Startup with IBM

-

DATABASE (997)

-

ARTICLES (811)

Guangzhou Emerging Industry Development Fund

Guangzhou Emerging Industry Development Fund (Emerging Fund) is a wholly-owned subsidiary of Guangzhou Industrial Investment Fund Management Co Ltd (SFund).It was found in line with the Guangzhou Municipal Government’s industrial upgrade strategy, with the aim of pooling capital, projects and talents together in Guangzhou. The Emerging Fund currently manages a set of government-guided funds and direct investment funds. It also invests in several state-level guidance funds on behalf of the municipal government. It mainly invests in emerging sectors in manufacturing, information technology, service sectors, seed and related industries.

Guangzhou Emerging Industry Development Fund (Emerging Fund) is a wholly-owned subsidiary of Guangzhou Industrial Investment Fund Management Co Ltd (SFund).It was found in line with the Guangzhou Municipal Government’s industrial upgrade strategy, with the aim of pooling capital, projects and talents together in Guangzhou. The Emerging Fund currently manages a set of government-guided funds and direct investment funds. It also invests in several state-level guidance funds on behalf of the municipal government. It mainly invests in emerging sectors in manufacturing, information technology, service sectors, seed and related industries.

Founded in 2016, Goldacre is a real-estate focused investor with a £2bn asset management business as part of the Noé Group, investing in British, EU and Israeli startups in that segment. It also operates the intensive proptech accelerator RElab with three editions to date, each time investing £100,000 in participating startups. The company does not divulge its full portfolio details but its most recent investments include in the summer 2020 a $9m Series A round of Israeli sustainable concrete tech ECOncrete and in the $7.8m June 2020 Series A round of Spanish hyperloop engineer Zeleros.

Founded in 2016, Goldacre is a real-estate focused investor with a £2bn asset management business as part of the Noé Group, investing in British, EU and Israeli startups in that segment. It also operates the intensive proptech accelerator RElab with three editions to date, each time investing £100,000 in participating startups. The company does not divulge its full portfolio details but its most recent investments include in the summer 2020 a $9m Series A round of Israeli sustainable concrete tech ECOncrete and in the $7.8m June 2020 Series A round of Spanish hyperloop engineer Zeleros.

Openspace Ventures (formerly NSI Ventures)

Originally formed in 2014 as NSI Ventures, Openspace Ventures makes investments in technology companies based in Southeast Asia. Led by Shane Chesson and Hian Goh, Openspace Ventures used to be a part of Northstar Group, a private equity firm primarily invested in the financial services, retail, energy and telecom sectors. In 2018, Chesson and Goh took NSI Ventures independent and rebranded it as Openspace Ventures. They still maintain links with Northstar, with Northstar managing partner Patrick Goh becoming senior advisor to Openspace.

Originally formed in 2014 as NSI Ventures, Openspace Ventures makes investments in technology companies based in Southeast Asia. Led by Shane Chesson and Hian Goh, Openspace Ventures used to be a part of Northstar Group, a private equity firm primarily invested in the financial services, retail, energy and telecom sectors. In 2018, Chesson and Goh took NSI Ventures independent and rebranded it as Openspace Ventures. They still maintain links with Northstar, with Northstar managing partner Patrick Goh becoming senior advisor to Openspace.

Country Garden Venture Capital

Founded in 2019, Country Garden Venture Capital is the corporate venturing arm of Chinese real estate developer Country Garden. With its parent company as the cornerstone investor, it is focused on certain sectors of the supply chain, namely, technology, healthcare and consumption. As of March 2021, Country Garden Venture Capital has invested around RMB 10bn in over 50 companies with an average return above 80%. Among them, 15 have achieved unicorn status ($1bn in valuation), while four have successfully gone public.

Founded in 2019, Country Garden Venture Capital is the corporate venturing arm of Chinese real estate developer Country Garden. With its parent company as the cornerstone investor, it is focused on certain sectors of the supply chain, namely, technology, healthcare and consumption. As of March 2021, Country Garden Venture Capital has invested around RMB 10bn in over 50 companies with an average return above 80%. Among them, 15 have achieved unicorn status ($1bn in valuation), while four have successfully gone public.

Invest FWD A/S is an investment vehicle owned by Anders Holch Povlsen, founder of BESTSELLER and Heartland. It is also BESTSELLER’s investment arm for sustainable fashion. In June 2021, the firm made its investment by participating in a Series B round of Finnish cleantech Infinited Fiber. BESTSELLER’s sustainability innovation platform Fashion FWD Lab has been collaborating with Infinited Fiber over the past year to develop and patent Infinna™ fiber material. BESTSELLER has also signed a multi-year commercial agreement with Infinited Fiber to secure access to the startup’s regenerated fibers to be made from textile and other industrial waste.

Invest FWD A/S is an investment vehicle owned by Anders Holch Povlsen, founder of BESTSELLER and Heartland. It is also BESTSELLER’s investment arm for sustainable fashion. In June 2021, the firm made its investment by participating in a Series B round of Finnish cleantech Infinited Fiber. BESTSELLER’s sustainability innovation platform Fashion FWD Lab has been collaborating with Infinited Fiber over the past year to develop and patent Infinna™ fiber material. BESTSELLER has also signed a multi-year commercial agreement with Infinited Fiber to secure access to the startup’s regenerated fibers to be made from textile and other industrial waste.

One of the largest institutional investors, GIC is a sovereign wealth fund managed by the Singapore government. With over US$100 billion under management, GIC invests in companies from over 40 countries.

One of the largest institutional investors, GIC is a sovereign wealth fund managed by the Singapore government. With over US$100 billion under management, GIC invests in companies from over 40 countries.

Furnished workplaces providing flexibility for post-Covid hybrid working arrangements, purpose-designed for early-stage startups requiring short-term rental and investment-free commitments.

Furnished workplaces providing flexibility for post-Covid hybrid working arrangements, purpose-designed for early-stage startups requiring short-term rental and investment-free commitments.

Co-founder of AllRead MLT

Dimosthenis Karatzas is Senior Research Fellow and Associate Director at the Computer Vision Centre (CVC) of the Autonomous University of Barcelona (UAB). He specializes in computer vision, document image analysis and color science. In 2007, he co-founded TruColour in the UK, where he currently is a member of the board of directors. In 2013, he was awarded the IAPR/ICDAR Young Investigator Award “for outstanding service and innovative research in human perception-based document analysis.” Karatzas also worked as a Research Fellow at the University of Liverpool and University of Southampton in the UK. Since 2019, he has been part of the co-founding team of Allread MLT, a deep-tech startup that converts text, symbols and codes to Big Data using computer vision technology, character recognition and machine learning.

Dimosthenis Karatzas is Senior Research Fellow and Associate Director at the Computer Vision Centre (CVC) of the Autonomous University of Barcelona (UAB). He specializes in computer vision, document image analysis and color science. In 2007, he co-founded TruColour in the UK, where he currently is a member of the board of directors. In 2013, he was awarded the IAPR/ICDAR Young Investigator Award “for outstanding service and innovative research in human perception-based document analysis.” Karatzas also worked as a Research Fellow at the University of Liverpool and University of Southampton in the UK. Since 2019, he has been part of the co-founding team of Allread MLT, a deep-tech startup that converts text, symbols and codes to Big Data using computer vision technology, character recognition and machine learning.

CSO and co-founder of iLoF

Paula Sampaio is a biochemist who completed a PhD in biomedical sciences at the University of Porto in 1998. She worked as a postdoctoral research fellow at the IMBC INEB Associate Laboratory for four years. In 2002, she was promoted to the role of head of advanced light microscopy and stayed there until 2015. Sampaio is now the national coordinator for Portuguese bioimage platform PPBI and the head of advanced light microscopy at the Institute of Research and Innovation of the University of Porto (i3S).In November 2019, she joined iLoF as CSO and co-founder. iLoF gets technical support from i3S at the R&D center in Porto. The medtech startup focuses on personalized medicine through the use of AI and photonics to create optical fingerprints in a cloud-based library to gather and manages disease biomarkers and biological profiles.

Paula Sampaio is a biochemist who completed a PhD in biomedical sciences at the University of Porto in 1998. She worked as a postdoctoral research fellow at the IMBC INEB Associate Laboratory for four years. In 2002, she was promoted to the role of head of advanced light microscopy and stayed there until 2015. Sampaio is now the national coordinator for Portuguese bioimage platform PPBI and the head of advanced light microscopy at the Institute of Research and Innovation of the University of Porto (i3S).In November 2019, she joined iLoF as CSO and co-founder. iLoF gets technical support from i3S at the R&D center in Porto. The medtech startup focuses on personalized medicine through the use of AI and photonics to create optical fingerprints in a cloud-based library to gather and manages disease biomarkers and biological profiles.

COO and Co-founder of Tuhu Yangche

A graduate of Shanghai Jiao Tong University, Hu Xiaodong has his professional background in software and programming. He once worked at Microsoft, and then co-founded Tuhu with Chen Min.

A graduate of Shanghai Jiao Tong University, Hu Xiaodong has his professional background in software and programming. He once worked at Microsoft, and then co-founded Tuhu with Chen Min.

Goodwater was founded in San Mateo in 2014 with a team less than 10 by Chi-Hua Chien and Eric J.Kim, who were previously at Kleiner Perkins and Maverick.

Goodwater was founded in San Mateo in 2014 with a team less than 10 by Chi-Hua Chien and Eric J.Kim, who were previously at Kleiner Perkins and Maverick.

Founded in 2014, Midas Capital invests mainly in businesses offering customer products and services over the Internet. With offices in Guangzhou, Shenzhen, Beijing and Hangzhou, it currently manages assets worth around RMB 3bn.

Founded in 2014, Midas Capital invests mainly in businesses offering customer products and services over the Internet. With offices in Guangzhou, Shenzhen, Beijing and Hangzhou, it currently manages assets worth around RMB 3bn.

Surfilter Network Technology is an IT services company based in Shenzhen. It works with clients in the government, military, finance, telecommunication, education and energy sectors.

Surfilter Network Technology is an IT services company based in Shenzhen. It works with clients in the government, military, finance, telecommunication, education and energy sectors.

Co-founder and CEO of Moka

Haryanto Tanjo graduated with a degree in Industrial Engineering and Operations Research from the University of California Berkeley in 2009. He worked as an associate consultant at Webster Pacific LLC in San Francisco for over two years before attaining an MBA at the UCLA Anderson School of Management USA in 2014. He had previous stints working at Cisco Systems, Bayer and McKinsey & Company. He left McKinsey and eventually teamed up with a software engineer Grady Laksmono to start Moka, a mobile point-of-sale service. He became the CEO of Moka in August 2014.

Haryanto Tanjo graduated with a degree in Industrial Engineering and Operations Research from the University of California Berkeley in 2009. He worked as an associate consultant at Webster Pacific LLC in San Francisco for over two years before attaining an MBA at the UCLA Anderson School of Management USA in 2014. He had previous stints working at Cisco Systems, Bayer and McKinsey & Company. He left McKinsey and eventually teamed up with a software engineer Grady Laksmono to start Moka, a mobile point-of-sale service. He became the CEO of Moka in August 2014.

Co-founder and Group CFO of Orami, Co-founder and Managing Director of Xurya

Gusmantara Ekamukti Himawan, known as Eka, holds a degree in Electrical Engineering from Purdue University, USA. However, he chose a career in finance instead, beginning as a research associate at Independence Capital Asset Partners. After becoming an analyst there, he moved on to become an investment banker at Barclays for two years. He left Barclays in 2012 to co-found Bilna with fellow Purdue alumni Ferry Tenka and Jason Lamuda. He was the CFO of Bilna that merged with Moxy to become Orami. Eka is now the CFO and executive vice chairman of Orami.

Gusmantara Ekamukti Himawan, known as Eka, holds a degree in Electrical Engineering from Purdue University, USA. However, he chose a career in finance instead, beginning as a research associate at Independence Capital Asset Partners. After becoming an analyst there, he moved on to become an investment banker at Barclays for two years. He left Barclays in 2012 to co-found Bilna with fellow Purdue alumni Ferry Tenka and Jason Lamuda. He was the CFO of Bilna that merged with Moxy to become Orami. Eka is now the CFO and executive vice chairman of Orami.

FIWARE Accelerator: More open source ecosystem than accelerator

The European open source initiative to boost smart infrastructures and solutions is calling for new participants to join its unique acceleration ecosystem

HEMAV: World’s leading drone services company for agriculture

Now a global leader known for its industry-targeted software, HEMAV has expanded to 15 countries, working with utilities, farms and public bodies

After insurtech and fintech, Newralers applies AI to winemaking

Newralers expects strong demand for its disruptive AI solutions that test the cognitive value of information, with clients from listed companies to SMEs

DefinedCrowd: Helping companies mine, structure highly accurate data in AI applications

The Portuguese startup's quality-controlling smart data platform is driving its exponential growth and major partnerships with the likes of IBM's Watson Studio and Amazon

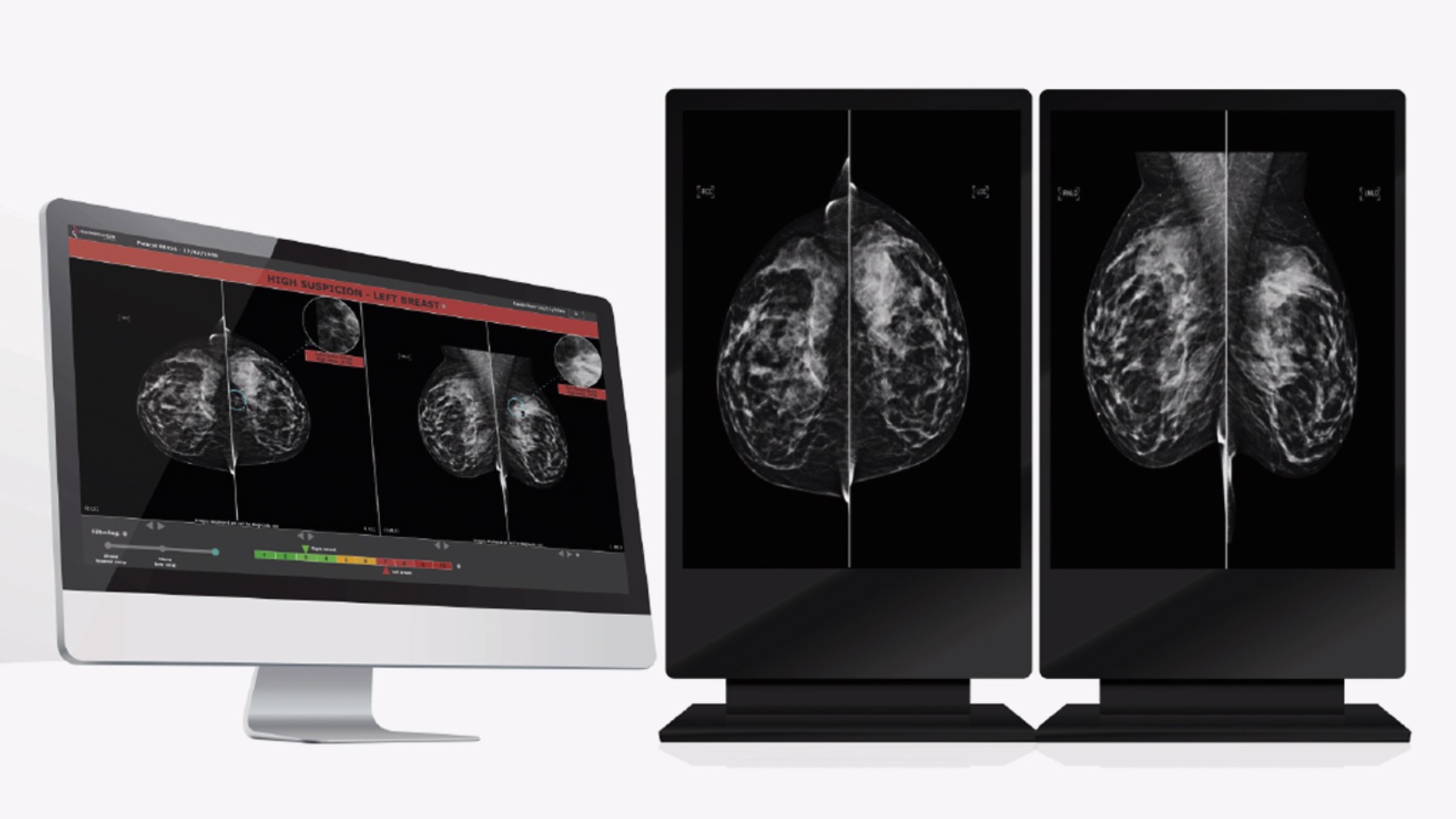

Therapixel: Using AI to improve breast cancer detection

Therapixel is raising €15m for commercial expansion of its AI-powered MammoScreen that gives accurate breast cancer screening results within minutes

This Chinese café startup aims to best Starbucks with “new retail” strategy

Luckin Coffee has gone from scratch to China’s first coffee shop unicorn in less than a year, pouring more than 5 million cups of coffee along the way

Waste management startup Magalarva aims for profitability with new factory, B2B services

Partnerships with supermarkets and waste transporters provide Magalarva with new revenue streams and sources of production input as the company ramps up its manufacturing activities

Sheetgo: Easy and secure cloud-powered spreadsheet data at your fingertips

Named Most Scalable Product at South Summit 2018, Sheetgo turns spreadsheets into data clouds for business users around the world

Gago Inc: Satellite data agritech startup ramps up growth with financial sector solutions

Founded by former NASA scientists, Gago began as a data solution to improve China’s traditionally low-yielding and inefficient smallholder-based farming sector

Billin offers unlimited free e-invoicing services to SMEs and freelancers

Offering automated online invoice generating, sharing, tracking and payments, the Spanish fintech wants to become the billing Dropbox for businesses worldwide

Fish trading startup Aruna thrives despite Covid-19 with a pivot to domestic sales

Having brought forward its domestic expansion by one year, Aruna wants to use its recent funding to further boost market expansion, develop the tech for product traceability and an intelligent supply chain

Farmer Connect: Blockchain powered platform tracing coffee beans from field to cup

Farmer Connect’s platform enables consumers to trace the origin, quality and ethical footprint of a product by just scanning a QR code

With a new focus on smart clinics, healthcare SaaS startup Medigo offers Covid-19 testing

A pivot to revenue-sharing and partnerships to provide Covid-19 testing has given Medigo a fighting chance, with a new funding round on the cards

EXCLUSIVE: Qlue raising Series B funding, "confident" of turning profitable in 2020

Qlue is also targeting more enterprise clients as it expands overseas and improved accountability and management practices

Delectatech: "Food data" proves its value in Spain's Covid-hit F&B industry

Delectatech deploys AI, NLP and big data to help restaurants and food suppliers optimize business information, decisions and operations

Sorry, we couldn’t find any matches for“Startup with IBM”.