Tsinghua Holdings

DATABASE (96)

ARTICLES (31)

Formerly known as Tsinghua University Science Park (TusPark) Development Center founded in August 1994, Tus-Holdings was incorporated in 2000. The company takes full responsibility for developing, constructing, operating and managing TusPark.Tus-Holdings is the controlling shareholder, or shareholder, of over 800 listed and non-listed enterprises. The total assets under its management amount to nearly RMB 200bn.

Formerly known as Tsinghua University Science Park (TusPark) Development Center founded in August 1994, Tus-Holdings was incorporated in 2000. The company takes full responsibility for developing, constructing, operating and managing TusPark.Tus-Holdings is the controlling shareholder, or shareholder, of over 800 listed and non-listed enterprises. The total assets under its management amount to nearly RMB 200bn.

Gorry's suite of wellness services targets Indonesia's increasingly health conscious population.

Gorry's suite of wellness services targets Indonesia's increasingly health conscious population.

Founded in 2001, Oriza Holdings manages over RMB 51.4 billion in assets. The fund focuses on equity investment, debt financing and equity investment services. Through its equity investment platforms and venture capital funds, Oriza Holdings has backed 65 startups that have gone public.

Founded in 2001, Oriza Holdings manages over RMB 51.4 billion in assets. The fund focuses on equity investment, debt financing and equity investment services. Through its equity investment platforms and venture capital funds, Oriza Holdings has backed 65 startups that have gone public.

Founded in Shenzhen in 1993, Grandland Holdings comprises four companies - Grandland Group, Grandland Property, Grandland Capital, and Grandland Investment. It operates in the sectors of decoration, real estate, high-tech and finance. Grandland Holdings has total assets of RMB 30 billion, which are invested in more than 30 listed companies. It acquired the Permasteelisa Group, a leading Italian curtain wall corporation, for RMB 3.66 billion in 2017.

Founded in Shenzhen in 1993, Grandland Holdings comprises four companies - Grandland Group, Grandland Property, Grandland Capital, and Grandland Investment. It operates in the sectors of decoration, real estate, high-tech and finance. Grandland Holdings has total assets of RMB 30 billion, which are invested in more than 30 listed companies. It acquired the Permasteelisa Group, a leading Italian curtain wall corporation, for RMB 3.66 billion in 2017.

Shenzhen-listed Oceanwide Holdings is part of the China Oceanwide empire founded and controlled by Lu Zhiqiang, one of China’s wealthiest billionaires. Oceanwide is also the founding and controlling shareholder of Minsheng Bank, the first private sector-backed commercial bank in China, and the third-largest shareholder of Legend Holdings, the investment group behind Lenovo. Its interests span globally across financial services, energy, culture and media, and real estate.

Shenzhen-listed Oceanwide Holdings is part of the China Oceanwide empire founded and controlled by Lu Zhiqiang, one of China’s wealthiest billionaires. Oceanwide is also the founding and controlling shareholder of Minsheng Bank, the first private sector-backed commercial bank in China, and the third-largest shareholder of Legend Holdings, the investment group behind Lenovo. Its interests span globally across financial services, energy, culture and media, and real estate.

Established in 2002, Hong Kong Stock Exchange-listed NWS Holdings’ main businesses are in infrastructure and service. Its main shareholder is New World Development. Henry Cheng currently serves as chairman and executive director of NWS Holdings. He is the eldest son of Dr Cheng Yu-tung, the founder of New World Development, a Hong Kong-based conglomerate engaged in property development, infrastructure and services.

Established in 2002, Hong Kong Stock Exchange-listed NWS Holdings’ main businesses are in infrastructure and service. Its main shareholder is New World Development. Henry Cheng currently serves as chairman and executive director of NWS Holdings. He is the eldest son of Dr Cheng Yu-tung, the founder of New World Development, a Hong Kong-based conglomerate engaged in property development, infrastructure and services.

The VC arm of Tsinghua University, THG Ventures was founded in 2015. It is managed by the investment team from the state-owned Tsinghua Holdings Ltd., which has specialized in venture capital investments since 1999 and is one of the first China teams focused on RMB investment. The team also founded TusPark Incubator and TusPark Ventures.

The VC arm of Tsinghua University, THG Ventures was founded in 2015. It is managed by the investment team from the state-owned Tsinghua Holdings Ltd., which has specialized in venture capital investments since 1999 and is one of the first China teams focused on RMB investment. The team also founded TusPark Incubator and TusPark Ventures.

Founded in December 2013, MOOC-CN Education is a wholly-owned subsidiary of Tsinghua Holdings. It is headquartered in Beijing and invests in education startups with a focus on online education.

Founded in December 2013, MOOC-CN Education is a wholly-owned subsidiary of Tsinghua Holdings. It is headquartered in Beijing and invests in education startups with a focus on online education.

Yangtze Delta Region Institute of Tsinghua University, Zhejiang

Yangtze Delta Region Research Institute of Tsinghua University, Zhejiang was co-founded by the provincial government of Zhejiang and Tsinghua University in 2003 for tech transfer. It has set up over 50 R&D platforms in the areas of life sciences, digital creativity, information technology and ecological environment and 11 offshore incubators in the US, UK, Germany and Australia. The institute manages over RMB 7.5bn of assets and also makes investments through its sub-funds with a total size of more than RMB 10bn. So far, it has incubated and invested in over 2,500 companies, 35 of whom have gone public or been acquired by listed companies.

Yangtze Delta Region Research Institute of Tsinghua University, Zhejiang was co-founded by the provincial government of Zhejiang and Tsinghua University in 2003 for tech transfer. It has set up over 50 R&D platforms in the areas of life sciences, digital creativity, information technology and ecological environment and 11 offshore incubators in the US, UK, Germany and Australia. The institute manages over RMB 7.5bn of assets and also makes investments through its sub-funds with a total size of more than RMB 10bn. So far, it has incubated and invested in over 2,500 companies, 35 of whom have gone public or been acquired by listed companies.

Hongtai Capital Holdings (Aplus Capital)

Well-known entrepreneur Yu Minhong and Sheng Xitai, a senior investment banker, co-founded Aplus Capital in November 2014. In November 2017, Aplus Capital formally changed its name to Hongtai Capital Holdings. By the end of 2018, the assets under its management have amounted to over RMB 20 billion. Hongtai Capital Holdings mainly invests in startups in various stages of growth and focuses on sectors of artificial intelligence, big data, consumer products, entertainment, education, manufacturing and fintech.

Well-known entrepreneur Yu Minhong and Sheng Xitai, a senior investment banker, co-founded Aplus Capital in November 2014. In November 2017, Aplus Capital formally changed its name to Hongtai Capital Holdings. By the end of 2018, the assets under its management have amounted to over RMB 20 billion. Hongtai Capital Holdings mainly invests in startups in various stages of growth and focuses on sectors of artificial intelligence, big data, consumer products, entertainment, education, manufacturing and fintech.

TusPark Technology Asset Management Co., Ltd., and TusPark Business Incubator Co., Ltd., were both founded in 2001 as the investment arms of Tsinghua Science Park. Affiliated with Tsinghua University, Tsinghua Science Park promotes technology innovation and entrepreneurship. In 2007, the two companies were merged and became TusPark Ventures. The firm employs an “investment + incubation” model when investing in Chinese high-tech startups. TusPark Ventures currently manages over RMB 3 billion in assets.

TusPark Technology Asset Management Co., Ltd., and TusPark Business Incubator Co., Ltd., were both founded in 2001 as the investment arms of Tsinghua Science Park. Affiliated with Tsinghua University, Tsinghua Science Park promotes technology innovation and entrepreneurship. In 2007, the two companies were merged and became TusPark Ventures. The firm employs an “investment + incubation” model when investing in Chinese high-tech startups. TusPark Ventures currently manages over RMB 3 billion in assets.

Co-founder and CTO of Codacy

Universidade Nova de Lisboa graduate João Caxaria is a seasoned software engineer, having developed software at Inosat, Checkfree, Focus Business Solution, Feel Fine Games, 6PM Holdings PLC and Infusion. Before co-founding Codacy, Caxaria co-founded web and mobile application development company Imaginary Cloud.

Universidade Nova de Lisboa graduate João Caxaria is a seasoned software engineer, having developed software at Inosat, Checkfree, Focus Business Solution, Feel Fine Games, 6PM Holdings PLC and Infusion. Before co-founding Codacy, Caxaria co-founded web and mobile application development company Imaginary Cloud.

CEO and Founder of QinLin Technology

Guan Ke has nearly 20 years of work experience in the media industry. He was the general manager of Shenzhen Jusiwei Advertising Co Ltd. He was also a former stockholder of Shenzhen One Media Investment Holdings Limited. He founded QinLin Technology in Shenzhen in 2015.

Guan Ke has nearly 20 years of work experience in the media industry. He was the general manager of Shenzhen Jusiwei Advertising Co Ltd. He was also a former stockholder of Shenzhen One Media Investment Holdings Limited. He founded QinLin Technology in Shenzhen in 2015.

CTO and co-founder of AgroCenta (Holdings)

Michael Ocansey graduated in accounting and IT from Regent University of Science and Technology in Dansoman, Ghana. From 2005 to 2010, Ocansey worked as a lead web developer at Ghanaian digital development agency Esoko in Accra, where he met business development executive Francis Obirikorang. Ocansey also worked as a contract web developer for software developer Origo in San Diego for two years until 2013.In 2015, Ocansey and Obirikorang co-founded Swappaholics Holdings in British Virgin Islands. He worked for one year as CTO for the online marketplace that allows users to “barter” or exchange products, skills and services.In January 2016, Ocansey and Obirikorang established AgroCenta (Holdings) Limited in Mauritius. The agritech startup set up its first office in Accra to provide an e-commerce platform, supply-chain and fintech services to smallholder farmers in Ghana.

Michael Ocansey graduated in accounting and IT from Regent University of Science and Technology in Dansoman, Ghana. From 2005 to 2010, Ocansey worked as a lead web developer at Ghanaian digital development agency Esoko in Accra, where he met business development executive Francis Obirikorang. Ocansey also worked as a contract web developer for software developer Origo in San Diego for two years until 2013.In 2015, Ocansey and Obirikorang co-founded Swappaholics Holdings in British Virgin Islands. He worked for one year as CTO for the online marketplace that allows users to “barter” or exchange products, skills and services.In January 2016, Ocansey and Obirikorang established AgroCenta (Holdings) Limited in Mauritius. The agritech startup set up its first office in Accra to provide an e-commerce platform, supply-chain and fintech services to smallholder farmers in Ghana.

Founding partner of China Bridge Capital, Zeng Qiang used to be nominated the Most Influential Chinese IT Leader by TIME in 1998. He founded Sparkice, one of the first B2B e-commerce platforms in China, in 1996. He co-founded LeTV CBC Buyout Fund, Wumei CBC Buyout Fund, iCarbonX CBC Buyout Fund, E-China Alliance, and Yabuli China Entrepreneurs Forum. Zeng Qiang received his Master of Economic Management in Tsinghua University and Master of Financial Economics in The University of Toronto. He also serves as the guest professor at the Business School of Tsinghua.

Founding partner of China Bridge Capital, Zeng Qiang used to be nominated the Most Influential Chinese IT Leader by TIME in 1998. He founded Sparkice, one of the first B2B e-commerce platforms in China, in 1996. He co-founded LeTV CBC Buyout Fund, Wumei CBC Buyout Fund, iCarbonX CBC Buyout Fund, E-China Alliance, and Yabuli China Entrepreneurs Forum. Zeng Qiang received his Master of Economic Management in Tsinghua University and Master of Financial Economics in The University of Toronto. He also serves as the guest professor at the Business School of Tsinghua.

Xu Jinghong: Champion of young entrepreneurs and high-tech startups

Under Xu Jinghong’s leadership, Tsinghua Holdings grew its assets sevenfold and incubated over 10,000 businesses. In his new role as VC investor, Xu wants to nurture startups into future global leaders

Tiger Brokers, a Chinese online brokerage for trading foreign stocks, announces US IPO

The Jim Rogers-backed fintech startup wants to raise US$150 million as it sees growing demand from younger Chinese investors

Gorry Holdings: Promoting staff wellness in Indonesia

The healthtech startup wants companies to understand how healthy employees can translate into good business

Bluepha to boost PHA bioplastics production with $30m fresh funding

The Beijing-based startup aims to produce 10,000 tons of PHA bioplastic a year and build a SynBio community through its STEM education spinoff, Bluepha Lab

Soon, a cute robot will bring you your online shopping

Using robots to automate last-mile delivery, Zhen Robotics wants to help the logistics industry slash costs and boost customer satisfaction.

Clear Plate: Anti-food waste AI that rewards the diners who finish their food

Taking little steps to make a big difference in fighting food waste, Clear Plate engages with digital natives to spread the message

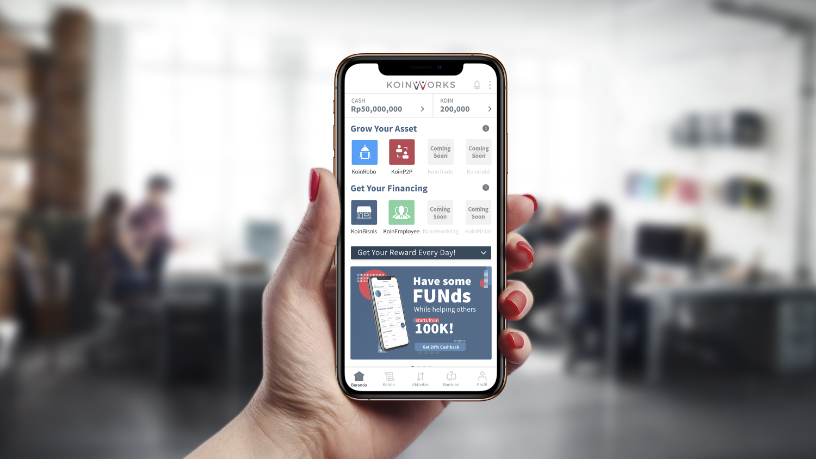

Amid Covid-19, Indonesian P2P lender KoinWorks raises $20m in convertible note funding

Backed by Quona Capital, EV Growth and other investors, KoinWorks plans to disburse more loans amid greater uncertainty and default risk

Healthy eating: The Southeast Asian startups making it a breeze

From meal plans to novel ingredients, agriculture and foodtech startups in the region are developing new ways to improve nutrition without sacrificing taste

For your X-ray records, just check the cloud

A Chinese startup has built a digital medical image library on the cloud, bringing ease and cost savings to patients, doctors and hospitals countrywide

Innovate big or go home: logistics unicorn YH Global eyes “Belt and Road” gold

The world’s first logistics firm to become a unicorn at Series A is a model of innovation in China. More overseas growth is next

Tiger Brokers: At the right place, at the right time

China’s new middle-class elite is educated and tech-savvy – and they want to put their money in US stocks. A fintech app is cashing in on this

HighPitch 2020: Event ticketing and legal tech startups come up tops in Jakarta chapter

VC judges favored Goers’s strong pivot amid Covid and HAKITA’s outstanding pitch

Good Startup: Alt-protein products can be better than real meat

The investor of Eat Just, Ripple Foods and more expects its portfolio companies will exit in the next four to six years, mostly through acquisition

Meituan-Dianping’s Wang Xing: From struggling copycat to IPO billionaire

As the internet startup sets to list in Hong Kong this week, we take a look back at the journey of its founder Wang Xing, once dubbed “the unluckiest serial entrepreneur”

Xuebacoming: Promising edtech had compliance issues from day one

Other hefty mistakes also contributed to Xuebacoming's demise – proof that investor and media support, and a booming market, won't guarantee success

Sorry, we couldn’t find any matches for“Tsinghua Holdings”.