Swanlaab Venture Factory

-

DATABASE (450)

-

ARTICLES (256)

Shanghai Alliance Investment Ltd

Shanghai Alliance Investment Ltd is a state-owned company founded in September 1994 under the State-owned Assets Supervision and Administration Commission of Shanghai. It mainly engages in equity investment in hi-tech and modern services industry.It has invested over RMB 10bn in diverse sectors including information technology, biomedicine, new energy, environmental protection, new materials and financial services. In 2004, the company and Microsoft set up the joint venture Shanghai MSN Network Communications Technology Co Ltd that operates MSN China's website: msn.com.cn.

Shanghai Alliance Investment Ltd is a state-owned company founded in September 1994 under the State-owned Assets Supervision and Administration Commission of Shanghai. It mainly engages in equity investment in hi-tech and modern services industry.It has invested over RMB 10bn in diverse sectors including information technology, biomedicine, new energy, environmental protection, new materials and financial services. In 2004, the company and Microsoft set up the joint venture Shanghai MSN Network Communications Technology Co Ltd that operates MSN China's website: msn.com.cn.

Qingdao Haier Venture Capital is the investment arm of China-based electronics manufacturer Haier Group. The Haier SAIF fund was established in September 2014, in partnership with private equity firm SAIF Partners and other investors. The RMB 320m investment fund is managed by SAIF Partners. The fund mainly invests smart home product developers and related sectors like AI, IoT and big data. As of December 2017, it has invested in 16 startups.

Qingdao Haier Venture Capital is the investment arm of China-based electronics manufacturer Haier Group. The Haier SAIF fund was established in September 2014, in partnership with private equity firm SAIF Partners and other investors. The RMB 320m investment fund is managed by SAIF Partners. The fund mainly invests smart home product developers and related sectors like AI, IoT and big data. As of December 2017, it has invested in 16 startups.

Li is a TV presenter, entrepreneur and investor. Born in June 1970, she joined Beijing TV in 1993 as a news anchor. From 1995 to 1999, Li worked at CCTV as a TV show host. In 1999, she left CCTV and co-founded Fleet Entertainment with fellow TV host Dai Jun. The two co-hosted Super Talk Show from 2000 to 2016, one of the most highly viewed shows in China. Li founded cosmetics e-retailer Lefeng.com in 2008, skincare brand JPlus in 2009 and Star Venture Fund in 2015.

Li is a TV presenter, entrepreneur and investor. Born in June 1970, she joined Beijing TV in 1993 as a news anchor. From 1995 to 1999, Li worked at CCTV as a TV show host. In 1999, she left CCTV and co-founded Fleet Entertainment with fellow TV host Dai Jun. The two co-hosted Super Talk Show from 2000 to 2016, one of the most highly viewed shows in China. Li founded cosmetics e-retailer Lefeng.com in 2008, skincare brand JPlus in 2009 and Star Venture Fund in 2015.

Based in Singapore, Clermont Group is a venture capital group that was founded by New Zealand-born billionaire Richard F. Chandler. The company styles itself as a "business house" with a philosophy that entrepreneurship and managing capital are noble callings. To this end, Clermont invests in businesses that are geared towards fulfilling customer needs and those that generate employment. As a group, Clermont owns shares in Vietnamese healthcare group Hoan My, Philippines based clinic network The Medical City and the Small Business FinCredit company in India.

Based in Singapore, Clermont Group is a venture capital group that was founded by New Zealand-born billionaire Richard F. Chandler. The company styles itself as a "business house" with a philosophy that entrepreneurship and managing capital are noble callings. To this end, Clermont invests in businesses that are geared towards fulfilling customer needs and those that generate employment. As a group, Clermont owns shares in Vietnamese healthcare group Hoan My, Philippines based clinic network The Medical City and the Small Business FinCredit company in India.

Junrun Capital was founded in 2009 in Ningbo, Zhejiang province. It's the largest private equity fund in Ningbo and specializes in M&A, equity and venture capital investments. So far, it has successfully exited seven deals out of a total of 21. Junrun has investment managers and researchers with backgrounds in science and technology. It has offices in Hangzhou, Shanghai, Shenzhen and the US. The company mainly seeks investment opportunities in sustainable materials, cleantech, agriculture, manufacture, biotechnology and the dotcom economy.

Junrun Capital was founded in 2009 in Ningbo, Zhejiang province. It's the largest private equity fund in Ningbo and specializes in M&A, equity and venture capital investments. So far, it has successfully exited seven deals out of a total of 21. Junrun has investment managers and researchers with backgrounds in science and technology. It has offices in Hangzhou, Shanghai, Shenzhen and the US. The company mainly seeks investment opportunities in sustainable materials, cleantech, agriculture, manufacture, biotechnology and the dotcom economy.

Established in 2017 in the UK, Firstminute Capital's investments are founders-driven, rather than by investment sectors. The early-stage venture capital firm has already invested in 32 companies in the US, UK, mainland Europe and Israel. In mid-2018, it raised its first fund of US$100m from 30 unicorns. Recent investments include in the Series A round of tax reclaim company Wevat, in peer-to-peer (P2P) fiat to crypto exchange platform Ramp's pre-seed round and in the seed round of cannabis e-commerce site Miss Grass.

Established in 2017 in the UK, Firstminute Capital's investments are founders-driven, rather than by investment sectors. The early-stage venture capital firm has already invested in 32 companies in the US, UK, mainland Europe and Israel. In mid-2018, it raised its first fund of US$100m from 30 unicorns. Recent investments include in the Series A round of tax reclaim company Wevat, in peer-to-peer (P2P) fiat to crypto exchange platform Ramp's pre-seed round and in the seed round of cannabis e-commerce site Miss Grass.

Founded in October 2013, JD Finance was renamed as JD Digits in November 2018. The fintech arm of Chinese e-commerce giant JD.com focuses on applying digital technology, artificial intelligence and IoT in five sectors: finance, smart cities, agriculture, campus development and marketing.The company manages five sub-brands: JD Finance, JD iCity, JD Agriculture, JD Shaodongjia, and JD MO Media. In September 2017, a joint venture was established with Central Group, one of Thailand’s biggest retailers. In December 2017, JD Digits also started operating an AI lab in Silicon Valley.

Founded in October 2013, JD Finance was renamed as JD Digits in November 2018. The fintech arm of Chinese e-commerce giant JD.com focuses on applying digital technology, artificial intelligence and IoT in five sectors: finance, smart cities, agriculture, campus development and marketing.The company manages five sub-brands: JD Finance, JD iCity, JD Agriculture, JD Shaodongjia, and JD MO Media. In September 2017, a joint venture was established with Central Group, one of Thailand’s biggest retailers. In December 2017, JD Digits also started operating an AI lab in Silicon Valley.

Serena Ventures is a venture capital investment firm founded by professional tennis player and businesswoman Serena Williams. The company focuses on early-stage companies founded by young, diverse teams. Since it was founded in 2014, it has invested in more than 30 companies with a cumulative market cap of $12b. Coffee brand Kopi Kenangan is its first investment in the Indonesian market. Serena Ventures has invested in notable companies like plant-based meat maker Impossible Foods, cryptocurrency exchange Coinbase, as well as Serena Williams’ own fashion label, S by Serena.

Serena Ventures is a venture capital investment firm founded by professional tennis player and businesswoman Serena Williams. The company focuses on early-stage companies founded by young, diverse teams. Since it was founded in 2014, it has invested in more than 30 companies with a cumulative market cap of $12b. Coffee brand Kopi Kenangan is its first investment in the Indonesian market. Serena Ventures has invested in notable companies like plant-based meat maker Impossible Foods, cryptocurrency exchange Coinbase, as well as Serena Williams’ own fashion label, S by Serena.

Toyota AI Ventures, the venture capital arm of the Toyota Research Institute, is a Silicon Valley-based fund investing globally in startups with cutting-edge solutions in the AI, smart-mobility, autonomy, robotics, data and cloud spaces while leveraging the global expertise and technical resources of the Toyota Group.In 2015 Toyota created the Toyota Research Institute aiming to support the research on next-generation mobility, robotics and new materials. Toyota AI Ventures was founded in 2017 with initial funding of $100m.

Toyota AI Ventures, the venture capital arm of the Toyota Research Institute, is a Silicon Valley-based fund investing globally in startups with cutting-edge solutions in the AI, smart-mobility, autonomy, robotics, data and cloud spaces while leveraging the global expertise and technical resources of the Toyota Group.In 2015 Toyota created the Toyota Research Institute aiming to support the research on next-generation mobility, robotics and new materials. Toyota AI Ventures was founded in 2017 with initial funding of $100m.

M Capital Partners is a leading private equity firm in the French small-cap market. It specializes in SME financing in the development and transmission phases. Based in Paris, the company has offices in Toulouse, Nice, Montepellier and Bordeaux. Founded 17 years ago, M Capital has €530m under active management. It is engaged in venture and capital investments, real estate, and impact investing. Recently it declared its aim to obtain the B Corp sustainability label, and created a foundation and several positive impact funds and moved to decarbonize its portfolio.

M Capital Partners is a leading private equity firm in the French small-cap market. It specializes in SME financing in the development and transmission phases. Based in Paris, the company has offices in Toulouse, Nice, Montepellier and Bordeaux. Founded 17 years ago, M Capital has €530m under active management. It is engaged in venture and capital investments, real estate, and impact investing. Recently it declared its aim to obtain the B Corp sustainability label, and created a foundation and several positive impact funds and moved to decarbonize its portfolio.

Established in 1996, SBI Investment is a venture capital firm that focuses on growth sectors such as information technology, biotechnology, life science, mobile, environment and energy. The VC arm of the SBI Group is developed to quickly find new, emerging technologies and investing in those technologies to further the development of the group. SBI Group then introduces the new technologies to existing businesses in order to help them stay ahead in the market, as well as to revitalize local industries in Japan, particularly in the financial and banking sectors.

Established in 1996, SBI Investment is a venture capital firm that focuses on growth sectors such as information technology, biotechnology, life science, mobile, environment and energy. The VC arm of the SBI Group is developed to quickly find new, emerging technologies and investing in those technologies to further the development of the group. SBI Group then introduces the new technologies to existing businesses in order to help them stay ahead in the market, as well as to revitalize local industries in Japan, particularly in the financial and banking sectors.

The late-stage venture capital and growth equity firm founded and led by Russian billionaire Yuri Milner manages about $10bn in assets. Among its well-known investments are Facebook, Twitter, Alibaba, Xiaomi, JD.com, Spotify, Flipkart and AirBnB.DST Global was founded in 2009 as a means for Milner’s Mail.ru to continue investing at scale, by separately managing investment activities from the Mail.ru primary business. In 2012, Milner stepped down from Mail.ru to focus on DST Global, and DST Global eventually became fully independent from Mail.ru.

The late-stage venture capital and growth equity firm founded and led by Russian billionaire Yuri Milner manages about $10bn in assets. Among its well-known investments are Facebook, Twitter, Alibaba, Xiaomi, JD.com, Spotify, Flipkart and AirBnB.DST Global was founded in 2009 as a means for Milner’s Mail.ru to continue investing at scale, by separately managing investment activities from the Mail.ru primary business. In 2012, Milner stepped down from Mail.ru to focus on DST Global, and DST Global eventually became fully independent from Mail.ru.

RakSul is a Japanese online and outsourcing commercial printing services platform, with almost US$72 million in total equity funding in August 2016. Its US$350,000 Prinzio seed investment is its first venture outside Japan, giving it a 20% stake in the Indonesian printing startup.Founder and CEO Yasukane Matsumoto is set to acquire more printing start-ups in the Philippines and Singapore as part of the expansion into Southeast Asia. The Tokyo-based startup is often dubbed the Uber of printing, with flyers accounting for 60% of total print orders. It expected to start making profits in 2016.

RakSul is a Japanese online and outsourcing commercial printing services platform, with almost US$72 million in total equity funding in August 2016. Its US$350,000 Prinzio seed investment is its first venture outside Japan, giving it a 20% stake in the Indonesian printing startup.Founder and CEO Yasukane Matsumoto is set to acquire more printing start-ups in the Philippines and Singapore as part of the expansion into Southeast Asia. The Tokyo-based startup is often dubbed the Uber of printing, with flyers accounting for 60% of total print orders. It expected to start making profits in 2016.

Founded in 2013, Telstra’s muru-D accelerator has so far worked with 44 startups, with total revenue generated of over AUD 7.8 million. Telstra also has another venture capital arm that connects with technology businesses at a much later stage in their life cycles and looks to build strategic alliances. muru-D companies receive AUD 20,000 at the start of the program and if they achieve specific milestones by the midpoint of the program they unlock a further AUD 20,000. The accelerator has also dropped the requirement that companies raise AUD15,000 from mentors and investors.

Founded in 2013, Telstra’s muru-D accelerator has so far worked with 44 startups, with total revenue generated of over AUD 7.8 million. Telstra also has another venture capital arm that connects with technology businesses at a much later stage in their life cycles and looks to build strategic alliances. muru-D companies receive AUD 20,000 at the start of the program and if they achieve specific milestones by the midpoint of the program they unlock a further AUD 20,000. The accelerator has also dropped the requirement that companies raise AUD15,000 from mentors and investors.

Caffeinated Capital is a San Francisco-based venture capital firm founded by Raymond Tonsing, founded in 2009. Since 2016, it has launched three funds, investing a total US$242 million in 60 companies, including five as the lead investor. It has seen a number of prominent exits including Parse, WePay and Appurify and was the lead investor in Series B rounds for Sapho and Airtable, besides MemSQL's Series C funding. Its recent investments include in Opendoor's Series E round and in Triplebyte's Series B and SentiLink's Series A rounds. Healthcare, fintech and cryptosecurity are key investment areas.

Caffeinated Capital is a San Francisco-based venture capital firm founded by Raymond Tonsing, founded in 2009. Since 2016, it has launched three funds, investing a total US$242 million in 60 companies, including five as the lead investor. It has seen a number of prominent exits including Parse, WePay and Appurify and was the lead investor in Series B rounds for Sapho and Airtable, besides MemSQL's Series C funding. Its recent investments include in Opendoor's Series E round and in Triplebyte's Series B and SentiLink's Series A rounds. Healthcare, fintech and cryptosecurity are key investment areas.

Swanlaab Venture Factory: €40 million funding chest to give power to the people

The female co-founder of Swanlaab Venture Factory believes that diversity enriches decision-making and drives performance. CompassList recently caught up with Verónica Trapa Díaz-Obregón to find out what's in store for Spain's first Israeli-backed VC fund

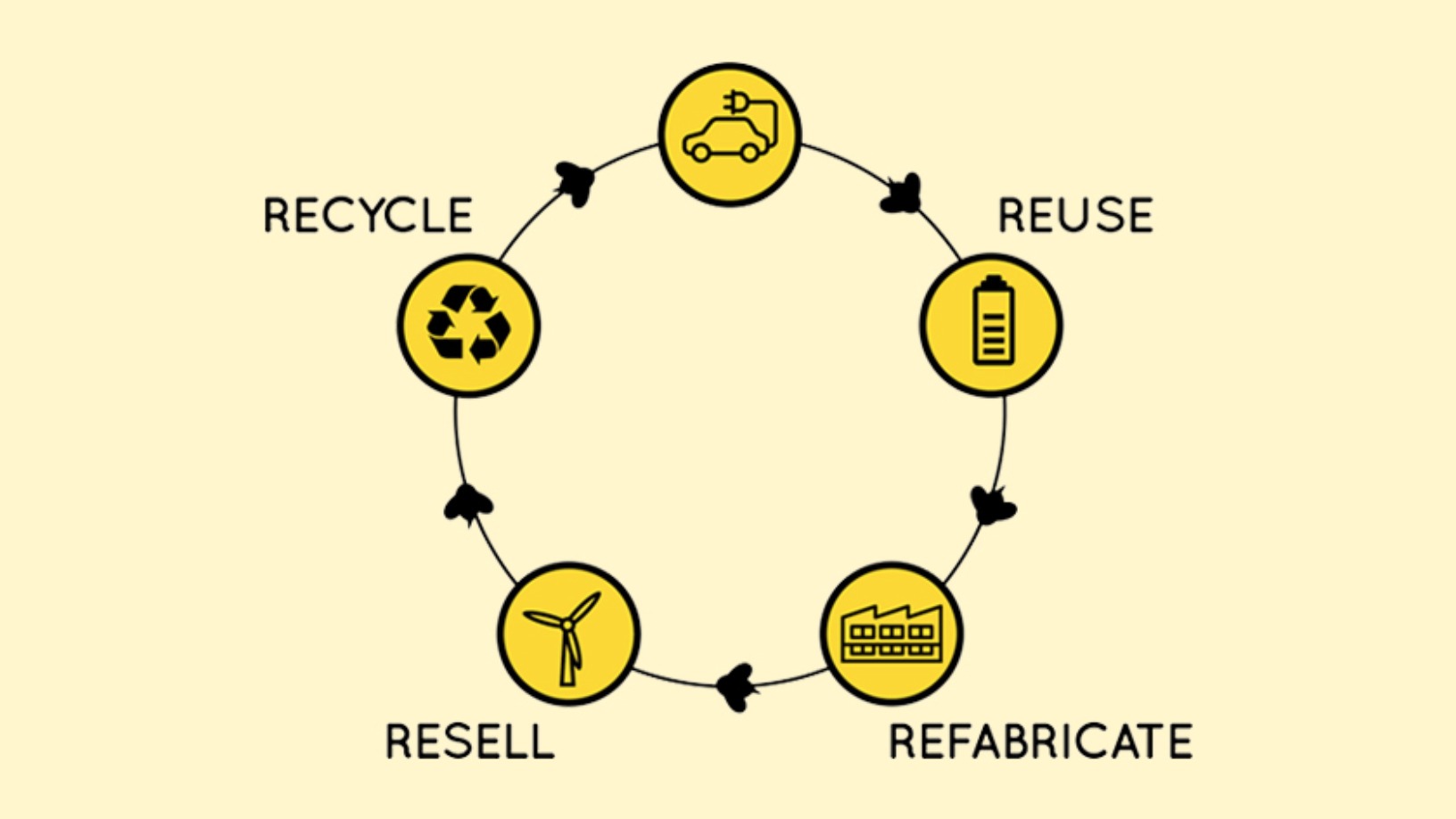

BeePlanet Factory: Recycling EV batteries as a sustainable, profitable business

With 4kWh–200kWh residential and industrial battery packs, the Pamplona-based startup wants to scale its energy storage solutions in the agri-food sector, camping sites and mountain huts

Faraday Venture Partners’ MP Gonzalo Tradacete: “We are actively looking for startups”

Amid the Covid-19 slump, Faraday Venture Partners' CIO and MP shares his expectations for startup investments and favored sectors, the measures his firm has taken so far to help investees ride out the crisis, and more.

Bluepha to boost PHA bioplastics production with $30m fresh funding

The Beijing-based startup aims to produce 10,000 tons of PHA bioplastic a year and build a SynBio community through its STEM education spinoff, Bluepha Lab

String Bio: Asia's first startup to harness methane gas for protein production

Using bacteria to turn the harmful greenhouse gas into a purer form of protein, String Bio is raising Series B funding to scale production

Waste management startup Magalarva aims for profitability with new factory, B2B services

Partnerships with supermarkets and waste transporters provide Magalarva with new revenue streams and sources of production input as the company ramps up its manufacturing activities

Qorium: Lab-grown premium leather for the future of luxury

The Dutch biotech startup co-founded by cell-based meat pioneer Mark Post is targeting the luxury goods market with its “clean leather” sheets made from cultivating bovine skin cells, and plans to raise up to €100m

Linptech: Smart home devices powered by movement

The first in China to tap kinetic energy to control smart home devices, Linptech has seen its wireless, battery-free products used in smart homes, and even at the Tokyo Olympics

Solatom plans overseas expansion with backing from energy giants, impact investor

With a US patent in hand, the Valencian startup is banking on international sales of its concentrated solar power modules, targeting €1m in revenue by end-2021

COMY Energy: Closing the plastic waste loop with chemical recycling

The Chinese startup transforms plastic wastes to virgin-quality recycled products without releasing toxic gas or pollution and is attracting interest from petrochemical giants and waste management companies

In-store robots and online doctors serve customers 24/7 at Dingdang Medicine Express

Dingdang also offers cheaper medicines and 28-minute home delivery, thanks to its innovative logistics and partnership models

4YFN: Investment booms across Europe during pandemic

Speaking at the recent 4YFN conference, prolific European startup investor Mattias Ljungman provided a highly optimistic assessment of the continent's current ecosystem strength and climate for seed funding

Mycorena: Fungi-based vegan protein challenging traditional plant-based ingredients

Award-winning Swedish biotech startup is scaling production of mycoprotein to become a key player in the emerging market for functional proteins

Future Food Asia 2021: Long road ahead for the clean meat industry

Crucial basic research is still needed to ensure the safety, quality, and production efficiency of lab-grown meat. Concerted public and private sector efforts will accelerate progress

Qairos Energies: Mass producing green hydrogen from industrial hemp

The French startup is seeking a €19m Series B round to produce industrial quantities of green hydrogen and is planning a “circular economy” partnership with local farmers

Sorry, we couldn’t find any matches for“Swanlaab Venture Factory”.