Tiger Global

-

DATABASE (218)

-

ARTICLES (377)

With about US$20 billion under management worldwide, New York-headquartered Tiger Global Management was founded in 2000 with US$25 million by billionaire Charles "Chase“ Coleman. Part private equity manager, part hedge fund manager, Tiger Global is known for its big bets on tech startups, including some of today's leading names Facebook, LinkedIn, Zynga and Uber.

With about US$20 billion under management worldwide, New York-headquartered Tiger Global Management was founded in 2000 with US$25 million by billionaire Charles "Chase“ Coleman. Part private equity manager, part hedge fund manager, Tiger Global is known for its big bets on tech startups, including some of today's leading names Facebook, LinkedIn, Zynga and Uber.

The most popular app and online brokerage of Chinese-speaking investors to trade US- and HK-listed shares is also backed by the legendary Jim Rogers.

The most popular app and online brokerage of Chinese-speaking investors to trade US- and HK-listed shares is also backed by the legendary Jim Rogers.

Co-founder and CEO of Kargo Technologies

Tiger Fang is the CEO of logistics company Kargo Technologies. He was formerly the Country General Manager for Uber Indonesia. Prior to joining Uber in 2013 and leading its expansion into China, Fang was Assistant Vice President at Bank of America-Merrill Lynch, where he had been an investment analyst. He had earlier moved to Asia in 2012 and had a brief stint at Rocket Internet's Lazada. Fang holds a bachelor's in Business Administration from the University of Hawaii and was enrolled in Harvard Business School's Strategy & Leadership Executive Education program.

Tiger Fang is the CEO of logistics company Kargo Technologies. He was formerly the Country General Manager for Uber Indonesia. Prior to joining Uber in 2013 and leading its expansion into China, Fang was Assistant Vice President at Bank of America-Merrill Lynch, where he had been an investment analyst. He had earlier moved to Asia in 2012 and had a brief stint at Rocket Internet's Lazada. Fang holds a bachelor's in Business Administration from the University of Hawaii and was enrolled in Harvard Business School's Strategy & Leadership Executive Education program.

Co-founder and President of Chinapex

Co-founder and President of Chinapex. Tiger Yang attended high school in Singapore and graduated from the University of California, Berkeley with a Bachelor of Science in Political Economy. Before co-founding Chinapex, Yang managed multiple internal data analytics projects for clients such as Microsoft. He was nominated for the “Innovative Leader of the Year Award” by China Internet Weekly in 2017.

Co-founder and President of Chinapex. Tiger Yang attended high school in Singapore and graduated from the University of California, Berkeley with a Bachelor of Science in Political Economy. Before co-founding Chinapex, Yang managed multiple internal data analytics projects for clients such as Microsoft. He was nominated for the “Innovative Leader of the Year Award” by China Internet Weekly in 2017.

Creator of the integrated supply chain management model, YH Global’s participation in the One Belt One Road Initiative gives it enormous growth potential.

Creator of the integrated supply chain management model, YH Global’s participation in the One Belt One Road Initiative gives it enormous growth potential.

Co-founder and Vice President of Tiger Brokers

Co-founder and Vice President of Tiger Brokers.

Co-founder and Vice President of Tiger Brokers.

The late-stage venture capital and growth equity firm founded and led by Russian billionaire Yuri Milner manages about $10bn in assets. Among its well-known investments are Facebook, Twitter, Alibaba, Xiaomi, JD.com, Spotify, Flipkart and AirBnB.DST Global was founded in 2009 as a means for Milner’s Mail.ru to continue investing at scale, by separately managing investment activities from the Mail.ru primary business. In 2012, Milner stepped down from Mail.ru to focus on DST Global, and DST Global eventually became fully independent from Mail.ru.

The late-stage venture capital and growth equity firm founded and led by Russian billionaire Yuri Milner manages about $10bn in assets. Among its well-known investments are Facebook, Twitter, Alibaba, Xiaomi, JD.com, Spotify, Flipkart and AirBnB.DST Global was founded in 2009 as a means for Milner’s Mail.ru to continue investing at scale, by separately managing investment activities from the Mail.ru primary business. In 2012, Milner stepped down from Mail.ru to focus on DST Global, and DST Global eventually became fully independent from Mail.ru.

Co-founder and Vice President of Tiger Brokers

Co-founder and Vice President of Tiger Brokers. She used to work for Baidu and Tencent.

Co-founder and Vice President of Tiger Brokers. She used to work for Baidu and Tencent.

Founded by pioneering tech investor Ozi Amanat in 2015, K2 Global is a venture capital firm based in Silicon Valley and Singapore. Amanat, who moved to Singapore in 2012, is one of Twitter’s early backers, raising $25m to invest in the social media startup that later went public in 2013. The Harvard graduate in psychology and economics also invested in Uber, Spotify and Alibaba during his career as a venture capitalist. Amanat is the chief investment officer of K2 VC, K2 Global and Singapore-based Spice Global controlled by Indian billionaire B K Modi.In 2017, K2 also announced a $183m VC fund focusing on early-stage startups that aim to address global challenges. The majority of K2 limited partners are based outside the US in countries like Australia, Japan, Singapore, Hong Kong and Indonesia.

Founded by pioneering tech investor Ozi Amanat in 2015, K2 Global is a venture capital firm based in Silicon Valley and Singapore. Amanat, who moved to Singapore in 2012, is one of Twitter’s early backers, raising $25m to invest in the social media startup that later went public in 2013. The Harvard graduate in psychology and economics also invested in Uber, Spotify and Alibaba during his career as a venture capitalist. Amanat is the chief investment officer of K2 VC, K2 Global and Singapore-based Spice Global controlled by Indian billionaire B K Modi.In 2017, K2 also announced a $183m VC fund focusing on early-stage startups that aim to address global challenges. The majority of K2 limited partners are based outside the US in countries like Australia, Japan, Singapore, Hong Kong and Indonesia.

Established in 1995, Richmond Global Ventures is a global venture capital managed by Partners Peter Kellner and David Frazee.

Established in 1995, Richmond Global Ventures is a global venture capital managed by Partners Peter Kellner and David Frazee.

Global Founders Capital is a global venture fund that invests in seed and Series A, or participates in later rounds. It typically does not invest in pre-launch. The venture fund was set up in 2013 by Rocket Internet chief Oliver Samwer, his brother Marc, and former Delivery Hero co-CEO Fabian Siegel as a €150 million fund for high-potential internet businesses.

Global Founders Capital is a global venture fund that invests in seed and Series A, or participates in later rounds. It typically does not invest in pre-launch. The venture fund was set up in 2013 by Rocket Internet chief Oliver Samwer, his brother Marc, and former Delivery Hero co-CEO Fabian Siegel as a €150 million fund for high-potential internet businesses.

Target Global is an international venture capital firm based in Berlin with offices in London, Tel Aviv and Barcelona.The firm has a total of more than €800m in assets under management, investing mainly in fast-growing tech startups across multiple investment stages and focusing on trillion-euro markets.

Target Global is an international venture capital firm based in Berlin with offices in London, Tel Aviv and Barcelona.The firm has a total of more than €800m in assets under management, investing mainly in fast-growing tech startups across multiple investment stages and focusing on trillion-euro markets.

Global Brain Corporation is an early stage venture capital fund based in Tokyo, Japan. It was founded in 1998 and has expanded globally, with offices in South Korea’s Seoul, Southeast Asia and Silicon Valley, USA. Leveraging its global network, the company aims to nurture world-class venture companies through investments and hands-on support. It also offers corporate venture capital fund management services and currently manages three such funds.

Global Brain Corporation is an early stage venture capital fund based in Tokyo, Japan. It was founded in 1998 and has expanded globally, with offices in South Korea’s Seoul, Southeast Asia and Silicon Valley, USA. Leveraging its global network, the company aims to nurture world-class venture companies through investments and hands-on support. It also offers corporate venture capital fund management services and currently manages three such funds.

VNV Global was originally founded as Vostok Nafta in 1996, with its first investment in Russia. The investment vehicle initially focused on investments in agriculture and natural resources, but began to diversify into early consumer internet companies like Avito and Tinkoff Bank. Shares were listed on NASDAQ OMX and the VC pivoted to high-growth tech investments in 2007. In 2015, the name was changed to Vostok New Ventures and shortened to VNV Global in 2020 to reflect its international strategy to expand outside Europe.The mid-cap NASDAQ Stockholm exchange-listed VNV mainly invests in mobility, medtech and marketplaces. It currently has 31 startups in its portfolio and six exits managed to date. Recent investments led by VNV include the $43m Series B funding of London-based food waste app OLIO in September 2021 and the $1.6m seed round of Vietnamese dating app Fika in October 2021.

VNV Global was originally founded as Vostok Nafta in 1996, with its first investment in Russia. The investment vehicle initially focused on investments in agriculture and natural resources, but began to diversify into early consumer internet companies like Avito and Tinkoff Bank. Shares were listed on NASDAQ OMX and the VC pivoted to high-growth tech investments in 2007. In 2015, the name was changed to Vostok New Ventures and shortened to VNV Global in 2020 to reflect its international strategy to expand outside Europe.The mid-cap NASDAQ Stockholm exchange-listed VNV mainly invests in mobility, medtech and marketplaces. It currently has 31 startups in its portfolio and six exits managed to date. Recent investments led by VNV include the $43m Series B funding of London-based food waste app OLIO in September 2021 and the $1.6m seed round of Vietnamese dating app Fika in October 2021.

Founded in 2001, Mitsui Global Investment is a subsidiary of Mitsui & Co. The firm typically invests in the US, and has offices in Silicon Valley, New York, Shanghai, Beijing and Mumbai.

Founded in 2001, Mitsui Global Investment is a subsidiary of Mitsui & Co. The firm typically invests in the US, and has offices in Silicon Valley, New York, Shanghai, Beijing and Mumbai.

Patamar Capital’s impact investing: On preferred business model, backing women, Mapan

The pioneer in impact investing in Asia gives us the lowdown on its investment criteria, its new focus on women entrepreneurs and related sectors, how it helps its portfolio companies and more

UBTECH: CES robotics star wants to bring humanoid robots to every family

UBTECH’s next-generation bipedal robot recently made an impressive global debut, and the startup’s founder has once again become the focus of attention

Beemine Lab: Nurturing the fast-growing CBD cosmetics market

The first biotech company in Spain to produce CBD-rich cosmetics, The Beemine Lab is in a market poised to reach nearly $1bn by 2024, or 10% of the total skincare market

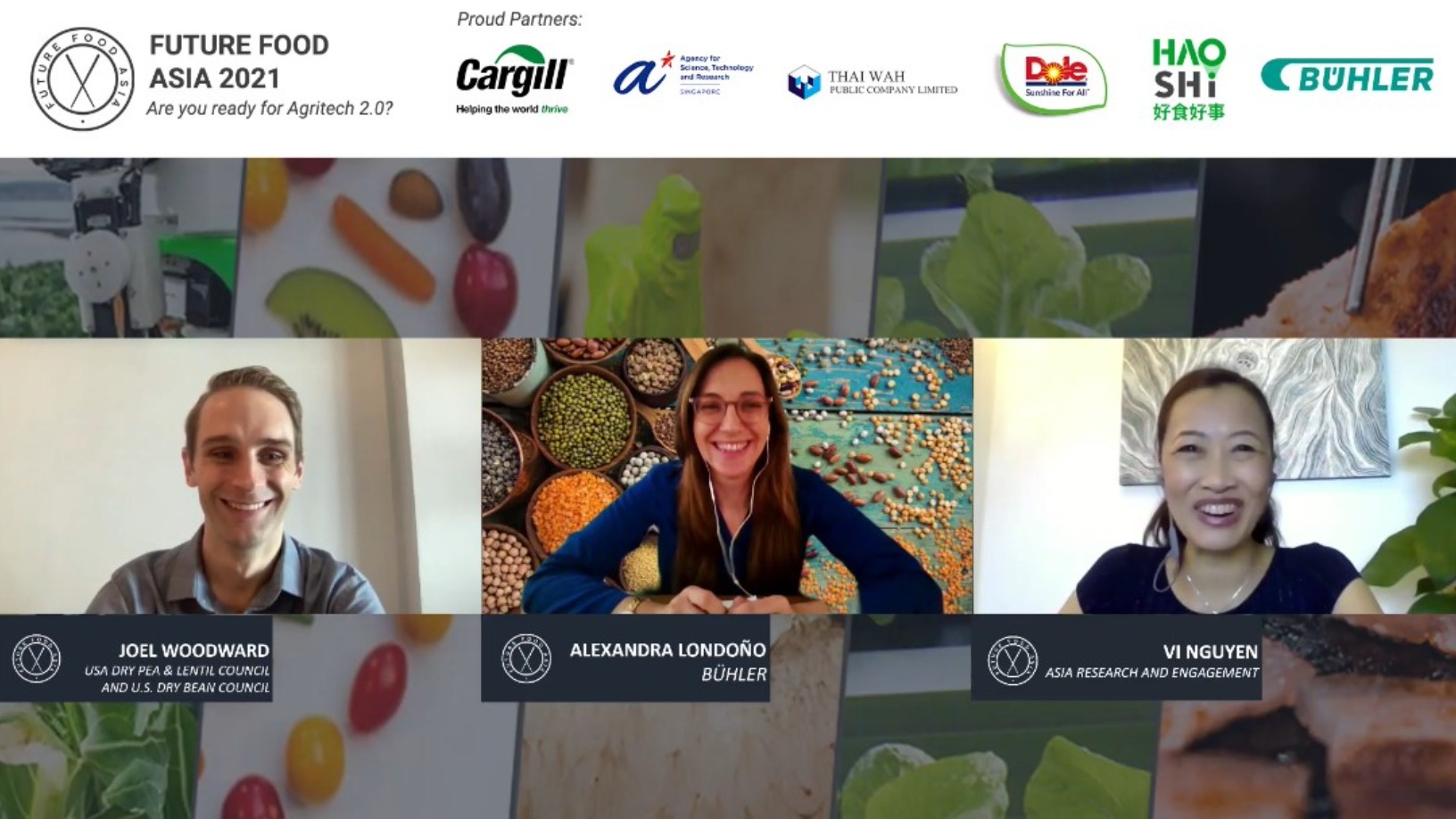

Future Food Asia 2021: Potential of pulses in the alt-protein space

Asia presents a unique opportunity for pulses as people in the region, who traditionally fractionated pulses for starch, now see protein as a useful byproduct

Swanlaab Venture Factory: €40 million funding chest to give power to the people

The female co-founder of Swanlaab Venture Factory believes that diversity enriches decision-making and drives performance. CompassList recently caught up with Verónica Trapa Díaz-Obregón to find out what's in store for Spain's first Israeli-backed VC fund

Amid Covid-19, contactless smart mailbox startup Mayordomo eyes €75m revenue by 2024

Mayordomo's Smart Point app-locker system helps consumers get the best deals online while minimizing CO2 emissions from multiple vendors’ last-mile deliveries

GeoDB: Empowering consumers through monetizing their digital data

Consumers and businesses, and not just tech giants, should tap the value of big data too, says blockchain-based data trading platform GeoDB, which has raised £5.5m since 2018

Tuya Smart announces more partnerships, files for IPO in the US

Tuya Smart’s platform enables the creation of smart devices with little or no code writing needed, shortening R&D from months to a matter of days

CoRTP: Building sustainable supply chains with returnable packaging

The Shanghai-based startup’s award-winning returnable transit packaging reduced carbon emissions in 2020 by 250,000 tons, and the figure is estimated to reach 8m by 2030

An AI future as seen through Chinese retail

Retail provides a good contemporary case study for how an AI future might look in China

Triporate: Producing business travel itineraries and bookings 10x faster than human agents

Triporate helps corporates save time and money with its automated travel bookings from analyzing staff emails; it raised €1.3m recently

AgroCenta: Providing market access and credit to African smallholder farmers

AgroCenta’s platforms empower Ghanaian subsistence farmers, especially women, boosting productivity and sales with e-payments, micro-credits and insurance, and direct connections to buyers, cutting out the intermediaries

Science4you cancels IPO amid market jitters, foresees slower growth

Portugal's largest toymaker will continue to focus on international markets, digital boost

iOLAND: Farm management technology created for and by farmers

Precision farming startup iOLAND provides farmers recommendations based on data collected by its IoT devices and refined by machine learning

Data integration platform Onna accelerates growth with Covid-19 boost

Corporates use up to 80 different apps in their workflows. Slack- and Dropbox-backed Onna is a central platform integrating all that fragmented data, giving companies greater control

Sorry, we couldn’t find any matches for“Tiger Global”.