Target Global

-

DATABASE (360)

-

ARTICLES (712)

Founded in 1907 and currently headquartered in Atlanta, Georgia, US, United Parcel Service (UPS) is the world's largest package and document delivery company in revenue and volume. It is also a global provider of specialized transportation and logistics services. UPS serves more than 220 countries and territories worldwide. In 2018, the company generated US$71.8bn in revenue and had a net income of about US$4.8bn with 481,000 employees. It invests in transportation-related companies.

Founded in 1907 and currently headquartered in Atlanta, Georgia, US, United Parcel Service (UPS) is the world's largest package and document delivery company in revenue and volume. It is also a global provider of specialized transportation and logistics services. UPS serves more than 220 countries and territories worldwide. In 2018, the company generated US$71.8bn in revenue and had a net income of about US$4.8bn with 481,000 employees. It invests in transportation-related companies.

Based in San Francisco, the Mulago Foundation is a philanthropic foundation designed to carry on the life work of pediatrician Rainer Arnhold who died in 1993 while working in the mountains of Bolivia. He originally set up the Mulago Foundation in 1968, naming it after a hospital in Uganda. His Jewish family, bankers for generations, continued to support the foundation for impact investing across diverse sectors and geographies, with scalable solutions to alleviate poverty.It has invested in 61 companies to date. Successful ventures include: Kenya’s Komaza that raised $28m in its 2020 Series B and Myanmar’s Proximity Finance, a fintech for small-holder farmers that raised $14m in 2020. Komaza helps poor families turn dry land into small-scale, income-generating tree farms, benefiting more than 2m farmers in Sub-Saharan Africa.

Based in San Francisco, the Mulago Foundation is a philanthropic foundation designed to carry on the life work of pediatrician Rainer Arnhold who died in 1993 while working in the mountains of Bolivia. He originally set up the Mulago Foundation in 1968, naming it after a hospital in Uganda. His Jewish family, bankers for generations, continued to support the foundation for impact investing across diverse sectors and geographies, with scalable solutions to alleviate poverty.It has invested in 61 companies to date. Successful ventures include: Kenya’s Komaza that raised $28m in its 2020 Series B and Myanmar’s Proximity Finance, a fintech for small-holder farmers that raised $14m in 2020. Komaza helps poor families turn dry land into small-scale, income-generating tree farms, benefiting more than 2m farmers in Sub-Saharan Africa.

Mark Pincus is the US co-founder of online social game maker Zynga, known for the mobile app games Words With Friends, Mafia Wars and FarmVille. He is also the managing member and co-founder of VC firm Reinvent Capital and a prolific angel investor worth $1.6bn, with early investments in Facebook and Twitter. To date, Pincus has invested in more than 50 startups and managed numerous successful exits including the aforementioned social media giants. His most recent investments include participation in the April 2021 $10m Series A round of US gaming app Underdog Fantasy and in the April 2021 €23.1m Series B round of Finland’s Yousician, the world’s largest music edtech.

Mark Pincus is the US co-founder of online social game maker Zynga, known for the mobile app games Words With Friends, Mafia Wars and FarmVille. He is also the managing member and co-founder of VC firm Reinvent Capital and a prolific angel investor worth $1.6bn, with early investments in Facebook and Twitter. To date, Pincus has invested in more than 50 startups and managed numerous successful exits including the aforementioned social media giants. His most recent investments include participation in the April 2021 $10m Series A round of US gaming app Underdog Fantasy and in the April 2021 €23.1m Series B round of Finland’s Yousician, the world’s largest music edtech.

Founded by Finnish serial entrepreneur and angel investor Riku Asikainen, Helsinki-based Evli Growth Partners invest across market segments, with typical initial stakes of €3m–5m at Series A and B funding stages. The VC is currently building up a total fund of €200m to focus on investments in later-stage growth companies Europe. The first fund, EGP Fund I Ky, was launched in December 2018 and closed at €60m in November 2019. New funds will be set up every two years until 2028.EGP currently has seven companies in its portfolio. In 2021, Evli was co-lead investor for the $54m Series B round of Austrian refurbished electronics goods marketplace Refurbed in August, and investor lead in the €22m Series C round of Polish customized furniture design platform Tylko in March.

Founded by Finnish serial entrepreneur and angel investor Riku Asikainen, Helsinki-based Evli Growth Partners invest across market segments, with typical initial stakes of €3m–5m at Series A and B funding stages. The VC is currently building up a total fund of €200m to focus on investments in later-stage growth companies Europe. The first fund, EGP Fund I Ky, was launched in December 2018 and closed at €60m in November 2019. New funds will be set up every two years until 2028.EGP currently has seven companies in its portfolio. In 2021, Evli was co-lead investor for the $54m Series B round of Austrian refurbished electronics goods marketplace Refurbed in August, and investor lead in the €22m Series C round of Polish customized furniture design platform Tylko in March.

Lugard Road Capital/ Luxor Capital

Lugard Road Capital is a New York-based hedge fund under the Luxor Capital Group. The fund invests across market segments and geographies, with several late-stage investments included in its current portfolio of 11 startups.In 2021, Lugard and Luxor led the €450m Series F round for Spanish on-demand delivery app Glovo and also joined the $146m Series J round of Indian foodtech Zomato in 2020. Recent investments include participation in the $43m Series B round of food-sharing app OLIO in September 2021 and the June 2021 $28.5m Series C round of Norwegian ocean and air freight benchmarking and market analytics platform Xeneta.

Lugard Road Capital is a New York-based hedge fund under the Luxor Capital Group. The fund invests across market segments and geographies, with several late-stage investments included in its current portfolio of 11 startups.In 2021, Lugard and Luxor led the €450m Series F round for Spanish on-demand delivery app Glovo and also joined the $146m Series J round of Indian foodtech Zomato in 2020. Recent investments include participation in the $43m Series B round of food-sharing app OLIO in September 2021 and the June 2021 $28.5m Series C round of Norwegian ocean and air freight benchmarking and market analytics platform Xeneta.

Founder and CEO of Yidianling

Xu Yingqi has over a decade of work experience in the gaming, pharmaceutical and finance sectors. He joined an online gaming company named 5173 in 2003 and expanded the team from 20 to 3,000 employees, increasing the yearly GMV from US$3m to more than US$1.5bn. Xu then joined a pharmaceutical company named 818 in 2009, helping over 300 pharmacies go online. The company's business grew 248% annually under his leadership. In 2003, Xu started financial services platform 658 that generated RMB1.3bn worth of transactions. In 2015, he went on to establish Yidianling, an online mental health consultancy.

Xu Yingqi has over a decade of work experience in the gaming, pharmaceutical and finance sectors. He joined an online gaming company named 5173 in 2003 and expanded the team from 20 to 3,000 employees, increasing the yearly GMV from US$3m to more than US$1.5bn. Xu then joined a pharmaceutical company named 818 in 2009, helping over 300 pharmacies go online. The company's business grew 248% annually under his leadership. In 2003, Xu started financial services platform 658 that generated RMB1.3bn worth of transactions. In 2015, he went on to establish Yidianling, an online mental health consultancy.

ATM Capital is a China-based venture capital firm with a focus on Southeast Asia. In 2017, ATM Capital participated in the seed round of Indonesian coworking space operator Rework (now GoWork). Its its partners have invested in Go-Jek, Rocket Internet and several Chinese companies. It closed its US$200 million fund in January 2019.

ATM Capital is a China-based venture capital firm with a focus on Southeast Asia. In 2017, ATM Capital participated in the seed round of Indonesian coworking space operator Rework (now GoWork). Its its partners have invested in Go-Jek, Rocket Internet and several Chinese companies. It closed its US$200 million fund in January 2019.

Jose Maria Tarragó was the VP of Ficosa International, a global provider in research, development and manufacturing of advanced technology for the motor and mobility sectors. He was also VP of Carbures Europe that specialized in the design and manufacture of engineering systems for automotive, aerospace and security industries. In 2015, Tarragó and his four brothers founded the Lacus Group that invests and mentors new tech companies and industrial manufacturers. He is also an adviser to the Eurofred Group.

Jose Maria Tarragó was the VP of Ficosa International, a global provider in research, development and manufacturing of advanced technology for the motor and mobility sectors. He was also VP of Carbures Europe that specialized in the design and manufacture of engineering systems for automotive, aerospace and security industries. In 2015, Tarragó and his four brothers founded the Lacus Group that invests and mentors new tech companies and industrial manufacturers. He is also an adviser to the Eurofred Group.

Founded in Boston in 2015, Material Impact is a science-based investment fund backing products that make an impact on real-world problems. It currently has 10 companies in its portfolio, from seed to Series C investments. Its most recent investments have been in the $50m 2020 Series C round of SOURCE Global (formerly Zero Mass Water), the premier off-grid drinking water production tech using solar-powered panels, and in the 2020 $12m Series A round of US electronics protective substance producer actnano.

Founded in Boston in 2015, Material Impact is a science-based investment fund backing products that make an impact on real-world problems. It currently has 10 companies in its portfolio, from seed to Series C investments. Its most recent investments have been in the $50m 2020 Series C round of SOURCE Global (formerly Zero Mass Water), the premier off-grid drinking water production tech using solar-powered panels, and in the 2020 $12m Series A round of US electronics protective substance producer actnano.

SOURCE Global (formerly Zero Mass Water)

The first off-grid technology to create drinking water from the air using solar energy-powered hardware. Provides an entirely sustainable solution for droughts or contaminated supplies.

The first off-grid technology to create drinking water from the air using solar energy-powered hardware. Provides an entirely sustainable solution for droughts or contaminated supplies.

Bånt AB is the investment vehicle of Karl Sverker Forsén based in Luleå, a coastal city in Swedish Lapland. In May 2020, the Swedish family office invested in a Gothenburg startup Mycorena, a biotech that produces mycoproteins through fermentation. The fungi-based protein can be used as an alt-protein ingredient instead of traditional plant-based food components.

Bånt AB is the investment vehicle of Karl Sverker Forsén based in Luleå, a coastal city in Swedish Lapland. In May 2020, the Swedish family office invested in a Gothenburg startup Mycorena, a biotech that produces mycoproteins through fermentation. The fungi-based protein can be used as an alt-protein ingredient instead of traditional plant-based food components.

UBS is a Switzerland-based financial institution providing banking, wealth management, and securities services. Originally established in 1862 as the Bank in Winterthur, it is the largest Swiss banking institution. UBS engages in venture capital activities as part of its investment banking services. In 2020, UBS began a partnership with venture capital firm Anthemis to launch UBS Next, a $200m fund that will invest in fintech and other tech startups.

UBS is a Switzerland-based financial institution providing banking, wealth management, and securities services. Originally established in 1862 as the Bank in Winterthur, it is the largest Swiss banking institution. UBS engages in venture capital activities as part of its investment banking services. In 2020, UBS began a partnership with venture capital firm Anthemis to launch UBS Next, a $200m fund that will invest in fintech and other tech startups.

Headquartered in Madrid with satellite offices in Barcelona, London, Seattle and New York, Alma Mundi is a venture fund that aims to connect Spanish and Latin American entrepreneurs. Alma Mundi’s investments range between €500,000 and €5 million.Alma Mundi offers its investee companies direct access to a global network of investors and industry experts in leading technology ecosystems. Called the Mundi Club, the group comprises over 700 members from 41 cities worldwide. The group’s board members include advisers and executives from Merck, Havas, PepsiCo, Carrefour, Nestlé and HP.

Headquartered in Madrid with satellite offices in Barcelona, London, Seattle and New York, Alma Mundi is a venture fund that aims to connect Spanish and Latin American entrepreneurs. Alma Mundi’s investments range between €500,000 and €5 million.Alma Mundi offers its investee companies direct access to a global network of investors and industry experts in leading technology ecosystems. Called the Mundi Club, the group comprises over 700 members from 41 cities worldwide. The group’s board members include advisers and executives from Merck, Havas, PepsiCo, Carrefour, Nestlé and HP.

Partech Ventures is a global venture capital firm established in San Francisco in 1982 as Paribas Technologies, a subsidiary of French bank Paribas that currently holds €1.3 billion in assets under its management. In addition to San Francisco, Partech also has offices in Paris, Berlin and Dakar, Senegal, with the latter focused exclusively on African startups. The company is now based in Paris and has invested in over 300 companies across different funding stages with 48 exits to date.

Partech Ventures is a global venture capital firm established in San Francisco in 1982 as Paribas Technologies, a subsidiary of French bank Paribas that currently holds €1.3 billion in assets under its management. In addition to San Francisco, Partech also has offices in Paris, Berlin and Dakar, Senegal, with the latter focused exclusively on African startups. The company is now based in Paris and has invested in over 300 companies across different funding stages with 48 exits to date.

Oil and Gas Climate Initiative (OGCI) Climate Investments is a $1bn fund investing in innovative startups with solutions aimed at decarbonizing the oil and gas sectors and transportation, as well as those that recycle and store CO2 and reduce related emissions.Members of the organization are big players of the oil and gas industry representing more than 30% of global operated oil and gas production. These companies include Shell, Total, BP, Chevron, CNPC, Petrobras, Repsol, Eni, Equinor, ExxonMobil, Occidental and Saudi Aramco.

Oil and Gas Climate Initiative (OGCI) Climate Investments is a $1bn fund investing in innovative startups with solutions aimed at decarbonizing the oil and gas sectors and transportation, as well as those that recycle and store CO2 and reduce related emissions.Members of the organization are big players of the oil and gas industry representing more than 30% of global operated oil and gas production. These companies include Shell, Total, BP, Chevron, CNPC, Petrobras, Repsol, Eni, Equinor, ExxonMobil, Occidental and Saudi Aramco.

Heptasense wins trust at a time of (lax) global surveillance

There may be some 700 million surveillance cameras running worldwide in today's age of global security threats, yet 98% of them are unmonitored. A Lisbon-based startup is promising real-time response and greater reliability in security tech

Xtrem Biotech, an agritech startup from Granada, seeks global expansion

With its research roots in the University of Granada, Xtrem Biotech was named one of the world's most innovative agtech spin-offs by accelerator TERRA Food & AgTech

Mediktor: AI medical diagnosis app wants to improve global health outcomes

NLP-based triage and diagnosis tool has achieved a 91% accuracy rate in clinical trials and raised €3 million funding

GoWithFlow: Scaling ERP platform for sustainable mobility in global transportation markets

Portugal’s CEiiA spin-off leads the way to manage smart transportation systems of cities and corporations to boost fleet performance by reducing CO2 emissions and maintenance costs

From state to BAT, China backs startups for global AI dominance

Finance, automobile, retail and healthcare seen to lead China’s advances and gains in AI, as part of a RMB 10 trillion economy by 2030

China's WeDoctor offers free coronavirus consultations globally in English and Chinese

WeDoctor lets anyone in the world send queries to doctors who fought to save lives in China's most affected Covid-19 districts, and now helping people overseas to stay safe during the pandemic

South Summit wants to go global, as it launches Brazilian chapter

CEO Marta del Castillo on South Summit’s LatAm, Asia expansion plans; its net-zero pledge; her new role as co-head to further drive growth and more

Li Zexiang and his game-changing plans to take Chinese robotics global

An early supporter of drone giant DJI, Professor Li Zexiang is building robotics hubs across China to pivot homegrown enterprises into global players

OLIO: Zero food waste app expands with new product categories, going global

Recent $43m Series B funding will let sustainability app more than triple hiring, add homemade products and household goods to product listings

Innovate big or go home: logistics unicorn YH Global eyes “Belt and Road” gold

The world’s first logistics firm to become a unicorn at Series A is a model of innovation in China. More overseas growth is next

European agritech is the new global focus, as startup investments nearly doubled in 2019

Last year, European agritech surpassed China for the first time in investments received, with openings in multiple subsectors from big data to blockchain

Lalibela Global-Networks: A mission to digitalize, move Africa's healthcare system to the cloud

This year’s Web Summit winner, Lalibela Global-Networks, is digitalizing Africa’s paper-based healthcare system in a low-cost, low-code way to save lives and make healthcare affordable

Smart Agrifood Summit 2021: A global innovation ecosystem is needed to catch up with other sectors

Investors from SVG Ventures/THRIVE, Pinduoduo and others agree that players must join forces to boost agrifood tech investment, internationally and across the value chain

Clarity AI uses machine learning and data analytics to effectively assess and score environmental, social and governance performance of companies and investment portfolios

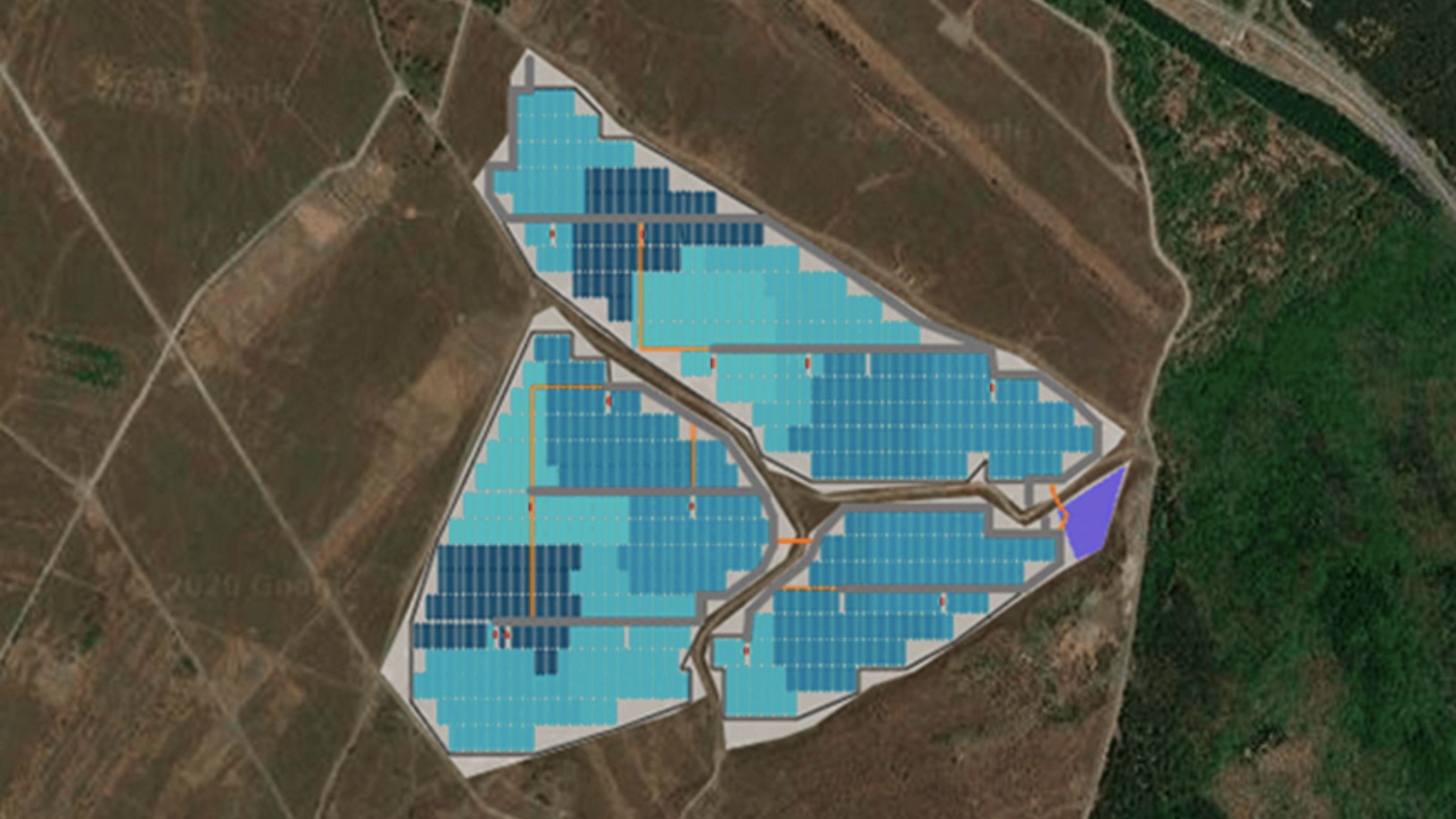

RatedPower: Creating solar power plant designs in minutes

The Spanish startup is helping solar plants expand exponentially worldwide and revolutionizing the sector with its automated software

Sorry, we couldn’t find any matches for“Target Global”.