The Venture City

DATABASE (998)

ARTICLES (811)

Swanlaab Venture Factory is a Spanish-Israeli VC fund founded in 2013 in Israel and in 2017 in Madrid, whose first investment fund totalled €40 million. Within Spain, its portfolio has 11 startups across different B2B verticals. Each startup selected for investment during investment rounds of €2–3 million, receives funds of €500,000 to €1.5 million.Swanlaab's Israeli backer Giza Venture Capital has already achieved more than 40 successful exits and is ranked amongst the top funds worldwide, investing over $600 million since 1992.Its most recent investments include in edtech and multimedia content platform Odilo’s July 2020 $10m undisclosed round and in the €3.5m Series A investment round of sales tech Sales Layer in May 2020.

Swanlaab Venture Factory is a Spanish-Israeli VC fund founded in 2013 in Israel and in 2017 in Madrid, whose first investment fund totalled €40 million. Within Spain, its portfolio has 11 startups across different B2B verticals. Each startup selected for investment during investment rounds of €2–3 million, receives funds of €500,000 to €1.5 million.Swanlaab's Israeli backer Giza Venture Capital has already achieved more than 40 successful exits and is ranked amongst the top funds worldwide, investing over $600 million since 1992.Its most recent investments include in edtech and multimedia content platform Odilo’s July 2020 $10m undisclosed round and in the €3.5m Series A investment round of sales tech Sales Layer in May 2020.

Founder & CEO of OnlinePajak

Charles Guinot is founder of Indonesian online tax services platform OnlinePajak and a project manager and board member at Farinia Group, a French multinational manufacturing business group. Guinot earned his bachelor’s in Mechanical Engineering from Université de Technologie de Troyes, France and holds master’s degrees in Mechatronics from the Université de Technologie de Compiègne, France and Manufacturing Engineering from the City University of Hong Kong.

Charles Guinot is founder of Indonesian online tax services platform OnlinePajak and a project manager and board member at Farinia Group, a French multinational manufacturing business group. Guinot earned his bachelor’s in Mechanical Engineering from Université de Technologie de Troyes, France and holds master’s degrees in Mechatronics from the Université de Technologie de Compiègne, France and Manufacturing Engineering from the City University of Hong Kong.

Yueyin Venture Capital was founded in 2015 in Beijing. It manages total assets worth US$300m, with investments in 22 companies. The VC focuses mainly in the healthcare, pharmaceutical and biotech sectors.

Yueyin Venture Capital was founded in 2015 in Beijing. It manages total assets worth US$300m, with investments in 22 companies. The VC focuses mainly in the healthcare, pharmaceutical and biotech sectors.

Founded in 2009, Septwolves Venture Capital is a subsidiary of Septwolves Holding Group Co Ltd. The VC firm currently manages assets worth RMB 1bn.Focusing on investment opportunities in the communications and other traditional industries like logistics, Septwolves also invests in diverse sectors including mobile internet, energy, food, pharmaceutical, textile and software.

Founded in 2009, Septwolves Venture Capital is a subsidiary of Septwolves Holding Group Co Ltd. The VC firm currently manages assets worth RMB 1bn.Focusing on investment opportunities in the communications and other traditional industries like logistics, Septwolves also invests in diverse sectors including mobile internet, energy, food, pharmaceutical, textile and software.

Gemboom Venture Capital was founded in Shenzhen in 2016 and mainly invests in early-stage startups from angel to Series A rounds. It specializes in high-tech, industrial upgrades and consumables. The VC invests primarily in big cities like Beijing, Shanghai, Guangzhou, Shenzhen, Hangzhou and Chengdu.

Gemboom Venture Capital was founded in Shenzhen in 2016 and mainly invests in early-stage startups from angel to Series A rounds. It specializes in high-tech, industrial upgrades and consumables. The VC invests primarily in big cities like Beijing, Shanghai, Guangzhou, Shenzhen, Hangzhou and Chengdu.

Cambrian Venture Capital was founded in Shanghai in 2016 and focuses on early-stage investments. It has invested in over 80 startups in edtech, B2B, internet and consumer sectors.

Cambrian Venture Capital was founded in Shanghai in 2016 and focuses on early-stage investments. It has invested in over 80 startups in edtech, B2B, internet and consumer sectors.

SWAN Venture Fund is a group of Seattle angel investors established in 2015. It leads in early seed rounds and tends to be the first major outside investment to a startup, ranging from US$200,000 – US$1.2 million. Besides tech startups, it also invests in companies producing innovative commercial products.

SWAN Venture Fund is a group of Seattle angel investors established in 2015. It leads in early seed rounds and tends to be the first major outside investment to a startup, ranging from US$200,000 – US$1.2 million. Besides tech startups, it also invests in companies producing innovative commercial products.

Established in Shanghai in 2014, Wuqiong Venture Capital is an early-stage investment firm, having backed more than 10 startups in China including Beautysite, CeCelife and Orange-social.

Established in Shanghai in 2014, Wuqiong Venture Capital is an early-stage investment firm, having backed more than 10 startups in China including Beautysite, CeCelife and Orange-social.

Leaguer Venture Capital was founded by Leaguer Group in 1999 as a wholly-owned subsidiary, responsible for incubating and investing in high-tech startups. It mainly invests in early- and mid-stage tech startups.

Leaguer Venture Capital was founded by Leaguer Group in 1999 as a wholly-owned subsidiary, responsible for incubating and investing in high-tech startups. It mainly invests in early- and mid-stage tech startups.

Tianjin Venture Capital was co-founded by Tianjin Municipal Science & Technology Commission and Tianjin Municipal Finance Bureau in 2003. It invests mainly in the sectors of advanced manufacturing, TMT, energy conservation & environmental protection, healthcare and consumer services. The firm manages RMB 8bn in capital. Of the 100+ tech startups in which the firm has invested, nearly 10 have gone public in China.

Tianjin Venture Capital was co-founded by Tianjin Municipal Science & Technology Commission and Tianjin Municipal Finance Bureau in 2003. It invests mainly in the sectors of advanced manufacturing, TMT, energy conservation & environmental protection, healthcare and consumer services. The firm manages RMB 8bn in capital. Of the 100+ tech startups in which the firm has invested, nearly 10 have gone public in China.

Led by media and entertainment veteran Frank Yang (Yang Xingnong), ANTS Venture Capital conducts early-stage investments in Chinese companies from the TMT, culture & entertainment, healthcare, consumption & retail and new energy sectors. It expects its selected companies to become market leaders in their industries, with a CAGR of at least 30% and the potential to go public in two years.

Led by media and entertainment veteran Frank Yang (Yang Xingnong), ANTS Venture Capital conducts early-stage investments in Chinese companies from the TMT, culture & entertainment, healthcare, consumption & retail and new energy sectors. It expects its selected companies to become market leaders in their industries, with a CAGR of at least 30% and the potential to go public in two years.

UOB Venture Management is a private equity firm backed by the United Overseas Bank (UOB). It invests in growing companies at their expansion stages, with special focus on the Southeast Asia and China markets. Its portfolio is diverse, ranging from food and health companies to petrochemicals and tech businesses like Giosis (which operates e-commerce site Qoo10) and AI-powered marketing service startup Appier.

UOB Venture Management is a private equity firm backed by the United Overseas Bank (UOB). It invests in growing companies at their expansion stages, with special focus on the Southeast Asia and China markets. Its portfolio is diverse, ranging from food and health companies to petrochemicals and tech businesses like Giosis (which operates e-commerce site Qoo10) and AI-powered marketing service startup Appier.

Everest Venture Capital was founded in Beijing in July 2010. By May 2019, it had invested in 80 companies in many different sectors, including, artificial intelligence, media, healthcare, robotics, automobile and edtech.

Everest Venture Capital was founded in Beijing in July 2010. By May 2019, it had invested in 80 companies in many different sectors, including, artificial intelligence, media, healthcare, robotics, automobile and edtech.

Founded in 2004, Active Venture Partners is based in Barcelona and has two VC funds totaling €74 million. The company has made 40 investments and managed nine exits, including cloud-based reservation platform Restaurants.com, business intelligence tool for hotels ReviewPro and ticket marketplace Ticketbis. The VC was the lead investor in 18 funding rounds to date, with the most recent being a €1-million round for sales and marketing platform Whisbi.

Founded in 2004, Active Venture Partners is based in Barcelona and has two VC funds totaling €74 million. The company has made 40 investments and managed nine exits, including cloud-based reservation platform Restaurants.com, business intelligence tool for hotels ReviewPro and ticket marketplace Ticketbis. The VC was the lead investor in 18 funding rounds to date, with the most recent being a €1-million round for sales and marketing platform Whisbi.

Swanlaab Venture Factory: €40 million funding chest to give power to the people

The female co-founder of Swanlaab Venture Factory believes that diversity enriches decision-making and drives performance. CompassList recently caught up with Verónica Trapa Díaz-Obregón to find out what's in store for Spain's first Israeli-backed VC fund

Turning Singapore into an Edible Garden City

Urban agriculture startup Edible Garden City embraces new tech for intensive, space-saving farming while staying true to its community-driven values

Faraday Venture Partners’ MP Gonzalo Tradacete: “We are actively looking for startups”

Amid the Covid-19 slump, Faraday Venture Partners' CIO and MP shares his expectations for startup investments and favored sectors, the measures his firm has taken so far to help investees ride out the crisis, and more.

Jakarta Smart City seeks startup solutions for life in post-Covid “new normal”

From collaborative working to cyberbullying, these startups will soon work with Indonesia’s first smart city agency

Zhongzheng Information: Big data and fully integrated services for smart office buildings

Joining the Microsoft for Startups program will boost Zhongzheng's R&D and business expansion in China

Beyond ride-hailing: Gojek, Grab and all their friends

Now that Grab and Go-Jek are in a faceoff on a regional scale, here's a look at how Southeast Asia's two biggest unicorns – and their investors – could be shaping the local digital economies and startup ecosystems

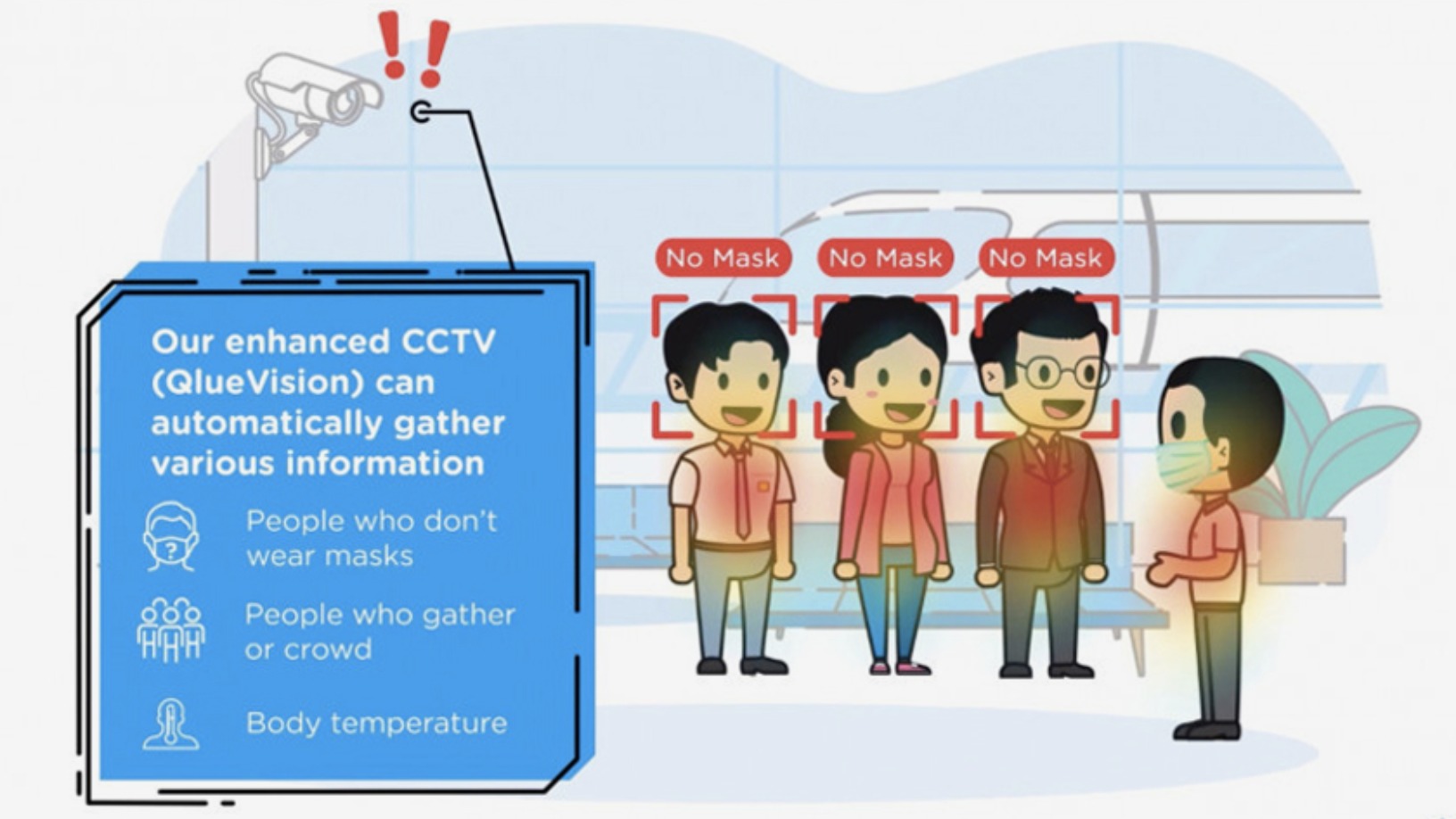

Interview with Qlue CEO: "We didn't know what a smart city should look like"

Co-founder and CEO of Qlue, Indonesia's largest "smart city" company, Rama Raditya explains how citizen involvement – not high-tech – is the true innovation of smart cities and the agent for change; plus how his startup has grown from partnering governments to businesses, and more

EXCLUSIVE: Qlue raising Series B funding, "confident" of turning profitable in 2020

Qlue is also targeting more enterprise clients as it expands overseas and improved accountability and management practices

EXCLUSIVE: Mexico’s Trendier invests in Chicfy as part of €1 million deal

Spain's most popular secondhand fashion marketplace and media darling gets lifeline as it struggles financially to stay afloat

Indonesian smart city tech leader Qlue thrives amid Covid-19 with thermal scanner and B2G refocus

Plans to tilt its client portfolio toward B2B work are delayed as Qlue returns to its B2G roots

Haoqipei: Connecting China's vast B2B auto parts market

Haoqipei not only connects buyers and sellers with a B2B trading platform, it also uses big data to build trust and relationships in a highly fragmented market

As Veniam’s “Internet of Moving Things” keeps growing, autonomous vehicles are next

The Portuguese startup is going places with its mesh networking technology, but that’s “just the beginning”, says Veniam founder and CEO João Barros. He talks to CompassList about partnering automakers to design self-driving cars, raising a new round of funding in 2018, and more

TheVentures founders launch Singapore VC to drive deals in Southeast Asia

The Korean Viki co-founders return to Singapore as venture builders and investors, offering South Korean partnerships and “CTO-as-a-service” in Southeast Asia

4YFN: Investment booms across Europe during pandemic

Speaking at the recent 4YFN conference, prolific European startup investor Mattias Ljungman provided a highly optimistic assessment of the continent's current ecosystem strength and climate for seed funding

For equality in education, Odilo brings books in the cloud free to millions worldwide

The "Amazon for digital content" Spanish edtech startup delivers virtual libraries and classrooms to kids and adults worldwide

Sorry, we couldn’t find any matches for“The Venture City”.