Swanlaab Venture Factory

-

DATABASE (450)

-

ARTICLES (256)

Founded by Li Shujun, the former CFO of Shengda, in 2006, Trustbridge Partners is a venture capital and private equity firm focusing on growth-stage and expansion-stage investments in Chinese companies in new energy, environmental protection, new materials, new media, retailing, healthcare, education, e-commerce, etc. The sources of its funds come mainly from university foundations in the US (such as Columbia University, Stanford University, New York University), world-renowned investment firms (Temasek Holdings, Kerry Group, etc.), and private investors.

Founded by Li Shujun, the former CFO of Shengda, in 2006, Trustbridge Partners is a venture capital and private equity firm focusing on growth-stage and expansion-stage investments in Chinese companies in new energy, environmental protection, new materials, new media, retailing, healthcare, education, e-commerce, etc. The sources of its funds come mainly from university foundations in the US (such as Columbia University, Stanford University, New York University), world-renowned investment firms (Temasek Holdings, Kerry Group, etc.), and private investors.

The VC arm of Tsinghua University, THG Ventures was founded in 2015. It is managed by the investment team from the state-owned Tsinghua Holdings Ltd., which has specialized in venture capital investments since 1999 and is one of the first China teams focused on RMB investment. The team also founded TusPark Incubator and TusPark Ventures.

The VC arm of Tsinghua University, THG Ventures was founded in 2015. It is managed by the investment team from the state-owned Tsinghua Holdings Ltd., which has specialized in venture capital investments since 1999 and is one of the first China teams focused on RMB investment. The team also founded TusPark Incubator and TusPark Ventures.

Founded in 2006 by executives from the People’s Bank of China, the China Securities Regulatory Commission, commercial banks, brokerages, insurance companies, funds and other financial institutions, Sensegain Asset Management has AUM (assets under management) of RMB 69 billion. It focuses on private equity, venture capital investment, M&A, market value management for public companies and public equity investment. Sensegain has 150+ FTEs with strong financial backgrounds and a broad range of industry expertise.

Founded in 2006 by executives from the People’s Bank of China, the China Securities Regulatory Commission, commercial banks, brokerages, insurance companies, funds and other financial institutions, Sensegain Asset Management has AUM (assets under management) of RMB 69 billion. It focuses on private equity, venture capital investment, M&A, market value management for public companies and public equity investment. Sensegain has 150+ FTEs with strong financial backgrounds and a broad range of industry expertise.

Co-founder of Fenbushi Capital, China’s first venture capital firm that focuses exclusively on blockchain investment, and of Bitshares, a blockchain-based financial platform. Among the earliest investors and entrepreneurs in the blockchain industry, Shen has 12 years of experience in senior management at brokerages, hedge funds and investment banks. He received his bachelor’s degree in mathematics from the University of Shanghai for Science and Technology and his master’s degree in Systems Engineering from the Georgia Institute of Technology.

Co-founder of Fenbushi Capital, China’s first venture capital firm that focuses exclusively on blockchain investment, and of Bitshares, a blockchain-based financial platform. Among the earliest investors and entrepreneurs in the blockchain industry, Shen has 12 years of experience in senior management at brokerages, hedge funds and investment banks. He received his bachelor’s degree in mathematics from the University of Shanghai for Science and Technology and his master’s degree in Systems Engineering from the Georgia Institute of Technology.

Caixa Capital Risc is the venture capital branch of CriteriaCaixa, an investment holding company that manages La Caixa's banking funds. It was established in 2004 and has registered capital of €195 million. It is based in Barcelona, Spain and has invested in more than 100 Spanish companies in different sectors. It invests across sectors, requiring the startup to work with market-proven technology in a profitable and innovative proposition.

Caixa Capital Risc is the venture capital branch of CriteriaCaixa, an investment holding company that manages La Caixa's banking funds. It was established in 2004 and has registered capital of €195 million. It is based in Barcelona, Spain and has invested in more than 100 Spanish companies in different sectors. It invests across sectors, requiring the startup to work with market-proven technology in a profitable and innovative proposition.

ESADE Ban is a network of private investors, comprised of ex-alumnae of the Barcelona, Spain-based ESADE Business School. Founded in 2010, the organization consists of 260 business angels, venture capital companies, family firms and senior managers that have invested more than €27 million in 120 startups. The entity won the European Business Angel Network's 2016 award for best performing business angel and hold investment events throughout the year.

ESADE Ban is a network of private investors, comprised of ex-alumnae of the Barcelona, Spain-based ESADE Business School. Founded in 2010, the organization consists of 260 business angels, venture capital companies, family firms and senior managers that have invested more than €27 million in 120 startups. The entity won the European Business Angel Network's 2016 award for best performing business angel and hold investment events throughout the year.

Discovery Nusantara Capital is a venture capital firm with a focus on video gaming and related industries. The firm is backed by China's Zhexin IT and Indonesian angel investors keen to support the growth of the local game industry. Discovery Nusantara Capital has helped introduce games from Touchten, an Indonesian game development studio, to the Chinese market. Aside from video games, the firm has recently invested in NaoBun Project, an Indonesian comics publisher and intellectual property management agency.

Discovery Nusantara Capital is a venture capital firm with a focus on video gaming and related industries. The firm is backed by China's Zhexin IT and Indonesian angel investors keen to support the growth of the local game industry. Discovery Nusantara Capital has helped introduce games from Touchten, an Indonesian game development studio, to the Chinese market. Aside from video games, the firm has recently invested in NaoBun Project, an Indonesian comics publisher and intellectual property management agency.

ATM Capital is a China-based venture capital firm with a focus on Southeast Asia. In 2017, ATM Capital participated in the seed round of Indonesian coworking space operator Rework (now GoWork). Its its partners have invested in Go-Jek, Rocket Internet and several Chinese companies. It closed its US$200 million fund in January 2019.

ATM Capital is a China-based venture capital firm with a focus on Southeast Asia. In 2017, ATM Capital participated in the seed round of Indonesian coworking space operator Rework (now GoWork). Its its partners have invested in Go-Jek, Rocket Internet and several Chinese companies. It closed its US$200 million fund in January 2019.

Ignacio Martín de Andrés has over eight years of experience working at consultancies such as KPMG, PwC and Grant Thornton.He made an angel investment in Reclamador.es, a web platform that manages and automates consumer claims, and has also helped define the company's strategy and service-level agreement.Since 2019, he's been a partner at Venture Partnership, supporting the company by defining growth strategy, KPIs and process optimization for startups in the company’s investment portfolio.

Ignacio Martín de Andrés has over eight years of experience working at consultancies such as KPMG, PwC and Grant Thornton.He made an angel investment in Reclamador.es, a web platform that manages and automates consumer claims, and has also helped define the company's strategy and service-level agreement.Since 2019, he's been a partner at Venture Partnership, supporting the company by defining growth strategy, KPIs and process optimization for startups in the company’s investment portfolio.

Founded in 2011, Ankur Capital is an early-stage venture capital fund based in Mumbai. The VC invests in Indian-based startups in diverse sectors like agritech, food, health and education. It has 15 startups in its investment portfolio and has managed one exit to date, Carmel Organics.Recent investments include seed funding for seafood supply chain platform Captain Fresh and agriproduce marketplace Vegrow, as well as participation in the $20m Series C round of predictive farming platform Cropin.

Founded in 2011, Ankur Capital is an early-stage venture capital fund based in Mumbai. The VC invests in Indian-based startups in diverse sectors like agritech, food, health and education. It has 15 startups in its investment portfolio and has managed one exit to date, Carmel Organics.Recent investments include seed funding for seafood supply chain platform Captain Fresh and agriproduce marketplace Vegrow, as well as participation in the $20m Series C round of predictive farming platform Cropin.

bp ventures is an investment arm of the energy group BP with an annual venture investment budget between $150m and $200m. The group invests in new energy solutions, with over 30 startups’ investments in its portfolio supporting BP’s core business in oil and gas.bp ventures has increasingly invested over the past years in carbon-management technologies, low-carbon products, and advanced mobility through EV charging companies like the Chinese Shanghai PowerShare Tech and the California-based FreeWire Technologies.

bp ventures is an investment arm of the energy group BP with an annual venture investment budget between $150m and $200m. The group invests in new energy solutions, with over 30 startups’ investments in its portfolio supporting BP’s core business in oil and gas.bp ventures has increasingly invested over the past years in carbon-management technologies, low-carbon products, and advanced mobility through EV charging companies like the Chinese Shanghai PowerShare Tech and the California-based FreeWire Technologies.

American financial services company Capital Group was established in 1931. As one of the world’s oldest investment management firms, it has over $2tn assets under management. Major known investments include arms and aerospace firm BAE Systems and British American Tobacco. In 1992, Capital Group established Capital Group Private Markets, which specializes in alternative private equity and venture capital investments. This organization has invested in companies like ride-hailing firms Gojek and Didi Chuxing, Philippines media conglomerate ABS-CBN, and more.

American financial services company Capital Group was established in 1931. As one of the world’s oldest investment management firms, it has over $2tn assets under management. Major known investments include arms and aerospace firm BAE Systems and British American Tobacco. In 1992, Capital Group established Capital Group Private Markets, which specializes in alternative private equity and venture capital investments. This organization has invested in companies like ride-hailing firms Gojek and Didi Chuxing, Philippines media conglomerate ABS-CBN, and more.

Passion Capital is an early stage venture capital firm that has been involved in several large European technology exits, such as QXL/Tradus, Ricardo.de and Last.fm. The partners include Robert Dighero, Eileen Burbidge and Stefan Glaenzer who believe that the passion and ability of the founders are critical keys to success. Passion Capital has a hub for activities in White Bear Yard in London and invests in digital media and technology companies.

Passion Capital is an early stage venture capital firm that has been involved in several large European technology exits, such as QXL/Tradus, Ricardo.de and Last.fm. The partners include Robert Dighero, Eileen Burbidge and Stefan Glaenzer who believe that the passion and ability of the founders are critical keys to success. Passion Capital has a hub for activities in White Bear Yard in London and invests in digital media and technology companies.

Jointly managed by Fondo de Fondos and Sun Mountain Capital, Mexico Ventures leads venture capital strategies in Mexico and USA. The VC offers solutions to add value to diverse business portfolios. Starting with minimum investments of US$1 million, the firm has interests in companies and other funds. It is based at the offices of the Mexican Capital Investment Corporation in Mexico City and also has operations in Santa Fe and New Mexico.

Jointly managed by Fondo de Fondos and Sun Mountain Capital, Mexico Ventures leads venture capital strategies in Mexico and USA. The VC offers solutions to add value to diverse business portfolios. Starting with minimum investments of US$1 million, the firm has interests in companies and other funds. It is based at the offices of the Mexican Capital Investment Corporation in Mexico City and also has operations in Santa Fe and New Mexico.

Catalan Finance Institute (ICF)

Owned by the Catalan Government, the Catalan Finance Institute (ICF) is a public institution that offers a range of financing solutions, including loans and venture capital. ICF aims to boost private angel and seed investments within the Catalan entrepreneurial ecosystem, while diversifying its investment sources. In 2012, ICF started investing in early-stage startups based in the Catalan territory, providing equity loans of between €50,000 and €200,000. It also participates in syndicated funding within a network of Catalan business angels.

Owned by the Catalan Government, the Catalan Finance Institute (ICF) is a public institution that offers a range of financing solutions, including loans and venture capital. ICF aims to boost private angel and seed investments within the Catalan entrepreneurial ecosystem, while diversifying its investment sources. In 2012, ICF started investing in early-stage startups based in the Catalan territory, providing equity loans of between €50,000 and €200,000. It also participates in syndicated funding within a network of Catalan business angels.

Swanlaab Venture Factory: €40 million funding chest to give power to the people

The female co-founder of Swanlaab Venture Factory believes that diversity enriches decision-making and drives performance. CompassList recently caught up with Verónica Trapa Díaz-Obregón to find out what's in store for Spain's first Israeli-backed VC fund

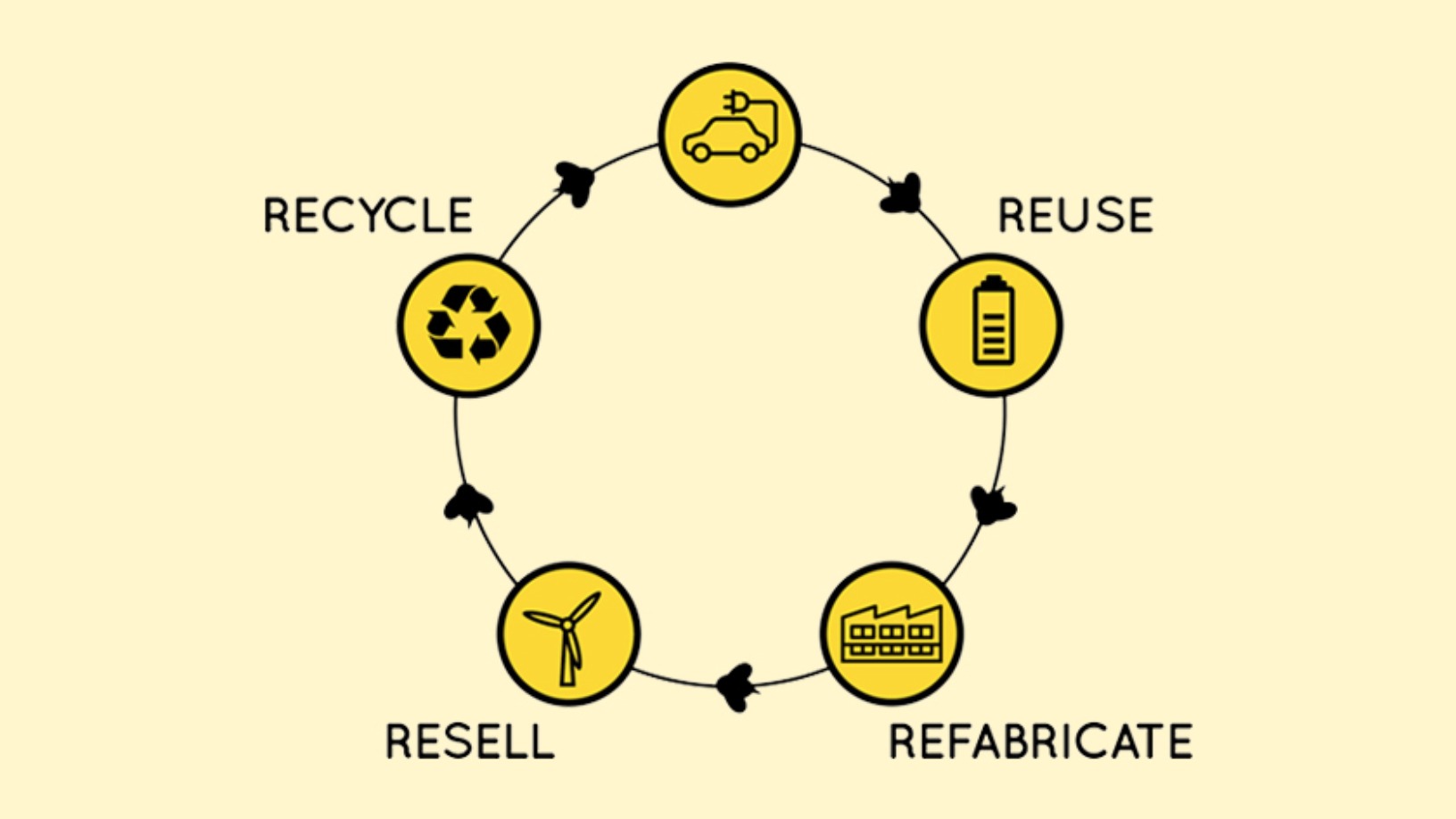

BeePlanet Factory: Recycling EV batteries as a sustainable, profitable business

With 4kWh–200kWh residential and industrial battery packs, the Pamplona-based startup wants to scale its energy storage solutions in the agri-food sector, camping sites and mountain huts

Faraday Venture Partners’ MP Gonzalo Tradacete: “We are actively looking for startups”

Amid the Covid-19 slump, Faraday Venture Partners' CIO and MP shares his expectations for startup investments and favored sectors, the measures his firm has taken so far to help investees ride out the crisis, and more.

Bluepha to boost PHA bioplastics production with $30m fresh funding

The Beijing-based startup aims to produce 10,000 tons of PHA bioplastic a year and build a SynBio community through its STEM education spinoff, Bluepha Lab

String Bio: Asia's first startup to harness methane gas for protein production

Using bacteria to turn the harmful greenhouse gas into a purer form of protein, String Bio is raising Series B funding to scale production

Waste management startup Magalarva aims for profitability with new factory, B2B services

Partnerships with supermarkets and waste transporters provide Magalarva with new revenue streams and sources of production input as the company ramps up its manufacturing activities

Qorium: Lab-grown premium leather for the future of luxury

The Dutch biotech startup co-founded by cell-based meat pioneer Mark Post is targeting the luxury goods market with its “clean leather” sheets made from cultivating bovine skin cells, and plans to raise up to €100m

Linptech: Smart home devices powered by movement

The first in China to tap kinetic energy to control smart home devices, Linptech has seen its wireless, battery-free products used in smart homes, and even at the Tokyo Olympics

Solatom plans overseas expansion with backing from energy giants, impact investor

With a US patent in hand, the Valencian startup is banking on international sales of its concentrated solar power modules, targeting €1m in revenue by end-2021

COMY Energy: Closing the plastic waste loop with chemical recycling

The Chinese startup transforms plastic wastes to virgin-quality recycled products without releasing toxic gas or pollution and is attracting interest from petrochemical giants and waste management companies

In-store robots and online doctors serve customers 24/7 at Dingdang Medicine Express

Dingdang also offers cheaper medicines and 28-minute home delivery, thanks to its innovative logistics and partnership models

4YFN: Investment booms across Europe during pandemic

Speaking at the recent 4YFN conference, prolific European startup investor Mattias Ljungman provided a highly optimistic assessment of the continent's current ecosystem strength and climate for seed funding

Mycorena: Fungi-based vegan protein challenging traditional plant-based ingredients

Award-winning Swedish biotech startup is scaling production of mycoprotein to become a key player in the emerging market for functional proteins

Future Food Asia 2021: Long road ahead for the clean meat industry

Crucial basic research is still needed to ensure the safety, quality, and production efficiency of lab-grown meat. Concerted public and private sector efforts will accelerate progress

Qairos Energies: Mass producing green hydrogen from industrial hemp

The French startup is seeking a €19m Series B round to produce industrial quantities of green hydrogen and is planning a “circular economy” partnership with local farmers

Sorry, we couldn’t find any matches for“Swanlaab Venture Factory”.