Startup with IBM

-

DATABASE (997)

-

ARTICLES (811)

Vence’s animal collars create “virtual fences” to monitor livestock movements and provide health data, saving ranchers 30% in farming costs and boosting grassland management.

Vence’s animal collars create “virtual fences” to monitor livestock movements and provide health data, saving ranchers 30% in farming costs and boosting grassland management.

Zheng Weihe (Alex Zheng) and his wife Li Huang started Cowin Capital, one of China's earliest private equity funds, in 2000 with RMB 80 million of their own money, investing in six companies within a year. Today, it has more than RMB 10 billion in assets under management, across six PE funds. It has invested in over 150 companies to date, with 57 successful exits, including 27 IPOs – earning Zheng the moniker "The Marksman".

Zheng Weihe (Alex Zheng) and his wife Li Huang started Cowin Capital, one of China's earliest private equity funds, in 2000 with RMB 80 million of their own money, investing in six companies within a year. Today, it has more than RMB 10 billion in assets under management, across six PE funds. It has invested in over 150 companies to date, with 57 successful exits, including 27 IPOs – earning Zheng the moniker "The Marksman".

Grand China Capital is a Beijing-based venture capital firm. It invests mainly in media, entertainment, sports, tourism, and smart manufacturing sectors. It provides businesses with services such as financial investment, strategic consulting and data-based marketing. Grand China Capital co-launched a RMB 2 billion fund with Japan's SBI Group (previously known as Softbank Investment Co., Ltd) in September 2018 to drive tech development in the Asia Pacific region.

Grand China Capital is a Beijing-based venture capital firm. It invests mainly in media, entertainment, sports, tourism, and smart manufacturing sectors. It provides businesses with services such as financial investment, strategic consulting and data-based marketing. Grand China Capital co-launched a RMB 2 billion fund with Japan's SBI Group (previously known as Softbank Investment Co., Ltd) in September 2018 to drive tech development in the Asia Pacific region.

A co-founder and angel investor of HomeRun, Cheng Xiaohua graduated with a major in Automation at Changsha Railway University in 1983. The university is now known as Railway Campus, Central South University. From 1984 to 1988, he spent his postgraduate years at Graduate School, University of Chinese Academy of Sciences and earned a master’s degree in Automation. He co-founded Netac with Deng Guoshun in 1999 and became the chairman in September 2010.

A co-founder and angel investor of HomeRun, Cheng Xiaohua graduated with a major in Automation at Changsha Railway University in 1983. The university is now known as Railway Campus, Central South University. From 1984 to 1988, he spent his postgraduate years at Graduate School, University of Chinese Academy of Sciences and earned a master’s degree in Automation. He co-founded Netac with Deng Guoshun in 1999 and became the chairman in September 2010.

BAN madri+d is a network of angel investors specializing in finding and backing technology-based startups in their seed stage of development and also headquartered in Madrid .With over 116 active investors, the institution aims to establish a competitive entrepreneurial ecosystem through collaboration with business experts, research centers and public institutions.To date, BAN madri+d has already invested (directly and indirectly) more than €70,000 across 480 projects.

BAN madri+d is a network of angel investors specializing in finding and backing technology-based startups in their seed stage of development and also headquartered in Madrid .With over 116 active investors, the institution aims to establish a competitive entrepreneurial ecosystem through collaboration with business experts, research centers and public institutions.To date, BAN madri+d has already invested (directly and indirectly) more than €70,000 across 480 projects.

Founded in October 1995, CITIC Securities is China's first securities company listed in Shanghai and the Hong Kong. CITIC is its major shareholder, with 15.47% stake in it. The company provides services from securities trading, brokerage, asset management to investment banking. In 2013, CITIC Securities acquired CLSA to extend its international businesses. With branches in 13 countries and regions, it now has over 40,000 business clients and more than 10.3m individual customers home and abroad.

Founded in October 1995, CITIC Securities is China's first securities company listed in Shanghai and the Hong Kong. CITIC is its major shareholder, with 15.47% stake in it. The company provides services from securities trading, brokerage, asset management to investment banking. In 2013, CITIC Securities acquired CLSA to extend its international businesses. With branches in 13 countries and regions, it now has over 40,000 business clients and more than 10.3m individual customers home and abroad.

Evonik Venture Capital is the investment arm of Evonik Industries AG, a chemicals specialty provider in Germany. The firm also has offices in the US and China.With a fund size of €250m, Evonik has made more than 30 investments since 2012. The VC mainly invests in sectors such as nutrition & care, specialty additives and smart materials. Its portfolio includes early to growth stage startups, with investments of €15m per portfolio company.

Evonik Venture Capital is the investment arm of Evonik Industries AG, a chemicals specialty provider in Germany. The firm also has offices in the US and China.With a fund size of €250m, Evonik has made more than 30 investments since 2012. The VC mainly invests in sectors such as nutrition & care, specialty additives and smart materials. Its portfolio includes early to growth stage startups, with investments of €15m per portfolio company.

Founded in 2016, Paris-based Future Positive Capital invests in European startups in deep tech and biotechnology to solve major problems, with funding for only 20 portfolio startups. It has backed eight startups to date with its most recent investments being in the April 2021 undisclosed €5.2m funding round of French renewable energytech SWEETCH Energy and in the £7.9m Series A round of British ecosystem restoration technology Dendra Systems in September 2020.

Founded in 2016, Paris-based Future Positive Capital invests in European startups in deep tech and biotechnology to solve major problems, with funding for only 20 portfolio startups. It has backed eight startups to date with its most recent investments being in the April 2021 undisclosed €5.2m funding round of French renewable energytech SWEETCH Energy and in the £7.9m Series A round of British ecosystem restoration technology Dendra Systems in September 2020.

Yuan Tou VC was founded as a private equity firm with a registered capital of RMB 10m in Beijing in December 2015.

Yuan Tou VC was founded as a private equity firm with a registered capital of RMB 10m in Beijing in December 2015.

Early-stage-focused VC firm with a €24m first fund mainly investing in B2B and B2C digital startups headquartered in Spain. Initial investment amounts range between €70,000 and €300,000, and followup investment amounts go up to €1m per company. Describing themselves as “momentum investors” seeking quick time-to-market projects, Encomenda Smart Capital was founded in 2017 and managed by renowned Spanish angel investors Carlos Blanco, Oriol Juncosa and Miguel Sanz Sanchez, along with a network of angel investors Encomenda supports the growth of startups' portfolios and helps startups to scale at national and international levels. Encomenda invests 30% in SaaS and in projects with a recurring income model; 20% are fintech, and they also bet on the human resources, edtech and healthcare. Just two out of 25 investments have folded up between 2017 and 2020, with half the fund monies committed. Encomenda is seeking to launch a second fund in 2022 focusing on Spanish and Portuguese startups, of €40m–€50m, and multi-stage, by starting in the early-stage investments, with follow-through investments in subsequent stages.

Early-stage-focused VC firm with a €24m first fund mainly investing in B2B and B2C digital startups headquartered in Spain. Initial investment amounts range between €70,000 and €300,000, and followup investment amounts go up to €1m per company. Describing themselves as “momentum investors” seeking quick time-to-market projects, Encomenda Smart Capital was founded in 2017 and managed by renowned Spanish angel investors Carlos Blanco, Oriol Juncosa and Miguel Sanz Sanchez, along with a network of angel investors Encomenda supports the growth of startups' portfolios and helps startups to scale at national and international levels. Encomenda invests 30% in SaaS and in projects with a recurring income model; 20% are fintech, and they also bet on the human resources, edtech and healthcare. Just two out of 25 investments have folded up between 2017 and 2020, with half the fund monies committed. Encomenda is seeking to launch a second fund in 2022 focusing on Spanish and Portuguese startups, of €40m–€50m, and multi-stage, by starting in the early-stage investments, with follow-through investments in subsequent stages.

Co-founder of Mindstores

Armed with a master’s in Multimedia Arts from Birmingham City University in the UK, Jeffrey Budiman is an experienced creative and branding professional. After his master’s in 2003, he worked at a strategic brand consultancy company DM Brands for five years. He developed a new brand agency DM ID with Daniel Surya. Jeffrey joined Daniel’s WIR Group as CTO and also became a director of WIR’s brand technology unit Spacesym, now known as Redspace.

Armed with a master’s in Multimedia Arts from Birmingham City University in the UK, Jeffrey Budiman is an experienced creative and branding professional. After his master’s in 2003, he worked at a strategic brand consultancy company DM Brands for five years. He developed a new brand agency DM ID with Daniel Surya. Jeffrey joined Daniel’s WIR Group as CTO and also became a director of WIR’s brand technology unit Spacesym, now known as Redspace.

Founder and CEO of Geetest

After graduating with a bachelor’s degree in Remote Sensing and Information Engineering from Wuhan University in 2009, Wu worked as a lab researcher at his alma mater. In 2012, he left Wuhan University to found Geetest with Zhang Zhenyu.

After graduating with a bachelor’s degree in Remote Sensing and Information Engineering from Wuhan University in 2009, Wu worked as a lab researcher at his alma mater. In 2012, he left Wuhan University to found Geetest with Zhang Zhenyu.

Co-founder, Vice President and CTO of Geetest

Zhang graduated with a master’s degree in Remote Sensing and Information Engineering from Wuhan University in 2012. Upon graduation, he joined Huawei Technologies and worked there for six months. Later in 2012, he left Huawei to co-found Geetest with Wu Yuan.

Zhang graduated with a master’s degree in Remote Sensing and Information Engineering from Wuhan University in 2012. Upon graduation, he joined Huawei Technologies and worked there for six months. Later in 2012, he left Huawei to co-found Geetest with Wu Yuan.

Co-founder, CFO and Chief of Real Estate of GoWork

Richard Lim is a co-founder of Jakarta-based coworking operator GoWork. After GoWork's merger with Rework, he became the company's CFO and Chief of Real Estate. Prior to establishing GoWork, Richard had worked at the Monetary Authority of Singapore, Bain & Company and business consultancy firm Quvat Management. Richard graduated from Singapore's Nanyang Technological University with a bachelor's degree in Accounting. He also holds an MBA from Harvard Business School.

Richard Lim is a co-founder of Jakarta-based coworking operator GoWork. After GoWork's merger with Rework, he became the company's CFO and Chief of Real Estate. Prior to establishing GoWork, Richard had worked at the Monetary Authority of Singapore, Bain & Company and business consultancy firm Quvat Management. Richard graduated from Singapore's Nanyang Technological University with a bachelor's degree in Accounting. He also holds an MBA from Harvard Business School.

Co-founder and Chief Product Officer of Payfazz

Jefriyanto graduated from Universitas Bina Nusantara, Indonesia, with a bachelor's in Computer Science in 2012. He worked for online travel agent Tiket.com, where he focused on the company's train travel features and oversaw the development of a ticket purchasing app in collaboration with Indonesia's national train company. Jefriyanto left Tiket.com at the end of 2014 to join property rental firm Travelio, before eventually establishing O2O financial services platform Payfazz in 2016.

Jefriyanto graduated from Universitas Bina Nusantara, Indonesia, with a bachelor's in Computer Science in 2012. He worked for online travel agent Tiket.com, where he focused on the company's train travel features and oversaw the development of a ticket purchasing app in collaboration with Indonesia's national train company. Jefriyanto left Tiket.com at the end of 2014 to join property rental firm Travelio, before eventually establishing O2O financial services platform Payfazz in 2016.

FIWARE Accelerator: More open source ecosystem than accelerator

The European open source initiative to boost smart infrastructures and solutions is calling for new participants to join its unique acceleration ecosystem

HEMAV: World’s leading drone services company for agriculture

Now a global leader known for its industry-targeted software, HEMAV has expanded to 15 countries, working with utilities, farms and public bodies

After insurtech and fintech, Newralers applies AI to winemaking

Newralers expects strong demand for its disruptive AI solutions that test the cognitive value of information, with clients from listed companies to SMEs

DefinedCrowd: Helping companies mine, structure highly accurate data in AI applications

The Portuguese startup's quality-controlling smart data platform is driving its exponential growth and major partnerships with the likes of IBM's Watson Studio and Amazon

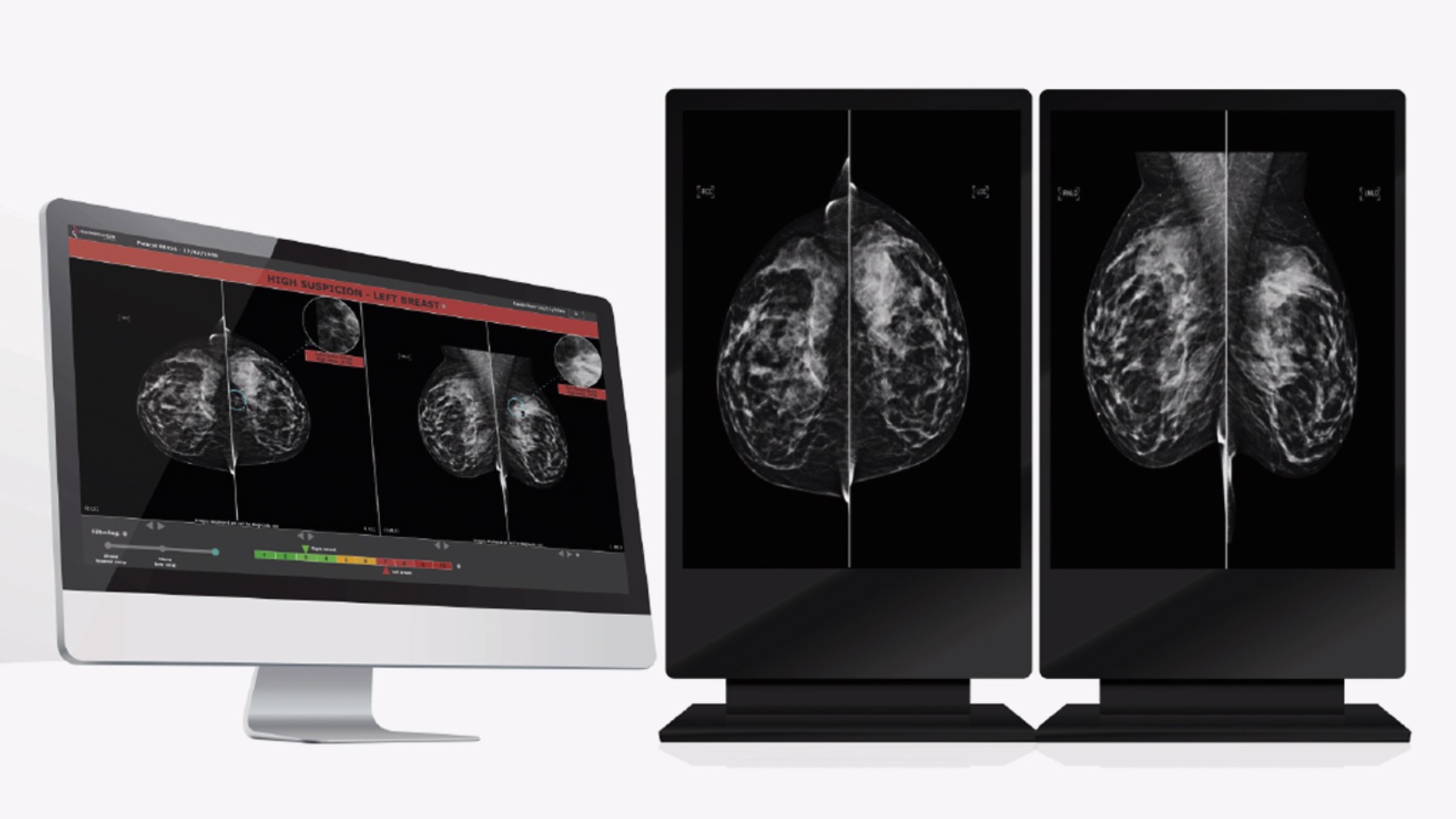

Therapixel: Using AI to improve breast cancer detection

Therapixel is raising €15m for commercial expansion of its AI-powered MammoScreen that gives accurate breast cancer screening results within minutes

This Chinese café startup aims to best Starbucks with “new retail” strategy

Luckin Coffee has gone from scratch to China’s first coffee shop unicorn in less than a year, pouring more than 5 million cups of coffee along the way

Waste management startup Magalarva aims for profitability with new factory, B2B services

Partnerships with supermarkets and waste transporters provide Magalarva with new revenue streams and sources of production input as the company ramps up its manufacturing activities

Sheetgo: Easy and secure cloud-powered spreadsheet data at your fingertips

Named Most Scalable Product at South Summit 2018, Sheetgo turns spreadsheets into data clouds for business users around the world

Gago Inc: Satellite data agritech startup ramps up growth with financial sector solutions

Founded by former NASA scientists, Gago began as a data solution to improve China’s traditionally low-yielding and inefficient smallholder-based farming sector

Billin offers unlimited free e-invoicing services to SMEs and freelancers

Offering automated online invoice generating, sharing, tracking and payments, the Spanish fintech wants to become the billing Dropbox for businesses worldwide

Fish trading startup Aruna thrives despite Covid-19 with a pivot to domestic sales

Having brought forward its domestic expansion by one year, Aruna wants to use its recent funding to further boost market expansion, develop the tech for product traceability and an intelligent supply chain

Farmer Connect: Blockchain powered platform tracing coffee beans from field to cup

Farmer Connect’s platform enables consumers to trace the origin, quality and ethical footprint of a product by just scanning a QR code

With a new focus on smart clinics, healthcare SaaS startup Medigo offers Covid-19 testing

A pivot to revenue-sharing and partnerships to provide Covid-19 testing has given Medigo a fighting chance, with a new funding round on the cards

EXCLUSIVE: Qlue raising Series B funding, "confident" of turning profitable in 2020

Qlue is also targeting more enterprise clients as it expands overseas and improved accountability and management practices

Delectatech: "Food data" proves its value in Spain's Covid-hit F&B industry

Delectatech deploys AI, NLP and big data to help restaurants and food suppliers optimize business information, decisions and operations

Sorry, we couldn’t find any matches for“Startup with IBM”.