Startup with IBM

DATABASE (997)

ARTICLES (811)

WA4STEAM is a not-for-profit organization that provides seed capital with an investment focus on supporting women with projects and ideas applicable to STEAM sectors (Science, Technology, Engineering, Arts/Architecture and Mathematics).The association is composed of women with backgrounds and experiences in biosciences, mathematics, finance, engineering, law, accounting and coaching. It offers significant support to the founders during the early stages of the startup cycle.WA4STEAM cooperates with a network of co-investors, VC funds, family offices, accelerators and incubators. It also collaborates with university associations and science and technology parks that back and leverage the portfolio of companies.

WA4STEAM is a not-for-profit organization that provides seed capital with an investment focus on supporting women with projects and ideas applicable to STEAM sectors (Science, Technology, Engineering, Arts/Architecture and Mathematics).The association is composed of women with backgrounds and experiences in biosciences, mathematics, finance, engineering, law, accounting and coaching. It offers significant support to the founders during the early stages of the startup cycle.WA4STEAM cooperates with a network of co-investors, VC funds, family offices, accelerators and incubators. It also collaborates with university associations and science and technology parks that back and leverage the portfolio of companies.

Founded by Zhang Yiming in 2012, ByteDance is currently the world’s most valuable startup, worth over $100bn by May 2020. It owns quite a number of popular apps including the news aggregator Jinri Toutiao and short video platforms such as Douyin and its overseas version TikTok.ByteDance is also an active investor in China’s startup ecosystem. With a focus on education and gaming, it also invests in sectors of media, enterprise tech, education, gaming, finance, real estate, artificial intelligence and hardware. As of mid-2020, it had invested in 89 companies.

Founded by Zhang Yiming in 2012, ByteDance is currently the world’s most valuable startup, worth over $100bn by May 2020. It owns quite a number of popular apps including the news aggregator Jinri Toutiao and short video platforms such as Douyin and its overseas version TikTok.ByteDance is also an active investor in China’s startup ecosystem. With a focus on education and gaming, it also invests in sectors of media, enterprise tech, education, gaming, finance, real estate, artificial intelligence and hardware. As of mid-2020, it had invested in 89 companies.

Kinesys Group is an Indonesian VC founded in 2019 by startup ecosystem builder Yansen Kamto. The company made their debut investment in new retail F&B startup Wahyoo. They have also backed sweet-drinks chain Goola and online learning center Zenius. While the company has made at least five investments in Indonesian companies, they have not closed their first fund, for which they targeted to reach $20m. Kinesys targets seed rounds, contributing ticket sizes averaging around $500,000 per startup.

Kinesys Group is an Indonesian VC founded in 2019 by startup ecosystem builder Yansen Kamto. The company made their debut investment in new retail F&B startup Wahyoo. They have also backed sweet-drinks chain Goola and online learning center Zenius. While the company has made at least five investments in Indonesian companies, they have not closed their first fund, for which they targeted to reach $20m. Kinesys targets seed rounds, contributing ticket sizes averaging around $500,000 per startup.

Founded in 2012, Purple Orange’s objective is to support the transition away from animals in the food chain, supporting early-stage food and biotech companies across the globe with a focus on alternative proteins and cellular agriculture. It currently has 12 startups from different nations in its portfolio. Its most recently disclosed investments have been in the December 2020 pre-seed round of Chinese cultured meat startup CellX and in the November 2020 $500,000 pre-seed round of Swedish plant-based food vending startup VEAT.

Founded in 2012, Purple Orange’s objective is to support the transition away from animals in the food chain, supporting early-stage food and biotech companies across the globe with a focus on alternative proteins and cellular agriculture. It currently has 12 startups from different nations in its portfolio. Its most recently disclosed investments have been in the December 2020 pre-seed round of Chinese cultured meat startup CellX and in the November 2020 $500,000 pre-seed round of Swedish plant-based food vending startup VEAT.

CTO and co-founder of CrowdDana

Handison Jaya graduated from Universitas Indonesia with a bachelor's in Computer Engineering. After graduating in 2015, he joined Bornevia, a now-defunct startup that created an email-focused CRM system for corporates. He left Bornevia in 2016 and joined Ematic, another email-based marketing service startup. He stayed at Ematic for almost three years and became a senior software engineer.In 2019, Handison left Ematic with work colleague Stevanus Iskandar Halim to develop an equity crowdfunding platform. Together with Halim's university acquaintance James Wiryadi, they co-founded CrowdDana.

Handison Jaya graduated from Universitas Indonesia with a bachelor's in Computer Engineering. After graduating in 2015, he joined Bornevia, a now-defunct startup that created an email-focused CRM system for corporates. He left Bornevia in 2016 and joined Ematic, another email-based marketing service startup. He stayed at Ematic for almost three years and became a senior software engineer.In 2019, Handison left Ematic with work colleague Stevanus Iskandar Halim to develop an equity crowdfunding platform. Together with Halim's university acquaintance James Wiryadi, they co-founded CrowdDana.

UOB Venture Management is a private equity firm backed by the United Overseas Bank (UOB). It invests in growing companies at their expansion stages, with special focus on the Southeast Asia and China markets. Its portfolio is diverse, ranging from food and health companies to petrochemicals and tech businesses like Giosis (which operates e-commerce site Qoo10) and AI-powered marketing service startup Appier.

UOB Venture Management is a private equity firm backed by the United Overseas Bank (UOB). It invests in growing companies at their expansion stages, with special focus on the Southeast Asia and China markets. Its portfolio is diverse, ranging from food and health companies to petrochemicals and tech businesses like Giosis (which operates e-commerce site Qoo10) and AI-powered marketing service startup Appier.

Co-founder of EatTasty

University of Minho graduate Rui Costa holds a master’s degree in Marketing and Strategic Management. Since graduation, he had been working at marketing and advertising agency BySide as a digital strategist and business developer, before leaving to focus on his startup EatTasty. He co-founded the startup with BySide colleague Orlando Lopes.

University of Minho graduate Rui Costa holds a master’s degree in Marketing and Strategic Management. Since graduation, he had been working at marketing and advertising agency BySide as a digital strategist and business developer, before leaving to focus on his startup EatTasty. He co-founded the startup with BySide colleague Orlando Lopes.

ICONIQ Capital is a private investment management company that is known for serving a wide variety of famous clients, including Facebook’s Mark Zuckerberg and Sheryl Sandberg, Twitter founder Jack Dorsey and Asian billionaire Li Ka-shing, among other Silicon Valley elites and world-famous billionaires. The company is led by Divesh Makan, Chad Boeding and Michael Anders, who were coworkers at Goldman Sachs and joined Morgan Stanley together before establishing ICONIQ in 2011.The investment company is a mix of family office and venture capital, with specialized verticals in tech startup investing, real estate, and impact investments. Its VC arm, ICONIQ Growth, manages over $9b in capital commitments, and has invested into companies like stock brokerage app Robinhood, short-term accommodation startup Airbnb, and online signature company DocuSign.

ICONIQ Capital is a private investment management company that is known for serving a wide variety of famous clients, including Facebook’s Mark Zuckerberg and Sheryl Sandberg, Twitter founder Jack Dorsey and Asian billionaire Li Ka-shing, among other Silicon Valley elites and world-famous billionaires. The company is led by Divesh Makan, Chad Boeding and Michael Anders, who were coworkers at Goldman Sachs and joined Morgan Stanley together before establishing ICONIQ in 2011.The investment company is a mix of family office and venture capital, with specialized verticals in tech startup investing, real estate, and impact investments. Its VC arm, ICONIQ Growth, manages over $9b in capital commitments, and has invested into companies like stock brokerage app Robinhood, short-term accommodation startup Airbnb, and online signature company DocuSign.

Public-listed PT Surya Semesta Internusa Tbk (aka Surya Internusa or SSIA) is a property conglomerate with interests in hospitality, property, construction and infrastructure. Founded by the President Director Johannes Suriadjaja in 1971 as a private property developer, the company was listed as SSIA in 1997. His daughter Christina Suriadjaja is a co-founder of Travelio, a tech startup that was originally created for Surya Internusa in 2014.

Public-listed PT Surya Semesta Internusa Tbk (aka Surya Internusa or SSIA) is a property conglomerate with interests in hospitality, property, construction and infrastructure. Founded by the President Director Johannes Suriadjaja in 1971 as a private property developer, the company was listed as SSIA in 1997. His daughter Christina Suriadjaja is a co-founder of Travelio, a tech startup that was originally created for Surya Internusa in 2014.

S2 Capital was founded by Y Combinator alums Sohail Prasad, Samvit Ramadurgam and Ritik Malhotra. The founders of S2 Capital have mostly invested in the US, leveraging their relationships with startups there, both before and during their time at Y Combinator. Payfazz is a notable exception in S2 Capital's portfolio, being the first startup from Indonesia to have participated in the Y Combinator program.

S2 Capital was founded by Y Combinator alums Sohail Prasad, Samvit Ramadurgam and Ritik Malhotra. The founders of S2 Capital have mostly invested in the US, leveraging their relationships with startups there, both before and during their time at Y Combinator. Payfazz is a notable exception in S2 Capital's portfolio, being the first startup from Indonesia to have participated in the Y Combinator program.

Led by co-founder and Managing Partner Alexandre Barbosa, Faber Ventures is a pan-European venture capital firm with offices in Lisbon and London. It was founded in 2012 with VCs Caixa Capital and Shilling Capital Partners investors in Faber Ventures.The firm works alongside founders from idea to market, either as co-founders or angel investors, and typically continues to support the startup as seed co-investors. Faber Ventures also supports startups at the seed stage with financial investment and hands-on mentorship. The company has invested in 19 startups to date in varied sectors and managed two exits, Glitter and Gleam.

Led by co-founder and Managing Partner Alexandre Barbosa, Faber Ventures is a pan-European venture capital firm with offices in Lisbon and London. It was founded in 2012 with VCs Caixa Capital and Shilling Capital Partners investors in Faber Ventures.The firm works alongside founders from idea to market, either as co-founders or angel investors, and typically continues to support the startup as seed co-investors. Faber Ventures also supports startups at the seed stage with financial investment and hands-on mentorship. The company has invested in 19 startups to date in varied sectors and managed two exits, Glitter and Gleam.

With more than 175 years of history, Navistar is the fourth biggest truck-maker in the US. The company drives new innovations in engine technologies, with products ranging from commercial trucks and buses to defense vehicles.In June 2020, it partnered with self-driving trucking startup TuSimple to produce L4 autonomous trucks. It also invested in its first Chinese company TuSimple.In March 2021, Navistar stockholders approved acquisition by TRATON, part of the Volkswagen Group. TRATON has also invested in TuSimple.

With more than 175 years of history, Navistar is the fourth biggest truck-maker in the US. The company drives new innovations in engine technologies, with products ranging from commercial trucks and buses to defense vehicles.In June 2020, it partnered with self-driving trucking startup TuSimple to produce L4 autonomous trucks. It also invested in its first Chinese company TuSimple.In March 2021, Navistar stockholders approved acquisition by TRATON, part of the Volkswagen Group. TRATON has also invested in TuSimple.

Allianz X is the venture capital arm of Allianz Group. Its investments primarily focus on insurance, healthcare and finance-related tech startups, such as American Well, BIMA (micro-insurance company) and Simplesurance. However, it recently made investments in Indonesian ride-hailing startup Gojek as well as the Drone Racing League, a startup that promotes drone racing as an emerging sport.

Allianz X is the venture capital arm of Allianz Group. Its investments primarily focus on insurance, healthcare and finance-related tech startups, such as American Well, BIMA (micro-insurance company) and Simplesurance. However, it recently made investments in Indonesian ride-hailing startup Gojek as well as the Drone Racing League, a startup that promotes drone racing as an emerging sport.

Based in UK, Will Neale is a prolific angel and early-stage investor with interests in over a dozen startups from the pre-seed to Series B stages. The tech consultant had previously worked as a manager at Accenture for six years.In 2006, Neale founded mobile payments and processing startup Fonix Mobile. He also created Grabyo, a cloud-based video production, editing and distribution platform in 2013.

Based in UK, Will Neale is a prolific angel and early-stage investor with interests in over a dozen startups from the pre-seed to Series B stages. The tech consultant had previously worked as a manager at Accenture for six years.In 2006, Neale founded mobile payments and processing startup Fonix Mobile. He also created Grabyo, a cloud-based video production, editing and distribution platform in 2013.

FIWARE Accelerator: More open source ecosystem than accelerator

The European open source initiative to boost smart infrastructures and solutions is calling for new participants to join its unique acceleration ecosystem

HEMAV: World’s leading drone services company for agriculture

Now a global leader known for its industry-targeted software, HEMAV has expanded to 15 countries, working with utilities, farms and public bodies

After insurtech and fintech, Newralers applies AI to winemaking

Newralers expects strong demand for its disruptive AI solutions that test the cognitive value of information, with clients from listed companies to SMEs

DefinedCrowd: Helping companies mine, structure highly accurate data in AI applications

The Portuguese startup's quality-controlling smart data platform is driving its exponential growth and major partnerships with the likes of IBM's Watson Studio and Amazon

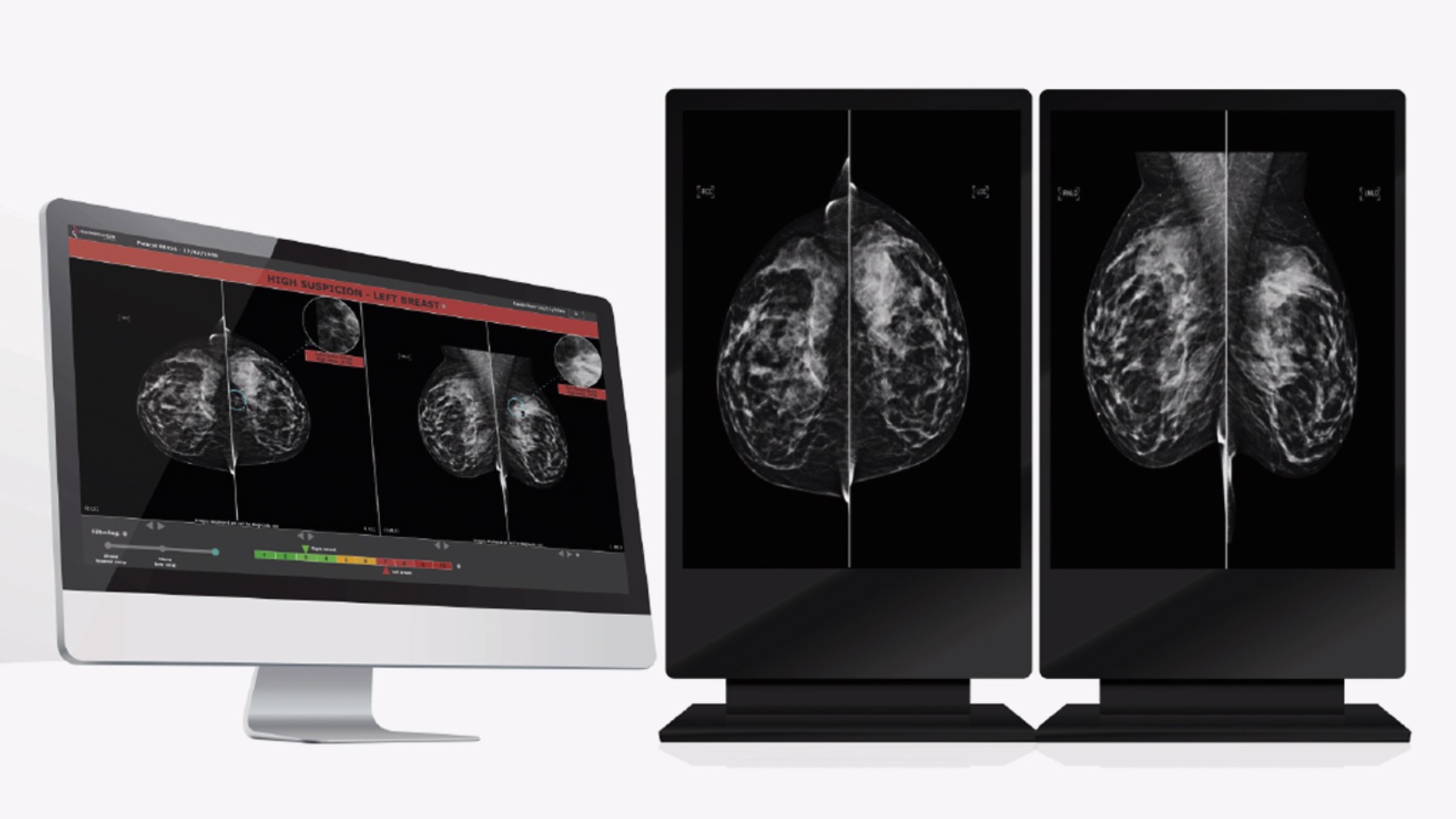

Therapixel: Using AI to improve breast cancer detection

Therapixel is raising €15m for commercial expansion of its AI-powered MammoScreen that gives accurate breast cancer screening results within minutes

This Chinese café startup aims to best Starbucks with “new retail” strategy

Luckin Coffee has gone from scratch to China’s first coffee shop unicorn in less than a year, pouring more than 5 million cups of coffee along the way

Waste management startup Magalarva aims for profitability with new factory, B2B services

Partnerships with supermarkets and waste transporters provide Magalarva with new revenue streams and sources of production input as the company ramps up its manufacturing activities

Sheetgo: Easy and secure cloud-powered spreadsheet data at your fingertips

Named Most Scalable Product at South Summit 2018, Sheetgo turns spreadsheets into data clouds for business users around the world

Gago Inc: Satellite data agritech startup ramps up growth with financial sector solutions

Founded by former NASA scientists, Gago began as a data solution to improve China’s traditionally low-yielding and inefficient smallholder-based farming sector

Billin offers unlimited free e-invoicing services to SMEs and freelancers

Offering automated online invoice generating, sharing, tracking and payments, the Spanish fintech wants to become the billing Dropbox for businesses worldwide

Fish trading startup Aruna thrives despite Covid-19 with a pivot to domestic sales

Having brought forward its domestic expansion by one year, Aruna wants to use its recent funding to further boost market expansion, develop the tech for product traceability and an intelligent supply chain

Farmer Connect: Blockchain powered platform tracing coffee beans from field to cup

Farmer Connect’s platform enables consumers to trace the origin, quality and ethical footprint of a product by just scanning a QR code

With a new focus on smart clinics, healthcare SaaS startup Medigo offers Covid-19 testing

A pivot to revenue-sharing and partnerships to provide Covid-19 testing has given Medigo a fighting chance, with a new funding round on the cards

EXCLUSIVE: Qlue raising Series B funding, "confident" of turning profitable in 2020

Qlue is also targeting more enterprise clients as it expands overseas and improved accountability and management practices

Delectatech: "Food data" proves its value in Spain's Covid-hit F&B industry

Delectatech deploys AI, NLP and big data to help restaurants and food suppliers optimize business information, decisions and operations

Sorry, we couldn’t find any matches for“Startup with IBM”.