The Venture City

-

DATABASE (998)

-

ARTICLES (811)

Qianhai Fund of Funds (Qianhai FoF)

Headquartered in Shenzhen, Qianhai FoF was founded in 2015 with Shenzhen Capital Group as its only institutional partner. It is China's biggest FoF, with RMB 21.5bn in capital under management. Qianhai FoF is the largest single fundraising venture capital and private equity investment fund in China.

Headquartered in Shenzhen, Qianhai FoF was founded in 2015 with Shenzhen Capital Group as its only institutional partner. It is China's biggest FoF, with RMB 21.5bn in capital under management. Qianhai FoF is the largest single fundraising venture capital and private equity investment fund in China.

Lisbon-based venture capital and private equity firm, HCapital Partners focuses on energy, mobility and smart technologies in Portugal and Spain. HCapital typically invests between €500,000 and €2.5m per funding round. Its New Ideas fund is directed toward scalable startups. The firm was founded in 2014.

Lisbon-based venture capital and private equity firm, HCapital Partners focuses on energy, mobility and smart technologies in Portugal and Spain. HCapital typically invests between €500,000 and €2.5m per funding round. Its New Ideas fund is directed toward scalable startups. The firm was founded in 2014.

GX Capital is a venture capital firm focusing on mid-stage investment in TMT, internet and healthcare companies. It has over RMB 3 billion of assets under management.

GX Capital is a venture capital firm focusing on mid-stage investment in TMT, internet and healthcare companies. It has over RMB 3 billion of assets under management.

Angel Investment Network Indonesia (ANGIN)

ANGIN (Angel Investment Network Indonesia) is the first and largest network of angel investors in Indonesia. The funding and mentoring network comprises high net-worth individuals from diverse industry sectors, including venture capitalists, senior executives and celebrities. ANGIN also manages its own impact investment fund and a fund for women’s empowerment and entrepreneurship.

ANGIN (Angel Investment Network Indonesia) is the first and largest network of angel investors in Indonesia. The funding and mentoring network comprises high net-worth individuals from diverse industry sectors, including venture capitalists, senior executives and celebrities. ANGIN also manages its own impact investment fund and a fund for women’s empowerment and entrepreneurship.

NEA was founded in 1978 and is one of the largest venture capital firms in the world today. They have more than US$17 billion in committed capital across 15 funds. NEA has invested US$400 million in over 20 companies in China to date, including Uroaming, GrowingIO, Gushengtang, 51lietou and Baihe.

NEA was founded in 1978 and is one of the largest venture capital firms in the world today. They have more than US$17 billion in committed capital across 15 funds. NEA has invested US$400 million in over 20 companies in China to date, including Uroaming, GrowingIO, Gushengtang, 51lietou and Baihe.

One of Silicon Valley's most prestigious venture capital firms, Sequoia Capital, was established in 1972. Sequoia’s investment thesis leads them to invest primarily in early-stage companies, but they have also invested in Series F rounds and beyond. As a former venture capital firm, it has also made exits from major internet companies, such as Google, Apple, Nvidia, and GitHub. Sequoia Capital operates divisions in Israel, Hong Kong and Mainland China. It also acquired India-based VC Westbridge to form Sequoia Capital India.

One of Silicon Valley's most prestigious venture capital firms, Sequoia Capital, was established in 1972. Sequoia’s investment thesis leads them to invest primarily in early-stage companies, but they have also invested in Series F rounds and beyond. As a former venture capital firm, it has also made exits from major internet companies, such as Google, Apple, Nvidia, and GitHub. Sequoia Capital operates divisions in Israel, Hong Kong and Mainland China. It also acquired India-based VC Westbridge to form Sequoia Capital India.

Founded by John Ball in 2000, Steamboat Ventures is Disney’s venture capital subsidiary. They invest in early through growth stage companies with specialization in digital media and consumer technology.

Founded by John Ball in 2000, Steamboat Ventures is Disney’s venture capital subsidiary. They invest in early through growth stage companies with specialization in digital media and consumer technology.

Pearson Affordable Learning Fund

Pearson Affordable Learning Fund (PALF) is the venture capital arm of Pearson, the world’s largest education company. With investments in 10 education startups and a total of 350,000 learners,PALF is expanding its range of affordable education solutions in Africa, Asia and Latin America. Indonesia’s online learning provider HarukaEdu is the 11th addition.It is PALF’s first foray into the online higher education market.

Pearson Affordable Learning Fund (PALF) is the venture capital arm of Pearson, the world’s largest education company. With investments in 10 education startups and a total of 350,000 learners,PALF is expanding its range of affordable education solutions in Africa, Asia and Latin America. Indonesia’s online learning provider HarukaEdu is the 11th addition.It is PALF’s first foray into the online higher education market.

CEO and founder of Diamond Foundry

Martin Roscheisen is an American-Austrian tech entrepreneur. He is CEO and co-founder of US-based unicorn Diamond Foundry, the first certified carbon-neutral producer of lab-grown diamonds. He has worked there since 2012, prior to the company’s official establishment in 2013.Roscheisen holds a PhD in computer science from Stanford University, where his classmates included Google founders Larry Page and Sergey Brin. He is one of the first generation of internet entrepreneurs, and has been involved in starting a number of companies. Before starting Diamond Foundry, Roscheisen headed the $640m solar startup Nanosolar from 2002–2010 as its CEO and founder. This was Silicon Valley's first solar power tech startup financed by American venture capital and, at the time, the highest-valued solar startup.When Nanosolar closed due to cheaper competition from China, much of its remaining technical expertise and resources went to setting up Diamond Foundry.In addition, Roscheisen was also formerlyCEO and the founder of eGroups. One of the first social media platforms to reach 50m users, the firm was acquired by Yahoo!.CTO and co-founder of enterprise software firm TradingDynamics, which sold to Ariba for $1.2bn.CTO and co-founder of FindLaw, a leading Internet legal site eventually sold to Thomson Reuters.In 2003, Fortune Magazine named Roscheisen one of America’s 40 Under 40, and one of the top 10 entrepreneurs in the country.

Martin Roscheisen is an American-Austrian tech entrepreneur. He is CEO and co-founder of US-based unicorn Diamond Foundry, the first certified carbon-neutral producer of lab-grown diamonds. He has worked there since 2012, prior to the company’s official establishment in 2013.Roscheisen holds a PhD in computer science from Stanford University, where his classmates included Google founders Larry Page and Sergey Brin. He is one of the first generation of internet entrepreneurs, and has been involved in starting a number of companies. Before starting Diamond Foundry, Roscheisen headed the $640m solar startup Nanosolar from 2002–2010 as its CEO and founder. This was Silicon Valley's first solar power tech startup financed by American venture capital and, at the time, the highest-valued solar startup.When Nanosolar closed due to cheaper competition from China, much of its remaining technical expertise and resources went to setting up Diamond Foundry.In addition, Roscheisen was also formerlyCEO and the founder of eGroups. One of the first social media platforms to reach 50m users, the firm was acquired by Yahoo!.CTO and co-founder of enterprise software firm TradingDynamics, which sold to Ariba for $1.2bn.CTO and co-founder of FindLaw, a leading Internet legal site eventually sold to Thomson Reuters.In 2003, Fortune Magazine named Roscheisen one of America’s 40 Under 40, and one of the top 10 entrepreneurs in the country.

Charlotte Street Capital is a London-based venture capital firm focused on early stage investments. It invests from £150,000 to £1 million in innovative technology businesses, ranging from hardware products, software and services in the B2C and B2B sectors.

Charlotte Street Capital is a London-based venture capital firm focused on early stage investments. It invests from £150,000 to £1 million in innovative technology businesses, ranging from hardware products, software and services in the B2C and B2B sectors.

Former investment banker Tian Jiangchuan is co-founder of Initial Venture Capital, which focuses on early-stage investment in the mobile internet, O2O, e-commerce and education sectors. She holds a bachelor’s degree in Statistics and Economics from the University of London, and was an associate director at UBS. Tian was born in 1987.

Former investment banker Tian Jiangchuan is co-founder of Initial Venture Capital, which focuses on early-stage investment in the mobile internet, O2O, e-commerce and education sectors. She holds a bachelor’s degree in Statistics and Economics from the University of London, and was an associate director at UBS. Tian was born in 1987.

Omidyar Network is a private equity fund and venture capital firm. Founded in 2004 by eBay co-founder Pierre Omidyar, it focuses on “impact investing” in diverse startups that are able to cater to the needs of even the poorest consumers worldwide. Omidyar provides investment funds and nonprofit grants, as well as management support services including talent recruitment.

Omidyar Network is a private equity fund and venture capital firm. Founded in 2004 by eBay co-founder Pierre Omidyar, it focuses on “impact investing” in diverse startups that are able to cater to the needs of even the poorest consumers worldwide. Omidyar provides investment funds and nonprofit grants, as well as management support services including talent recruitment.

Social Capital is a Palo Alto-based venture capital firm. Its stated mission is to "advance humanity by solving the world's hardest problems", with the firm investing in entrepreneurs who markedly improve their communities. Social Capital's diverse portfolio comprises healthcare companies, workplace productivity software Slack and SurveyMonkey and coworking space operator Rework (now GoWork).

Social Capital is a Palo Alto-based venture capital firm. Its stated mission is to "advance humanity by solving the world's hardest problems", with the firm investing in entrepreneurs who markedly improve their communities. Social Capital's diverse portfolio comprises healthcare companies, workplace productivity software Slack and SurveyMonkey and coworking space operator Rework (now GoWork).

TPG-SV China Ventures is a joint investment venture established in September 2018 by SoftBank Ventures Korea and private equity group TPG. With a fund of $300m, the VC is managed by TPG’s China team in the TMT industry and seeks early-stage investment opportunities in internet, technology and media.

TPG-SV China Ventures is a joint investment venture established in September 2018 by SoftBank Ventures Korea and private equity group TPG. With a fund of $300m, the VC is managed by TPG’s China team in the TMT industry and seeks early-stage investment opportunities in internet, technology and media.

Part of the Thai-headquartered venture capitalist firm Ardent Capital, Ardent Ventures invests in early-stage technology startups across Southeast Asia. In 2016, Ardent Capital announced its merger with US-based Wavemaker Partners.

Part of the Thai-headquartered venture capitalist firm Ardent Capital, Ardent Ventures invests in early-stage technology startups across Southeast Asia. In 2016, Ardent Capital announced its merger with US-based Wavemaker Partners.

Swanlaab Venture Factory: €40 million funding chest to give power to the people

The female co-founder of Swanlaab Venture Factory believes that diversity enriches decision-making and drives performance. CompassList recently caught up with Verónica Trapa Díaz-Obregón to find out what's in store for Spain's first Israeli-backed VC fund

Turning Singapore into an Edible Garden City

Urban agriculture startup Edible Garden City embraces new tech for intensive, space-saving farming while staying true to its community-driven values

Faraday Venture Partners’ MP Gonzalo Tradacete: “We are actively looking for startups”

Amid the Covid-19 slump, Faraday Venture Partners' CIO and MP shares his expectations for startup investments and favored sectors, the measures his firm has taken so far to help investees ride out the crisis, and more.

Jakarta Smart City seeks startup solutions for life in post-Covid “new normal”

From collaborative working to cyberbullying, these startups will soon work with Indonesia’s first smart city agency

Zhongzheng Information: Big data and fully integrated services for smart office buildings

Joining the Microsoft for Startups program will boost Zhongzheng's R&D and business expansion in China

Beyond ride-hailing: Gojek, Grab and all their friends

Now that Grab and Go-Jek are in a faceoff on a regional scale, here's a look at how Southeast Asia's two biggest unicorns – and their investors – could be shaping the local digital economies and startup ecosystems

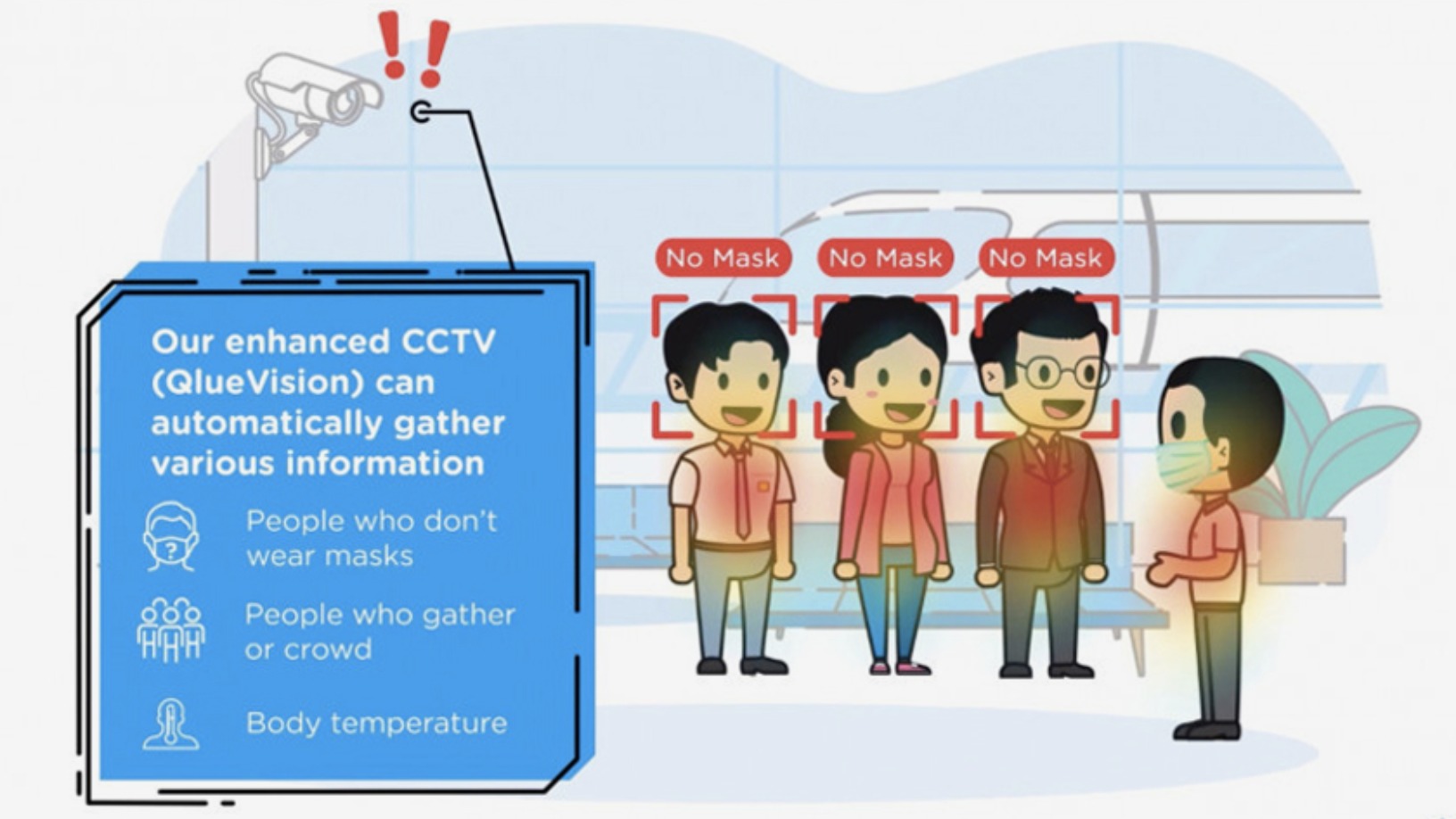

Interview with Qlue CEO: "We didn't know what a smart city should look like"

Co-founder and CEO of Qlue, Indonesia's largest "smart city" company, Rama Raditya explains how citizen involvement – not high-tech – is the true innovation of smart cities and the agent for change; plus how his startup has grown from partnering governments to businesses, and more

EXCLUSIVE: Qlue raising Series B funding, "confident" of turning profitable in 2020

Qlue is also targeting more enterprise clients as it expands overseas and improved accountability and management practices

EXCLUSIVE: Mexico’s Trendier invests in Chicfy as part of €1 million deal

Spain's most popular secondhand fashion marketplace and media darling gets lifeline as it struggles financially to stay afloat

Indonesian smart city tech leader Qlue thrives amid Covid-19 with thermal scanner and B2G refocus

Plans to tilt its client portfolio toward B2B work are delayed as Qlue returns to its B2G roots

Haoqipei: Connecting China's vast B2B auto parts market

Haoqipei not only connects buyers and sellers with a B2B trading platform, it also uses big data to build trust and relationships in a highly fragmented market

As Veniam’s “Internet of Moving Things” keeps growing, autonomous vehicles are next

The Portuguese startup is going places with its mesh networking technology, but that’s “just the beginning”, says Veniam founder and CEO João Barros. He talks to CompassList about partnering automakers to design self-driving cars, raising a new round of funding in 2018, and more

TheVentures founders launch Singapore VC to drive deals in Southeast Asia

The Korean Viki co-founders return to Singapore as venture builders and investors, offering South Korean partnerships and “CTO-as-a-service” in Southeast Asia

4YFN: Investment booms across Europe during pandemic

Speaking at the recent 4YFN conference, prolific European startup investor Mattias Ljungman provided a highly optimistic assessment of the continent's current ecosystem strength and climate for seed funding

For equality in education, Odilo brings books in the cloud free to millions worldwide

The "Amazon for digital content" Spanish edtech startup delivers virtual libraries and classrooms to kids and adults worldwide

Sorry, we couldn’t find any matches for“The Venture City”.