US Farmers

-

DATABASE (482)

-

ARTICLES (629)

Founded in Boston in 2019, Transformation is entirely dedicated to healthcare disruption, predominently focuses on US investments and typically invests $10-30m per startup. It currently has 22 companies in its portfolio. Its most recent investments include in the June 2021 $85m Series C round of Portuguese home physiotherapy tech solution SWORD Health, the world’s fastest-growing musculoskeletal solution, and, the same month, in the $21m Series D round of Protenus, the US’ leading healthcare compliance analytics firm.

Founded in Boston in 2019, Transformation is entirely dedicated to healthcare disruption, predominently focuses on US investments and typically invests $10-30m per startup. It currently has 22 companies in its portfolio. Its most recent investments include in the June 2021 $85m Series C round of Portuguese home physiotherapy tech solution SWORD Health, the world’s fastest-growing musculoskeletal solution, and, the same month, in the $21m Series D round of Protenus, the US’ leading healthcare compliance analytics firm.

Founded in 2020 in Boulder, Colorado, Trailhead Capital is a specialist agtech and foodtech investor that focuses on startups in the US, Canada, Australia and Israel. The VC’s regenerative agriculture portfolio includes investments in food ingredients traceability, food supply chains, reducing food waste and soil health environmental management.Recent investments include in the $12m Series A round of Vence, a US-based producer of virtual fencing wearables for livestock management in May 2021. In February 2021, it also participated in the $6m funding round of foodtech HowGood that specializes in rating the sustainability of grocery products.

Founded in 2020 in Boulder, Colorado, Trailhead Capital is a specialist agtech and foodtech investor that focuses on startups in the US, Canada, Australia and Israel. The VC’s regenerative agriculture portfolio includes investments in food ingredients traceability, food supply chains, reducing food waste and soil health environmental management.Recent investments include in the $12m Series A round of Vence, a US-based producer of virtual fencing wearables for livestock management in May 2021. In February 2021, it also participated in the $6m funding round of foodtech HowGood that specializes in rating the sustainability of grocery products.

RMKB Ventures is a hands-on venture firm investing in seed stage digital companies in Indonesia. Managing partner Kevin Sutantyo is a veteran entrepreneur in the US and in Indonesia. He recently became a venture partner at Sovereign’s Capital, also an investor in Printerous.

RMKB Ventures is a hands-on venture firm investing in seed stage digital companies in Indonesia. Managing partner Kevin Sutantyo is a veteran entrepreneur in the US and in Indonesia. He recently became a venture partner at Sovereign’s Capital, also an investor in Printerous.

Alvaro Córdoba is better known as co-founder and chief strategy officer at Spanish online room rental platform Badi that secured US$30m in Series B investment in 2019. Córdoba joined the seed round of household bill management tool Polaroo in 2019.

Alvaro Córdoba is better known as co-founder and chief strategy officer at Spanish online room rental platform Badi that secured US$30m in Series B investment in 2019. Córdoba joined the seed round of household bill management tool Polaroo in 2019.

Korea Investment Partners is a venture capital fund established in 1986. It primarily invests in companies from Korea, China and the United States. It has invested a total of more than US$1.7 billion in over 500 companies across various sectors, from social media to medtech.

Korea Investment Partners is a venture capital fund established in 1986. It primarily invests in companies from Korea, China and the United States. It has invested a total of more than US$1.7 billion in over 500 companies across various sectors, from social media to medtech.

Founder of PreAngel Fund, an early-stage investment firm with over RMB 300 million under management. Since 2011, PreAngel has invested in 260+ startups from China and the US. Leo Wang has over 14 years of experience in mobile, telecommunication and internet industries.

Founder of PreAngel Fund, an early-stage investment firm with over RMB 300 million under management. Since 2011, PreAngel has invested in 260+ startups from China and the US. Leo Wang has over 14 years of experience in mobile, telecommunication and internet industries.

Carlos Pierre is the co-founder and CEO of Spanish online room rental platform Badi that was established in 2015 and secured Series B investment of US$30m in 2019. Pierre's first investment is the seed funding of household bill manager Polaroo in 2019.

Carlos Pierre is the co-founder and CEO of Spanish online room rental platform Badi that was established in 2015 and secured Series B investment of US$30m in 2019. Pierre's first investment is the seed funding of household bill manager Polaroo in 2019.

Among the first private equity firms to invest in Asia, TPG Capital Asia is the regional investment arm of US private equity firm TPG Capital. With offices in Beijing, Hong Kong, Melbourne, Mumbai and Singapore, it currently has about $9.9bn in assets under management.

Among the first private equity firms to invest in Asia, TPG Capital Asia is the regional investment arm of US private equity firm TPG Capital. With offices in Beijing, Hong Kong, Melbourne, Mumbai and Singapore, it currently has about $9.9bn in assets under management.

The International Financial Corporation (IFC) was founded in 1956 and is a member of the World Bank Group. It is one of the world’s largest development institutions focusing on the private sector in developing countries. It operates in more than 100 countries and has leveraged US$2.6 billion in capital from the private investment sector to deliver more than US$265 billion in financing for businesses.

The International Financial Corporation (IFC) was founded in 1956 and is a member of the World Bank Group. It is one of the world’s largest development institutions focusing on the private sector in developing countries. It operates in more than 100 countries and has leveraged US$2.6 billion in capital from the private investment sector to deliver more than US$265 billion in financing for businesses.

Endeavor Catalyst is part of the global investment company Endeavor. Launched in 2012 and based in New York, it supports the equity funding efforts of Endeavour entrepreneurs with third party investors. Its portfolio investments had a total capital value of over US$100 million and it specializes in mid-stage investments across sectors and different countries, with significant investment in transportation startups to date. In 2020, it participated in the second €12m part of the €23m Series A round of EV charging hardware startup, Wallbox, with an undisclosed investment. Other recent investments in 2020 include in the US$40m Series D round of Egyptian healthtech Vezeeta and in the undisclosed seed round of Turkish fintech Figopara.

Endeavor Catalyst is part of the global investment company Endeavor. Launched in 2012 and based in New York, it supports the equity funding efforts of Endeavour entrepreneurs with third party investors. Its portfolio investments had a total capital value of over US$100 million and it specializes in mid-stage investments across sectors and different countries, with significant investment in transportation startups to date. In 2020, it participated in the second €12m part of the €23m Series A round of EV charging hardware startup, Wallbox, with an undisclosed investment. Other recent investments in 2020 include in the US$40m Series D round of Egyptian healthtech Vezeeta and in the undisclosed seed round of Turkish fintech Figopara.

Founded in 1997, Seventure Partners is one of Europe’s most prolific VC investors with a portfolio of over 200 startups across both tech and non-tech sectors. The French VC has also managed more than 40 exits in total. It mainly focuses on fintech and insurtech, French and German startups and in life sciences in Europe, North America and Asia.Its five funds cover different market segments, ranging from €24m–€200m, with investments of €500,000–€10m per round. Total funding for a company can reach €20m, right through the early to late stages. Recent investments include the $6.7m Series A round of US biotech Dermala and the $10.7m Series A round of US self-cleaning water bottle startup LARQ.

Founded in 1997, Seventure Partners is one of Europe’s most prolific VC investors with a portfolio of over 200 startups across both tech and non-tech sectors. The French VC has also managed more than 40 exits in total. It mainly focuses on fintech and insurtech, French and German startups and in life sciences in Europe, North America and Asia.Its five funds cover different market segments, ranging from €24m–€200m, with investments of €500,000–€10m per round. Total funding for a company can reach €20m, right through the early to late stages. Recent investments include the $6.7m Series A round of US biotech Dermala and the $10.7m Series A round of US self-cleaning water bottle startup LARQ.

Founded in Chicago in 2011, Hyde Park invests in Midwestern US and occasionally Canadian startups from early-stage usually through two investment rounds across tech sectors. It currently has 62 startups in its portfolio and has managed 12 exits to date. Its most recent investments in January 2021 include Canadian e-commerce site BlackCart’s $8.8m Series A round and US podcast database Podchaser’s $5.7m Series A round. In November 2020, it invested in real estate productivity software NestEgg’s $7m Series A round.

Founded in Chicago in 2011, Hyde Park invests in Midwestern US and occasionally Canadian startups from early-stage usually through two investment rounds across tech sectors. It currently has 62 startups in its portfolio and has managed 12 exits to date. Its most recent investments in January 2021 include Canadian e-commerce site BlackCart’s $8.8m Series A round and US podcast database Podchaser’s $5.7m Series A round. In November 2020, it invested in real estate productivity software NestEgg’s $7m Series A round.

Founded in 2008, the US-based Kickstart Fund specializes in supporting midwestern US startups in Utah, Colorado and the Mountain West. The community investment platform has more than 110 companies in its portfolio valued at over $300m. It invests across all market segments, mostly in companies based in Utah, with a few in New Mexico and the UK.Recent investments in May 2021 include participation in the Series A $12m funding of Vence and $1.5m seed round of skincare marketplace, Pomp. In July 2021, it also joined the $4.5m investment round of retail SaaS provider Clientbook.

Founded in 2008, the US-based Kickstart Fund specializes in supporting midwestern US startups in Utah, Colorado and the Mountain West. The community investment platform has more than 110 companies in its portfolio valued at over $300m. It invests across all market segments, mostly in companies based in Utah, with a few in New Mexico and the UK.Recent investments in May 2021 include participation in the Series A $12m funding of Vence and $1.5m seed round of skincare marketplace, Pomp. In July 2021, it also joined the $4.5m investment round of retail SaaS provider Clientbook.

Co-founder, CEO of Bodyswaps

Christophe Mallet is the French co-founder and CEO of UK-based VR edtech for soft-skills training Bodyswaps, where he has worked since its founding in 2019. Prior to this, he was CEO and co-founder at VR marketing agency Somewhere Else from 2016 before the agency pivoted to training and skills development and became the basis of Bodyswaps’ product offer. The agency had clients such as Adidas, for which Somewhere Else produced an interactive VR in-store promotional tool that was deployed in over 100 locations in China, Europe and the US and was nominated for a VR Award and an Immersive Perspective award. Mallet also co-founded another VR agency Exheb, forerunner to Somewhere Else in 2014.For almost six years before that, Mallet worked in social media and digital strategy management at Carve Consulting in London, a digital agency helping organisations to become social businesses. Mallet also co-founded a music label, Ubermax Records, in 2011.Mallet holds two master’s degrees: Science in Management and Business from the HEC School of Management in Paris, and International Business and Management from Vienna University of Economics and Management.

Christophe Mallet is the French co-founder and CEO of UK-based VR edtech for soft-skills training Bodyswaps, where he has worked since its founding in 2019. Prior to this, he was CEO and co-founder at VR marketing agency Somewhere Else from 2016 before the agency pivoted to training and skills development and became the basis of Bodyswaps’ product offer. The agency had clients such as Adidas, for which Somewhere Else produced an interactive VR in-store promotional tool that was deployed in over 100 locations in China, Europe and the US and was nominated for a VR Award and an Immersive Perspective award. Mallet also co-founded another VR agency Exheb, forerunner to Somewhere Else in 2014.For almost six years before that, Mallet worked in social media and digital strategy management at Carve Consulting in London, a digital agency helping organisations to become social businesses. Mallet also co-founded a music label, Ubermax Records, in 2011.Mallet holds two master’s degrees: Science in Management and Business from the HEC School of Management in Paris, and International Business and Management from Vienna University of Economics and Management.

Founded in 2015 by former vice president of Tencent and GM of Tencent M&A, Richard Peng (Peng Zhijian), and former vice GM of Tencent M&A, Kurt Xu, Genesis Capital specializes in growth stage investment of internet startups in China and the US.

Founded in 2015 by former vice president of Tencent and GM of Tencent M&A, Richard Peng (Peng Zhijian), and former vice GM of Tencent M&A, Kurt Xu, Genesis Capital specializes in growth stage investment of internet startups in China and the US.

8villages is one of the first agritech startups in Indonesia, and the social media for farmers has since expanded into e-commerce and agriculture data collection

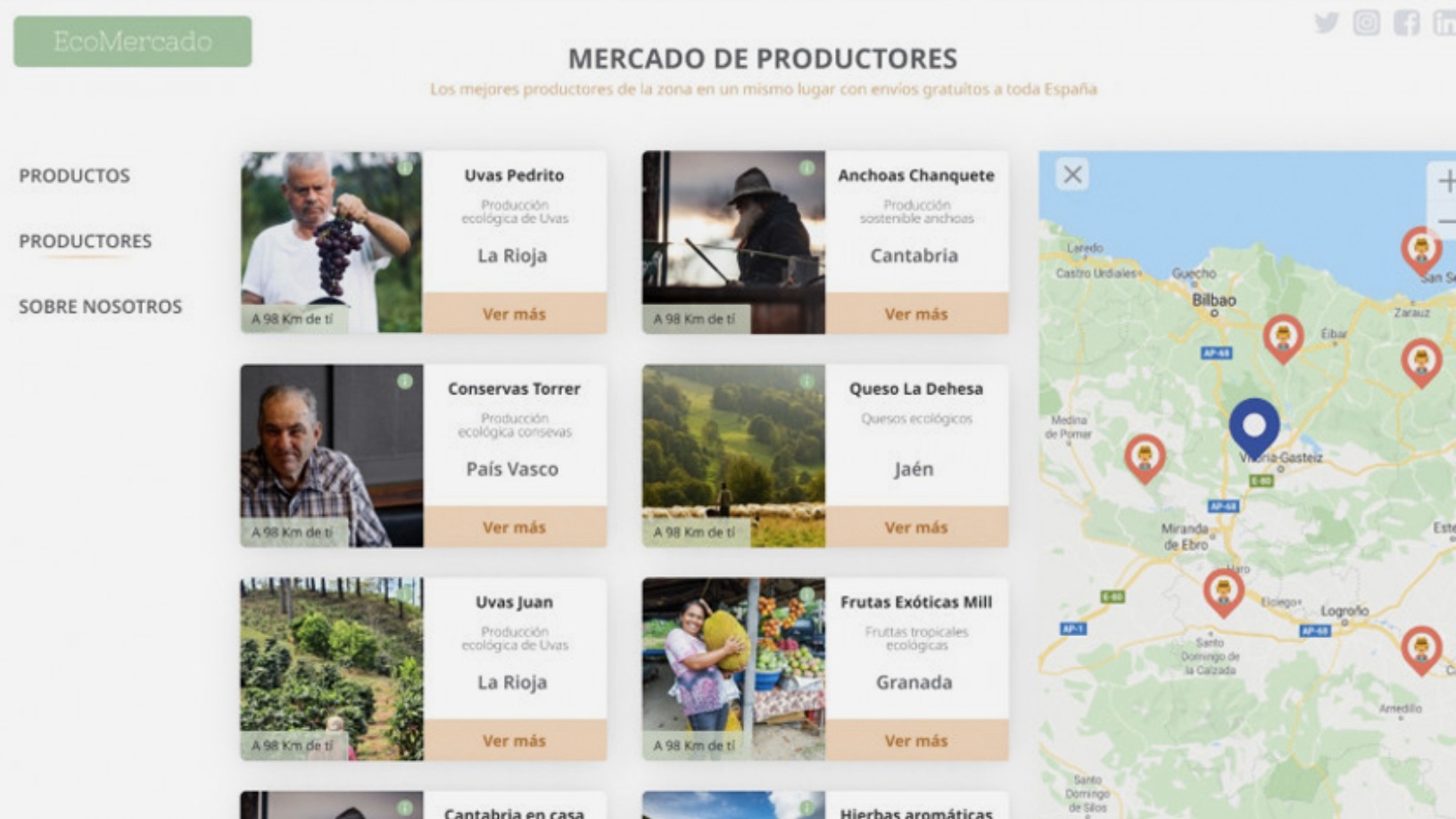

Plant on Demand: Helping small-scale organic farmers to thrive, sustainably

Plant on Demand will soon deploy product PODX’s “prescriptive” analytics to boost organic farmers’ productivity and prices, by optimizing future crop yields to match seasonal sales trends

Red Points: US$38 million Series C to power US conquest

The Barcelona-based startup is ramping up US sales and deep-tech capabilities for its online brand protection platform

Inspired by kangaroos, ProAgni wants to wean the livestock farming industry off antibiotics

Australia’s ProAgni is making grain-feed supplements to improve livestock growth, negate antibiotic use and even reduce methane emissions, all based on kangaroo gut health research

AgroCenta: Providing market access and credit to African smallholder farmers

AgroCenta’s platforms empower Ghanaian subsistence farmers, especially women, boosting productivity and sales with e-payments, micro-credits and insurance, and direct connections to buyers, cutting out the intermediaries

Future Food Asia 2021: Regenerative agriculture in Asia

The unique challenges facing regenerative agriculture in Asia require solutions different from those in the West, presenting opportunities for microfinancing and impact investment

Yudha Kartohadiprodjo wants to empower Indonesian farmers

Kartohadiprodjo founded Karsa, an agritech social media startup, to arm farmers with better knowledge and information sharing

Ricult: Providing smallholder farmers easier access to capital

Based in Pakistan and Thailand, Ricult’s mobile app platform provides advanced weather forecasting, easy loan applications and direct market access to help farmers increase productivity and profits

Indonesia's aquaculture startup eFishery eyes 1m farmer users in region

Bandung-based eFishery has diversified to fish sales and loan services, seeking to replicate its success in 10 countries in Southeast and South Asia, starting with Thailand

Nongguanjia: Housekeeper of Chinese farmers' fortunes

Combining fintech and e-commerce, Nongguanjia started by monetizing land circulation, to help hundreds of millions of Chinese farmers get financing and thrive

Crowde-funding Indonesia's fields

Agritech startup Crowde offers retail investors direct access to Indonesia’s US$25 billion agricultural sector, transforming the way traditional farmers fund, run and grow their businesses

Future Food Asia: Covid-19 sparked dramatic shifts in agriculture in China and India

Key Chinese players from e-commerce giant Pinduoduo and and agritech VC Omnivore share their insights at last week’s agrifood conference by ID Capital

Pula: Pioneering insurtech helps to improve Africa's food security

With Kenyan insurtech Pula’s micro-insurance products, millions of farmers no longer have to bear the full risk of losses from natural disasters and crop failures

For crop pest control, McFly does all the thinking

Chinese agtech startup McFly deploys data-driven crop health and pesticide monitoring systems so farmers get higher-quality yields and less wastage

Vence: Virtual fencing for sustainable livestock rearing

The startup uses GPS and AI algorithms to create virtual fences that work with animal collars for more efficient management of livestock and grasslands

Sorry, we couldn’t find any matches for“US Farmers”.