US Xpress

-

DATABASE (434)

-

ARTICLES (604)

Based in New York City, Pavilion Capital is linked to Singapore's Temasek Holdings. The firm primarily invests in US and Asian companies. Its portfolio includes entertainment and social media holding company M17, smart retail kiosk startup Warung Pintar and delivery coffee chain Fore Coffee.

Based in New York City, Pavilion Capital is linked to Singapore's Temasek Holdings. The firm primarily invests in US and Asian companies. Its portfolio includes entertainment and social media holding company M17, smart retail kiosk startup Warung Pintar and delivery coffee chain Fore Coffee.

Innovative Sports Investment (ISIN) focuses on the eSports sector, backing startups that develop disruptive technologies for athletes and investors through seed investment rounds. Led by Javier Morales, Ander Iñarrairaegui and Javier Colás, the firm also has international offices in Japan, South Korea, India, the US and Argentina.

Innovative Sports Investment (ISIN) focuses on the eSports sector, backing startups that develop disruptive technologies for athletes and investors through seed investment rounds. Led by Javier Morales, Ander Iñarrairaegui and Javier Colás, the firm also has international offices in Japan, South Korea, India, the US and Argentina.

KTB Network is a leading investment firm in South Korea, conducting investments across all stages in South Korea, China and the US. KTB Network is the first South Korean investment firm to enter the Chinese PE/VC market. Since 2000, it has invested in 40+ companies in China.

KTB Network is a leading investment firm in South Korea, conducting investments across all stages in South Korea, China and the US. KTB Network is the first South Korean investment firm to enter the Chinese PE/VC market. Since 2000, it has invested in 40+ companies in China.

Part of the Thai-headquartered venture capitalist firm Ardent Capital, Ardent Ventures invests in early-stage technology startups across Southeast Asia. In 2016, Ardent Capital announced its merger with US-based Wavemaker Partners.

Part of the Thai-headquartered venture capitalist firm Ardent Capital, Ardent Ventures invests in early-stage technology startups across Southeast Asia. In 2016, Ardent Capital announced its merger with US-based Wavemaker Partners.

Founded in 2001, Mitsui Global Investment is a subsidiary of Mitsui & Co. The firm typically invests in the US, and has offices in Silicon Valley, New York, Shanghai, Beijing and Mumbai.

Founded in 2001, Mitsui Global Investment is a subsidiary of Mitsui & Co. The firm typically invests in the US, and has offices in Silicon Valley, New York, Shanghai, Beijing and Mumbai.

Founded in Boston in 1946, Fidelity is one of the world’s largest asset managers, with more than 25m household investors and 22,000 corporates using its services. It has invested in more than 100 companies across market segments, investment rounds and geographies and managed numerous IPOs, including Twilio, Reddit, and Peloton. Its most recent investments include injecting $200m in March 2021 into US-based unicorn Diamond Foundry, the first certified carbon-neutral lab-produced diamond manufacturer. In the same month, it also participated in the $29m Series B round for US asset management fintech player Ethic.

Founded in Boston in 1946, Fidelity is one of the world’s largest asset managers, with more than 25m household investors and 22,000 corporates using its services. It has invested in more than 100 companies across market segments, investment rounds and geographies and managed numerous IPOs, including Twilio, Reddit, and Peloton. Its most recent investments include injecting $200m in March 2021 into US-based unicorn Diamond Foundry, the first certified carbon-neutral lab-produced diamond manufacturer. In the same month, it also participated in the $29m Series B round for US asset management fintech player Ethic.

China Softbank Capital (SBCVC)

Established in 2000 and led by Chauncey Shey (Xue Cunhe), the SoftBank-backed VC/PE firm manages over US$2 billion, focusing on companies in the TMT, cleantech, healthcare, consumer/retail and advanced manufacturing sectors. Notable investments include Alibaba, Focus Media Holding, Wanguo Data, Shenwu Group, GDS, PPLive and Yooli.

Established in 2000 and led by Chauncey Shey (Xue Cunhe), the SoftBank-backed VC/PE firm manages over US$2 billion, focusing on companies in the TMT, cleantech, healthcare, consumer/retail and advanced manufacturing sectors. Notable investments include Alibaba, Focus Media Holding, Wanguo Data, Shenwu Group, GDS, PPLive and Yooli.

Integral was founded in 2011 by a group of experienced entrepreneurs, investment bankers and wealth management professionals. It has funds under management of more than US$300 million. Targeting startups in Greater China, Integral has eight years of investment experience in the fields of TMT, healthcare, internet and consumer products.

Integral was founded in 2011 by a group of experienced entrepreneurs, investment bankers and wealth management professionals. It has funds under management of more than US$300 million. Targeting startups in Greater China, Integral has eight years of investment experience in the fields of TMT, healthcare, internet and consumer products.

With a specific focus on clean energy, Innogy Innovation Hub was established in 2014 and currently has 53 startups in its portfolio spanning from Austria to Bangladesh. Recent investments include HypeLabs' US$3m seed round and the €4m Series A round of augmented and mixed reality solutions provider Holo-Light.

With a specific focus on clean energy, Innogy Innovation Hub was established in 2014 and currently has 53 startups in its portfolio spanning from Austria to Bangladesh. Recent investments include HypeLabs' US$3m seed round and the €4m Series A round of augmented and mixed reality solutions provider Holo-Light.

Formation Group aims to create a bridge between Silicon Valley and Asian technology companies. It currently has three offices, in the US, South Korea and Singapore. So far it only has six known portfolio companies, including ride-hailing firm Gojek, grocery shopping company Honestbee, and retail experience technology firm Memebox.

Formation Group aims to create a bridge between Silicon Valley and Asian technology companies. It currently has three offices, in the US, South Korea and Singapore. So far it only has six known portfolio companies, including ride-hailing firm Gojek, grocery shopping company Honestbee, and retail experience technology firm Memebox.

A private equity fund targeting fintech firms at the growth expansion and mature stage mainly in China, Europe, and the US. Its founding members include China Minsheng International Capital Limited (CMIC), a subsidiary of China Minsheng Investment Corporation Limited (CMI); and GF Investments (Cayman) Company Limited (GF Investments), a subsidiary of GF Securities.

A private equity fund targeting fintech firms at the growth expansion and mature stage mainly in China, Europe, and the US. Its founding members include China Minsheng International Capital Limited (CMIC), a subsidiary of China Minsheng Investment Corporation Limited (CMI); and GF Investments (Cayman) Company Limited (GF Investments), a subsidiary of GF Securities.

Founded by Matt Cheng, a leading angel investor, serial entrepreneur and top-ranked ITF world junior tennis player, in 2010, Cherubic Ventures is an early-stage venture capital firm with coverage across Silicon Valley and Greater China. With US$120 million of assets under management, it has invested in 100+ companies.

Founded by Matt Cheng, a leading angel investor, serial entrepreneur and top-ranked ITF world junior tennis player, in 2010, Cherubic Ventures is an early-stage venture capital firm with coverage across Silicon Valley and Greater China. With US$120 million of assets under management, it has invested in 100+ companies.

UCommune is a Chinese coworking space operator, best known for its UrWork brand. As of November 2018, it has raised over US$650 million and has most recently completed series D funding. UCommune has also invested in Chinese companies Danke Apartment and Huodongxing, as well as Indonesian coworking space operator Rework (now GoWork).

UCommune is a Chinese coworking space operator, best known for its UrWork brand. As of November 2018, it has raised over US$650 million and has most recently completed series D funding. UCommune has also invested in Chinese companies Danke Apartment and Huodongxing, as well as Indonesian coworking space operator Rework (now GoWork).

A prolific investor, Eddy Chan has been involved in venture investments for US companies like Paypal, SpaceX, and Palantir, as well as Indonesian ones like coworking space EV Hive (now CoHive), BeliMobilGue (used car marketplace) and Kata.ai (chatbot builder). He is also the founding partner of Intudo Ventures, an "Indonesia-only" VC firm.

A prolific investor, Eddy Chan has been involved in venture investments for US companies like Paypal, SpaceX, and Palantir, as well as Indonesian ones like coworking space EV Hive (now CoHive), BeliMobilGue (used car marketplace) and Kata.ai (chatbot builder). He is also the founding partner of Intudo Ventures, an "Indonesia-only" VC firm.

Co-founder, COO of Bodyswaps

Julien Denoël is the Belgian co-founder and COO of UK-based VR edtech for soft-skills training Bodyswaps, where he has worked since its founding in 2019. Prior to this, he was CEO and managing director at VR marketing agency Somewhere Else from 2016, before the agency pivoted to training and skills development and became the basis of Bodyswaps’ product offer. The agency had clients such as Adidas, for which Somewhere Else produced an interactive VR in-store promotional tool that was deployed in over 100 locations in China, Europe and the US and was nominated for a VR Award and an Immersive Perspective award. Denoël has also been a guest lecturer in VR and AR at INSEEC business school in London and Geneva since 2017. Prior to this, Denoël also co-founded another VR agency, Exheb, in 2014, where he worked for almost three years as VR Producer. He also worked in digital marketing for Quotient Technology, formerly Coupons.com for two years, and in business development and marketing at the WorldOne agency for the same amount of time. Denoël holds both a master’s and a bachelor’s degree from HEC Management School in Liege, Belgium, the former in Marketing and Organization, the latter in Management.

Julien Denoël is the Belgian co-founder and COO of UK-based VR edtech for soft-skills training Bodyswaps, where he has worked since its founding in 2019. Prior to this, he was CEO and managing director at VR marketing agency Somewhere Else from 2016, before the agency pivoted to training and skills development and became the basis of Bodyswaps’ product offer. The agency had clients such as Adidas, for which Somewhere Else produced an interactive VR in-store promotional tool that was deployed in over 100 locations in China, Europe and the US and was nominated for a VR Award and an Immersive Perspective award. Denoël has also been a guest lecturer in VR and AR at INSEEC business school in London and Geneva since 2017. Prior to this, Denoël also co-founded another VR agency, Exheb, in 2014, where he worked for almost three years as VR Producer. He also worked in digital marketing for Quotient Technology, formerly Coupons.com for two years, and in business development and marketing at the WorldOne agency for the same amount of time. Denoël holds both a master’s and a bachelor’s degree from HEC Management School in Liege, Belgium, the former in Marketing and Organization, the latter in Management.

Buy Yourself GO: Relieving the pressure in high-demand retail

Buy Yourself's patented self-checkout technology specifically targets peak sales periods for bricks-and-mortars and requires no prior download of software

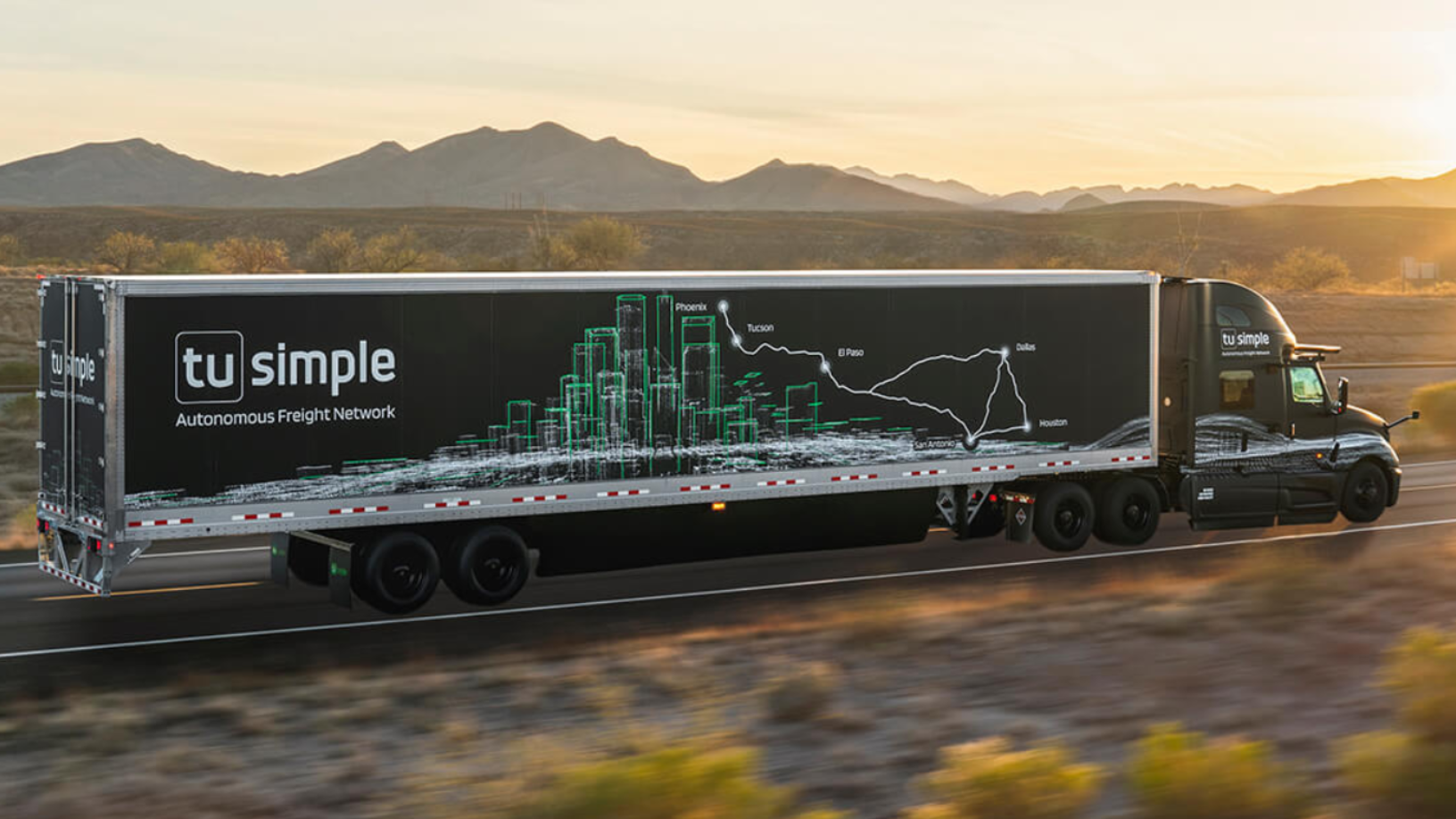

TuSimple: Banking on autonomous trucking in the US

TuSimple aims to scale its Waymo-style driverless trucking network to disrupt the $4tn global truck freight market starting with the US, with mass production by 2024

Red Points: US$38 million Series C to power US conquest

The Barcelona-based startup is ramping up US sales and deep-tech capabilities for its online brand protection platform

Vottun: The "WordPress for blockchain" seeks US expansion, investors

Seeking Series A funding this year, the agnostic SaaS opens blockchain's wealth of possibilities to businesses unfamiliar with the technology

Indonesian unicorn Traveloka aims for US listing via SPAC

The online travel aggregator reported revenue drops and layoffs in 2020 but became profitable late last year, led by recoveries in Vietnam and Thailand

Portugal's Prodsmart takes AI, IoT-based manufacturing to US factories

Smart factories can cut wastage by 80% and improve inventory, production and supply chains, tackling US$200 billion worth of losses

HypeLabs wins bumper US$3m seed funding to democratize connectivity

HypeLab's P2P mesh networking technology enables everyone to communicate within their own networks without needing internet, in cities, remote villages and even in disaster zones

Taronga Ventures takes RealTechX to Singapore; plans Japan, US growth

The Australian proptech investor to focus on ESG in its acceleration program, including women under-representation and site safety

Indonesian rental and asset management platform Travelio bags US$18m funding

The four-year-old proptech startup recently raised Series B funding as it gains ground in Indonesia’s growing real estate investment market

Animal AgTech Innovation Summit 2021: Future of aquaculture in the US

With the US Importing over 85% of its seafood, industry experts examine how and why the country should develop a sustainable aquaculture industry

Tuya Smart announces more partnerships, files for IPO in the US

Tuya Smart’s platform enables the creation of smart devices with little or no code writing needed, shortening R&D from months to a matter of days

New Food Invest: Building a plant-based business in the US

With plant-based startups experiencing exponential growth but facing increasingly intense competition, experts consider the opportunities and barriers in the sector

China's new unicorn: Secondhand electronics platform Aihuishou now worth US$1.5 billion

Aihuishou's latest funding round is the largest yet for a secondhand electronics platform

SoccerDream: World's first VR soccer training platform to launch in China, US

SoccerDream uses virtual reality to boost trainee players' performance on the field by 36% compared to their peers

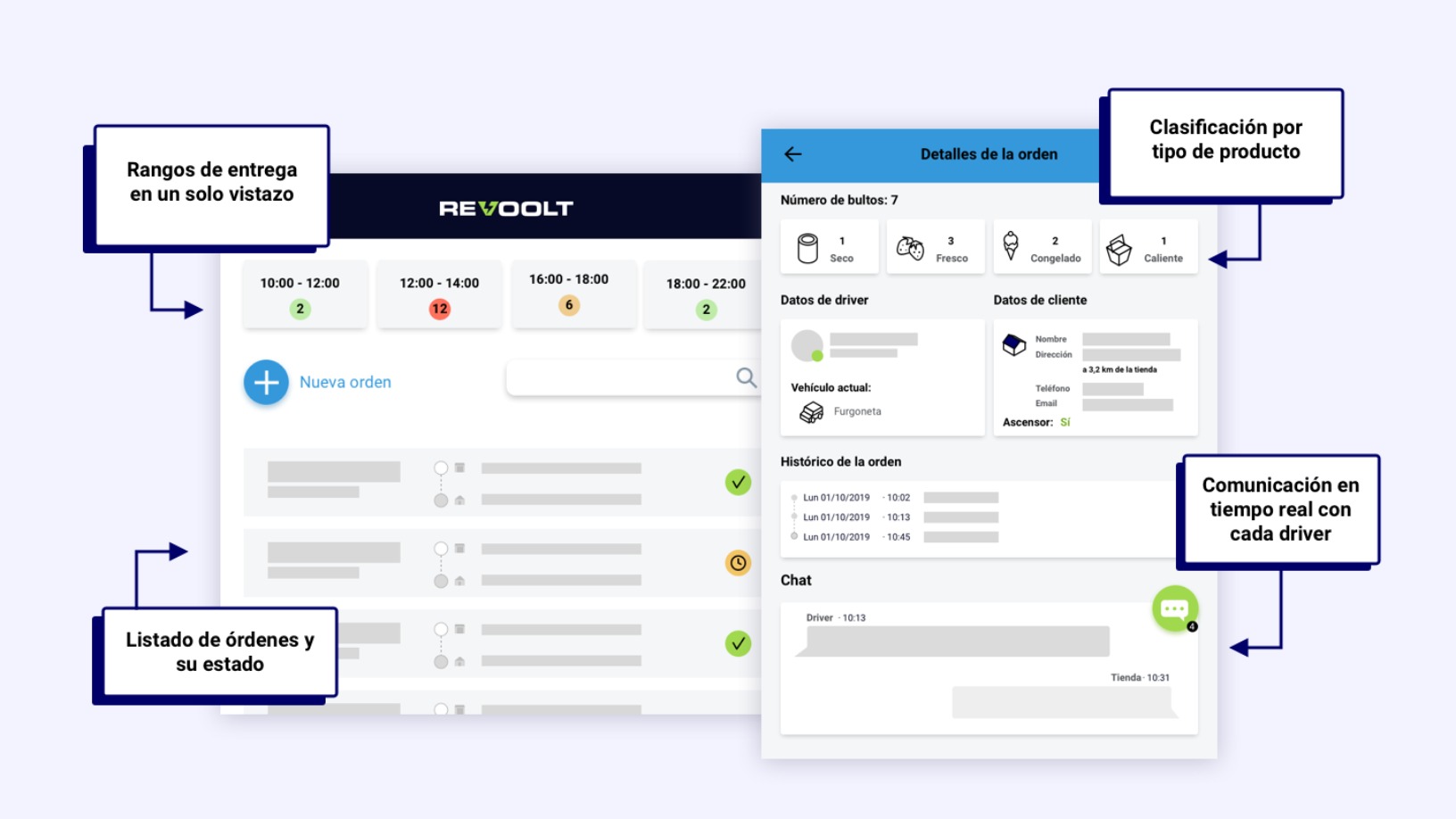

Revoolt: “Covid-19 accelerated our expansion plans and made us more ambitious”

Revoolt’s emission-free last-mile delivery model proved viable during the lockdown in Spain – growth that’s now its launchpad for international expansion and new funding

Sorry, we couldn’t find any matches for“US Xpress”.