Target Global

-

DATABASE (360)

-

ARTICLES (712)

Co-founder and CEO of Advotics

In 2009 Boris Sanjaya graduated in Industrial and System Engineering at the University of Washington, USA. He worked for one year as an intern at Boeing Commercial Airplanes in Seattle. He worked as a business analyst at Amazon for four months before joining a Distribution Management Program at General Electric in 2010. He left GE and returned to Indonesia to work as a consultant for BCG in 2012. Together with Hendi Chandi, Boris co-founded telecoms startup Kokatto in 2014. He later left BCG in 2016 to join Hendi to establish PT Advotics Teknologi Global as CEO.

In 2009 Boris Sanjaya graduated in Industrial and System Engineering at the University of Washington, USA. He worked for one year as an intern at Boeing Commercial Airplanes in Seattle. He worked as a business analyst at Amazon for four months before joining a Distribution Management Program at General Electric in 2010. He left GE and returned to Indonesia to work as a consultant for BCG in 2012. Together with Hendi Chandi, Boris co-founded telecoms startup Kokatto in 2014. He later left BCG in 2016 to join Hendi to establish PT Advotics Teknologi Global as CEO.

Co-founder and CTO of Advotics

After completing a Computer Engineering degree at the University of Washington in 2005, Hendi Chandi worked as a senior software engineer at Amazon from 2006 to 2010. He returned to Indonesia and founded online groceries vendor Greenie in 2011 that operated for only one year. Hendi later completed a two-year master's in Law at the University of Indonesia.In 2014, he co-founded SaaS telecom Kokatto with co-founder Boris Sanjaya. They also started another company PT Advotics Teknologi Global in 2016 to help retail companies digitize their supply chains.

After completing a Computer Engineering degree at the University of Washington in 2005, Hendi Chandi worked as a senior software engineer at Amazon from 2006 to 2010. He returned to Indonesia and founded online groceries vendor Greenie in 2011 that operated for only one year. Hendi later completed a two-year master's in Law at the University of Indonesia.In 2014, he co-founded SaaS telecom Kokatto with co-founder Boris Sanjaya. They also started another company PT Advotics Teknologi Global in 2016 to help retail companies digitize their supply chains.

Co-founder, CTO of Polaroo

Sergio Sanchez is the CTO and co-founder of Widuid that was later re-branded as Polaroo, a Spanish household bill management app. He spent eight months working on building the MVP with the Rovira brothers in 2017.The mechanical engineer also completed a master's in Automatic Control and Robotics at his alma mater, the Polytechnic Degree of Barcelona. Like fellow co-founder Marc Rovira, Sanchez was also at space tech startup Zero2Infinity working as a full stack developer and HMI engineer. He has also worked in biotech company Fungitech Global as a mechanical engineer.

Sergio Sanchez is the CTO and co-founder of Widuid that was later re-branded as Polaroo, a Spanish household bill management app. He spent eight months working on building the MVP with the Rovira brothers in 2017.The mechanical engineer also completed a master's in Automatic Control and Robotics at his alma mater, the Polytechnic Degree of Barcelona. Like fellow co-founder Marc Rovira, Sanchez was also at space tech startup Zero2Infinity working as a full stack developer and HMI engineer. He has also worked in biotech company Fungitech Global as a mechanical engineer.

CEO and co-founder of Natural Machines / Foodini

Emilio Sepulveda is a Spanish engineer and MBA graduate with over 20 years of experience in the technology space at a global level. He worked as Strategy and Innovation Manager at Telefónica, leading multiple startups and projects. He was also involved in team structuring, seed funding round support, business model and strategy development.Passionate about IoT and robotics, Sepulveda co-founded Natural Machines in 2012 to develop 3D food-grade home appliances for both B2B and B2C customers. The company has just launched the world’s first 3D food printer equipped with laser-cooking technology.

Emilio Sepulveda is a Spanish engineer and MBA graduate with over 20 years of experience in the technology space at a global level. He worked as Strategy and Innovation Manager at Telefónica, leading multiple startups and projects. He was also involved in team structuring, seed funding round support, business model and strategy development.Passionate about IoT and robotics, Sepulveda co-founded Natural Machines in 2012 to develop 3D food-grade home appliances for both B2B and B2C customers. The company has just launched the world’s first 3D food printer equipped with laser-cooking technology.

Founded in 2017, Timestamp Capital is a blockchain investment fund. With a focus on research, investment and consulting services in the blockchain field, Timestamp Capital provides all-in-one assistance to blockchain startups by helping them optimize their business models and establish a compliance framework as well as by accelerating the construction of a global community.

Founded in 2017, Timestamp Capital is a blockchain investment fund. With a focus on research, investment and consulting services in the blockchain field, Timestamp Capital provides all-in-one assistance to blockchain startups by helping them optimize their business models and establish a compliance framework as well as by accelerating the construction of a global community.

GWC Innovator Fund was established by GWC, which hosts the annual Global Mobile Internet Conference and the invite-only G-Network. The fund aims to brings Silicon Valley investment into the wider world, reaching startups like India’s women-focused platform POPxo, Chinese AI chatbot TravelFlan and Indonesian restaurant review site Qraved.

GWC Innovator Fund was established by GWC, which hosts the annual Global Mobile Internet Conference and the invite-only G-Network. The fund aims to brings Silicon Valley investment into the wider world, reaching startups like India’s women-focused platform POPxo, Chinese AI chatbot TravelFlan and Indonesian restaurant review site Qraved.

Based in Singapore, Antler is a venture capital firm that runs a global five-month venture building program. Aside from funding and company building, Antler matches founders and the talent they need prior to the start of the program. Antler's programs are run in Singapore, Stockholm, Sydney, Amsterdam and London. Antler was founded by former managing director of Zalora, Magnus Grimeland.

Based in Singapore, Antler is a venture capital firm that runs a global five-month venture building program. Aside from funding and company building, Antler matches founders and the talent they need prior to the start of the program. Antler's programs are run in Singapore, Stockholm, Sydney, Amsterdam and London. Antler was founded by former managing director of Zalora, Magnus Grimeland.

Haier Group Corporation is a Chinese consumer electronics and home appliances company headquartered in Qingdao, Shandong province. It started as a refrigerator manufacturer in 1984 and has become the world's largest producer of major home appliances, with more than 10% of global market share. Now Haier is focusing on offering smart home solutions to customers.

Haier Group Corporation is a Chinese consumer electronics and home appliances company headquartered in Qingdao, Shandong province. It started as a refrigerator manufacturer in 1984 and has become the world's largest producer of major home appliances, with more than 10% of global market share. Now Haier is focusing on offering smart home solutions to customers.

Tony Fadell is the inventor of the iPod, co-inventor of the iPhone, and former CEO and founder of Nest Labs, which was later acquired by Google. He is also an angel investor and head of Paris-based deeptech advisory and investing firm Future Shape, which has over 200 companies in its portfolio and a focus on issues like the electrification and digital connection of things, biomanufacturing and the eradication of waste. Fadell has invested in at least 10 startups, with his most recent disclosed investments having taken place in 4Q20. These included his participation in the $7m seed round of London-based consumer technology and conceptual design house Nothing, the $45m Series B round of US biotech firm and vegan leather maker MycoWorks, well as the $31m Series A round of video call effects and presentation tools company mmhmm.

Tony Fadell is the inventor of the iPod, co-inventor of the iPhone, and former CEO and founder of Nest Labs, which was later acquired by Google. He is also an angel investor and head of Paris-based deeptech advisory and investing firm Future Shape, which has over 200 companies in its portfolio and a focus on issues like the electrification and digital connection of things, biomanufacturing and the eradication of waste. Fadell has invested in at least 10 startups, with his most recent disclosed investments having taken place in 4Q20. These included his participation in the $7m seed round of London-based consumer technology and conceptual design house Nothing, the $45m Series B round of US biotech firm and vegan leather maker MycoWorks, well as the $31m Series A round of video call effects and presentation tools company mmhmm.

Alison Gelb Pincus is an entrepreneur who co-founded One King’s Lane, a direct-to-consumer home decor company which was sold to Bed, Bath & Beyond, and more recently, sustainable packaging start-up kari.earth. She is also an angel investor and founder of Short List Capital, a San Francisco-based early-stage VC collective run by women. Short List Capital currently lists 20 companies in its portfolio, which has a focus on investing in e-commerce platforms with healthy, user-friendly or sustainable products. Gelb Pincus’s recent investments included participation in the May 2020 $5.3m seed round of US cookware maker Caraway and a 2015 investment in US-based unicorn Diamond Foundry, the first certified carbon-neutral lab-produced diamond manufacturer.Alison Gelb Pincus was married to Mark Pincus, the co-founder of Zynga and a founding investor in Facebook, Snapchat, Twitter, and Xiaomi.

Alison Gelb Pincus is an entrepreneur who co-founded One King’s Lane, a direct-to-consumer home decor company which was sold to Bed, Bath & Beyond, and more recently, sustainable packaging start-up kari.earth. She is also an angel investor and founder of Short List Capital, a San Francisco-based early-stage VC collective run by women. Short List Capital currently lists 20 companies in its portfolio, which has a focus on investing in e-commerce platforms with healthy, user-friendly or sustainable products. Gelb Pincus’s recent investments included participation in the May 2020 $5.3m seed round of US cookware maker Caraway and a 2015 investment in US-based unicorn Diamond Foundry, the first certified carbon-neutral lab-produced diamond manufacturer.Alison Gelb Pincus was married to Mark Pincus, the co-founder of Zynga and a founding investor in Facebook, Snapchat, Twitter, and Xiaomi.

Co-founder and CEO of Akseleran

Ivan Nikolas Tambunan is a lawyer-turned-entrepreneur who co-founded the P2P lending site Akseleran. After graduating from Universitas Indonesia in 2009 with a Bachelor's in Law, Ivan worked as an associate at AFS Partnership, handling various corporate law cases in civil and criminal courts. He left in 2011 for a short stint at the Makarim & Taira S law firm. In 2012, he joined Allen & Overy as a transactional banking lawyer. Before he left Allen & Overy in 2017, he advised various clients, including the Artha Graha Group and Macquarie. He and his co-founders started developing Akseleran in 2016 and launched an early version in March 2017.Ivan earned a Master's degree in Law & Finance from Queen Mary University of London. His thesis was on the topic of crowdfunding and became part of the inspiration behind establishing Akseleran.

Ivan Nikolas Tambunan is a lawyer-turned-entrepreneur who co-founded the P2P lending site Akseleran. After graduating from Universitas Indonesia in 2009 with a Bachelor's in Law, Ivan worked as an associate at AFS Partnership, handling various corporate law cases in civil and criminal courts. He left in 2011 for a short stint at the Makarim & Taira S law firm. In 2012, he joined Allen & Overy as a transactional banking lawyer. Before he left Allen & Overy in 2017, he advised various clients, including the Artha Graha Group and Macquarie. He and his co-founders started developing Akseleran in 2016 and launched an early version in March 2017.Ivan earned a Master's degree in Law & Finance from Queen Mary University of London. His thesis was on the topic of crowdfunding and became part of the inspiration behind establishing Akseleran.

CTO and co-founder of Diamond Foundry

Jeremy Scholz is CTO and co-founder at US-based unicorn Diamond Foundry, the first certified carbon-neutral lab-produced diamond manufacturer. He has worked there since 2012, leading up to the company’s official establishment. Prior to this, Scholz co-founded startup consultancy Alicanto in 2011 and briefly worked at startup YottaQ as director of engineering. From 2006–2011, Scholz worked as an engineer and manager at the $640m solar power startup Nanosolar. Silicon Valley's first solar power technology startup financed by American venture capital, the firm was the highest-valued firm in the industry at the time. When Nanosolar closed due to cheaper competition from China, much of its technical expertise and experience were diverted to set up Diamond Foundry. Scholz graduated from the Massachusetts Institute of Technology in mechanical engineering and started his career working at Boeing as a mechanical engineer from 2005–2006.

Jeremy Scholz is CTO and co-founder at US-based unicorn Diamond Foundry, the first certified carbon-neutral lab-produced diamond manufacturer. He has worked there since 2012, leading up to the company’s official establishment. Prior to this, Scholz co-founded startup consultancy Alicanto in 2011 and briefly worked at startup YottaQ as director of engineering. From 2006–2011, Scholz worked as an engineer and manager at the $640m solar power startup Nanosolar. Silicon Valley's first solar power technology startup financed by American venture capital, the firm was the highest-valued firm in the industry at the time. When Nanosolar closed due to cheaper competition from China, much of its technical expertise and experience were diverted to set up Diamond Foundry. Scholz graduated from the Massachusetts Institute of Technology in mechanical engineering and started his career working at Boeing as a mechanical engineer from 2005–2006.

Changsha Lugu Venture Capital was founded in December 2007. The VC manages total assets worth RMB 300m and mainly invests in the internet and technology sectors. As a state-owned company, Changsha Lugu Venture Capital also provides free office facilities and funding of RMB200,000 for talented startups in Changsha.

Changsha Lugu Venture Capital was founded in December 2007. The VC manages total assets worth RMB 300m and mainly invests in the internet and technology sectors. As a state-owned company, Changsha Lugu Venture Capital also provides free office facilities and funding of RMB200,000 for talented startups in Changsha.

Founded in 1983, the Brunei Investment Agency (BIA) is a government-owned investment organization that reports to the Ministry of Finance, Government of Brunei. BIA manages the country’s general reserve fund and its external assets, worth an estimated amount of $170bn. Its activities are rarely publicly disclosed.

Founded in 1983, the Brunei Investment Agency (BIA) is a government-owned investment organization that reports to the Ministry of Finance, Government of Brunei. BIA manages the country’s general reserve fund and its external assets, worth an estimated amount of $170bn. Its activities are rarely publicly disclosed.

Founded in 2018, Trinity Innovation Fund is a fund management firm that mainly invests in pharmaceutical innovations. TIF currently manages two PE funds and its limited partners include renowned pharmaceuticals and institutional investors. It also has offices managing funds overseas, for example, Trinity Innovation Bioventure Singapore Pte Ltd.

Founded in 2018, Trinity Innovation Fund is a fund management firm that mainly invests in pharmaceutical innovations. TIF currently manages two PE funds and its limited partners include renowned pharmaceuticals and institutional investors. It also has offices managing funds overseas, for example, Trinity Innovation Bioventure Singapore Pte Ltd.

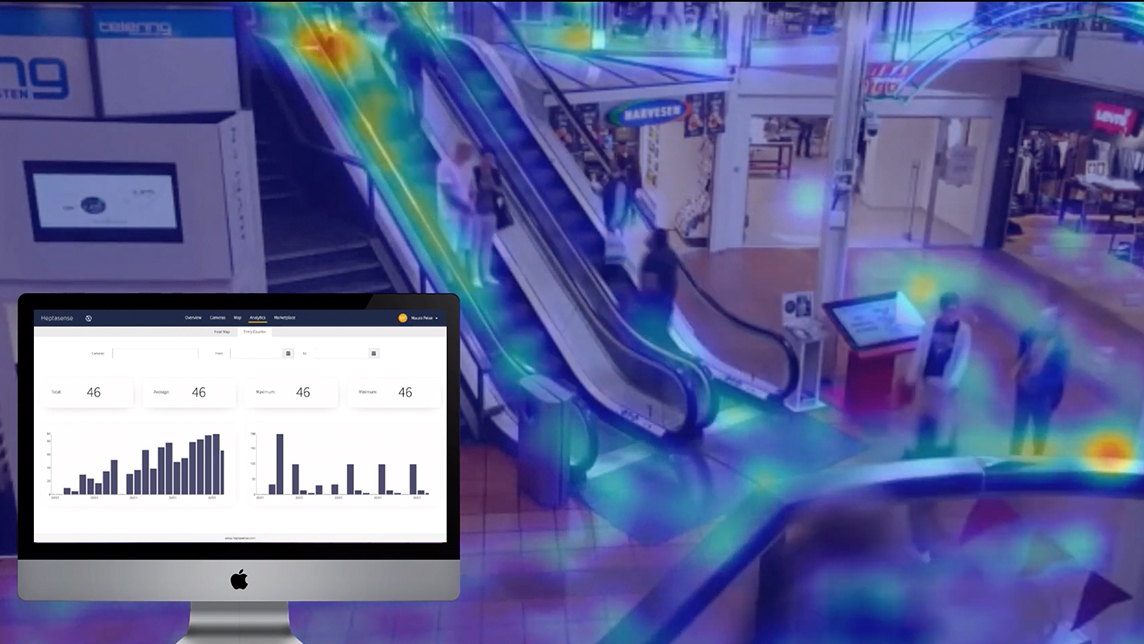

Heptasense wins trust at a time of (lax) global surveillance

There may be some 700 million surveillance cameras running worldwide in today's age of global security threats, yet 98% of them are unmonitored. A Lisbon-based startup is promising real-time response and greater reliability in security tech

Xtrem Biotech, an agritech startup from Granada, seeks global expansion

With its research roots in the University of Granada, Xtrem Biotech was named one of the world's most innovative agtech spin-offs by accelerator TERRA Food & AgTech

Mediktor: AI medical diagnosis app wants to improve global health outcomes

NLP-based triage and diagnosis tool has achieved a 91% accuracy rate in clinical trials and raised €3 million funding

GoWithFlow: Scaling ERP platform for sustainable mobility in global transportation markets

Portugal’s CEiiA spin-off leads the way to manage smart transportation systems of cities and corporations to boost fleet performance by reducing CO2 emissions and maintenance costs

From state to BAT, China backs startups for global AI dominance

Finance, automobile, retail and healthcare seen to lead China’s advances and gains in AI, as part of a RMB 10 trillion economy by 2030

China's WeDoctor offers free coronavirus consultations globally in English and Chinese

WeDoctor lets anyone in the world send queries to doctors who fought to save lives in China's most affected Covid-19 districts, and now helping people overseas to stay safe during the pandemic

South Summit wants to go global, as it launches Brazilian chapter

CEO Marta del Castillo on South Summit’s LatAm, Asia expansion plans; its net-zero pledge; her new role as co-head to further drive growth and more

Li Zexiang and his game-changing plans to take Chinese robotics global

An early supporter of drone giant DJI, Professor Li Zexiang is building robotics hubs across China to pivot homegrown enterprises into global players

OLIO: Zero food waste app expands with new product categories, going global

Recent $43m Series B funding will let sustainability app more than triple hiring, add homemade products and household goods to product listings

Innovate big or go home: logistics unicorn YH Global eyes “Belt and Road” gold

The world’s first logistics firm to become a unicorn at Series A is a model of innovation in China. More overseas growth is next

European agritech is the new global focus, as startup investments nearly doubled in 2019

Last year, European agritech surpassed China for the first time in investments received, with openings in multiple subsectors from big data to blockchain

Lalibela Global-Networks: A mission to digitalize, move Africa's healthcare system to the cloud

This year’s Web Summit winner, Lalibela Global-Networks, is digitalizing Africa’s paper-based healthcare system in a low-cost, low-code way to save lives and make healthcare affordable

Smart Agrifood Summit 2021: A global innovation ecosystem is needed to catch up with other sectors

Investors from SVG Ventures/THRIVE, Pinduoduo and others agree that players must join forces to boost agrifood tech investment, internationally and across the value chain

Clarity AI uses machine learning and data analytics to effectively assess and score environmental, social and governance performance of companies and investment portfolios

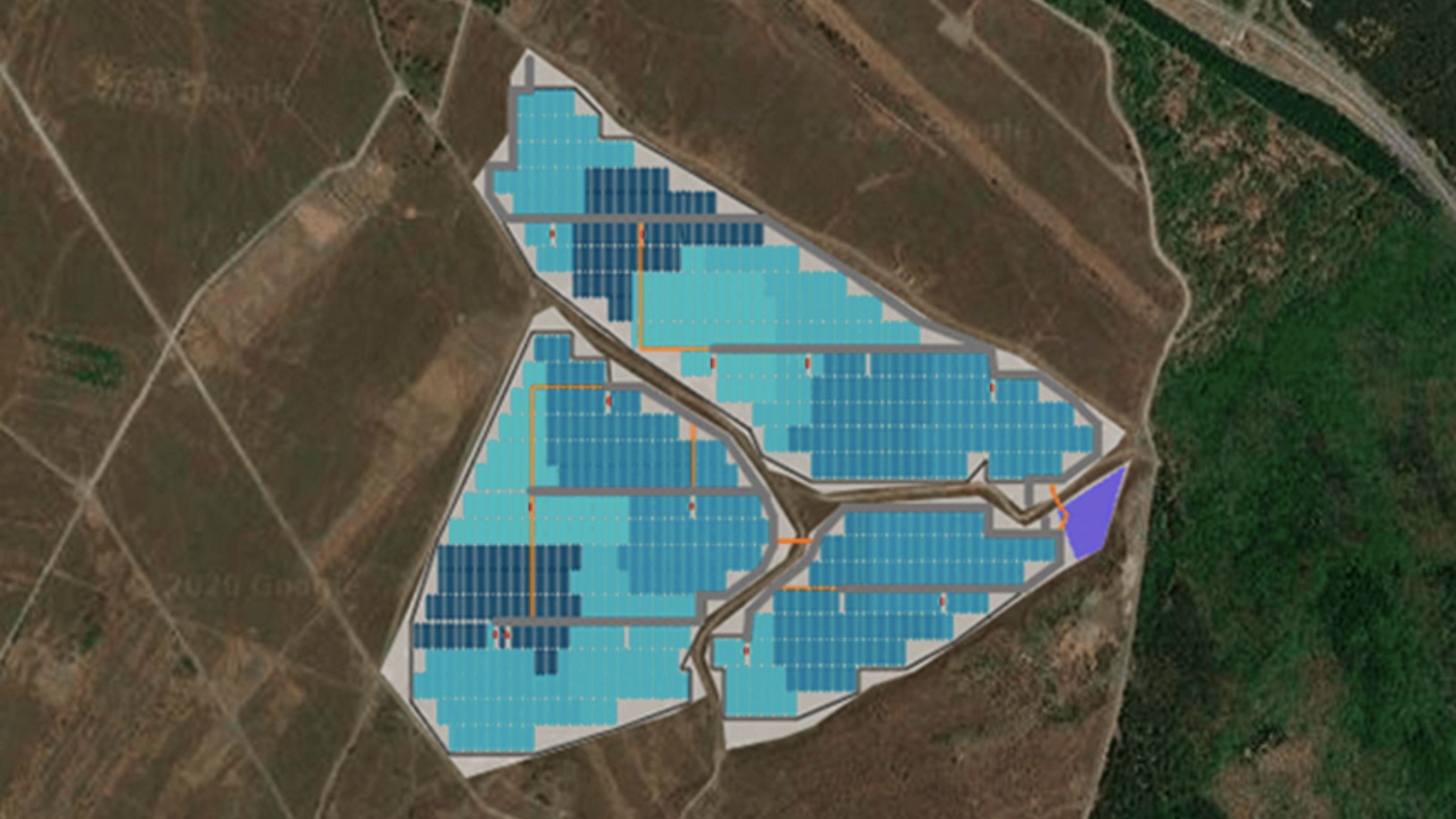

RatedPower: Creating solar power plant designs in minutes

The Spanish startup is helping solar plants expand exponentially worldwide and revolutionizing the sector with its automated software

Sorry, we couldn’t find any matches for“Target Global”.