US Xpress

-

DATABASE (434)

-

ARTICLES (604)

Established in 2014, WOW Aceleradora is a startup accelerator based in Porto Alegre, Brazil. It has invested over BR$8 million (US$2.1 million) through its network of 170 angel investors, specializing in tech companies.

Established in 2014, WOW Aceleradora is a startup accelerator based in Porto Alegre, Brazil. It has invested over BR$8 million (US$2.1 million) through its network of 170 angel investors, specializing in tech companies.

Headquartered in Shanghai, FC Capital was founded in 2017 to focus on investments in China and the US. The VC mainly invests in medtech sectors like biotechnology, medical devices, medical services and health-related consumer products.

Headquartered in Shanghai, FC Capital was founded in 2017 to focus on investments in China and the US. The VC mainly invests in medtech sectors like biotechnology, medical devices, medical services and health-related consumer products.

Led by billionaire investors includings Bill Gates, Jeff Bezos, Jack Ma, Michael Bloomberg and Richard Branson, US-based Breakthrough Energy Ventures (BEV) is an energy tech innovation fund for highly-scalable tech with the potential to help cut net greenhouse gas emissions to zero. Since its founding in 2016, it has launched several funds, including the $1bn Breakthrough Energy Ventures initial fund and a $100m European fund. The entity employs scientists and has a model available to startups to identify sustainability opportunities in the US grid. It currently has 30 startups in its portfolio across technologies and geographies. Among its most recent investments in early 2021 are the $11.5m Series A round of US low-emission hydrogen producer C-Zero and in the $50m Series B round of US sustainable metal producer Boston Metals. In January 2021, BEV also closed a new round of another $1 billion to invest in up to 50 startups. The round saw the addition participation of several new investors including Abigail Johnson, CEO of Fidelity Investments, Shopify founder Tobias Lütke, property developer John Sobrato, of CEO of hedge fund Baupost Group Seth Klarman, founder of Tableau Software Chris Stolte and Walmart heir Sam Walton.

Led by billionaire investors includings Bill Gates, Jeff Bezos, Jack Ma, Michael Bloomberg and Richard Branson, US-based Breakthrough Energy Ventures (BEV) is an energy tech innovation fund for highly-scalable tech with the potential to help cut net greenhouse gas emissions to zero. Since its founding in 2016, it has launched several funds, including the $1bn Breakthrough Energy Ventures initial fund and a $100m European fund. The entity employs scientists and has a model available to startups to identify sustainability opportunities in the US grid. It currently has 30 startups in its portfolio across technologies and geographies. Among its most recent investments in early 2021 are the $11.5m Series A round of US low-emission hydrogen producer C-Zero and in the $50m Series B round of US sustainable metal producer Boston Metals. In January 2021, BEV also closed a new round of another $1 billion to invest in up to 50 startups. The round saw the addition participation of several new investors including Abigail Johnson, CEO of Fidelity Investments, Shopify founder Tobias Lütke, property developer John Sobrato, of CEO of hedge fund Baupost Group Seth Klarman, founder of Tableau Software Chris Stolte and Walmart heir Sam Walton.

Charles Xue Biqun (b. 1953), alias Xue Manzi, is a popular Chinese-American billionaire venture capitalist and angel investor with over 10 million followers on Weibo. He studied foreign relations at the University of California, Berkeley. His most famous deal to date is his US$250,000 investment in Unitech in the early 1990s, which later became UTStarcom. The company went public in 2000, reaching a post-IPO value of over US$5 billion. He was also chairman of 8848.com (the earliest Chinese e-commerce network). Xue has invested in many internet startups in China, including PCPOP, Autohome, Xueqiu, CreatyChina, Community001 and 265.com (bought by Google).

Charles Xue Biqun (b. 1953), alias Xue Manzi, is a popular Chinese-American billionaire venture capitalist and angel investor with over 10 million followers on Weibo. He studied foreign relations at the University of California, Berkeley. His most famous deal to date is his US$250,000 investment in Unitech in the early 1990s, which later became UTStarcom. The company went public in 2000, reaching a post-IPO value of over US$5 billion. He was also chairman of 8848.com (the earliest Chinese e-commerce network). Xue has invested in many internet startups in China, including PCPOP, Autohome, Xueqiu, CreatyChina, Community001 and 265.com (bought by Google).

Yamaha Motor Ventures & Laboratory Silicon Valley

The investment arm of Yamaha Motor Group (Japan) was founded in 2015 and is headquartered in Palo Alto, California. It focuses on industrial automation and transportation technology, and on smart and automated solutions in particular. Recent investments include automated strawberry picker Advanced Farm Technologies' US$7.5m Series A round and drone and robotics startup Exyn Technology's US$16m Series A round.

The investment arm of Yamaha Motor Group (Japan) was founded in 2015 and is headquartered in Palo Alto, California. It focuses on industrial automation and transportation technology, and on smart and automated solutions in particular. Recent investments include automated strawberry picker Advanced Farm Technologies' US$7.5m Series A round and drone and robotics startup Exyn Technology's US$16m Series A round.

Paris-based Orange Digital Ventures is part of French telco Orange and was established in 2015. It invests up to €150m in businesses with technology that aligns with Orange's development plans. It has a geographical focus on Africa and has made a commitment to boosting the continent's startup ecosystem through its 2017 €50m dedicated Africa fund. Recent investments include fintech Monzo's US$144m Series F round and B2C savings and investment marketplace Raisin's US$$114m Series D round.

Paris-based Orange Digital Ventures is part of French telco Orange and was established in 2015. It invests up to €150m in businesses with technology that aligns with Orange's development plans. It has a geographical focus on Africa and has made a commitment to boosting the continent's startup ecosystem through its 2017 €50m dedicated Africa fund. Recent investments include fintech Monzo's US$144m Series F round and B2C savings and investment marketplace Raisin's US$$114m Series D round.

Labeled "world’s most powerful startup incubator" by Fast Company, Y Combinator was established in 2005 as a seed accelerator. Since then, Y Combinator has funded over 1,850 startups with a combined valuation of over US$100 billion. Twice a year, Y Combinator invests US$150,000 per company across a large number of startups in exchange for a 7% stake. The startups then move to Silicon Valley for three months. Each cycle ends with a Demo Day, where the startups pitch to an invite-only audience of high-profile investors. Its most valuable startups to date are Airbnb, Stripe, Cruise, Dropbox and Coinbase.

Labeled "world’s most powerful startup incubator" by Fast Company, Y Combinator was established in 2005 as a seed accelerator. Since then, Y Combinator has funded over 1,850 startups with a combined valuation of over US$100 billion. Twice a year, Y Combinator invests US$150,000 per company across a large number of startups in exchange for a 7% stake. The startups then move to Silicon Valley for three months. Each cycle ends with a Demo Day, where the startups pitch to an invite-only audience of high-profile investors. Its most valuable startups to date are Airbnb, Stripe, Cruise, Dropbox and Coinbase.

Indogen Capital is Indonesia’s latest VC founded in early 2017. The private fund looks for founder “athletes and shapes them into champions”, with capital injections of US$100,000 to US$500,000.VC advisor and Tokopedia co-founder, Leonitus Alpha Edison is passionate about mentoring startups on how to negotiate founder-friendly deals.The other VC partners are: Hendry Willy (Leon’s friend and founder of TokoUSB.com), private equity veteran Teezar Firmansyah, Nararya Ciputra Sastrawinata of business tycoon family in real estate and Ciputra University. Indogen’s CEO Chandra Firmanto is Leon’s childhood friend whose family business had joint ventures with Ciputra.

Indogen Capital is Indonesia’s latest VC founded in early 2017. The private fund looks for founder “athletes and shapes them into champions”, with capital injections of US$100,000 to US$500,000.VC advisor and Tokopedia co-founder, Leonitus Alpha Edison is passionate about mentoring startups on how to negotiate founder-friendly deals.The other VC partners are: Hendry Willy (Leon’s friend and founder of TokoUSB.com), private equity veteran Teezar Firmansyah, Nararya Ciputra Sastrawinata of business tycoon family in real estate and Ciputra University. Indogen’s CEO Chandra Firmanto is Leon’s childhood friend whose family business had joint ventures with Ciputra.

Brad Bao (Bao Zhoujia) graduated in International Marketing at Wuhan University in 1997 and obtained an MBA from UC Berkeley in 2005. He worked in marketing at FORMICA from January 1997 to March 1998 and went on to work at Kodak until April 2000. He was at IBM until April 2001 when he finally decided to become an entrepreneur and co-founded NORICT in Beijing.He was also the GM and VP of the US branch for Tencent from 2005–2012. He joined Kinzon Capital as managing partner in September 2013 and co-founded LimeBike in the US in November 2016.

Brad Bao (Bao Zhoujia) graduated in International Marketing at Wuhan University in 1997 and obtained an MBA from UC Berkeley in 2005. He worked in marketing at FORMICA from January 1997 to March 1998 and went on to work at Kodak until April 2000. He was at IBM until April 2001 when he finally decided to become an entrepreneur and co-founded NORICT in Beijing.He was also the GM and VP of the US branch for Tencent from 2005–2012. He joined Kinzon Capital as managing partner in September 2013 and co-founded LimeBike in the US in November 2016.

Founded in Silicon Valley in 2000 by Kate Mitchell and Rory O'Driscoll, Scale Venture Partners invests in 75% early revenue and 25% growth stage companies, with an average initial investment of US$8 million. It's mainly interested in startups that disrupt the workplace and it usually invests between US$5-25 million per funding round. It has invested in more than 200 companies to date and was the lead investor in more than 80 investments. Scale has managed 62 exits to date including DocuSign, Box, HubSpot, Exact Target and Realm. Its recent investments include in Keep Truckin, Pantheon and PubNub's Series D rounds.

Founded in Silicon Valley in 2000 by Kate Mitchell and Rory O'Driscoll, Scale Venture Partners invests in 75% early revenue and 25% growth stage companies, with an average initial investment of US$8 million. It's mainly interested in startups that disrupt the workplace and it usually invests between US$5-25 million per funding round. It has invested in more than 200 companies to date and was the lead investor in more than 80 investments. Scale has managed 62 exits to date including DocuSign, Box, HubSpot, Exact Target and Realm. Its recent investments include in Keep Truckin, Pantheon and PubNub's Series D rounds.

Established in 2012, Mountain Nazca is a Latin American VC with offices in Mexico, Chile and Colombia. Its operations are centered in México City, Santiago, Buenos Aires, and Bogotá to back startups willing to consolidate their market positions in Latin American countries. The firm also facilitates cross-border investments between Europe, Latin America and the US. It has managed two exits to date, Petsy and Nubelo, and was the lead investor in 35 of its more than 60 investments. Its recent investments include Destacame's US$3 million Series A funding round, and the Series A funding rounds of Albo and Crehana.

Established in 2012, Mountain Nazca is a Latin American VC with offices in Mexico, Chile and Colombia. Its operations are centered in México City, Santiago, Buenos Aires, and Bogotá to back startups willing to consolidate their market positions in Latin American countries. The firm also facilitates cross-border investments between Europe, Latin America and the US. It has managed two exits to date, Petsy and Nubelo, and was the lead investor in 35 of its more than 60 investments. Its recent investments include Destacame's US$3 million Series A funding round, and the Series A funding rounds of Albo and Crehana.

M12 is the venture capital arm of Microsoft, formerly known as Microsoft Ventures, founded in 2016 to invest in Series A rounds and beyond. M12 has invested in more than 70 startups to date and has managed four exits, all of them acquisitions: Comfy, Figure Eight, Bonsai and Frame. M12 is especially interested in enterprise software and its biggest investment to date was US$114 in Outreach's Series D round. It has also invested recently in Nautilus Labs' Series A and Onfido's Series C.The VC also awards a US$4 million Female Founders prize to boost the participation of women in tech.

M12 is the venture capital arm of Microsoft, formerly known as Microsoft Ventures, founded in 2016 to invest in Series A rounds and beyond. M12 has invested in more than 70 startups to date and has managed four exits, all of them acquisitions: Comfy, Figure Eight, Bonsai and Frame. M12 is especially interested in enterprise software and its biggest investment to date was US$114 in Outreach's Series D round. It has also invested recently in Nautilus Labs' Series A and Onfido's Series C.The VC also awards a US$4 million Female Founders prize to boost the participation of women in tech.

Total Energy Ventures is a corporate venture capital arm of French multinational energy company Total. Headquartered in Paris with offices in San Francisco, its investment focus is in startups committed to reducing CO2 emissions through groundbreaking technologies and innovative models applied to clean-tech and sustainable energy, transport and waste management.Total Energy Ventures invests mainly by acquiring minority stakes in backed companies. The company has invested a total of US$200 million in more than 30 companies, with three exits to date. Recent investments include in Peg and Sunfire's Series C rounds and in Tado's Series F round that raised US$50 million.

Total Energy Ventures is a corporate venture capital arm of French multinational energy company Total. Headquartered in Paris with offices in San Francisco, its investment focus is in startups committed to reducing CO2 emissions through groundbreaking technologies and innovative models applied to clean-tech and sustainable energy, transport and waste management.Total Energy Ventures invests mainly by acquiring minority stakes in backed companies. The company has invested a total of US$200 million in more than 30 companies, with three exits to date. Recent investments include in Peg and Sunfire's Series C rounds and in Tado's Series F round that raised US$50 million.

Rick Klausner is an award-winning scientist, former executive director of the Bill & Melinda Gates Foundation and an entrepreneur. Cell and molecular biologist Klausner was also director of the US National Cancer Institute from 1999-2001 and currently serves as CEO at biotech Lyell Immunopharma working with cell-based technology. He has also co-founded three US healthcare startups to date, Juno Therapeutics in 2013, MindStrong Health in 2014 and GRAIL in 2015. In 2021, he participated as an investor in the $48m Series A round of Dutch cell-based meat startup Meatable which leverages pluripotent stem cells for the first time in foodtech.

Rick Klausner is an award-winning scientist, former executive director of the Bill & Melinda Gates Foundation and an entrepreneur. Cell and molecular biologist Klausner was also director of the US National Cancer Institute from 1999-2001 and currently serves as CEO at biotech Lyell Immunopharma working with cell-based technology. He has also co-founded three US healthcare startups to date, Juno Therapeutics in 2013, MindStrong Health in 2014 and GRAIL in 2015. In 2021, he participated as an investor in the $48m Series A round of Dutch cell-based meat startup Meatable which leverages pluripotent stem cells for the first time in foodtech.

Scott Banister is a prolific Silicon Valley-based angel investor. From 2000–2007, he was CTO and co-founder at IronPort, an enterprise email routing and anti-spam solutions provider that was acquired by Cisco Systems for $830m. He has invested in more than 100 companies to date and managed numerous exits, including Uber. His most recent undisclosed amounts of investments include participating in the $150m investment round of US investment analytics firm Forge Global in May 2021, as well as the April 2021 $35m funding round of US video streaming server Plex.

Scott Banister is a prolific Silicon Valley-based angel investor. From 2000–2007, he was CTO and co-founder at IronPort, an enterprise email routing and anti-spam solutions provider that was acquired by Cisco Systems for $830m. He has invested in more than 100 companies to date and managed numerous exits, including Uber. His most recent undisclosed amounts of investments include participating in the $150m investment round of US investment analytics firm Forge Global in May 2021, as well as the April 2021 $35m funding round of US video streaming server Plex.

Buy Yourself GO: Relieving the pressure in high-demand retail

Buy Yourself's patented self-checkout technology specifically targets peak sales periods for bricks-and-mortars and requires no prior download of software

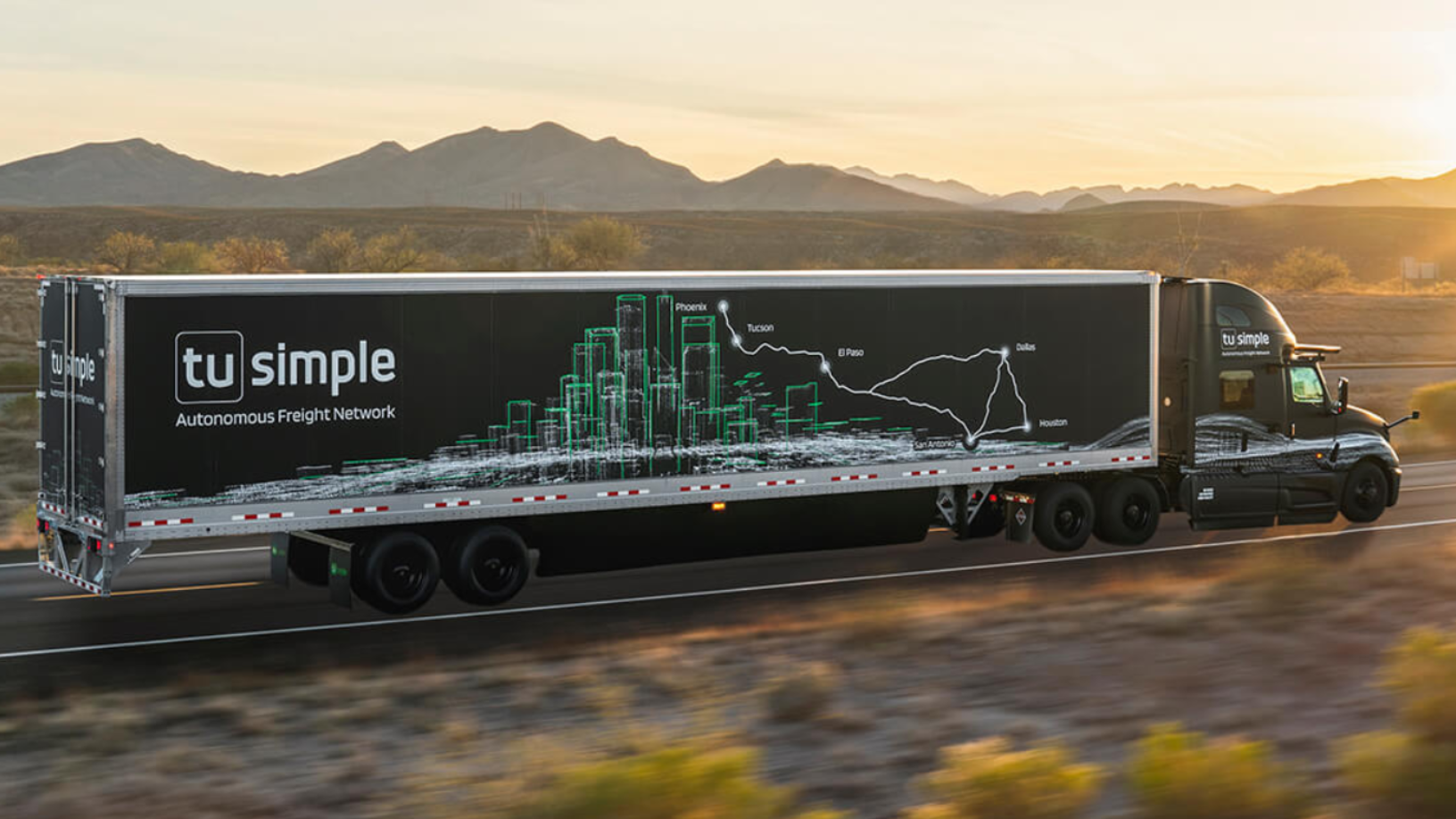

TuSimple: Banking on autonomous trucking in the US

TuSimple aims to scale its Waymo-style driverless trucking network to disrupt the $4tn global truck freight market starting with the US, with mass production by 2024

Red Points: US$38 million Series C to power US conquest

The Barcelona-based startup is ramping up US sales and deep-tech capabilities for its online brand protection platform

Vottun: The "WordPress for blockchain" seeks US expansion, investors

Seeking Series A funding this year, the agnostic SaaS opens blockchain's wealth of possibilities to businesses unfamiliar with the technology

Indonesian unicorn Traveloka aims for US listing via SPAC

The online travel aggregator reported revenue drops and layoffs in 2020 but became profitable late last year, led by recoveries in Vietnam and Thailand

Portugal's Prodsmart takes AI, IoT-based manufacturing to US factories

Smart factories can cut wastage by 80% and improve inventory, production and supply chains, tackling US$200 billion worth of losses

HypeLabs wins bumper US$3m seed funding to democratize connectivity

HypeLab's P2P mesh networking technology enables everyone to communicate within their own networks without needing internet, in cities, remote villages and even in disaster zones

Taronga Ventures takes RealTechX to Singapore; plans Japan, US growth

The Australian proptech investor to focus on ESG in its acceleration program, including women under-representation and site safety

Indonesian rental and asset management platform Travelio bags US$18m funding

The four-year-old proptech startup recently raised Series B funding as it gains ground in Indonesia’s growing real estate investment market

Animal AgTech Innovation Summit 2021: Future of aquaculture in the US

With the US Importing over 85% of its seafood, industry experts examine how and why the country should develop a sustainable aquaculture industry

Tuya Smart announces more partnerships, files for IPO in the US

Tuya Smart’s platform enables the creation of smart devices with little or no code writing needed, shortening R&D from months to a matter of days

New Food Invest: Building a plant-based business in the US

With plant-based startups experiencing exponential growth but facing increasingly intense competition, experts consider the opportunities and barriers in the sector

China's new unicorn: Secondhand electronics platform Aihuishou now worth US$1.5 billion

Aihuishou's latest funding round is the largest yet for a secondhand electronics platform

SoccerDream: World's first VR soccer training platform to launch in China, US

SoccerDream uses virtual reality to boost trainee players' performance on the field by 36% compared to their peers

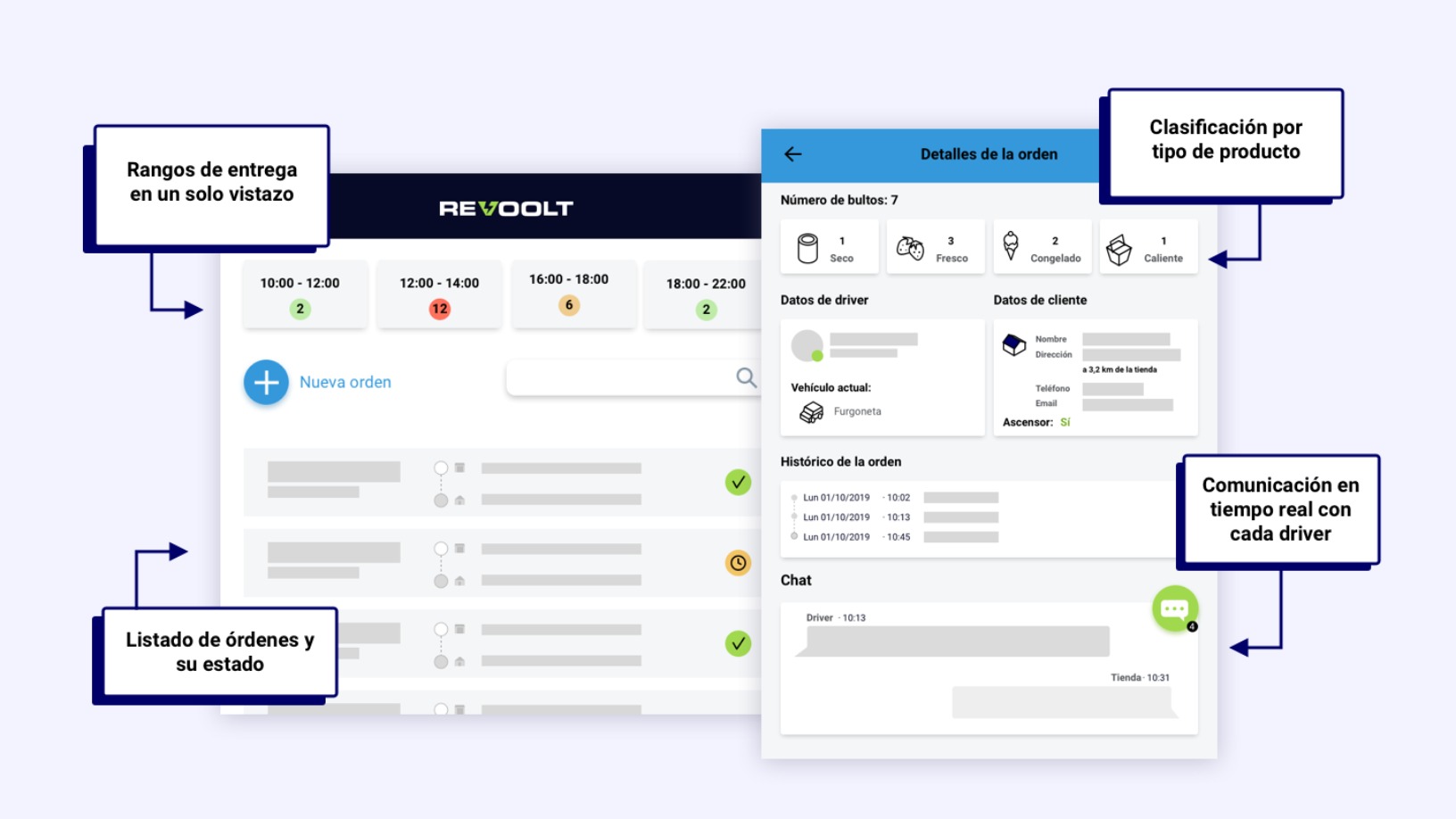

Revoolt: “Covid-19 accelerated our expansion plans and made us more ambitious”

Revoolt’s emission-free last-mile delivery model proved viable during the lockdown in Spain – growth that’s now its launchpad for international expansion and new funding

Sorry, we couldn’t find any matches for“US Xpress”.