Swanlaab Venture Factory

-

DATABASE (450)

-

ARTICLES (256)

Xange is the venture capital arm of Siparex Group, with offices in Paris and Munich. It is dedicated to supporting entrepreneurs in disruptive digital, deep tech and social impact. It has €450m under management and 65 startups in its portfolio.

Xange is the venture capital arm of Siparex Group, with offices in Paris and Munich. It is dedicated to supporting entrepreneurs in disruptive digital, deep tech and social impact. It has €450m under management and 65 startups in its portfolio.

CEO and Founder of Didimo

Argentinian-born Verónica Costa Orvalho is a veteran in animation technology. In 2016, she became the CEO and founder of Didimo that was inspired by an earlier venture Face In Motion, established in 2007 to focus on cinematic quality and animation production of faces. Orvalho won the award for the AI and virtual reality category at a Women Startup Challenge event held in New York in 2017. Orvalho has a long academic track record in related fields, beginning with a first degree in Software Engineering from the University of Belgrano in Buenos Aires. She moved to Barcelona and obtained a master's degree in Videogame Design and Development at University Pompeu Fabra where she continued to work on creating a facial animation system “For CG Films”. She later completed her PhD at the Polytechnic University of Catalonia with her thesis: Fast and Reusable Facial Rigging and Animation to develop an application that could speed up the traditional “slowing rigging” process. She has worked at Ericsson as a systems analyst and was a producer at the Argentinian film company Patagonik Film Group that helped to produce the Oscar-winning movie El hijo de la novia. She worked for four years as the founder of Panorama Consulting, a consultancy focusing on developing systems for the medical, logistics and entertainment industries. Since 2003, she has lectured in different institutions, including Porto University's Porto Interactive Center as its specialist in facial animation since 2008.

Argentinian-born Verónica Costa Orvalho is a veteran in animation technology. In 2016, she became the CEO and founder of Didimo that was inspired by an earlier venture Face In Motion, established in 2007 to focus on cinematic quality and animation production of faces. Orvalho won the award for the AI and virtual reality category at a Women Startup Challenge event held in New York in 2017. Orvalho has a long academic track record in related fields, beginning with a first degree in Software Engineering from the University of Belgrano in Buenos Aires. She moved to Barcelona and obtained a master's degree in Videogame Design and Development at University Pompeu Fabra where she continued to work on creating a facial animation system “For CG Films”. She later completed her PhD at the Polytechnic University of Catalonia with her thesis: Fast and Reusable Facial Rigging and Animation to develop an application that could speed up the traditional “slowing rigging” process. She has worked at Ericsson as a systems analyst and was a producer at the Argentinian film company Patagonik Film Group that helped to produce the Oscar-winning movie El hijo de la novia. She worked for four years as the founder of Panorama Consulting, a consultancy focusing on developing systems for the medical, logistics and entertainment industries. Since 2003, she has lectured in different institutions, including Porto University's Porto Interactive Center as its specialist in facial animation since 2008.

Founded by pioneering tech investor Ozi Amanat in 2015, K2 Global is a venture capital firm based in Silicon Valley and Singapore. Amanat, who moved to Singapore in 2012, is one of Twitter’s early backers, raising $25m to invest in the social media startup that later went public in 2013. The Harvard graduate in psychology and economics also invested in Uber, Spotify and Alibaba during his career as a venture capitalist. Amanat is the chief investment officer of K2 VC, K2 Global and Singapore-based Spice Global controlled by Indian billionaire B K Modi.In 2017, K2 also announced a $183m VC fund focusing on early-stage startups that aim to address global challenges. The majority of K2 limited partners are based outside the US in countries like Australia, Japan, Singapore, Hong Kong and Indonesia.

Founded by pioneering tech investor Ozi Amanat in 2015, K2 Global is a venture capital firm based in Silicon Valley and Singapore. Amanat, who moved to Singapore in 2012, is one of Twitter’s early backers, raising $25m to invest in the social media startup that later went public in 2013. The Harvard graduate in psychology and economics also invested in Uber, Spotify and Alibaba during his career as a venture capitalist. Amanat is the chief investment officer of K2 VC, K2 Global and Singapore-based Spice Global controlled by Indian billionaire B K Modi.In 2017, K2 also announced a $183m VC fund focusing on early-stage startups that aim to address global challenges. The majority of K2 limited partners are based outside the US in countries like Australia, Japan, Singapore, Hong Kong and Indonesia.

Founded in 1998, Asiaec Partnership is one of the earliest venture capital firms in China, with about 20 funds under management. It has invested in 100+ companies, of which about one-third have gone public, with an IRR of over 35%.

Founded in 1998, Asiaec Partnership is one of the earliest venture capital firms in China, with about 20 funds under management. It has invested in 100+ companies, of which about one-third have gone public, with an IRR of over 35%.

Fenghou Capital is a venture capital firm focusing on early-stage investment in entertainment, industrial internet and fintech. It has invested in more than 80 companies since its inception in 2013 and has about RMB 500 million in assets under management.

Fenghou Capital is a venture capital firm focusing on early-stage investment in entertainment, industrial internet and fintech. It has invested in more than 80 companies since its inception in 2013 and has about RMB 500 million in assets under management.

Established in 2002, the Edge Group focuses on real estate investment and venture capital holdings. Headed by José Luis Pinto Basto, its investment strategy is based on the “triple bottom line” philosophy: reaching the optimal balance between economic, social and environmental sustainability.

Established in 2002, the Edge Group focuses on real estate investment and venture capital holdings. Headed by José Luis Pinto Basto, its investment strategy is based on the “triple bottom line” philosophy: reaching the optimal balance between economic, social and environmental sustainability.

Founded in 2013 by BYD co-founder Yang Longzhong, Hui Capital focuses on new energy, new materials, electronic information technology and artificial intelligence. It plays a role as the administrator of the National Development and Reform Commission’s emerging industry venture capital fund.

Founded in 2013 by BYD co-founder Yang Longzhong, Hui Capital focuses on new energy, new materials, electronic information technology and artificial intelligence. It plays a role as the administrator of the National Development and Reform Commission’s emerging industry venture capital fund.

Cloud Angel Fund was co-founded by China Broadband Capital, Sequoia China, Northern Light Venture Capital, GSR Ventures and Wu Capital in 2013. It operates as a VC firm and invests mainly in early-stage startups in China.

Cloud Angel Fund was co-founded by China Broadband Capital, Sequoia China, Northern Light Venture Capital, GSR Ventures and Wu Capital in 2013. It operates as a VC firm and invests mainly in early-stage startups in China.

Founded in 2010, East Ventures is a venture capital firm with offices in Indonesia, Japan and USA. Today, the company has invested in over 150 companies across Asia, mainly Southeast Asia and Japan, and the USA. Its ticket size ranges from US$100,000 to US$500,000.

Founded in 2010, East Ventures is a venture capital firm with offices in Indonesia, Japan and USA. Today, the company has invested in over 150 companies across Asia, mainly Southeast Asia and Japan, and the USA. Its ticket size ranges from US$100,000 to US$500,000.

Korea Investment Partners is a venture capital fund established in 1986. It primarily invests in companies from Korea, China and the United States. It has invested a total of more than US$1.7 billion in over 500 companies across various sectors, from social media to medtech.

Korea Investment Partners is a venture capital fund established in 1986. It primarily invests in companies from Korea, China and the United States. It has invested a total of more than US$1.7 billion in over 500 companies across various sectors, from social media to medtech.

Lenovo Capital & Incubator Group

Established in 2016, Lenovo Capital is a venture capital fund that invests in the global technology sector. The fourth business division of Legend Group, Lenovo Capital has invested in and supported more than 80 startups and incubated nine subsidiaries that have more than one billion global users.

Established in 2016, Lenovo Capital is a venture capital fund that invests in the global technology sector. The fourth business division of Legend Group, Lenovo Capital has invested in and supported more than 80 startups and incubated nine subsidiaries that have more than one billion global users.

Shanghai Zhangjiang Haocheng Venture Capital Co., Ltd. (Zhangjiang Haocheng) was founded in 2007 as a wholly-owned subsidiary of listed real estate developer Shanghai Zhangjiang Hi-Tech Park Development Co., Ltd. It has invested RMB 2.5 billion in high-tech startups.

Shanghai Zhangjiang Haocheng Venture Capital Co., Ltd. (Zhangjiang Haocheng) was founded in 2007 as a wholly-owned subsidiary of listed real estate developer Shanghai Zhangjiang Hi-Tech Park Development Co., Ltd. It has invested RMB 2.5 billion in high-tech startups.

Singapore/Japan-based venture capital firm Rebright Partners is backed by publicly listed Japanese internet companies and leading angel investors. The team operates in Tokyo, Singapore and Bangalore.

Singapore/Japan-based venture capital firm Rebright Partners is backed by publicly listed Japanese internet companies and leading angel investors. The team operates in Tokyo, Singapore and Bangalore.

Hirokazu “Hiro” Mashita is a founder and director at M&S Partners Pte Ltd, a venture capital firm based in Singapore. A prolific business angel, he is known to have invested in more than 20 Indian startups in 2015 alone, earning him the nickname “Super Angel from Japan”.

Hirokazu “Hiro” Mashita is a founder and director at M&S Partners Pte Ltd, a venture capital firm based in Singapore. A prolific business angel, he is known to have invested in more than 20 Indian startups in 2015 alone, earning him the nickname “Super Angel from Japan”.

Pathena is a Porto-based venture capital firm founded in 2010 and focuses on IT investments, particularly medtech. Pathena closed its first portfolio fund in 2011, having invested in 10 companies and it launched its current portfolio fund in 2013 worth €56 million.

Pathena is a Porto-based venture capital firm founded in 2010 and focuses on IT investments, particularly medtech. Pathena closed its first portfolio fund in 2011, having invested in 10 companies and it launched its current portfolio fund in 2013 worth €56 million.

Swanlaab Venture Factory: €40 million funding chest to give power to the people

The female co-founder of Swanlaab Venture Factory believes that diversity enriches decision-making and drives performance. CompassList recently caught up with Verónica Trapa Díaz-Obregón to find out what's in store for Spain's first Israeli-backed VC fund

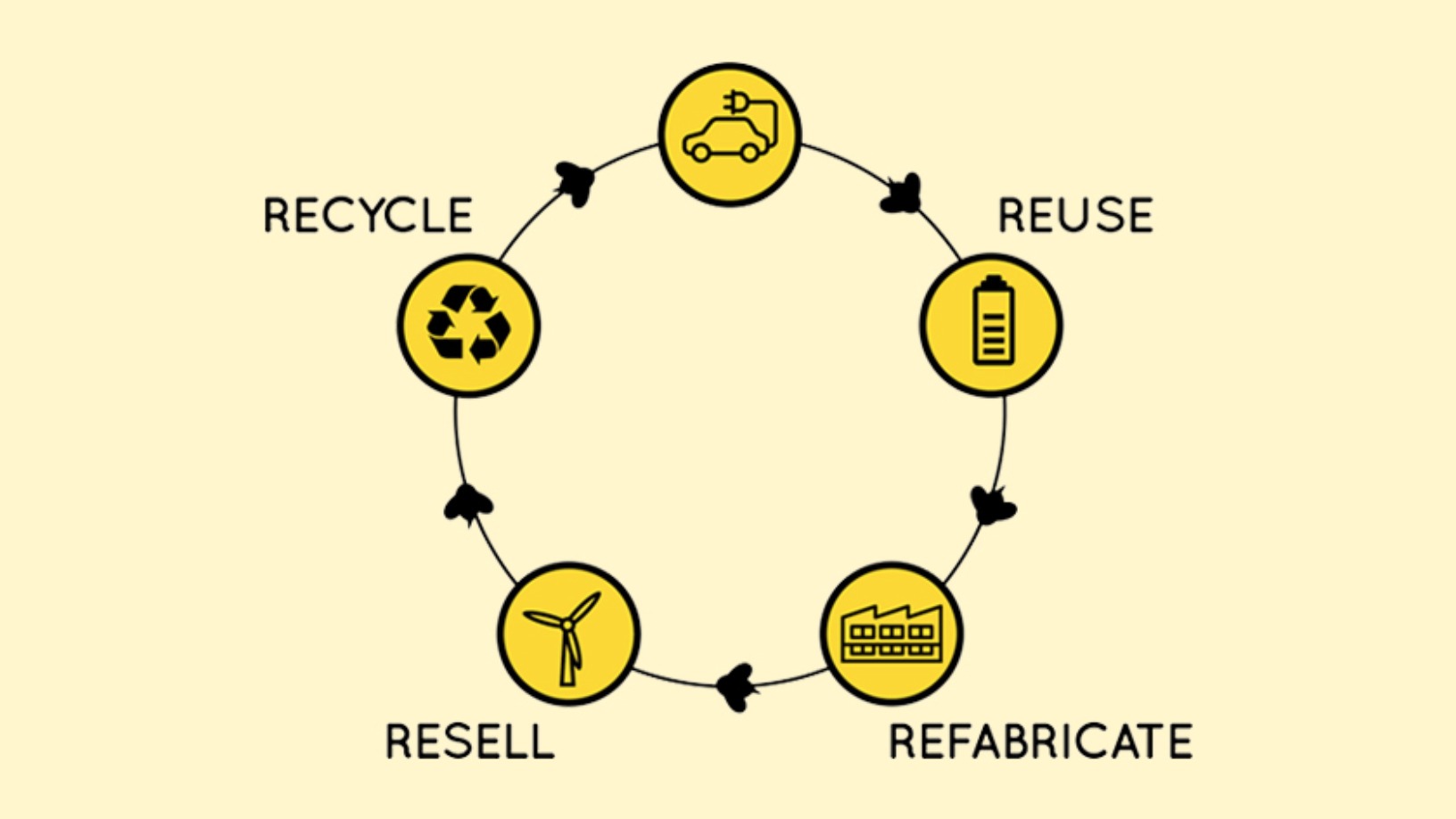

BeePlanet Factory: Recycling EV batteries as a sustainable, profitable business

With 4kWh–200kWh residential and industrial battery packs, the Pamplona-based startup wants to scale its energy storage solutions in the agri-food sector, camping sites and mountain huts

Faraday Venture Partners’ MP Gonzalo Tradacete: “We are actively looking for startups”

Amid the Covid-19 slump, Faraday Venture Partners' CIO and MP shares his expectations for startup investments and favored sectors, the measures his firm has taken so far to help investees ride out the crisis, and more.

Bluepha to boost PHA bioplastics production with $30m fresh funding

The Beijing-based startup aims to produce 10,000 tons of PHA bioplastic a year and build a SynBio community through its STEM education spinoff, Bluepha Lab

String Bio: Asia's first startup to harness methane gas for protein production

Using bacteria to turn the harmful greenhouse gas into a purer form of protein, String Bio is raising Series B funding to scale production

Waste management startup Magalarva aims for profitability with new factory, B2B services

Partnerships with supermarkets and waste transporters provide Magalarva with new revenue streams and sources of production input as the company ramps up its manufacturing activities

Qorium: Lab-grown premium leather for the future of luxury

The Dutch biotech startup co-founded by cell-based meat pioneer Mark Post is targeting the luxury goods market with its “clean leather” sheets made from cultivating bovine skin cells, and plans to raise up to €100m

Linptech: Smart home devices powered by movement

The first in China to tap kinetic energy to control smart home devices, Linptech has seen its wireless, battery-free products used in smart homes, and even at the Tokyo Olympics

Solatom plans overseas expansion with backing from energy giants, impact investor

With a US patent in hand, the Valencian startup is banking on international sales of its concentrated solar power modules, targeting €1m in revenue by end-2021

COMY Energy: Closing the plastic waste loop with chemical recycling

The Chinese startup transforms plastic wastes to virgin-quality recycled products without releasing toxic gas or pollution and is attracting interest from petrochemical giants and waste management companies

In-store robots and online doctors serve customers 24/7 at Dingdang Medicine Express

Dingdang also offers cheaper medicines and 28-minute home delivery, thanks to its innovative logistics and partnership models

4YFN: Investment booms across Europe during pandemic

Speaking at the recent 4YFN conference, prolific European startup investor Mattias Ljungman provided a highly optimistic assessment of the continent's current ecosystem strength and climate for seed funding

Mycorena: Fungi-based vegan protein challenging traditional plant-based ingredients

Award-winning Swedish biotech startup is scaling production of mycoprotein to become a key player in the emerging market for functional proteins

Future Food Asia 2021: Long road ahead for the clean meat industry

Crucial basic research is still needed to ensure the safety, quality, and production efficiency of lab-grown meat. Concerted public and private sector efforts will accelerate progress

Qairos Energies: Mass producing green hydrogen from industrial hemp

The French startup is seeking a €19m Series B round to produce industrial quantities of green hydrogen and is planning a “circular economy” partnership with local farmers

Sorry, we couldn’t find any matches for“Swanlaab Venture Factory”.