Top Seed Lab

-

DATABASE (380)

-

ARTICLES (440)

Archipelago Next is an investor based in Spain’s Canary Islands and owned by prominent local companies. It has a non-sectorial focus on startups based in the archipelago and in Africa and is the Canary Islands’ only venture builder. It currently has 20 startups in its portfolio. Its most recent investments were €520,000 in a seed funding round in 2021 of Valencian accessibility hardware and app for the deaf, Visualfy and €260,000 in the 2021 seed round of AI-powered crop prediction agtech RawData.

Archipelago Next is an investor based in Spain’s Canary Islands and owned by prominent local companies. It has a non-sectorial focus on startups based in the archipelago and in Africa and is the Canary Islands’ only venture builder. It currently has 20 startups in its portfolio. Its most recent investments were €520,000 in a seed funding round in 2021 of Valencian accessibility hardware and app for the deaf, Visualfy and €260,000 in the 2021 seed round of AI-powered crop prediction agtech RawData.

RND Capital is an Indonesian venture capital firm. Its only publicized investment to date is its US$3 million seed funding for mutual funds investment platform Tanamduit.

RND Capital is an Indonesian venture capital firm. Its only publicized investment to date is its US$3 million seed funding for mutual funds investment platform Tanamduit.

Launched in 2015 in Brussels, EIT Food was established by the not-for-profit European Institute of Innovation & Technology (EIT) and funded by the European Union as an investor and accelerator. Its aim is to support mainly European startups in foodtech areas ranging from traceability to alternative proteins, with sustainability a key deciding factor in the startups it backs from pre-seed to Series-B level. The organization currently has 55 startups in its portfolio, which raised more than €91m in investments in 2020. Its most recent investments include 700,000 Swiss francs (€637,000) in the seed round in January 2021 of Swiss biotech SwissDeCode, a company that applies DNA testing to food traceability. Another investment was the December 2020 €900,000 seed round of Spanish compostable-packaging tech Food Sourcing Specialists.

Launched in 2015 in Brussels, EIT Food was established by the not-for-profit European Institute of Innovation & Technology (EIT) and funded by the European Union as an investor and accelerator. Its aim is to support mainly European startups in foodtech areas ranging from traceability to alternative proteins, with sustainability a key deciding factor in the startups it backs from pre-seed to Series-B level. The organization currently has 55 startups in its portfolio, which raised more than €91m in investments in 2020. Its most recent investments include 700,000 Swiss francs (€637,000) in the seed round in January 2021 of Swiss biotech SwissDeCode, a company that applies DNA testing to food traceability. Another investment was the December 2020 €900,000 seed round of Spanish compostable-packaging tech Food Sourcing Specialists.

Established in 2017 in the UK, Firstminute Capital's investments are founders-driven, rather than by investment sectors. The early-stage venture capital firm has already invested in 32 companies in the US, UK, mainland Europe and Israel. In mid-2018, it raised its first fund of US$100m from 30 unicorns. Recent investments include in the Series A round of tax reclaim company Wevat, in peer-to-peer (P2P) fiat to crypto exchange platform Ramp's pre-seed round and in the seed round of cannabis e-commerce site Miss Grass.

Established in 2017 in the UK, Firstminute Capital's investments are founders-driven, rather than by investment sectors. The early-stage venture capital firm has already invested in 32 companies in the US, UK, mainland Europe and Israel. In mid-2018, it raised its first fund of US$100m from 30 unicorns. Recent investments include in the Series A round of tax reclaim company Wevat, in peer-to-peer (P2P) fiat to crypto exchange platform Ramp's pre-seed round and in the seed round of cannabis e-commerce site Miss Grass.

Lachy Groom is a young San Francisco-based Australian entrepreneur and angel investor who gained recognition as a teenage coder and was founder of Cardnap and PSDtoWP, acquired by PSD2HTML.com. He also ran fintech Stripe until 2018. To date, he has invested in nine early-stage startups. His recent investments include in the $9m second phase of home physiotherapy tech solution SWORD Health's Series A round, in the $3.8m seed round of collaboration platform for data scientists, Deepnote, and in the $2.2m seed round of trading platform Convictional.

Lachy Groom is a young San Francisco-based Australian entrepreneur and angel investor who gained recognition as a teenage coder and was founder of Cardnap and PSDtoWP, acquired by PSD2HTML.com. He also ran fintech Stripe until 2018. To date, he has invested in nine early-stage startups. His recent investments include in the $9m second phase of home physiotherapy tech solution SWORD Health's Series A round, in the $3.8m seed round of collaboration platform for data scientists, Deepnote, and in the $2.2m seed round of trading platform Convictional.

D Moonshots is an investment fund created by Romanian entrepreneur Sacha Dragic, founder of the Superbets online sports betting group. The Cyprus-based investor was founded in 2019 and typically invests €100,000-500,000. To date, the firm has invested in Romanian medtech Medicai’s €500,000 seed round and UK-based soft-skills VR software Bodyswaps’ £470,000 seed funding.

D Moonshots is an investment fund created by Romanian entrepreneur Sacha Dragic, founder of the Superbets online sports betting group. The Cyprus-based investor was founded in 2019 and typically invests €100,000-500,000. To date, the firm has invested in Romanian medtech Medicai’s €500,000 seed round and UK-based soft-skills VR software Bodyswaps’ £470,000 seed funding.

BACKED VC is primarily a seed-stage funder based in London and founded in 2015 that selects its investments based on the founding team rather than on market-based decisions. It typically invests from €0.5m to €2.5m per round and, to date, has invested in 45 startups with two exits so far. Its most recent investments include in the March 2021 £5m Series A round of British legal digitization platform Legl and in the February 2021 £2.7m seed round of UK-based cellular fat producer Hoxton Farms.

BACKED VC is primarily a seed-stage funder based in London and founded in 2015 that selects its investments based on the founding team rather than on market-based decisions. It typically invests from €0.5m to €2.5m per round and, to date, has invested in 45 startups with two exits so far. Its most recent investments include in the March 2021 £5m Series A round of British legal digitization platform Legl and in the February 2021 £2.7m seed round of UK-based cellular fat producer Hoxton Farms.

500 Startups is a global venture capital seed fund and startup accelerator based in Silicon Valley.

500 Startups is a global venture capital seed fund and startup accelerator based in Silicon Valley.

Alberto Knapp Bjeren has more than 20 years of experience in the tech startup ecosystem in Spain and internationally. He is the CEO of London-based digital tech PR agency Wunderman Thompson. He also founded the agency’s Madrid-based digital consultancy The Cocktail that has offices in London, New York, Mexico City and Bogota.Knapp is also a partner and advisor at Seaya Ventures, a Spanish VC with investments in startups like Cabify and Glovo. As an angel investor, he has participated in the pre-seed and seed rounds of Spain’s femtech WOOM and other undisclosed startups.

Alberto Knapp Bjeren has more than 20 years of experience in the tech startup ecosystem in Spain and internationally. He is the CEO of London-based digital tech PR agency Wunderman Thompson. He also founded the agency’s Madrid-based digital consultancy The Cocktail that has offices in London, New York, Mexico City and Bogota.Knapp is also a partner and advisor at Seaya Ventures, a Spanish VC with investments in startups like Cabify and Glovo. As an angel investor, he has participated in the pre-seed and seed rounds of Spain’s femtech WOOM and other undisclosed startups.

Founded in 2008, Newfund Capital is a Paris-based VC firm investing in pre-seed, seed and follow-up rounds with fundings between $300,000 and $2m in startups based in Europe and North America. To date, it has $260m worth of assets under management, mostly subscribed by entrepreneurs and family offices. The firm has also started a NAEH fund of $100,000 in the Nouvelle Aquitaine region. Newfund Capital describes the NAEH fund as a risky mutual fund that will take minority stakes in unlisted companies.

Founded in 2008, Newfund Capital is a Paris-based VC firm investing in pre-seed, seed and follow-up rounds with fundings between $300,000 and $2m in startups based in Europe and North America. To date, it has $260m worth of assets under management, mostly subscribed by entrepreneurs and family offices. The firm has also started a NAEH fund of $100,000 in the Nouvelle Aquitaine region. Newfund Capital describes the NAEH fund as a risky mutual fund that will take minority stakes in unlisted companies.

Founded in 2006, the Silicon Valley-based venture capital firm was one of the earliest to focus on seed investing. It has around US$1.3 billion under management and has backed more than 700 founders.

Founded in 2006, the Silicon Valley-based venture capital firm was one of the earliest to focus on seed investing. It has around US$1.3 billion under management and has backed more than 700 founders.

Led by co-founder and Managing Partner Alexandre Barbosa, Faber Ventures is a pan-European venture capital firm with offices in Lisbon and London. It was founded in 2012 with VCs Caixa Capital and Shilling Capital Partners investors in Faber Ventures.The firm works alongside founders from idea to market, either as co-founders or angel investors, and typically continues to support the startup as seed co-investors. Faber Ventures also supports startups at the seed stage with financial investment and hands-on mentorship. The company has invested in 19 startups to date in varied sectors and managed two exits, Glitter and Gleam.

Led by co-founder and Managing Partner Alexandre Barbosa, Faber Ventures is a pan-European venture capital firm with offices in Lisbon and London. It was founded in 2012 with VCs Caixa Capital and Shilling Capital Partners investors in Faber Ventures.The firm works alongside founders from idea to market, either as co-founders or angel investors, and typically continues to support the startup as seed co-investors. Faber Ventures also supports startups at the seed stage with financial investment and hands-on mentorship. The company has invested in 19 startups to date in varied sectors and managed two exits, Glitter and Gleam.

Bynd Venture Capital (formerly Busy Angels)

Bynd Venture Capital is a Portuguese seed/early-stage VC firm that changed its name from Busy Angels in 2019 and opened a new €10M investment fund, with Didimo its first recipient. Busy Angels' more than 30-strong portfolio has passed under Bynd's stewardship. Bynd is led by former senior corporate executives and counts among its shareholders former Cabinet minister Luís Mira Amaral and corporate entities Danone, P&G and Pepsi. Busy Angels was founded in 2010 in Lisbon and concentrates on seed and early-stage B2B and B2C startups doing business in Portugal and/or Spain. DefinedCrowd and Zaask! are among its best known portfolio companies.

Bynd Venture Capital is a Portuguese seed/early-stage VC firm that changed its name from Busy Angels in 2019 and opened a new €10M investment fund, with Didimo its first recipient. Busy Angels' more than 30-strong portfolio has passed under Bynd's stewardship. Bynd is led by former senior corporate executives and counts among its shareholders former Cabinet minister Luís Mira Amaral and corporate entities Danone, P&G and Pepsi. Busy Angels was founded in 2010 in Lisbon and concentrates on seed and early-stage B2B and B2C startups doing business in Portugal and/or Spain. DefinedCrowd and Zaask! are among its best known portfolio companies.

LocalGlobe is one of the most active VC firms in the UK. Founded by father and son Robin and Saul Klein in 1999 and focused on seed and early-stage fundings, the firm has undertaken over 200 investments to date.In 2019, LocalGlobe aims to launch a new sister fund called Latitude to help startups in their investment portfolio, to scale up and to continue after seed through later funding rounds. LocalGlobe has managed 28 exits to date including Graze, Bitly and Zoopla. Its recent investments include in Zencargo and Weengs' Series A rounds and in VOI Technology's Series B round.

LocalGlobe is one of the most active VC firms in the UK. Founded by father and son Robin and Saul Klein in 1999 and focused on seed and early-stage fundings, the firm has undertaken over 200 investments to date.In 2019, LocalGlobe aims to launch a new sister fund called Latitude to help startups in their investment portfolio, to scale up and to continue after seed through later funding rounds. LocalGlobe has managed 28 exits to date including Graze, Bitly and Zoopla. Its recent investments include in Zencargo and Weengs' Series A rounds and in VOI Technology's Series B round.

Innovation Nest is an early-stage venture capitalist firm based in Krakow, Poland. Founded in 2010, the VC has invested in more than 50 startups, with a special focus on European B2B SaaS companies. The firm was the lead investor in eight of the startups' funding rounds.The VC usually participates in seed rounds, with the most recent being a US$1-million investment in Poland's fraud detection company Netone and another seed investment in Portuguese facility management platform Infraspeak. The VC has also joined a Series A round for ICT SaaS company CallPage and Series B funding in sensor company Estimote.

Innovation Nest is an early-stage venture capitalist firm based in Krakow, Poland. Founded in 2010, the VC has invested in more than 50 startups, with a special focus on European B2B SaaS companies. The firm was the lead investor in eight of the startups' funding rounds.The VC usually participates in seed rounds, with the most recent being a US$1-million investment in Poland's fraud detection company Netone and another seed investment in Portuguese facility management platform Infraspeak. The VC has also joined a Series A round for ICT SaaS company CallPage and Series B funding in sensor company Estimote.

Triporate: Producing business travel itineraries and bookings 10x faster than human agents

Triporate helps corporates save time and money with its automated travel bookings from analyzing staff emails; it raised €1.3m recently

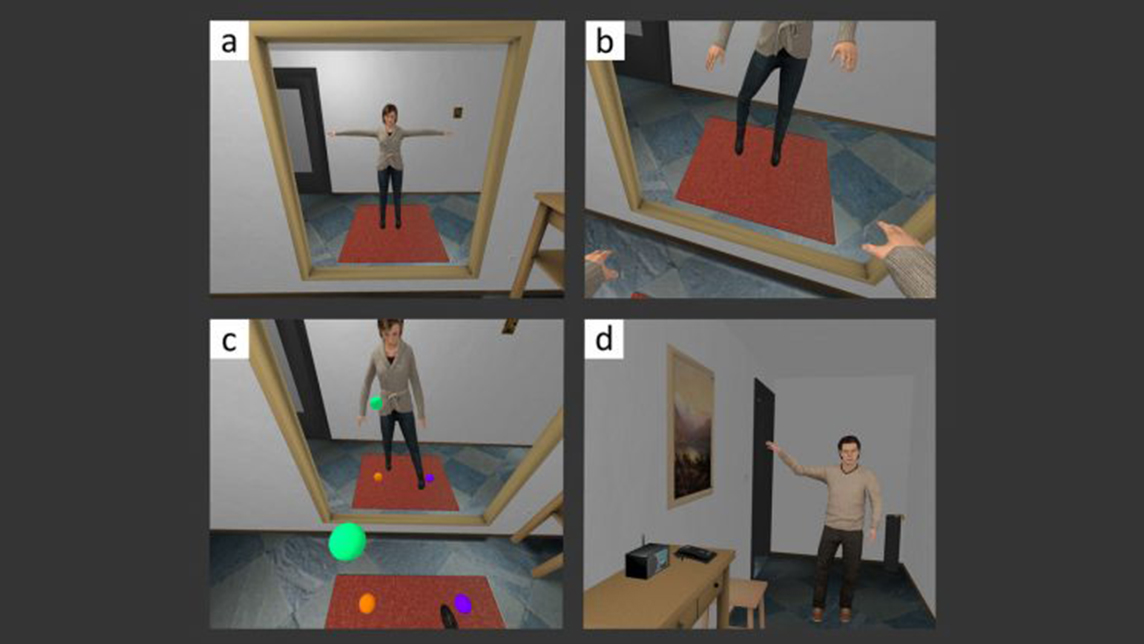

Virtual Bodyworks: VR psychotherapy to reduce crime and health issues

Applications created by the Barcelona-based startup could be used to track and influence human behavior

HighPitch 2020: Goers wins Indonesia's national startup competition

Event ticketing startup Goers gains new revenue streams with pivot to helping leisure spots go online; hotel SaaS Izy and on-demand medical testing service CekLab also in top three

QOA: Gourmet guilt-free chocolate, without the cocoa

Munich-based QOA transforms industrial food waste into vegan chocolate, enabling consumers to avoid the sustainability and ethical issues of cocoa production

HighPitch 2020: Yogyakarta chapter won by on-demand lab testing and solar cell startups

Judges lauded the variety of ideas, but said startups could improve their presentations and clearly state the problems they are solving

Diamond Foundry: Growing conflict-free, eco-friendly diamonds in a lab

The world’s first lab-grown diamond producer certified carbon-neutral, Diamond Foundry became a unicorn recently with a $200m investment from Fidelity, adding to earlier funding from tech billionaires

Beemine Lab: Nurturing the fast-growing CBD cosmetics market

The first biotech company in Spain to produce CBD-rich cosmetics, The Beemine Lab is in a market poised to reach nearly $1bn by 2024, or 10% of the total skincare market

Biomilq: Creating cell-based mothers’ milk in a lab

With the aim of helping women struggling to breastfeed, Bill Gates-backed Biomilq is disrupting the $45bn baby formula industry developing lab-grown breast milk from mammary epithelial cells

TurtleTree Labs: Creating sustainable mammalian milk alternatives from stem cells

Founder’s search for high-quality dairy milk led to the creation in a lab of naturally occurring ingredients found in human milk for supply to dairy milk and infant formula businesses

HighPitch: E-grocery marketplace Pasar20 and healthcare edtech Appskep top the Medan chapter

Representing Sumatra’s startup ecosystem in the national finals later in November, Pasar20 and Appskep have ambitious expansion plans in store

HighPitch 2020: In conversation with top winners and UMG Idealab head Kiwi Aliwarga

Goers, Izy and CekLab demonstrated quick thinking when adapting their businesses to the pandemic, a capability they will need to stay competitive post-Covid

Yali Bio: Recreating a juicy steak in plant-based alternatives

Founded by the former head of Impossible Foods’ pilot plant, this Bay Area genomics and foodtech startup is one of the first to engineer a better fat for plant-based meat

Qorium: Lab-grown premium leather for the future of luxury

The Dutch biotech startup co-founded by cell-based meat pioneer Mark Post is targeting the luxury goods market with its “clean leather” sheets made from cultivating bovine skin cells, and plans to raise up to €100m

Because Animals: Pioneering cultured meat for pets

The biotech startup is disrupting the pet food processing industry with cell-based food to minimize environmental “pawprints” and promote animal welfare

Shilling Capital Partners: Growing Portuguese tech businesses from seed

An early mover, the influential angel investing firm is accelerating local techs into Brazil and globally

Sorry, we couldn’t find any matches for“Top Seed Lab”.