US Xpress

-

DATABASE (434)

-

ARTICLES (604)

Deutsche Telekom is Germany's largest telecoms company, with operations in over 50 countries and more than 178 million mobile customers. It is a major investor in tech companies and has managed more than 20 investments and seven acquisitions to date. Its most well-known acquisition is teleco operator T-Mobile for €828m in 2014. Recent investments include HypeLabs' US$3m seed round and the €6m Series A round of automated IoT platform Axonise.

Deutsche Telekom is Germany's largest telecoms company, with operations in over 50 countries and more than 178 million mobile customers. It is a major investor in tech companies and has managed more than 20 investments and seven acquisitions to date. Its most well-known acquisition is teleco operator T-Mobile for €828m in 2014. Recent investments include HypeLabs' US$3m seed round and the €6m Series A round of automated IoT platform Axonise.

Stanley Ventures / Stanley Black & Decker

Founded in 1843, Connecticut-based Stanley Black & Decker, is one of the oldest US manufacturing companies. It has acquired tons of organizations in recent decades and invests in a very selected number of startups. Its most recent disclosed tech startup investments via its VC arm Stanley Ventures were in the 2021 $1.8m seed round of Spain’s Triditive, and in the 2019 undisclosed investment round of Argentinian field operations software Iguana Fix.

Founded in 1843, Connecticut-based Stanley Black & Decker, is one of the oldest US manufacturing companies. It has acquired tons of organizations in recent decades and invests in a very selected number of startups. Its most recent disclosed tech startup investments via its VC arm Stanley Ventures were in the 2021 $1.8m seed round of Spain’s Triditive, and in the 2019 undisclosed investment round of Argentinian field operations software Iguana Fix.

Bristol Myers Squibb or BMS is one of the world’s largest biopharmaceutical companies developing medicines in oncology, hematology, immunology and cardiovascular disease. It invests directly and via VC funds, including Life Sciences Partners (LSP) and BioGeneration Ventures, as LP. BMS is headquartered in New York and has 10 offices and facilities within the US and 13 in overseas locations, namely, Puerto Rico, Canada, France, Belgium, the UK, Ireland, Germany, Japan and China.

Bristol Myers Squibb or BMS is one of the world’s largest biopharmaceutical companies developing medicines in oncology, hematology, immunology and cardiovascular disease. It invests directly and via VC funds, including Life Sciences Partners (LSP) and BioGeneration Ventures, as LP. BMS is headquartered in New York and has 10 offices and facilities within the US and 13 in overseas locations, namely, Puerto Rico, Canada, France, Belgium, the UK, Ireland, Germany, Japan and China.

GGV Capital manages $3.8 billion across eight funds, making multi-stage investments in companies from mobile internet, hardware, cloud technology and SaaS sectors. Among them, 27 GGV-invested companies have completed IPOs in the last 10 years. Its portfolio features a wide range of companies, such as Alibaba, AirBnb, Qunar, YY, Didi, Soundcloud, slack, Youku Tudou and more. Founded in 2000, the firm deploys a single team operating in both China and the US.

GGV Capital manages $3.8 billion across eight funds, making multi-stage investments in companies from mobile internet, hardware, cloud technology and SaaS sectors. Among them, 27 GGV-invested companies have completed IPOs in the last 10 years. Its portfolio features a wide range of companies, such as Alibaba, AirBnb, Qunar, YY, Didi, Soundcloud, slack, Youku Tudou and more. Founded in 2000, the firm deploys a single team operating in both China and the US.

Sandeep Aggarwal is a serial entrepreneur with an MBA from Washington University at St. Louis, USA. He worked at Microsoft and Citibank before returning to India in 2011 to establish ShopClues, India’s first online managed marketplace and the country’s fifth unicorn in the consumer internet sector . In 2014, he also founded an automotive e-commerce site Droom, where he currently serves as CEO. He recently became an angel investor and plans to invest US$3 million in 2017.

Sandeep Aggarwal is a serial entrepreneur with an MBA from Washington University at St. Louis, USA. He worked at Microsoft and Citibank before returning to India in 2011 to establish ShopClues, India’s first online managed marketplace and the country’s fifth unicorn in the consumer internet sector . In 2014, he also founded an automotive e-commerce site Droom, where he currently serves as CEO. He recently became an angel investor and plans to invest US$3 million in 2017.

Spiral Ventures (IMJ Investment Partners)

Founded in 2012 in Japan, IMJ Investment Partners was a Singapore-based venture capital firm focusing on startups based in Southeast Asia and Japan. It had raised US$52 million in funding as a company under IMJ Corporation, one of the biggest digital agencies in Japan. A new VC company Spiral Ventures Pte Ltd was established to takeover IMJ-IP after a successful management buyout led by IMJ-IP Managing Partner Yuji Horiguchi in 2017.

Founded in 2012 in Japan, IMJ Investment Partners was a Singapore-based venture capital firm focusing on startups based in Southeast Asia and Japan. It had raised US$52 million in funding as a company under IMJ Corporation, one of the biggest digital agencies in Japan. A new VC company Spiral Ventures Pte Ltd was established to takeover IMJ-IP after a successful management buyout led by IMJ-IP Managing Partner Yuji Horiguchi in 2017.

Founded in 2003, Northstar Group is a private equity firm managing over US$2 billion in equity capital. The firm focuses on investments in Indonesia and the rest of Southeast Asia. Its investment portfolio includes many different companies, from banks to manufacturing firms. It launched NSI Ventures in 2014, which focuses on early-stage investing in Southeast Asia and has invested in noted startups like Go-Jek and Moka. Northstar Group invested in Go-Jek as well.

Founded in 2003, Northstar Group is a private equity firm managing over US$2 billion in equity capital. The firm focuses on investments in Indonesia and the rest of Southeast Asia. Its investment portfolio includes many different companies, from banks to manufacturing firms. It launched NSI Ventures in 2014, which focuses on early-stage investing in Southeast Asia and has invested in noted startups like Go-Jek and Moka. Northstar Group invested in Go-Jek as well.

Eduardo Saverin is a Brazilian tech entrepreneur and angel investor who is most famous for co-founding Facebook. A skilled investor, he reportedly made US$300,000 from trading while he was a Harvard undergraduate. He was also a co-founder and partner at B Capital Group that invested in logistics startup Ninja Van. In 2015, he invested in Indonesian e-commerce site Bilna and joined another funding round when Bilna merged with Moxy to form Orami.

Eduardo Saverin is a Brazilian tech entrepreneur and angel investor who is most famous for co-founding Facebook. A skilled investor, he reportedly made US$300,000 from trading while he was a Harvard undergraduate. He was also a co-founder and partner at B Capital Group that invested in logistics startup Ninja Van. In 2015, he invested in Indonesian e-commerce site Bilna and joined another funding round when Bilna merged with Moxy to form Orami.

Born in 1972, Wang started out in finance in 1992 at Xiangcai Securities, where she was employed in multiple capacities. She founded Noah Wealth Management in 2005 and has served as chairperson and CEO ever since. In 2010, Noah became China's first wealth management firm to go public in the US. Wang holds an EMBA from China Europe International Business School.

Born in 1972, Wang started out in finance in 1992 at Xiangcai Securities, where she was employed in multiple capacities. She founded Noah Wealth Management in 2005 and has served as chairperson and CEO ever since. In 2010, Noah became China's first wealth management firm to go public in the US. Wang holds an EMBA from China Europe International Business School.

All Iron Ventures, inspired by the “alliron” cry of the Biscay province in Spain, is a venture capital firm based in Bilbao. The VC was established by Ander Michelena and Jon Uriarte, the co-founders of Ticketbis who sold the business to eBay in 2016 for €165 million. The VC invests in capital-efficient and fast-growing e-commerce and marketplaces in Europe and the US.

All Iron Ventures, inspired by the “alliron” cry of the Biscay province in Spain, is a venture capital firm based in Bilbao. The VC was established by Ander Michelena and Jon Uriarte, the co-founders of Ticketbis who sold the business to eBay in 2016 for €165 million. The VC invests in capital-efficient and fast-growing e-commerce and marketplaces in Europe and the US.

Haibang Fund was created in 2011 by Haibang Venture based in Hangzhou. Haibang Fund manages total assets worth US$360m with investments in 60 companies, four of which have gone public. Started by a group of overseas returnees and experienced investors, the VC focuses on startups founded by returnees from overseas.

Haibang Fund was created in 2011 by Haibang Venture based in Hangzhou. Haibang Fund manages total assets worth US$360m with investments in 60 companies, four of which have gone public. Started by a group of overseas returnees and experienced investors, the VC focuses on startups founded by returnees from overseas.

Founded in October 1962, Mando Corporation is a South Korean automotive parts manufacturer. It supplies many automobile manufacturers worldwide, including General Motors, Volkswagen, Chrysler, Ford, Nissan, Hyundai, Kia, Suzuki and Chevrolet. With more than 11,000 staff, Mando Corporation produces 4m automotive parts per year, generating annual sales of US$4.74bn in 2018. The company was listed on the Korea Stock Exchange in May 2010; its controlling shareholder is Halla Holdings Corp.

Founded in October 1962, Mando Corporation is a South Korean automotive parts manufacturer. It supplies many automobile manufacturers worldwide, including General Motors, Volkswagen, Chrysler, Ford, Nissan, Hyundai, Kia, Suzuki and Chevrolet. With more than 11,000 staff, Mando Corporation produces 4m automotive parts per year, generating annual sales of US$4.74bn in 2018. The company was listed on the Korea Stock Exchange in May 2010; its controlling shareholder is Halla Holdings Corp.

Founded in 2007 in Shanghai, CTC Capital currently has branches in Beijing, Suzhou and Taipei. The company invests in both US dollars and RMB and has three funds under its management. It mainly targets the TMT, clean energy and consumer product sectors. Half of its management team have many years experience working in Taiwan’s semiconductor industry. In 2019, CTC Capital set up the Guodiao Guoxin Zhixin Fund to invest in the semiconductor integrated circuit sector.

Founded in 2007 in Shanghai, CTC Capital currently has branches in Beijing, Suzhou and Taipei. The company invests in both US dollars and RMB and has three funds under its management. It mainly targets the TMT, clean energy and consumer product sectors. Half of its management team have many years experience working in Taiwan’s semiconductor industry. In 2019, CTC Capital set up the Guodiao Guoxin Zhixin Fund to invest in the semiconductor integrated circuit sector.

Alexander von Schirmeister is an angel investor and Executive VP Europe of mobile payments company SumUp. In 2017, he participated in the first seed round of Spanish AI-driven femtech Woom, his only disclosed investment to date.The German native has worked at Spanish telco Telefonica and held various executive roles in the US. He was a manager at eBay and became an executive director on the Board of eBay International.

Alexander von Schirmeister is an angel investor and Executive VP Europe of mobile payments company SumUp. In 2017, he participated in the first seed round of Spanish AI-driven femtech Woom, his only disclosed investment to date.The German native has worked at Spanish telco Telefonica and held various executive roles in the US. He was a manager at eBay and became an executive director on the Board of eBay International.

Based in San Francisco, SV Angel was founded in 2009 by Ron Conway, one of Silicon Valley’s super-angels. The firm was originally Conway’s personal investment vehicle that was later turned into a VC with initial investment capital of $10m from external investors.The firm typically invests in early-seed stage rounds, supporting portfolio companies in M&A, business development and financing. Investments include US unicorns like Dropbox, Slack, Pinterest and Airbnb.

Based in San Francisco, SV Angel was founded in 2009 by Ron Conway, one of Silicon Valley’s super-angels. The firm was originally Conway’s personal investment vehicle that was later turned into a VC with initial investment capital of $10m from external investors.The firm typically invests in early-seed stage rounds, supporting portfolio companies in M&A, business development and financing. Investments include US unicorns like Dropbox, Slack, Pinterest and Airbnb.

Buy Yourself GO: Relieving the pressure in high-demand retail

Buy Yourself's patented self-checkout technology specifically targets peak sales periods for bricks-and-mortars and requires no prior download of software

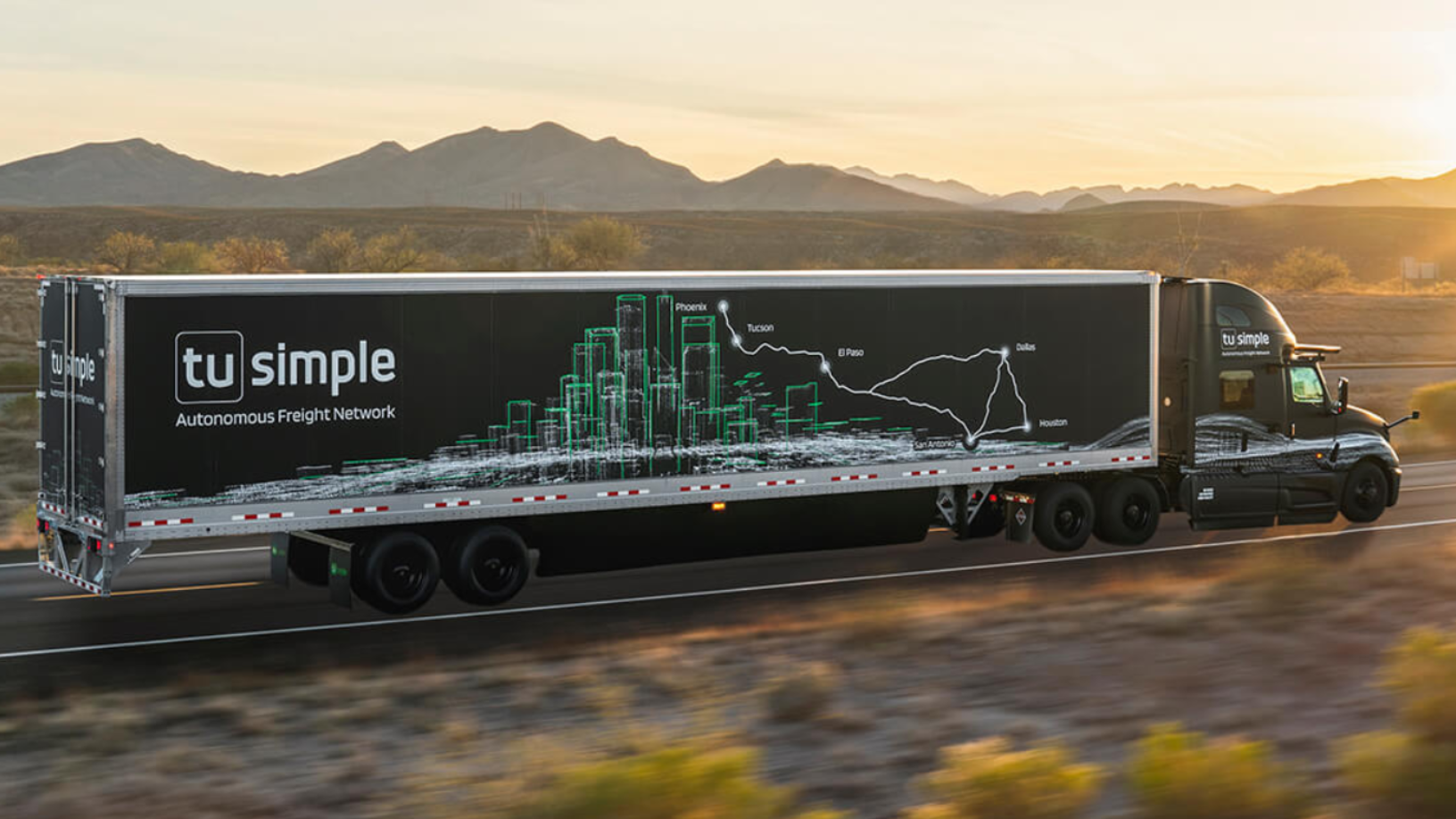

TuSimple: Banking on autonomous trucking in the US

TuSimple aims to scale its Waymo-style driverless trucking network to disrupt the $4tn global truck freight market starting with the US, with mass production by 2024

Red Points: US$38 million Series C to power US conquest

The Barcelona-based startup is ramping up US sales and deep-tech capabilities for its online brand protection platform

Vottun: The "WordPress for blockchain" seeks US expansion, investors

Seeking Series A funding this year, the agnostic SaaS opens blockchain's wealth of possibilities to businesses unfamiliar with the technology

Indonesian unicorn Traveloka aims for US listing via SPAC

The online travel aggregator reported revenue drops and layoffs in 2020 but became profitable late last year, led by recoveries in Vietnam and Thailand

Portugal's Prodsmart takes AI, IoT-based manufacturing to US factories

Smart factories can cut wastage by 80% and improve inventory, production and supply chains, tackling US$200 billion worth of losses

HypeLabs wins bumper US$3m seed funding to democratize connectivity

HypeLab's P2P mesh networking technology enables everyone to communicate within their own networks without needing internet, in cities, remote villages and even in disaster zones

Taronga Ventures takes RealTechX to Singapore; plans Japan, US growth

The Australian proptech investor to focus on ESG in its acceleration program, including women under-representation and site safety

Indonesian rental and asset management platform Travelio bags US$18m funding

The four-year-old proptech startup recently raised Series B funding as it gains ground in Indonesia’s growing real estate investment market

Animal AgTech Innovation Summit 2021: Future of aquaculture in the US

With the US Importing over 85% of its seafood, industry experts examine how and why the country should develop a sustainable aquaculture industry

Tuya Smart announces more partnerships, files for IPO in the US

Tuya Smart’s platform enables the creation of smart devices with little or no code writing needed, shortening R&D from months to a matter of days

New Food Invest: Building a plant-based business in the US

With plant-based startups experiencing exponential growth but facing increasingly intense competition, experts consider the opportunities and barriers in the sector

China's new unicorn: Secondhand electronics platform Aihuishou now worth US$1.5 billion

Aihuishou's latest funding round is the largest yet for a secondhand electronics platform

SoccerDream: World's first VR soccer training platform to launch in China, US

SoccerDream uses virtual reality to boost trainee players' performance on the field by 36% compared to their peers

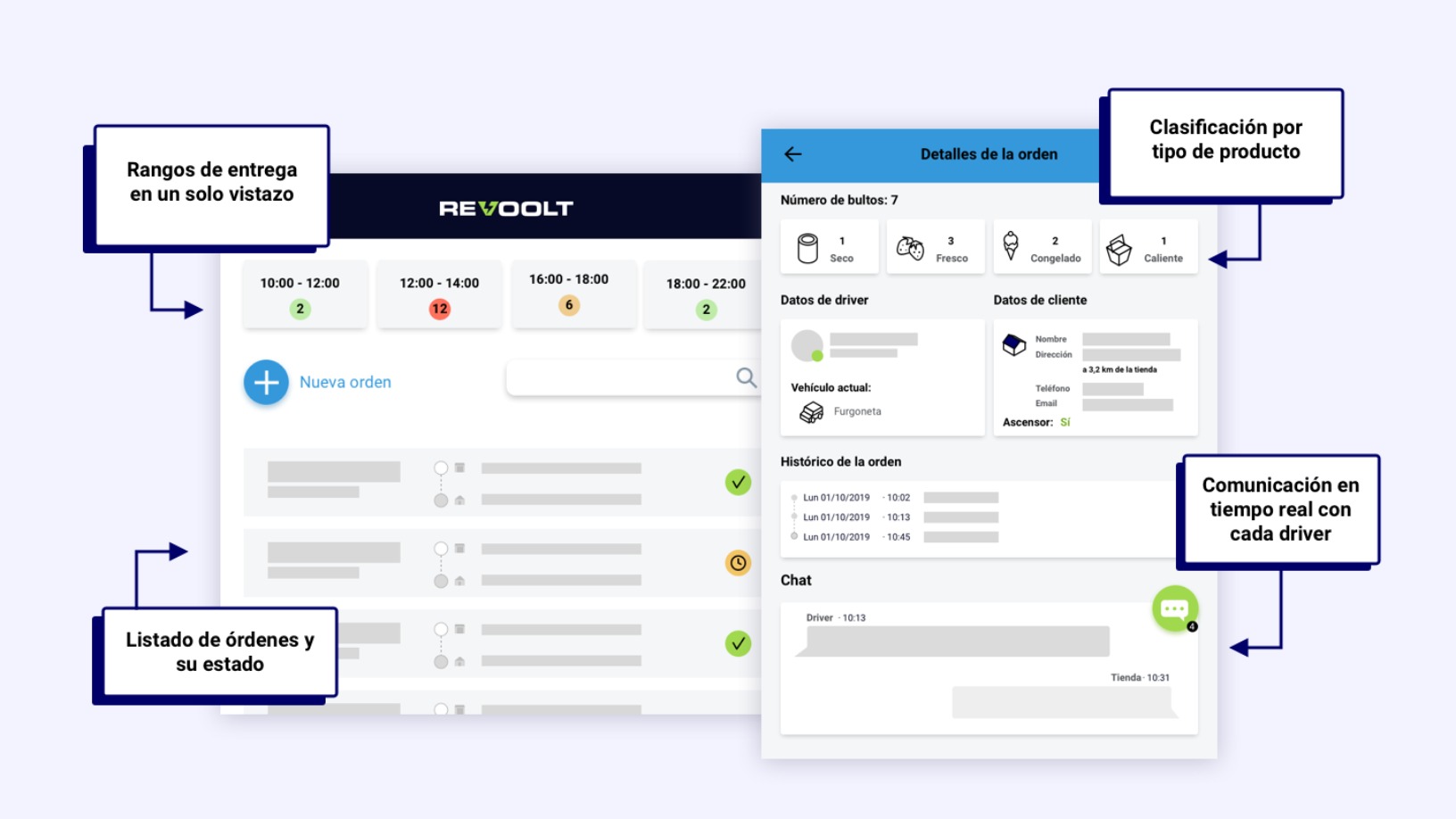

Revoolt: “Covid-19 accelerated our expansion plans and made us more ambitious”

Revoolt’s emission-free last-mile delivery model proved viable during the lockdown in Spain – growth that’s now its launchpad for international expansion and new funding

Sorry, we couldn’t find any matches for“US Xpress”.