US

-

DATABASE (434)

-

ARTICLES (604)

Listed and based out of London, Standard Chartered Bank, or StanChart, has operations in Asia, Africa and the Middle East. It has about US$60 billion of assets under management, which it hopes to grow to more than US$100 billion by 2020.

Listed and based out of London, Standard Chartered Bank, or StanChart, has operations in Asia, Africa and the Middle East. It has about US$60 billion of assets under management, which it hopes to grow to more than US$100 billion by 2020.

Healthcare-focused investment firm Vivo Capital was formed in 1996. Today it has over US$1.8 billion under management, making investments into private and public healthcare companies in the US and Greater China, as well as into promising early-stage innovative healthcare companies.

Healthcare-focused investment firm Vivo Capital was formed in 1996. Today it has over US$1.8 billion under management, making investments into private and public healthcare companies in the US and Greater China, as well as into promising early-stage innovative healthcare companies.

Based in Berlin, Point Nine Capital is a seed/early-stage VC that has invested in companies across Europe, the US, New Zealand and Asia. The firm typically invests between a few hundred thousand and US$1m in startups from many different sectors.

Based in Berlin, Point Nine Capital is a seed/early-stage VC that has invested in companies across Europe, the US, New Zealand and Asia. The firm typically invests between a few hundred thousand and US$1m in startups from many different sectors.

Insight Venture Partners is a US venture capital and private equity firm, headquartered in New York and founded in 1995. It holds over US$20 billion in assets under management, invested in more than 300 companies in 65 countries and has completed more than 200 mergers and acquisitions for its portfolio companies and 84 exits. It specializes in growth-round investments at all levels and has raised more than US$7.6 billion to invest in both minority and majority transactions.

Insight Venture Partners is a US venture capital and private equity firm, headquartered in New York and founded in 1995. It holds over US$20 billion in assets under management, invested in more than 300 companies in 65 countries and has completed more than 200 mergers and acquisitions for its portfolio companies and 84 exits. It specializes in growth-round investments at all levels and has raised more than US$7.6 billion to invest in both minority and majority transactions.

Founded in 1907 and currently headquartered in Atlanta, Georgia, US, United Parcel Service (UPS) is the world's largest package and document delivery company in revenue and volume. It is also a global provider of specialized transportation and logistics services. UPS serves more than 220 countries and territories worldwide. In 2018, the company generated US$71.8bn in revenue and had a net income of about US$4.8bn with 481,000 employees. It invests in transportation-related companies.

Founded in 1907 and currently headquartered in Atlanta, Georgia, US, United Parcel Service (UPS) is the world's largest package and document delivery company in revenue and volume. It is also a global provider of specialized transportation and logistics services. UPS serves more than 220 countries and territories worldwide. In 2018, the company generated US$71.8bn in revenue and had a net income of about US$4.8bn with 481,000 employees. It invests in transportation-related companies.

Founded in 2010, East Ventures is a venture capital firm with offices in Indonesia, Japan and USA. Today, the company has invested in over 150 companies across Asia, mainly Southeast Asia and Japan, and the USA. Its ticket size ranges from US$100,000 to US$500,000.

Founded in 2010, East Ventures is a venture capital firm with offices in Indonesia, Japan and USA. Today, the company has invested in over 150 companies across Asia, mainly Southeast Asia and Japan, and the USA. Its ticket size ranges from US$100,000 to US$500,000.

Point72 Ventures is the investment arm of US financial group Point 72, established in 2016 in New York. Its principal interests are Fintech, Enterprise technology and A.I. It currently manages 39 companies in its portfolio and has managed the exit of another company, enterprise tech Apprente. Its recent investments include leading multilingual AI-driven translation platform Unbabel's US$60m Series C round, as well as leading the US$42m Series B investment round of Mexican fintech Creditjusto.

Point72 Ventures is the investment arm of US financial group Point 72, established in 2016 in New York. Its principal interests are Fintech, Enterprise technology and A.I. It currently manages 39 companies in its portfolio and has managed the exit of another company, enterprise tech Apprente. Its recent investments include leading multilingual AI-driven translation platform Unbabel's US$60m Series C round, as well as leading the US$42m Series B investment round of Mexican fintech Creditjusto.

Founder and CEO of Makaron

Cai received a degree in engineering from Université de Technologie de Troyes in 2011. In 2012, he obtained a master's degree in Project Management from Essec Business School Paris and a Master of Sciences from Telecom ParisTech. Cai then worked at Microsoft France for a year. In 2013, he co-founded DreamStorm, which helped like-minded people start businesses, which was acquired by EFactor at a valuation of US$6.5m in 2014. Cai then became a partner at Gewara, a movie ticket booking startup. He left the company after it was acquired by Weiying Times in 2016. In 2017, Cai founded Makaron and has acted as CEO ever since.

Cai received a degree in engineering from Université de Technologie de Troyes in 2011. In 2012, he obtained a master's degree in Project Management from Essec Business School Paris and a Master of Sciences from Telecom ParisTech. Cai then worked at Microsoft France for a year. In 2013, he co-founded DreamStorm, which helped like-minded people start businesses, which was acquired by EFactor at a valuation of US$6.5m in 2014. Cai then became a partner at Gewara, a movie ticket booking startup. He left the company after it was acquired by Weiying Times in 2016. In 2017, Cai founded Makaron and has acted as CEO ever since.

Telstra is a corporate venture capitalist headquartered in Sydney, Australia. It has significant investments in Asia, USA and Europe. It typically invests from US$5 million to US$50 million in established businesses that generate millions of dollars in existing revenue.

Telstra is a corporate venture capitalist headquartered in Sydney, Australia. It has significant investments in Asia, USA and Europe. It typically invests from US$5 million to US$50 million in established businesses that generate millions of dollars in existing revenue.

NEA was founded in 1978 and is one of the largest venture capital firms in the world today. They have more than US$17 billion in committed capital across 15 funds. NEA has invested US$400 million in over 20 companies in China to date, including Uroaming, GrowingIO, Gushengtang, 51lietou and Baihe.

NEA was founded in 1978 and is one of the largest venture capital firms in the world today. They have more than US$17 billion in committed capital across 15 funds. NEA has invested US$400 million in over 20 companies in China to date, including Uroaming, GrowingIO, Gushengtang, 51lietou and Baihe.

SWAN Venture Fund is a group of Seattle angel investors established in 2015. It leads in early seed rounds and tends to be the first major outside investment to a startup, ranging from US$200,000 – US$1.2 million. Besides tech startups, it also invests in companies producing innovative commercial products.

SWAN Venture Fund is a group of Seattle angel investors established in 2015. It leads in early seed rounds and tends to be the first major outside investment to a startup, ranging from US$200,000 – US$1.2 million. Besides tech startups, it also invests in companies producing innovative commercial products.

Founded in 1996. With over US$3 billion under management, DCM Ventures has invested more than 280 tech companies in the US and Asia. They focus on seed, early and mid-stage companies in the mobile, consumer internet, software and services sectors. They are behind the A-Fund, which is the world’s first Android-focused VC fund.

Founded in 1996. With over US$3 billion under management, DCM Ventures has invested more than 280 tech companies in the US and Asia. They focus on seed, early and mid-stage companies in the mobile, consumer internet, software and services sectors. They are behind the A-Fund, which is the world’s first Android-focused VC fund.

Founder and CEO of Zen Video

Kang Hongwen earned his doctoral degree in Robotics at Carnegie Mellon University from August 2006 to December 2012. Prior to that, he was a research intern for more than a year at Microsoft Research Asia, during which time he worked on video content analysis, video synthesis, and was part of a team that was awarded a US patent for spacetime montage. An algorithm he worked on was shipped into the Windows XP Media Center Edition. Kang subsequently interned at Intel Research Seattle and Microsoft Research Redmond. In December 2013, he founded Hunch.ai, the company that created the AI-based, cloud video platform Zen Video.

Kang Hongwen earned his doctoral degree in Robotics at Carnegie Mellon University from August 2006 to December 2012. Prior to that, he was a research intern for more than a year at Microsoft Research Asia, during which time he worked on video content analysis, video synthesis, and was part of a team that was awarded a US patent for spacetime montage. An algorithm he worked on was shipped into the Windows XP Media Center Edition. Kang subsequently interned at Intel Research Seattle and Microsoft Research Redmond. In December 2013, he founded Hunch.ai, the company that created the AI-based, cloud video platform Zen Video.

CTO and co-founder of IOMED Medical Solutions

Gabriel de Maeztu is CTO and co-founder of IOMED Medical Solutions, which facilitates data extraction from electronic health records (EHR) and where he has worked since 2016. He had the idea for the software in 2014 and worked on it from then, completing two internships during that time: at QMENTA, formerly Mint Labs, a US drug development startup dedicated to brain diseases (where he worked in data science) and at Barcelona bioresearch center IDIBAPS in neuro-imaging research.De Maeztu holds a doctorate in Medicine from the International University of Catalonia, where he first had the idea for IOMED. He also holds a bachelor’s in Mathematics and a postgraduate qualification in Data Processing, Data Science and Big Data. He was also previously a developer at Barcelona tech agency Chroma Branding.

Gabriel de Maeztu is CTO and co-founder of IOMED Medical Solutions, which facilitates data extraction from electronic health records (EHR) and where he has worked since 2016. He had the idea for the software in 2014 and worked on it from then, completing two internships during that time: at QMENTA, formerly Mint Labs, a US drug development startup dedicated to brain diseases (where he worked in data science) and at Barcelona bioresearch center IDIBAPS in neuro-imaging research.De Maeztu holds a doctorate in Medicine from the International University of Catalonia, where he first had the idea for IOMED. He also holds a bachelor’s in Mathematics and a postgraduate qualification in Data Processing, Data Science and Big Data. He was also previously a developer at Barcelona tech agency Chroma Branding.

Chief Creative Officer and co-founder of Beyond Leather Materials / Leap

Hannah Michaud first started exploring ways to develop sustainable textiles in 2016 while completing her studies in sustainable fashion at Copenhagen’s KEA School of Design & Technology. She also studied fashion technology and design at the KEA academy from 2012 to 2015.Michaud worked as a fashion design intern at Danish company Barbara I Gongini in 2016 and also at Weekend CPH in 2014. After her graduation in 2017, she decided to continue her research work on sustainable fabrics as co-founder and chief creative officer of Danish alt-leather startup, Beyond Leather Materials ApS, in Copenhagen.Originally from Maine, US, Michaud also studied music as a classical flutist at the University of Maine, where she was first chair in its Symphony Orchestra, and Sustainable Agriculture in the university’s Natural Science and Forestry department.

Hannah Michaud first started exploring ways to develop sustainable textiles in 2016 while completing her studies in sustainable fashion at Copenhagen’s KEA School of Design & Technology. She also studied fashion technology and design at the KEA academy from 2012 to 2015.Michaud worked as a fashion design intern at Danish company Barbara I Gongini in 2016 and also at Weekend CPH in 2014. After her graduation in 2017, she decided to continue her research work on sustainable fabrics as co-founder and chief creative officer of Danish alt-leather startup, Beyond Leather Materials ApS, in Copenhagen.Originally from Maine, US, Michaud also studied music as a classical flutist at the University of Maine, where she was first chair in its Symphony Orchestra, and Sustainable Agriculture in the university’s Natural Science and Forestry department.

Red Points: US$38 million Series C to power US conquest

The Barcelona-based startup is ramping up US sales and deep-tech capabilities for its online brand protection platform

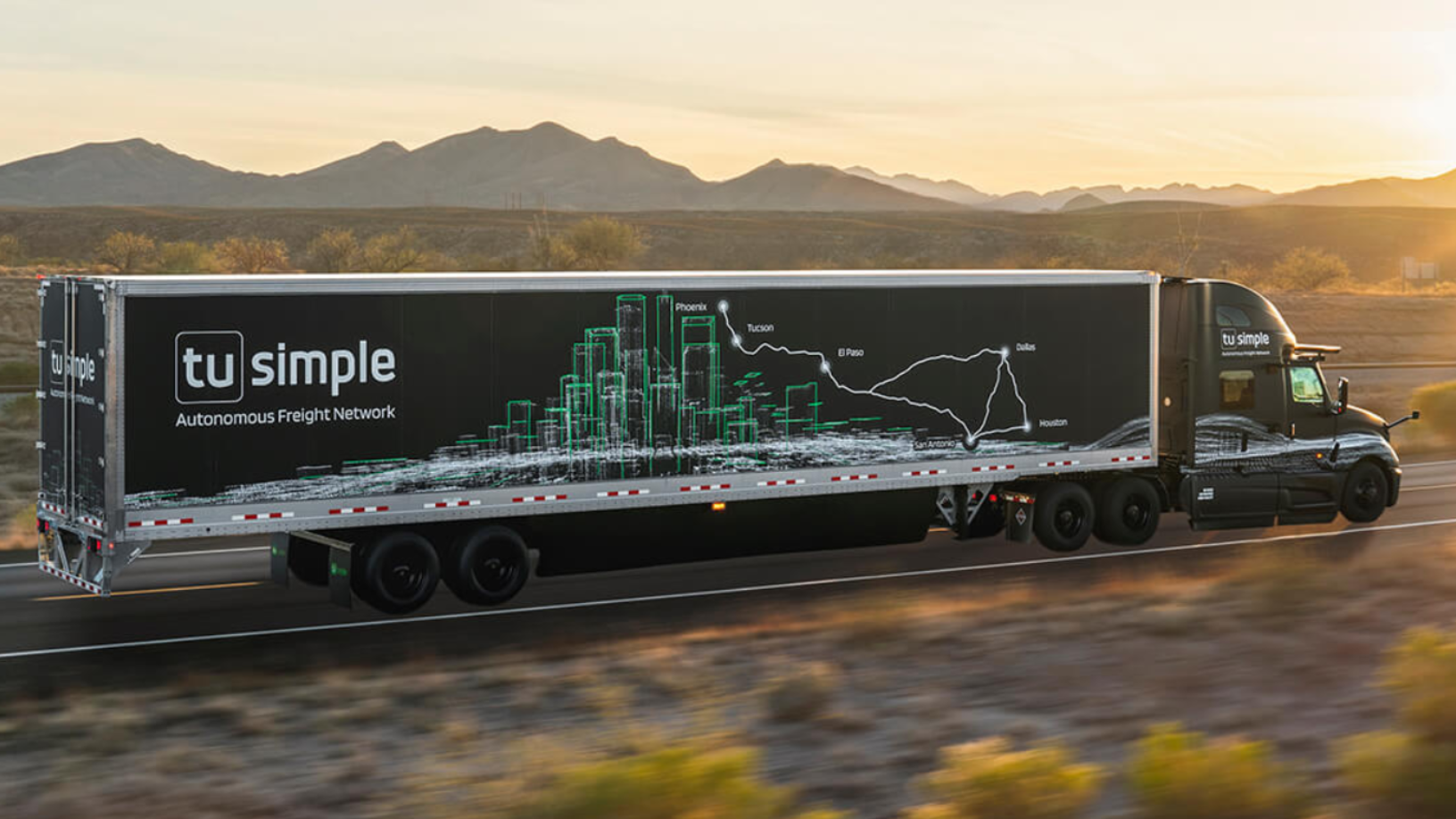

TuSimple: Banking on autonomous trucking in the US

TuSimple aims to scale its Waymo-style driverless trucking network to disrupt the $4tn global truck freight market starting with the US, with mass production by 2024

Vottun: The "WordPress for blockchain" seeks US expansion, investors

Seeking Series A funding this year, the agnostic SaaS opens blockchain's wealth of possibilities to businesses unfamiliar with the technology

Indonesian unicorn Traveloka aims for US listing via SPAC

The online travel aggregator reported revenue drops and layoffs in 2020 but became profitable late last year, led by recoveries in Vietnam and Thailand

Portugal's Prodsmart takes AI, IoT-based manufacturing to US factories

Smart factories can cut wastage by 80% and improve inventory, production and supply chains, tackling US$200 billion worth of losses

HypeLabs wins bumper US$3m seed funding to democratize connectivity

HypeLab's P2P mesh networking technology enables everyone to communicate within their own networks without needing internet, in cities, remote villages and even in disaster zones

Taronga Ventures takes RealTechX to Singapore; plans Japan, US growth

The Australian proptech investor to focus on ESG in its acceleration program, including women under-representation and site safety

Indonesian rental and asset management platform Travelio bags US$18m funding

The four-year-old proptech startup recently raised Series B funding as it gains ground in Indonesia’s growing real estate investment market

Animal AgTech Innovation Summit 2021: Future of aquaculture in the US

With the US Importing over 85% of its seafood, industry experts examine how and why the country should develop a sustainable aquaculture industry

Tuya Smart announces more partnerships, files for IPO in the US

Tuya Smart’s platform enables the creation of smart devices with little or no code writing needed, shortening R&D from months to a matter of days

New Food Invest: Building a plant-based business in the US

With plant-based startups experiencing exponential growth but facing increasingly intense competition, experts consider the opportunities and barriers in the sector

China's new unicorn: Secondhand electronics platform Aihuishou now worth US$1.5 billion

Aihuishou's latest funding round is the largest yet for a secondhand electronics platform

SoccerDream: World's first VR soccer training platform to launch in China, US

SoccerDream uses virtual reality to boost trainee players' performance on the field by 36% compared to their peers

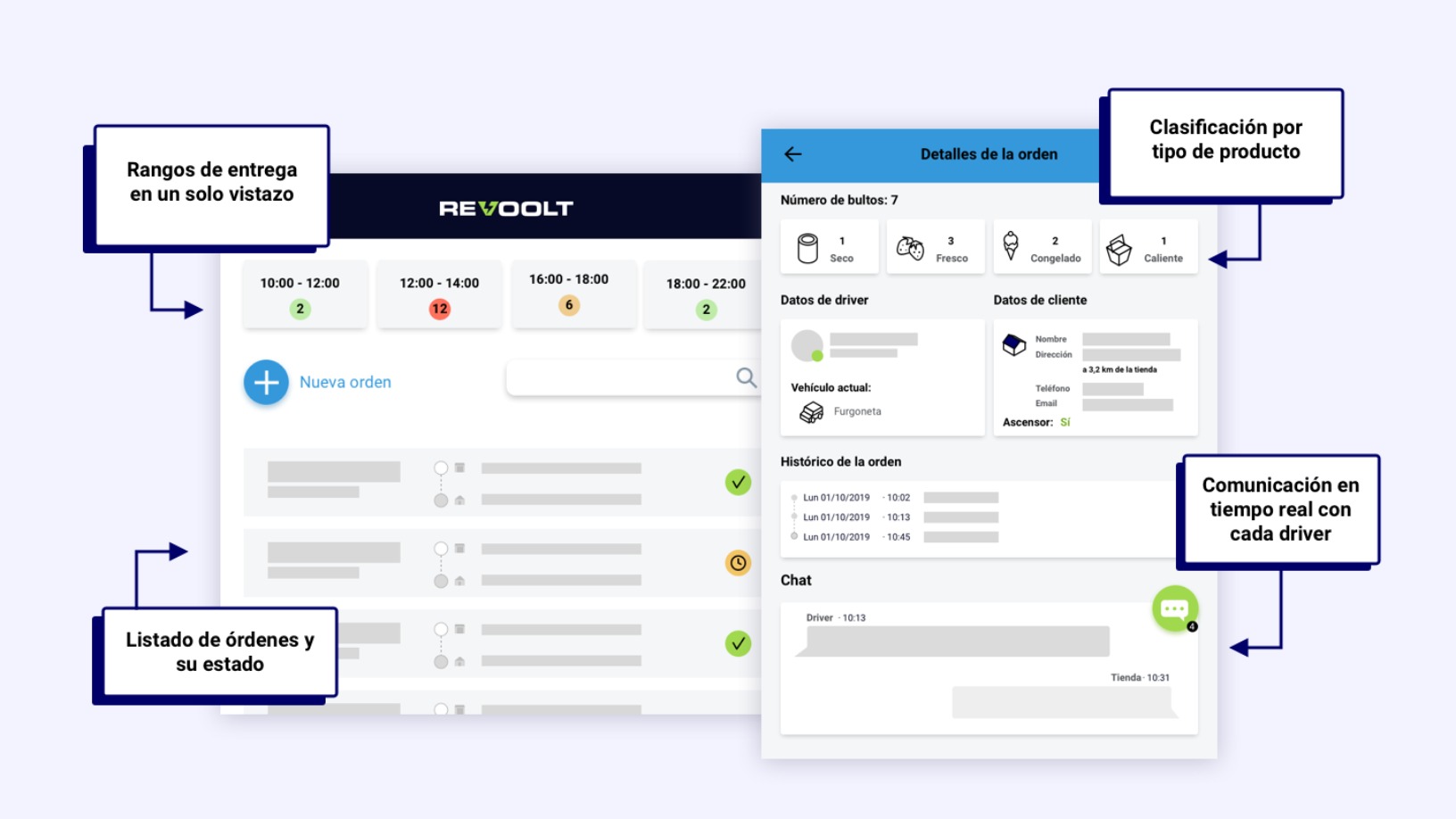

Revoolt: “Covid-19 accelerated our expansion plans and made us more ambitious”

Revoolt’s emission-free last-mile delivery model proved viable during the lockdown in Spain – growth that’s now its launchpad for international expansion and new funding

China’s startups have much to gain from the US-China trade war

The prolonged trade conflict may be exactly what Chinese startups need to strengthen their technological capabilities

Sorry, we couldn’t find any matches for“US”.