Top Seed Lab

-

DATABASE (380)

-

ARTICLES (440)

Based in Frankfurt, GreenTec Capital Partners is a German social impact investor that focuses on supporting African tech and non-tech startups. The VC plans to increase its investment portfolio to a total of 400 enterprises by 2023. Its current stake in 20 startups is estimated to be €32.5m. In 2020, GreenTec joined the pre-seed round of Nigerian online food cooperative Principally and seed round of Freshbag, a farmers’ marketplace in Cameroon. Recent investments also include AgroCenta’s seed funding in January 2021.

Based in Frankfurt, GreenTec Capital Partners is a German social impact investor that focuses on supporting African tech and non-tech startups. The VC plans to increase its investment portfolio to a total of 400 enterprises by 2023. Its current stake in 20 startups is estimated to be €32.5m. In 2020, GreenTec joined the pre-seed round of Nigerian online food cooperative Principally and seed round of Freshbag, a farmers’ marketplace in Cameroon. Recent investments also include AgroCenta’s seed funding in January 2021.

Navarre-based Orizont is a Spanish accelerator that invests in its accelerated companies at the pre-seed and seed stages. It invests in agritech and local startups. Established in 2015, Orizont is managed by Sodena, the development agency of the Navarre Autonomous Community. It has accelerated 22 companies to date.

Navarre-based Orizont is a Spanish accelerator that invests in its accelerated companies at the pre-seed and seed stages. It invests in agritech and local startups. Established in 2015, Orizont is managed by Sodena, the development agency of the Navarre Autonomous Community. It has accelerated 22 companies to date.

Co-founder of Reworld

Yao Guangshi is a well-known game distributor and angel investor in the gaming industry. Born in 1972, he graduated from the University of Shanghai for Science and Technology in 1992. He studied for an EMBA in Renmin University of China from 2011 to 2013. In 1995, he joined the edible oil manufacturer Luhua Group, where he was in charge of import and export management. He founded Jinshi Software in 1997. In 2003, he became the exclusive distributor of many prominent gaming companies like Tencent and Shengqu Games in Shandong province. In 2008, he founded Xinhe Technology as an exclusive distributor for top games including Genghis Khan and Shumen. He invested in the online game developer Locojoy in 2011 and joined the company in 2013. In 2018, he co-founded Beijing Code View Technology, which launched Reworld in 2019.

Yao Guangshi is a well-known game distributor and angel investor in the gaming industry. Born in 1972, he graduated from the University of Shanghai for Science and Technology in 1992. He studied for an EMBA in Renmin University of China from 2011 to 2013. In 1995, he joined the edible oil manufacturer Luhua Group, where he was in charge of import and export management. He founded Jinshi Software in 1997. In 2003, he became the exclusive distributor of many prominent gaming companies like Tencent and Shengqu Games in Shandong province. In 2008, he founded Xinhe Technology as an exclusive distributor for top games including Genghis Khan and Shumen. He invested in the online game developer Locojoy in 2011 and joined the company in 2013. In 2018, he co-founded Beijing Code View Technology, which launched Reworld in 2019.

CEO and co-founder of iLoF

Recognized by Forbes as one of the Top 30 Under 30 for science and healthcare, Luís Valente completed a master’s thesis in electrical and computer engineering at the University of Porto in Portugal. He also has won awards at the Global Management Challenge and the Global Marketing Competition.In 2009, he founded Gadgets4All, an online store supplying novelty gadgets in Portugal. While running his online business, he worked at Eurosider in the steel sector for over eight years in the technical support and procurement and supply chain departments. He exited the online business in 2016.In 2018, Valente joined INESC Technology and Science as a researcher in project management, procurement & supply chains. In May 2019, he left to work as a business manager for seven months at Portuguese startup Veniam. Valente left Veniam to focus full-time as CEO and co-founder of iLoF.

Recognized by Forbes as one of the Top 30 Under 30 for science and healthcare, Luís Valente completed a master’s thesis in electrical and computer engineering at the University of Porto in Portugal. He also has won awards at the Global Management Challenge and the Global Marketing Competition.In 2009, he founded Gadgets4All, an online store supplying novelty gadgets in Portugal. While running his online business, he worked at Eurosider in the steel sector for over eight years in the technical support and procurement and supply chain departments. He exited the online business in 2016.In 2018, Valente joined INESC Technology and Science as a researcher in project management, procurement & supply chains. In May 2019, he left to work as a business manager for seven months at Portuguese startup Veniam. Valente left Veniam to focus full-time as CEO and co-founder of iLoF.

A UK-based investor founded in 2018, Haatch currently has 14 mainly UK and Ireland-based companies in its portfolio, valued in excess of $160m. It has launched two funds to date and typically makes investments from £100,000 to £300,000 and up to £2m for Series A or B rounds. Its most recent investments include a £470,000 seed round in VR training soft-skills provider Bodyswaps, an undisclosed seed round in virtual office workspace Re-Flow, and a £155,000 post-seed round in tech development team provider Deazy. In many cases, Haatch is the sole investor.

A UK-based investor founded in 2018, Haatch currently has 14 mainly UK and Ireland-based companies in its portfolio, valued in excess of $160m. It has launched two funds to date and typically makes investments from £100,000 to £300,000 and up to £2m for Series A or B rounds. Its most recent investments include a £470,000 seed round in VR training soft-skills provider Bodyswaps, an undisclosed seed round in virtual office workspace Re-Flow, and a £155,000 post-seed round in tech development team provider Deazy. In many cases, Haatch is the sole investor.

Founded in 2012 in Geneva, Seedstars is one of the world’s largest accelerators with programs operating globally including Seedstars Global Startup Competition for emerging economies and seed-stage investors. Seedstars is also an investor, focusing on supporting startups founded in emerging economies across market segments. Its portfolio of 60 companies includes startups from its accelerator programs and participation in the $30,000 pre-seed round for Mexican loan fintech DB Menos. It is also one of two impact investors backing the $530,000 seed funding round for Bangladeshi cloud-kitchen and delivery startup Kludio.

Founded in 2012 in Geneva, Seedstars is one of the world’s largest accelerators with programs operating globally including Seedstars Global Startup Competition for emerging economies and seed-stage investors. Seedstars is also an investor, focusing on supporting startups founded in emerging economies across market segments. Its portfolio of 60 companies includes startups from its accelerator programs and participation in the $30,000 pre-seed round for Mexican loan fintech DB Menos. It is also one of two impact investors backing the $530,000 seed funding round for Bangladeshi cloud-kitchen and delivery startup Kludio.

Notpla (formerly Skipping Rocks Lab)

Compostable and edible seaweed-based packaging in a flexible product for many uses to replace polluting plastic, winning accolades from WIRED, Fortune and TIME.

Compostable and edible seaweed-based packaging in a flexible product for many uses to replace polluting plastic, winning accolades from WIRED, Fortune and TIME.

Zurich-based Übermorgen Ventures was founded in 2019 to invest in climate-change startups that focus on reducing greenhouse gas emissions. The VC has invested in five startups including recent participation in the €500,000 seed investment of German low-cost solar provider Sunvigo in January 2021 and the $6.2m seed round of Finnish biocarbon startup Carbo Culture in April.

Zurich-based Übermorgen Ventures was founded in 2019 to invest in climate-change startups that focus on reducing greenhouse gas emissions. The VC has invested in five startups including recent participation in the €500,000 seed investment of German low-cost solar provider Sunvigo in January 2021 and the $6.2m seed round of Finnish biocarbon startup Carbo Culture in April.

Shell Foundation is the not-for-profit investment arm of the global energy giant Shell. Based in London, the foundation was set up in 2000 to invest in social and environmental impact companies, including startups with the potential to reach out to over 10m low-income consumers and achieve financial viability within 10 years. The foundation mainly invests at the pre-seed and seed funding stage and currently has 77 startups in its portfolio. In January 2021, it joined the $790,000 seed round of African agritech social enterprise AgroCenta and also gave a $350,000 grant to sustainable mobility platform Easy Matatu in Uganda.

Shell Foundation is the not-for-profit investment arm of the global energy giant Shell. Based in London, the foundation was set up in 2000 to invest in social and environmental impact companies, including startups with the potential to reach out to over 10m low-income consumers and achieve financial viability within 10 years. The foundation mainly invests at the pre-seed and seed funding stage and currently has 77 startups in its portfolio. In January 2021, it joined the $790,000 seed round of African agritech social enterprise AgroCenta and also gave a $350,000 grant to sustainable mobility platform Easy Matatu in Uganda.

Portuguese venture capital firm Best Horizon was established in 2014. Since then, its portfolio has grown to about 50 companies based in Portugal, Spain, the Netherlands, Brazil and the US. The firm has €3m in two investment vehicles for pre-seed and seed investments in tech companies that either have their headquarters or a subsidiary in the North, Centre, Alentejo and Azores regions of Portugal.

Portuguese venture capital firm Best Horizon was established in 2014. Since then, its portfolio has grown to about 50 companies based in Portugal, Spain, the Netherlands, Brazil and the US. The firm has €3m in two investment vehicles for pre-seed and seed investments in tech companies that either have their headquarters or a subsidiary in the North, Centre, Alentejo and Azores regions of Portugal.

AngelPad is a New York and San Francisco-based accelerator program for seed-stage companies. Established in 2010, AngelPad has been ranked by MIT and others as the number one acceleration program in the US. It has invested in more than 150 companies, with recent investments in HypeLabs from Portugal and the US$4.5m seed round of local autonomous logistics vehicle maker Gatik.

AngelPad is a New York and San Francisco-based accelerator program for seed-stage companies. Established in 2010, AngelPad has been ranked by MIT and others as the number one acceleration program in the US. It has invested in more than 150 companies, with recent investments in HypeLabs from Portugal and the US$4.5m seed round of local autonomous logistics vehicle maker Gatik.

Jörg Mohaupt is the head of media at Warner Music Group and an angel investor who has funded several startups to date, many in the area of music. His other most recently known investments were in the August 2019 £2.2m seed round of British fintech for adolescents Penfold and in the May 2019 $1.7m seed round of Swedish music sampling store Tracklib.

Jörg Mohaupt is the head of media at Warner Music Group and an angel investor who has funded several startups to date, many in the area of music. His other most recently known investments were in the August 2019 £2.2m seed round of British fintech for adolescents Penfold and in the May 2019 $1.7m seed round of Swedish music sampling store Tracklib.

Founded in Colorado in 2006, Techstars is a prolific investor and accelerator. More than 2,300 companies have entered its portfolio, with a combined market cap of $32bn. It generally invests at the pre-seed and seed stages across sectors and geographies and has provided over $11.4bn in investment, with 86% of companies still active or acquired.Every year, it selects over 500 startups to join its three-month accelerators, held globally, investing $120,000 in each startup and providing access to the Techstars network for life. Its most recent investments include in the undisclosed January 2021 pre-seed rounds of Latvian logistics monitoring platform Kedeon and US product development software Bild.

Founded in Colorado in 2006, Techstars is a prolific investor and accelerator. More than 2,300 companies have entered its portfolio, with a combined market cap of $32bn. It generally invests at the pre-seed and seed stages across sectors and geographies and has provided over $11.4bn in investment, with 86% of companies still active or acquired.Every year, it selects over 500 startups to join its three-month accelerators, held globally, investing $120,000 in each startup and providing access to the Techstars network for life. Its most recent investments include in the undisclosed January 2021 pre-seed rounds of Latvian logistics monitoring platform Kedeon and US product development software Bild.

Taking venture capital to the next level of “Peace, Love and Seed funding”, Nordic Makers is a hands-on seed stage investor with business experience in the Nordic countries and abroad. The firm is founded and managed by serial entrepreneurs who are passionate about building and scaling tech companies for future M&A strategic planning and collaborations.

Taking venture capital to the next level of “Peace, Love and Seed funding”, Nordic Makers is a hands-on seed stage investor with business experience in the Nordic countries and abroad. The firm is founded and managed by serial entrepreneurs who are passionate about building and scaling tech companies for future M&A strategic planning and collaborations.

Bright Pixel is a Portuguese company of angel investors, established in 2016, owned by the investment division of one of Portugal's largest companies, retailer Sonae Group.To date, it has invested in six companies at the early-stage. Its most recent investments include in the €2m seed round of US security tech Fyde and in the €550,000 seed round of Portuguese online security tech Probely.

Bright Pixel is a Portuguese company of angel investors, established in 2016, owned by the investment division of one of Portugal's largest companies, retailer Sonae Group.To date, it has invested in six companies at the early-stage. Its most recent investments include in the €2m seed round of US security tech Fyde and in the €550,000 seed round of Portuguese online security tech Probely.

Triporate: Producing business travel itineraries and bookings 10x faster than human agents

Triporate helps corporates save time and money with its automated travel bookings from analyzing staff emails; it raised €1.3m recently

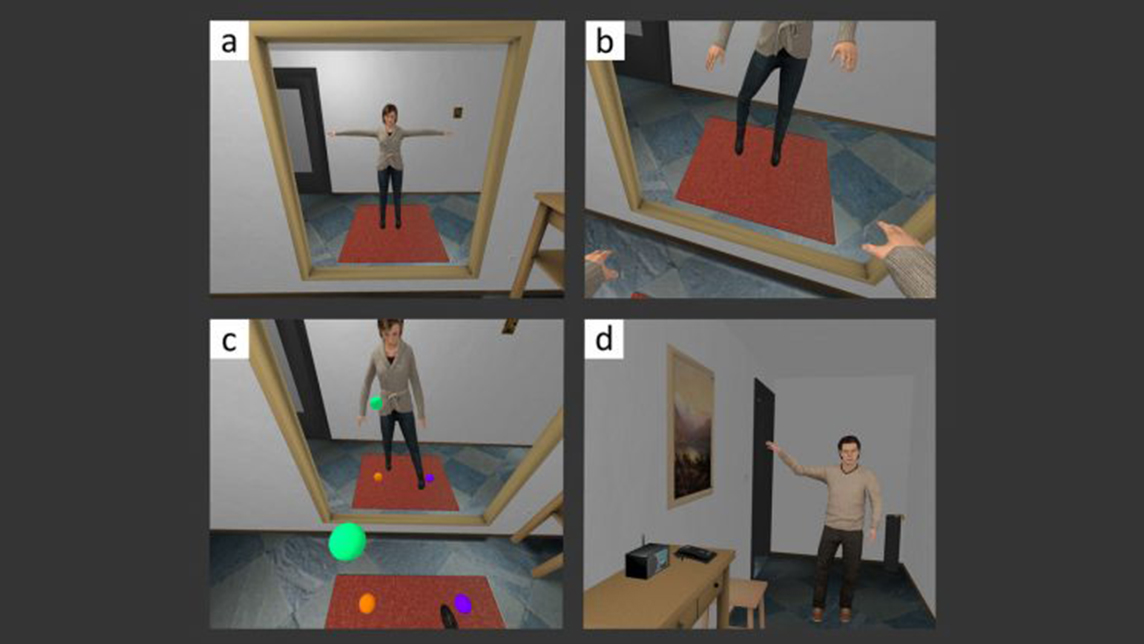

Virtual Bodyworks: VR psychotherapy to reduce crime and health issues

Applications created by the Barcelona-based startup could be used to track and influence human behavior

HighPitch 2020: Goers wins Indonesia's national startup competition

Event ticketing startup Goers gains new revenue streams with pivot to helping leisure spots go online; hotel SaaS Izy and on-demand medical testing service CekLab also in top three

QOA: Gourmet guilt-free chocolate, without the cocoa

Munich-based QOA transforms industrial food waste into vegan chocolate, enabling consumers to avoid the sustainability and ethical issues of cocoa production

HighPitch 2020: Yogyakarta chapter won by on-demand lab testing and solar cell startups

Judges lauded the variety of ideas, but said startups could improve their presentations and clearly state the problems they are solving

Diamond Foundry: Growing conflict-free, eco-friendly diamonds in a lab

The world’s first lab-grown diamond producer certified carbon-neutral, Diamond Foundry became a unicorn recently with a $200m investment from Fidelity, adding to earlier funding from tech billionaires

Beemine Lab: Nurturing the fast-growing CBD cosmetics market

The first biotech company in Spain to produce CBD-rich cosmetics, The Beemine Lab is in a market poised to reach nearly $1bn by 2024, or 10% of the total skincare market

Biomilq: Creating cell-based mothers’ milk in a lab

With the aim of helping women struggling to breastfeed, Bill Gates-backed Biomilq is disrupting the $45bn baby formula industry developing lab-grown breast milk from mammary epithelial cells

TurtleTree Labs: Creating sustainable mammalian milk alternatives from stem cells

Founder’s search for high-quality dairy milk led to the creation in a lab of naturally occurring ingredients found in human milk for supply to dairy milk and infant formula businesses

HighPitch: E-grocery marketplace Pasar20 and healthcare edtech Appskep top the Medan chapter

Representing Sumatra’s startup ecosystem in the national finals later in November, Pasar20 and Appskep have ambitious expansion plans in store

HighPitch 2020: In conversation with top winners and UMG Idealab head Kiwi Aliwarga

Goers, Izy and CekLab demonstrated quick thinking when adapting their businesses to the pandemic, a capability they will need to stay competitive post-Covid

Yali Bio: Recreating a juicy steak in plant-based alternatives

Founded by the former head of Impossible Foods’ pilot plant, this Bay Area genomics and foodtech startup is one of the first to engineer a better fat for plant-based meat

Qorium: Lab-grown premium leather for the future of luxury

The Dutch biotech startup co-founded by cell-based meat pioneer Mark Post is targeting the luxury goods market with its “clean leather” sheets made from cultivating bovine skin cells, and plans to raise up to €100m

Because Animals: Pioneering cultured meat for pets

The biotech startup is disrupting the pet food processing industry with cell-based food to minimize environmental “pawprints” and promote animal welfare

Shilling Capital Partners: Growing Portuguese tech businesses from seed

An early mover, the influential angel investing firm is accelerating local techs into Brazil and globally

Sorry, we couldn’t find any matches for“Top Seed Lab”.