Union of Musicians

-

DATABASE (996)

-

ARTICLES (811)

Born in 1968, Jerry Yang is a Taiwanese-American billionaire computer programmer. After co-creating the Yahoo internet navigational guide in 1994, he co-founded the company Yahoo! Inc in 1995 with David Filo while both were studying at Stanford University. Yang did not complete his PhD in electrical engineering to become an entrepreneur “selling internet advertising”.Yang was Yahoo! CEO for almost two years until 2009, rejecting Microsoft’s takeover offer of $47.5bn in 2008. He eventually left the board in 2012 when he resigned due to strategic disagreements such as whether to sell all or part of the company. In 2016, Yahoo! completed the sale of its core operating business to Verizon for $5bn. Yang was also a board member of the Alibaba Group from 2006 to 2012. Yang met Jack Ma in 1997 when Ma was working as a government-employed tour guide. The former English teacher gave him a tour of the Great Wall of China. Ma went on to found Alibaba a few months after meeting Yang.After leaving Yahoo!, Yang founded AME Cloud Ventures to invest in multiple tech startups. As of November 2020, Yang’s net worth was valued at $2.3bn. In 2017, he and his wife pledged $25m to the Asian Art Museum in San Francisco, the largest gift in the museum's history.

Born in 1968, Jerry Yang is a Taiwanese-American billionaire computer programmer. After co-creating the Yahoo internet navigational guide in 1994, he co-founded the company Yahoo! Inc in 1995 with David Filo while both were studying at Stanford University. Yang did not complete his PhD in electrical engineering to become an entrepreneur “selling internet advertising”.Yang was Yahoo! CEO for almost two years until 2009, rejecting Microsoft’s takeover offer of $47.5bn in 2008. He eventually left the board in 2012 when he resigned due to strategic disagreements such as whether to sell all or part of the company. In 2016, Yahoo! completed the sale of its core operating business to Verizon for $5bn. Yang was also a board member of the Alibaba Group from 2006 to 2012. Yang met Jack Ma in 1997 when Ma was working as a government-employed tour guide. The former English teacher gave him a tour of the Great Wall of China. Ma went on to found Alibaba a few months after meeting Yang.After leaving Yahoo!, Yang founded AME Cloud Ventures to invest in multiple tech startups. As of November 2020, Yang’s net worth was valued at $2.3bn. In 2017, he and his wife pledged $25m to the Asian Art Museum in San Francisco, the largest gift in the museum's history.

With currently over $21bn of AUM, Baring Private Equity Asia (BPEA) was started in Hong Kong in 1997 by Jean Eric Salata, as the regional Asian PE investment arm of UK-based Baring Private Equity Partners. With $300m in its first fund, it focused on riding China’s economic rise spurred by the country’s market liberalization. In 2000, Salata led a management buyout of BPEA and continues to head the firm today as CEO and Founding Partner. BPEA has invested in more than 100 companies, across healthcare, logistics, IT services, media, education, financial services and retail. It is one of the largest independent PE firms in Asia and has eight offices across the continent.With offices in China, India, Japan, Australia, and Singapore, it currently has around 43 portfolio companies, almost all Asia-based, across multiple business segments in tech and non-tech startups, especially in bricks-and-mortar education establishments. It also makes acquisitions, including most recently of US outsourcing services company Virtusa in February 2021.Other recent investments include in the June 2021 $85m Series C round of Portuguese home physiotherapy tech solution SWORD Health, the world’s fastest-growing musculoskeletal solution, and in the November 2020 $198m Series D round of Chinese computer coding for kids edtech Codemao.

With currently over $21bn of AUM, Baring Private Equity Asia (BPEA) was started in Hong Kong in 1997 by Jean Eric Salata, as the regional Asian PE investment arm of UK-based Baring Private Equity Partners. With $300m in its first fund, it focused on riding China’s economic rise spurred by the country’s market liberalization. In 2000, Salata led a management buyout of BPEA and continues to head the firm today as CEO and Founding Partner. BPEA has invested in more than 100 companies, across healthcare, logistics, IT services, media, education, financial services and retail. It is one of the largest independent PE firms in Asia and has eight offices across the continent.With offices in China, India, Japan, Australia, and Singapore, it currently has around 43 portfolio companies, almost all Asia-based, across multiple business segments in tech and non-tech startups, especially in bricks-and-mortar education establishments. It also makes acquisitions, including most recently of US outsourcing services company Virtusa in February 2021.Other recent investments include in the June 2021 $85m Series C round of Portuguese home physiotherapy tech solution SWORD Health, the world’s fastest-growing musculoskeletal solution, and in the November 2020 $198m Series D round of Chinese computer coding for kids edtech Codemao.

Lei Ming graduated from Peking University (PKU) with a master's degree in Computer Science. While at university, he was a member of the PKU Sky Network search engine program. In 2000, Lei became one of the seven founding members of Baidu, where he led the search engine design and development team. Lei received his MBA from Stanford Business School in 2003. In 2005, he returned to China and started Kuwo Music, now one of the largest music platforms in China. As an angel investor, Lei focuses on the sectors of AI, consumption, education, medical services and entertainment.

Lei Ming graduated from Peking University (PKU) with a master's degree in Computer Science. While at university, he was a member of the PKU Sky Network search engine program. In 2000, Lei became one of the seven founding members of Baidu, where he led the search engine design and development team. Lei received his MBA from Stanford Business School in 2003. In 2005, he returned to China and started Kuwo Music, now one of the largest music platforms in China. As an angel investor, Lei focuses on the sectors of AI, consumption, education, medical services and entertainment.

P101, which stands for Programma 101, the first PC ever made in history, is an Italian VC focused on early-stage investments founded and headed by Managing Partner Andrea Di Camillo. As of January 2021, the firm has between €70m and €100m available for investments. The fund is backed by The European Investment Fund, the Italian Investment Fund SGR, and Azimut, an Italian asset manager operating since 1989 and parent company of Azimut Holding, listed on the Milan Stock Exchange (AZM.IM).Headquartered in Milan, P101 has invested in international startups through its two funds, P101 and P102. It usually co-invests maintaining a lead investor role. According to Di Camillo, the P102 fund has a higher investment ticket, ranging between €2m–5m, with the possibility of increasing to up to €10m in a single company. The firm also manages Ita500, a €40m fund established in partnership with Azimut in January 2020. With a 10-year term, Ita500 will co-invest with P101’s first and second funds in startups with revenues of up to €5m and SMEs with a turnover range of €5m–50m.

P101, which stands for Programma 101, the first PC ever made in history, is an Italian VC focused on early-stage investments founded and headed by Managing Partner Andrea Di Camillo. As of January 2021, the firm has between €70m and €100m available for investments. The fund is backed by The European Investment Fund, the Italian Investment Fund SGR, and Azimut, an Italian asset manager operating since 1989 and parent company of Azimut Holding, listed on the Milan Stock Exchange (AZM.IM).Headquartered in Milan, P101 has invested in international startups through its two funds, P101 and P102. It usually co-invests maintaining a lead investor role. According to Di Camillo, the P102 fund has a higher investment ticket, ranging between €2m–5m, with the possibility of increasing to up to €10m in a single company. The firm also manages Ita500, a €40m fund established in partnership with Azimut in January 2020. With a 10-year term, Ita500 will co-invest with P101’s first and second funds in startups with revenues of up to €5m and SMEs with a turnover range of €5m–50m.

Founded in 2017 in Hong Kong, Happiness Capital invests in seed to growth stage companies in the US, Europe, Israel, and China, with a focus on issues affecting global happiness within the areas of citizen trust, food, health, climate change, and reduced inequalities. It hosts its own annual contest, the Super Happiness Challenge , a global open innovation contest to fund individuals and startups with ideas and new products or services that tapped into unmet needs to achieve happiness, with a possible $1m in total investment on offer. The VC currently has 37 startups in its portfolio, around half of which are in foodtech and agtech. Its most recent investments include leading the $4.7m July 2021 seed funding round of NovoNutrients, the US-based biotech producer of alt-protein from fermentation using CO2 and other emissions, and co-leading the $29m February 2021 Series A round of Israeli 3D printed alt-meat startup Redefine Meat.

Founded in 2017 in Hong Kong, Happiness Capital invests in seed to growth stage companies in the US, Europe, Israel, and China, with a focus on issues affecting global happiness within the areas of citizen trust, food, health, climate change, and reduced inequalities. It hosts its own annual contest, the Super Happiness Challenge , a global open innovation contest to fund individuals and startups with ideas and new products or services that tapped into unmet needs to achieve happiness, with a possible $1m in total investment on offer. The VC currently has 37 startups in its portfolio, around half of which are in foodtech and agtech. Its most recent investments include leading the $4.7m July 2021 seed funding round of NovoNutrients, the US-based biotech producer of alt-protein from fermentation using CO2 and other emissions, and co-leading the $29m February 2021 Series A round of Israeli 3D printed alt-meat startup Redefine Meat.

Lugard Road Capital/ Luxor Capital

Lugard Road Capital is a New York-based hedge fund under the Luxor Capital Group. The fund invests across market segments and geographies, with several late-stage investments included in its current portfolio of 11 startups.In 2021, Lugard and Luxor led the €450m Series F round for Spanish on-demand delivery app Glovo and also joined the $146m Series J round of Indian foodtech Zomato in 2020. Recent investments include participation in the $43m Series B round of food-sharing app OLIO in September 2021 and the June 2021 $28.5m Series C round of Norwegian ocean and air freight benchmarking and market analytics platform Xeneta.

Lugard Road Capital is a New York-based hedge fund under the Luxor Capital Group. The fund invests across market segments and geographies, with several late-stage investments included in its current portfolio of 11 startups.In 2021, Lugard and Luxor led the €450m Series F round for Spanish on-demand delivery app Glovo and also joined the $146m Series J round of Indian foodtech Zomato in 2020. Recent investments include participation in the $43m Series B round of food-sharing app OLIO in September 2021 and the June 2021 $28.5m Series C round of Norwegian ocean and air freight benchmarking and market analytics platform Xeneta.

China Orient Asset Management Corporation

China's state-owned asset management company, COAMC has assets of nearly RMB 660 billion.

China's state-owned asset management company, COAMC has assets of nearly RMB 660 billion.

Zhang Zetian is the wife of JD.com founder and CEO Richard Liu (Liu Qiangdong).

Zhang Zetian is the wife of JD.com founder and CEO Richard Liu (Liu Qiangdong).

Javier Llorente Moral has extensive experience in managing and investing in internet startups and currently manages an investment portfolio of over 30 startups through his own investment company, Valderaduey Investments. A graduate in clinical psychology from the University of Barcelona, and in management from IESE Business School, he was a founding partner of Grupo Intercom in 1995.Since 1999, he has been a prolific investor in some of Spain's most successful internet businesses after his 10-year investment in Infojobs, until its acquisition by Schibsted. His other exited companies include Softonic and Bodas.net. He is also an investor in other startups including Emagister, Verticales Intercom, Buy Yourself, Red Points, Mailtrack and Camaloon, as well as in the startup investment platform Startupxplore.

Javier Llorente Moral has extensive experience in managing and investing in internet startups and currently manages an investment portfolio of over 30 startups through his own investment company, Valderaduey Investments. A graduate in clinical psychology from the University of Barcelona, and in management from IESE Business School, he was a founding partner of Grupo Intercom in 1995.Since 1999, he has been a prolific investor in some of Spain's most successful internet businesses after his 10-year investment in Infojobs, until its acquisition by Schibsted. His other exited companies include Softonic and Bodas.net. He is also an investor in other startups including Emagister, Verticales Intercom, Buy Yourself, Red Points, Mailtrack and Camaloon, as well as in the startup investment platform Startupxplore.

Gerard Olivé is a serial entrepreneur based in Barcelona. He is currently the co-CEO and co-founder of Antai Venture Builder, in charge of a multimillion-euro advertising inventory. He graduated in Audiovisual Communications at Barcelona's Ramon Llull University. As an angel investor, Olivé made his first disclosed investment in 2016 when he participated in the pre-seed and subsequent seed funding rounds of Spanish femtech WOOM. He founded BeRepublic, a strategic consulting firm specializing in digital businesses in southern Europe and Latin America. In 2015, he co-founded BeAgency, an interactive marketing agency with offices in Barcelona and Madrid. He is also a co-founder and mentor of Connector Startup Accelerator. He has also co-founded startups like Wallapop, Glovo, CornerJob, Deliberry, Shoppiday, Shopery, BePretty, Mascoteros, Marmota, Havet, Prontopiso, Medox and Trendier.

Gerard Olivé is a serial entrepreneur based in Barcelona. He is currently the co-CEO and co-founder of Antai Venture Builder, in charge of a multimillion-euro advertising inventory. He graduated in Audiovisual Communications at Barcelona's Ramon Llull University. As an angel investor, Olivé made his first disclosed investment in 2016 when he participated in the pre-seed and subsequent seed funding rounds of Spanish femtech WOOM. He founded BeRepublic, a strategic consulting firm specializing in digital businesses in southern Europe and Latin America. In 2015, he co-founded BeAgency, an interactive marketing agency with offices in Barcelona and Madrid. He is also a co-founder and mentor of Connector Startup Accelerator. He has also co-founded startups like Wallapop, Glovo, CornerJob, Deliberry, Shoppiday, Shopery, BePretty, Mascoteros, Marmota, Havet, Prontopiso, Medox and Trendier.

Founded in 2003, Bezos Expeditions is a family investment office based in Mercer Island in the US. The firm was originally set up to manage the personal investments of Amazon founder, Jeff Bezos.The Bezos fund owns the Washington Post, Blue Origin space projects and the Bezos family foundation. The fund has also backed early tech startups like Twitter, Airbnb and Uber. Today, Bezos Expeditions also supports non-profit projects. In 2013, it helped to recover parts of two engines from the Atlantic Ocean that were later identified as belonging to Apollo 11, the first space mission that successfully landed humans on the moon in 1969. The crew of the ship Seabed Worker spent three weeks at sea pulling up pieces of the Apollo F1 engines.

Founded in 2003, Bezos Expeditions is a family investment office based in Mercer Island in the US. The firm was originally set up to manage the personal investments of Amazon founder, Jeff Bezos.The Bezos fund owns the Washington Post, Blue Origin space projects and the Bezos family foundation. The fund has also backed early tech startups like Twitter, Airbnb and Uber. Today, Bezos Expeditions also supports non-profit projects. In 2013, it helped to recover parts of two engines from the Atlantic Ocean that were later identified as belonging to Apollo 11, the first space mission that successfully landed humans on the moon in 1969. The crew of the ship Seabed Worker spent three weeks at sea pulling up pieces of the Apollo F1 engines.

PT Prasetia Dwidharma is a telecommunications infrastructure contractor that focuses on base transceiver station (BTS) construction projects. The company was founded in 2008 by Budi Setiadharma, the chairman of the board of Indonesian conglomerate PT Astra Internasional. Besides its contractor business, the company has also invested in notable startups such as Indonesia’s smart city app Qlue and online language course site SquLine.com.

PT Prasetia Dwidharma is a telecommunications infrastructure contractor that focuses on base transceiver station (BTS) construction projects. The company was founded in 2008 by Budi Setiadharma, the chairman of the board of Indonesian conglomerate PT Astra Internasional. Besides its contractor business, the company has also invested in notable startups such as Indonesia’s smart city app Qlue and online language course site SquLine.com.

PT Juvisk Tri Swarna (JTS) was established in 2013 to provide technical project management, financial consultancy, site audits and other support services in diverse business sectors; ranging from infrastructure, civil engineering, construction and mineral mining. Juvisk is currently involved in the construction of radio and cellular towers and other related services. In 2016, Juvisk became an investor and business partner of Qlue.

PT Juvisk Tri Swarna (JTS) was established in 2013 to provide technical project management, financial consultancy, site audits and other support services in diverse business sectors; ranging from infrastructure, civil engineering, construction and mineral mining. Juvisk is currently involved in the construction of radio and cellular towers and other related services. In 2016, Juvisk became an investor and business partner of Qlue.

Established as an Internet forum in 1999, Kaskus is one of Indonesia's most successful online communities, outlasting many other Indonesian dotcom companies established at the turn of the century. Originally hosted in the USA where its founders lived and studied at the time, Kaskus eventually branched out into content creation and online advertisements, growing via several investments and acquisitions.

Established as an Internet forum in 1999, Kaskus is one of Indonesia's most successful online communities, outlasting many other Indonesian dotcom companies established at the turn of the century. Originally hosted in the USA where its founders lived and studied at the time, Kaskus eventually branched out into content creation and online advertisements, growing via several investments and acquisitions.

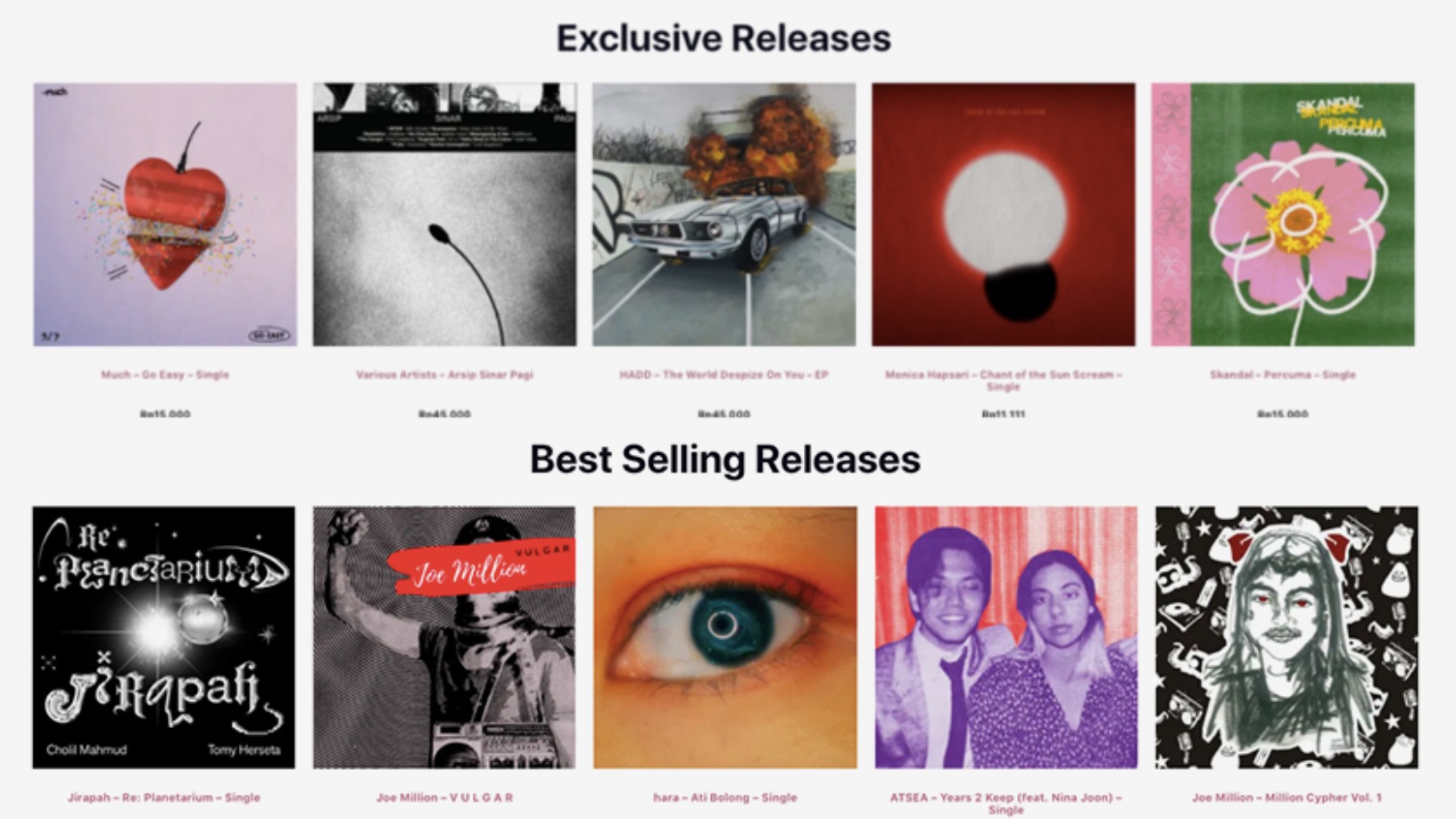

The Store Front: Striving to disrupt streaming with just rewards for musicians

Dubbing itself “the most equitable store around,” The Store Front aims to provide the fairest possible digital sales platform for musicians

Kolase: Crowdfunding platform for Indonesian musicians

Started by music industry veterans, Kolase sees a promising online market in contemporary music fandom

SFTC: Riding on the rise of independent music and alternative media

From recording music sessions for its YouTube channel, Sounds From The Corner has expanded into content production, reflecting Indonesia’s fast-evolving media landscape

This Portuguese startup lets you bet on your favorite musicians

Whether you’re a fan, groupie or just a good old-fashioned music lover, Tradiio is selling crowdfunding as the best way to put your money where your mouth is

Digital Union: Fighting fake users in China's mobile app industry

The Beijing-based cybersecurity startup is helping developers spot fake app downloads, so their ad money don’t go to waste

TMiRob's medical robots lighten the load of doctors and nurses in hospitals

The robots also reach an operating room three minutes faster than human nurses – that's more time for saving lives

Red Points: US$38 million Series C to power US conquest

The Barcelona-based startup is ramping up US sales and deep-tech capabilities for its online brand protection platform

Voicemod: Voice-tweaking tech that's conquering esports and streamers

Backed by esports and gaming VC BITKRAFT Ventures, Voicemod has become a leading name in voice modification tech for gamers and livestreamers, with 2.5m MAU across 65 countries

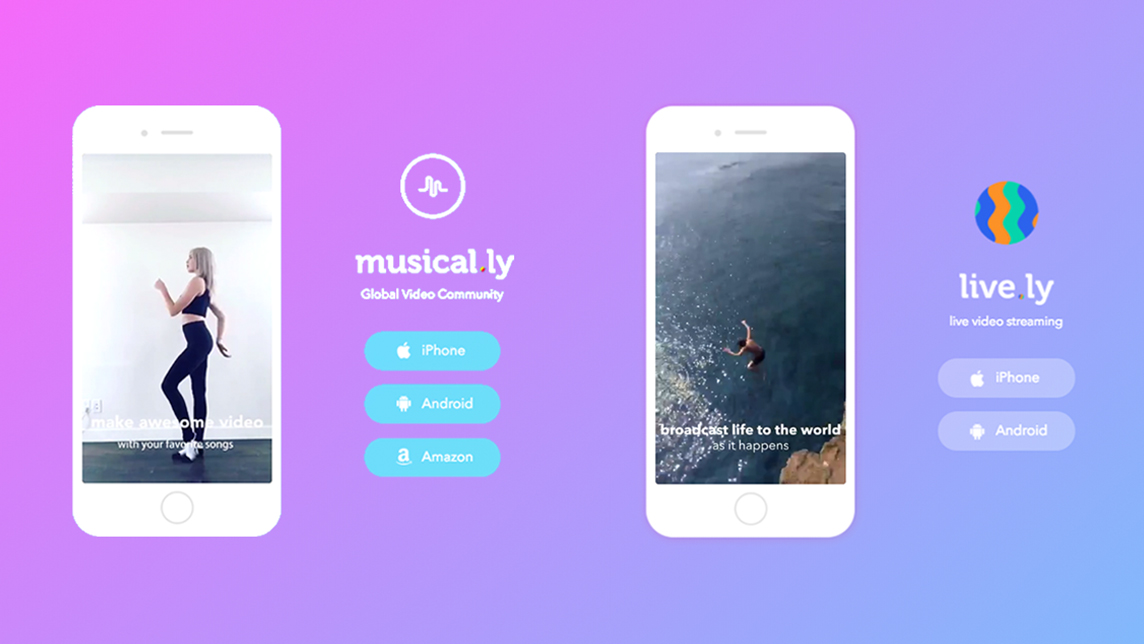

Inspired by rowdy teenagers: the Musical.ly story

Now better known as TikTok, the original Musical.ly was the only Chinese social app to have cracked the Western market – before it got snapped up by Bytedance and joined its stable of short video apps

Backed by pharmas, doctors, medtech startup DyCare is expanding fast across Europe

Its remote musculoskeletal rehabilitation and monitoring system sets to improve rehabilitation outcomes in an overtaxed sector

Impact investing: Spanish startups with a cause and the ecosystem backing them

As more thought and money go into socially and environmentally responsible projects, Spanish entrepreneurs, investors and big businesses are following suit

From Naples to Dhaka: Italo-Dutch precision farming startup Evja eyes funding for R&D, sales boost

Evja has a second office in the Dutch “Food Valley” and is investing to boost its advanced agronomic modeling, to stave off rising competition

Evix Safety's helmet with an airbag is a world-first for cycling safety

Evix Safety is launching a “smart” cycling helmet fitted with an airbag to prevent thousands of neck injuries from accidents

MatMap: Making the construction sector more sustainable

Alicante-based startup MatMap gives a second lease of life to used construction materials that account for almost a third of EU waste

Drone Hopper: Firefighters of the future

A senior Airbus engineer from Spain has developed heavy-duty autonomous drones to quell wildfires safely

Sorry, we couldn’t find any matches for“Union of Musicians”.