US Xpress

-

DATABASE (434)

-

ARTICLES (604)

Founded in 2014 by Cao Yi, formerly of Sequoia Capital and Ceyuan Ventures, Source Code Capital currently manages about US$500 million of capital, focusing on early-stage TMT (especially fintech, O2O, e-commerce) investments. Notable investments have included Qufenqi, Meituan, and PPzuche. Source Code Capital is part of the Sequoia Capital China.

Founded in 2014 by Cao Yi, formerly of Sequoia Capital and Ceyuan Ventures, Source Code Capital currently manages about US$500 million of capital, focusing on early-stage TMT (especially fintech, O2O, e-commerce) investments. Notable investments have included Qufenqi, Meituan, and PPzuche. Source Code Capital is part of the Sequoia Capital China.

Founded in 2008, Bertelsmann Asia Investments (BAI) is an evergreen fund wholly owned by Bertelsmann focusing on private equity investment in the Greater China Region. With over US$1 billion under management, BAI mainly invests in high-growth startups in industries including consumer upgrades, mobile sea, online education, financial services, mobile health and enterprise services.

Founded in 2008, Bertelsmann Asia Investments (BAI) is an evergreen fund wholly owned by Bertelsmann focusing on private equity investment in the Greater China Region. With over US$1 billion under management, BAI mainly invests in high-growth startups in industries including consumer upgrades, mobile sea, online education, financial services, mobile health and enterprise services.

Founded in 2010, Runa Capital is an early-stage VC that invests across North America, Asia and Europe. It manages funds worth US$270m and has invested in more than 40 companies, primarily in the healthcare, fintech, B2B SaaS and education sectors. The firm invested in Capptain, an app management platform acquired by Microsoft in 2014.

Founded in 2010, Runa Capital is an early-stage VC that invests across North America, Asia and Europe. It manages funds worth US$270m and has invested in more than 40 companies, primarily in the healthcare, fintech, B2B SaaS and education sectors. The firm invested in Capptain, an app management platform acquired by Microsoft in 2014.

Sky9 Capital is founded by the former co-founder and managing director of Lightspeed China Partners, Cao Darong. As an early-stage venture capital firm, it focuses on investing in TMT (Technology, Media and Telecommunications), especially Internet innovation and enterprise services. The company has a strong presence in Beijing, Shanghai, Shenzhen and Silicon Valley in the US.

Sky9 Capital is founded by the former co-founder and managing director of Lightspeed China Partners, Cao Darong. As an early-stage venture capital firm, it focuses on investing in TMT (Technology, Media and Telecommunications), especially Internet innovation and enterprise services. The company has a strong presence in Beijing, Shanghai, Shenzhen and Silicon Valley in the US.

Yueyin Venture Capital was founded in 2015 in Beijing. It manages total assets worth US$300m, with investments in 22 companies. The VC focuses mainly in the healthcare, pharmaceutical and biotech sectors.

Yueyin Venture Capital was founded in 2015 in Beijing. It manages total assets worth US$300m, with investments in 22 companies. The VC focuses mainly in the healthcare, pharmaceutical and biotech sectors.

Burda Principal Investments is part of Hubert Burda Media, an international media and tech conglomerate based in Germany. The VC also has offices in London and Singapore. Since 1998, BPI has invested mainly in consumer internet companies in Europe, Asia and the US. Key investments include Skillshare, fashion marketplace Zilingo and photography services platform SweetEscape.

Burda Principal Investments is part of Hubert Burda Media, an international media and tech conglomerate based in Germany. The VC also has offices in London and Singapore. Since 1998, BPI has invested mainly in consumer internet companies in Europe, Asia and the US. Key investments include Skillshare, fashion marketplace Zilingo and photography services platform SweetEscape.

Shangshi Capital was founded and headquartered in Beijing in 2014. It has branch offices in Shenzhen and San Francisco. The firm manages two US dollar funds and three RMB funds, totaling over RMB 1.5bn. It has invested in over 60 startups at home and abroad, mainly in digital healthcare, consumer goods, IoT and enterprise tech.

Shangshi Capital was founded and headquartered in Beijing in 2014. It has branch offices in Shenzhen and San Francisco. The firm manages two US dollar funds and three RMB funds, totaling over RMB 1.5bn. It has invested in over 60 startups at home and abroad, mainly in digital healthcare, consumer goods, IoT and enterprise tech.

Sway Ventures, formerly AITV, is a US-based venture capital firm with offices in San Francisco, La Jolla and London investing in early to mid-stage technology companies. The VC team comprises former founders and specialists from four key areas: capital, revenue, talent and product. Its portfolio includes Uber, Owl and Zipline.

Sway Ventures, formerly AITV, is a US-based venture capital firm with offices in San Francisco, La Jolla and London investing in early to mid-stage technology companies. The VC team comprises former founders and specialists from four key areas: capital, revenue, talent and product. Its portfolio includes Uber, Owl and Zipline.

The GlassWall Syndicate is a US investment group comprising venture capitalists, foundations, trusts, non-profits and individual investors. The VC members include Blue Horizon, Veg Invest and New Crop Capital.The syndicate funds are mostly invested in foodtech companies like Mosa Meat and Beyond Meat that are currently disrupting the traditional global food industry.

The GlassWall Syndicate is a US investment group comprising venture capitalists, foundations, trusts, non-profits and individual investors. The VC members include Blue Horizon, Veg Invest and New Crop Capital.The syndicate funds are mostly invested in foodtech companies like Mosa Meat and Beyond Meat that are currently disrupting the traditional global food industry.

Lippo Digital Ventures was the corporate venture arm of Indonesian conglomerate Lippo Group, founded by Indonesian billionaire and banker Mochtar Riady. In 2015, the company reincarnated as Venturra Capital, a US$150 million fund focusing on technology firms in Indonesia and Southeast Asia.

Lippo Digital Ventures was the corporate venture arm of Indonesian conglomerate Lippo Group, founded by Indonesian billionaire and banker Mochtar Riady. In 2015, the company reincarnated as Venturra Capital, a US$150 million fund focusing on technology firms in Indonesia and Southeast Asia.

Andrew McCollum is CEO of television streaming service Philo and was also one of its earliest investors. Prior to that, he was one of the co-founders of Facebook. He served as an entrepreneur in residence at two of Philo’s investors, the US-based VC firms New Enterprise Associates and Flybridge Partners, and is also an early-stage angel investor himself.His last disclosed investments were in 2015, in US-based unicorn Diamond Foundry, the first certified carbon-neutral lab-produced diamond manufacturer, as well as in breastfeeding app Moxxly’s undisclosed seed round prior to it being acquired by Medela.

Andrew McCollum is CEO of television streaming service Philo and was also one of its earliest investors. Prior to that, he was one of the co-founders of Facebook. He served as an entrepreneur in residence at two of Philo’s investors, the US-based VC firms New Enterprise Associates and Flybridge Partners, and is also an early-stage angel investor himself.His last disclosed investments were in 2015, in US-based unicorn Diamond Foundry, the first certified carbon-neutral lab-produced diamond manufacturer, as well as in breastfeeding app Moxxly’s undisclosed seed round prior to it being acquired by Medela.

Headquartered in Beijing and set up in 2006, China Growth Capital invests in early-stage internet startups in China and the US. As of May 2016, it has two USD-denominated funds and three RMB-denominated funds, valued around RMB 4 billion in total.

Headquartered in Beijing and set up in 2006, China Growth Capital invests in early-stage internet startups in China and the US. As of May 2016, it has two USD-denominated funds and three RMB-denominated funds, valued around RMB 4 billion in total.

Led by Ben Einstein, the Boston-based venture capital firm focuses on startups involved in hardware and software development. The VC invests up to US$500,000 in pre-seed, pre-product startups to Series A funding rounds. The firm has investment and engineering departments that provide engineering and product design support services. It has worked with Google, Ferrari and Disney.

Led by Ben Einstein, the Boston-based venture capital firm focuses on startups involved in hardware and software development. The VC invests up to US$500,000 in pre-seed, pre-product startups to Series A funding rounds. The firm has investment and engineering departments that provide engineering and product design support services. It has worked with Google, Ferrari and Disney.

Aavishkaar (‘invention’ in Hindi) was founded in 2001 as an early stage investor to help build sustainable enterprises in India’s underserved regions. Its VC portfolio, valued at over US$ 155 million, covers key industry sectors including sanitation, healthcare, agriculture and technology. Its Aavishkaar Frontier Fund was created in 2015 to invest in South and Southeast Asian countries like Indonesia, Pakistan and Bangladesh.

Aavishkaar (‘invention’ in Hindi) was founded in 2001 as an early stage investor to help build sustainable enterprises in India’s underserved regions. Its VC portfolio, valued at over US$ 155 million, covers key industry sectors including sanitation, healthcare, agriculture and technology. Its Aavishkaar Frontier Fund was created in 2015 to invest in South and Southeast Asian countries like Indonesia, Pakistan and Bangladesh.

Vangoo Capital Partners was founded in 2008 in Hongkong as a wholly owned subsidiary of Ant Capital Partners. Ant Capital Partners completed localization in China by finishing management buy-out of Vangoo Capital Partners in 2011. Vangoo Capital Partners manages both US$ Fund and RMB funds. It focuses on the investment of medical, Internet, consumer products, high-tech, and new energy.

Vangoo Capital Partners was founded in 2008 in Hongkong as a wholly owned subsidiary of Ant Capital Partners. Ant Capital Partners completed localization in China by finishing management buy-out of Vangoo Capital Partners in 2011. Vangoo Capital Partners manages both US$ Fund and RMB funds. It focuses on the investment of medical, Internet, consumer products, high-tech, and new energy.

Buy Yourself GO: Relieving the pressure in high-demand retail

Buy Yourself's patented self-checkout technology specifically targets peak sales periods for bricks-and-mortars and requires no prior download of software

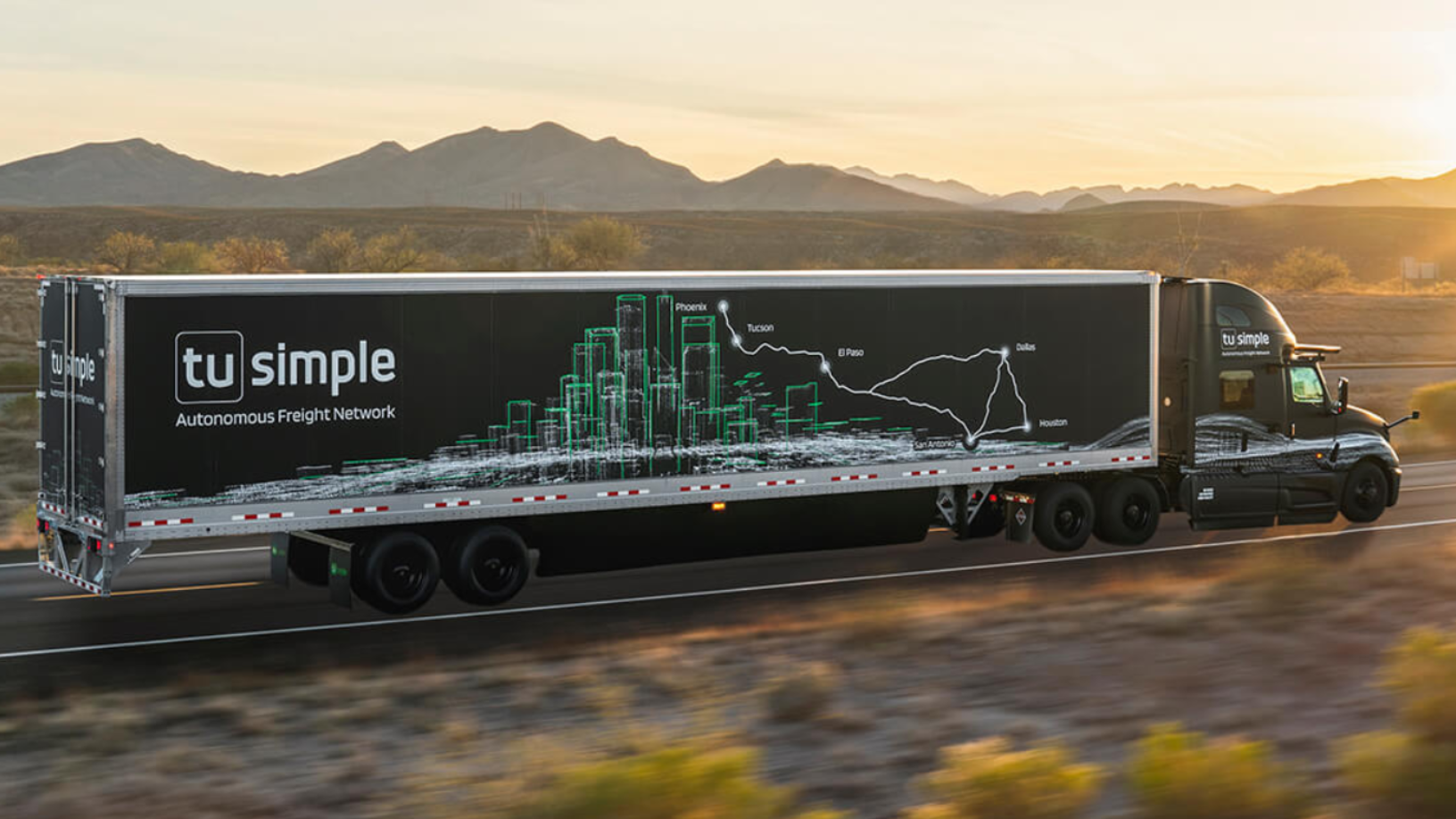

TuSimple: Banking on autonomous trucking in the US

TuSimple aims to scale its Waymo-style driverless trucking network to disrupt the $4tn global truck freight market starting with the US, with mass production by 2024

Red Points: US$38 million Series C to power US conquest

The Barcelona-based startup is ramping up US sales and deep-tech capabilities for its online brand protection platform

Vottun: The "WordPress for blockchain" seeks US expansion, investors

Seeking Series A funding this year, the agnostic SaaS opens blockchain's wealth of possibilities to businesses unfamiliar with the technology

Indonesian unicorn Traveloka aims for US listing via SPAC

The online travel aggregator reported revenue drops and layoffs in 2020 but became profitable late last year, led by recoveries in Vietnam and Thailand

Portugal's Prodsmart takes AI, IoT-based manufacturing to US factories

Smart factories can cut wastage by 80% and improve inventory, production and supply chains, tackling US$200 billion worth of losses

HypeLabs wins bumper US$3m seed funding to democratize connectivity

HypeLab's P2P mesh networking technology enables everyone to communicate within their own networks without needing internet, in cities, remote villages and even in disaster zones

Taronga Ventures takes RealTechX to Singapore; plans Japan, US growth

The Australian proptech investor to focus on ESG in its acceleration program, including women under-representation and site safety

Indonesian rental and asset management platform Travelio bags US$18m funding

The four-year-old proptech startup recently raised Series B funding as it gains ground in Indonesia’s growing real estate investment market

Animal AgTech Innovation Summit 2021: Future of aquaculture in the US

With the US Importing over 85% of its seafood, industry experts examine how and why the country should develop a sustainable aquaculture industry

Tuya Smart announces more partnerships, files for IPO in the US

Tuya Smart’s platform enables the creation of smart devices with little or no code writing needed, shortening R&D from months to a matter of days

New Food Invest: Building a plant-based business in the US

With plant-based startups experiencing exponential growth but facing increasingly intense competition, experts consider the opportunities and barriers in the sector

China's new unicorn: Secondhand electronics platform Aihuishou now worth US$1.5 billion

Aihuishou's latest funding round is the largest yet for a secondhand electronics platform

SoccerDream: World's first VR soccer training platform to launch in China, US

SoccerDream uses virtual reality to boost trainee players' performance on the field by 36% compared to their peers

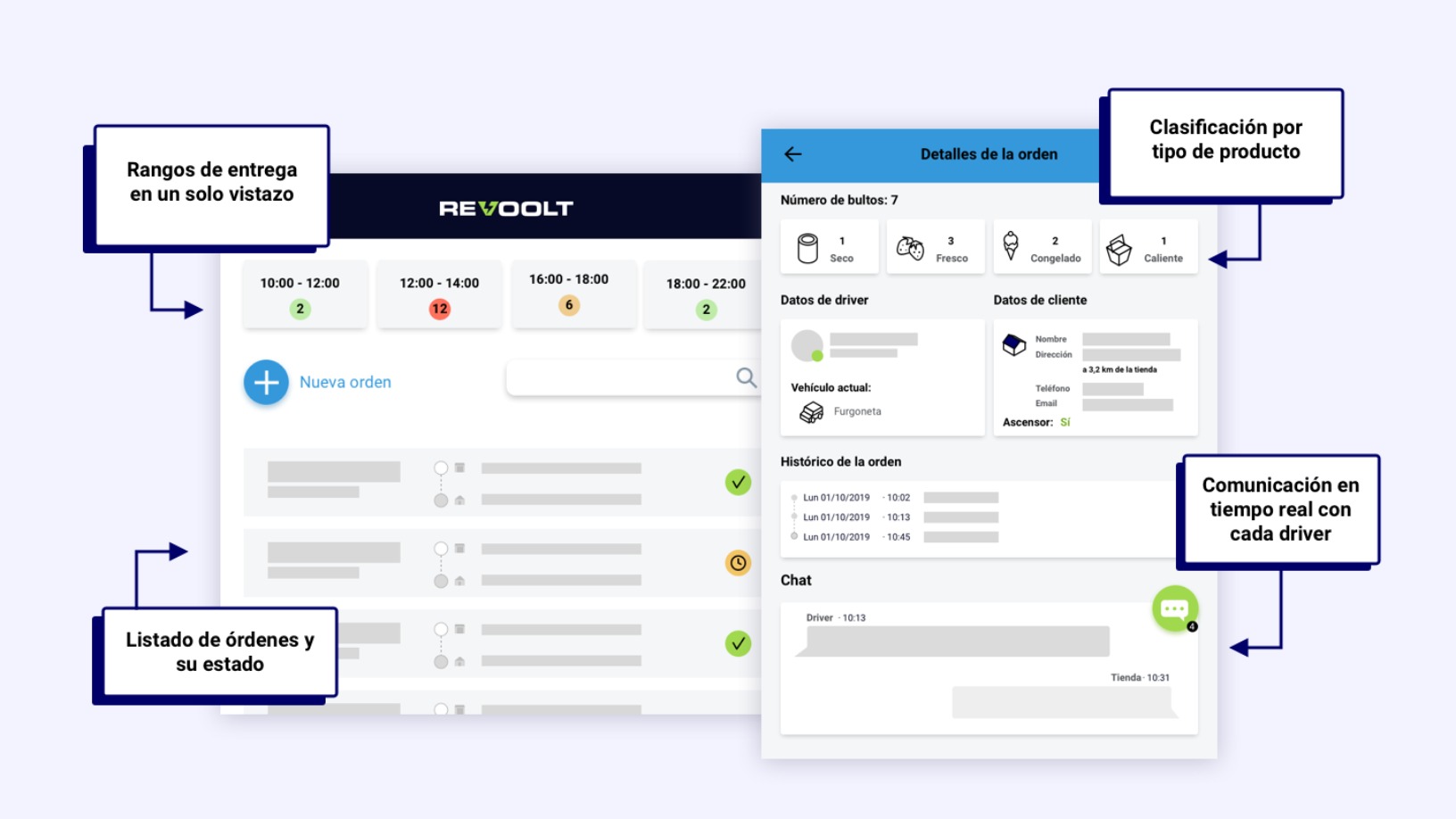

Revoolt: “Covid-19 accelerated our expansion plans and made us more ambitious”

Revoolt’s emission-free last-mile delivery model proved viable during the lockdown in Spain – growth that’s now its launchpad for international expansion and new funding

Sorry, we couldn’t find any matches for“US Xpress”.