Swanlaab Venture Factory

-

DATABASE (450)

-

ARTICLES (256)

Central Capital Ventura is backed by Bank Central Asia (BCA), one of Indonesia's largest banks. The venture capital firm is focused on identifying and investing in fintech and other technologies that can potentially support BCA's own businesses and service ecosystem. Central Capital Venture has backed Indonesian microlending company JULO and Singapore payments processing company Wallex. It has also invested in Gerbang Pembayaran Nasional (GPN), Indonesia's new national card-based payment gateway system.

Central Capital Ventura is backed by Bank Central Asia (BCA), one of Indonesia's largest banks. The venture capital firm is focused on identifying and investing in fintech and other technologies that can potentially support BCA's own businesses and service ecosystem. Central Capital Venture has backed Indonesian microlending company JULO and Singapore payments processing company Wallex. It has also invested in Gerbang Pembayaran Nasional (GPN), Indonesia's new national card-based payment gateway system.

Billing itself as the "world's first venture builder focused on the real estate and construction sectors," Construtech Ventures is a Brazilian investor and venture builder established in 2017 in Florianópolis. To date, it has invested in 11 companies, all of them local with the exception of Portuguese Infraspeak. Its most recent investments are in Infraspeak's seed round and in real estate marketplace EmCasa's Series A round. The company also has a second office in São Paulo.

Billing itself as the "world's first venture builder focused on the real estate and construction sectors," Construtech Ventures is a Brazilian investor and venture builder established in 2017 in Florianópolis. To date, it has invested in 11 companies, all of them local with the exception of Portuguese Infraspeak. Its most recent investments are in Infraspeak's seed round and in real estate marketplace EmCasa's Series A round. The company also has a second office in São Paulo.

Founded in 1972, Kleiner Perkins, formerly Kleiner Perkins Caufield & Byers (KPCB) is one of the world’s largest venture capital firms.The firm has raised $10bn through 20 venture funds and four growth funds and has invested in over 850 companies worldwide. Its China advisory team was founded in 2007 with a fund of $360m. It has invested in many of China’s star enterprises, including one of the country’s largest e-commerce platform JD.com.

Founded in 1972, Kleiner Perkins, formerly Kleiner Perkins Caufield & Byers (KPCB) is one of the world’s largest venture capital firms.The firm has raised $10bn through 20 venture funds and four growth funds and has invested in over 850 companies worldwide. Its China advisory team was founded in 2007 with a fund of $360m. It has invested in many of China’s star enterprises, including one of the country’s largest e-commerce platform JD.com.

SC Ventures is the venture capital arm of Standard Chartered Bank. The company serves as a platform from which Standard Chartered can identify innovative technologies in banking and financial services, and invest in the companies that build these technologies and business models. Besides investments, SC Ventures also operates an accelerator program named eXellerator and an internal venture builder unit. As an investor, SC Ventures focuses on Series B+ rounds, with each investment at the $1-5m range.

SC Ventures is the venture capital arm of Standard Chartered Bank. The company serves as a platform from which Standard Chartered can identify innovative technologies in banking and financial services, and invest in the companies that build these technologies and business models. Besides investments, SC Ventures also operates an accelerator program named eXellerator and an internal venture builder unit. As an investor, SC Ventures focuses on Series B+ rounds, with each investment at the $1-5m range.

Based in Jakarta, Maloekoe Ventures is an Indonesian-focused venture capital firm headed by Adrien Gheur, a former MD of hedge fund APS Asset Management.

Based in Jakarta, Maloekoe Ventures is an Indonesian-focused venture capital firm headed by Adrien Gheur, a former MD of hedge fund APS Asset Management.

Founded in 2006 and renamed in 2010, Floodgate Fund is a venture capital firm focused on early-stage investment in technology sectors.

Founded in 2006 and renamed in 2010, Floodgate Fund is a venture capital firm focused on early-stage investment in technology sectors.

Established in 2013, ZP Capital is a venture capital fund. It invests mainly in companies in the internet and consumer technology sectors.

Established in 2013, ZP Capital is a venture capital fund. It invests mainly in companies in the internet and consumer technology sectors.

Softbank-Indosat Fund (SB-ISAT Fund)

A joint US$50 million venture capital fund by SoftBank and Indonesian telecommunications company Indosat. The fund, founded in 2014, invests in companies based in Indonesia.

A joint US$50 million venture capital fund by SoftBank and Indonesian telecommunications company Indosat. The fund, founded in 2014, invests in companies based in Indonesia.

Regent Capital is a venture capital firm founded in 2015 in Shenzhen.

Regent Capital is a venture capital firm founded in 2015 in Shenzhen.

IDG-Accel is a joint venture between tech media company IDG and Accel Partners, focusing on early-stage, late-stage and pre-IPO investments.

IDG-Accel is a joint venture between tech media company IDG and Accel Partners, focusing on early-stage, late-stage and pre-IPO investments.

Founded in 2015 by three former core members of Legend Capital, JOY Capital is a venture capital firm focused on investment in TMT industries.

Founded in 2015 by three former core members of Legend Capital, JOY Capital is a venture capital firm focused on investment in TMT industries.

Maniv Mobility is an Israel-based venture capitalist firm, focused mainly on mobility, automotive, transportation and logistic solutions. The fund is backed by venture arms of BMW, Hyundai, LG Electronics, the Renault-Nissan-Mitsubishi Alliance, Shell and Valeo amongst others. Headquartered in Isreal, in Tel Aviv a city that is growing in the mobility space with an increasing number of automotive venture arms.Maniv Mobility operates since 2016 with an initial funding capital of $44mn and a further capital injection in 2019 of $100mn. With an international investment portfolio and global ambitions, the firm has built over the years strategic partners in Europe, North America, Israel looking for long term expansion in Asian markets.The company has been within the VCs that backed Drive.ai, the autonomous vehicle startup later acquired by Apple.

Maniv Mobility is an Israel-based venture capitalist firm, focused mainly on mobility, automotive, transportation and logistic solutions. The fund is backed by venture arms of BMW, Hyundai, LG Electronics, the Renault-Nissan-Mitsubishi Alliance, Shell and Valeo amongst others. Headquartered in Isreal, in Tel Aviv a city that is growing in the mobility space with an increasing number of automotive venture arms.Maniv Mobility operates since 2016 with an initial funding capital of $44mn and a further capital injection in 2019 of $100mn. With an international investment portfolio and global ambitions, the firm has built over the years strategic partners in Europe, North America, Israel looking for long term expansion in Asian markets.The company has been within the VCs that backed Drive.ai, the autonomous vehicle startup later acquired by Apple.

Xiamen Torch Group Co. Ltd. provides venture capital investment, technology guarantees, engineering project construction, bonded logistics, property management, and other related services for Xiamen Torch High-tech Zone.

Xiamen Torch Group Co. Ltd. provides venture capital investment, technology guarantees, engineering project construction, bonded logistics, property management, and other related services for Xiamen Torch High-tech Zone.

UBS is a Switzerland-based financial institution providing banking, wealth management, and securities services. Originally established in 1862 as the Bank in Winterthur, it is the largest Swiss banking institution. UBS engages in venture capital activities as part of its investment banking services. In 2020, UBS began a partnership with venture capital firm Anthemis to launch UBS Next, a $200m fund that will invest in fintech and other tech startups.

UBS is a Switzerland-based financial institution providing banking, wealth management, and securities services. Originally established in 1862 as the Bank in Winterthur, it is the largest Swiss banking institution. UBS engages in venture capital activities as part of its investment banking services. In 2020, UBS began a partnership with venture capital firm Anthemis to launch UBS Next, a $200m fund that will invest in fintech and other tech startups.

Batavia Incubator was founded as a joint venture between Rebright Partners, a Japanese incubator, and the Indonesian financial group, Corfina Group. The firm focuses on investing in Indonesian startups.

Batavia Incubator was founded as a joint venture between Rebright Partners, a Japanese incubator, and the Indonesian financial group, Corfina Group. The firm focuses on investing in Indonesian startups.

Swanlaab Venture Factory: €40 million funding chest to give power to the people

The female co-founder of Swanlaab Venture Factory believes that diversity enriches decision-making and drives performance. CompassList recently caught up with Verónica Trapa Díaz-Obregón to find out what's in store for Spain's first Israeli-backed VC fund

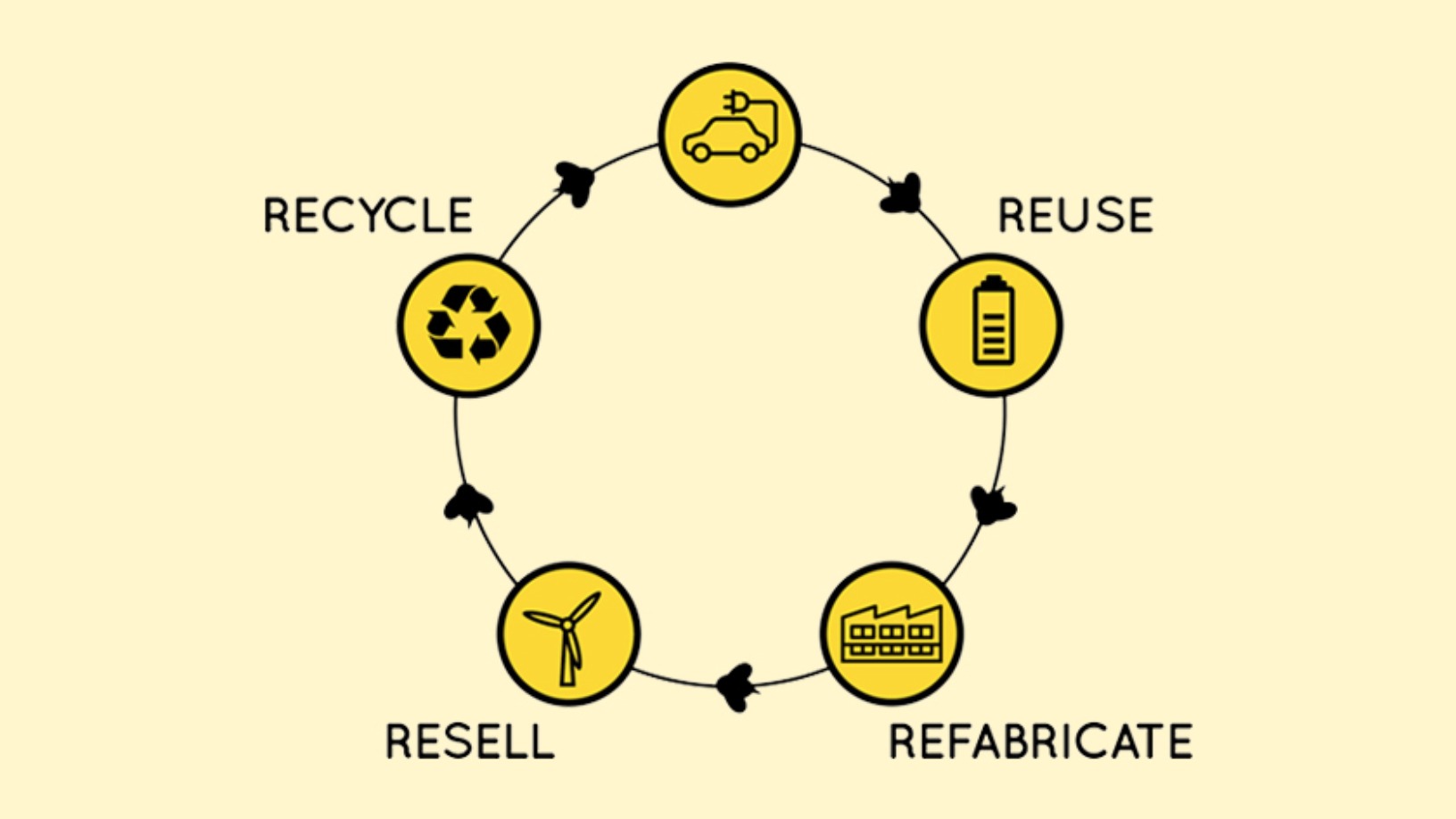

BeePlanet Factory: Recycling EV batteries as a sustainable, profitable business

With 4kWh–200kWh residential and industrial battery packs, the Pamplona-based startup wants to scale its energy storage solutions in the agri-food sector, camping sites and mountain huts

Faraday Venture Partners’ MP Gonzalo Tradacete: “We are actively looking for startups”

Amid the Covid-19 slump, Faraday Venture Partners' CIO and MP shares his expectations for startup investments and favored sectors, the measures his firm has taken so far to help investees ride out the crisis, and more.

Bluepha to boost PHA bioplastics production with $30m fresh funding

The Beijing-based startup aims to produce 10,000 tons of PHA bioplastic a year and build a SynBio community through its STEM education spinoff, Bluepha Lab

String Bio: Asia's first startup to harness methane gas for protein production

Using bacteria to turn the harmful greenhouse gas into a purer form of protein, String Bio is raising Series B funding to scale production

Waste management startup Magalarva aims for profitability with new factory, B2B services

Partnerships with supermarkets and waste transporters provide Magalarva with new revenue streams and sources of production input as the company ramps up its manufacturing activities

Qorium: Lab-grown premium leather for the future of luxury

The Dutch biotech startup co-founded by cell-based meat pioneer Mark Post is targeting the luxury goods market with its “clean leather” sheets made from cultivating bovine skin cells, and plans to raise up to €100m

Linptech: Smart home devices powered by movement

The first in China to tap kinetic energy to control smart home devices, Linptech has seen its wireless, battery-free products used in smart homes, and even at the Tokyo Olympics

Solatom plans overseas expansion with backing from energy giants, impact investor

With a US patent in hand, the Valencian startup is banking on international sales of its concentrated solar power modules, targeting €1m in revenue by end-2021

COMY Energy: Closing the plastic waste loop with chemical recycling

The Chinese startup transforms plastic wastes to virgin-quality recycled products without releasing toxic gas or pollution and is attracting interest from petrochemical giants and waste management companies

In-store robots and online doctors serve customers 24/7 at Dingdang Medicine Express

Dingdang also offers cheaper medicines and 28-minute home delivery, thanks to its innovative logistics and partnership models

4YFN: Investment booms across Europe during pandemic

Speaking at the recent 4YFN conference, prolific European startup investor Mattias Ljungman provided a highly optimistic assessment of the continent's current ecosystem strength and climate for seed funding

Mycorena: Fungi-based vegan protein challenging traditional plant-based ingredients

Award-winning Swedish biotech startup is scaling production of mycoprotein to become a key player in the emerging market for functional proteins

Future Food Asia 2021: Long road ahead for the clean meat industry

Crucial basic research is still needed to ensure the safety, quality, and production efficiency of lab-grown meat. Concerted public and private sector efforts will accelerate progress

Qairos Energies: Mass producing green hydrogen from industrial hemp

The French startup is seeking a €19m Series B round to produce industrial quantities of green hydrogen and is planning a “circular economy” partnership with local farmers

Sorry, we couldn’t find any matches for“Swanlaab Venture Factory”.