US Farmers

-

DATABASE (482)

-

ARTICLES (629)

Proxima Ventures was founded in 2016 in Shanghai. It manages both RMB and US dollar funds, worth around US$150m in total. The firm invests mainly in early-stage startups in the healthcare sector. It has invested in 18 companies and established six innovation centers to incubate medtech startups.

Proxima Ventures was founded in 2016 in Shanghai. It manages both RMB and US dollar funds, worth around US$150m in total. The firm invests mainly in early-stage startups in the healthcare sector. It has invested in 18 companies and established six innovation centers to incubate medtech startups.

Since 2000, Storm Ventures has grown into a US$600 million venture capital firm focusing on early-stage investments.

Since 2000, Storm Ventures has grown into a US$600 million venture capital firm focusing on early-stage investments.

New York-based VC firm Union Square Ventures (USV) was established in 2004 and has invested in more than 100 companies to date. It manages US$1.7bn in assets across nine funds. The most recent, totaling US$450m in commitments, was launched in 2019. USV invests across multiple sectors and all stages of investment. Its specific interest, however, is in businesses derived from academic theses. USV is a prolific investor: recent investments include blockchain-based gaming company Dapper Labs' US$11m Series A round and B2B loan marketplace C2FO's US$200m Series G round.

New York-based VC firm Union Square Ventures (USV) was established in 2004 and has invested in more than 100 companies to date. It manages US$1.7bn in assets across nine funds. The most recent, totaling US$450m in commitments, was launched in 2019. USV invests across multiple sectors and all stages of investment. Its specific interest, however, is in businesses derived from academic theses. USV is a prolific investor: recent investments include blockchain-based gaming company Dapper Labs' US$11m Series A round and B2B loan marketplace C2FO's US$200m Series G round.

The venture capital arm of Cisco was established in 1993 in San Francisco and currently has a US$2bn active portfolio. Each year, it invests between US$200-300m from Series A rounds to later investment stages. Cisco Investments has more than 120 companies in its portfolio. It has managed multiple exits and acquisitions, most recently by purchasing customer analytics technology CloudCherry for an undisclosed sum in August 2019. Cisco Investment's recent portfolio investments include healthcare platform Luma Health's US$16m Series B round and big data cybersecurity startup Exabeam's US$75m Series E round.

The venture capital arm of Cisco was established in 1993 in San Francisco and currently has a US$2bn active portfolio. Each year, it invests between US$200-300m from Series A rounds to later investment stages. Cisco Investments has more than 120 companies in its portfolio. It has managed multiple exits and acquisitions, most recently by purchasing customer analytics technology CloudCherry for an undisclosed sum in August 2019. Cisco Investment's recent portfolio investments include healthcare platform Luma Health's US$16m Series B round and big data cybersecurity startup Exabeam's US$75m Series E round.

Beyond Investing is a Geneva-based firm investing in early-stage venture capital and equity growth startups mainly in European developed markets. With average investments of €200,000, the firm’s core investment strategy focuses on sustainability with an investment period lasting 5–10 years.The impact investor targets innovative startups involved in vegan, cruelty-free and plant-based alternatives; biotechnologies, foodtech, new materials, clothing and lifestyle sectors. Successful portfolio foodtechs include Mosa Meat, BlueNalu and Shiok Meats.With a team of vegan finance professionals in the US and Europe, Beyond Investing listed the first US Vegan Climate ETF (VEGN) on the New York Stock Exchange in September 2019. The ETF tracks Beyond Investing’s US Vegan Climate Index which covers an index of 495 of the largest-capitalization companies in the US stock market. The ethical investment option aims to exclude stocks in companies with activities that are not aligned with its vegan-themed, cruelty-free and fossil-fuel-free investing ethos.

Beyond Investing is a Geneva-based firm investing in early-stage venture capital and equity growth startups mainly in European developed markets. With average investments of €200,000, the firm’s core investment strategy focuses on sustainability with an investment period lasting 5–10 years.The impact investor targets innovative startups involved in vegan, cruelty-free and plant-based alternatives; biotechnologies, foodtech, new materials, clothing and lifestyle sectors. Successful portfolio foodtechs include Mosa Meat, BlueNalu and Shiok Meats.With a team of vegan finance professionals in the US and Europe, Beyond Investing listed the first US Vegan Climate ETF (VEGN) on the New York Stock Exchange in September 2019. The ETF tracks Beyond Investing’s US Vegan Climate Index which covers an index of 495 of the largest-capitalization companies in the US stock market. The ethical investment option aims to exclude stocks in companies with activities that are not aligned with its vegan-themed, cruelty-free and fossil-fuel-free investing ethos.

Western Technology Investment (WTI)

Founded in 1980, Western Technology Investment invests in tech and life science startups. To date, it has invested over $6bn in 1,300 companies worldwide across diverse market segments.The Silicon Valley-based WTI currently has more than 500 companies in its global portfolio. Recent investments include US anti-aging medtech Elevio’s $15m funding in November 2020 and the $4.3m seed round in August 2020 for US fintech for teens Copper Banking.

Founded in 1980, Western Technology Investment invests in tech and life science startups. To date, it has invested over $6bn in 1,300 companies worldwide across diverse market segments.The Silicon Valley-based WTI currently has more than 500 companies in its global portfolio. Recent investments include US anti-aging medtech Elevio’s $15m funding in November 2020 and the $4.3m seed round in August 2020 for US fintech for teens Copper Banking.

Founded in 2017, Starlight Ventures is a venture capital firm based in Miami, Florida. Investing mainly in US-based startups, the VC currently has 29 startups in its portfolio including enterprises involved in alternative energy, carbon reduction or replacement and alt-proteins sectors. In 2020, the firm joined investment rounds for US deep-tech aerospace startup InterCosmos in July and the $84m Series A for fusion energy tech Commonwealth Fusion in May.

Founded in 2017, Starlight Ventures is a venture capital firm based in Miami, Florida. Investing mainly in US-based startups, the VC currently has 29 startups in its portfolio including enterprises involved in alternative energy, carbon reduction or replacement and alt-proteins sectors. In 2020, the firm joined investment rounds for US deep-tech aerospace startup InterCosmos in July and the $84m Series A for fusion energy tech Commonwealth Fusion in May.

Managing Director and co-founder of String Bio

Vinod Kumar originally founded Samrat Wears clothing company in India in 1993 and went on to graduate in mechanical engineering in 1997 at BMS College of Engineering in India.In 2000, he completed a master’s in supply chain management, industrial and manufacturing systems engineering at Ohio University in the US. He started his career at Bell Labs as a product engineer. In 2000, he worked at telco Alcatel-Lucent that later became part of Nokia. In 2008, he held various senior roles and became senior director at tech company Juniper Networks in Silicon Valley. In 2013, he joined his wife Ezhil Subbian to set up String Bio in India. He became a full-time managing director of the company in 2015. In 2019, he became a fellow member at Unreasonable, an investment fund and organization for supporting innovative entrepreneurs to solve social and environmental issues worldwide.

Vinod Kumar originally founded Samrat Wears clothing company in India in 1993 and went on to graduate in mechanical engineering in 1997 at BMS College of Engineering in India.In 2000, he completed a master’s in supply chain management, industrial and manufacturing systems engineering at Ohio University in the US. He started his career at Bell Labs as a product engineer. In 2000, he worked at telco Alcatel-Lucent that later became part of Nokia. In 2008, he held various senior roles and became senior director at tech company Juniper Networks in Silicon Valley. In 2013, he joined his wife Ezhil Subbian to set up String Bio in India. He became a full-time managing director of the company in 2015. In 2019, he became a fellow member at Unreasonable, an investment fund and organization for supporting innovative entrepreneurs to solve social and environmental issues worldwide.

Co-founder, CEO and Chairman of Feedzai

Nuno Sebastião is CEO and co-founder at Feedzai, the world’s market-leading digital solution in fighting online fraud and the fourth Portuguese unicorn, where he has worked full-time since 2010, from before its official launch. Since 2018, he has also been a senior advisor at Feedzai’s investor, the US-based VC Oak HC/FC. Prior to Feedzai, Sebastião was a product manager at the European Space Agency in Germany from 2006–10, where he led the development of the Satellite Simulation Infrastructure. Previously, he was Founder and CEO at his first startup, a company pioneering software validation for the aerospace sector, for just under two years, and worked as a consultant at Critical Software and Deloitte, for a total of three years.Sebastião holds two MBAs, one from London Business School and the other from UCLA, and completed his undergraduate studies in computer science at the University of Coimbra, Portugal.

Nuno Sebastião is CEO and co-founder at Feedzai, the world’s market-leading digital solution in fighting online fraud and the fourth Portuguese unicorn, where he has worked full-time since 2010, from before its official launch. Since 2018, he has also been a senior advisor at Feedzai’s investor, the US-based VC Oak HC/FC. Prior to Feedzai, Sebastião was a product manager at the European Space Agency in Germany from 2006–10, where he led the development of the Satellite Simulation Infrastructure. Previously, he was Founder and CEO at his first startup, a company pioneering software validation for the aerospace sector, for just under two years, and worked as a consultant at Critical Software and Deloitte, for a total of three years.Sebastião holds two MBAs, one from London Business School and the other from UCLA, and completed his undergraduate studies in computer science at the University of Coimbra, Portugal.

Co-founder and CTO of Feedzai

Paulo Marques is CTO and co-founder at Feedzai, the world’s market-leading solution in fighting online fraud and the fourth Portuguese unicorn, where he has worked full-time since 2009, from before its official launch. He has also been a member of Forbes Technology Council since 2016 and simultaneously Scientific Director and part of the leadership team of the Carnegie Mellon Portugal international program.He was previously an expert technical consultant for the European Space Agency at the European Space Operation Center in Darmstadt, Germany for six years as well as simultaneously being an assistant professor at his former university, the University of Coimbra. Marques was also previously a software consultant at Coimbra’s Critical Software for 11 years and founded his own software company WIT Software. Marques holds a PhD in informatics engineering from the University of Coimbra and also studied software engineering at Carnegie Mellon University in the US.

Paulo Marques is CTO and co-founder at Feedzai, the world’s market-leading solution in fighting online fraud and the fourth Portuguese unicorn, where he has worked full-time since 2009, from before its official launch. He has also been a member of Forbes Technology Council since 2016 and simultaneously Scientific Director and part of the leadership team of the Carnegie Mellon Portugal international program.He was previously an expert technical consultant for the European Space Agency at the European Space Operation Center in Darmstadt, Germany for six years as well as simultaneously being an assistant professor at his former university, the University of Coimbra. Marques was also previously a software consultant at Coimbra’s Critical Software for 11 years and founded his own software company WIT Software. Marques holds a PhD in informatics engineering from the University of Coimbra and also studied software engineering at Carnegie Mellon University in the US.

Co-founder of Therapixal

Olivier Clatz is the French co-founder of AI medical diagnosis company Therapixel, creator of MammoScreen breast cancer screening and diagnosis tool. Prior to co-founding Therapixel, Clatz worked for six years as a research scientist at INRIA (National Institute for Research in Digital Science and Technology) based at the Sophia Antipolis technology park near Antibes, in the south of France. His later work with INRIA focused on exploiting machine learning algorithms for medical imaging processing. Prior to this, he was a research associate at Harvard Medical School, in the US. In 2006, he completed his PhD at INRIA on the concept of personalized medicine. Clatz also holds a PhD in philosophy from the Ecole des Mines de Paris, and a master's degree in applied mathematics from the Ecole Normale Supérieure Paris-Saclay. Currently, he works at the French Government’s Commissariat Générale pour l’Investissement managing the national program AI For Diagnostics. He left Therapixel in 2019.

Olivier Clatz is the French co-founder of AI medical diagnosis company Therapixel, creator of MammoScreen breast cancer screening and diagnosis tool. Prior to co-founding Therapixel, Clatz worked for six years as a research scientist at INRIA (National Institute for Research in Digital Science and Technology) based at the Sophia Antipolis technology park near Antibes, in the south of France. His later work with INRIA focused on exploiting machine learning algorithms for medical imaging processing. Prior to this, he was a research associate at Harvard Medical School, in the US. In 2006, he completed his PhD at INRIA on the concept of personalized medicine. Clatz also holds a PhD in philosophy from the Ecole des Mines de Paris, and a master's degree in applied mathematics from the Ecole Normale Supérieure Paris-Saclay. Currently, he works at the French Government’s Commissariat Générale pour l’Investissement managing the national program AI For Diagnostics. He left Therapixel in 2019.

CEO and Founder of CH Biomedical

Chen Chen is an expert in artificial heart development. After graduating from Tsinghua University with a major in Thermal Engineering in 1984, he switched to study Biomechanics in Sichuan University and received a doctorate in 1991.He lectured at Nanjing University from 1991 to 1996 before going to Japan to continue his research on artificial heart technology and development. He was a visiting scholar at the University of Tokyo for one year until 1997.In 1999, Chen was headhunted and joined a US startup to work on developing an artificial heart (LVAD) product Levacor. The startup was later acquired by World Heart Corporation and Chen became its chief engineer. World Heart decided to shut down the program in 2006 because the product was too big to be placed inside a human chest.Chen went back to China in 2007 to found CH Biomedical to build a smaller LVAD device.

Chen Chen is an expert in artificial heart development. After graduating from Tsinghua University with a major in Thermal Engineering in 1984, he switched to study Biomechanics in Sichuan University and received a doctorate in 1991.He lectured at Nanjing University from 1991 to 1996 before going to Japan to continue his research on artificial heart technology and development. He was a visiting scholar at the University of Tokyo for one year until 1997.In 1999, Chen was headhunted and joined a US startup to work on developing an artificial heart (LVAD) product Levacor. The startup was later acquired by World Heart Corporation and Chen became its chief engineer. World Heart decided to shut down the program in 2006 because the product was too big to be placed inside a human chest.Chen went back to China in 2007 to found CH Biomedical to build a smaller LVAD device.

Arthur Kosten is an adviser for Booking.com and other companies like Festicket and eVentures Africa Fund. He was the former CMO and co-founder of Booking.com. Together with other business angels and VCs, he generally invests about US$200,000 to US$1 million in various marketplace platforms for expansion in Europe. He is also an investor and board member of rentalcars.com, catawiki.com, treatwell, 8fit.com, festicket and healthcare.com.

Arthur Kosten is an adviser for Booking.com and other companies like Festicket and eVentures Africa Fund. He was the former CMO and co-founder of Booking.com. Together with other business angels and VCs, he generally invests about US$200,000 to US$1 million in various marketplace platforms for expansion in Europe. He is also an investor and board member of rentalcars.com, catawiki.com, treatwell, 8fit.com, festicket and healthcare.com.

Softbank-Indosat Fund (SB-ISAT Fund)

A joint US$50 million venture capital fund by SoftBank and Indonesian telecommunications company Indosat. The fund, founded in 2014, invests in companies based in Indonesia.

A joint US$50 million venture capital fund by SoftBank and Indonesian telecommunications company Indosat. The fund, founded in 2014, invests in companies based in Indonesia.

Headquartered in Silicon Valley, Lightspeed Venture Partners is an early-stage VC firm that focuses on the enterprise and consumer sectors. Over the past two decades, the firm has backed more than 300 companies globally. It currently has over US$4bn in committed capital. The firm invests mainly in the US, Israel, India and China. It also works in collaboration with Lightspeed China Partners, a China-focused venture capital firm, to make investments in China.

Headquartered in Silicon Valley, Lightspeed Venture Partners is an early-stage VC firm that focuses on the enterprise and consumer sectors. Over the past two decades, the firm has backed more than 300 companies globally. It currently has over US$4bn in committed capital. The firm invests mainly in the US, Israel, India and China. It also works in collaboration with Lightspeed China Partners, a China-focused venture capital firm, to make investments in China.

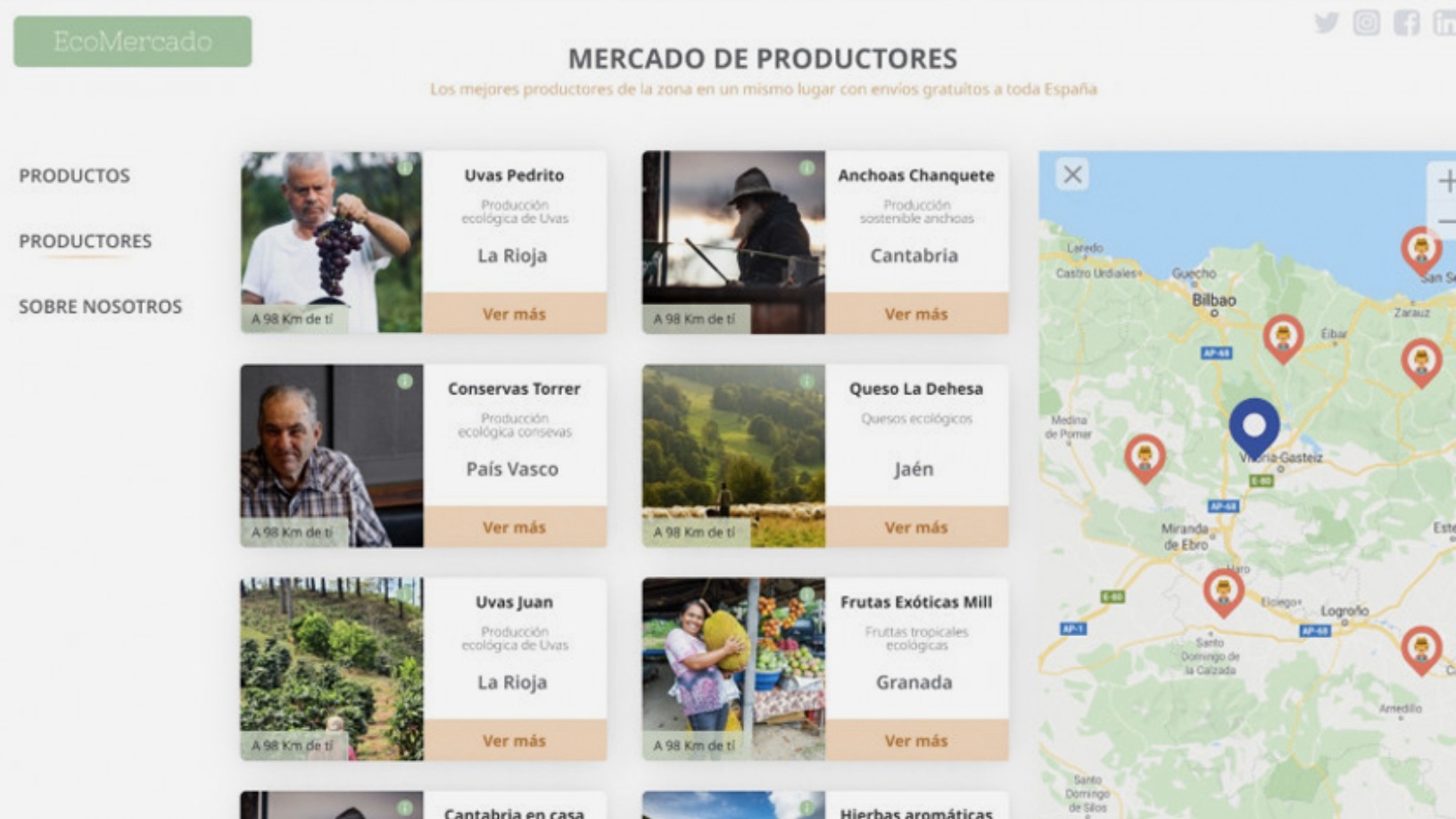

8villages is one of the first agritech startups in Indonesia, and the social media for farmers has since expanded into e-commerce and agriculture data collection

Plant on Demand: Helping small-scale organic farmers to thrive, sustainably

Plant on Demand will soon deploy product PODX’s “prescriptive” analytics to boost organic farmers’ productivity and prices, by optimizing future crop yields to match seasonal sales trends

Red Points: US$38 million Series C to power US conquest

The Barcelona-based startup is ramping up US sales and deep-tech capabilities for its online brand protection platform

Inspired by kangaroos, ProAgni wants to wean the livestock farming industry off antibiotics

Australia’s ProAgni is making grain-feed supplements to improve livestock growth, negate antibiotic use and even reduce methane emissions, all based on kangaroo gut health research

AgroCenta: Providing market access and credit to African smallholder farmers

AgroCenta’s platforms empower Ghanaian subsistence farmers, especially women, boosting productivity and sales with e-payments, micro-credits and insurance, and direct connections to buyers, cutting out the intermediaries

Future Food Asia 2021: Regenerative agriculture in Asia

The unique challenges facing regenerative agriculture in Asia require solutions different from those in the West, presenting opportunities for microfinancing and impact investment

Yudha Kartohadiprodjo wants to empower Indonesian farmers

Kartohadiprodjo founded Karsa, an agritech social media startup, to arm farmers with better knowledge and information sharing

Ricult: Providing smallholder farmers easier access to capital

Based in Pakistan and Thailand, Ricult’s mobile app platform provides advanced weather forecasting, easy loan applications and direct market access to help farmers increase productivity and profits

Indonesia's aquaculture startup eFishery eyes 1m farmer users in region

Bandung-based eFishery has diversified to fish sales and loan services, seeking to replicate its success in 10 countries in Southeast and South Asia, starting with Thailand

Nongguanjia: Housekeeper of Chinese farmers' fortunes

Combining fintech and e-commerce, Nongguanjia started by monetizing land circulation, to help hundreds of millions of Chinese farmers get financing and thrive

Crowde-funding Indonesia's fields

Agritech startup Crowde offers retail investors direct access to Indonesia’s US$25 billion agricultural sector, transforming the way traditional farmers fund, run and grow their businesses

Future Food Asia: Covid-19 sparked dramatic shifts in agriculture in China and India

Key Chinese players from e-commerce giant Pinduoduo and and agritech VC Omnivore share their insights at last week’s agrifood conference by ID Capital

Pula: Pioneering insurtech helps to improve Africa's food security

With Kenyan insurtech Pula’s micro-insurance products, millions of farmers no longer have to bear the full risk of losses from natural disasters and crop failures

For crop pest control, McFly does all the thinking

Chinese agtech startup McFly deploys data-driven crop health and pesticide monitoring systems so farmers get higher-quality yields and less wastage

Vence: Virtual fencing for sustainable livestock rearing

The startup uses GPS and AI algorithms to create virtual fences that work with animal collars for more efficient management of livestock and grasslands

Sorry, we couldn’t find any matches for“US Farmers”.