US

-

DATABASE (434)

-

ARTICLES (604)

Korea Investment Partners is a venture capital fund established in 1986. It primarily invests in companies from Korea, China and the United States. It has invested a total of more than US$1.7 billion in over 500 companies across various sectors, from social media to medtech.

Korea Investment Partners is a venture capital fund established in 1986. It primarily invests in companies from Korea, China and the United States. It has invested a total of more than US$1.7 billion in over 500 companies across various sectors, from social media to medtech.

Founder of PreAngel Fund, an early-stage investment firm with over RMB 300 million under management. Since 2011, PreAngel has invested in 260+ startups from China and the US. Leo Wang has over 14 years of experience in mobile, telecommunication and internet industries.

Founder of PreAngel Fund, an early-stage investment firm with over RMB 300 million under management. Since 2011, PreAngel has invested in 260+ startups from China and the US. Leo Wang has over 14 years of experience in mobile, telecommunication and internet industries.

Carlos Pierre is the co-founder and CEO of Spanish online room rental platform Badi that was established in 2015 and secured Series B investment of US$30m in 2019. Pierre's first investment is the seed funding of household bill manager Polaroo in 2019.

Carlos Pierre is the co-founder and CEO of Spanish online room rental platform Badi that was established in 2015 and secured Series B investment of US$30m in 2019. Pierre's first investment is the seed funding of household bill manager Polaroo in 2019.

Among the first private equity firms to invest in Asia, TPG Capital Asia is the regional investment arm of US private equity firm TPG Capital. With offices in Beijing, Hong Kong, Melbourne, Mumbai and Singapore, it currently has about $9.9bn in assets under management.

Among the first private equity firms to invest in Asia, TPG Capital Asia is the regional investment arm of US private equity firm TPG Capital. With offices in Beijing, Hong Kong, Melbourne, Mumbai and Singapore, it currently has about $9.9bn in assets under management.

The International Financial Corporation (IFC) was founded in 1956 and is a member of the World Bank Group. It is one of the world’s largest development institutions focusing on the private sector in developing countries. It operates in more than 100 countries and has leveraged US$2.6 billion in capital from the private investment sector to deliver more than US$265 billion in financing for businesses.

The International Financial Corporation (IFC) was founded in 1956 and is a member of the World Bank Group. It is one of the world’s largest development institutions focusing on the private sector in developing countries. It operates in more than 100 countries and has leveraged US$2.6 billion in capital from the private investment sector to deliver more than US$265 billion in financing for businesses.

Endeavor Catalyst is part of the global investment company Endeavor. Launched in 2012 and based in New York, it supports the equity funding efforts of Endeavour entrepreneurs with third party investors. Its portfolio investments had a total capital value of over US$100 million and it specializes in mid-stage investments across sectors and different countries, with significant investment in transportation startups to date. In 2020, it participated in the second €12m part of the €23m Series A round of EV charging hardware startup, Wallbox, with an undisclosed investment. Other recent investments in 2020 include in the US$40m Series D round of Egyptian healthtech Vezeeta and in the undisclosed seed round of Turkish fintech Figopara.

Endeavor Catalyst is part of the global investment company Endeavor. Launched in 2012 and based in New York, it supports the equity funding efforts of Endeavour entrepreneurs with third party investors. Its portfolio investments had a total capital value of over US$100 million and it specializes in mid-stage investments across sectors and different countries, with significant investment in transportation startups to date. In 2020, it participated in the second €12m part of the €23m Series A round of EV charging hardware startup, Wallbox, with an undisclosed investment. Other recent investments in 2020 include in the US$40m Series D round of Egyptian healthtech Vezeeta and in the undisclosed seed round of Turkish fintech Figopara.

Founded in 1997, Seventure Partners is one of Europe’s most prolific VC investors with a portfolio of over 200 startups across both tech and non-tech sectors. The French VC has also managed more than 40 exits in total. It mainly focuses on fintech and insurtech, French and German startups and in life sciences in Europe, North America and Asia.Its five funds cover different market segments, ranging from €24m–€200m, with investments of €500,000–€10m per round. Total funding for a company can reach €20m, right through the early to late stages. Recent investments include the $6.7m Series A round of US biotech Dermala and the $10.7m Series A round of US self-cleaning water bottle startup LARQ.

Founded in 1997, Seventure Partners is one of Europe’s most prolific VC investors with a portfolio of over 200 startups across both tech and non-tech sectors. The French VC has also managed more than 40 exits in total. It mainly focuses on fintech and insurtech, French and German startups and in life sciences in Europe, North America and Asia.Its five funds cover different market segments, ranging from €24m–€200m, with investments of €500,000–€10m per round. Total funding for a company can reach €20m, right through the early to late stages. Recent investments include the $6.7m Series A round of US biotech Dermala and the $10.7m Series A round of US self-cleaning water bottle startup LARQ.

Founded in Chicago in 2011, Hyde Park invests in Midwestern US and occasionally Canadian startups from early-stage usually through two investment rounds across tech sectors. It currently has 62 startups in its portfolio and has managed 12 exits to date. Its most recent investments in January 2021 include Canadian e-commerce site BlackCart’s $8.8m Series A round and US podcast database Podchaser’s $5.7m Series A round. In November 2020, it invested in real estate productivity software NestEgg’s $7m Series A round.

Founded in Chicago in 2011, Hyde Park invests in Midwestern US and occasionally Canadian startups from early-stage usually through two investment rounds across tech sectors. It currently has 62 startups in its portfolio and has managed 12 exits to date. Its most recent investments in January 2021 include Canadian e-commerce site BlackCart’s $8.8m Series A round and US podcast database Podchaser’s $5.7m Series A round. In November 2020, it invested in real estate productivity software NestEgg’s $7m Series A round.

Founded in 2008, the US-based Kickstart Fund specializes in supporting midwestern US startups in Utah, Colorado and the Mountain West. The community investment platform has more than 110 companies in its portfolio valued at over $300m. It invests across all market segments, mostly in companies based in Utah, with a few in New Mexico and the UK.Recent investments in May 2021 include participation in the Series A $12m funding of Vence and $1.5m seed round of skincare marketplace, Pomp. In July 2021, it also joined the $4.5m investment round of retail SaaS provider Clientbook.

Founded in 2008, the US-based Kickstart Fund specializes in supporting midwestern US startups in Utah, Colorado and the Mountain West. The community investment platform has more than 110 companies in its portfolio valued at over $300m. It invests across all market segments, mostly in companies based in Utah, with a few in New Mexico and the UK.Recent investments in May 2021 include participation in the Series A $12m funding of Vence and $1.5m seed round of skincare marketplace, Pomp. In July 2021, it also joined the $4.5m investment round of retail SaaS provider Clientbook.

Co-founder, CEO of Bodyswaps

Christophe Mallet is the French co-founder and CEO of UK-based VR edtech for soft-skills training Bodyswaps, where he has worked since its founding in 2019. Prior to this, he was CEO and co-founder at VR marketing agency Somewhere Else from 2016 before the agency pivoted to training and skills development and became the basis of Bodyswaps’ product offer. The agency had clients such as Adidas, for which Somewhere Else produced an interactive VR in-store promotional tool that was deployed in over 100 locations in China, Europe and the US and was nominated for a VR Award and an Immersive Perspective award. Mallet also co-founded another VR agency Exheb, forerunner to Somewhere Else in 2014.For almost six years before that, Mallet worked in social media and digital strategy management at Carve Consulting in London, a digital agency helping organisations to become social businesses. Mallet also co-founded a music label, Ubermax Records, in 2011.Mallet holds two master’s degrees: Science in Management and Business from the HEC School of Management in Paris, and International Business and Management from Vienna University of Economics and Management.

Christophe Mallet is the French co-founder and CEO of UK-based VR edtech for soft-skills training Bodyswaps, where he has worked since its founding in 2019. Prior to this, he was CEO and co-founder at VR marketing agency Somewhere Else from 2016 before the agency pivoted to training and skills development and became the basis of Bodyswaps’ product offer. The agency had clients such as Adidas, for which Somewhere Else produced an interactive VR in-store promotional tool that was deployed in over 100 locations in China, Europe and the US and was nominated for a VR Award and an Immersive Perspective award. Mallet also co-founded another VR agency Exheb, forerunner to Somewhere Else in 2014.For almost six years before that, Mallet worked in social media and digital strategy management at Carve Consulting in London, a digital agency helping organisations to become social businesses. Mallet also co-founded a music label, Ubermax Records, in 2011.Mallet holds two master’s degrees: Science in Management and Business from the HEC School of Management in Paris, and International Business and Management from Vienna University of Economics and Management.

Founded in 2015 by former vice president of Tencent and GM of Tencent M&A, Richard Peng (Peng Zhijian), and former vice GM of Tencent M&A, Kurt Xu, Genesis Capital specializes in growth stage investment of internet startups in China and the US.

Founded in 2015 by former vice president of Tencent and GM of Tencent M&A, Richard Peng (Peng Zhijian), and former vice GM of Tencent M&A, Kurt Xu, Genesis Capital specializes in growth stage investment of internet startups in China and the US.

Northern Light Venture Capital

Founded in 2005, NLVC focuses on early and early-growth stage Chinese companies in the TMT, cleantech, healthcare and consumer sectors. It has invested in over 180 companies and manages more than US$1.7 billion spread across four USD-denominated funds and four RMB ones.

Founded in 2005, NLVC focuses on early and early-growth stage Chinese companies in the TMT, cleantech, healthcare and consumer sectors. It has invested in over 180 companies and manages more than US$1.7 billion spread across four USD-denominated funds and four RMB ones.

Cathay Innovation invests in small to medium-sized companies with the potential to rapidly grow internationally. By 2016, Cathay Innovation had conducted 59 investments, with a total investment of €514 million. It has offices in France, China, the US and Germany, with €1.2 billion under management.

Cathay Innovation invests in small to medium-sized companies with the potential to rapidly grow internationally. By 2016, Cathay Innovation had conducted 59 investments, with a total investment of €514 million. It has offices in France, China, the US and Germany, with €1.2 billion under management.

Wang Gang is an angel investor and a former senior director at Alibaba. His investments are concentrated in the internet, mobile internet and e-commerce sectors, in over 70 companies to date in both China and the US; including Didi, Uucars (formerly Uuzuche), ofo and Huajuan.

Wang Gang is an angel investor and a former senior director at Alibaba. His investments are concentrated in the internet, mobile internet and e-commerce sectors, in over 70 companies to date in both China and the US; including Didi, Uucars (formerly Uuzuche), ofo and Huajuan.

With offices in UK's capital city London and Herzliya in Israel, Entrée Capital is led by Avi Eyal, a serial entrepreneur behind eight companies across South Africa, Europe and the US. The firm invests in companies at all stages and manages total assets worth $300m globally.

With offices in UK's capital city London and Herzliya in Israel, Entrée Capital is led by Avi Eyal, a serial entrepreneur behind eight companies across South Africa, Europe and the US. The firm invests in companies at all stages and manages total assets worth $300m globally.

Red Points: US$38 million Series C to power US conquest

The Barcelona-based startup is ramping up US sales and deep-tech capabilities for its online brand protection platform

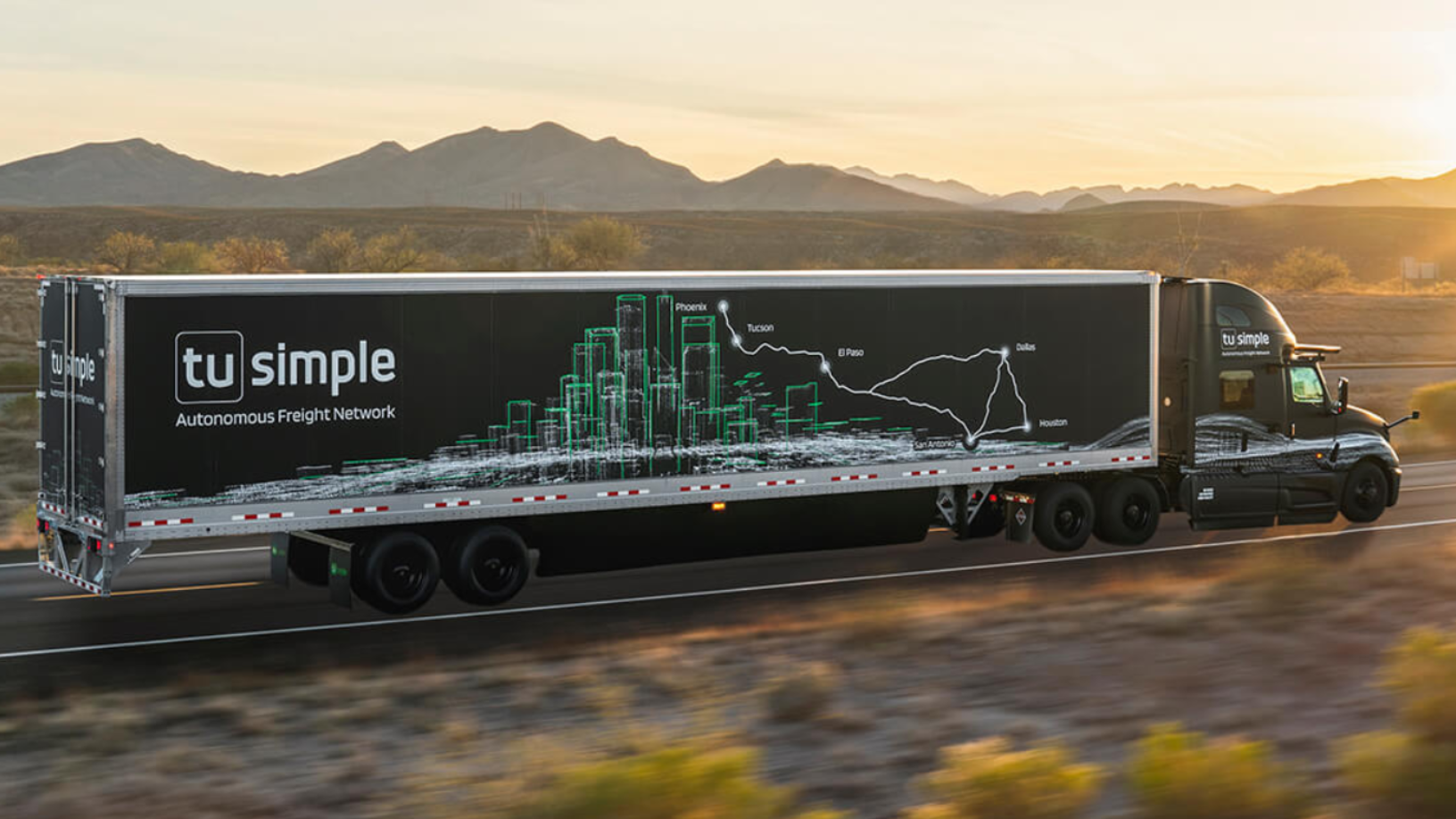

TuSimple: Banking on autonomous trucking in the US

TuSimple aims to scale its Waymo-style driverless trucking network to disrupt the $4tn global truck freight market starting with the US, with mass production by 2024

Vottun: The "WordPress for blockchain" seeks US expansion, investors

Seeking Series A funding this year, the agnostic SaaS opens blockchain's wealth of possibilities to businesses unfamiliar with the technology

Indonesian unicorn Traveloka aims for US listing via SPAC

The online travel aggregator reported revenue drops and layoffs in 2020 but became profitable late last year, led by recoveries in Vietnam and Thailand

Portugal's Prodsmart takes AI, IoT-based manufacturing to US factories

Smart factories can cut wastage by 80% and improve inventory, production and supply chains, tackling US$200 billion worth of losses

HypeLabs wins bumper US$3m seed funding to democratize connectivity

HypeLab's P2P mesh networking technology enables everyone to communicate within their own networks without needing internet, in cities, remote villages and even in disaster zones

Taronga Ventures takes RealTechX to Singapore; plans Japan, US growth

The Australian proptech investor to focus on ESG in its acceleration program, including women under-representation and site safety

Indonesian rental and asset management platform Travelio bags US$18m funding

The four-year-old proptech startup recently raised Series B funding as it gains ground in Indonesia’s growing real estate investment market

Animal AgTech Innovation Summit 2021: Future of aquaculture in the US

With the US Importing over 85% of its seafood, industry experts examine how and why the country should develop a sustainable aquaculture industry

Tuya Smart announces more partnerships, files for IPO in the US

Tuya Smart’s platform enables the creation of smart devices with little or no code writing needed, shortening R&D from months to a matter of days

New Food Invest: Building a plant-based business in the US

With plant-based startups experiencing exponential growth but facing increasingly intense competition, experts consider the opportunities and barriers in the sector

China's new unicorn: Secondhand electronics platform Aihuishou now worth US$1.5 billion

Aihuishou's latest funding round is the largest yet for a secondhand electronics platform

SoccerDream: World's first VR soccer training platform to launch in China, US

SoccerDream uses virtual reality to boost trainee players' performance on the field by 36% compared to their peers

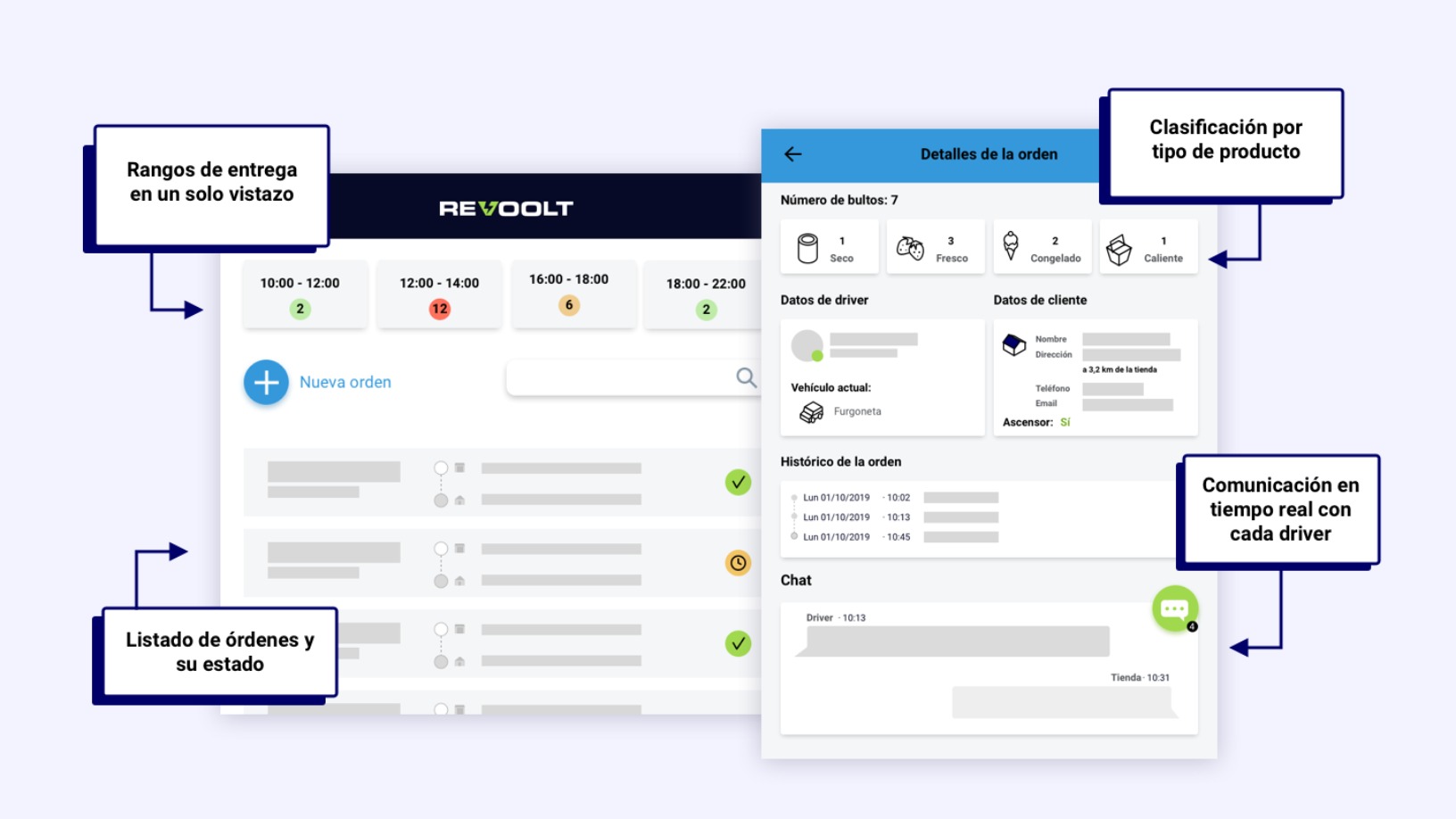

Revoolt: “Covid-19 accelerated our expansion plans and made us more ambitious”

Revoolt’s emission-free last-mile delivery model proved viable during the lockdown in Spain – growth that’s now its launchpad for international expansion and new funding

China’s startups have much to gain from the US-China trade war

The prolonged trade conflict may be exactly what Chinese startups need to strengthen their technological capabilities

Sorry, we couldn’t find any matches for“US”.