Startup with IBM

-

DATABASE (997)

-

ARTICLES (811)

Co-founder of Ciweishixi

Zhang Lei, who spent seven years as a senior HR manager at Huawei, is CEO of Shanghai Sousi International Trade Co., Ltd. He co-founded Ciweishixi with Li Yaping in 2015 and has served as vice president ever since.

Zhang Lei, who spent seven years as a senior HR manager at Huawei, is CEO of Shanghai Sousi International Trade Co., Ltd. He co-founded Ciweishixi with Li Yaping in 2015 and has served as vice president ever since.

Iberis Capital is a Portuguese investor established in 2017. Currently with 10 investments with more than €100m under management, it invests in both tech and non-tech startups and in real estate. Iberis was founded by ex-partner at Oxy Capital Luís Quaresma and João Henriques, ex-CFO of Vodafone Portugal. One of its prominent portfolio companies is Australian medtech LBT Innovations that seeks to automate healthcare processes and, to date, has the only US Food and Drug Administration-cleared instrument leveraging AI in clinical microbiology. Its most recent investment was a participation in a €32m Series C investment round in December 2020 for Portugal-based international online print store, 360imprimir.

Iberis Capital is a Portuguese investor established in 2017. Currently with 10 investments with more than €100m under management, it invests in both tech and non-tech startups and in real estate. Iberis was founded by ex-partner at Oxy Capital Luís Quaresma and João Henriques, ex-CFO of Vodafone Portugal. One of its prominent portfolio companies is Australian medtech LBT Innovations that seeks to automate healthcare processes and, to date, has the only US Food and Drug Administration-cleared instrument leveraging AI in clinical microbiology. Its most recent investment was a participation in a €32m Series C investment round in December 2020 for Portugal-based international online print store, 360imprimir.

Concept Investimentos is a Brazilian mid-market private equity investor based in São Paulo. Focusing mainly on medtech, the firm was established in 2016 with its first investment in Maquira, a leading manufacturer of dental products in Brazil. It has invested in three companies so far, including participation in the R$1.7m seed investment round of Brazilian edtech Blox.Founding partner Rafael Pilotto Gonçalez previously worked at Pacific Investimentos’ private equity division and Pacific’s partnership with One Equity Partners, JPM’s former global private equity arm in Brazil. He has also worked for the private equity arm of Banco Votorantim and London-based private equity firm Actis.

Concept Investimentos is a Brazilian mid-market private equity investor based in São Paulo. Focusing mainly on medtech, the firm was established in 2016 with its first investment in Maquira, a leading manufacturer of dental products in Brazil. It has invested in three companies so far, including participation in the R$1.7m seed investment round of Brazilian edtech Blox.Founding partner Rafael Pilotto Gonçalez previously worked at Pacific Investimentos’ private equity division and Pacific’s partnership with One Equity Partners, JPM’s former global private equity arm in Brazil. He has also worked for the private equity arm of Banco Votorantim and London-based private equity firm Actis.

Since 2005, Demeter Partners has been one of the major VC and private equity funds supporting technology companies in developing solutions for ecological and energy transitions. The firm typically invests €1m–€30m in early and growth stages of startups. With assets worth over €1bn under management, its portfolio in 2019 was estimated to have cut 4.3m tons of CO2 with 575 GWh of clean energy produced. In 2021, Demeter was named the “Best Sustainable Equity investor” by a panel of former Fortune 500 individuals, global experts and industry leaders to recognize Demeter’s commitment to the UN’s SDG and ESG strategy.

Since 2005, Demeter Partners has been one of the major VC and private equity funds supporting technology companies in developing solutions for ecological and energy transitions. The firm typically invests €1m–€30m in early and growth stages of startups. With assets worth over €1bn under management, its portfolio in 2019 was estimated to have cut 4.3m tons of CO2 with 575 GWh of clean energy produced. In 2021, Demeter was named the “Best Sustainable Equity investor” by a panel of former Fortune 500 individuals, global experts and industry leaders to recognize Demeter’s commitment to the UN’s SDG and ESG strategy.

Based in Berlin, Cherry Ventures was founded in 2012 to invest in startups across diverse sectors mainly in Europe including non-tech enterprises. With offices in London, Paris and Stockholm, the VC has invested in 53 startups and managed 12 exits. Initial investments range from €300,000 to €5m.In June 2019, a third fund “Cherry Ventures III” with €175m funding was launched to focus on providing seed funding for B2B and B2C startups. Recent investments in 2021 include the $6.2m seed round of Finnish cleantech Carbo Culture in April. The VC also acquired a stake in the $1.9m seed round of US Cloud-based product notification inbox, MagicBell, one of a handful of non-European startups in its portfolio.

Based in Berlin, Cherry Ventures was founded in 2012 to invest in startups across diverse sectors mainly in Europe including non-tech enterprises. With offices in London, Paris and Stockholm, the VC has invested in 53 startups and managed 12 exits. Initial investments range from €300,000 to €5m.In June 2019, a third fund “Cherry Ventures III” with €175m funding was launched to focus on providing seed funding for B2B and B2C startups. Recent investments in 2021 include the $6.2m seed round of Finnish cleantech Carbo Culture in April. The VC also acquired a stake in the $1.9m seed round of US Cloud-based product notification inbox, MagicBell, one of a handful of non-European startups in its portfolio.

SoftBank Ventures Asia, founded in 2000, is a subsidiary of SoftBank Korea and part of the SoftBank Group. It is SoftBank’s early stage venture arm, with a geographical focus in Asia, the US, Europe and Israel. It was previously known as SoftBank Ventures Korea.SoftBank Ventures Asia links early-stage startups with SoftBank’s wider network of partners and businesses, which include Yahoo Japan and Alibaba (both of which SoftBank has stakes in), components manufacturers ARM and nVidia, and Indonesian e-commerce platform Tokopedia, which SoftBank has invested in. Outside of its focus areas of AI, robotics and IoT, SoftBank Ventures has invested in companies like sports analytics company bepro11, telehealth service Alodokter, and property rental management Mamikos.

SoftBank Ventures Asia, founded in 2000, is a subsidiary of SoftBank Korea and part of the SoftBank Group. It is SoftBank’s early stage venture arm, with a geographical focus in Asia, the US, Europe and Israel. It was previously known as SoftBank Ventures Korea.SoftBank Ventures Asia links early-stage startups with SoftBank’s wider network of partners and businesses, which include Yahoo Japan and Alibaba (both of which SoftBank has stakes in), components manufacturers ARM and nVidia, and Indonesian e-commerce platform Tokopedia, which SoftBank has invested in. Outside of its focus areas of AI, robotics and IoT, SoftBank Ventures has invested in companies like sports analytics company bepro11, telehealth service Alodokter, and property rental management Mamikos.

Singapore's government-owned investor has a net portfolio value of just over S$300bn, with assets mainly in Asia and Singapore. In recent years it has begun investing in internet and tech companies in emerging markets, including in neighboring Indonesia and other Asian countries.As a state investor, Temasek aligns its investment portfolio and goals with areas that are relevant to Singapore’s national agenda. For example, to mitigate and reduce the effects of climate change, Temasek has set a commitment to reduce the carbon emissions of its portfolio companies, and invest in companies providing decarbonization solutions. It is also investing in biotechnology, medical technology, agritech and foodtech companies, which are some new focus areas in Singapore’s industrial development.

Singapore's government-owned investor has a net portfolio value of just over S$300bn, with assets mainly in Asia and Singapore. In recent years it has begun investing in internet and tech companies in emerging markets, including in neighboring Indonesia and other Asian countries.As a state investor, Temasek aligns its investment portfolio and goals with areas that are relevant to Singapore’s national agenda. For example, to mitigate and reduce the effects of climate change, Temasek has set a commitment to reduce the carbon emissions of its portfolio companies, and invest in companies providing decarbonization solutions. It is also investing in biotechnology, medical technology, agritech and foodtech companies, which are some new focus areas in Singapore’s industrial development.

Not just China’s most popular dating app, Momo has successfully betted on live broadcasting to become a highly profitable social-networking and entertainment platform.

Not just China’s most popular dating app, Momo has successfully betted on live broadcasting to become a highly profitable social-networking and entertainment platform.

China’s third most popular bike-sharing app provides differentiated services, such as lower rates and electronic parking stations.

China’s third most popular bike-sharing app provides differentiated services, such as lower rates and electronic parking stations.

Co-Founder and CEO of Ruangguru

Ex-Goldman Sachs and McKinsey employee Adamas Belva Syah Devara (known as Belva) holds a double degree in Business and Computer Science from Nanyang Technological University (NTU), where he graduated with honors. He was one of eight from Indonesia selected for full scholarship throughout his study. While studying at NTU, Adamas won triple gold medals for topping his cohorts academically for all four years of study. He graduated with an MBA from Stanford University and an MPA from Harvard University.

Ex-Goldman Sachs and McKinsey employee Adamas Belva Syah Devara (known as Belva) holds a double degree in Business and Computer Science from Nanyang Technological University (NTU), where he graduated with honors. He was one of eight from Indonesia selected for full scholarship throughout his study. While studying at NTU, Adamas won triple gold medals for topping his cohorts academically for all four years of study. He graduated with an MBA from Stanford University and an MPA from Harvard University.

CTO and Co-founder of Nusantics

Revata Utama has worked as an engineer and scientist in various biomedical R&D projects. After graduating from the National University of Singapore in 2012 with a bachelor's in Life and Biomedical Sciences, Utama joined Delta Electronics in 2013. He worked as a biomedical engineer from 2013 to 2017, as part of the R&D teams for joint projects with Singapore's Institute of Bioengineering and Nanotechnology (IBN) at Biopolis.In June 2017, he joined JN Medsys in Singapore to conduct research on polymerase chain reaction (PCR) chip projects. He left Medsys in January 2020 to return to Indonesia and run Nusantics full-time as CTO to lead the company's research into genomics-based services.

Revata Utama has worked as an engineer and scientist in various biomedical R&D projects. After graduating from the National University of Singapore in 2012 with a bachelor's in Life and Biomedical Sciences, Utama joined Delta Electronics in 2013. He worked as a biomedical engineer from 2013 to 2017, as part of the R&D teams for joint projects with Singapore's Institute of Bioengineering and Nanotechnology (IBN) at Biopolis.In June 2017, he joined JN Medsys in Singapore to conduct research on polymerase chain reaction (PCR) chip projects. He left Medsys in January 2020 to return to Indonesia and run Nusantics full-time as CTO to lead the company's research into genomics-based services.

CTO and co-founder of StudentFinance

Sérgio Pereira is an independent innovation expert at the European Commission, assisting with research and innovation assignments including policy design, monitoring of projects and the evaluation of various programs and proposals. He graduated with a master's in Computer Science at the New University of Lisbon and started his career as a consultant at Accenture. The Portuguese co-founder of StudentFinance has been working as CTO at the fintech since 2019. Prior to this, he founded Tech HQ as CTO of the tech consultancy where he continues to work part-time. Pereira has also worked as CTO at Boston-based student finance and talent platform FutureFuel. The serial entrepreneur has also co-founded Clickly, a Dutch content discovery platform and sportstech Goalstat.

Sérgio Pereira is an independent innovation expert at the European Commission, assisting with research and innovation assignments including policy design, monitoring of projects and the evaluation of various programs and proposals. He graduated with a master's in Computer Science at the New University of Lisbon and started his career as a consultant at Accenture. The Portuguese co-founder of StudentFinance has been working as CTO at the fintech since 2019. Prior to this, he founded Tech HQ as CTO of the tech consultancy where he continues to work part-time. Pereira has also worked as CTO at Boston-based student finance and talent platform FutureFuel. The serial entrepreneur has also co-founded Clickly, a Dutch content discovery platform and sportstech Goalstat.

CEO and co-founder of Coinscrap

David Conde is a serial entrepreneur from Galicia. He holds an executive MBA, a Fintech certificate from the Massachusetts Institute of Technology and participated in the Oxford Blockchain Strategy Program.He was one of the first European financial planners in Spain and is well-recognized in the financial sector, having over 10 years of experience in private banking roles. In 2015, he co-founded Senseitrade, a revolutionary technology that captures sentiments about the stock market from social networks, predicting stock exchange evolution with a success rate of 87%.Since 2017, he has been CEO and co-founder of Coinscrap, an app that facilitates micro-savings by rounding up purchases made with credit cards to the nearest euro.

David Conde is a serial entrepreneur from Galicia. He holds an executive MBA, a Fintech certificate from the Massachusetts Institute of Technology and participated in the Oxford Blockchain Strategy Program.He was one of the first European financial planners in Spain and is well-recognized in the financial sector, having over 10 years of experience in private banking roles. In 2015, he co-founded Senseitrade, a revolutionary technology that captures sentiments about the stock market from social networks, predicting stock exchange evolution with a success rate of 87%.Since 2017, he has been CEO and co-founder of Coinscrap, an app that facilitates micro-savings by rounding up purchases made with credit cards to the nearest euro.

CEO and co-founder of Zensei

David Martín-Corral is an industrial engineer with a PhD in Mathematical Engineering, focusing on complex systems, viral computing and machine learning.He has worked as an associate lecturer teaching classes in social network analysis, digital health and data visualization, and in R programming for top-notch Spanish universities such as CIFF Business School, the IE Business School and Carlos III University in Madrid.Martín-Corral was also the founder of Polibot, the popular chatbot for Telegram and Facebook. In 2018, he co-founded Zensei with Carlos Hernando, a virtual clinic app aimed at preventing and assisting users in their management of respiratory problems. Both founders are currently mentoring startups as part of the Tetuan Valley Network.

David Martín-Corral is an industrial engineer with a PhD in Mathematical Engineering, focusing on complex systems, viral computing and machine learning.He has worked as an associate lecturer teaching classes in social network analysis, digital health and data visualization, and in R programming for top-notch Spanish universities such as CIFF Business School, the IE Business School and Carlos III University in Madrid.Martín-Corral was also the founder of Polibot, the popular chatbot for Telegram and Facebook. In 2018, he co-founded Zensei with Carlos Hernando, a virtual clinic app aimed at preventing and assisting users in their management of respiratory problems. Both founders are currently mentoring startups as part of the Tetuan Valley Network.

Chief Strategist, CTO and co-founder of TurtleTree Labs

Max Rye graduated in computer science at the University of California, Davis, in 2001. Currently based in Berkeley, Rye has worked in the IT industry for over 15 years. He was the CEO of Royal IT from 2003 to 2018 in California. He was also a senior information technology specialist at Mahler Enterprises from 2011 to 2018.In 2019, he set up TurtleTree Labs in Singapore with Lin Fengru whom he had previously met at a Google conference. He became the CTO of TurtleTree Labs with Lin as CEO. In January 2020, he was appointed chief strategist based at the company’s office in San Francisco. In December 2020, he and Lin also co-founded TurtleTree Scientific in Singapore.

Max Rye graduated in computer science at the University of California, Davis, in 2001. Currently based in Berkeley, Rye has worked in the IT industry for over 15 years. He was the CEO of Royal IT from 2003 to 2018 in California. He was also a senior information technology specialist at Mahler Enterprises from 2011 to 2018.In 2019, he set up TurtleTree Labs in Singapore with Lin Fengru whom he had previously met at a Google conference. He became the CTO of TurtleTree Labs with Lin as CEO. In January 2020, he was appointed chief strategist based at the company’s office in San Francisco. In December 2020, he and Lin also co-founded TurtleTree Scientific in Singapore.

FIWARE Accelerator: More open source ecosystem than accelerator

The European open source initiative to boost smart infrastructures and solutions is calling for new participants to join its unique acceleration ecosystem

HEMAV: World’s leading drone services company for agriculture

Now a global leader known for its industry-targeted software, HEMAV has expanded to 15 countries, working with utilities, farms and public bodies

After insurtech and fintech, Newralers applies AI to winemaking

Newralers expects strong demand for its disruptive AI solutions that test the cognitive value of information, with clients from listed companies to SMEs

DefinedCrowd: Helping companies mine, structure highly accurate data in AI applications

The Portuguese startup's quality-controlling smart data platform is driving its exponential growth and major partnerships with the likes of IBM's Watson Studio and Amazon

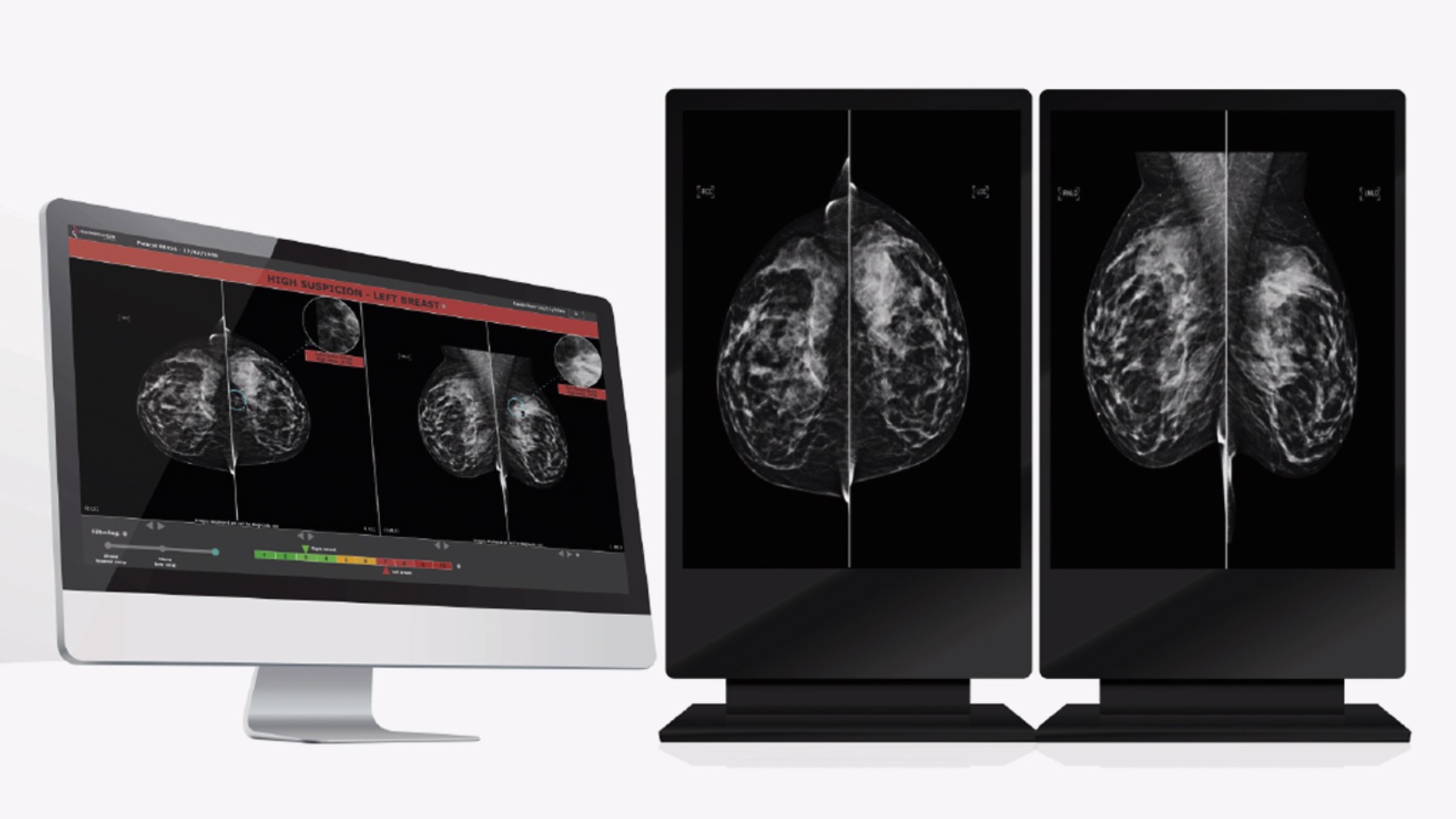

Therapixel: Using AI to improve breast cancer detection

Therapixel is raising €15m for commercial expansion of its AI-powered MammoScreen that gives accurate breast cancer screening results within minutes

This Chinese café startup aims to best Starbucks with “new retail” strategy

Luckin Coffee has gone from scratch to China’s first coffee shop unicorn in less than a year, pouring more than 5 million cups of coffee along the way

Waste management startup Magalarva aims for profitability with new factory, B2B services

Partnerships with supermarkets and waste transporters provide Magalarva with new revenue streams and sources of production input as the company ramps up its manufacturing activities

Sheetgo: Easy and secure cloud-powered spreadsheet data at your fingertips

Named Most Scalable Product at South Summit 2018, Sheetgo turns spreadsheets into data clouds for business users around the world

Gago Inc: Satellite data agritech startup ramps up growth with financial sector solutions

Founded by former NASA scientists, Gago began as a data solution to improve China’s traditionally low-yielding and inefficient smallholder-based farming sector

Billin offers unlimited free e-invoicing services to SMEs and freelancers

Offering automated online invoice generating, sharing, tracking and payments, the Spanish fintech wants to become the billing Dropbox for businesses worldwide

Fish trading startup Aruna thrives despite Covid-19 with a pivot to domestic sales

Having brought forward its domestic expansion by one year, Aruna wants to use its recent funding to further boost market expansion, develop the tech for product traceability and an intelligent supply chain

Farmer Connect: Blockchain powered platform tracing coffee beans from field to cup

Farmer Connect’s platform enables consumers to trace the origin, quality and ethical footprint of a product by just scanning a QR code

With a new focus on smart clinics, healthcare SaaS startup Medigo offers Covid-19 testing

A pivot to revenue-sharing and partnerships to provide Covid-19 testing has given Medigo a fighting chance, with a new funding round on the cards

EXCLUSIVE: Qlue raising Series B funding, "confident" of turning profitable in 2020

Qlue is also targeting more enterprise clients as it expands overseas and improved accountability and management practices

Delectatech: "Food data" proves its value in Spain's Covid-hit F&B industry

Delectatech deploys AI, NLP and big data to help restaurants and food suppliers optimize business information, decisions and operations

Sorry, we couldn’t find any matches for“Startup with IBM”.