US Xpress

-

DATABASE (434)

-

ARTICLES (604)

Established in 1990, JAFCO Asia is a private equity and venture capital firm with US$650m assets under management. It has offices in Singapore, Taipei, Seoul, Beijing and Shanghai. Its parent company, JAFCO Co., Ltd., is Japan's largest venture capital firm. JAFCO Asia has invested in more than 480 companies, 110 of which have been publicly listed.

Established in 1990, JAFCO Asia is a private equity and venture capital firm with US$650m assets under management. It has offices in Singapore, Taipei, Seoul, Beijing and Shanghai. Its parent company, JAFCO Co., Ltd., is Japan's largest venture capital firm. JAFCO Asia has invested in more than 480 companies, 110 of which have been publicly listed.

Prosperity7 Ventures is the $1bn diversified VC fund of Aramco Ventures, a subsidiary of Aramco, the world's leading integrated energy and chemicals company. The fund's name derives from “Prosperity Well", the 7th oil well drilled in Saudi Arabia and the first to strike oil. Prosperity7 Ventures invests globally, focusing on highly scalable startups in the US and China.

Prosperity7 Ventures is the $1bn diversified VC fund of Aramco Ventures, a subsidiary of Aramco, the world's leading integrated energy and chemicals company. The fund's name derives from “Prosperity Well", the 7th oil well drilled in Saudi Arabia and the first to strike oil. Prosperity7 Ventures invests globally, focusing on highly scalable startups in the US and China.

Founded in 2018, Linden Asset Group currently has offices in Nanjing, Shenzhen and Singapore. With both US dollar- and RMB-denominated funds under management, it is focused on the fields of biotechnology, medtech and smart technology in the Asia Pacific region. Linden Asset prefers growth-stage startups that are cutting-edge in their respective areas and plans for overseas expansion.

Founded in 2018, Linden Asset Group currently has offices in Nanjing, Shenzhen and Singapore. With both US dollar- and RMB-denominated funds under management, it is focused on the fields of biotechnology, medtech and smart technology in the Asia Pacific region. Linden Asset prefers growth-stage startups that are cutting-edge in their respective areas and plans for overseas expansion.

Verizon Ventures is the venture capital arm of Verizon Communications, the US's largest wireless provider, established in 2000. It invests from Series A to IPO. Verizon Ventures has made more than 100 investments to date and managed 20 exits, including healthcare diagnostics company NantHealth and P2P video content service Streamroot. Recent investments include holographic lighting technology company Light Field Lab's US$28m Series A round and AI-powered mass transportation technology company Optibus's US$40m Series B round.

Verizon Ventures is the venture capital arm of Verizon Communications, the US's largest wireless provider, established in 2000. It invests from Series A to IPO. Verizon Ventures has made more than 100 investments to date and managed 20 exits, including healthcare diagnostics company NantHealth and P2P video content service Streamroot. Recent investments include holographic lighting technology company Light Field Lab's US$28m Series A round and AI-powered mass transportation technology company Optibus's US$40m Series B round.

David Spector is the president and co-founder of the online lingerie company ThirdLove. A former partner at Sequioa Capital, he is a prolific angel investor with investments in around 30 startups across different geographies and market segments. Spector’s most recent disclosed investments are from 2020 and include participation in the $4.6m seed round of US fintech provider CapChase and in the $70m Series C round of US mobile marketing company Attentive.

David Spector is the president and co-founder of the online lingerie company ThirdLove. A former partner at Sequioa Capital, he is a prolific angel investor with investments in around 30 startups across different geographies and market segments. Spector’s most recent disclosed investments are from 2020 and include participation in the $4.6m seed round of US fintech provider CapChase and in the $70m Series C round of US mobile marketing company Attentive.

Founded in San Francisco in 2009, Eniac Ventures is an early-stage investor in diverse sectors. It currently has 59 startups in its portolio. The vast majority of its exits have been via acquisitions by larger companies such as Anchor sold to Spotify. The VC also invested in Airbnb and Medallia that went public in 2020 and 2019 respectively.Recent investments in June 2021 include co-leading the $4.2m seed round of US mental healthcare platform Nirvana Health and participation in the $30m Series B round of Briq, a US financial planning and workflow automation platform for the construction industry. The VC also joined in the Series A round of Vence, the California-based producer of smart wearables for livestock management.

Founded in San Francisco in 2009, Eniac Ventures is an early-stage investor in diverse sectors. It currently has 59 startups in its portolio. The vast majority of its exits have been via acquisitions by larger companies such as Anchor sold to Spotify. The VC also invested in Airbnb and Medallia that went public in 2020 and 2019 respectively.Recent investments in June 2021 include co-leading the $4.2m seed round of US mental healthcare platform Nirvana Health and participation in the $30m Series B round of Briq, a US financial planning and workflow automation platform for the construction industry. The VC also joined in the Series A round of Vence, the California-based producer of smart wearables for livestock management.

Marinya Capital is the family office ofJohn B Fairfax from the Australian Fairfax family, who originally established Fairfax Media, a large media company. Marinya largely invests in property and agricultural businesses but has also made at least two investments in tech startups and in an Australian VC. Its most recent disclosed investments were in the $4.7m July 2021 seed funding round of NovoNutrients, the US-based biotech producer of alt-protein using fermentation and CO2 and other emissions, and in the $55m Series B round of Australia’s premier plant-based brand v2food in 2020.

Marinya Capital is the family office ofJohn B Fairfax from the Australian Fairfax family, who originally established Fairfax Media, a large media company. Marinya largely invests in property and agricultural businesses but has also made at least two investments in tech startups and in an Australian VC. Its most recent disclosed investments were in the $4.7m July 2021 seed funding round of NovoNutrients, the US-based biotech producer of alt-protein using fermentation and CO2 and other emissions, and in the $55m Series B round of Australia’s premier plant-based brand v2food in 2020.

Advisor, board member, co-founder of NovoNutrients

Brian Sefton has been co-founder, a board member and a part-time advisor at NovoNutrients, a San Francisco-based biotech manufacturer of alt-protein produced from fermentation and CO2 since it was founded in 2017. In 2009, he co-founded research entity Oakbio, from which NovoNutrients evolved, and was its President and CTO. Sefton was CTO and President at NovoNutrients and also co-CEO and Chief Scientist at Oakbio until 2021 when he became the CEO at San Francisco-based fermentation commercialization startup Sincarne. Between 2005 and 2011, Sefton was also CEO at pharma research company Pharmadyn, working on drugs development for Alzheimer's Disease, and, for three of those years, was also Managing Partner of Stratsyn, a consultancy specializing in creation, development, management and fund raising for not-for-profit organizations. Sefton’s earlier posts include: directing nanotechnology commercialization and investment company Nanosig for three years, CEO of Silicon Valley’s Fastlane, a high-profile pioneer in real-time network traffic and security analysis for six years; and, simultaneously, being CEO at Bluebox Communications, developing high-end network security applications and appliances for Fortune 500 companies and the US government.Sefton holds an MBA from Santa Clara University in California and a bachelor’s degree in biochemistry from the University of California, Berkeley

Brian Sefton has been co-founder, a board member and a part-time advisor at NovoNutrients, a San Francisco-based biotech manufacturer of alt-protein produced from fermentation and CO2 since it was founded in 2017. In 2009, he co-founded research entity Oakbio, from which NovoNutrients evolved, and was its President and CTO. Sefton was CTO and President at NovoNutrients and also co-CEO and Chief Scientist at Oakbio until 2021 when he became the CEO at San Francisco-based fermentation commercialization startup Sincarne. Between 2005 and 2011, Sefton was also CEO at pharma research company Pharmadyn, working on drugs development for Alzheimer's Disease, and, for three of those years, was also Managing Partner of Stratsyn, a consultancy specializing in creation, development, management and fund raising for not-for-profit organizations. Sefton’s earlier posts include: directing nanotechnology commercialization and investment company Nanosig for three years, CEO of Silicon Valley’s Fastlane, a high-profile pioneer in real-time network traffic and security analysis for six years; and, simultaneously, being CEO at Bluebox Communications, developing high-end network security applications and appliances for Fortune 500 companies and the US government.Sefton holds an MBA from Santa Clara University in California and a bachelor’s degree in biochemistry from the University of California, Berkeley

Founder of DST Global, a late-stage investment firm with US $10 billion under management. Yuri Milner is one of the most influential tech investor in Russia. Under his leadership, DST Global invested in industry leading companies like Facebook, Twitter, Airbnb, Alibaba and Xiaomi. Together with Mark Zuckerberg and Sergey Brin, Yuri Milner founded the Breakthrough Prize to reward top scientists.

Founder of DST Global, a late-stage investment firm with US $10 billion under management. Yuri Milner is one of the most influential tech investor in Russia. Under his leadership, DST Global invested in industry leading companies like Facebook, Twitter, Airbnb, Alibaba and Xiaomi. Together with Mark Zuckerberg and Sergey Brin, Yuri Milner founded the Breakthrough Prize to reward top scientists.

Song founded Kidsmile, a child photography studio, in 2002. The company grew from one person with one shop to over 50 shops and 1 million registered members. He also founded Moments in 2014, an on-demand photography services platform, which received US$20 million in its Series A funding round in 2015. Song participated in Kuaipeilian's seed funding round.

Song founded Kidsmile, a child photography studio, in 2002. The company grew from one person with one shop to over 50 shops and 1 million registered members. He also founded Moments in 2014, an on-demand photography services platform, which received US$20 million in its Series A funding round in 2015. Song participated in Kuaipeilian's seed funding round.

Norway-based Katapult Accelerator focuses on technology-based startups targeting environmental and societal causes. Katapult's three-month accelerator program offers training and mentorship opportunities across a range of technologies including AI, blockchain and IoT, along with access to funding and investors. The company has recently teamed up with New York's ERA accelerator to help Katapult's startups expand to the US.

Norway-based Katapult Accelerator focuses on technology-based startups targeting environmental and societal causes. Katapult's three-month accelerator program offers training and mentorship opportunities across a range of technologies including AI, blockchain and IoT, along with access to funding and investors. The company has recently teamed up with New York's ERA accelerator to help Katapult's startups expand to the US.

China Renaissance offers private placement advisory, M&A advisory, securities underwriting, research, sales and trading, investment management and other financial services. It has clients in mainland China, Hong Kong and the United States as well as offices in Shanghai, Beijing, Hong Kong and New York. China Renaissance has facilitated more than 300 private financial transactions collectively valued at over US$20 billion.

China Renaissance offers private placement advisory, M&A advisory, securities underwriting, research, sales and trading, investment management and other financial services. It has clients in mainland China, Hong Kong and the United States as well as offices in Shanghai, Beijing, Hong Kong and New York. China Renaissance has facilitated more than 300 private financial transactions collectively valued at over US$20 billion.

Unreasonable Capital is a US-based venture capital firm. It focuses on early to mid-stage startups in emerging markets that address social and environmental challenges. The firm does not lead investments on its own, participating only when a local entity participates in financing. Its portfolio includes Nigerian fintech firm Paga, Indonesian automated fish feeder maker eFishery and solar power system producer BuffaloGrid.

Unreasonable Capital is a US-based venture capital firm. It focuses on early to mid-stage startups in emerging markets that address social and environmental challenges. The firm does not lead investments on its own, participating only when a local entity participates in financing. Its portfolio includes Nigerian fintech firm Paga, Indonesian automated fish feeder maker eFishery and solar power system producer BuffaloGrid.

WPS is a subsidiary of Kingsoft Corporation, one of the first Internet services and software companies in China. Its flagship product, WPS Office, which runs on iOS, Android, Windows and Linux, is one of the world’s most commonly used office suites. With over 900 employees, WPS has offices in mainland China, Hong Kong and the US.

WPS is a subsidiary of Kingsoft Corporation, one of the first Internet services and software companies in China. Its flagship product, WPS Office, which runs on iOS, Android, Windows and Linux, is one of the world’s most commonly used office suites. With over 900 employees, WPS has offices in mainland China, Hong Kong and the US.

Portuguese venture capital firm Best Horizon was established in 2014. Since then, its portfolio has grown to about 50 companies based in Portugal, Spain, the Netherlands, Brazil and the US. The firm has €3m in two investment vehicles for pre-seed and seed investments in tech companies that either have their headquarters or a subsidiary in the North, Centre, Alentejo and Azores regions of Portugal.

Portuguese venture capital firm Best Horizon was established in 2014. Since then, its portfolio has grown to about 50 companies based in Portugal, Spain, the Netherlands, Brazil and the US. The firm has €3m in two investment vehicles for pre-seed and seed investments in tech companies that either have their headquarters or a subsidiary in the North, Centre, Alentejo and Azores regions of Portugal.

Buy Yourself GO: Relieving the pressure in high-demand retail

Buy Yourself's patented self-checkout technology specifically targets peak sales periods for bricks-and-mortars and requires no prior download of software

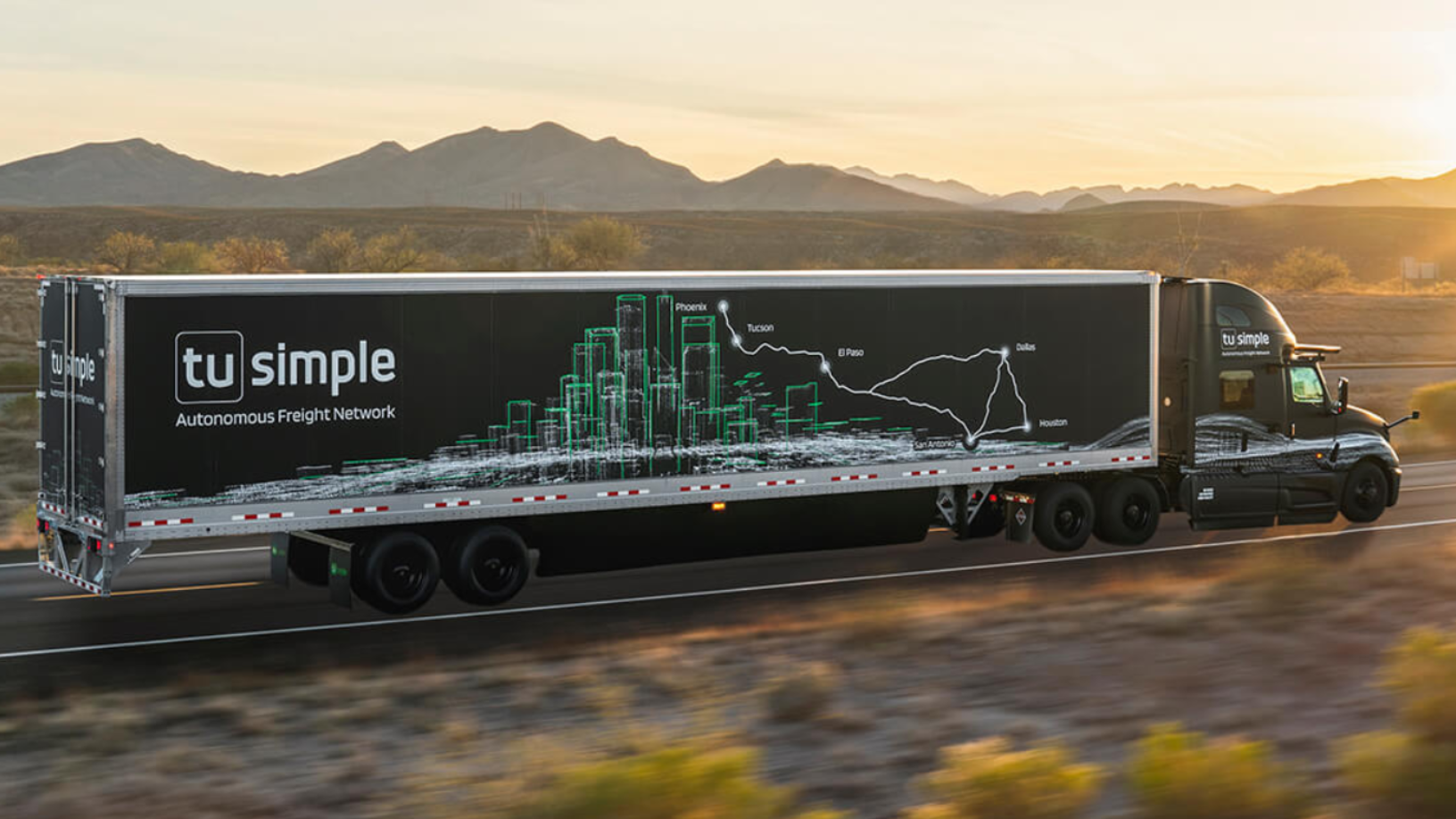

TuSimple: Banking on autonomous trucking in the US

TuSimple aims to scale its Waymo-style driverless trucking network to disrupt the $4tn global truck freight market starting with the US, with mass production by 2024

Red Points: US$38 million Series C to power US conquest

The Barcelona-based startup is ramping up US sales and deep-tech capabilities for its online brand protection platform

Vottun: The "WordPress for blockchain" seeks US expansion, investors

Seeking Series A funding this year, the agnostic SaaS opens blockchain's wealth of possibilities to businesses unfamiliar with the technology

Indonesian unicorn Traveloka aims for US listing via SPAC

The online travel aggregator reported revenue drops and layoffs in 2020 but became profitable late last year, led by recoveries in Vietnam and Thailand

Portugal's Prodsmart takes AI, IoT-based manufacturing to US factories

Smart factories can cut wastage by 80% and improve inventory, production and supply chains, tackling US$200 billion worth of losses

HypeLabs wins bumper US$3m seed funding to democratize connectivity

HypeLab's P2P mesh networking technology enables everyone to communicate within their own networks without needing internet, in cities, remote villages and even in disaster zones

Taronga Ventures takes RealTechX to Singapore; plans Japan, US growth

The Australian proptech investor to focus on ESG in its acceleration program, including women under-representation and site safety

Indonesian rental and asset management platform Travelio bags US$18m funding

The four-year-old proptech startup recently raised Series B funding as it gains ground in Indonesia’s growing real estate investment market

Animal AgTech Innovation Summit 2021: Future of aquaculture in the US

With the US Importing over 85% of its seafood, industry experts examine how and why the country should develop a sustainable aquaculture industry

Tuya Smart announces more partnerships, files for IPO in the US

Tuya Smart’s platform enables the creation of smart devices with little or no code writing needed, shortening R&D from months to a matter of days

New Food Invest: Building a plant-based business in the US

With plant-based startups experiencing exponential growth but facing increasingly intense competition, experts consider the opportunities and barriers in the sector

China's new unicorn: Secondhand electronics platform Aihuishou now worth US$1.5 billion

Aihuishou's latest funding round is the largest yet for a secondhand electronics platform

SoccerDream: World's first VR soccer training platform to launch in China, US

SoccerDream uses virtual reality to boost trainee players' performance on the field by 36% compared to their peers

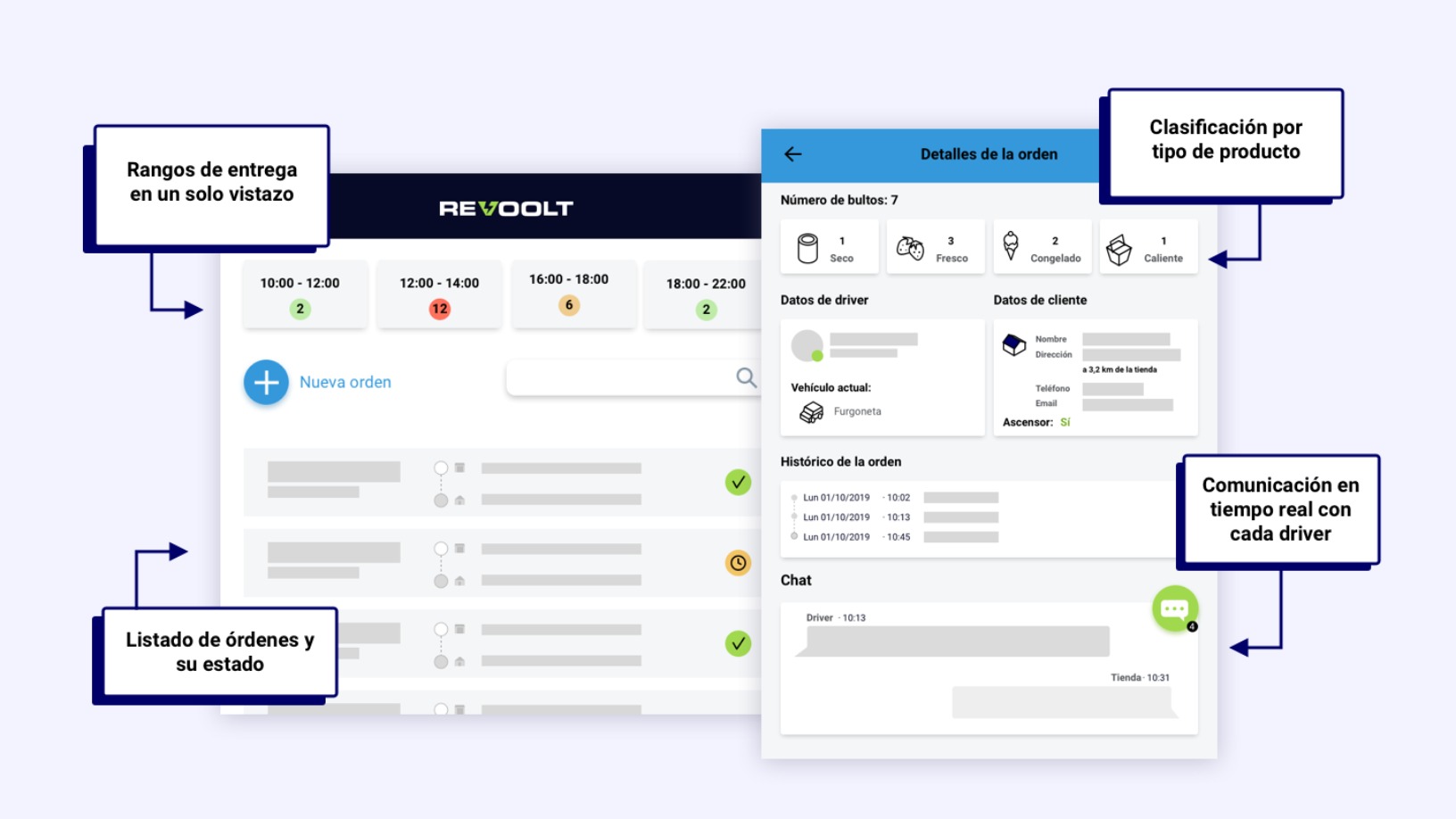

Revoolt: “Covid-19 accelerated our expansion plans and made us more ambitious”

Revoolt’s emission-free last-mile delivery model proved viable during the lockdown in Spain – growth that’s now its launchpad for international expansion and new funding

Sorry, we couldn’t find any matches for“US Xpress”.