Startup with IBM

-

DATABASE (997)

-

ARTICLES (811)

Co-founder of BuddyGuard

Angga Tirta is a seasoned executive who has filled various management roles for over a decade. After graduating from Institut Teknologi Bandung with a bachelor's in Business and Management, Angga worked briefly at his alma mater as a tutor. In 2008, he joined mining firm Atamimi, rising through the ranks to eventually become Assistant Vice President in 2012, a position he held for five years. Prior to joining BuddyGuard as a consultant, Angga was also with creative agency Akaraya, where he continues to be its human resource manager.

Angga Tirta is a seasoned executive who has filled various management roles for over a decade. After graduating from Institut Teknologi Bandung with a bachelor's in Business and Management, Angga worked briefly at his alma mater as a tutor. In 2008, he joined mining firm Atamimi, rising through the ranks to eventually become Assistant Vice President in 2012, a position he held for five years. Prior to joining BuddyGuard as a consultant, Angga was also with creative agency Akaraya, where he continues to be its human resource manager.

Co-founder of Magalarva

Xandega Tahajuansya is a co-founder of property developer PT Magale Sayana Indonesia and STUDIORAMA, an Indonesian art collective. The London School of Public Relations graduate had worked briefly at insurance company Manulife and film studio Kinekuma. Xandega is also a member of the Polka Wars band, together with fellow Magale co-founder Karaeng Adjie. Both are not actively involved with Magalarva, since Magale completed an eco-living residential development and moved on to another project to recycle food waste using larvae.

Xandega Tahajuansya is a co-founder of property developer PT Magale Sayana Indonesia and STUDIORAMA, an Indonesian art collective. The London School of Public Relations graduate had worked briefly at insurance company Manulife and film studio Kinekuma. Xandega is also a member of the Polka Wars band, together with fellow Magale co-founder Karaeng Adjie. Both are not actively involved with Magalarva, since Magale completed an eco-living residential development and moved on to another project to recycle food waste using larvae.

Co-founder of Uniplaces, CEO and co-founder of StudentFinance

Global citizen Mariano Kostelec is an Argentinian native who has lived in Asia and Europe. After earning his bachelor’s degree in Computer Science with Management from King’s College London, Kostelec moved to Asia to work at Groupon China (GaoPeng) and Wimbu China. He then moved to Portugal to launch Uniplaces with friends Miguel Amaro and Ben Grech. He is a member of the Entrepreneur Organization in Lisbon and of the Sandbox Network and has appeared on the Forbes 30 Under 30 list.

Global citizen Mariano Kostelec is an Argentinian native who has lived in Asia and Europe. After earning his bachelor’s degree in Computer Science with Management from King’s College London, Kostelec moved to Asia to work at Groupon China (GaoPeng) and Wimbu China. He then moved to Portugal to launch Uniplaces with friends Miguel Amaro and Ben Grech. He is a member of the Entrepreneur Organization in Lisbon and of the Sandbox Network and has appeared on the Forbes 30 Under 30 list.

CMO, CPO and co-founder of CrowdDana

Stevanus Iskandar Halim graduated with an associate's degree in Computer Science from Bellevue College in the US and continued to pursue a bachelor's degree at UC Irvine. During his time at university, he developed and monetized games for the iOS platform.After graduating from UCI, he returned to Indonesia and joined Ematic Solutions, an email-based marketing campaign solutions company. After two years, he left the company in 2019 to develop equity crowdfunding platform CrowdDana together with university acquaintance James Wiryadi and Ematic colleague Handison Jaya.

Stevanus Iskandar Halim graduated with an associate's degree in Computer Science from Bellevue College in the US and continued to pursue a bachelor's degree at UC Irvine. During his time at university, he developed and monetized games for the iOS platform.After graduating from UCI, he returned to Indonesia and joined Ematic Solutions, an email-based marketing campaign solutions company. After two years, he left the company in 2019 to develop equity crowdfunding platform CrowdDana together with university acquaintance James Wiryadi and Ematic colleague Handison Jaya.

CTO and co-founder of Intelligent Learning

From 1997 to 2001, Li Guibin finished his undergraduate studies at the Harbin Institute of Technology.In November 2004, he went to work at Alibaba as R&D manager on wireless technology for its sub-brands including Yahoo China, Koubei.com, Taobao.com and Fliggy.com.He left Alibaba in July 2014 and co-founded neighborhood social app Youlin with ex-Alibaba colleague Yang Renbin. They went on to set up edtech platform Intelligent Learning in January 2018, with Li as CTO and Yang as CEO.

From 1997 to 2001, Li Guibin finished his undergraduate studies at the Harbin Institute of Technology.In November 2004, he went to work at Alibaba as R&D manager on wireless technology for its sub-brands including Yahoo China, Koubei.com, Taobao.com and Fliggy.com.He left Alibaba in July 2014 and co-founded neighborhood social app Youlin with ex-Alibaba colleague Yang Renbin. They went on to set up edtech platform Intelligent Learning in January 2018, with Li as CTO and Yang as CEO.

Co-founder and CTO of Jike Xueyuan (Geek College)

Co-author of the first Android development textbook in China, Android Development Introduction & Practice, which he wrote together with fellow Jike Xueyuan co-founder Jin Yan.

Co-author of the first Android development textbook in China, Android Development Introduction & Practice, which he wrote together with fellow Jike Xueyuan co-founder Jin Yan.

Co-founder and COO of Shiyin Tech

Gao Shuai graduated from Zhejiang University in 2013 with a master's in Economics. He co-founded Shiyin Tech in 2015 and has since served as its COO.

Gao Shuai graduated from Zhejiang University in 2013 with a master's in Economics. He co-founded Shiyin Tech in 2015 and has since served as its COO.

Goldman Sachs is one of the biggest investment banking and financial services group in the world. The firm went public in 1999 under the ticker NYSE:GS. To date, Goldman Sachs has raised seven funds, their latest in May 2019 for a total of $4.4bn. Based in New York, the private banking group has made 788 investments with 256 exits. Investments include tech unicorns such as Spotify, Square, Zipline, Xiaomi and the Alibaba Group.Its 2019 annual report showed that Goldman Sachs generated over $36.55 bn in net revenues, with 10% ROE and 10.6% ROTE. As of mid-July 2020, the firm has a market capitalization of $74.33 bn. Goldman Sachs has offices in over 30 countries with major operations in four sectors: investment banking, global markets, asset management and consumer & wealth management.

Goldman Sachs is one of the biggest investment banking and financial services group in the world. The firm went public in 1999 under the ticker NYSE:GS. To date, Goldman Sachs has raised seven funds, their latest in May 2019 for a total of $4.4bn. Based in New York, the private banking group has made 788 investments with 256 exits. Investments include tech unicorns such as Spotify, Square, Zipline, Xiaomi and the Alibaba Group.Its 2019 annual report showed that Goldman Sachs generated over $36.55 bn in net revenues, with 10% ROE and 10.6% ROTE. As of mid-July 2020, the firm has a market capitalization of $74.33 bn. Goldman Sachs has offices in over 30 countries with major operations in four sectors: investment banking, global markets, asset management and consumer & wealth management.

Silicon Valley-based investor Sapphire Ventures was formerly known as SAP Ventures, the investment arm of the software giant SAP SE, until 2011. It typically invests in mid-stage startups with at least $5–10m in annual revenue across market verticals, geographies and technologies. It typically invests $10–50m (with the flexibility to invest less or up to $100m) as part of its initial investment. With approximately $4bn in assets under active management and more than 50 startups in its portfolio at present, Sapphire has also managed more than 35 exits and 20 IPOs. Its most recent investments include co-leading the $153m Series D round of workplace skills training platform Degreed in April 2021, and, in March 2021, it invested in two new unicorns. Sapphire contributed to US digital home workout tech Tonal’s $250m Series E round and to the $200m Series D round of Portugal’s Feedzai, the world’s market-leading solution in fighting online fraud.

Silicon Valley-based investor Sapphire Ventures was formerly known as SAP Ventures, the investment arm of the software giant SAP SE, until 2011. It typically invests in mid-stage startups with at least $5–10m in annual revenue across market verticals, geographies and technologies. It typically invests $10–50m (with the flexibility to invest less or up to $100m) as part of its initial investment. With approximately $4bn in assets under active management and more than 50 startups in its portfolio at present, Sapphire has also managed more than 35 exits and 20 IPOs. Its most recent investments include co-leading the $153m Series D round of workplace skills training platform Degreed in April 2021, and, in March 2021, it invested in two new unicorns. Sapphire contributed to US digital home workout tech Tonal’s $250m Series E round and to the $200m Series D round of Portugal’s Feedzai, the world’s market-leading solution in fighting online fraud.

American investment capital firm Farallon Capital Management was established in 1986. The company manages equity capital for institutions, including college endowments, charitable foundations and pension plans, and funds for high net worth individuals. While most of its investments are in risk arbitrage and debt restructuring, it has also invested in startups across different verticals, such as Indonesian ride-hailing firm Gojek and a host of biotechnology, pharmaceuticals and medical technology companies.Farallon’s history with Indonesia began long before Gojek came into existence. In 2002, Farallon bought a controlling stake in Bank Central Asia (BCA), an Indonesian bank, during a time when investors avoided Indonesian banks that had been saddled with bad debt. With the controlling stake, Farallon installed a new bank chairman and reformed BCA. Over the next four years Farallon slowly divested in BCA and finally sold the remaining 4% stake in 2006 to earn a profit.

American investment capital firm Farallon Capital Management was established in 1986. The company manages equity capital for institutions, including college endowments, charitable foundations and pension plans, and funds for high net worth individuals. While most of its investments are in risk arbitrage and debt restructuring, it has also invested in startups across different verticals, such as Indonesian ride-hailing firm Gojek and a host of biotechnology, pharmaceuticals and medical technology companies.Farallon’s history with Indonesia began long before Gojek came into existence. In 2002, Farallon bought a controlling stake in Bank Central Asia (BCA), an Indonesian bank, during a time when investors avoided Indonesian banks that had been saddled with bad debt. With the controlling stake, Farallon installed a new bank chairman and reformed BCA. Over the next four years Farallon slowly divested in BCA and finally sold the remaining 4% stake in 2006 to earn a profit.

Founded in 2008, Delian Capital focuses on healthcare, TMT, high-end manufacturing, new materials, new energy, and resources utilization in environmental protection, with RMB 2 billion of funds under management.

Founded in 2008, Delian Capital focuses on healthcare, TMT, high-end manufacturing, new materials, new energy, and resources utilization in environmental protection, with RMB 2 billion of funds under management.

Based in Jakarta, Indonesia, GnB Accelerator is a part of Fenox Venture Capital. With access to Fenox’s international network of investors, entrepreneurs and advisors, GnB Accelerator supports early stage startups in diverse industries.

Based in Jakarta, Indonesia, GnB Accelerator is a part of Fenox Venture Capital. With access to Fenox’s international network of investors, entrepreneurs and advisors, GnB Accelerator supports early stage startups in diverse industries.

Private equity and venture capital arm of Portuguese banking group Caixa Geral de Depósitos. Founded in 1991, Caixa Capital manages €500m with total potential capital of €700m for its managed funds.

Private equity and venture capital arm of Portuguese banking group Caixa Geral de Depósitos. Founded in 1991, Caixa Capital manages €500m with total potential capital of €700m for its managed funds.

Changce Investment was established in Guangzhou in May 2015. With more than RMB 1 billion under management, the firm invests mainly in unlisted high-growth companies in the IoT sector.

Changce Investment was established in Guangzhou in May 2015. With more than RMB 1 billion under management, the firm invests mainly in unlisted high-growth companies in the IoT sector.

Co-founder, CTO and Vice-GM of Zhuojian

With 15+ years' experience in software development and internet communications, Ye Jiantong has a master's in Telecommunications and Information System from Beijing University of Posts and Telecommunications.

With 15+ years' experience in software development and internet communications, Ye Jiantong has a master's in Telecommunications and Information System from Beijing University of Posts and Telecommunications.

FIWARE Accelerator: More open source ecosystem than accelerator

The European open source initiative to boost smart infrastructures and solutions is calling for new participants to join its unique acceleration ecosystem

HEMAV: World’s leading drone services company for agriculture

Now a global leader known for its industry-targeted software, HEMAV has expanded to 15 countries, working with utilities, farms and public bodies

After insurtech and fintech, Newralers applies AI to winemaking

Newralers expects strong demand for its disruptive AI solutions that test the cognitive value of information, with clients from listed companies to SMEs

DefinedCrowd: Helping companies mine, structure highly accurate data in AI applications

The Portuguese startup's quality-controlling smart data platform is driving its exponential growth and major partnerships with the likes of IBM's Watson Studio and Amazon

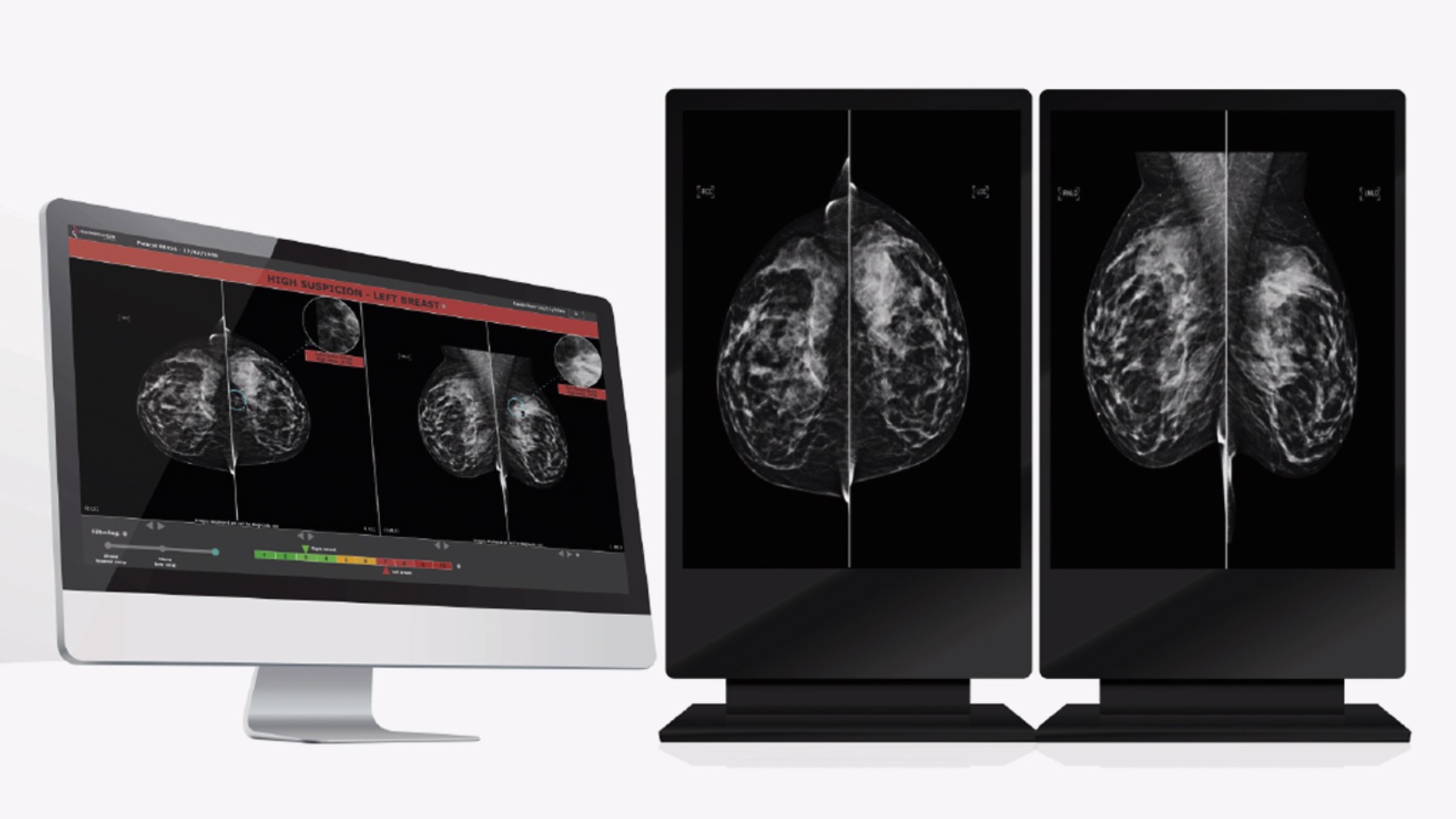

Therapixel: Using AI to improve breast cancer detection

Therapixel is raising €15m for commercial expansion of its AI-powered MammoScreen that gives accurate breast cancer screening results within minutes

This Chinese café startup aims to best Starbucks with “new retail” strategy

Luckin Coffee has gone from scratch to China’s first coffee shop unicorn in less than a year, pouring more than 5 million cups of coffee along the way

Waste management startup Magalarva aims for profitability with new factory, B2B services

Partnerships with supermarkets and waste transporters provide Magalarva with new revenue streams and sources of production input as the company ramps up its manufacturing activities

Sheetgo: Easy and secure cloud-powered spreadsheet data at your fingertips

Named Most Scalable Product at South Summit 2018, Sheetgo turns spreadsheets into data clouds for business users around the world

Gago Inc: Satellite data agritech startup ramps up growth with financial sector solutions

Founded by former NASA scientists, Gago began as a data solution to improve China’s traditionally low-yielding and inefficient smallholder-based farming sector

Billin offers unlimited free e-invoicing services to SMEs and freelancers

Offering automated online invoice generating, sharing, tracking and payments, the Spanish fintech wants to become the billing Dropbox for businesses worldwide

Fish trading startup Aruna thrives despite Covid-19 with a pivot to domestic sales

Having brought forward its domestic expansion by one year, Aruna wants to use its recent funding to further boost market expansion, develop the tech for product traceability and an intelligent supply chain

Farmer Connect: Blockchain powered platform tracing coffee beans from field to cup

Farmer Connect’s platform enables consumers to trace the origin, quality and ethical footprint of a product by just scanning a QR code

With a new focus on smart clinics, healthcare SaaS startup Medigo offers Covid-19 testing

A pivot to revenue-sharing and partnerships to provide Covid-19 testing has given Medigo a fighting chance, with a new funding round on the cards

EXCLUSIVE: Qlue raising Series B funding, "confident" of turning profitable in 2020

Qlue is also targeting more enterprise clients as it expands overseas and improved accountability and management practices

Delectatech: "Food data" proves its value in Spain's Covid-hit F&B industry

Delectatech deploys AI, NLP and big data to help restaurants and food suppliers optimize business information, decisions and operations

Sorry, we couldn’t find any matches for“Startup with IBM”.