US-China trade war

-

DATABASE (997)

-

ARTICLES (687)

The most popular app and online brokerage of Chinese-speaking investors to trade US- and HK-listed shares is also backed by the legendary Jim Rogers.

The most popular app and online brokerage of Chinese-speaking investors to trade US- and HK-listed shares is also backed by the legendary Jim Rogers.

HGI Finaves China is initiated by HGI Capital, a Hong Kong-based investment fund, and CEIBS, a business school established under an agreement between China’s trade ministry and the European Commission. It makes seed/angel round as well as Series A investments in the TMT, culture and creative, and consumer-related sectors in China.

HGI Finaves China is initiated by HGI Capital, a Hong Kong-based investment fund, and CEIBS, a business school established under an agreement between China’s trade ministry and the European Commission. It makes seed/angel round as well as Series A investments in the TMT, culture and creative, and consumer-related sectors in China.

Thanks to Beile’s integrated online-offline education system, Chinese children can get an American education and perfect their English from young, without having to go abroad.

Thanks to Beile’s integrated online-offline education system, Chinese children can get an American education and perfect their English from young, without having to go abroad.

World's first robotic pet-sitter feeds, cleans, plays with pets, so busy owners don't worry about leaving pets home alone, are less likely to abandon them.

World's first robotic pet-sitter feeds, cleans, plays with pets, so busy owners don't worry about leaving pets home alone, are less likely to abandon them.

Banking on demand for healthy tea beverages, Changsha's cultural tea house will operate over 200 outlets, offering on-demand deliveries to customers across the city.

Banking on demand for healthy tea beverages, Changsha's cultural tea house will operate over 200 outlets, offering on-demand deliveries to customers across the city.

China Renaissance offers private placement advisory, M&A advisory, securities underwriting, research, sales and trading, investment management and other financial services. It has clients in mainland China, Hong Kong and the United States as well as offices in Shanghai, Beijing, Hong Kong and New York. China Renaissance has facilitated more than 300 private financial transactions collectively valued at over US$20 billion.

China Renaissance offers private placement advisory, M&A advisory, securities underwriting, research, sales and trading, investment management and other financial services. It has clients in mainland China, Hong Kong and the United States as well as offices in Shanghai, Beijing, Hong Kong and New York. China Renaissance has facilitated more than 300 private financial transactions collectively valued at over US$20 billion.

BlueRun Ventures China was founded in 2005, focusing on early-stage investment of companies. The investments are usually from US$100,000 to US$10 million.

BlueRun Ventures China was founded in 2005, focusing on early-stage investment of companies. The investments are usually from US$100,000 to US$10 million.

As part of Vertex Ventures Holdings, a member of Temasek Holdings and Singapore's oldest and largest venture capital firm, Vertex Ventures China focuses on investment in high-growth internet and technology startups across mainland China. Vertex Ventures Holdings has a capital of US$600 million. It also has offices in Singapore, the US and Israel; and investments in these regions as well as Asia.

As part of Vertex Ventures Holdings, a member of Temasek Holdings and Singapore's oldest and largest venture capital firm, Vertex Ventures China focuses on investment in high-growth internet and technology startups across mainland China. Vertex Ventures Holdings has a capital of US$600 million. It also has offices in Singapore, the US and Israel; and investments in these regions as well as Asia.

A private equity fund targeting fintech firms at the growth expansion and mature stage mainly in China, Europe, and the US. Its founding members include China Minsheng International Capital Limited (CMIC), a subsidiary of China Minsheng Investment Corporation Limited (CMI); and GF Investments (Cayman) Company Limited (GF Investments), a subsidiary of GF Securities.

A private equity fund targeting fintech firms at the growth expansion and mature stage mainly in China, Europe, and the US. Its founding members include China Minsheng International Capital Limited (CMIC), a subsidiary of China Minsheng Investment Corporation Limited (CMI); and GF Investments (Cayman) Company Limited (GF Investments), a subsidiary of GF Securities.

Co-founder and Board Chairman of Ziztour

With a computer engineering background, Zheng Junde was formerly general manager of Proxim Wireless Corporation in the US. Zheng has 30 years of working experience in the US, mainland China, Hong Kong and Taiwan, and is now chairman of Ziztour and co-chairman of China Fortune Investment.

With a computer engineering background, Zheng Junde was formerly general manager of Proxim Wireless Corporation in the US. Zheng has 30 years of working experience in the US, mainland China, Hong Kong and Taiwan, and is now chairman of Ziztour and co-chairman of China Fortune Investment.

Russia-China Investment Fund (RCIF) is a private equity fund that invests in projects created to advance economic cooperation between Russia and China. RCIF was founded in 2012 by two government-backed funds: Russian Direct Investment Fund (RDIF) and China Investment Corporation (CIC). RCIF has received US$1 billion commitments from both RDIF and CIC. International institutional investors are expected to commit an additional US$2 billion. RCIF will invest at least 70% of its capital in Russia and CIS countries and around 30% in China.

Russia-China Investment Fund (RCIF) is a private equity fund that invests in projects created to advance economic cooperation between Russia and China. RCIF was founded in 2012 by two government-backed funds: Russian Direct Investment Fund (RDIF) and China Investment Corporation (CIC). RCIF has received US$1 billion commitments from both RDIF and CIC. International institutional investors are expected to commit an additional US$2 billion. RCIF will invest at least 70% of its capital in Russia and CIS countries and around 30% in China.

Founded in 2007 by two US-educated and -trained returnees, David Zhang (Zhang Pin) and Shao Bo (Shao Yibo), Matrix Partners China has managed more than RMB 15.5 billion in capital and invested in over 320 companies, including Cheetah Mobile, Didi, Kuaidi, Ele.me, Koudai Shopping and Momo. Zhang has described the 100-strong firm’s investment style as “aggressive”, backing about 80 companies a year. An affiliate of Matrix Partners in the US, the firm focuses on internet & mobile internet, financial services, healthcare and SaaS companies in China.

Founded in 2007 by two US-educated and -trained returnees, David Zhang (Zhang Pin) and Shao Bo (Shao Yibo), Matrix Partners China has managed more than RMB 15.5 billion in capital and invested in over 320 companies, including Cheetah Mobile, Didi, Kuaidi, Ele.me, Koudai Shopping and Momo. Zhang has described the 100-strong firm’s investment style as “aggressive”, backing about 80 companies a year. An affiliate of Matrix Partners in the US, the firm focuses on internet & mobile internet, financial services, healthcare and SaaS companies in China.

Headquartered in Beijing and set up in 2006, China Growth Capital invests in early-stage internet startups in China and the US. As of May 2016, it has two USD-denominated funds and three RMB-denominated funds, valued around RMB 4 billion in total.

Headquartered in Beijing and set up in 2006, China Growth Capital invests in early-stage internet startups in China and the US. As of May 2016, it has two USD-denominated funds and three RMB-denominated funds, valued around RMB 4 billion in total.

The Chinese affiliate of top Silicon Valley venture capital firm Sequoia Capital was founded in 2005 by Neil Shen (Shen Nanpeng), a co-founder of Ctrip, China's largest travel booking site. With more than US$6 billion under management in 2015, the firm has invested in more than 300 startups in China, including some of the country's biggest brands: Alibaba, JD.com, Didi, DJI, Sina and Qihoo 360. Sequoia, together with China Broadband Capital, also helped to bring to China LinkedIn and AirBnB, companies that both have invested in.

The Chinese affiliate of top Silicon Valley venture capital firm Sequoia Capital was founded in 2005 by Neil Shen (Shen Nanpeng), a co-founder of Ctrip, China's largest travel booking site. With more than US$6 billion under management in 2015, the firm has invested in more than 300 startups in China, including some of the country's biggest brands: Alibaba, JD.com, Didi, DJI, Sina and Qihoo 360. Sequoia, together with China Broadband Capital, also helped to bring to China LinkedIn and AirBnB, companies that both have invested in.

China Merchants Capital (CMC), the investment management platform of China Merchants Group, was established in 2012 with a registered capital of RMB 1 billion. As of the end of 2014, it had assets under management worth nearly US$3 billion. CMC invests mainly in the infrastructure, medical & pharmaceutical, financial services, real estate, high-tech, agriculture & foods, media, equipment machinery, mining and energy sectors, among others.

China Merchants Capital (CMC), the investment management platform of China Merchants Group, was established in 2012 with a registered capital of RMB 1 billion. As of the end of 2014, it had assets under management worth nearly US$3 billion. CMC invests mainly in the infrastructure, medical & pharmaceutical, financial services, real estate, high-tech, agriculture & foods, media, equipment machinery, mining and energy sectors, among others.

BukuWarung: Accounting-payments app targets Indonesia's 60m MSMEs

BukuWarung’s easy-to-use 6MB app designed for lower-end smartphones gets boost from Covid-19-accelerated digitalization

Future Food Asia 2021: Two winners take home $100,000 each

Agrifood startups, corporations and investors urged to collaborate and take action, tackling challenges in nutrition and climate change

How influential is your influencer? This startup has the metrics to turn buzz into gold

Influencity is a new way for companies and brands to win in social media marketing

Jesús Encinar: The Man Behind Idealista and 11870.com

Entrepreneur, angel investor and down-to-earth idealist

Treasury: Bringing gold savings to millennials

Gold savings online platform Treasury targets a younger demographic with its playful and contemporary branding

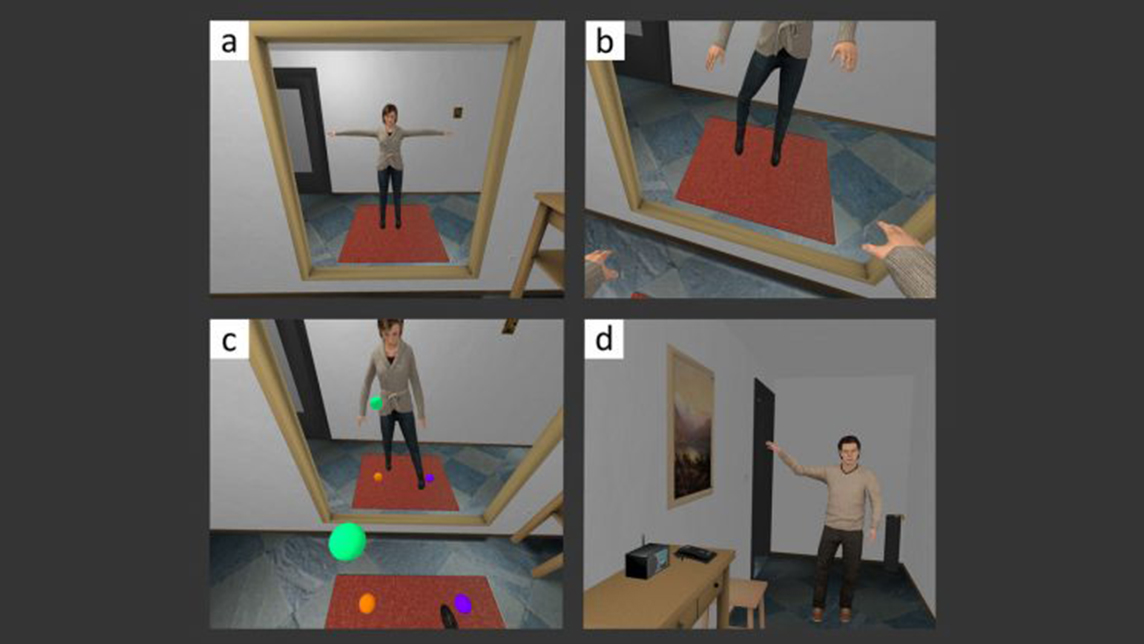

Virtual Bodyworks: VR psychotherapy to reduce crime and health issues

Applications created by the Barcelona-based startup could be used to track and influence human behavior

Biomede: Harnessing plants’ natural attributes to decontaminate soil

The Lyon-based startup says using plants to remove harmful metals from the earth is a sustainable, cost-effective green alternative to decontaminate soil in agricultural or urban environments

Ruangguru cracks business model as it reaches 13 million student users

Holding pole position as Indonesia's popular tutoring services app, Ruangguru is revving up to expand into the lucrative corporate training sector

Polaroo: An expense app that finds the best deals and automates payments

Take control of your finances and save money and time with Polaroo's personalized expenses app

Eco-friendly vegan leather from recycled waste, made in Indonesia

In the battle for ethical consumer dollars, mass production of vegan leather by startups like Mycotech and Bell Society, could be the game-changer for the fashion industry

From real estate to rearing insects for food: Magalarva's way to a sustainable future

The Indonesian agritech startup is already using insects to replace fishmeal and has new funding to grow further

Indonesia launches national pitch competition HighPitch 2020 to re-energize its startup ecosystem

With 43 VC investors so far joining as judges and mentors, HighPitch 2020 aims to reconnect investors with young startups across the country amid Covid-19

Indonesian edtechs attract funding even as students head back to school

With services that complement and support conventional schools at a fraction of offline tuition cost, edtech companies are likely to continue growing

Nuuk, the cooler box poised to disrupt cold chain logistics

Barcelona-based startup Groenlandia Tech has developed a smart cooler box to track and monitor biological samples, providing an extra layer of security and control during transport

Accelerating Asia's Amra Naidoo: We’re at an inflection point in Southeast Asia

Accelerating Asia’s co-founder Amra Naidoo reveals how the program adapts its curriculum to meet startups’ needs and the challenges accelerator programs face during the pandemic

Sorry, we couldn’t find any matches for“US-China trade war”.