Union of Musicians

-

DATABASE (996)

-

ARTICLES (811)

Tim Hart is an investor and consultant at Charlotte Street Capital, focusing on early stage and general tech businesses. He became a non-executive director at Nixplay and Creedon Technologies Limited in 2017. He joined the advisory board of Chorus Intelligence Ltd in 2016. He has acquired a wide range of finance and trading experience since 1989 when he started work as a junior trader at James Capel. He has also served as VP at Robert Fleming, a director at Merrill Lynch and MD of Deutsche Bank.

Tim Hart is an investor and consultant at Charlotte Street Capital, focusing on early stage and general tech businesses. He became a non-executive director at Nixplay and Creedon Technologies Limited in 2017. He joined the advisory board of Chorus Intelligence Ltd in 2016. He has acquired a wide range of finance and trading experience since 1989 when he started work as a junior trader at James Capel. He has also served as VP at Robert Fleming, a director at Merrill Lynch and MD of Deutsche Bank.

M12 is the venture capital arm of Microsoft, formerly known as Microsoft Ventures, founded in 2016 to invest in Series A rounds and beyond. M12 has invested in more than 70 startups to date and has managed four exits, all of them acquisitions: Comfy, Figure Eight, Bonsai and Frame. M12 is especially interested in enterprise software and its biggest investment to date was US$114 in Outreach's Series D round. It has also invested recently in Nautilus Labs' Series A and Onfido's Series C.The VC also awards a US$4 million Female Founders prize to boost the participation of women in tech.

M12 is the venture capital arm of Microsoft, formerly known as Microsoft Ventures, founded in 2016 to invest in Series A rounds and beyond. M12 has invested in more than 70 startups to date and has managed four exits, all of them acquisitions: Comfy, Figure Eight, Bonsai and Frame. M12 is especially interested in enterprise software and its biggest investment to date was US$114 in Outreach's Series D round. It has also invested recently in Nautilus Labs' Series A and Onfido's Series C.The VC also awards a US$4 million Female Founders prize to boost the participation of women in tech.

Alfonso Villanueva is a well known angel investor based in San Jose, California. He is currently also the Global Head of Strategy of Corporate Ventures and the CEO Office at Paypal, where he has worked since 2015. He has been an angel investor in various European, US, Asian and Latin American startups since 2008, investing in 13 companies to date. His last investment was in Spanish real estate developer Peranakan, where he invested €650,000 in debt financing. He has also invested in the Series A round of Spanish space transportation services company Zero 2 Infinity.

Alfonso Villanueva is a well known angel investor based in San Jose, California. He is currently also the Global Head of Strategy of Corporate Ventures and the CEO Office at Paypal, where he has worked since 2015. He has been an angel investor in various European, US, Asian and Latin American startups since 2008, investing in 13 companies to date. His last investment was in Spanish real estate developer Peranakan, where he invested €650,000 in debt financing. He has also invested in the Series A round of Spanish space transportation services company Zero 2 Infinity.

IGF is a crowdfunding platform for impact investing in Asia. It aims to partner with innovative, high-impact enterprises in need of capital to scale their businesses and, as a result, be of value to society and the environment. The fund seeks to mobilize its US$50m in investment capital to deliver affordable healthcare, cut CO2 emissions, help more than 2m people gain access to clean energy and empower women. IGF's investments range in size from US$250,000 to US$5m, and primarily take the form of equity or quasi-equity. All its investments include pre-agreed social or environmental impact targets.

IGF is a crowdfunding platform for impact investing in Asia. It aims to partner with innovative, high-impact enterprises in need of capital to scale their businesses and, as a result, be of value to society and the environment. The fund seeks to mobilize its US$50m in investment capital to deliver affordable healthcare, cut CO2 emissions, help more than 2m people gain access to clean energy and empower women. IGF's investments range in size from US$250,000 to US$5m, and primarily take the form of equity or quasi-equity. All its investments include pre-agreed social or environmental impact targets.

AIA Group is the largest independent publicly listed pan-Asian life insurance group. Headquartered in Hong Kong, the group operates in 18 markets across Asia-Pacific. In 2014, AIA began to partner with venture capital firms to launch AIA Accelerator to support innovative and disruptive startups.AIA Group was originally founded in Shanghai, under the name of American Asiatic Underwriters. In 1939, the founder Cornelius Vander Starr relocated the head office to New York. AIA became a subsidiary of American International Group (AIG). AIA was listed in Hong Kong in 2010 and AIG sold all its shares of AIA Group in 2012.

AIA Group is the largest independent publicly listed pan-Asian life insurance group. Headquartered in Hong Kong, the group operates in 18 markets across Asia-Pacific. In 2014, AIA began to partner with venture capital firms to launch AIA Accelerator to support innovative and disruptive startups.AIA Group was originally founded in Shanghai, under the name of American Asiatic Underwriters. In 1939, the founder Cornelius Vander Starr relocated the head office to New York. AIA became a subsidiary of American International Group (AIG). AIA was listed in Hong Kong in 2010 and AIG sold all its shares of AIA Group in 2012.

SFund, aka Guangzhou Industrial Investment Fund Management Co Ltd, was established in March 2013 by the Guangzhou Municipal Government to boost industrial upgrading in the city. Its business covers government fund management, private equity investment and venture capital investment.In July 2018, SFund became a subsidiary of Guangzhou City Construction Investment Group. The decision was made by the Guangzhou Municipal Government and the State-owned Assets Supervision and Administration Commission of the State Council.SFund has set up seven funds, managing total assets worth RMB 139bn. It has invested in 343 companies, 13 of which have become public-listed.

SFund, aka Guangzhou Industrial Investment Fund Management Co Ltd, was established in March 2013 by the Guangzhou Municipal Government to boost industrial upgrading in the city. Its business covers government fund management, private equity investment and venture capital investment.In July 2018, SFund became a subsidiary of Guangzhou City Construction Investment Group. The decision was made by the Guangzhou Municipal Government and the State-owned Assets Supervision and Administration Commission of the State Council.SFund has set up seven funds, managing total assets worth RMB 139bn. It has invested in 343 companies, 13 of which have become public-listed.

Ocean Link is a private equity firm that mainly invests in consumer goods, tourism and TMT sectors in China. It currently manages two USD funds and one RMB fund. It has offices in Shanghai, Beijing and Hong Kong. The limited partners include Chinese and global corporates, financial institutions, sovereign wealth funds and family offices. China’s largest online travel agency Trip.com and international private equity firm General Atlantic are strategic partners.In April 2020, Ocean Link proposed to acquire all of the outstanding ordinary shares of the Chinese online classifieds marketplace 58.com. The NYSE-listed company is in the process of evaluating the proposal.

Ocean Link is a private equity firm that mainly invests in consumer goods, tourism and TMT sectors in China. It currently manages two USD funds and one RMB fund. It has offices in Shanghai, Beijing and Hong Kong. The limited partners include Chinese and global corporates, financial institutions, sovereign wealth funds and family offices. China’s largest online travel agency Trip.com and international private equity firm General Atlantic are strategic partners.In April 2020, Ocean Link proposed to acquire all of the outstanding ordinary shares of the Chinese online classifieds marketplace 58.com. The NYSE-listed company is in the process of evaluating the proposal.

Accelerating Asia focuses on Asian startups for its three-month intensive acceleration program. The Singapore-based investor was founded in 2018 and focuses on diversity investments, with 40% of its portfolio companies being led by women.The firm invests up to S$200,000 in participating pre-Series A startups. All of the program’s startups receive S$50,000–75,000 with an additional investment of up to S$150,000 for top performing companies.To date, the early-stage VC has invested in 25 startups. Recent investments in 2020 include stakes in Bangladeshi mobility platform Shuttle and Indonesian startups KaryaKarsa and MyBrand.

Accelerating Asia focuses on Asian startups for its three-month intensive acceleration program. The Singapore-based investor was founded in 2018 and focuses on diversity investments, with 40% of its portfolio companies being led by women.The firm invests up to S$200,000 in participating pre-Series A startups. All of the program’s startups receive S$50,000–75,000 with an additional investment of up to S$150,000 for top performing companies.To date, the early-stage VC has invested in 25 startups. Recent investments in 2020 include stakes in Bangladeshi mobility platform Shuttle and Indonesian startups KaryaKarsa and MyBrand.

Founded in Connecticut in 2014, Oak has a total of $3.3bn assets under management, the overwhelming majority within healthcare and fintech, and invests at all stages of growth. Approximately one third of its portfolio companies that currently number 55, seek re-investment from the VC. It has managed eight exits to date and has a special interest in investing in women in tech.Its most recent investments have included in Canadian unicorn the startup financing fintech Clearco that raised $100m in its April 2021 Series C round, and, the same month, in US virtual healthcare platform Firefly Health’s $40m Series B round.

Founded in Connecticut in 2014, Oak has a total of $3.3bn assets under management, the overwhelming majority within healthcare and fintech, and invests at all stages of growth. Approximately one third of its portfolio companies that currently number 55, seek re-investment from the VC. It has managed eight exits to date and has a special interest in investing in women in tech.Its most recent investments have included in Canadian unicorn the startup financing fintech Clearco that raised $100m in its April 2021 Series C round, and, the same month, in US virtual healthcare platform Firefly Health’s $40m Series B round.

Rick Klausner is an award-winning scientist, former executive director of the Bill & Melinda Gates Foundation and an entrepreneur. Cell and molecular biologist Klausner was also director of the US National Cancer Institute from 1999-2001 and currently serves as CEO at biotech Lyell Immunopharma working with cell-based technology. He has also co-founded three US healthcare startups to date, Juno Therapeutics in 2013, MindStrong Health in 2014 and GRAIL in 2015. In 2021, he participated as an investor in the $48m Series A round of Dutch cell-based meat startup Meatable which leverages pluripotent stem cells for the first time in foodtech.

Rick Klausner is an award-winning scientist, former executive director of the Bill & Melinda Gates Foundation and an entrepreneur. Cell and molecular biologist Klausner was also director of the US National Cancer Institute from 1999-2001 and currently serves as CEO at biotech Lyell Immunopharma working with cell-based technology. He has also co-founded three US healthcare startups to date, Juno Therapeutics in 2013, MindStrong Health in 2014 and GRAIL in 2015. In 2021, he participated as an investor in the $48m Series A round of Dutch cell-based meat startup Meatable which leverages pluripotent stem cells for the first time in foodtech.

Founded in 2015 in Guatemala City, the Invariantes Fund invests in technology startups based in the US and Latin America, across different market segments. It is the only VC based in Guatamala, and bills itself as the country’s first early-stage VC firm. As of June 2021, its portfolio includes 24 startups. Invariantes’ most recent investments include participation in the $21m Series A round of US edtech player Reforge, as well in the $130m Series B round of US-based Axiom Space, which is building the first international commercial space station. Both investments were in February 2021.

Founded in 2015 in Guatemala City, the Invariantes Fund invests in technology startups based in the US and Latin America, across different market segments. It is the only VC based in Guatamala, and bills itself as the country’s first early-stage VC firm. As of June 2021, its portfolio includes 24 startups. Invariantes’ most recent investments include participation in the $21m Series A round of US edtech player Reforge, as well in the $130m Series B round of US-based Axiom Space, which is building the first international commercial space station. Both investments were in February 2021.

Scott Banister is a prolific Silicon Valley-based angel investor. From 2000–2007, he was CTO and co-founder at IronPort, an enterprise email routing and anti-spam solutions provider that was acquired by Cisco Systems for $830m. He has invested in more than 100 companies to date and managed numerous exits, including Uber. His most recent undisclosed amounts of investments include participating in the $150m investment round of US investment analytics firm Forge Global in May 2021, as well as the April 2021 $35m funding round of US video streaming server Plex.

Scott Banister is a prolific Silicon Valley-based angel investor. From 2000–2007, he was CTO and co-founder at IronPort, an enterprise email routing and anti-spam solutions provider that was acquired by Cisco Systems for $830m. He has invested in more than 100 companies to date and managed numerous exits, including Uber. His most recent undisclosed amounts of investments include participating in the $150m investment round of US investment analytics firm Forge Global in May 2021, as well as the April 2021 $35m funding round of US video streaming server Plex.

Part of the Finnish Virala Group, Nidoco AB was established in Stockholm in 1965. The Swedish investment company is run by well-known Nordic family investors Alexander and Albert Ehrnrooth. The former is the CEO of Virala Oy AB. The latter was appointed as chairman of the Virala board in 2015. Nidoco and its four subsidiaries have stakes in more than 300 companies worldwide, including major shareholdings in three listed companies like Enersense International in Finland. Nidoco’s equity portfolio was worth nearly €360m in 2020.

Part of the Finnish Virala Group, Nidoco AB was established in Stockholm in 1965. The Swedish investment company is run by well-known Nordic family investors Alexander and Albert Ehrnrooth. The former is the CEO of Virala Oy AB. The latter was appointed as chairman of the Virala board in 2015. Nidoco and its four subsidiaries have stakes in more than 300 companies worldwide, including major shareholdings in three listed companies like Enersense International in Finland. Nidoco’s equity portfolio was worth nearly €360m in 2020.

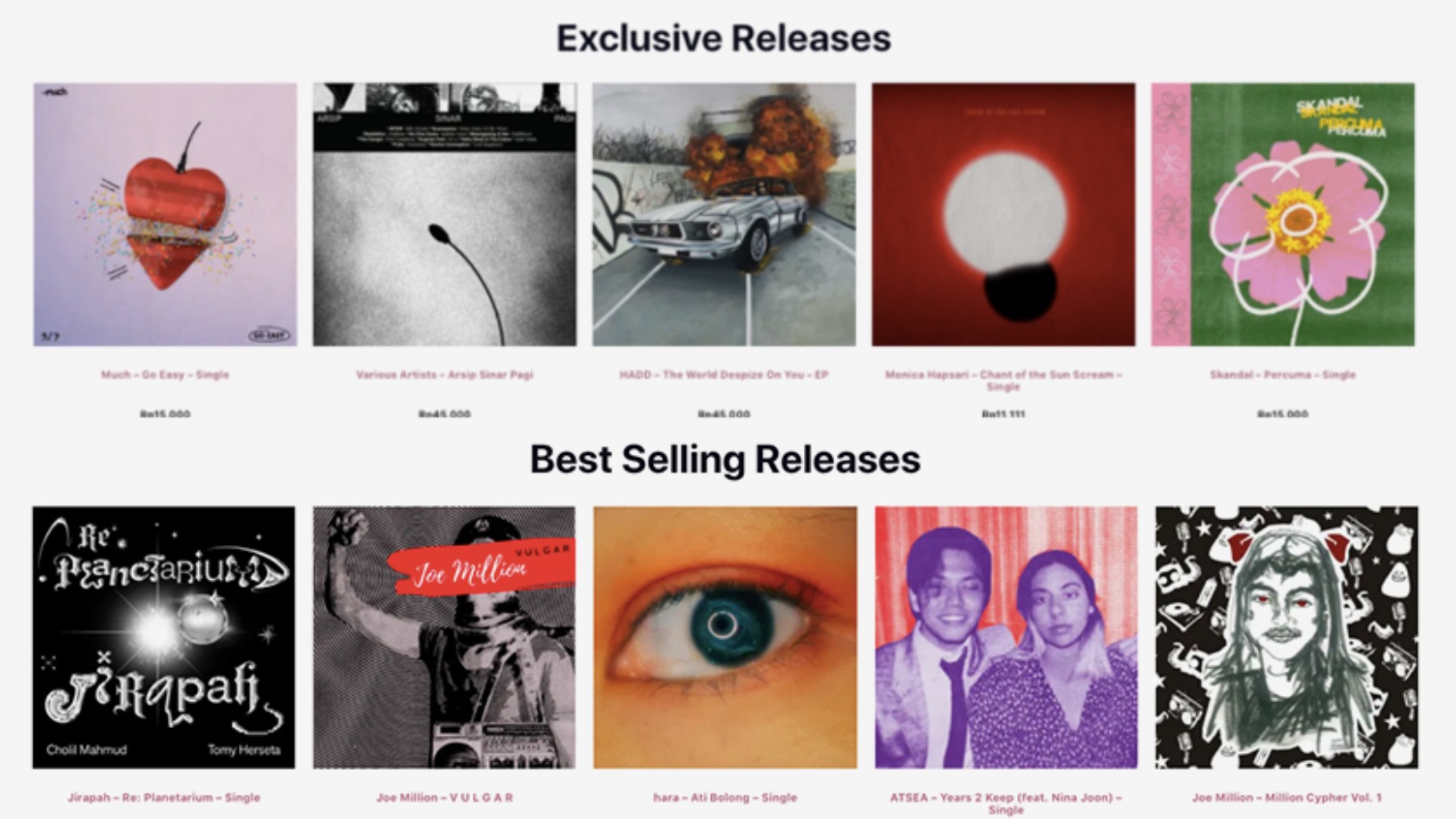

The Store Front: Striving to disrupt streaming with just rewards for musicians

Dubbing itself “the most equitable store around,” The Store Front aims to provide the fairest possible digital sales platform for musicians

Kolase: Crowdfunding platform for Indonesian musicians

Started by music industry veterans, Kolase sees a promising online market in contemporary music fandom

SFTC: Riding on the rise of independent music and alternative media

From recording music sessions for its YouTube channel, Sounds From The Corner has expanded into content production, reflecting Indonesia’s fast-evolving media landscape

This Portuguese startup lets you bet on your favorite musicians

Whether you’re a fan, groupie or just a good old-fashioned music lover, Tradiio is selling crowdfunding as the best way to put your money where your mouth is

Digital Union: Fighting fake users in China's mobile app industry

The Beijing-based cybersecurity startup is helping developers spot fake app downloads, so their ad money don’t go to waste

TMiRob's medical robots lighten the load of doctors and nurses in hospitals

The robots also reach an operating room three minutes faster than human nurses – that's more time for saving lives

Red Points: US$38 million Series C to power US conquest

The Barcelona-based startup is ramping up US sales and deep-tech capabilities for its online brand protection platform

Voicemod: Voice-tweaking tech that's conquering esports and streamers

Backed by esports and gaming VC BITKRAFT Ventures, Voicemod has become a leading name in voice modification tech for gamers and livestreamers, with 2.5m MAU across 65 countries

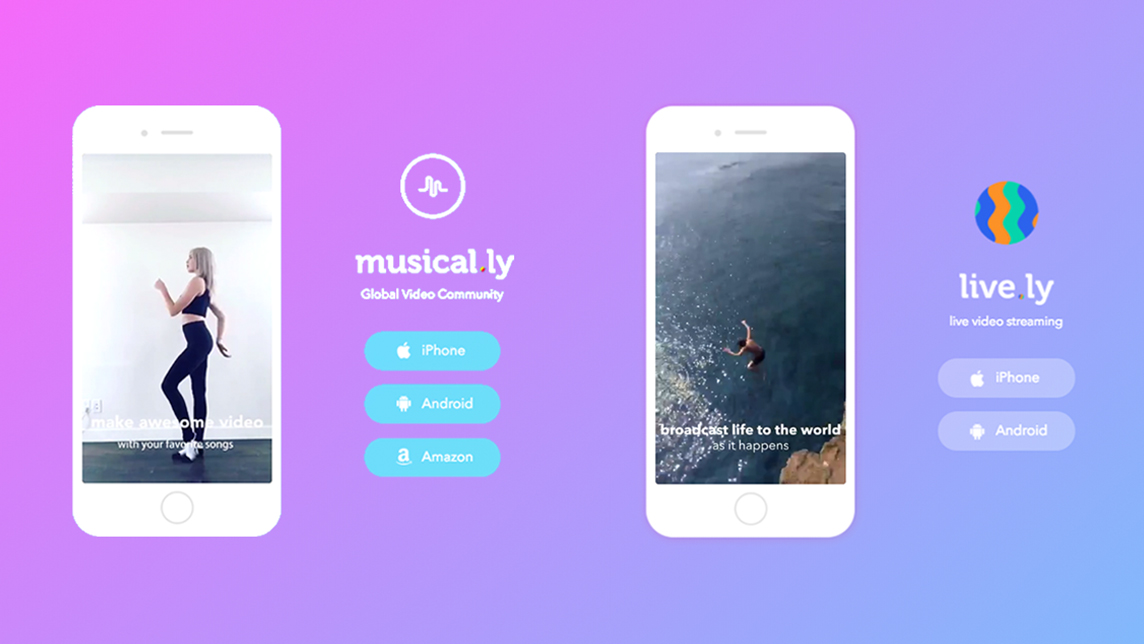

Inspired by rowdy teenagers: the Musical.ly story

Now better known as TikTok, the original Musical.ly was the only Chinese social app to have cracked the Western market – before it got snapped up by Bytedance and joined its stable of short video apps

Backed by pharmas, doctors, medtech startup DyCare is expanding fast across Europe

Its remote musculoskeletal rehabilitation and monitoring system sets to improve rehabilitation outcomes in an overtaxed sector

Impact investing: Spanish startups with a cause and the ecosystem backing them

As more thought and money go into socially and environmentally responsible projects, Spanish entrepreneurs, investors and big businesses are following suit

From Naples to Dhaka: Italo-Dutch precision farming startup Evja eyes funding for R&D, sales boost

Evja has a second office in the Dutch “Food Valley” and is investing to boost its advanced agronomic modeling, to stave off rising competition

Evix Safety's helmet with an airbag is a world-first for cycling safety

Evix Safety is launching a “smart” cycling helmet fitted with an airbag to prevent thousands of neck injuries from accidents

MatMap: Making the construction sector more sustainable

Alicante-based startup MatMap gives a second lease of life to used construction materials that account for almost a third of EU waste

Drone Hopper: Firefighters of the future

A senior Airbus engineer from Spain has developed heavy-duty autonomous drones to quell wildfires safely

Sorry, we couldn’t find any matches for“Union of Musicians”.