The Venture City

DATABASE (998)

ARTICLES (811)

BASF Venture Capital is the investment arm of the BASF Group. Founded in 2001, the VC also has offices in Ludwigshafen, San Francisco, Boston, Austin, Shanghai, Sao Paulo, Mumbai and Tel Aviv.Global investments include stakes in young, fast-growing companies involved in agritech, chemistry, new materials, sustainability, digitalization and disruptive business models. The firm also holds shares in technology funds that target enterprises in Asia, North America and South America.

BASF Venture Capital is the investment arm of the BASF Group. Founded in 2001, the VC also has offices in Ludwigshafen, San Francisco, Boston, Austin, Shanghai, Sao Paulo, Mumbai and Tel Aviv.Global investments include stakes in young, fast-growing companies involved in agritech, chemistry, new materials, sustainability, digitalization and disruptive business models. The firm also holds shares in technology funds that target enterprises in Asia, North America and South America.

The earliest backer of Xiaomi and an early investor in YY, Morningside Venture Capital started in 2008 and is part of HK real estate tycoon Ronnie Chan's Morningside Group. Today, led by Richard Liu, the early-stage investor has over US$1.5 billion under management and counts among its other successful investments Sohu, Ctrip, Xunlei and China Distance Education. It has offices in Shanghai, Beijing and Hong Kong.

The earliest backer of Xiaomi and an early investor in YY, Morningside Venture Capital started in 2008 and is part of HK real estate tycoon Ronnie Chan's Morningside Group. Today, led by Richard Liu, the early-stage investor has over US$1.5 billion under management and counts among its other successful investments Sohu, Ctrip, Xunlei and China Distance Education. It has offices in Shanghai, Beijing and Hong Kong.

The Madrid-based JME Venture Capital invests mostly in early-stage Spanish technology startups, from seed to Series A rounds. The fund was launched in 2016, worth €50 million, and is headed by CEO Javier Alarcó and CIO Samuel Gil.JME VC is part of the Fundación José Manuel Entrecanales, an innovation and entrepreneurship foundation started and headed by José Manuel Entrecanales Domecq, the boss of Spanish infrastructure giant Acciona.

The Madrid-based JME Venture Capital invests mostly in early-stage Spanish technology startups, from seed to Series A rounds. The fund was launched in 2016, worth €50 million, and is headed by CEO Javier Alarcó and CIO Samuel Gil.JME VC is part of the Fundación José Manuel Entrecanales, an innovation and entrepreneurship foundation started and headed by José Manuel Entrecanales Domecq, the boss of Spanish infrastructure giant Acciona.

PT Prasetia Dwidharma is a telecommunications infrastructure contractor that focuses on base transceiver station (BTS) construction projects. The company was founded in 2008 by Budi Setiadharma, the chairman of the board of Indonesian conglomerate PT Astra Internasional. Besides its contractor business, the company has also invested in notable startups such as Indonesia’s smart city app Qlue and online language course site SquLine.com.

PT Prasetia Dwidharma is a telecommunications infrastructure contractor that focuses on base transceiver station (BTS) construction projects. The company was founded in 2008 by Budi Setiadharma, the chairman of the board of Indonesian conglomerate PT Astra Internasional. Besides its contractor business, the company has also invested in notable startups such as Indonesia’s smart city app Qlue and online language course site SquLine.com.

Country Garden Venture Capital

Founded in 2019, Country Garden Venture Capital is the corporate venturing arm of Chinese real estate developer Country Garden. With its parent company as the cornerstone investor, it is focused on certain sectors of the supply chain, namely, technology, healthcare and consumption. As of March 2021, Country Garden Venture Capital has invested around RMB 10bn in over 50 companies with an average return above 80%. Among them, 15 have achieved unicorn status ($1bn in valuation), while four have successfully gone public.

Founded in 2019, Country Garden Venture Capital is the corporate venturing arm of Chinese real estate developer Country Garden. With its parent company as the cornerstone investor, it is focused on certain sectors of the supply chain, namely, technology, healthcare and consumption. As of March 2021, Country Garden Venture Capital has invested around RMB 10bn in over 50 companies with an average return above 80%. Among them, 15 have achieved unicorn status ($1bn in valuation), while four have successfully gone public.

CNBB Venture Partners is a Dutch fund with 30+ years' experience in the SaaS cloud industry – the company’s main investment focus. Through the VC fund, CNBB invests in funding rounds from €500,000 to €5m, usually provided to companies with a minimum of €1m annual recurring revenue.Through the private equity vehicle, CNBB identifies and acquires Europe-based SaaS companies active in markets with consistent growth, profitability and consolidation. CNBB provides equity investment from €3m to €10m.

CNBB Venture Partners is a Dutch fund with 30+ years' experience in the SaaS cloud industry – the company’s main investment focus. Through the VC fund, CNBB invests in funding rounds from €500,000 to €5m, usually provided to companies with a minimum of €1m annual recurring revenue.Through the private equity vehicle, CNBB identifies and acquires Europe-based SaaS companies active in markets with consistent growth, profitability and consolidation. CNBB provides equity investment from €3m to €10m.

Co-founder of Mindstores

Armed with a master’s in Multimedia Arts from Birmingham City University in the UK, Jeffrey Budiman is an experienced creative and branding professional. After his master’s in 2003, he worked at a strategic brand consultancy company DM Brands for five years. He developed a new brand agency DM ID with Daniel Surya. Jeffrey joined Daniel’s WIR Group as CTO and also became a director of WIR’s brand technology unit Spacesym, now known as Redspace.

Armed with a master’s in Multimedia Arts from Birmingham City University in the UK, Jeffrey Budiman is an experienced creative and branding professional. After his master’s in 2003, he worked at a strategic brand consultancy company DM Brands for five years. He developed a new brand agency DM ID with Daniel Surya. Jeffrey joined Daniel’s WIR Group as CTO and also became a director of WIR’s brand technology unit Spacesym, now known as Redspace.

CEO and founder of Swan Daojia (formerly 58 Daojia)

Chen received a bachelor’s degree in material formation from Xiangtan University in 2004. While in college, he co-founded 0755.org.cn, one of the earliest online classifieds providers in China. He is also a co-founder of dunsh.org, a nonprofit search engine optimization website in China. After graduation, he served as senior project manager and chief editor at Xiamen Haowei Network Technology. From June–December 2007, Chen served as head of the product department at ganji.com, an online classified site, responsible for product management and customer experience. He then joined 58.com the same year, serving as senior VP of product management and website operation from December 2007 to August 2014.In November 2014, he founded 58 Daojia and has served as CEO since then. In August 2017, 58 Daojia announced a merger with 58 Su Yun and Gogovan, a logistics platform in Southeast Asia, and he became Chairman of the new company. The merger created Asia's largest city-to-city cargo delivery platform. In 2018, 58 Daojia was rebranded as Daojia Group. The group’s 58 Su Yun received $250m funding and was relaunched as Kuaigou Express.

Chen received a bachelor’s degree in material formation from Xiangtan University in 2004. While in college, he co-founded 0755.org.cn, one of the earliest online classifieds providers in China. He is also a co-founder of dunsh.org, a nonprofit search engine optimization website in China. After graduation, he served as senior project manager and chief editor at Xiamen Haowei Network Technology. From June–December 2007, Chen served as head of the product department at ganji.com, an online classified site, responsible for product management and customer experience. He then joined 58.com the same year, serving as senior VP of product management and website operation from December 2007 to August 2014.In November 2014, he founded 58 Daojia and has served as CEO since then. In August 2017, 58 Daojia announced a merger with 58 Su Yun and Gogovan, a logistics platform in Southeast Asia, and he became Chairman of the new company. The merger created Asia's largest city-to-city cargo delivery platform. In 2018, 58 Daojia was rebranded as Daojia Group. The group’s 58 Su Yun received $250m funding and was relaunched as Kuaigou Express.

LGT Venture Philanthropy is an independent charitable foundation that supports organizations and companies which implement solutions that contribute to the achievement of sustainable development goals. It strives to improve the quality of life of disadvantaged people, contribute to healthy ecosystems and build resilient, inclusive and prosperous communities. LGT supports the growth of innovative social organizations by providing them with a tailored combination of growth capital, access to business skills, management know-how and strategic advice.

LGT Venture Philanthropy is an independent charitable foundation that supports organizations and companies which implement solutions that contribute to the achievement of sustainable development goals. It strives to improve the quality of life of disadvantaged people, contribute to healthy ecosystems and build resilient, inclusive and prosperous communities. LGT supports the growth of innovative social organizations by providing them with a tailored combination of growth capital, access to business skills, management know-how and strategic advice.

Co-founder and CEO of Crowde

Yohanes Sugihtononugroho is an experienced serial entrepreneur who started his first venture, a shoe manufacturing company, while reading his degree in Business at Universitas Prasetiya Mulya, Indonesia. As a student, he had also established agricultural and fashion-related businesses and continued to do so after graduation. His current venture is Crowde, a crowd investment platform connecting farmers and individual investors. Yohanes holds a Professional Development Certificate in Entrepreneurship from Stanford University.

Yohanes Sugihtononugroho is an experienced serial entrepreneur who started his first venture, a shoe manufacturing company, while reading his degree in Business at Universitas Prasetiya Mulya, Indonesia. As a student, he had also established agricultural and fashion-related businesses and continued to do so after graduation. His current venture is Crowde, a crowd investment platform connecting farmers and individual investors. Yohanes holds a Professional Development Certificate in Entrepreneurship from Stanford University.

China Merchants Venture, a subsidiary of China Merchants Group, was founded in November 2015. It is headquartered in Shenzhen and has opened offices in Beijing, Hong Kong, Israel and Silicon Valley. The company invests in finance, real estate, logistics, transportation, healthcare, AI, among other industries. Of the RMB 5 bn capital under its management, RMB 2bn is earmarked for a fund of funds (FOF) and the other RMB 3 bn for direct investment. As of April 2019, the FOF has invested in 28 early and growth stage funds, and directly invested in over 50 startups.

China Merchants Venture, a subsidiary of China Merchants Group, was founded in November 2015. It is headquartered in Shenzhen and has opened offices in Beijing, Hong Kong, Israel and Silicon Valley. The company invests in finance, real estate, logistics, transportation, healthcare, AI, among other industries. Of the RMB 5 bn capital under its management, RMB 2bn is earmarked for a fund of funds (FOF) and the other RMB 3 bn for direct investment. As of April 2019, the FOF has invested in 28 early and growth stage funds, and directly invested in over 50 startups.

Founded in June 2015, Horizon Robotics is an AI solutions provider. Devices carrying its AI systems have been widely applied in smart driving, smart city and smart retail scenarios. Horizon developed China’s first embedded AI processors for computer vision tasks: the Sunrise 1.0 Processor, which is used in smart cameras, and the Journey 1.0 Processor, which is used in autonomous vehicles.

Founded in June 2015, Horizon Robotics is an AI solutions provider. Devices carrying its AI systems have been widely applied in smart driving, smart city and smart retail scenarios. Horizon developed China’s first embedded AI processors for computer vision tasks: the Sunrise 1.0 Processor, which is used in smart cameras, and the Journey 1.0 Processor, which is used in autonomous vehicles.

Bpifrance Large Venture is the growth equity arm of French state investor Bpifrance. It is a €1bn VC fund focused on high-growth, capital-intensive, innovative tech and life sciences companies that have already raised capital. It invests minority stakes of at least €10m as well as co-invests alongside current or new investors in rounds of at least about €20m. It has invested €600m to date and currently has 34 portfolio companies, including 18 listed ones.

Bpifrance Large Venture is the growth equity arm of French state investor Bpifrance. It is a €1bn VC fund focused on high-growth, capital-intensive, innovative tech and life sciences companies that have already raised capital. It invests minority stakes of at least €10m as well as co-invests alongside current or new investors in rounds of at least about €20m. It has invested €600m to date and currently has 34 portfolio companies, including 18 listed ones.

Co-Founder and CEO of Tokopedia

North Sumatran native from Pematangsiantar city, William Tanuwijaya, holds a bachelor’s degree in Information Technology from Bina Nusantara University. After graduation, he worked as a software developer in various companies. In 2006, he joined the content provider company, PT Indocom Mediatama, as an IT and Business Development Manager; where he met co-founder Leontinus Alpha Edison and future Tokopedia investor Victor Fungkong. When Tokopedia merged with Gojek in 2021, Tanuwijaya remained as Tokopedia’s CEO.

North Sumatran native from Pematangsiantar city, William Tanuwijaya, holds a bachelor’s degree in Information Technology from Bina Nusantara University. After graduation, he worked as a software developer in various companies. In 2006, he joined the content provider company, PT Indocom Mediatama, as an IT and Business Development Manager; where he met co-founder Leontinus Alpha Edison and future Tokopedia investor Victor Fungkong. When Tokopedia merged with Gojek in 2021, Tanuwijaya remained as Tokopedia’s CEO.

With a special interest in enterprise tech, Silicon Valley-based Omega Venture Partners has 25 startups in its portfolio and, to date, has invested from pre-seed to Series E stages. It has managed eight exits to date. Its most recent investments were in the 2020 $55m Series B round of US-based small business management platform ZenBusiness and in the February 2021 $50m Series B round of US voice transcription software Otter.ai. The investor boasts an extensive network of major corporations as advisors and partners including Google, Microsoft, Amazon, IBM, SAP and CitiGroup.

With a special interest in enterprise tech, Silicon Valley-based Omega Venture Partners has 25 startups in its portfolio and, to date, has invested from pre-seed to Series E stages. It has managed eight exits to date. Its most recent investments were in the 2020 $55m Series B round of US-based small business management platform ZenBusiness and in the February 2021 $50m Series B round of US voice transcription software Otter.ai. The investor boasts an extensive network of major corporations as advisors and partners including Google, Microsoft, Amazon, IBM, SAP and CitiGroup.

Swanlaab Venture Factory: €40 million funding chest to give power to the people

The female co-founder of Swanlaab Venture Factory believes that diversity enriches decision-making and drives performance. CompassList recently caught up with Verónica Trapa Díaz-Obregón to find out what's in store for Spain's first Israeli-backed VC fund

Turning Singapore into an Edible Garden City

Urban agriculture startup Edible Garden City embraces new tech for intensive, space-saving farming while staying true to its community-driven values

Faraday Venture Partners’ MP Gonzalo Tradacete: “We are actively looking for startups”

Amid the Covid-19 slump, Faraday Venture Partners' CIO and MP shares his expectations for startup investments and favored sectors, the measures his firm has taken so far to help investees ride out the crisis, and more.

Jakarta Smart City seeks startup solutions for life in post-Covid “new normal”

From collaborative working to cyberbullying, these startups will soon work with Indonesia’s first smart city agency

Zhongzheng Information: Big data and fully integrated services for smart office buildings

Joining the Microsoft for Startups program will boost Zhongzheng's R&D and business expansion in China

Beyond ride-hailing: Gojek, Grab and all their friends

Now that Grab and Go-Jek are in a faceoff on a regional scale, here's a look at how Southeast Asia's two biggest unicorns – and their investors – could be shaping the local digital economies and startup ecosystems

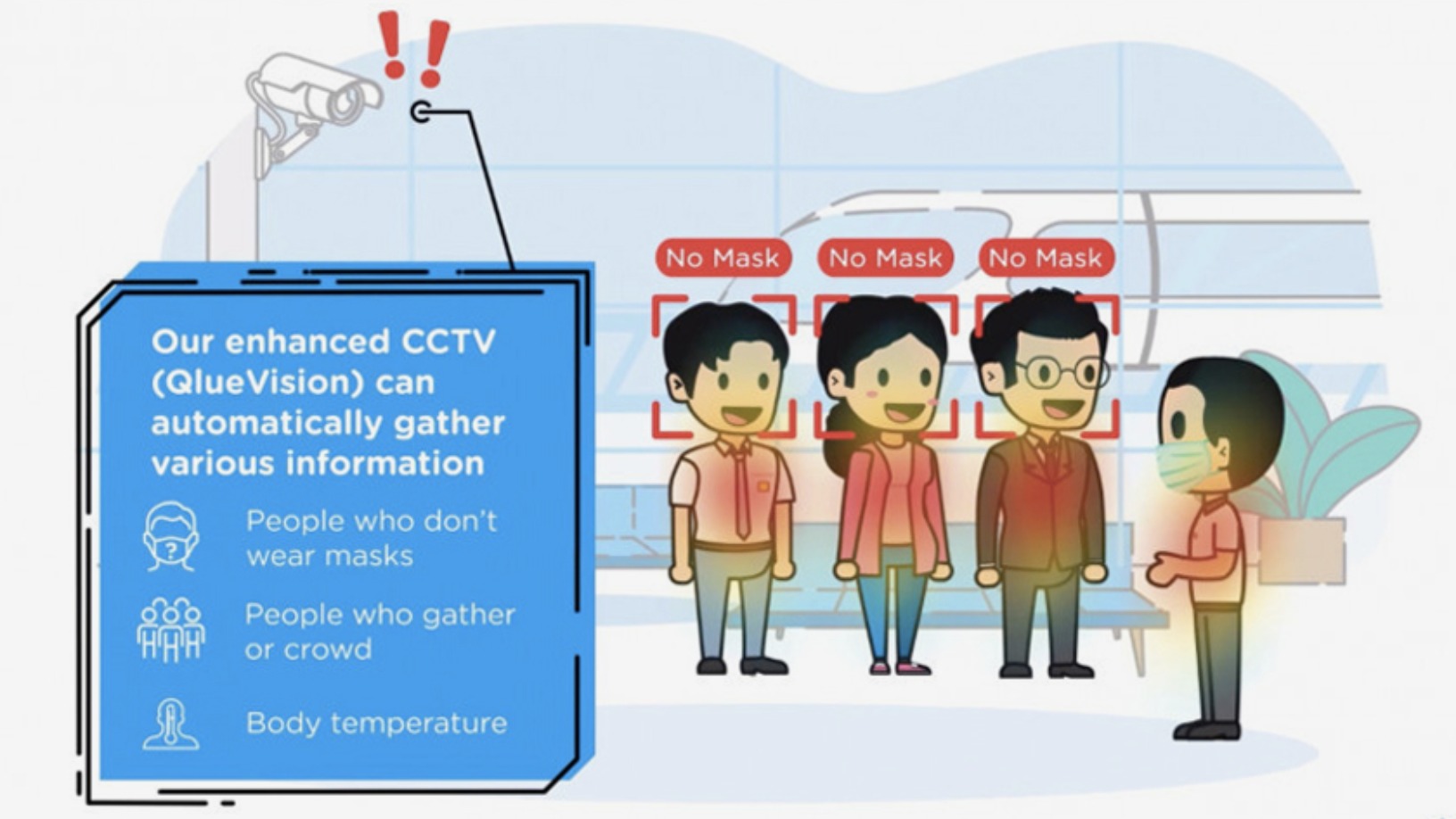

Interview with Qlue CEO: "We didn't know what a smart city should look like"

Co-founder and CEO of Qlue, Indonesia's largest "smart city" company, Rama Raditya explains how citizen involvement – not high-tech – is the true innovation of smart cities and the agent for change; plus how his startup has grown from partnering governments to businesses, and more

EXCLUSIVE: Qlue raising Series B funding, "confident" of turning profitable in 2020

Qlue is also targeting more enterprise clients as it expands overseas and improved accountability and management practices

EXCLUSIVE: Mexico’s Trendier invests in Chicfy as part of €1 million deal

Spain's most popular secondhand fashion marketplace and media darling gets lifeline as it struggles financially to stay afloat

Indonesian smart city tech leader Qlue thrives amid Covid-19 with thermal scanner and B2G refocus

Plans to tilt its client portfolio toward B2B work are delayed as Qlue returns to its B2G roots

Haoqipei: Connecting China's vast B2B auto parts market

Haoqipei not only connects buyers and sellers with a B2B trading platform, it also uses big data to build trust and relationships in a highly fragmented market

As Veniam’s “Internet of Moving Things” keeps growing, autonomous vehicles are next

The Portuguese startup is going places with its mesh networking technology, but that’s “just the beginning”, says Veniam founder and CEO João Barros. He talks to CompassList about partnering automakers to design self-driving cars, raising a new round of funding in 2018, and more

TheVentures founders launch Singapore VC to drive deals in Southeast Asia

The Korean Viki co-founders return to Singapore as venture builders and investors, offering South Korean partnerships and “CTO-as-a-service” in Southeast Asia

4YFN: Investment booms across Europe during pandemic

Speaking at the recent 4YFN conference, prolific European startup investor Mattias Ljungman provided a highly optimistic assessment of the continent's current ecosystem strength and climate for seed funding

For equality in education, Odilo brings books in the cloud free to millions worldwide

The "Amazon for digital content" Spanish edtech startup delivers virtual libraries and classrooms to kids and adults worldwide

Sorry, we couldn’t find any matches for“The Venture City”.