The Venture City

-

DATABASE (998)

-

ARTICLES (811)

ESADE Ban is a network of private investors, comprised of ex-alumnae of the Barcelona, Spain-based ESADE Business School. Founded in 2010, the organization consists of 260 business angels, venture capital companies, family firms and senior managers that have invested more than €27 million in 120 startups. The entity won the European Business Angel Network's 2016 award for best performing business angel and hold investment events throughout the year.

ESADE Ban is a network of private investors, comprised of ex-alumnae of the Barcelona, Spain-based ESADE Business School. Founded in 2010, the organization consists of 260 business angels, venture capital companies, family firms and senior managers that have invested more than €27 million in 120 startups. The entity won the European Business Angel Network's 2016 award for best performing business angel and hold investment events throughout the year.

Discovery Nusantara Capital is a venture capital firm with a focus on video gaming and related industries. The firm is backed by China's Zhexin IT and Indonesian angel investors keen to support the growth of the local game industry. Discovery Nusantara Capital has helped introduce games from Touchten, an Indonesian game development studio, to the Chinese market. Aside from video games, the firm has recently invested in NaoBun Project, an Indonesian comics publisher and intellectual property management agency.

Discovery Nusantara Capital is a venture capital firm with a focus on video gaming and related industries. The firm is backed by China's Zhexin IT and Indonesian angel investors keen to support the growth of the local game industry. Discovery Nusantara Capital has helped introduce games from Touchten, an Indonesian game development studio, to the Chinese market. Aside from video games, the firm has recently invested in NaoBun Project, an Indonesian comics publisher and intellectual property management agency.

bp ventures is an investment arm of the energy group BP with an annual venture investment budget between $150m and $200m. The group invests in new energy solutions, with over 30 startups’ investments in its portfolio supporting BP’s core business in oil and gas.bp ventures has increasingly invested over the past years in carbon-management technologies, low-carbon products, and advanced mobility through EV charging companies like the Chinese Shanghai PowerShare Tech and the California-based FreeWire Technologies.

bp ventures is an investment arm of the energy group BP with an annual venture investment budget between $150m and $200m. The group invests in new energy solutions, with over 30 startups’ investments in its portfolio supporting BP’s core business in oil and gas.bp ventures has increasingly invested over the past years in carbon-management technologies, low-carbon products, and advanced mobility through EV charging companies like the Chinese Shanghai PowerShare Tech and the California-based FreeWire Technologies.

Since its acquisition by US-based internet giant IAC in 2003, Expedia Inc has quickly transformed into a worldwide travel group with stakes in SilverRail, Hotels.com, Trivago, HomeAway, Orbitz, Travelocity, Mobiata travel apps and long-term China partner eLong.Expedia.com was originally launched in 1996 as Microsoft’s pioneering online travel booking venture to help consumers to search for the best travel deals and book tickets at the best prices.

Since its acquisition by US-based internet giant IAC in 2003, Expedia Inc has quickly transformed into a worldwide travel group with stakes in SilverRail, Hotels.com, Trivago, HomeAway, Orbitz, Travelocity, Mobiata travel apps and long-term China partner eLong.Expedia.com was originally launched in 1996 as Microsoft’s pioneering online travel booking venture to help consumers to search for the best travel deals and book tickets at the best prices.

Stella Maris Partners is a venture capital fund based in San Pedro Garza García, Mexico with a focus on the education, healthcare and financial services sectors. It invests in Mexican and foreign startups looking to expand to Mexico and Latin America. The firm was founded by Armando Badillo in 2012 and has four other managing partners, Angel Alvarez Cadaveico, Guillermo Zambrano Martinez, Jesus O. Lanza Losa and Marcelo Antonio Benitez Akbo.

Stella Maris Partners is a venture capital fund based in San Pedro Garza García, Mexico with a focus on the education, healthcare and financial services sectors. It invests in Mexican and foreign startups looking to expand to Mexico and Latin America. The firm was founded by Armando Badillo in 2012 and has four other managing partners, Angel Alvarez Cadaveico, Guillermo Zambrano Martinez, Jesus O. Lanza Losa and Marcelo Antonio Benitez Akbo.

Launched in 2013, Japan’s Rakuten Capital is the corporate venture capital arm of conglomerate Rakuten. It manages a range of funds, such as the early-stage Rakuten Ventures, Rakuten Fintech Fund, and Rakuten Mobility Investments. Its portfolio covers a broad range of companies, including C2C e-commerce platform Carousell, ride-hailing unicorn Gojek, and video game vouchers platform CodaPay. Notable exits include the IPOs of US-based ride hailing company Lyft and image sharing site Pinterest.

Launched in 2013, Japan’s Rakuten Capital is the corporate venture capital arm of conglomerate Rakuten. It manages a range of funds, such as the early-stage Rakuten Ventures, Rakuten Fintech Fund, and Rakuten Mobility Investments. Its portfolio covers a broad range of companies, including C2C e-commerce platform Carousell, ride-hailing unicorn Gojek, and video game vouchers platform CodaPay. Notable exits include the IPOs of US-based ride hailing company Lyft and image sharing site Pinterest.

Shanghai Zhangjiang Haocheng Venture Capital Co., Ltd. (Zhangjiang Haocheng) was founded in 2007 as a wholly-owned subsidiary of listed real estate developer Shanghai Zhangjiang Hi-Tech Park Development Co., Ltd. It has invested RMB 2.5 billion in high-tech startups.

Shanghai Zhangjiang Haocheng Venture Capital Co., Ltd. (Zhangjiang Haocheng) was founded in 2007 as a wholly-owned subsidiary of listed real estate developer Shanghai Zhangjiang Hi-Tech Park Development Co., Ltd. It has invested RMB 2.5 billion in high-tech startups.

Co-founder of Fenbushi Capital, China’s first venture capital firm that focuses exclusively on blockchain investment, and of Bitshares, a blockchain-based financial platform. Among the earliest investors and entrepreneurs in the blockchain industry, Shen has 12 years of experience in senior management at brokerages, hedge funds and investment banks. He received his bachelor’s degree in mathematics from the University of Shanghai for Science and Technology and his master’s degree in Systems Engineering from the Georgia Institute of Technology.

Co-founder of Fenbushi Capital, China’s first venture capital firm that focuses exclusively on blockchain investment, and of Bitshares, a blockchain-based financial platform. Among the earliest investors and entrepreneurs in the blockchain industry, Shen has 12 years of experience in senior management at brokerages, hedge funds and investment banks. He received his bachelor’s degree in mathematics from the University of Shanghai for Science and Technology and his master’s degree in Systems Engineering from the Georgia Institute of Technology.

Pathena is a Porto-based venture capital firm founded in 2010 and focuses on IT investments, particularly medtech. Pathena closed its first portfolio fund in 2011, having invested in 10 companies and it launched its current portfolio fund in 2013 worth €56 million.

Pathena is a Porto-based venture capital firm founded in 2010 and focuses on IT investments, particularly medtech. Pathena closed its first portfolio fund in 2011, having invested in 10 companies and it launched its current portfolio fund in 2013 worth €56 million.

Founded by Li Shujun, the former CFO of Shengda, in 2006, Trustbridge Partners is a venture capital and private equity firm focusing on growth-stage and expansion-stage investments in Chinese companies in new energy, environmental protection, new materials, new media, retailing, healthcare, education, e-commerce, etc. The sources of its funds come mainly from university foundations in the US (such as Columbia University, Stanford University, New York University), world-renowned investment firms (Temasek Holdings, Kerry Group, etc.), and private investors.

Founded by Li Shujun, the former CFO of Shengda, in 2006, Trustbridge Partners is a venture capital and private equity firm focusing on growth-stage and expansion-stage investments in Chinese companies in new energy, environmental protection, new materials, new media, retailing, healthcare, education, e-commerce, etc. The sources of its funds come mainly from university foundations in the US (such as Columbia University, Stanford University, New York University), world-renowned investment firms (Temasek Holdings, Kerry Group, etc.), and private investors.

Ignacio Martín de Andrés has over eight years of experience working at consultancies such as KPMG, PwC and Grant Thornton.He made an angel investment in Reclamador.es, a web platform that manages and automates consumer claims, and has also helped define the company's strategy and service-level agreement.Since 2019, he's been a partner at Venture Partnership, supporting the company by defining growth strategy, KPIs and process optimization for startups in the company’s investment portfolio.

Ignacio Martín de Andrés has over eight years of experience working at consultancies such as KPMG, PwC and Grant Thornton.He made an angel investment in Reclamador.es, a web platform that manages and automates consumer claims, and has also helped define the company's strategy and service-level agreement.Since 2019, he's been a partner at Venture Partnership, supporting the company by defining growth strategy, KPIs and process optimization for startups in the company’s investment portfolio.

Albert Domingo is a Spanish entrepreneur and investor. He is the founder and CEO NexTReT, which was established in 1992 to provide IT systems and infrastructure services. Domingo is also an active business angel, backing startups as a partner investor in Barcelona-based venture builder Itnig's network, which has seen two exits, Gym For Less and Playfulbet. He studied computer engineering and also management development at the IESE Business School in Barcelona.

Albert Domingo is a Spanish entrepreneur and investor. He is the founder and CEO NexTReT, which was established in 1992 to provide IT systems and infrastructure services. Domingo is also an active business angel, backing startups as a partner investor in Barcelona-based venture builder Itnig's network, which has seen two exits, Gym For Less and Playfulbet. He studied computer engineering and also management development at the IESE Business School in Barcelona.

SPH Media Fund is a S$100 million venture capital fund set up by government-backed listed group, Singapore Press Holdings Limited.The fund invests in early growth technology companies globally. Although the fund is stage agnostic, most of the portfolio companies are at Series A or later. The size of the investment depends on the needs of the startup. A typical ticket size is between S$1 million and S$2 million, with possible bigger amounts of up to S$5 million per round.

SPH Media Fund is a S$100 million venture capital fund set up by government-backed listed group, Singapore Press Holdings Limited.The fund invests in early growth technology companies globally. Although the fund is stage agnostic, most of the portfolio companies are at Series A or later. The size of the investment depends on the needs of the startup. A typical ticket size is between S$1 million and S$2 million, with possible bigger amounts of up to S$5 million per round.

Toyota AI Ventures, the venture capital arm of the Toyota Research Institute, is a Silicon Valley-based fund investing globally in startups with cutting-edge solutions in the AI, smart-mobility, autonomy, robotics, data and cloud spaces while leveraging the global expertise and technical resources of the Toyota Group.In 2015 Toyota created the Toyota Research Institute aiming to support the research on next-generation mobility, robotics and new materials. Toyota AI Ventures was founded in 2017 with initial funding of $100m.

Toyota AI Ventures, the venture capital arm of the Toyota Research Institute, is a Silicon Valley-based fund investing globally in startups with cutting-edge solutions in the AI, smart-mobility, autonomy, robotics, data and cloud spaces while leveraging the global expertise and technical resources of the Toyota Group.In 2015 Toyota created the Toyota Research Institute aiming to support the research on next-generation mobility, robotics and new materials. Toyota AI Ventures was founded in 2017 with initial funding of $100m.

Established in 1996, SBI Investment is a venture capital firm that focuses on growth sectors such as information technology, biotechnology, life science, mobile, environment and energy. The VC arm of the SBI Group is developed to quickly find new, emerging technologies and investing in those technologies to further the development of the group. SBI Group then introduces the new technologies to existing businesses in order to help them stay ahead in the market, as well as to revitalize local industries in Japan, particularly in the financial and banking sectors.

Established in 1996, SBI Investment is a venture capital firm that focuses on growth sectors such as information technology, biotechnology, life science, mobile, environment and energy. The VC arm of the SBI Group is developed to quickly find new, emerging technologies and investing in those technologies to further the development of the group. SBI Group then introduces the new technologies to existing businesses in order to help them stay ahead in the market, as well as to revitalize local industries in Japan, particularly in the financial and banking sectors.

Swanlaab Venture Factory: €40 million funding chest to give power to the people

The female co-founder of Swanlaab Venture Factory believes that diversity enriches decision-making and drives performance. CompassList recently caught up with Verónica Trapa Díaz-Obregón to find out what's in store for Spain's first Israeli-backed VC fund

Turning Singapore into an Edible Garden City

Urban agriculture startup Edible Garden City embraces new tech for intensive, space-saving farming while staying true to its community-driven values

Faraday Venture Partners’ MP Gonzalo Tradacete: “We are actively looking for startups”

Amid the Covid-19 slump, Faraday Venture Partners' CIO and MP shares his expectations for startup investments and favored sectors, the measures his firm has taken so far to help investees ride out the crisis, and more.

Jakarta Smart City seeks startup solutions for life in post-Covid “new normal”

From collaborative working to cyberbullying, these startups will soon work with Indonesia’s first smart city agency

Zhongzheng Information: Big data and fully integrated services for smart office buildings

Joining the Microsoft for Startups program will boost Zhongzheng's R&D and business expansion in China

Beyond ride-hailing: Gojek, Grab and all their friends

Now that Grab and Go-Jek are in a faceoff on a regional scale, here's a look at how Southeast Asia's two biggest unicorns – and their investors – could be shaping the local digital economies and startup ecosystems

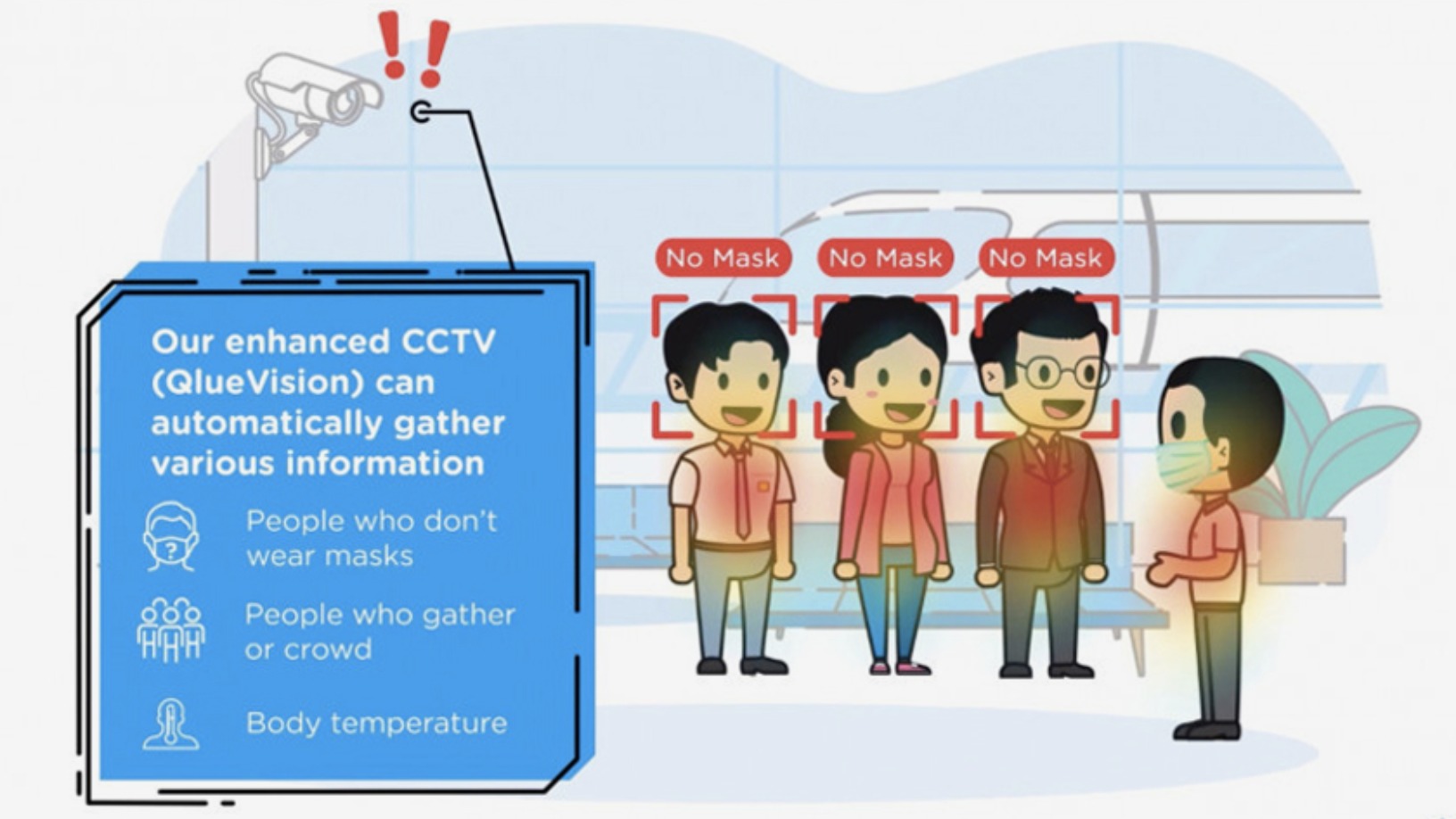

Interview with Qlue CEO: "We didn't know what a smart city should look like"

Co-founder and CEO of Qlue, Indonesia's largest "smart city" company, Rama Raditya explains how citizen involvement – not high-tech – is the true innovation of smart cities and the agent for change; plus how his startup has grown from partnering governments to businesses, and more

EXCLUSIVE: Qlue raising Series B funding, "confident" of turning profitable in 2020

Qlue is also targeting more enterprise clients as it expands overseas and improved accountability and management practices

EXCLUSIVE: Mexico’s Trendier invests in Chicfy as part of €1 million deal

Spain's most popular secondhand fashion marketplace and media darling gets lifeline as it struggles financially to stay afloat

Indonesian smart city tech leader Qlue thrives amid Covid-19 with thermal scanner and B2G refocus

Plans to tilt its client portfolio toward B2B work are delayed as Qlue returns to its B2G roots

Haoqipei: Connecting China's vast B2B auto parts market

Haoqipei not only connects buyers and sellers with a B2B trading platform, it also uses big data to build trust and relationships in a highly fragmented market

As Veniam’s “Internet of Moving Things” keeps growing, autonomous vehicles are next

The Portuguese startup is going places with its mesh networking technology, but that’s “just the beginning”, says Veniam founder and CEO João Barros. He talks to CompassList about partnering automakers to design self-driving cars, raising a new round of funding in 2018, and more

TheVentures founders launch Singapore VC to drive deals in Southeast Asia

The Korean Viki co-founders return to Singapore as venture builders and investors, offering South Korean partnerships and “CTO-as-a-service” in Southeast Asia

4YFN: Investment booms across Europe during pandemic

Speaking at the recent 4YFN conference, prolific European startup investor Mattias Ljungman provided a highly optimistic assessment of the continent's current ecosystem strength and climate for seed funding

For equality in education, Odilo brings books in the cloud free to millions worldwide

The "Amazon for digital content" Spanish edtech startup delivers virtual libraries and classrooms to kids and adults worldwide

Sorry, we couldn’t find any matches for“The Venture City”.