US Xpress

-

DATABASE (434)

-

ARTICLES (604)

AddVenture is a Russian VC fund investing internationally. The firm has US$120m under management, participating in funding rounds with an investment range between US$1m and US$10m. The firm’s portfolio comprises 23 investments and five exits.AddVenture's investment criteria focus on local services, marketplaces, SaaS, food-tech and health-tech startups.

AddVenture is a Russian VC fund investing internationally. The firm has US$120m under management, participating in funding rounds with an investment range between US$1m and US$10m. The firm’s portfolio comprises 23 investments and five exits.AddVenture's investment criteria focus on local services, marketplaces, SaaS, food-tech and health-tech startups.

Silicon Valley-based Bessemer Venture Partners is one of the largest startup investors in the world, with US$5.4bn invested across five funds, the most recent raised in August 2018. Founded in 1911, the VC has five US offices as well as premises in India and Israel. It invests starting from seed and Series A level, sticking with portfolio companies through later-stage investments. Bessemer Venture Partners has invested in over 880 startups and managed more than 120 exits to date. Recent investments include Korean fintech Toss's US$64m Series F, US accounting unicorn ScaleFactor's US$60m Series C and fintech Mambu's Series C.

Silicon Valley-based Bessemer Venture Partners is one of the largest startup investors in the world, with US$5.4bn invested across five funds, the most recent raised in August 2018. Founded in 1911, the VC has five US offices as well as premises in India and Israel. It invests starting from seed and Series A level, sticking with portfolio companies through later-stage investments. Bessemer Venture Partners has invested in over 880 startups and managed more than 120 exits to date. Recent investments include Korean fintech Toss's US$64m Series F, US accounting unicorn ScaleFactor's US$60m Series C and fintech Mambu's Series C.

Founded in 2014, Stellar Kapital is a VC and investment firm that seeks to empower new entrepreneurs and launch new tech events including a cultural and music Stellar Fest in 2018. Its first fund of US$10 million was mainly invested in real-sector companies. Armed with a second investment fund of US$25 million, Stellar Kapital is looking to invest in startups with funding ranging from US$200,000 to US$1 million. The VC also invests directly in offline companies like co-working business Freeware Spaces, Stellar Parking and Divestekno, an oil and gas company.

Founded in 2014, Stellar Kapital is a VC and investment firm that seeks to empower new entrepreneurs and launch new tech events including a cultural and music Stellar Fest in 2018. Its first fund of US$10 million was mainly invested in real-sector companies. Armed with a second investment fund of US$25 million, Stellar Kapital is looking to invest in startups with funding ranging from US$200,000 to US$1 million. The VC also invests directly in offline companies like co-working business Freeware Spaces, Stellar Parking and Divestekno, an oil and gas company.

Vynn Capital LP was founded in early 2018 by former Gobi Partners vice president Victor Chua and Darren Chua from Singapore. Victor joined Gobi in 2015 and was on Forbes’ 30 under 30 Asia list 2017: Finance and Venture Capital.The Malaysian VC, with plans to raise a maiden fund of US$40 million, will focus on financing collaborations among large corporates, SMEs and innovative startups in the ASEAN region including Myanmar. It will invest in 15 to 30 companies. with seed funds ranging from US$300,000 to US$500,000 and Series A of US$1 million.

Vynn Capital LP was founded in early 2018 by former Gobi Partners vice president Victor Chua and Darren Chua from Singapore. Victor joined Gobi in 2015 and was on Forbes’ 30 under 30 Asia list 2017: Finance and Venture Capital.The Malaysian VC, with plans to raise a maiden fund of US$40 million, will focus on financing collaborations among large corporates, SMEs and innovative startups in the ASEAN region including Myanmar. It will invest in 15 to 30 companies. with seed funds ranging from US$300,000 to US$500,000 and Series A of US$1 million.

Co-founder of Xiaoming Bike

Deng Yonghao founded his first bike store in Guagzhou, China in 1993, when bicycle was the dominant transportation tool in China. He agented Wuyang Bike and made profit by earning RMB200 from each bike. In 1995, he established first firm and shifted interest to European market.In 2008, Cronus the brand was born in France and Deng brought it bacto Guanghzhou in 2010 as sport bike industry was striving in China. In 2016, Deng Yonghao invested RMB100 million, up to US$ 14million, to Xiaoming Bike in series A round funding and joined as cofounder. CRONUS is now responsible for full production of Xiaoming Bike.

Deng Yonghao founded his first bike store in Guagzhou, China in 1993, when bicycle was the dominant transportation tool in China. He agented Wuyang Bike and made profit by earning RMB200 from each bike. In 1995, he established first firm and shifted interest to European market.In 2008, Cronus the brand was born in France and Deng brought it bacto Guanghzhou in 2010 as sport bike industry was striving in China. In 2016, Deng Yonghao invested RMB100 million, up to US$ 14million, to Xiaoming Bike in series A round funding and joined as cofounder. CRONUS is now responsible for full production of Xiaoming Bike.

Co-founder and CEO of IMOOJI

Mujianto "Muji" Rusman earned his bachelor's in Electrical Engineering from the Texas A&M University in 1998, after which he worked for Dell as a development manager while concurrently pursuing an MBA at Texas State University. He then joined Rovi Corporation in 2006, where he spent the next five years. In 2013, Muji returned to Indonesia to establish event photo sharing company EventPic, before building IMOOJI, a new digital brochure development firm in 2016. Although he spent most of his professional career in the US, Muji now divides his time between Indonesia and Seattle, where his family lives.

Mujianto "Muji" Rusman earned his bachelor's in Electrical Engineering from the Texas A&M University in 1998, after which he worked for Dell as a development manager while concurrently pursuing an MBA at Texas State University. He then joined Rovi Corporation in 2006, where he spent the next five years. In 2013, Muji returned to Indonesia to establish event photo sharing company EventPic, before building IMOOJI, a new digital brochure development firm in 2016. Although he spent most of his professional career in the US, Muji now divides his time between Indonesia and Seattle, where his family lives.

CEO and Co-founder of Coinffeine

Alberto Gómez Toribio is a computer engineer and an influential blockchain expert in Spain. In 2013, he co-founded Coinffeine, a P2P cryptocurrency exchange platform and the first to on-board a banking investor. Coinffeine consulted institutions including the Bank of Spain, the US Federal Reserve and the European Commission during development of the platform. In 2015, Toribio established the blockchain division within the Barrabés Group to launch blockchain startups projects. He has also worked as a technology expert for Sony Entertainment and Telefonica R&D. Currently he is working on projects developing blockchain strategies to identify business opportunities and new innovative product design.

Alberto Gómez Toribio is a computer engineer and an influential blockchain expert in Spain. In 2013, he co-founded Coinffeine, a P2P cryptocurrency exchange platform and the first to on-board a banking investor. Coinffeine consulted institutions including the Bank of Spain, the US Federal Reserve and the European Commission during development of the platform. In 2015, Toribio established the blockchain division within the Barrabés Group to launch blockchain startups projects. He has also worked as a technology expert for Sony Entertainment and Telefonica R&D. Currently he is working on projects developing blockchain strategies to identify business opportunities and new innovative product design.

Co-CEO and co-founder of Elio

Walton Hartanto graduated in Business Administration and Management at the University of Southern California in 2014. While in the US, he worked for over a year as a financial analyst at Houlihan Lokey, an American multinational independent investment bank and financial services company in San Francisco. In 2016, he worked as an analyst for private equity firm General Atlantic in Singapore. He returned to Jakarta in August 2018 and worked in business development for Wahyu Abadi, an Indonesian company that focused on printing, packaging, digital and supply chain technology. Walton and his older brother Waldo co-founded Elio in April 2018, an Indonesian online health clinic for men.

Walton Hartanto graduated in Business Administration and Management at the University of Southern California in 2014. While in the US, he worked for over a year as a financial analyst at Houlihan Lokey, an American multinational independent investment bank and financial services company in San Francisco. In 2016, he worked as an analyst for private equity firm General Atlantic in Singapore. He returned to Jakarta in August 2018 and worked in business development for Wahyu Abadi, an Indonesian company that focused on printing, packaging, digital and supply chain technology. Walton and his older brother Waldo co-founded Elio in April 2018, an Indonesian online health clinic for men.

Established in 1977, Matrix Partners is an American venture capital firm with offices in San Francisco and Cambridge in the US, as well as in Shanghai, Beijing, Mumbai and Bangalore, and has invested in prominent companies like Apple and FedEx. It participates in all stages of investment and, to date, has invested over US$4 billion and has over US$4 billion currently under management. The company has invested in more than 500 companies and was lead investor in over 150. It has seen more than 100 exits. Recent investments include US$11 million in Brightback Series A and in Klook's Series D.

Established in 1977, Matrix Partners is an American venture capital firm with offices in San Francisco and Cambridge in the US, as well as in Shanghai, Beijing, Mumbai and Bangalore, and has invested in prominent companies like Apple and FedEx. It participates in all stages of investment and, to date, has invested over US$4 billion and has over US$4 billion currently under management. The company has invested in more than 500 companies and was lead investor in over 150. It has seen more than 100 exits. Recent investments include US$11 million in Brightback Series A and in Klook's Series D.

Billed as the world’s first online venture capital platform, launched in 2012 in San Francisco, FundersClub is a marketplace that allows accredited investors to become equity holders in managed venture funds, which then fund pre-screened private companies. It has invested in more than 340 companies to date, valued at more than US$7.6 billion and has seen 35 exits. The platform has invested more than US$115 million to date across sectors and technologies in companies from 21 different countries. Recent investments include in SendBird's Series B, that raised US$52 million, and Zentail's Series A that raised US$5 million.

Billed as the world’s first online venture capital platform, launched in 2012 in San Francisco, FundersClub is a marketplace that allows accredited investors to become equity holders in managed venture funds, which then fund pre-screened private companies. It has invested in more than 340 companies to date, valued at more than US$7.6 billion and has seen 35 exits. The platform has invested more than US$115 million to date across sectors and technologies in companies from 21 different countries. Recent investments include in SendBird's Series B, that raised US$52 million, and Zentail's Series A that raised US$5 million.

Co-founder and CEO of ChainGo

Since March 2017, Andrés Garrido Piñero has been working as a consultant at Altair Management Consultants in Barcelona, specializing as a digital transformation and blockchain advisor. He graduated as an Aerospace engineer from the Universidad de Sevilla in 2008 and has worked as a design engineer in Spain and the US for over six years.He completed an international MBA at the IE Business School in Madrid in 2016 and became the CEO and co-founder of ChainGoTech SL in November 2017. ChainGo is a blockchain-powered platform that can be used to build logistics solutions for the industry.

Since March 2017, Andrés Garrido Piñero has been working as a consultant at Altair Management Consultants in Barcelona, specializing as a digital transformation and blockchain advisor. He graduated as an Aerospace engineer from the Universidad de Sevilla in 2008 and has worked as a design engineer in Spain and the US for over six years.He completed an international MBA at the IE Business School in Madrid in 2016 and became the CEO and co-founder of ChainGoTech SL in November 2017. ChainGo is a blockchain-powered platform that can be used to build logistics solutions for the industry.

Co-founder, co-CEO and CCO of Shotl

Based in the US and Spain, Gerard Martret is a member of Founders Network in San Francisco. After graduating from the University of Barcelona in 2000, he and his brothers established a mobility venture builder Camina Lab in New York. In 2001, they also co-founded two businesses in Barcelona: on-demand driving service Drivania Chauffeurs and Bhagna Innovation, a communication agency that ceased operations in 2011. The Martrets also co-founded transport tech startup Routebox Technologies in 2010. In 2016, they diversified into the provision of on-demand shuttles and bus-pooling services. Martret is Co-CEO and Chief Communication Officer at Shotl.

Based in the US and Spain, Gerard Martret is a member of Founders Network in San Francisco. After graduating from the University of Barcelona in 2000, he and his brothers established a mobility venture builder Camina Lab in New York. In 2001, they also co-founded two businesses in Barcelona: on-demand driving service Drivania Chauffeurs and Bhagna Innovation, a communication agency that ceased operations in 2011. The Martrets also co-founded transport tech startup Routebox Technologies in 2010. In 2016, they diversified into the provision of on-demand shuttles and bus-pooling services. Martret is Co-CEO and Chief Communication Officer at Shotl.

Co-founder of Volantis

Ryan Haryadi went to Diablo Valley College in the US and Indiana University, Bloomington, where he earned a bachelor's degree in Informatics. In 2010, he returned to Indonesia, where he briefly joined ORIX Indonesia Finance as an account manager till the end of 2011. In 2012, he joined online travel aggregator Pegipegi, which is now owned by Traveloka. In 2013, Haryadi moved on and joined Bachtiar Rifai at digital marketing consultancy WireHub. The duo continued on to establish digital marketing automation service firm Kofera Technology, and, subsequently, spun off a second company, Volantis Technology.

Ryan Haryadi went to Diablo Valley College in the US and Indiana University, Bloomington, where he earned a bachelor's degree in Informatics. In 2010, he returned to Indonesia, where he briefly joined ORIX Indonesia Finance as an account manager till the end of 2011. In 2012, he joined online travel aggregator Pegipegi, which is now owned by Traveloka. In 2013, Haryadi moved on and joined Bachtiar Rifai at digital marketing consultancy WireHub. The duo continued on to establish digital marketing automation service firm Kofera Technology, and, subsequently, spun off a second company, Volantis Technology.

CEO and co-founder of agroSingularity

In 2019, Juanfra Abad Navarro became the CEO and co-founder of agroSingularity, a Murcia-based startup producing natural powder ingredients from wasted agricultural by-products.The graphic and product designer has led multiple international innovation projects at the Catholic University of Murcia and at the European Business Factory. He also co-founded and headed Innovarligero for over nine years, facilitating innovative agile processes for agrifood SMEs. Navarro was selected as one of 10 brilliant Murcian entrepreneurs to join the executive training programs of the Advanced Leadership Foundation (ALF). Through AFL, he had the opportunity to meet former US President Barack Obama during the Summit of Technological Innovation and Circular Economy held in Madrid in 2018.

In 2019, Juanfra Abad Navarro became the CEO and co-founder of agroSingularity, a Murcia-based startup producing natural powder ingredients from wasted agricultural by-products.The graphic and product designer has led multiple international innovation projects at the Catholic University of Murcia and at the European Business Factory. He also co-founded and headed Innovarligero for over nine years, facilitating innovative agile processes for agrifood SMEs. Navarro was selected as one of 10 brilliant Murcian entrepreneurs to join the executive training programs of the Advanced Leadership Foundation (ALF). Through AFL, he had the opportunity to meet former US President Barack Obama during the Summit of Technological Innovation and Circular Economy held in Madrid in 2018.

CEO and Co-founder of Oceanium

Karen Scofield Seal is the CEO and co-founder of Oceanium, a Scottish startup developing marine-safe bio packaging and plant-based food and nutrition products from sustainably farmed seaweed. During the 90s she lived in New York working as Senior Manager and Producer for the National Football League, as Production Supervisor and Event director at the US OPEN Tennis, and as Coordinating Producer at ABC News.She later moved to London with her husband, where she worked in Comic Relief and in RED, liaising with Apple, American Express and Converse partnerships. In 2009 she co-founded LUCZA, a luxury e-commerce active since 2014. There, she executed marketing and PR strategies including offline and online initiatives.

Karen Scofield Seal is the CEO and co-founder of Oceanium, a Scottish startup developing marine-safe bio packaging and plant-based food and nutrition products from sustainably farmed seaweed. During the 90s she lived in New York working as Senior Manager and Producer for the National Football League, as Production Supervisor and Event director at the US OPEN Tennis, and as Coordinating Producer at ABC News.She later moved to London with her husband, where she worked in Comic Relief and in RED, liaising with Apple, American Express and Converse partnerships. In 2009 she co-founded LUCZA, a luxury e-commerce active since 2014. There, she executed marketing and PR strategies including offline and online initiatives.

Buy Yourself GO: Relieving the pressure in high-demand retail

Buy Yourself's patented self-checkout technology specifically targets peak sales periods for bricks-and-mortars and requires no prior download of software

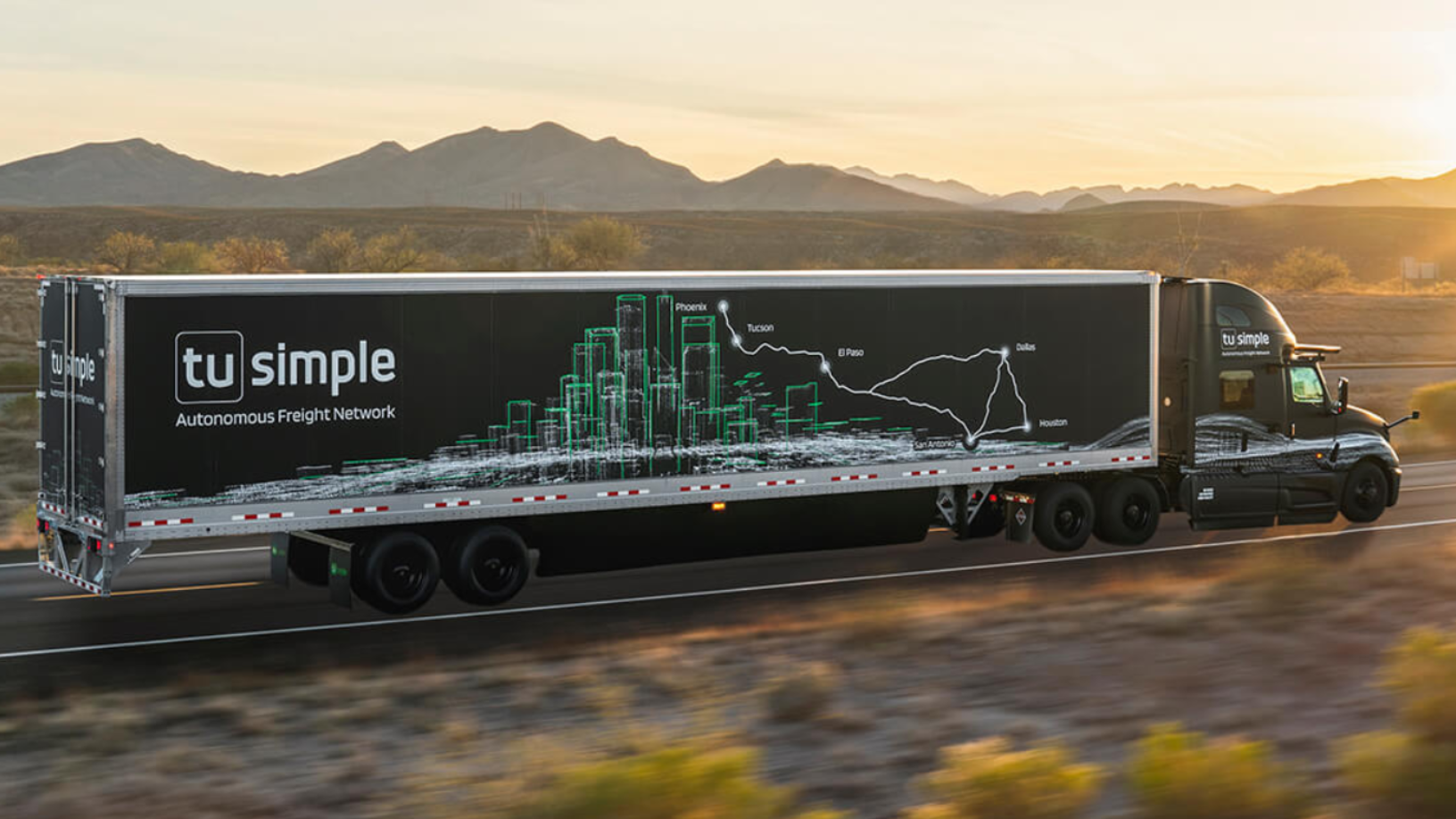

TuSimple: Banking on autonomous trucking in the US

TuSimple aims to scale its Waymo-style driverless trucking network to disrupt the $4tn global truck freight market starting with the US, with mass production by 2024

Red Points: US$38 million Series C to power US conquest

The Barcelona-based startup is ramping up US sales and deep-tech capabilities for its online brand protection platform

Vottun: The "WordPress for blockchain" seeks US expansion, investors

Seeking Series A funding this year, the agnostic SaaS opens blockchain's wealth of possibilities to businesses unfamiliar with the technology

Indonesian unicorn Traveloka aims for US listing via SPAC

The online travel aggregator reported revenue drops and layoffs in 2020 but became profitable late last year, led by recoveries in Vietnam and Thailand

Portugal's Prodsmart takes AI, IoT-based manufacturing to US factories

Smart factories can cut wastage by 80% and improve inventory, production and supply chains, tackling US$200 billion worth of losses

HypeLabs wins bumper US$3m seed funding to democratize connectivity

HypeLab's P2P mesh networking technology enables everyone to communicate within their own networks without needing internet, in cities, remote villages and even in disaster zones

Taronga Ventures takes RealTechX to Singapore; plans Japan, US growth

The Australian proptech investor to focus on ESG in its acceleration program, including women under-representation and site safety

Indonesian rental and asset management platform Travelio bags US$18m funding

The four-year-old proptech startup recently raised Series B funding as it gains ground in Indonesia’s growing real estate investment market

Animal AgTech Innovation Summit 2021: Future of aquaculture in the US

With the US Importing over 85% of its seafood, industry experts examine how and why the country should develop a sustainable aquaculture industry

Tuya Smart announces more partnerships, files for IPO in the US

Tuya Smart’s platform enables the creation of smart devices with little or no code writing needed, shortening R&D from months to a matter of days

New Food Invest: Building a plant-based business in the US

With plant-based startups experiencing exponential growth but facing increasingly intense competition, experts consider the opportunities and barriers in the sector

China's new unicorn: Secondhand electronics platform Aihuishou now worth US$1.5 billion

Aihuishou's latest funding round is the largest yet for a secondhand electronics platform

SoccerDream: World's first VR soccer training platform to launch in China, US

SoccerDream uses virtual reality to boost trainee players' performance on the field by 36% compared to their peers

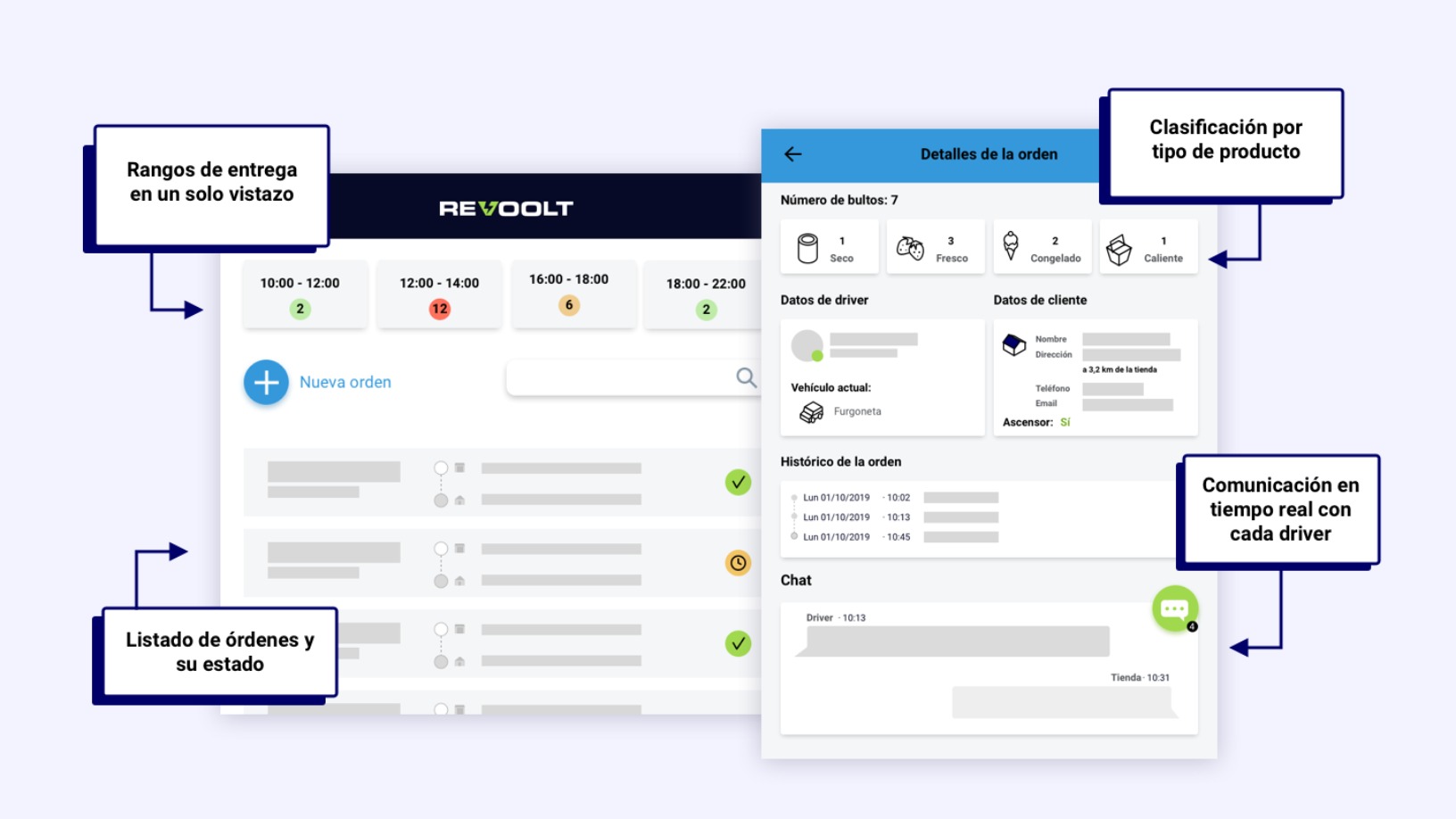

Revoolt: “Covid-19 accelerated our expansion plans and made us more ambitious”

Revoolt’s emission-free last-mile delivery model proved viable during the lockdown in Spain – growth that’s now its launchpad for international expansion and new funding

Sorry, we couldn’t find any matches for“US Xpress”.