Startup Lisboa

-

DATABASE (570)

-

ARTICLES (690)

Based in New York City, Pavilion Capital is linked to Singapore's Temasek Holdings. The firm primarily invests in US and Asian companies. Its portfolio includes entertainment and social media holding company M17, smart retail kiosk startup Warung Pintar and delivery coffee chain Fore Coffee.

Based in New York City, Pavilion Capital is linked to Singapore's Temasek Holdings. The firm primarily invests in US and Asian companies. Its portfolio includes entertainment and social media holding company M17, smart retail kiosk startup Warung Pintar and delivery coffee chain Fore Coffee.

Plug and Play, the world’s largest startup accelerator, is a seed and early-stage investment firm. Based in Silicon Valley, Plug and Play invests in more than 160 of the 5,000 startups it reviews every year and runs industry-specific accelerator programs to help the startups it funds grow faster.

Plug and Play, the world’s largest startup accelerator, is a seed and early-stage investment firm. Based in Silicon Valley, Plug and Play invests in more than 160 of the 5,000 startups it reviews every year and runs industry-specific accelerator programs to help the startups it funds grow faster.

ICONIQ Capital is a private investment management company that is known for serving a wide variety of famous clients, including Facebook’s Mark Zuckerberg and Sheryl Sandberg, Twitter founder Jack Dorsey and Asian billionaire Li Ka-shing, among other Silicon Valley elites and world-famous billionaires. The company is led by Divesh Makan, Chad Boeding and Michael Anders, who were coworkers at Goldman Sachs and joined Morgan Stanley together before establishing ICONIQ in 2011.The investment company is a mix of family office and venture capital, with specialized verticals in tech startup investing, real estate, and impact investments. Its VC arm, ICONIQ Growth, manages over $9b in capital commitments, and has invested into companies like stock brokerage app Robinhood, short-term accommodation startup Airbnb, and online signature company DocuSign.

ICONIQ Capital is a private investment management company that is known for serving a wide variety of famous clients, including Facebook’s Mark Zuckerberg and Sheryl Sandberg, Twitter founder Jack Dorsey and Asian billionaire Li Ka-shing, among other Silicon Valley elites and world-famous billionaires. The company is led by Divesh Makan, Chad Boeding and Michael Anders, who were coworkers at Goldman Sachs and joined Morgan Stanley together before establishing ICONIQ in 2011.The investment company is a mix of family office and venture capital, with specialized verticals in tech startup investing, real estate, and impact investments. Its VC arm, ICONIQ Growth, manages over $9b in capital commitments, and has invested into companies like stock brokerage app Robinhood, short-term accommodation startup Airbnb, and online signature company DocuSign.

Rocky Pesik is the son of Rudy Pesik, founder of the Caraka Group of logistics companies and Birotika Semesta, DHL's partner company in Indonesia. Rocky is a director at both the Caraka Group and Birotika Semesta and has invested in two startups, logistics startup Pakde and international shopping intermediary GudangImpor.

Rocky Pesik is the son of Rudy Pesik, founder of the Caraka Group of logistics companies and Birotika Semesta, DHL's partner company in Indonesia. Rocky is a director at both the Caraka Group and Birotika Semesta and has invested in two startups, logistics startup Pakde and international shopping intermediary GudangImpor.

GROW is a Singapore-based food and agriculture technology accelerator for global impact-focused startups. It is financially backed by AgFunder, an agrifood tech venture investment through the AgFunder GROW Impact Fund. Grow is also supported by the Singapore Government and is an accredited mentor partner of Startup SG.

GROW is a Singapore-based food and agriculture technology accelerator for global impact-focused startups. It is financially backed by AgFunder, an agrifood tech venture investment through the AgFunder GROW Impact Fund. Grow is also supported by the Singapore Government and is an accredited mentor partner of Startup SG.

Chu Ge is a founding partner of Happy Together (Chunguangli), a startup incubator and venture capital firm focusing on internet projects. Formerly creative director at Bates and Ogilvy, he was also a guest lecturer at Communication University of China. He has been listed as one of China’s 50 most influential creators.

Chu Ge is a founding partner of Happy Together (Chunguangli), a startup incubator and venture capital firm focusing on internet projects. Formerly creative director at Bates and Ogilvy, he was also a guest lecturer at Communication University of China. He has been listed as one of China’s 50 most influential creators.

SWAN Venture Fund is a group of Seattle angel investors established in 2015. It leads in early seed rounds and tends to be the first major outside investment to a startup, ranging from US$200,000 – US$1.2 million. Besides tech startups, it also invests in companies producing innovative commercial products.

SWAN Venture Fund is a group of Seattle angel investors established in 2015. It leads in early seed rounds and tends to be the first major outside investment to a startup, ranging from US$200,000 – US$1.2 million. Besides tech startups, it also invests in companies producing innovative commercial products.

IDEPA is the governmental Agency for Economic Development of the Principality of Asturias, under the Ministry of Employment, Industry, and Economic Promition, founded in 1983. Its only disclosed tech startup investment to date was in the 2021 $1.8m seed round of Asturias-based Triditive the first automated additive manufacturing technology.

IDEPA is the governmental Agency for Economic Development of the Principality of Asturias, under the Ministry of Employment, Industry, and Economic Promition, founded in 1983. Its only disclosed tech startup investment to date was in the 2021 $1.8m seed round of Asturias-based Triditive the first automated additive manufacturing technology.

Heritas Capital Management began as an investment/fund management arm of IMC Group, a diversified conglomerate in Singapore. It became a Capital Management Services firm in 2013, and according to its website it manages over SGD 250m in assets. In Indonesia, it has backed telemedicine startup Alodokter and healthy catering company Gorry Holdings.

Heritas Capital Management began as an investment/fund management arm of IMC Group, a diversified conglomerate in Singapore. It became a Capital Management Services firm in 2013, and according to its website it manages over SGD 250m in assets. In Indonesia, it has backed telemedicine startup Alodokter and healthy catering company Gorry Holdings.

Goat Capital is a venture capital fund was set up by video livestreamer Justin.tv and Twitch co-founder Justin Kan and Robin Chan, also an angel investor and entrepreneur. Chan met Kan while working at Verizon Wireless when Justin.tv was being launched. Both have since become private investors for over 10 years, with early investments including Twitter, Xiaomi, Bird, Uber and Square. Established in September 2020, the fund’s name was inspired by the goat because good startup founders need to be agile and resilient to survive and be successful, according to Kan.Kan was also an early investor of Indonesian payment gateway Xendit before Goat Capital joined Xendit’s $150m Series C round in September 2021. Goat Capital’s portfolio includes corporate credit card startup Kodo, Indian neobank Bueno Finance, carbon capture developers Holy Grail and web development tool Spore. The hybrid incubator and VC fund has already secured $25m and aims to raise a total of $40m to invest in diverse sectors like digital health, e-commerce, robotics, climate change and gaming entertainment. Funding per startup would range from $500,000 to $3m.

Goat Capital is a venture capital fund was set up by video livestreamer Justin.tv and Twitch co-founder Justin Kan and Robin Chan, also an angel investor and entrepreneur. Chan met Kan while working at Verizon Wireless when Justin.tv was being launched. Both have since become private investors for over 10 years, with early investments including Twitter, Xiaomi, Bird, Uber and Square. Established in September 2020, the fund’s name was inspired by the goat because good startup founders need to be agile and resilient to survive and be successful, according to Kan.Kan was also an early investor of Indonesian payment gateway Xendit before Goat Capital joined Xendit’s $150m Series C round in September 2021. Goat Capital’s portfolio includes corporate credit card startup Kodo, Indian neobank Bueno Finance, carbon capture developers Holy Grail and web development tool Spore. The hybrid incubator and VC fund has already secured $25m and aims to raise a total of $40m to invest in diverse sectors like digital health, e-commerce, robotics, climate change and gaming entertainment. Funding per startup would range from $500,000 to $3m.

Established in 2015, Unovis Asset Management is a New York-based investor focussed on the alternative protein sector. It has raised two funds to date, the New Crop Capital Trust and The Alternative Protein Fund. It aims to transform the global food system by investing in solutions that facilitate sustained behavioral change and eliminate the consumption of animal protein products. It partners with entrepreneurs developing innovative plant-based and cultivated replacements to animal products, including meat, seafood, dairy and eggs. It currently has 33 companies in its portfolio and has managed three exits to date including Beyond Meat. Its recent investments include the undisclosed convertible note round of Spanish plant-based meat startup Foods for Tomorrow in May 2020 and in the $28m seed round of US plant-based startup Alpha Foods in February 2020.

Established in 2015, Unovis Asset Management is a New York-based investor focussed on the alternative protein sector. It has raised two funds to date, the New Crop Capital Trust and The Alternative Protein Fund. It aims to transform the global food system by investing in solutions that facilitate sustained behavioral change and eliminate the consumption of animal protein products. It partners with entrepreneurs developing innovative plant-based and cultivated replacements to animal products, including meat, seafood, dairy and eggs. It currently has 33 companies in its portfolio and has managed three exits to date including Beyond Meat. Its recent investments include the undisclosed convertible note round of Spanish plant-based meat startup Foods for Tomorrow in May 2020 and in the $28m seed round of US plant-based startup Alpha Foods in February 2020.

Antai Venture Builder is co-founded by Miguel Vicente, named “the magician of startups” by the El País newspaper. Its other co-founder is also a well-known serial entrepreneur and publicist Gerard Olivé who has interests focusing on digital businesses. He is one of the most iconic names in the Barcelona startup ecosystem.

Antai Venture Builder is co-founded by Miguel Vicente, named “the magician of startups” by the El País newspaper. Its other co-founder is also a well-known serial entrepreneur and publicist Gerard Olivé who has interests focusing on digital businesses. He is one of the most iconic names in the Barcelona startup ecosystem.

Wang, a former CCTV host, is the founder and CEO of Kaishu Story. His startup operates a WeChat official account with 20 million followers that generates RMB 200 million in revenue annually. Wang participated in Kuaipeilian's seed funding round.

Wang, a former CCTV host, is the founder and CEO of Kaishu Story. His startup operates a WeChat official account with 20 million followers that generates RMB 200 million in revenue annually. Wang participated in Kuaipeilian's seed funding round.

Healthbox is a Chicago-based medtech accelerator that was established in 2010 with a global focus. To date, it has invested in more than 90 startups, mostly in seed rounds of up to $100,000 per startup. The firm has seen three exits so far. Since 2014, Healthbox has also been offering consultancy services.

Healthbox is a Chicago-based medtech accelerator that was established in 2010 with a global focus. To date, it has invested in more than 90 startups, mostly in seed rounds of up to $100,000 per startup. The firm has seen three exits so far. Since 2014, Healthbox has also been offering consultancy services.

Mahanusa Capital is a financial services company founded by Daniel Budiman. The firm provides investment banking and brokerage services through its subsidiaries, Mahanusa Securities and Magna Finance. It also manages major property assets in Indonesia, including the Pacific Place mall in Jakarta. Mahanusa Capital has invested in digital signature startup PrivyID and local event discovery app Goers.

Mahanusa Capital is a financial services company founded by Daniel Budiman. The firm provides investment banking and brokerage services through its subsidiaries, Mahanusa Securities and Magna Finance. It also manages major property assets in Indonesia, including the Pacific Place mall in Jakarta. Mahanusa Capital has invested in digital signature startup PrivyID and local event discovery app Goers.

Pushed by Covid-19, Landing.Jobs repositions itself as IT talent ecosystem

The Portuguese tech jobs portal is pivoting into global talent hub with Future.Works, providing AI-driven recruitment services, training and career management for IT professionals

Portugal's Prodsmart takes AI, IoT-based manufacturing to US factories

Smart factories can cut wastage by 80% and improve inventory, production and supply chains, tackling US$200 billion worth of losses

Heptasense wins trust at a time of (lax) global surveillance

There may be some 700 million surveillance cameras running worldwide in today's age of global security threats, yet 98% of them are unmonitored. A Lisbon-based startup is promising real-time response and greater reliability in security tech

EatTasty: Portugal's sustainable meal delivery service has arrived in Spain

EatTasty's different and more sustainable business model turns the on-demand food delivery sector on its head

Women entrepreneurs get ahead faster in Portugal

Still a long way to go for equality, but female founders in Portugal have made significant headstarts as tech innovators

Coronavirus: Portuguese startups pitch in as nation battles pandemic

More than 120 startups join the #tech4COVID19 initiative, offering the public free medical help, meals for the vulnerable, online education and more

In Portugal tourism tech gets disrupted, in time for post-Covid-19 era

As Portugal reopens to tourists early next month, the sector is banking on a new generation of tourism tech startups to enable safety and reassure visitors

Startup shutdown: Some takeaways from BlackGarlic’s demise

Meal subscription service BlackGarlic shut down in July, blaming the high costs of customer acquisition and retention. Here’s a look at why the Blue Apron copy couldn't satisfy the Indonesian market’s palate

Lawtech startup Reclamador.es takes negligent companies to task

Reclamador.es’ team of top-notch lawyers has seen a 98% success rate in their fight for consumers’ rights, though scaling up has been difficult

Chinese DIY robotics startup Makeblock enters the classroom

Present in more than 140 countries, this ambitious startup is taking global STEM education by storm

Indonesia agritech startup HARA goes on the blockchain

What began as a way to help farmers make data-driven decisions has unexpectedly expanded into blockchain. How does HARA plan to use this technology to improve outcomes in agriculture?

HighPitch 2020: Goers wins Indonesia's national startup competition

Event ticketing startup Goers gains new revenue streams with pivot to helping leisure spots go online; hotel SaaS Izy and on-demand medical testing service CekLab also in top three

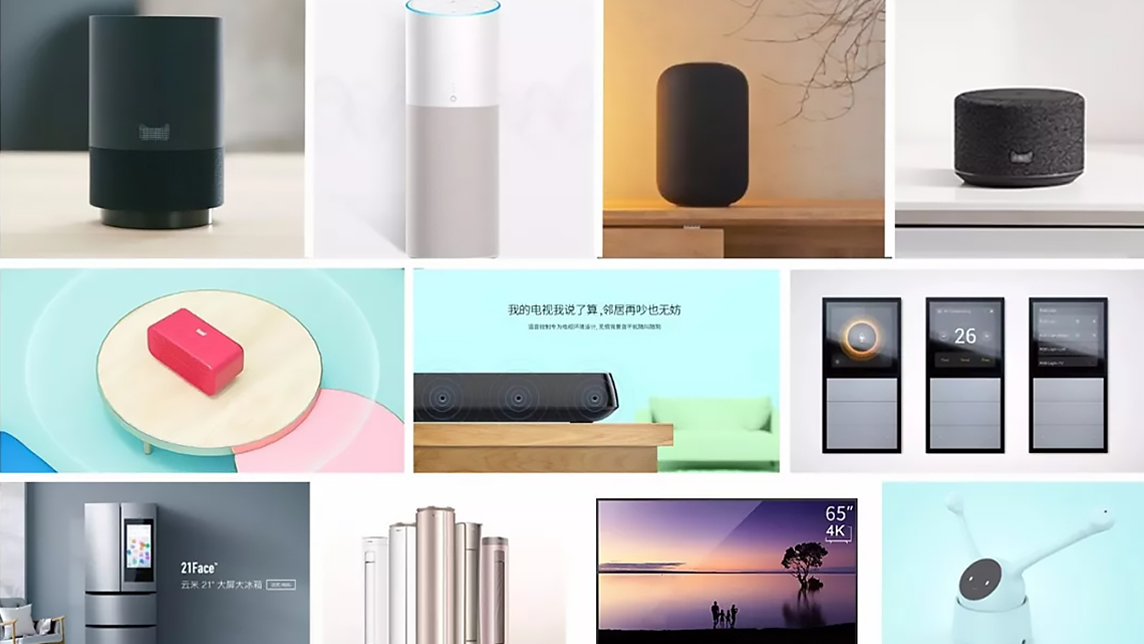

This voice technology startup empowers both developers and machines

AISpeech shifted its business from education to IoT but has always remained focused on voice interaction between humans and machines

Chinese startup Xianghuanji takes a gamble on smartphone leasing

Now you can rent the newest phones for half the price of an upgrade

Intracity delivery startup Fengxiansheng takes on the Middle East

Backed by the most popular online shopping platform in the Middle East, Hangzhou's No. 1 intracity delivery startup Fengxiansheng (“Mr Wind”) is expanding to the region

Sorry, we couldn’t find any matches for“Startup Lisboa”.