US-China trade war

-

DATABASE (997)

-

ARTICLES (687)

The most popular app and online brokerage of Chinese-speaking investors to trade US- and HK-listed shares is also backed by the legendary Jim Rogers.

The most popular app and online brokerage of Chinese-speaking investors to trade US- and HK-listed shares is also backed by the legendary Jim Rogers.

HGI Finaves China is initiated by HGI Capital, a Hong Kong-based investment fund, and CEIBS, a business school established under an agreement between China’s trade ministry and the European Commission. It makes seed/angel round as well as Series A investments in the TMT, culture and creative, and consumer-related sectors in China.

HGI Finaves China is initiated by HGI Capital, a Hong Kong-based investment fund, and CEIBS, a business school established under an agreement between China’s trade ministry and the European Commission. It makes seed/angel round as well as Series A investments in the TMT, culture and creative, and consumer-related sectors in China.

Thanks to Beile’s integrated online-offline education system, Chinese children can get an American education and perfect their English from young, without having to go abroad.

Thanks to Beile’s integrated online-offline education system, Chinese children can get an American education and perfect their English from young, without having to go abroad.

World's first robotic pet-sitter feeds, cleans, plays with pets, so busy owners don't worry about leaving pets home alone, are less likely to abandon them.

World's first robotic pet-sitter feeds, cleans, plays with pets, so busy owners don't worry about leaving pets home alone, are less likely to abandon them.

Banking on demand for healthy tea beverages, Changsha's cultural tea house will operate over 200 outlets, offering on-demand deliveries to customers across the city.

Banking on demand for healthy tea beverages, Changsha's cultural tea house will operate over 200 outlets, offering on-demand deliveries to customers across the city.

China Renaissance offers private placement advisory, M&A advisory, securities underwriting, research, sales and trading, investment management and other financial services. It has clients in mainland China, Hong Kong and the United States as well as offices in Shanghai, Beijing, Hong Kong and New York. China Renaissance has facilitated more than 300 private financial transactions collectively valued at over US$20 billion.

China Renaissance offers private placement advisory, M&A advisory, securities underwriting, research, sales and trading, investment management and other financial services. It has clients in mainland China, Hong Kong and the United States as well as offices in Shanghai, Beijing, Hong Kong and New York. China Renaissance has facilitated more than 300 private financial transactions collectively valued at over US$20 billion.

BlueRun Ventures China was founded in 2005, focusing on early-stage investment of companies. The investments are usually from US$100,000 to US$10 million.

BlueRun Ventures China was founded in 2005, focusing on early-stage investment of companies. The investments are usually from US$100,000 to US$10 million.

As part of Vertex Ventures Holdings, a member of Temasek Holdings and Singapore's oldest and largest venture capital firm, Vertex Ventures China focuses on investment in high-growth internet and technology startups across mainland China. Vertex Ventures Holdings has a capital of US$600 million. It also has offices in Singapore, the US and Israel; and investments in these regions as well as Asia.

As part of Vertex Ventures Holdings, a member of Temasek Holdings and Singapore's oldest and largest venture capital firm, Vertex Ventures China focuses on investment in high-growth internet and technology startups across mainland China. Vertex Ventures Holdings has a capital of US$600 million. It also has offices in Singapore, the US and Israel; and investments in these regions as well as Asia.

A private equity fund targeting fintech firms at the growth expansion and mature stage mainly in China, Europe, and the US. Its founding members include China Minsheng International Capital Limited (CMIC), a subsidiary of China Minsheng Investment Corporation Limited (CMI); and GF Investments (Cayman) Company Limited (GF Investments), a subsidiary of GF Securities.

A private equity fund targeting fintech firms at the growth expansion and mature stage mainly in China, Europe, and the US. Its founding members include China Minsheng International Capital Limited (CMIC), a subsidiary of China Minsheng Investment Corporation Limited (CMI); and GF Investments (Cayman) Company Limited (GF Investments), a subsidiary of GF Securities.

Co-founder and Board Chairman of Ziztour

With a computer engineering background, Zheng Junde was formerly general manager of Proxim Wireless Corporation in the US. Zheng has 30 years of working experience in the US, mainland China, Hong Kong and Taiwan, and is now chairman of Ziztour and co-chairman of China Fortune Investment.

With a computer engineering background, Zheng Junde was formerly general manager of Proxim Wireless Corporation in the US. Zheng has 30 years of working experience in the US, mainland China, Hong Kong and Taiwan, and is now chairman of Ziztour and co-chairman of China Fortune Investment.

Russia-China Investment Fund (RCIF) is a private equity fund that invests in projects created to advance economic cooperation between Russia and China. RCIF was founded in 2012 by two government-backed funds: Russian Direct Investment Fund (RDIF) and China Investment Corporation (CIC). RCIF has received US$1 billion commitments from both RDIF and CIC. International institutional investors are expected to commit an additional US$2 billion. RCIF will invest at least 70% of its capital in Russia and CIS countries and around 30% in China.

Russia-China Investment Fund (RCIF) is a private equity fund that invests in projects created to advance economic cooperation between Russia and China. RCIF was founded in 2012 by two government-backed funds: Russian Direct Investment Fund (RDIF) and China Investment Corporation (CIC). RCIF has received US$1 billion commitments from both RDIF and CIC. International institutional investors are expected to commit an additional US$2 billion. RCIF will invest at least 70% of its capital in Russia and CIS countries and around 30% in China.

Founded in 2007 by two US-educated and -trained returnees, David Zhang (Zhang Pin) and Shao Bo (Shao Yibo), Matrix Partners China has managed more than RMB 15.5 billion in capital and invested in over 320 companies, including Cheetah Mobile, Didi, Kuaidi, Ele.me, Koudai Shopping and Momo. Zhang has described the 100-strong firm’s investment style as “aggressive”, backing about 80 companies a year. An affiliate of Matrix Partners in the US, the firm focuses on internet & mobile internet, financial services, healthcare and SaaS companies in China.

Founded in 2007 by two US-educated and -trained returnees, David Zhang (Zhang Pin) and Shao Bo (Shao Yibo), Matrix Partners China has managed more than RMB 15.5 billion in capital and invested in over 320 companies, including Cheetah Mobile, Didi, Kuaidi, Ele.me, Koudai Shopping and Momo. Zhang has described the 100-strong firm’s investment style as “aggressive”, backing about 80 companies a year. An affiliate of Matrix Partners in the US, the firm focuses on internet & mobile internet, financial services, healthcare and SaaS companies in China.

Headquartered in Beijing and set up in 2006, China Growth Capital invests in early-stage internet startups in China and the US. As of May 2016, it has two USD-denominated funds and three RMB-denominated funds, valued around RMB 4 billion in total.

Headquartered in Beijing and set up in 2006, China Growth Capital invests in early-stage internet startups in China and the US. As of May 2016, it has two USD-denominated funds and three RMB-denominated funds, valued around RMB 4 billion in total.

The Chinese affiliate of top Silicon Valley venture capital firm Sequoia Capital was founded in 2005 by Neil Shen (Shen Nanpeng), a co-founder of Ctrip, China's largest travel booking site. With more than US$6 billion under management in 2015, the firm has invested in more than 300 startups in China, including some of the country's biggest brands: Alibaba, JD.com, Didi, DJI, Sina and Qihoo 360. Sequoia, together with China Broadband Capital, also helped to bring to China LinkedIn and AirBnB, companies that both have invested in.

The Chinese affiliate of top Silicon Valley venture capital firm Sequoia Capital was founded in 2005 by Neil Shen (Shen Nanpeng), a co-founder of Ctrip, China's largest travel booking site. With more than US$6 billion under management in 2015, the firm has invested in more than 300 startups in China, including some of the country's biggest brands: Alibaba, JD.com, Didi, DJI, Sina and Qihoo 360. Sequoia, together with China Broadband Capital, also helped to bring to China LinkedIn and AirBnB, companies that both have invested in.

China Merchants Capital (CMC), the investment management platform of China Merchants Group, was established in 2012 with a registered capital of RMB 1 billion. As of the end of 2014, it had assets under management worth nearly US$3 billion. CMC invests mainly in the infrastructure, medical & pharmaceutical, financial services, real estate, high-tech, agriculture & foods, media, equipment machinery, mining and energy sectors, among others.

China Merchants Capital (CMC), the investment management platform of China Merchants Group, was established in 2012 with a registered capital of RMB 1 billion. As of the end of 2014, it had assets under management worth nearly US$3 billion. CMC invests mainly in the infrastructure, medical & pharmaceutical, financial services, real estate, high-tech, agriculture & foods, media, equipment machinery, mining and energy sectors, among others.

Once the darling of investors, unmanned shelf startups are going through a hard time in China

Startups are being forced to transform their business models to survive

Portugal oceantech II: Single-minded efforts to build an ecosystem of international reference

With dedicated accelerators and investment programs, supported by the EU’s vote of confidence, Portugal appears on track to lead in oceantech

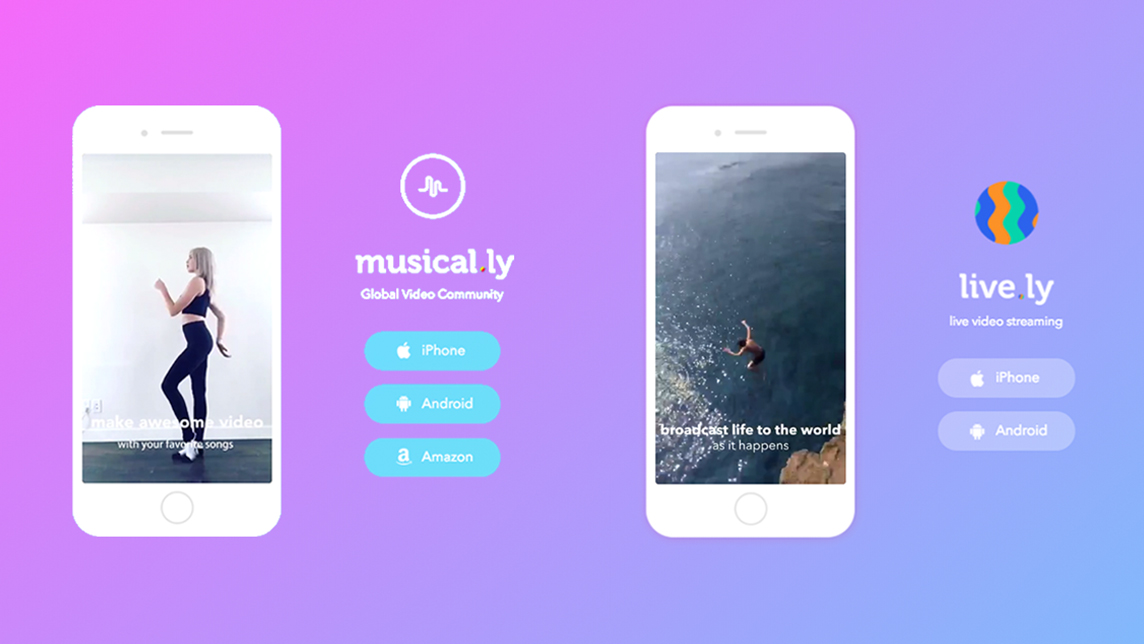

Inspired by rowdy teenagers: the Musical.ly story

Now better known as TikTok, the original Musical.ly was the only Chinese social app to have cracked the Western market – before it got snapped up by Bytedance and joined its stable of short video apps

The B2B platform for greater route efficiency and sustainability in trucking raised €17m despite supply chain disruptions, economic uncertainties during Covid-19

Promising market, but China’s DTC genetic testing startups have to first overcome a few hurdles

Genetic information is being used for everything from predicting health risks to personalizing exercise and dietary regimes. China represents a huge potential market for direct-to-consumer (DTC) genetic testing

Day Day Cook: Creating content that sells

She may not be a celebrity chef but Norma Chu, the analyst-turned-cook, is a familiar face in food-obsessed Hong Kong, where she has her recipe website to encourage youths to learn cooking

Meituan-Dianping’s Wang Xing: From struggling copycat to IPO billionaire

As the internet startup sets to list in Hong Kong this week, we take a look back at the journey of its founder Wang Xing, once dubbed “the unluckiest serial entrepreneur”

Li Bin: Aiming for more than a Chinese copy of Tesla

Good at making and investing money, he founded two companies that went on to list on the NYSE and invested in over 40 startups

Meituan, the “Amazon for local services”

Now worth over US$50 billion, the company has always focused on one end-goal: help consumers eat better, live better

Kuaikan Comic: Discover the potential of Chinese comics

This startup wants to prove Japan isn’t the only comic game in town

Indonesian online basic food startups like Sayurbox and Wahyoo have had as much as a fivefold jump in orders and are working to sustain strong sales post-social distancing

Chinapex: Maximizing the marketing value of customer data

The startup’s also creating a transparent and efficient industry environment for digital marketing in China

Neil Shen: The super unicorn hunter

His bet on ByteDance, the startup that gave the world TikTok, helped Neil Shen top this year's Forbes Midas List. But for Shen, even in that deal he once made the wrong call

Future Food Asia 2021: Regenerative agriculture in Asia

The unique challenges facing regenerative agriculture in Asia require solutions different from those in the West, presenting opportunities for microfinancing and impact investment

Intracity delivery startup Fengxiansheng takes on the Middle East

Backed by the most popular online shopping platform in the Middle East, Hangzhou's No. 1 intracity delivery startup Fengxiansheng (“Mr Wind”) is expanding to the region

Sorry, we couldn’t find any matches for“US-China trade war”.