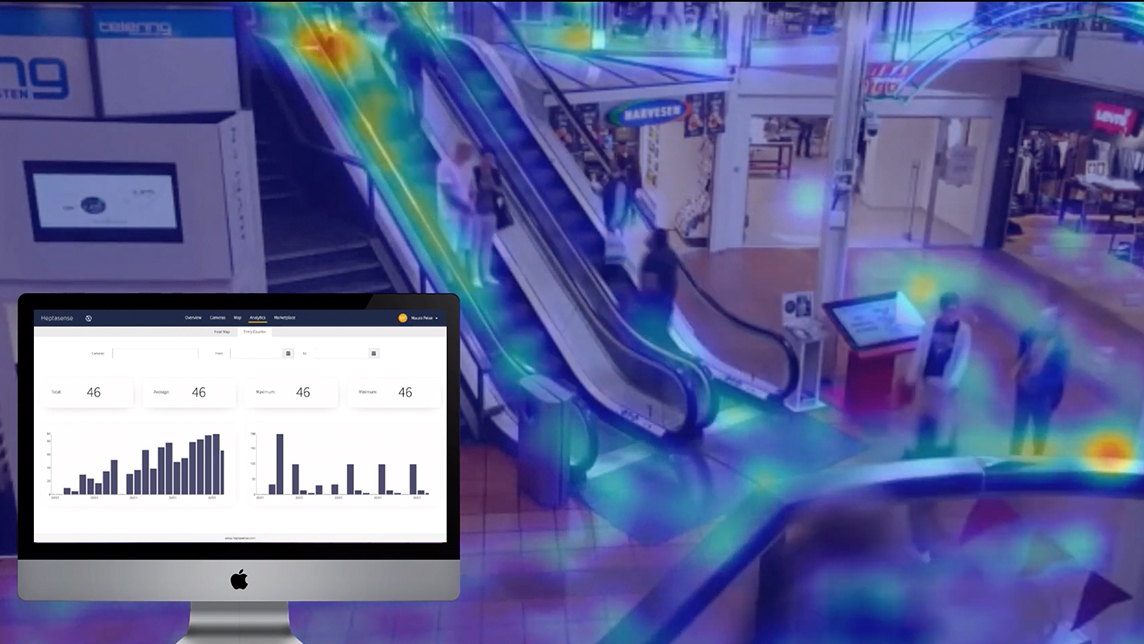

Heptasense wins trust at a time of (lax) global surveillance

There may be some 700 million surveillance cameras running worldwide in today's age of global security threats, yet 98% of them are unmonitored. A Lisbon-based startup is promising real-time response and greater reliability in security tech

EatTasty: Portugal's sustainable meal delivery service has arrived in Spain

EatTasty's different and more sustainable business model turns the on-demand food delivery sector on its head

Women entrepreneurs get ahead faster in Portugal

Still a long way to go for equality, but female founders in Portugal have made significant headstarts as tech innovators

Coronavirus: Portuguese startups pitch in as nation battles pandemic

More than 120 startups join the #tech4COVID19 initiative, offering the public free medical help, meals for the vulnerable, online education and more

In Portugal tourism tech gets disrupted, in time for post-Covid-19 era

As Portugal reopens to tourists early next month, the sector is banking on a new generation of tourism tech startups to enable safety and reassure visitors

Startup shutdown: Some takeaways from BlackGarlic’s demise

Meal subscription service BlackGarlic shut down in July, blaming the high costs of customer acquisition and retention. Here’s a look at why the Blue Apron copy couldn't satisfy the Indonesian market’s palate

Lawtech startup Reclamador.es takes negligent companies to task

Reclamador.es’ team of top-notch lawyers has seen a 98% success rate in their fight for consumers’ rights, though scaling up has been difficult

Chinese DIY robotics startup Makeblock enters the classroom

Present in more than 140 countries, this ambitious startup is taking global STEM education by storm

Indonesia agritech startup HARA goes on the blockchain

What began as a way to help farmers make data-driven decisions has unexpectedly expanded into blockchain. How does HARA plan to use this technology to improve outcomes in agriculture?

HighPitch 2020: Goers wins Indonesia's national startup competition

Event ticketing startup Goers gains new revenue streams with pivot to helping leisure spots go online; hotel SaaS Izy and on-demand medical testing service CekLab also in top three

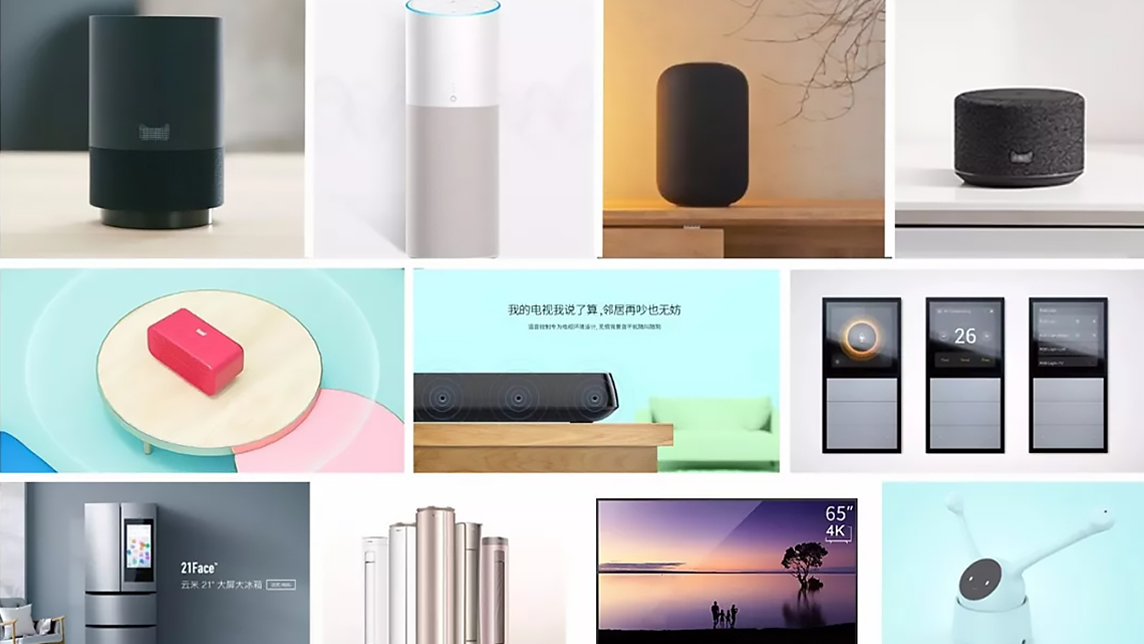

This voice technology startup empowers both developers and machines

AISpeech shifted its business from education to IoT but has always remained focused on voice interaction between humans and machines

Chinese startup Xianghuanji takes a gamble on smartphone leasing

Now you can rent the newest phones for half the price of an upgrade

Intracity delivery startup Fengxiansheng takes on the Middle East

Backed by the most popular online shopping platform in the Middle East, Hangzhou's No. 1 intracity delivery startup Fengxiansheng (“Mr Wind”) is expanding to the region

Sorry, we couldn’t find any matches for“Startup Lisboa”.