The Venture City

-

DATABASE (998)

-

ARTICLES (811)

Founded in 2013 by BYD co-founder Yang Longzhong, Hui Capital focuses on new energy, new materials, electronic information technology and artificial intelligence. It plays a role as the administrator of the National Development and Reform Commission’s emerging industry venture capital fund.

Founded in 2013 by BYD co-founder Yang Longzhong, Hui Capital focuses on new energy, new materials, electronic information technology and artificial intelligence. It plays a role as the administrator of the National Development and Reform Commission’s emerging industry venture capital fund.

Founded by pioneering tech investor Ozi Amanat in 2015, K2 Global is a venture capital firm based in Silicon Valley and Singapore. Amanat, who moved to Singapore in 2012, is one of Twitter’s early backers, raising $25m to invest in the social media startup that later went public in 2013. The Harvard graduate in psychology and economics also invested in Uber, Spotify and Alibaba during his career as a venture capitalist. Amanat is the chief investment officer of K2 VC, K2 Global and Singapore-based Spice Global controlled by Indian billionaire B K Modi.In 2017, K2 also announced a $183m VC fund focusing on early-stage startups that aim to address global challenges. The majority of K2 limited partners are based outside the US in countries like Australia, Japan, Singapore, Hong Kong and Indonesia.

Founded by pioneering tech investor Ozi Amanat in 2015, K2 Global is a venture capital firm based in Silicon Valley and Singapore. Amanat, who moved to Singapore in 2012, is one of Twitter’s early backers, raising $25m to invest in the social media startup that later went public in 2013. The Harvard graduate in psychology and economics also invested in Uber, Spotify and Alibaba during his career as a venture capitalist. Amanat is the chief investment officer of K2 VC, K2 Global and Singapore-based Spice Global controlled by Indian billionaire B K Modi.In 2017, K2 also announced a $183m VC fund focusing on early-stage startups that aim to address global challenges. The majority of K2 limited partners are based outside the US in countries like Australia, Japan, Singapore, Hong Kong and Indonesia.

Founded in 2015 by venture capitalists from renowned Chinese investment firms including Morningside, Qiming and Ceyuan, Panda Capital focuses on early-stage investment in the internet sectors of real estate, automobile, finance, corporate services, logistics and healthcare.

Founded in 2015 by venture capitalists from renowned Chinese investment firms including Morningside, Qiming and Ceyuan, Panda Capital focuses on early-stage investment in the internet sectors of real estate, automobile, finance, corporate services, logistics and healthcare.

Huaxin Capital is a private equity fund management platform that was set up by Luxin Venture Capital Group in 2011. Huaxin Capital invests in the fields of biomedicine, medical equipment, internet, IoT, clean energy, high-end equipment manufacturing, among others.

Huaxin Capital is a private equity fund management platform that was set up by Luxin Venture Capital Group in 2011. Huaxin Capital invests in the fields of biomedicine, medical equipment, internet, IoT, clean energy, high-end equipment manufacturing, among others.

Founded in 2010, East Ventures is a venture capital firm with offices in Indonesia, Japan and USA. Today, the company has invested in over 150 companies across Asia, mainly Southeast Asia and Japan, and the USA. Its ticket size ranges from US$100,000 to US$500,000.

Founded in 2010, East Ventures is a venture capital firm with offices in Indonesia, Japan and USA. Today, the company has invested in over 150 companies across Asia, mainly Southeast Asia and Japan, and the USA. Its ticket size ranges from US$100,000 to US$500,000.

Lenovo Capital & Incubator Group

Established in 2016, Lenovo Capital is a venture capital fund that invests in the global technology sector. The fourth business division of Legend Group, Lenovo Capital has invested in and supported more than 80 startups and incubated nine subsidiaries that have more than one billion global users.

Established in 2016, Lenovo Capital is a venture capital fund that invests in the global technology sector. The fourth business division of Legend Group, Lenovo Capital has invested in and supported more than 80 startups and incubated nine subsidiaries that have more than one billion global users.

Xange is the venture capital arm of Siparex Group, with offices in Paris and Munich. It is dedicated to supporting entrepreneurs in disruptive digital, deep tech and social impact. It has €450m under management and 65 startups in its portfolio.

Xange is the venture capital arm of Siparex Group, with offices in Paris and Munich. It is dedicated to supporting entrepreneurs in disruptive digital, deep tech and social impact. It has €450m under management and 65 startups in its portfolio.

Based in Jakarta, Maloekoe Ventures is an Indonesian-focused venture capital firm headed by Adrien Gheur, a former MD of hedge fund APS Asset Management.

Based in Jakarta, Maloekoe Ventures is an Indonesian-focused venture capital firm headed by Adrien Gheur, a former MD of hedge fund APS Asset Management.

Founded in 2006 and renamed in 2010, Floodgate Fund is a venture capital firm focused on early-stage investment in technology sectors.

Founded in 2006 and renamed in 2010, Floodgate Fund is a venture capital firm focused on early-stage investment in technology sectors.

A famous angel investor in the healthcare sector, Shao Hui founded Youxiang, the first cross-border medical tourism player in China in 2006, targeting the Chinese upper class. In 2001, he participated in the venture-stage funding of Beijing Nanshan Ski Village, now the most popular ski village in China.

A famous angel investor in the healthcare sector, Shao Hui founded Youxiang, the first cross-border medical tourism player in China in 2006, targeting the Chinese upper class. In 2001, he participated in the venture-stage funding of Beijing Nanshan Ski Village, now the most popular ski village in China.

Regent Capital is a venture capital firm founded in 2015 in Shenzhen.

Regent Capital is a venture capital firm founded in 2015 in Shenzhen.

Part of the larger Sonae Group of companies, Sonae IM was launched in 2015 and is the corporate venture arm for tech-based investments. Since their launch, they have backed various companies particularly in the retail technology sector. These include StyleSage (fashion tech in predictive analytics) and InovRetail (demand forecasting for retailers).

Part of the larger Sonae Group of companies, Sonae IM was launched in 2015 and is the corporate venture arm for tech-based investments. Since their launch, they have backed various companies particularly in the retail technology sector. These include StyleSage (fashion tech in predictive analytics) and InovRetail (demand forecasting for retailers).

The investment fund was established in 1998 by Luis Martín Cabiedes, one of the most prominent business angels in Spain. The VC provides funds for early-stage growth of internet and technology ventures in Spain, acting initially as a business angel and then becoming a venture capitalist for future funding rounds.

The investment fund was established in 1998 by Luis Martín Cabiedes, one of the most prominent business angels in Spain. The VC provides funds for early-stage growth of internet and technology ventures in Spain, acting initially as a business angel and then becoming a venture capitalist for future funding rounds.

Founded in 1998, Asiaec Partnership is one of the earliest venture capital firms in China, with about 20 funds under management. It has invested in 100+ companies, of which about one-third have gone public, with an IRR of over 35%.

Founded in 1998, Asiaec Partnership is one of the earliest venture capital firms in China, with about 20 funds under management. It has invested in 100+ companies, of which about one-third have gone public, with an IRR of over 35%.

IDG-Accel is a joint venture between tech media company IDG and Accel Partners, focusing on early-stage, late-stage and pre-IPO investments.

IDG-Accel is a joint venture between tech media company IDG and Accel Partners, focusing on early-stage, late-stage and pre-IPO investments.

Swanlaab Venture Factory: €40 million funding chest to give power to the people

The female co-founder of Swanlaab Venture Factory believes that diversity enriches decision-making and drives performance. CompassList recently caught up with Verónica Trapa Díaz-Obregón to find out what's in store for Spain's first Israeli-backed VC fund

Turning Singapore into an Edible Garden City

Urban agriculture startup Edible Garden City embraces new tech for intensive, space-saving farming while staying true to its community-driven values

Faraday Venture Partners’ MP Gonzalo Tradacete: “We are actively looking for startups”

Amid the Covid-19 slump, Faraday Venture Partners' CIO and MP shares his expectations for startup investments and favored sectors, the measures his firm has taken so far to help investees ride out the crisis, and more.

Jakarta Smart City seeks startup solutions for life in post-Covid “new normal”

From collaborative working to cyberbullying, these startups will soon work with Indonesia’s first smart city agency

Zhongzheng Information: Big data and fully integrated services for smart office buildings

Joining the Microsoft for Startups program will boost Zhongzheng's R&D and business expansion in China

Beyond ride-hailing: Gojek, Grab and all their friends

Now that Grab and Go-Jek are in a faceoff on a regional scale, here's a look at how Southeast Asia's two biggest unicorns – and their investors – could be shaping the local digital economies and startup ecosystems

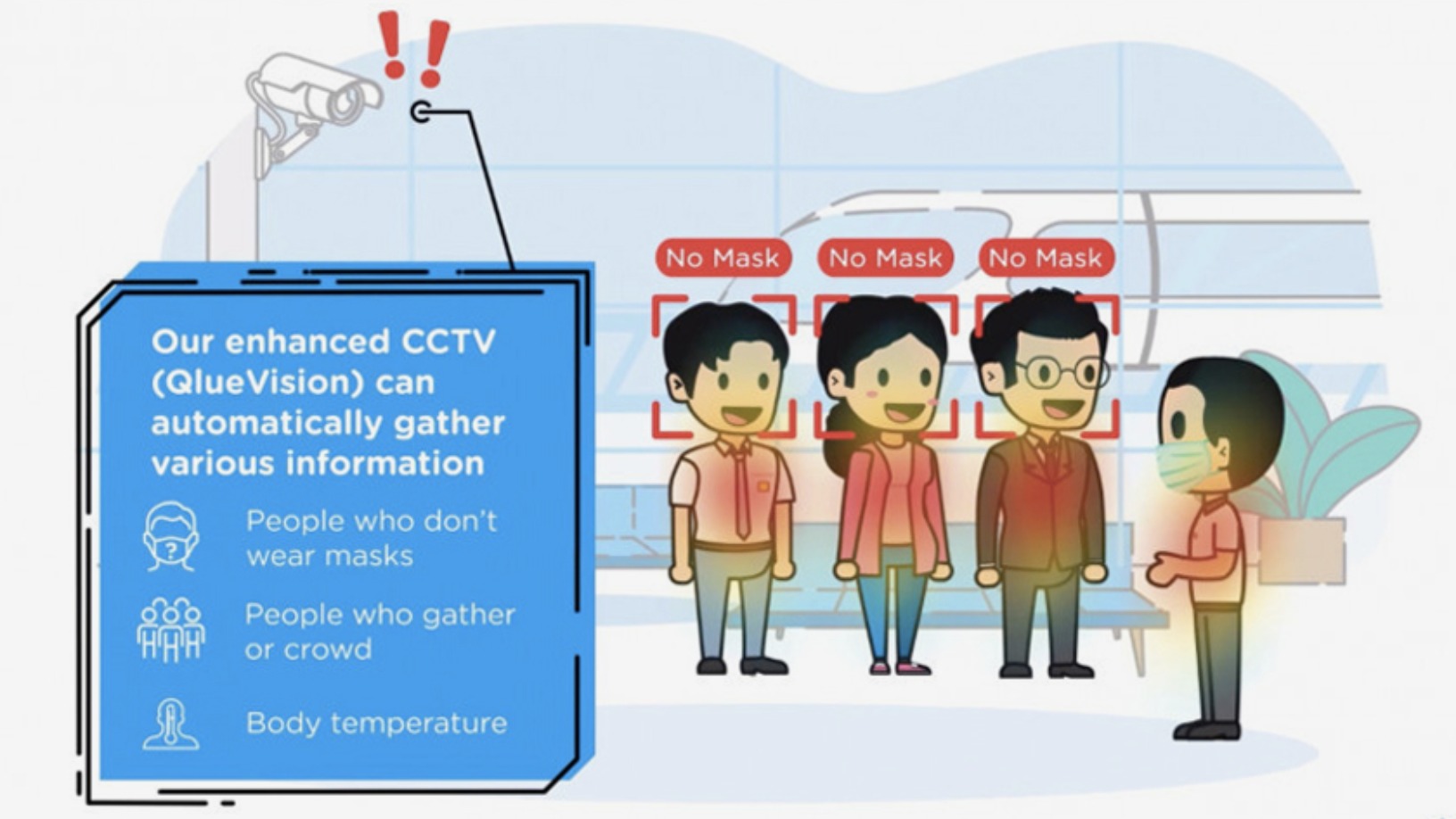

Interview with Qlue CEO: "We didn't know what a smart city should look like"

Co-founder and CEO of Qlue, Indonesia's largest "smart city" company, Rama Raditya explains how citizen involvement – not high-tech – is the true innovation of smart cities and the agent for change; plus how his startup has grown from partnering governments to businesses, and more

EXCLUSIVE: Qlue raising Series B funding, "confident" of turning profitable in 2020

Qlue is also targeting more enterprise clients as it expands overseas and improved accountability and management practices

EXCLUSIVE: Mexico’s Trendier invests in Chicfy as part of €1 million deal

Spain's most popular secondhand fashion marketplace and media darling gets lifeline as it struggles financially to stay afloat

Indonesian smart city tech leader Qlue thrives amid Covid-19 with thermal scanner and B2G refocus

Plans to tilt its client portfolio toward B2B work are delayed as Qlue returns to its B2G roots

Haoqipei: Connecting China's vast B2B auto parts market

Haoqipei not only connects buyers and sellers with a B2B trading platform, it also uses big data to build trust and relationships in a highly fragmented market

As Veniam’s “Internet of Moving Things” keeps growing, autonomous vehicles are next

The Portuguese startup is going places with its mesh networking technology, but that’s “just the beginning”, says Veniam founder and CEO João Barros. He talks to CompassList about partnering automakers to design self-driving cars, raising a new round of funding in 2018, and more

TheVentures founders launch Singapore VC to drive deals in Southeast Asia

The Korean Viki co-founders return to Singapore as venture builders and investors, offering South Korean partnerships and “CTO-as-a-service” in Southeast Asia

4YFN: Investment booms across Europe during pandemic

Speaking at the recent 4YFN conference, prolific European startup investor Mattias Ljungman provided a highly optimistic assessment of the continent's current ecosystem strength and climate for seed funding

For equality in education, Odilo brings books in the cloud free to millions worldwide

The "Amazon for digital content" Spanish edtech startup delivers virtual libraries and classrooms to kids and adults worldwide

Sorry, we couldn’t find any matches for“The Venture City”.