The Venture City

-

DATABASE (998)

-

ARTICLES (811)

Co-founder of Ximalaya

Before co-founding Ximalaya with Yu Jianjun, Chen Xiaoyu worked as an investment director at one of Thailand's largest conglomerates, Charoen Pokphand Group, in its China office. There, she supervised the Group’s investments in internet startups. With seed funding from the Group in 2009, Chen and Yu Jianjun founded their first startup, Na Li Shi Jie, building online virtual city maps. Though the business failed after two years, they utilised the rich experience they gained and founded the much more successful Ximalaya in 2012.

Before co-founding Ximalaya with Yu Jianjun, Chen Xiaoyu worked as an investment director at one of Thailand's largest conglomerates, Charoen Pokphand Group, in its China office. There, she supervised the Group’s investments in internet startups. With seed funding from the Group in 2009, Chen and Yu Jianjun founded their first startup, Na Li Shi Jie, building online virtual city maps. Though the business failed after two years, they utilised the rich experience they gained and founded the much more successful Ximalaya in 2012.

Founded in 2015 in Limassol in Cyprus, Caspian Venture Capital Partners has at least six companies in its portfolio. Its last disclosed investment was in 2017 when it participated in sustainable transportation and magnetic levitation firm Hyperloop’s $135m Series B round. Prior to that, in 2015 it invested in US-based Diamond Foundry, the world’s first certified carbon-neutral lab-produced diamond manufacturer.

Founded in 2015 in Limassol in Cyprus, Caspian Venture Capital Partners has at least six companies in its portfolio. Its last disclosed investment was in 2017 when it participated in sustainable transportation and magnetic levitation firm Hyperloop’s $135m Series B round. Prior to that, in 2015 it invested in US-based Diamond Foundry, the world’s first certified carbon-neutral lab-produced diamond manufacturer.

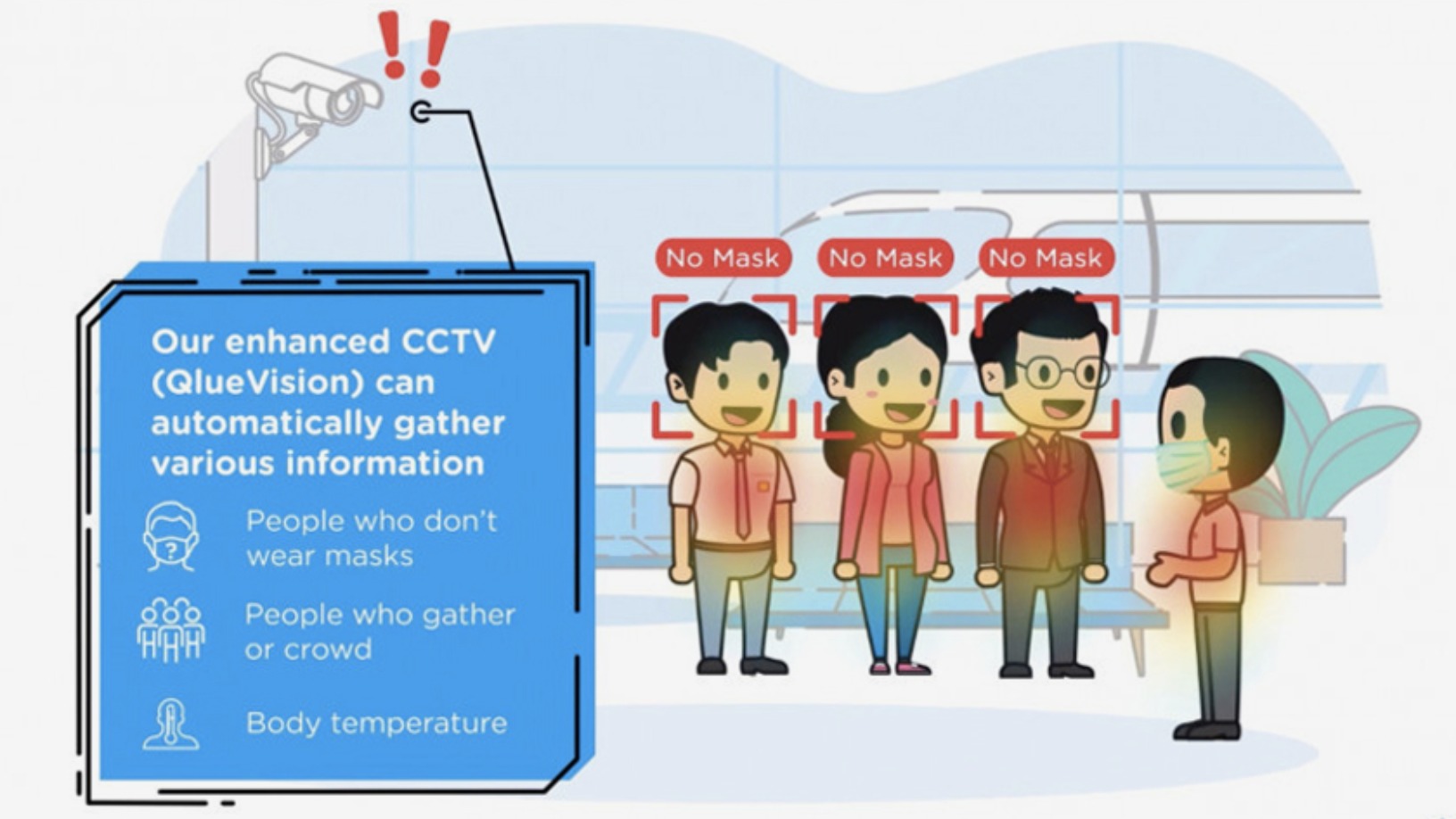

Co-founder and CEO of Qlue

Rama Raditya graduated with a master’s in Management Information Systems in 2005 from Strayer University, USA. He returned to Indonesia and joined PwC as an IT auditor for a year. He then worked at Bank Danamon as an IT auditor and advisor before moving on to Ernst & Young. In 2013, he founded TerralogiQ, which later launched Qlue as part of Jakarta’s Smart City initiative. Rama became the CEO of PT Qlue Performa Indonesia when Qlue was incorporated as a standalone company.

Rama Raditya graduated with a master’s in Management Information Systems in 2005 from Strayer University, USA. He returned to Indonesia and joined PwC as an IT auditor for a year. He then worked at Bank Danamon as an IT auditor and advisor before moving on to Ernst & Young. In 2013, he founded TerralogiQ, which later launched Qlue as part of Jakarta’s Smart City initiative. Rama became the CEO of PT Qlue Performa Indonesia when Qlue was incorporated as a standalone company.

Co-founder of Shuaidanbao

Serial entrepreneur Lu Tong is co-founder of college social networking app Shixiongbangbangmang, microcredit processing platform Shuaidanbao and a luxury brand leasing venture.

Serial entrepreneur Lu Tong is co-founder of college social networking app Shixiongbangbangmang, microcredit processing platform Shuaidanbao and a luxury brand leasing venture.

Founded in Silicon Valley in 2000 by Kate Mitchell and Rory O'Driscoll, Scale Venture Partners invests in 75% early revenue and 25% growth stage companies, with an average initial investment of US$8 million. It's mainly interested in startups that disrupt the workplace and it usually invests between US$5-25 million per funding round. It has invested in more than 200 companies to date and was the lead investor in more than 80 investments. Scale has managed 62 exits to date including DocuSign, Box, HubSpot, Exact Target and Realm. Its recent investments include in Keep Truckin, Pantheon and PubNub's Series D rounds.

Founded in Silicon Valley in 2000 by Kate Mitchell and Rory O'Driscoll, Scale Venture Partners invests in 75% early revenue and 25% growth stage companies, with an average initial investment of US$8 million. It's mainly interested in startups that disrupt the workplace and it usually invests between US$5-25 million per funding round. It has invested in more than 200 companies to date and was the lead investor in more than 80 investments. Scale has managed 62 exits to date including DocuSign, Box, HubSpot, Exact Target and Realm. Its recent investments include in Keep Truckin, Pantheon and PubNub's Series D rounds.

The municipal government of Wuhan launched Wuhan S&T Angel Venture Fund in September 2013. With RMB 300 million under management, the fund is operated by Wuhan S&T Angel Venture Fund Management Co., Ltd. It invests mainly in the information technology, new materials, advanced equipment manufacturing, biomedicine, new energy, automotive, energy conservation, environmental protection and modern agriculture fields.

The municipal government of Wuhan launched Wuhan S&T Angel Venture Fund in September 2013. With RMB 300 million under management, the fund is operated by Wuhan S&T Angel Venture Fund Management Co., Ltd. It invests mainly in the information technology, new materials, advanced equipment manufacturing, biomedicine, new energy, automotive, energy conservation, environmental protection and modern agriculture fields.

Co-founder and COO of Orange 100

Co-founded Orange 100 with Leng Fei. From 2014 to 2016, Yuan was a senior manager at Baidu's Location Based Services division. From 2013 to 2014, he was in charge of business operations at yintai.com, an online department store run by Intime Retail Group Co Ltd. He received his bachelor's degree in E-commerce from Wuhan University of Science and Technology City College in 2011.

Co-founded Orange 100 with Leng Fei. From 2014 to 2016, Yuan was a senior manager at Baidu's Location Based Services division. From 2013 to 2014, he was in charge of business operations at yintai.com, an online department store run by Intime Retail Group Co Ltd. He received his bachelor's degree in E-commerce from Wuhan University of Science and Technology City College in 2011.

Co-founder of Exovite

Mario López de Ávila Muñoz is a Spanish entrepreneur who has established four tech companies, including Exovite and Nodos CTC, the latter in operation since 2001. Muñoz currently works at City_Ex, an initiative aimed at promoting smart city technology among municipalities. He is also a partner at Bip Iberia, a business tech consultancy, where he is focused on enterprise agility. Muñoz holds an Executive MBA from IE Business School and a doctorate in Creativity and Innovation in Industrial Engineering from the Polytechnic University of Madrid.

Mario López de Ávila Muñoz is a Spanish entrepreneur who has established four tech companies, including Exovite and Nodos CTC, the latter in operation since 2001. Muñoz currently works at City_Ex, an initiative aimed at promoting smart city technology among municipalities. He is also a partner at Bip Iberia, a business tech consultancy, where he is focused on enterprise agility. Muñoz holds an Executive MBA from IE Business School and a doctorate in Creativity and Innovation in Industrial Engineering from the Polytechnic University of Madrid.

Flourish Libra Venture Capital

Established in 2010, Flourish Libra Venture Capital is a Fund of Funds (FOF) management firm and focuses on private equity in Greater China. It has invested some funds under Jiuding Capital, Fortune, NewMargin Ventures, Tiantu Capital, SAIF Partners, etc.

Established in 2010, Flourish Libra Venture Capital is a Fund of Funds (FOF) management firm and focuses on private equity in Greater China. It has invested some funds under Jiuding Capital, Fortune, NewMargin Ventures, Tiantu Capital, SAIF Partners, etc.

The VC arm of Kalonia, a Barcelona-based management consultancy focused on corporate digital transformation, Kalonia Venture Partners invests in B2B software, AI and fintech startups in the Spanish-speaking world. The VC is currently investing via its KVP III fund of €4.3m, with a target of 10 investments of about €5m on average each, taking equity stakes of 10% onward in co-investment; plus two follow-ons. Founded by Josep Arroyo, Alejandro Olabarría y Enrique Marugán, Kalonia began helping Spanish investors diversify into Silicon Valley and other US startups as early as 2001. Currently its funds come mainly from Barcelona-based family offices. Co-founder Alejandro Olabarría is son of Pedro Olabarría Delclaux, the powerful patriarch heading one of Spain's richest industrialist families today, with interests across industrial farming, banking, real estate, automotive and paper.

The VC arm of Kalonia, a Barcelona-based management consultancy focused on corporate digital transformation, Kalonia Venture Partners invests in B2B software, AI and fintech startups in the Spanish-speaking world. The VC is currently investing via its KVP III fund of €4.3m, with a target of 10 investments of about €5m on average each, taking equity stakes of 10% onward in co-investment; plus two follow-ons. Founded by Josep Arroyo, Alejandro Olabarría y Enrique Marugán, Kalonia began helping Spanish investors diversify into Silicon Valley and other US startups as early as 2001. Currently its funds come mainly from Barcelona-based family offices. Co-founder Alejandro Olabarría is son of Pedro Olabarría Delclaux, the powerful patriarch heading one of Spain's richest industrialist families today, with interests across industrial farming, banking, real estate, automotive and paper.

Co-founder of Mapan by Ruma

After graduating with an Industrial Engineering degree from Purdue University in the US, Sean DeWitt became a management consultant at PricewaterhouseCoopers. He later worked at the US Department of State and the Fund for New York City.In 2007, he joined the nonprofit Grameen Foundation that was established by Grameen Bank founder Muhammad Yunus. As part of the nonprofit, he helped Aldi Haryopratomo establish the social enterprise Ruma. DeWitt currently works for the World Resource Institute. He also holds master’s degrees in Development Finance and Environmental Economics from the University of London.

After graduating with an Industrial Engineering degree from Purdue University in the US, Sean DeWitt became a management consultant at PricewaterhouseCoopers. He later worked at the US Department of State and the Fund for New York City.In 2007, he joined the nonprofit Grameen Foundation that was established by Grameen Bank founder Muhammad Yunus. As part of the nonprofit, he helped Aldi Haryopratomo establish the social enterprise Ruma. DeWitt currently works for the World Resource Institute. He also holds master’s degrees in Development Finance and Environmental Economics from the University of London.

BayWa Venture GmbH is a subsidiary company of BayWa AG, the German agriculture, energy and construction conglomerate.Putting digitalization at the core of its agriculture strategy, the company is looking to expand its core business into digital services within the existing businesses. It is investigating new digital business models and stand-alone concepts through collaboration with emerging startups focusing on cutting-edge technologies in the agrifood tech space.BayWa started to invest in startups in 2012 mainly focused on online customer management, services and sales platforms. In 2015, the company purchased Farm Facts, a German farm management SaaS and in 2017 invested in Abundant Robotics, a US-based automated harvest company. One of the firms’ most recent investments has been Evja, an Italian startup developing precision farming hardware based on advanced agronomic models and machine learning technology.

BayWa Venture GmbH is a subsidiary company of BayWa AG, the German agriculture, energy and construction conglomerate.Putting digitalization at the core of its agriculture strategy, the company is looking to expand its core business into digital services within the existing businesses. It is investigating new digital business models and stand-alone concepts through collaboration with emerging startups focusing on cutting-edge technologies in the agrifood tech space.BayWa started to invest in startups in 2012 mainly focused on online customer management, services and sales platforms. In 2015, the company purchased Farm Facts, a German farm management SaaS and in 2017 invested in Abundant Robotics, a US-based automated harvest company. One of the firms’ most recent investments has been Evja, an Italian startup developing precision farming hardware based on advanced agronomic models and machine learning technology.

Coatue is a tech sector hedge fund that invests in public and private equity markets. It is run by Philippe Laffont, who founded the hedge fund after leaving Tiger Management in 1999. Coatue is based in New York City and has several other offices around the globe. Its Beijing office was set up in 2014 and has since invested in several notable Chinese startups, including Didi Chuxing, Mafengwo and Kuaikan Comic.

Coatue is a tech sector hedge fund that invests in public and private equity markets. It is run by Philippe Laffont, who founded the hedge fund after leaving Tiger Management in 1999. Coatue is based in New York City and has several other offices around the globe. Its Beijing office was set up in 2014 and has since invested in several notable Chinese startups, including Didi Chuxing, Mafengwo and Kuaikan Comic.

Subtraction Capital is a VC founded by managing partner Jason Portnoy who was previously VP of Financial Planning and Analysis at PayPal Inc.Portnoy supports portfolio companies in their scale-up and hyper-growth stage, working with their CEOs to raise capital, navigate complex negotiations, build and manage teams. The firm typically invests in SaaS startups in the San Francisco Bay Area and Salt Lake City.

Subtraction Capital is a VC founded by managing partner Jason Portnoy who was previously VP of Financial Planning and Analysis at PayPal Inc.Portnoy supports portfolio companies in their scale-up and hyper-growth stage, working with their CEOs to raise capital, navigate complex negotiations, build and manage teams. The firm typically invests in SaaS startups in the San Francisco Bay Area and Salt Lake City.

Co-founder, CTO and Head of Innovation of BEEVERYCREATIVE

Francisco Mendes is the CTO, Head of Innovation and co-founder of BEEVERYCREATIVE, the innovative 3D printer and software producer in Portugal. In 2010, he co-founded the startup's preliminary project bitBOX that was transformed into BEEVERYCREATIVE in 2013.Mendes is also a co-founder of Hardware City, a community of entrepreneurs that links hardware startups to manufacturers. He has worked in R&D at Tellus Mater and Milenio 3 in Portugal. He has a master's in Industrial Automation from the University of Aveiro in Portugal.

Francisco Mendes is the CTO, Head of Innovation and co-founder of BEEVERYCREATIVE, the innovative 3D printer and software producer in Portugal. In 2010, he co-founded the startup's preliminary project bitBOX that was transformed into BEEVERYCREATIVE in 2013.Mendes is also a co-founder of Hardware City, a community of entrepreneurs that links hardware startups to manufacturers. He has worked in R&D at Tellus Mater and Milenio 3 in Portugal. He has a master's in Industrial Automation from the University of Aveiro in Portugal.

Swanlaab Venture Factory: €40 million funding chest to give power to the people

The female co-founder of Swanlaab Venture Factory believes that diversity enriches decision-making and drives performance. CompassList recently caught up with Verónica Trapa Díaz-Obregón to find out what's in store for Spain's first Israeli-backed VC fund

Turning Singapore into an Edible Garden City

Urban agriculture startup Edible Garden City embraces new tech for intensive, space-saving farming while staying true to its community-driven values

Faraday Venture Partners’ MP Gonzalo Tradacete: “We are actively looking for startups”

Amid the Covid-19 slump, Faraday Venture Partners' CIO and MP shares his expectations for startup investments and favored sectors, the measures his firm has taken so far to help investees ride out the crisis, and more.

Jakarta Smart City seeks startup solutions for life in post-Covid “new normal”

From collaborative working to cyberbullying, these startups will soon work with Indonesia’s first smart city agency

Zhongzheng Information: Big data and fully integrated services for smart office buildings

Joining the Microsoft for Startups program will boost Zhongzheng's R&D and business expansion in China

Beyond ride-hailing: Gojek, Grab and all their friends

Now that Grab and Go-Jek are in a faceoff on a regional scale, here's a look at how Southeast Asia's two biggest unicorns – and their investors – could be shaping the local digital economies and startup ecosystems

Interview with Qlue CEO: "We didn't know what a smart city should look like"

Co-founder and CEO of Qlue, Indonesia's largest "smart city" company, Rama Raditya explains how citizen involvement – not high-tech – is the true innovation of smart cities and the agent for change; plus how his startup has grown from partnering governments to businesses, and more

EXCLUSIVE: Qlue raising Series B funding, "confident" of turning profitable in 2020

Qlue is also targeting more enterprise clients as it expands overseas and improved accountability and management practices

EXCLUSIVE: Mexico’s Trendier invests in Chicfy as part of €1 million deal

Spain's most popular secondhand fashion marketplace and media darling gets lifeline as it struggles financially to stay afloat

Indonesian smart city tech leader Qlue thrives amid Covid-19 with thermal scanner and B2G refocus

Plans to tilt its client portfolio toward B2B work are delayed as Qlue returns to its B2G roots

Haoqipei: Connecting China's vast B2B auto parts market

Haoqipei not only connects buyers and sellers with a B2B trading platform, it also uses big data to build trust and relationships in a highly fragmented market

As Veniam’s “Internet of Moving Things” keeps growing, autonomous vehicles are next

The Portuguese startup is going places with its mesh networking technology, but that’s “just the beginning”, says Veniam founder and CEO João Barros. He talks to CompassList about partnering automakers to design self-driving cars, raising a new round of funding in 2018, and more

TheVentures founders launch Singapore VC to drive deals in Southeast Asia

The Korean Viki co-founders return to Singapore as venture builders and investors, offering South Korean partnerships and “CTO-as-a-service” in Southeast Asia

4YFN: Investment booms across Europe during pandemic

Speaking at the recent 4YFN conference, prolific European startup investor Mattias Ljungman provided a highly optimistic assessment of the continent's current ecosystem strength and climate for seed funding

For equality in education, Odilo brings books in the cloud free to millions worldwide

The "Amazon for digital content" Spanish edtech startup delivers virtual libraries and classrooms to kids and adults worldwide

Sorry, we couldn’t find any matches for“The Venture City”.